UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

| |

Filed by the Registrant: | ý |

|

| |

Filed by a Party other than the Registrant: | o |

Check the appropriate box:

|

| | |

| o | Preliminary Proxy Statement |

|

| | |

| o | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

|

| | |

| ý | Definitive Proxy Statement |

|

| | |

| o | Definitive Additional Materials |

|

| | |

| o | Soliciting Material Pursuant to §240.14a-12 |

REDWOOD TRUST, INC.

|

|

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

| | | |

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

REDWOOD TRUST, INC.

One Belvedere Place, Suite 300

Mill Valley, California 94941

(415) 389-7373

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Redwood Trust, Inc.:

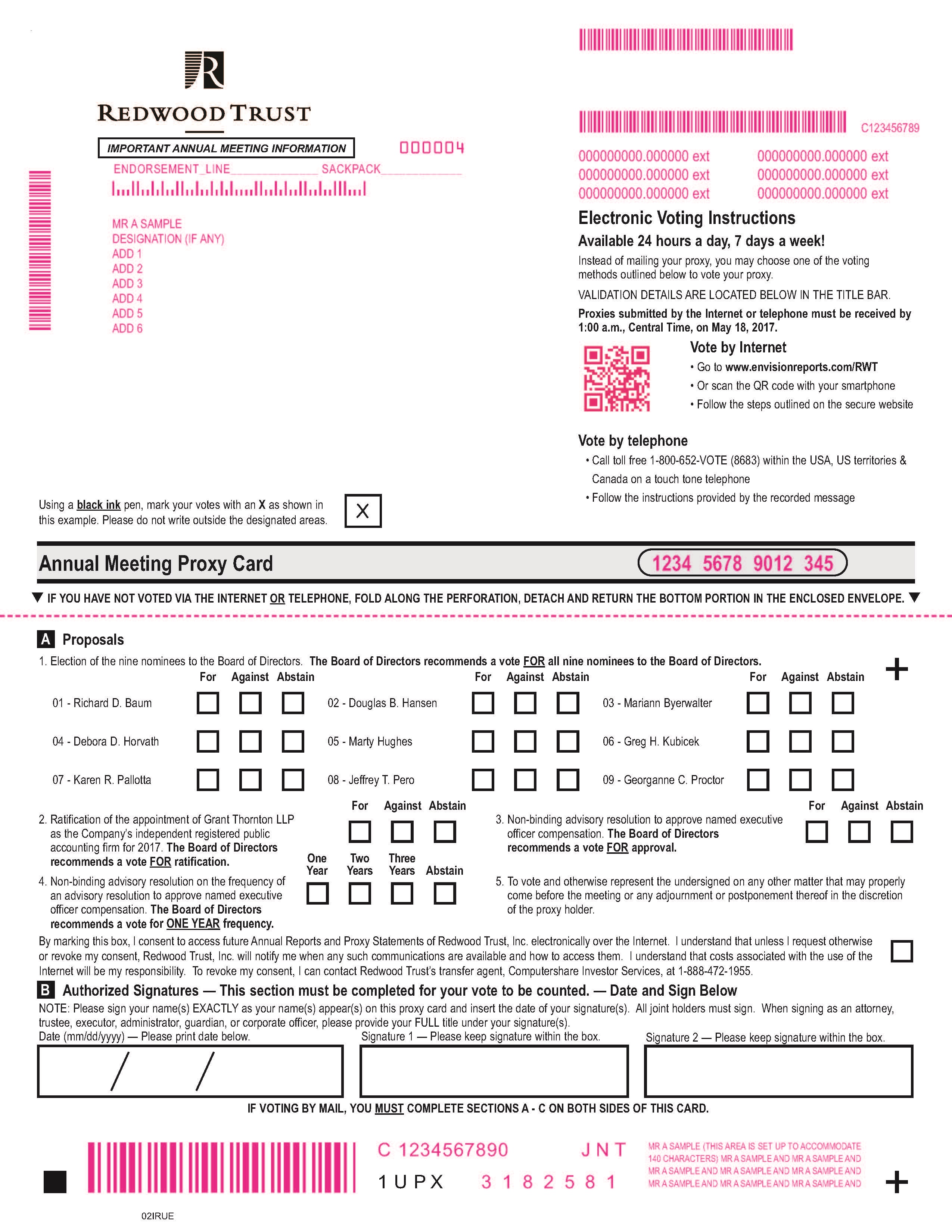

You are cordially invited to attend the Annual Meeting of Stockholders of Redwood Trust, Inc., a Maryland corporation, to be held on May 18, 2017 at 10:30 a.m., local time, at the Acqua Hotel, 555 Redwood Highway, Mill Valley, California 94941, for the following purposes:

| |

1. | To elect Richard D. Baum, Douglas B. Hansen, Mariann Byerwalter, Debora D. Horvath, Marty Hughes, Greg H. Kubicek, Karen R. Pallotta, Jeffrey T. Pero, and Georganne C. Proctor to serve as directors until the Annual Meeting of Stockholders in 2018 and until their successors are duly elected and qualify; |

| |

2. | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2017; |

| |

3. | To vote on a non-binding advisory resolution to approve named executive officer compensation; |

| |

4. | To vote on a non-binding advisory resolution to approve the frequency of holding an advisory vote on named executive officer compensation; and |

| |

5. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

We have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, stockholders will not receive paper copies of our proxy materials unless they specifically request them. We will send a Notice of Internet Availability of Proxy Materials (the Notice) on or about April 7, 2017 to our stockholders of record as of the close of business on March 24, 2017. We are also providing access to our proxy materials over the Internet beginning on March 21, 2017. Electronic delivery of our proxy materials will reduce printing and mailing costs relating to our Annual Meeting.

The Notice contains instructions for accessing the proxy materials, including the Proxy Statement and our annual report, and provides information on how stockholders may obtain paper copies free of charge. The Notice also provides the date and time of the Annual Meeting; the matters to be acted upon at the Annual Meeting and the Board’s recommendation with regard to each matter to be acted upon; and information on how to attend the Annual Meeting and vote online.

Our Board of Directors has fixed the close of business on March 24, 2017 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement of the Annual Meeting.

We would like your shares to be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we respectfully request that you authorize your proxy over the Internet following the voting procedures described in the Notice. In addition, if you have requested or received a paper or email copy of the proxy materials, you can authorize your proxy over the telephone or by signing, dating and returning the proxy card sent to you. We encourage you to authorize your proxy by any of these methods even if you currently plan to attend the Annual Meeting. By doing so, you will ensure that your shares are represented and voted at the Annual Meeting.

By Order of the Board of Directors,

/s/ Andrew P. Stone

Secretary

March 21, 2017

|

|

YOUR VOTE IS IMPORTANT.

PLEASE PROMPTLY AUTHORIZE A PROXY TO CAST YOUR VOTES THROUGH THE INTERNET FOLLOWING THE VOTING PROCEDURES DESCRIBED IN THE NOTICE OR, IF YOU HAVE REQUESTED AND RECEIVED PAPER COPIES OF THE PROXY MATERIALS, BY TELEPHONE OR BY SIGNING, DATING AND RETURNING THE PROXY CARD SENT TO YOU. |

REDWOOD TRUST, INC.

TABLE OF CONTENTS

REDWOOD TRUST, INC.

One Belvedere Place, Suite 300

Mill Valley, California 94941

(415) 389-7373

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2017

INTRODUCTION

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Redwood Trust, Inc., a Maryland corporation (Redwood, the Company, we, or us), for exercise at the Annual Meeting of Stockholders (the Annual Meeting) to be held on Monday, May 18, 2017 at 10:30 a.m., local time, at the Acqua Hotel, 555 Redwood Highway, Mill Valley, California 94941, and at any adjournment or postponement thereof.

We have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the Notice) to our stockholders of record, while brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice of Internet Availability of Proxy Materials. All stockholders will have the ability to access proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this Proxy Statement available on the Internet on or about March 21, 2017 and to mail the Notice to all stockholders entitled to vote at the Annual Meeting on or about April 7, 2017. We intend to mail this Proxy Statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials on or about April 7, 2017 or within three business days of such request.

The address and telephone number of our principal executive office are as set forth above and our website is www.redwoodtrust.com. Information on our website is not a part of this Proxy Statement.

INFORMATION ABOUT THE ANNUAL MEETING

Who May Attend the Annual Meeting

Only stockholders who own our common stock as of the close of business on March 24, 2017, the record date for the Annual Meeting, will be entitled to attend the Annual Meeting. In the discretion of management, we may permit certain other individuals to attend the Annual Meeting, including members of the media and our employees.

Who May Vote

Each share of our common stock outstanding on the record date for the Annual Meeting entitles the holder thereof to one vote. The record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting is the close of business on March 24, 2017. As of March 16, 2017, there were 77,032,899 shares of common stock issued and outstanding. You can vote in person at the Annual Meeting or by proxy. You may authorize your proxy through the Internet by following the voting procedures described in the Notice or, if you have requested and received paper copies of the proxy materials, by telephone or by signing, dating, and returning the proxy card sent to you. To use a particular voting procedure, follow the instructions on the Notice or the proxy card that you request and receive by mail or email.

If your shares are held in the name of a bank, broker, or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. If your shares are not registered in your own name and you plan to cast your votes in person at the Annual Meeting, you should contact your broker or agent to obtain a broker’s proxy card and bring it to the Annual Meeting in order to vote.

Voting by Proxy; Board of Directors’ Voting Recommendations

You may authorize your proxy over the Internet or, if you request and receive a proxy card by mail or email, over the phone or by signing, dating and returning the proxy card sent to you. If you vote by proxy, the individuals named on the proxy, or their substitutes, will cast your votes in the manner you indicate. If you date, sign, and return a proxy card without marking your voting instructions, your votes will be cast in accordance with the recommendations of Redwood’s Board of Directors, as follows:

| |

• | For the election of each of the nine nominees to serve as directors until the Annual Meeting of Stockholders in 2018 and until their successors are duly elected and qualify; |

| |

• | For the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2017; |

| |

• | For the approval, on an advisory basis, of the resolution approving the compensation of our named executive officers; |

| |

• | For the approval, on an advisory basis, of an annual advisory vote on named executive officer compensation; and |

| |

• | In the discretion of the proxy holder on any other matter that properly comes before the Annual Meeting. |

You may revoke or change your proxy at any time before it is exercised by submitting a new proxy through the Internet or by telephone, delivering to us a signed proxy with a date later than your previously delivered proxy, by voting in person at the Annual Meeting, or by sending a written revocation of your proxy addressed to Redwood’s Secretary at our principal executive office.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Under rules adopted by the Securities and Exchange Commission (SEC), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending the Notice to our stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce printing and mailing costs relating to our Annual Meeting.

Quorum Requirement

The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum for the transaction of business. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum. A broker non-vote occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have or chooses not to exercise discretionary authority to vote the shares.

Other Matters

Our Board of Directors knows of no other matters that may be presented for stockholder action at the Annual Meeting. If other matters properly come before the Annual Meeting, however, it is intended that the persons named in the proxies will vote on those matters in their discretion.

Information About the Proxy Statement and the Solicitation of Proxies

Your proxy is solicited by our Board of Directors and we will bear the costs of this solicitation. Proxy solicitations will be made by mail, and also may be made by our directors, officers, and employees in person or by telephone, facsimile transmission, e-mail, or other means of communication. Banks, brokerage houses, nominees, and other fiduciaries will be requested to forward the proxy soliciting material to the beneficial owners of shares of our common stock entitled to be voted at the Annual Meeting and to obtain authorization for the execution of proxies on behalf of beneficial owners. We will, upon request, reimburse those parties for their reasonable expenses in forwarding proxy materials to their beneficial owners.

In addition, we have retained MacKenzie Partners, Inc., 105 Madison Avenue, New York, NY, 10016, to aid in the solicitation of proxies by mail, telephone, facsimile, e-mail and personal solicitation and to contact brokerage houses and other nominees, fiduciaries and custodians to request that such entities forward soliciting materials to beneficial owners of our common stock. For these services, we will pay MacKenzie Partners, Inc. a fee not expected to exceed $15,000, plus expenses.

Annual Report

Our 2016 Annual Report, consisting of our Annual Report on Form 10-K for the year ended December 31, 2016, is being made available to stockholders together with this Proxy Statement and contains financial and other information about Redwood, including audited financial statements for our fiscal year ended December 31, 2016. Certain sections of our 2016 Annual Report are incorporated into this Proxy Statement

by reference, as described in more detail under “Information Incorporated by Reference” at the end of this Proxy Statement. Our 2016 Annual Report is also available on our website.

Householding

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name will receive only one copy of the Notice, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure reduces our printing and mailing costs.

Householding will not in any way affect dividend check mailings.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of the Notice, or if you hold stock in more than one account, and in either case you wish to receive only a single copy of this document for your household, please contact our transfer agent, Computershare Trust Company, N.A., either in writing at: Computershare Investor Services, 250 Royall Street, Canton, MA 02021; or by telephone at: (888) 472-1955.

If you participate in householding and wish to receive a separate copy of the Notice, or if you do not wish to participate in householding and prefer to receive separate copies of this document in the future, please contact Computershare as indicated above.

Beneficial owners can request information about householding from their banks, brokers, or other holders of record.

CORPORATE GOVERNANCE

Corporate Governance Standards

Our Board of Directors has adopted Corporate Governance Standards (Governance Standards). Our Governance Standards are available on our website as well as in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office. The Governance Standards contain general principles regarding the composition and functions of our Board of Directors and its committees.

Process for Nominating Potential Director Candidates

Identifying and Evaluating Nominees for Directors. Our Board of Directors nominates director candidates for election by stockholders at each annual meeting and elects new directors to fill vacancies on our Board of Directors between annual meetings of the stockholders. Our Board of Directors has delegated the selection and initial evaluation of potential director nominees to the Governance and Nominating Committee with input from the Chief Executive Officer and President. The Governance and Nominating Committee makes the final recommendation of candidates to our Board of Directors for nomination. Our Board of Directors, taking into consideration the assessment of the Governance and Nominating Committee, also determines whether a nominee would be an independent director.

Stockholders’ Nominees. Our Bylaws permit stockholders to nominate a candidate for election as a director at an annual meeting of the stockholders subject to compliance with certain notice and informational requirements, as more fully described below in this Proxy Statement under “Stockholder Proposals for the 2018 Annual Meeting.” A copy of the full text of our Bylaws may be obtained by any stockholder upon written request addressed to Redwood’s Secretary at our principal executive office. Among other matters required under our Bylaws, any stockholder nominations should include the nominee’s name and qualifications for Board membership and should be addressed to Redwood’s Secretary at our principal executive office.

The policy of the Governance and Nominating Committee is to consider properly submitted stockholder nominations for candidates for election to our Board of Directors. The Governance and Nominating Committee evaluates stockholder nominations in connection with its responsibilities set forth in its written charter and applies the qualification and diversity criteria set forth in the Governance Standards.

Director Qualifications. Our Governance Standards contain Board membership criteria that apply to nominees for our Board of Directors. Each member of our Board of Directors must exhibit high standards of integrity, commitment, and independence of thought and judgment, and must be committed to promoting the best interests of Redwood. In addition, each director must devote the time and effort necessary to be a responsible and productive member of our Board of Directors. This includes developing knowledge about Redwood’s business operations and doing the work necessary to participate actively and effectively in Board and committee meetings.

Our Governance Standards also contain criteria that are intended to guide our Governance and Nominating Committee’s considerations of diversity in identifying nominees for our Board of Directors. In particular, our Governance Standards provide that the members of our Board of Directors should collectively possess a broad range of talent, skill, expertise, and experience useful to effective oversight of our business and affairs and sufficient to provide sound and prudent guidance with respect to our operations and interests. The self-assessments that are conducted each year by our Board of Directors and our Governance and Nominating

Committee include an assessment of whether the Board’s then current composition represents the broad range of talent, skill, expertise, and experience that is called for by our Governance Standards.

Director Independence

As required under Section 303A of the New York Stock Exchange (NYSE) Listed Company Manual and our Governance Standards, our Board of Directors has affirmatively determined that none of the following directors has a material relationship (either directly or as a partner, shareholder, or officer of an organization that has a relationship) with us and that each of them qualifies as “independent” under Section 303A: Richard D. Baum, Douglas B. Hansen, Mariann Byerwalter, Debora D. Horvath, Greg H. Kubicek, Karen R. Pallotta, Jeffrey T. Pero, and Georganne C. Proctor. The Board of Directors’ determination was made with respect to Mr. Pero after consideration of the following: Mr. Pero is a retired partner of Latham & Watkins LLP and has been a director of Redwood since November 2009; Latham & Watkins LLP provides legal services to Redwood; and Mr. Pero’s retirement payments from Latham & Watkins LLP are adjusted to exclude any proportionate benefit received from the fees paid by Redwood to Latham & Watkins LLP.

One member of our Board of Directors, Mr. Hughes, does not qualify as “independent” under Section 303A of the NYSE Listed Company Manual or our Governance Standards. Mr. Hughes does not qualify as independent because he is Redwood’s current Chief Executive Officer.

Board Leadership Structure

At Redwood, there is a separation of the chairman and chief executive officer roles. The Chairman of the Board of Directors presides over meetings of the Board and serves as a liaison between the Board and management of Redwood. In addition, the Chairman provides input regarding Board agendas, materials, and areas of focus, and may represent Redwood to external constituencies such as investors, governmental representatives, and business counterparties. The Chairman is currently Richard D. Baum, who was elected Chairman in September 2012 and who has continuously served as an independent director of Redwood since 2001.

Under Redwood’s Governance Standards, the Board of Directors also has a Vice-Chairman who presides over meetings of the Board in the absence of the Chairman and who also acts as a resource to management by providing strategic counsel and advice. The Vice-Chairman is currently Douglas B. Hansen, who was elected Vice-Chairman in September 2012. Mr. Hansen is currently an independent director, has served as a director of Redwood since 1994, and is a founder of Redwood and served as Redwood’s President from 1994 through his retirement from that position at the end of 2008. In addition, under the Governance Standards, each of the Audit Committee, Compensation Committee, and Governance and Nominating Committee of Redwood’s Board of Directors is comprised solely of independent directors.

The Board believes this leadership structure is appropriate for Redwood, as it provides for the Board to be led by, and its standing committees to be composed of, independent directors. As an independent Chairman of the Board, Mr. Baum brings more than a decade of experience of serving on Redwood’s Board along with the important perspective of an independent director to this leadership position. As an independent Vice-Chairman of the Board, Mr. Hansen also brings significant prior experience as the President of Redwood to bear on his leadership responsibilities.

Executive Sessions

Our Governance Standards require that our non-employee directors (i.e., the eight of our nine directors who are not Redwood employees) meet in executive session at each regularly scheduled quarterly meeting of our Board of Directors and at such other times as determined by our Chairman. In addition, if any non-employee director is not also an independent director, then our Governance Standards require that our independent directors meet at least annually in executive session without any such non-independent directors.

Board of Directors’ Role in Risk Oversight

The Board of Directors takes a primary role in risk oversight. At its regular meetings it reviews Redwood’s business and investment strategies and plans and seeks an understanding of the related risks as well as management’s approach to identifying and managing those risks. In carrying out its role in risk oversight, the Board of Directors receives and discusses quarterly reports from the Chief Executive Officer and Audit Committee, which also carries out a risk oversight function delegated by the Board of Directors.

Under its charter, the Audit Committee is specifically charged with (i) inquiring of management and Redwood’s independent registered public accounting firm about significant risks or exposures with respect to corporate accounting, reporting practices of Redwood, the quality and integrity of the financial reports and controls of Redwood, regulatory and accounting initiatives, and any off-balance sheet structures and (ii) assessing the steps management has taken to minimize such risks. In addition, the Audit Committee is specifically charged with regularly discussing with management Redwood’s policies with respect to risk assessment and risk management, including identification of Redwood’s major financial and operational risk exposures and the steps management has taken to monitor or control those exposures.

The Audit Committee carries out this function by, among other things, receiving a quarterly risk management report from Redwood’s Chief Executive Officer and other Redwood officers, and a quarterly internal audit report from Redwood’s head of internal audit, reviewing these reports, and discussing them by asking questions and providing direction to management. In addition, as noted below under “Audit Committee Matters — Audit Committee Report,” the Audit Committee also receives and discusses regular and required communications from Redwood’s independent registered public accounting firm regarding, among other things, Redwood’s internal controls. In addition to discussion of these reports during Audit Committee meetings, as circumstances merit, the Audit Committee holds separate executive sessions with one or more of the Chief Executive Officer, Redwood’s head of internal audit, and representatives of Redwood’s independent registered public accounting firm to discuss any matters that the Audit Committee or these persons believe should be discussed in the absence of other members of management.

In addition, when appropriate, the Board of Directors may delegate to other standing committees risk oversight responsibilities with respect to certain matters or request that other committees review certain risk oversight matters. For example, the Compensation Committee has been delegated to review, on an annual basis, whether Redwood’s compensation policies and practices are reasonably likely to have a material adverse effect on Redwood.

The Board of Directors believes that this manner of administering the risk oversight function effectively integrates such oversight into the Board of Directors’ leadership structure, because the risk oversight function is carried out both at the Board level as well as through delegation to the Audit Committee, which consists solely of independent directors, and when appropriate to the other standing committees of the Board of Directors, which also consist solely of independent directors.

Board of Directors’ Self-Evaluation Process

The Board believes it is important to periodically assess its own performance and effectiveness in carrying out its strategic and oversight role with respect to the Company. The Board evaluates its performance through annual self-assessments at the Board and Committee levels, as well as through annual individual director self-assessments that include one-on-one meetings conducted by the Chairman with each of the other directors (or, with respect to the Chairman, the Chair of the Governance and Nominating Committee). These self-assessments include analysis of the effectiveness of the Board, its Committees and its directors, how they are functioning and areas of potential improvement. The results of these performance reviews are also considered by the Governance and Nominating Committee and the Board when considering whether to recommend the re-election of each director nominated for re-election and whether to consider new director candidates.

Communications with the Board of Directors

Stockholders and other interested parties may communicate with our Board of Directors by e-mail addressed to [email protected]. The Chairman has access to this e-mail address and provides access to the other directors as appropriate. Communications that are intended specifically for non-employee directors should be addressed to the Chairman.

Director Attendance at Annual Meetings of Stockholders

Pursuant to our Governance Standards, our directors are expected to attend annual meetings of stockholders. All of our directors attended last year’s annual meeting of stockholders in person. We currently expect all of our directors to attend this year’s Annual Meeting.

Code of Ethics

Our Board of Directors has adopted a Code of Ethics that applies to all of our directors, officers, and employees. Our Code of Ethics is available on our website as well as in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office.

We intend to post on our website and disclose in a Current Report on Form 8-K, to the extent required by applicable regulations, any change to the provisions of our Code of Ethics and any waiver of a provision of the Code of Ethics.

STOCK OWNERSHIP REQUIREMENTS

Required Stock Ownership by Directors

Pursuant to our Governance Standards, non-employee directors are required to purchase from their own funds at least $50,000 of our common stock within three years from the date of commencement of their Board membership. Vested deferred stock units (DSUs) acquired by a director under our Executive Deferred Compensation Plan through the voluntary deferral of cash compensation that otherwise would have been paid to that director are counted towards this requirement. Any director whose status has changed from being an employee director to being a non-employee director is not subject to this requirement if that director held at least $50,000 of our common stock at the time of that change in status.

Additionally, non-employee directors are required to own at least $375,000 of our common stock, including vested DSUs acquired through both voluntary and involuntary deferred compensation, within five years from the date of commencement of their Board membership. Beginning in May 2017, this requirement will increase to $400,000 in connection with an increase in the annual cash retainer payable to non-employee directors (described below under the heading "Director Compensation") to ensure that the ownership guidelines remain at five times the annual cash retainer. Stock and DSUs acquired with respect to the $50,000 stock purchase requirement count toward the attainment of this additional stock ownership requirement. Compliance with the ownership requirements is measured on a purchase/acquisition cost basis.

As of the date of this Proxy Statement, all of our non-employee directors were in compliance with these requirements either due to ownership of the requisite number of shares or because the director was within the time period permitted to attain the required level of ownership.

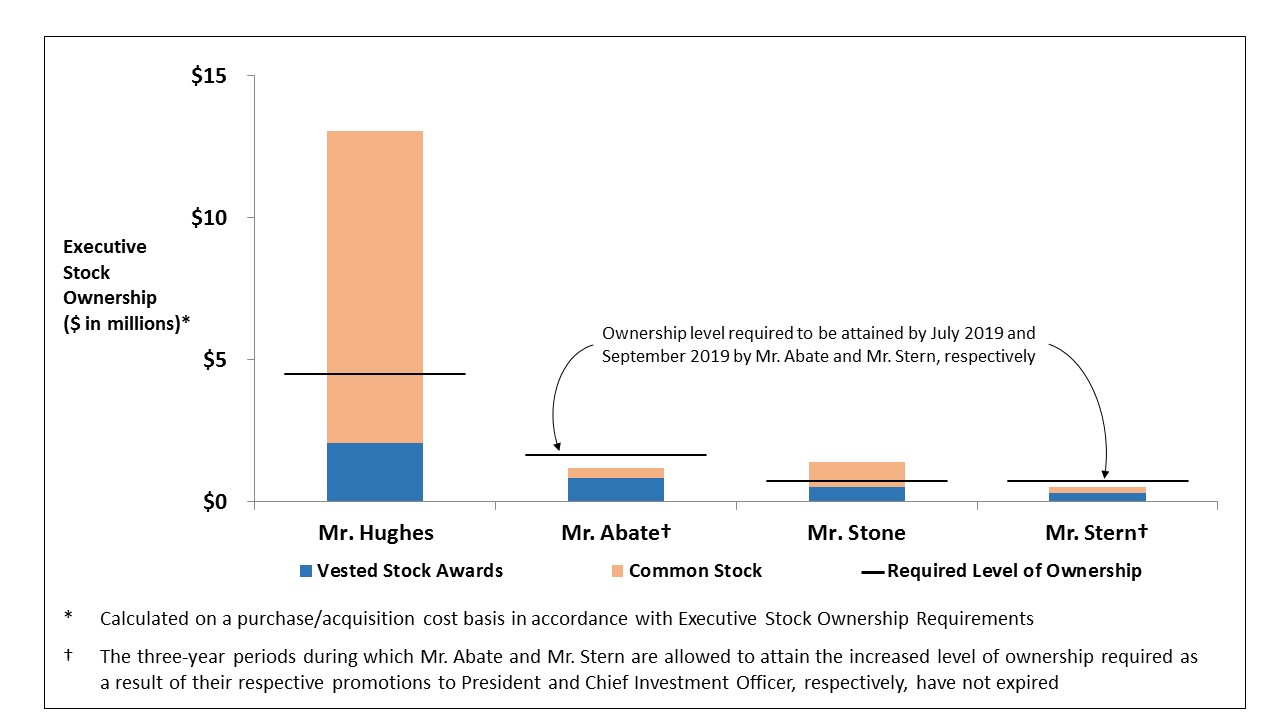

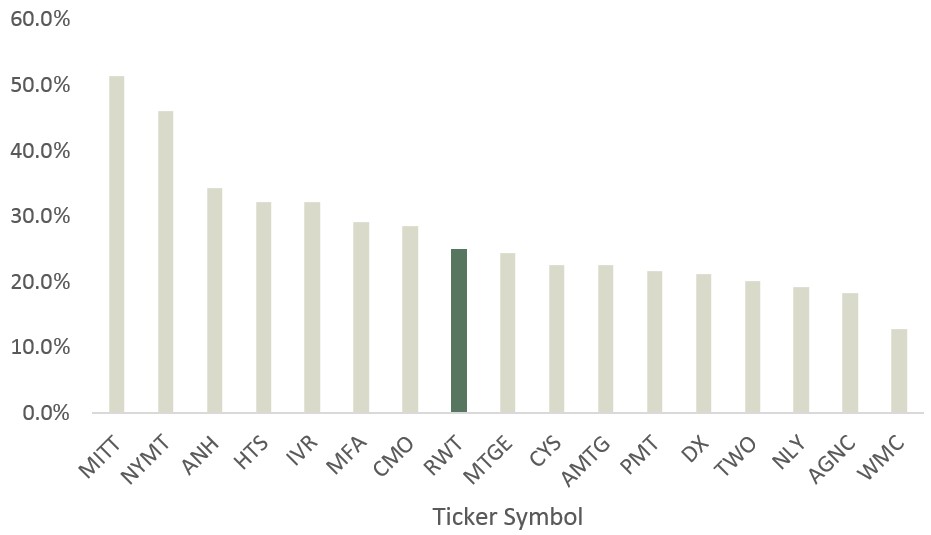

Required Stock Ownership by Executive Officers

The Compensation Committee of our Board of Directors has set the following executive stock ownership requirements with respect to our executive officers:

| |

• | Each executive officer is required to own stock with a value at least equal to (i) six times current salary for the Chief Executive Officer, (ii) three times current salary for the President, and (iii) two times current salary for the other executive officers; |

| |

• | Three years are allowed to initially attain the required level of ownership and three years are allowed to acquire additional incremental shares if promoted to a position with a higher requirement or when a salary increase results in a higher requirement (if not in compliance at the indicated times, then the executive officer is required to retain net after-tax shares delivered as compensation or from the Executive Deferred Compensation Plan until compliance is achieved); |

| |

• | All shares owned outright are counted, including those held in trust for the executive officer and his or her immediate family, as well as vested DSUs and any other vested shares held pursuant to other employee plans; and |

| |

• | Compliance with the guidelines is measured on a purchase/acquisition cost basis, and includes deferred stock units acquired through both voluntary and involuntary deferred compensation. |

As of the date of this Proxy Statement, all of Redwood’s executive officers were in compliance with these requirements. The chart below illustrates the stock ownership level relative to the applicable requirement for each of our executive officers.

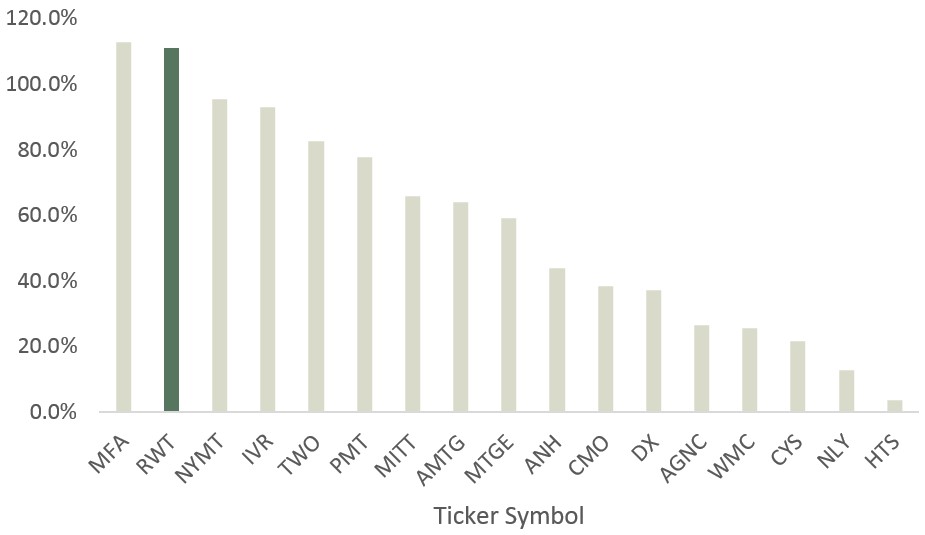

Compliance with Executive Stock Ownership Requirements

ITEM 1 — ELECTION OF DIRECTORS

In May 2015, Redwood completed transitioning to a declassified Board of Directors pursuant to an amendment to Redwood’s charter approved at the 2012 annual meeting of stockholders. As a result, all directors elected at the Annual Meeting will be elected to serve until the next annual meeting of stockholders and until their respective successors are duly elected and qualify.

The nominees for the nine director positions are set forth below. In the event we are advised prior to the Annual Meeting that any nominee will be unable to serve or for good cause will not serve as a director if elected at the Annual Meeting, the proxies will cast votes for any person who shall be nominated by the present Board of Directors to fill such directorship. As of the date of this Proxy Statement, we are not aware of any nominee who is unable or unwilling to serve as a director. The nominees listed below currently are serving as directors of Redwood.

Vote Required

If a quorum is present, the election of each nominee as a director requires a majority of the votes cast with respect to such nominee at the Annual Meeting. For purposes of the election of directors, a majority of the votes cast means that the number of votes cast “for” a nominee for election as a director exceeds the number of votes cast “against” that nominee. Cumulative voting in the election of directors is not permitted. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of the vote in the election of directors. In accordance with Redwood’s Bylaws and its Policy Regarding Majority Voting, any incumbent nominee for director must offer to resign from the Board if he or she fails to receive the required number of votes for re-election.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE NOMINEES IDENTIFIED BELOW.

Nominees to Board of Directors

|

| | |

Name | | Position with Redwood |

Richard D. Baum | | Chairman of the Board |

Douglas B. Hansen | | Vice-Chairman of the Board |

Mariann Byerwalter | | Director |

Debora D. Horvath | | Director |

Marty Hughes | | Director and Chief Executive Officer |

Greg H. Kubicek | | Director |

Karen R. Pallotta | | Director |

Jeffrey T. Pero | | Director |

Georganne C. Proctor | | Director |

Set forth on the following pages is a summary of the experience, qualifications, attributes and skills of each of the nominees for election at the Annual Meeting and current directors of Redwood, as well as certain biographical information regarding each of these individuals.

Summary of Current Directors’ Experience, Qualifications, Attributes and Skills

|

| | | | | | | | | |

| | | | | | | | | |

| Baum | Hansen | Byerwalter | Horvath | Hughes | Kubicek | Pallotta | Pero | Proctor |

Leadership | ü | ü | ü | ü | ü | ü | ü | ü | ü |

Real Estate Industry | ü | ü | | | ü | ü | ü | ü | |

Accounting/Finance | | ü | ü | | ü | | | | ü |

Insurance Industry | ü | | ü | ü | | | | | |

Government / Government- Sponsored Entity | ü | | | | | | ü | | |

Capital Markets | | ü | | | ü | | | ü | |

Corporate / Institutional Governance | ü | | ü | ü | | | | ü | |

Banking / Investment Management | | | ü | | ü | | | | ü |

Technology | | | | ü | | | | | |

| | | | | | | | | |

Richard D. Baum, age 70, is Chairman of the Board and has been a director of Redwood since 2001. Mr. Baum is currently the President and Managing Partner of Atwater Retirement Village LLC (a private company). From 2008 to mid-2009, Mr. Baum served as Executive Director of the California Commission for Economic Development. He also served as the Chief Deputy Insurance Commissioner for the State of California from 1991 to 1994 and 2003 to 2007. Mr. Baum served from 1996 to 2003 as the President and CEO of Care West Insurance Company, a worker’s compensation insurance company, and prior to 1991 as Senior Vice President of Amfac, Inc., a diversified operating company engaged in various businesses, including real estate development and property management. Mr. Baum holds a B.A. from Stanford University, an M.A. from the State University of New York, and a J.D. from George Washington University, National Law Center.

The Board of Directors concluded that Mr. Baum should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Leadership attributes and management experience |

| |

• | Experience as a chief executive officer |

| |

• | Experience in government service and financial regulation |

| |

• | Expertise and experience relating to the insurance industry |

| |

• | Expertise and experience relating to the real estate development industry and property management business |

| |

• | Expertise and experience relating to institutional governance |

| |

• | Professional and educational background |

Douglas B. Hansen, age 59, is Vice-Chairman of the Board, is a founder of Redwood, and served as Redwood’s President from 1994 through 2008. Mr. Hansen retired from his position as President of Redwood at the end of 2008. Mr. Hansen has been a director of Redwood since 1994. Mr. Hansen serves on the Board of Directors of Four Corners Property Trust, Inc., a publicly traded real estate investment trust. Mr. Hansen also serves on the boards of several not-for-profit institutions, including the International Center of Photography and River of Knowledge. Mr. Hansen holds a B.A. in Economics from Harvard College and an M.B.A. from Harvard Business School.

The Board of Directors concluded that Mr. Hansen should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Leadership attributes and management experience, including experience as President of Redwood since its founding in 1994 through 2008 |

| |

• | Skill and experience in investing in real estate-related assets and managing portfolios of such investments |

| |

• | Skill and experience in managing balance sheet exposures and managing risks |

| |

• | Skill and experience in executing capital markets transactions |

| |

• | Experience in finance and accounting matters |

| |

• | Professional and educational background |

Mariann Byerwalter, age 56, has been a director of Redwood since 1998. Ms. Byerwalter is Chairman of the Board of Directors of SRI International, an independent nonprofit technology research and development organization, and Chairman of JDN Corporate Advisory, LLC, a privately held advisory services firm. Ms. Byerwalter served as interim CEO and President of Stanford Health Care from January 1, 2016 to July 4, 2016. Ms. Byerwalter served as the Chief Financial Officer and Vice President for Business Affairs of Stanford University from 1996 to 2001. She was a partner and co-founder of America First Financial Corporation from 1987 to 1996, and she served as Chief Operating Officer, Chief Financial Officer, and a director of America First Eureka Holdings, a publicly traded institution and the holding company for Eureka Bank, from 1993 to 1996. She also serves on the Board of Directors of Pacific Life Corp., Franklin Resources, Inc., Burlington Capital Corporation, WageWorks, Inc., the Lucile Packard Children’s Hospital, and the Stanford Hospital and Clinics Board of Directors (Chair, 2006 – 2013). In April 2012, she completed her term on the Board of Trustees of Stanford University. Ms. Byerwalter holds a B.A. from Stanford University and an M.B.A. from Harvard Business School.

The Board of Directors concluded that Ms. Byerwalter should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Leadership attributes and management and entrepreneurial experience |

| |

• | Experience as a chief financial officer |

| |

• | Expertise and experience in the banking and insurance industries |

| |

• | Expertise and experience relating to institutional governance |

| |

• | Professional and educational background |

Debora D. Horvath, age 62, has been a director of Redwood since 2016. Ms. Horvath is Principal of Horvath Consulting LLC, which she founded in 2010. From 2008 to 2010, Ms. Horvath served as an Executive Vice President for JP Morgan Chase & Co. Ms. Horvath served as an Executive Vice President and Chief Information Officer for Washington Mutual, Inc. from 2004 to 2008. Ms. Horvath, a 25 year veteran from General Electric Company (“GE”), served 12 years as a Senior Vice President and Chief Information Officer for the GE insurance businesses. Ms. Horvath has been a Director of StanCorp Financial Group, Inc. since 2013. She was a director of the Federal Home Loan Bank of Seattle from 2012 to January 2014. Ms. Horvath holds a B.A. from Baldwin Wallace University.

The Board of Directors concluded that Ms. Horvath should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Leadership attributes and management experience |

| |

• | Experience as a chief information officer |

| |

• | Expertise and experience relating to information technology and technology risk management |

| |

• | Expertise and experience relating to the insurance industry |

| |

• | Expertise and experience relating to institutional governance |

| |

• | Professional and educational background |

Marty Hughes, age 59, has served as Chief Executive Officer since May 2010 and as a director since January 2011. Mr. Hughes served as President from January 2009 to January 2012, Co-Chief Operating Officer from November 2007 to May 2010, Chief Financial Officer from 2006 to April 2010, Treasurer from 2006 to 2007, and Vice President from 2005 to 2007. Mr. Hughes has 20 years of senior management experience in the financial services industry. From 2000 to 2004, Mr. Hughes was the President and Chief Financial Officer for Paymap, Inc. In addition, Mr. Hughes served as a Vice President and Chief Financial Officer for Redwood from 1998 to 1999. Mr. Hughes also served as Chief Financial Officer for North American Mortgage Company from 1992 to 1998. Prior to 1992, Mr. Hughes was employed for eight years at an investment banking firm and for four years at Deloitte & Touche. Mr. Hughes has a BS in accounting from Villanova University.

The Board of Directors concluded that Mr. Hughes should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Leadership attributes and management experience, including experience as Chief Executive Officer, President, and Chief Financial Officer of Redwood |

| |

• | Skill and experience in managing balance sheet exposures and managing risks |

| |

• | Skill and experience in executing capital markets transactions |

| |

• | Expertise and experience in the mortgage lending and investment banking industries |

| |

• | Accounting expertise and experience |

| |

• | Professional and educational background |

Greg H. Kubicek, age 60, has been a director of Redwood since 2002. Mr. Kubicek is President of The Holt Group, Inc., a real estate company and associated funds that purchase, develop, own, and manage real estate properties. Mr. Kubicek has also served as Chairman of the Board of Cascade Corporation, an international manufacturing corporation. Mr. Kubicek holds a B.A. in Economics from Harvard College.

The Board of Directors concluded that Mr. Kubicek should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Leadership attributes, including experience as a chief executive officer and as chairman of the board of directors of an NYSE-listed company |

| |

• | Management and entrepreneurial experience |

| |

• | Expertise and experience in the real estate development industry |

| |

• | Experience and expertise in the property management business |

| |

• | Professional and educational background |

Karen R. Pallotta, age 53, has been a director of Redwood since December 2014. Ms. Pallotta is currently the owner of KRP Advisory Services, LLC a consultancy business. Ms. Pallotta was employed at Fannie Mae for more than 20 years until her retirement in 2011. At Fannie Mae she served in various leadership roles, most recently as Executive Vice President of its Single Family Credit Guaranty business, a role she assumed during the height of the financial crisis and subsequent to Fannie Mae’s government conservatorship. In that role Ms. Pallotta had direct responsibility for Fannie Mae’s single family mortgage business, which comprised more than $2.5 trillion in guaranteed mortgages and mortgage backed securities. Ms. Pallotta holds a B.A. from Pennsylvania State University and an M.B.A. from the University of Maryland.

The Board of Directors concluded that Ms. Pallotta should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Expertise and experience relating to residential mortgage finance and mortgage-backed securities |

| |

• | Management experience and leadership attributes |

| |

• | Expertise and experience relating to government sponsored entities |

| |

• | Professional and educational background |

Jeffrey T. Pero, age 70, has been a director of Redwood since November 2009. Mr. Pero retired in October 2009, after serving as a partner for more than 23 years, from the international law firm of Latham & Watkins LLP. At Latham & Watkins LLP, Mr. Pero’s practice focused on advising clients regarding corporate governance matters, debt and equity financings, mergers and acquisitions, and compliance with U.S. securities laws; Mr. Pero also served in various firm management positions. Mr. Pero served on the Board of Directors of BRE Properties, Inc. from 2009 to 2014. Mr. Pero holds a B.A. from the University of Notre Dame and a J.D. from New York University School of Law.

The Board of Directors concluded that Mr. Pero should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Expertise and experience in structuring and negotiating debt and equity financings |

| |

• | Expertise and experience relating to corporate governance |

| |

• | Expertise and experience relating to real estate investment trusts |

| |

• | Expertise and experience relating to the U.S. securities laws |

| |

• | Professional and educational background |

Georganne C. Proctor, age 60, has been a director of Redwood since March 2006. Ms. Proctor is the former Chief Financial Officer of TIAA-CREF, and served in that position from June 2006 to July 2010. Additionally, Ms. Proctor served as Executive Vice President for Enterprise Integration from January 2010 to July 2010. From July 2010 to October 2010, she served as Enterprise Integration’s Executive Vice President. From 2003 to 2005, Ms. Proctor was Executive Vice President of Golden West Financial Corporation, a thrift institution. From 1994 to 1997, Ms. Proctor was Vice President of Bechtel Group, a global engineering firm, and also served as its Senior Vice President and Chief Financial Officer from 1997 to 2002 and as a director from 1999 to 2002. From 1991 to 1994, Ms. Proctor served as finance director of certain divisions of The Walt Disney Company, a diversified worldwide entertainment company. Ms. Proctor currently serves on the Board of Directors of Och-Ziff Capital Management Group and SunEdison, Inc. Ms. Proctor previously served on the Board of Directors of Kaiser Aluminum Corporation from 2006 to 2009. Ms. Proctor holds a B.S. in Business Management from the University of South Dakota and an M.B.A. from California State University East Bay.

The Board of Directors concluded that Ms. Proctor should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

| |

• | Experience as a chief financial officer |

| |

• | Expertise and experience in the banking and investment management industries |

| |

• | Professional and educational background |

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board of Directors currently consists of nine directors. Our Board of Directors has established three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee. The membership of each committee and the function of each committee are described below. Each of the committees has adopted a charter and the charters of all committees are available on our website and in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office.

Our Board of Directors held a total of eight meetings during 2016. The non-employee directors of Redwood met in executive session at six of the eight meetings during 2016. Mr. Baum presided at executive sessions of the independent directors. No director attended fewer than 75% of the meetings of the Board of Directors and the committees on which he or she served and all of our directors attended last year’s annual meeting of stockholders in person.

Audit Committee

We have a separately-designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee provides oversight regarding accounting, auditing, risk management, and financial reporting practices of Redwood. The Audit Committee consists solely of non-employee directors, all of whom our Board of Directors has determined are independent within the meaning of the listing standards of the NYSE and the rules of the SEC. Our Board of Directors has determined that all members of the Audit Committee are “financially literate” within the meaning of the applicable regulations and standards and has designated Ms. Proctor as an “audit committee financial expert” within the meaning of the applicable regulations and standards. The Audit Committee met four times in 2016 in order to carry out its responsibilities, as discussed below under “Audit Committee Matters — Audit Committee Report.”

Compensation Committee

The Compensation Committee reviews and approves Redwood’s compensation philosophy, reviews the competitiveness of Redwood’s compensation practices, as well as risks that may arise from those practices, determines and approves the annual base salaries and incentive compensation paid to our executive officers, approves the terms and conditions of proposed incentive plans applicable to our executive officers and other employees, approves and oversees the administration of Redwood’s employee benefit plans, and reviews and approves hiring and severance arrangements for our executive officers. The Compensation Committee consists solely of non-employee directors, all of whom our Board of Directors has determined are independent within the meaning of the listing standards of the NYSE, are “non-employee directors” within the meaning of the rules of the SEC, and are “outside directors” within the meaning of the rules of the Internal Revenue Service (the IRS). The Compensation Committee met seven times in 2016 in order to carry out its responsibilities as more fully discussed below under “Executive Compensation — Compensation Discussion and Analysis.”

Governance and Nominating Committee

The Governance and Nominating Committee reviews and considers corporate governance guidelines and principles, evaluates potential director candidates and recommends qualified candidates to the full Board, reviews the management succession plan and evaluates executives in connection with succession planning, and oversees the evaluation of the Board of Directors. The Governance and Nominating Committee consists

solely of non-employee directors, all of whom our Board of Directors has determined are independent within the meaning of the listing standards of the NYSE. The Governance and Nominating Committee met five times in 2016 in order to carry out its responsibilities.

Committee Members

The current members of each of the three standing committees are listed below, with the Chair appearing first.

|

| | | | |

Audit | | Compensation | | Governance and Nominating |

Greg H. Kubicek | | Georganne C. Proctor | | Jeffrey T. Pero |

Mariann Byerwalter | | Richard D. Baum | | Richard D. Baum |

Debora D. Horvath | | Karen R. Pallotta | | Mariann Byerwalter |

Karen R. Pallotta | | Jeffrey T. Pero | | Debora D. Horvath |

Georganne C. Proctor | | | | Greg H. Kubicek |

DIRECTOR COMPENSATION

Information on our non-employee director cash compensation paid (or to be paid) during the annual periods between May 2015 and May 2018, is set forth in the table below.

|

| | | | | | | | | | | | |

| | Annual Period Commencing May 1, |

| | 2015 | | 2016 | | 2017 |

Annual Retainer * | | $ | 75,000 |

| | $ | 75,000 |

| | $ | 80,000 |

|

Committee Meeting Fee (in person attendance) | | $ | 2,000 |

| | $ | 2,000 |

| | $ | 2,000 |

|

Committee Meeting Fee (telephonic attendance) | | $ | 1,000 |

| | $ | 1,000 |

| | $ | 1,000 |

|

* The Chairs of the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee each receive an additional annual cash retainer of $20,000. The Chairman of the Board of Directors receives an additional annual cash retainer of $50,000.

Non-employee directors are also reimbursed for reasonable out-of-pocket expenses incurred in attending Board and committee meetings, as well as for their and, in some cases, their guests’ attendance at other Redwood-related meetings or events. Non-employee directors may also be reimbursed for out-of-pocket expenses incurred in attending conferences or educational seminars that relate to their Board service.

Non-employee directors are also granted deferred stock units (or comparable equity-based awards) each year at the time of the annual meeting of stockholders. The number of deferred stock units granted is determined by dividing the dollar value of the grant by the closing price of Redwood’s common stock on the NYSE on the day of grant (and rounding to the nearest whole share amount). In May 2016, non-employee directors received an annual deferred stock unit award valued at $85,000, and, as discussed below, in May 2017, non-employee directors will receive an annual deferred stock unit award valued at $95,000. Non-employee directors may also be granted equity-based awards upon their initial election to the Board. These initial and annual deferred stock units are fully vested upon grant, and they are generally subject to a mandatory three-year holding period. Dividend equivalent rights on deferred stock units are generally paid in cash to directors on each dividend distribution date. Deferred stock units may be credited under our Executive Deferred Compensation Plan.

As noted above, at the February 2017 meeting of the Board of Directors, the Board approved certain changes jointly recommended by the Compensation Committee and the Governance and Nominating Committee to non-employee director compensation for the May 2017 to May 2018 annual period. In connection with these changes, the Compensation Committee's independent compensation consultant, Frederic W. Cook & Co., Inc. (FW Cook), conducted an independent review of Redwood’s non-employee director compensation program at the request of the Compensation Committee. The review conducted by FW Cook included benchmarking against non-employee director compensation at the companies that comprise Redwood's executive compensation benchmarking peer group. The changes for the program commencing in May 2017 are intended to keep Redwood's total average annual compensation for non-employee directors at or near the compensation benchmarking peer group median. Further details regarding the executive compensation benchmarking peer group and benchmarking practices are provided on pages 39 - 41 of this Proxy Statement under the heading "Executive Compensation - Compensation Benchmarking for 2016." The table below illustrates the changes approved. Committee meeting attendance fees and retainers for service as a committee chair or Chairman of the Board remained unchanged from 2016 to 2017.

|

| | | | | | |

| 2017 Fee | | % Change |

| | from 2016 |

Annual Cash Retainer | $ | 80,000 |

| | 6.7 | % |

Annual Equity Award | $ | 95,000 |

| | 11.8 | % |

Each director may elect to defer receipt of cash compensation or dividend equivalent rights through Redwood's Executive Deferred Compensation Plan. Cash balances in the Executive Deferred Compensation Plan are unsecured liabilities of Redwood and are utilized by Redwood as available capital to fund investments and operations. Based on each director’s election, deferred compensation can either be deferred into a cash account and earn a rate of return that is equivalent to 120% of the applicable long-term federal rate published by the IRS compounded monthly or be deferred into deferred stock units which will, among other things, entitle them to receive dividend equivalent rights related to those units.

The following table provides information on non-employee director compensation for 2016. Director compensation is set by the Board and is subject to change. Directors who are employed by Redwood do not receive any compensation for their Board activities.

Non-Employee Director Compensation — 2016(1)

|

| | | | | | | | | | | | | | |

Name | | Fees Earned or Paid in Cash ($)(2) | | Stock Awards ($)(3)(4) | | All Other Compensation ($)(5) | | Total ($) |

Richard D. Baum | | $ | 148,000 |

| | $ | 84,996 |

| | — | | $ | 232,996 |

|

Douglas B. Hansen | | $ | 82,000 |

| | $ | 84,996 |

| | — | | $ | 166,996 |

|

Mariann Byerwalter | | $ | 91,000 |

| | $ | 84,996 |

| | — | | $ | 175,996 |

|

Debora D. Horvath | | $ | 71,898 |

| | $ | 97,306 |

| | — | | $ | 169,204 |

|

Greg H. Kubicek | | $ | 113,000 |

| | $ | 84,996 |

| | — | | $ | 197,996 |

|

Karen R. Pallotta | | $ | 97,000 |

| | $ | 84,996 |

| | — | | $ | 181,996 |

|

Jeffrey T. Pero | | $ | 119,000 |

| | $ | 84,996 |

| | — | | $ | 203,996 |

|

Georganne C. Proctor | | $ | 117,000 |

| | $ | 84,996 |

| | — | | $ | 201,996 |

|

Charles J. Toeniskoetter(6) | | $ | 36,226 |

| | — |

| | — | | $ | 36,226 |

|

| |

(1) | The table does not include dividend equivalent rights paid on deferred stock units, as the value of the dividend equivalent rights was factored into the grant date fair value of the original deferred stock unit awards in accordance with FASB Accounting Standards Codification Topic 718. |

| |

(2) | Fees earned are based on the non-employee director compensation policy in place for 2016: (i) annual cash retainer of $75,000; (ii) additional annual retainer for the Chairman of the Board of $50,000; (iii) additional annual retainer for Audit Committee Chair, Compensation Committee Chair, and Governance and Nominating Committee Chair of $20,000; (iv) committee meeting fee (in person attendance) of $2,000 per meeting; and (v) committee meeting fee (telephonic attendance) of $1,000 per meeting. |

| |

(3) | Stock awards consisted of an annual grant of vested deferred stock units. Value of deferred stock units awarded was determined in accordance with FASB Accounting Standards Codification Topic 718. Information regarding the assumptions used to value our non-employee directors' deferred stock units is provided in Note 17 to our consolidated financial statements included in our Annual Report on Form 10‑K for the year ended December 31, 2016, filed with the Securities and Exchange Commission on February 24, 2017. |

| |

(4) | As of December 31, 2016, the aggregate number of stock awards outstanding for each non-employee director was as follows: Richard D. Baum had 15,815 vested DSUs; Douglas B. Hansen had 15,815 vested DSUs; Mariann Byerwalter had 15,815 vested DSUs; Debora D. Horvath had 7,310 vested DSUs; Greg H. Kubicek had 118,866 vested DSUs; Karen R. Pallotta had 13,211 vested DSUs; Jeffrey T. Pero had 16,772 vested DSUs; Georganne C. Proctor had 70,129 vested DSUs, and Charles J. Toeniskoetter had 9,505 vested DSUs. No director held unvested DSUs. |

| |

(5) | During 2016 certain non-employee directors brought a guest when traveling to a meeting of Redwood’s Board of Directors, at a cost per guest of less than $2,000 to Redwood, and at an aggregate cost to Redwood in 2016 for all guests of less than $5,000. |

| |

(6) | Mr. Toeniskoetter retired from Redwood's Board of Directors effective May 16, 2016. |

The following table provides information on stock unit distributions in common stock to non-employee directors from our Executive Deferred Compensation Plan in 2016. Stock units distributed represent compensation previously awarded in prior years and were reported as director or executive compensation in those prior years.

|

| | | | | | | |

Name | | Stock Units Distributed (#) | | Aggregate Value of Stock Units Distributed ($)(1) |

Richard D. Baum(2) | | 9,759 |

| | $ | 127,760 |

|

Douglas B. Hansen(2) | | 9,759 |

| | $ | 127,760 |

|

Mariann Byerwalter(2) | | 9,759 |

| | $ | 127,760 |

|

Jeffrey T. Pero(2) | | 11,016 |

| | $ | 144,047 |

|

Charles J. Toeniskoetter(2) (3) | | 9,759 |

| | $ | 127,760 |

|

| |

(1) | The aggregate value of stock units distributed is calculated by multiplying the number of stock units distributed by the fair market value of Redwood common stock on the date of distribution. |

| |

(2) | Deferred stock units distributed in 2016 were originally awarded in 2012 and 2013. |

| |

(3) | Mr. Toeniskoetter retired from Redwood's Board of Directors effective May 16, 2016. |

EXECUTIVE OFFICERS

Executive officers of Redwood as of the date of this Proxy Statement are listed in the table below. For purposes of this Proxy Statement, each of Mr. Hughes, Mr. Abate, Mr. Stern, and Mr. Stone were Named Executive Officers (NEOs) in 2016.

|

| | | | |

Name | | Position with Redwood as of December 31, 2016 | | Age |

Marty Hughes | | Chief Executive Officer | | 59 |

Christopher J. Abate | | President and Chief Financial Officer | | 37 |

Shoshone (Bo) Stern | | Chief Investment Officer | | 39 |

Andrew P. Stone | | Executive Vice President, General Counsel & Secretary | | 45 |

Executive officers of Redwood serve at the discretion of our Board of Directors. Biographical information regarding Mr. Hughes is provided in the preceding pages. Additional information regarding Mr. Abate, Mr. Stern, and Mr. Stone is set forth below.

Christopher J. Abate, age 37, serves as President and Chief Financial Officer of Redwood. Mr. Abate has served as Redwood’s President since July 2016 and as its Chief Financial Officer since March 2012. Mr. Abate also served as Redwood’s Controller from January 2009 to March 2013 and has been employed by Redwood since April 2006. Before joining Redwood, Mr. Abate was employed by PricewaterhouseCoopers LLP as an auditor and consultant. He holds a B.A. in accounting and finance from Western Michigan University, an M.B.A. from the University of California at Berkeley and Columbia University, and is a certified public accountant.

Shoshone A. Stern, “Bo Stern,” age 39, serves as Chief Investment Officer of Redwood. Mr. Stern joined Redwood in 2003, and previously served as Redwood’s Treasurer from December 2009 to August 2016, and as Managing Director from December 2007 to December 2009. During February 2003 to December 2007, Mr. Stern served in several other management positions at Redwood. Prior to joining Redwood, Mr. Stern was employed by CIBC Oppenheimer in its investment banking group. Mr. Stern holds a B.S. in business administration from the University of California at Berkeley and an M.B.A from the University of California at Berkeley and Columbia University; he is also a CFA Charterholder.

Andrew P. Stone, age 45, serves as Executive Vice President, General Counsel, and Secretary of Redwood. Mr. Stone has been employed by Redwood as General Counsel since December 2008. Prior to joining Redwood, he served as Deputy General Counsel of Thomas Weisel Partners Group, Inc. from 2006 to 2008 and between 1996 and 2006 practiced corporate and securities law at Sullivan & Cromwell LLP and Brobeck, Phleger & Harrison LLP. Mr. Stone holds a B.A. in mathematics and history from Kenyon College and a J.D. from New York University School of Law.

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information, as of March 16, 2017, on the beneficial ownership of our common stock by our current directors and executive officers, and by all of these directors and executive officers as a group. As indicated in the notes, the table includes common stock equivalents held by these individuals through Redwood-sponsored benefits programs. Except as otherwise indicated and for such power that may be shared with a spouse, each person has sole investment and voting power with respect to the shares shown to be beneficially owned. Beneficial ownership is determined in accordance with the rules of the SEC.

|

| | | | | |

Executive Officers | | Number of Shares of Common Stock Beneficially Owned(1) | | Percent of Class(2) |

Marty Hughes(3) | | 797,503 |

| | 1.0% |

Christopher J. Abate(4) | | 86,938 |

| | * |

Shoshone (Bo) Stern(5) | | 43,524 |

| | * |

Andrew P. Stone(6) | | 85,464 |

| | * |

Non-Employee Directors | | |

| | |

Richard D. Baum(7) | | 43,367 |

| | * |

Douglas B. Hansen(8) | | 344,880 |

| | * |

Mariann Byerwalter(9) | | 26,128 |

| | * |

Debora D. Horvath(10) | | 7,310 |

| | * |

Greg H. Kubicek(11) | | 224,897 |

| | * |

Karen R. Pallotta(12) | | 13,211 |

| | * |

Jeffrey T. Pero(13) | | 56,952 |

| | * |

Georganne C. Proctor(14) | | 79,974 |

| | * |

All directors and executive officers as a group (12 persons)(15) | | 1,810,147 |

| | 2.33% |

* Less than 1%.

| |

(1) | Represents shares of common stock outstanding and common stock underlying vested performance stock units and deferred stock units that have vested or will vest within 60 days of March 16, 2017. |

| |

(2) | Based on 77,032,899 shares of our common stock outstanding as March 16, 2017. |

| |

(3) | Includes 645,013 shares of common stock, and 152,490 deferred stock units that have vested or will vest within 60 days of March 16, 2017. |

| |

(4) | Includes 19,993 shares of common stock and 66,945 deferred stock units that have vested or will vest within 60 days March 16, 2017. |

| |

(5) | Includes 16,032 shares of common stock and 27,492 deferred stock units that have vested or will vest within 60 days March 16, 2017. |

| |

(6) | Includes 45,896 shares of common stock, and 39,568 deferred stock units that have vested or will vest within 60 days of March 16, 2017. |

| |

(7) | Includes 27,552 shares of common stock and 15,815 vested deferred stock units. |

| |

(8) | Includes 329,065 shares of common stock and 15,815 vested deferred stock units. |

| |

(9) | Includes 10,313 shares of common stock and 15,815 vested deferred stock units. |

| |

(10) | Includes 7,310 vested deferred stock units. |

| |

(11) | Includes 104,119 shares of common stock held in direct ownership, living trusts and through an unaffiliated pension plan, 1,912 shares held of record by Mr. Kubicek’s spouse, and 118,866 vested deferred stock units. |

| |

(12) | Includes 13,211 vested deferred stock units. |

| |

(13) | Includes 40,180 shares of common stock and 16,772 vested deferred stock units. |

| |

(14) | Includes 9,845 shares held in the Proctor Trust and 70,129 vested deferred stock units. |

| |

(15) | Includes 1,249,920 shares of common stock, and 560,227 vested deferred stock units. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth information as of the dates noted below, with respect to shares of our common stock owned by each person or entity known by us to be the beneficial owner of approximately 5% or more of our common stock.

|

| | | | | |

Name of Beneficial Owner | | Number of Shares of Common Stock Beneficially Owned | | Percent of Class(1) |

Capital World Investors(2) | | 8,006,717 | | 10.4 | % |

Wellington Management Group LLP(3) | | 7,196,825 | | 9.3 | % |

BlackRock, Inc.(4) | | 6,360,111 | | 8.3 | % |

The Vanguard Group(5) | | 5,941,281 | | 7.7 | % |

Weitz Investment Management, Inc.(6) | | 5,406,215 | | 7.0 | % |

FMR LLC(7) | | 4,936,088 | | 6.4 | % |

| |

(1) | Based on 77,032,899 shares of our common stock outstanding as March 16, 2017. |

| |

(2) | Address: 333 South Hope Street, Los Angeles, California 90071. The information in the above table and this footnote concerning the shares of common stock beneficially owned by Capital World Investors (Capital World), a division of Capital Research and Management Company (CRMC), is based on the amended Schedule 13G filed by Capital World with the SEC on February 13, 2017, which indicates that Capital World has sole voting and dispositive power with respect to 8,006,717 shares. Capital World is deemed to be the beneficial owner of these securities as a result of CRMC acting as investment advisor to various registered investment companies. |

| |

(3) | Address: 280 Congress Street, Boston, Massachusetts 02210. The information in the above table and this footnote concerning the shares of common stock beneficially owned by Wellington Management Group LLP (Wellington) is based on the amended Schedule 13G filed by Wellington with the SEC on February 9, 2017, which indicates that Wellington and certain other subsidiary entities make aggregate reports on Schedule 13G and that such entities, in the aggregate, have shared dispositive power with respect to 7,196,825 shares and shared voting power with respect to 3,806,397 shares. |

| |

(4) | Address: 55 East 52nd Street, New York, New York 10055. The information in the above table and this footnote concerning the shares of common stock beneficially owned by BlackRock, Inc. (BlackRock) is based on the amended Schedule 13G filed by BlackRock with the SEC on January 25, 2017, which indicates that BlackRock and certain other subsidiary entities make aggregate reports on Schedule 13G and that such entities, in the aggregate, have sole dispositive power with respect to 6,360,111 shares and sole voting power with respect to 6,180,945 shares. |

| |

(5) | Address: 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. The information in the above table and this footnote concerning the shares of common stock beneficially owned by The Vanguard Group (Vanguard) is based on the amended Schedule 13G filed by Vanguard with the SEC on February 10, 2017, which indicates that Vanguard and certain other subsidiary entities make aggregate reports on Schedule 13G and that such entities, in the aggregate, have sole dispositive power with respect to 5,844,461 shares, shared dispositive power with respect to 96,820 shares, sole voting power with respect to 91,520 shares, and shared voting power with respect to 9,400 shares. |

| |

(6) | Address: 1125 South 103rd Street, Suite 200, Omaha, Nebraska 68124. The information in the above table and this footnote concerning the shares of common stock beneficially owned by Weitz Investment |

Management, Inc. (Weitz Inc.) and Wallace R. Weitz (Weitz) is based on the amended Schedule 13G filed by Weitz with the SEC on January 23, 2017. The aggregate number of shares of common stock reported as beneficially owned by Weitz Inc. includes 5,406,215 shares with respect to which Weitz has shared dispositive power and shared voting power.

| |

(7) | Address: 245 Summer Street, Boston, Massachusetts 02210. The information in the above table and this footnote concerning the shares of common stock beneficially owned by FMR LLC (FMR) is based on the amended Schedule 13G filed by FMR with the SEC on February 14, 2017, which indicates that FMR and certain other subsidiary entities make aggregate reports on Schedule 13G and that the such entities, in the aggregate, have sole dispositive power with respect to 4,936,088 shares and sole voting power with respect to 1,238,154 shares. |

EXECUTIVE COMPENSATION

Table of Contents

|

| |

Executive Summary of Compensation Discussion and Analysis | 27 |

Compensation Discussion and Analysis (CD&A) | 33 |

Section I - Introduction | 33 |

Named Executive Officers | 33 |

Compensation Committee | 34 |

Redwood's Business Model and Internal Management Structure | 34 |

Overall Compensation Philosophy and Objectives | 34 |

Outreach to Stockholders / Consistent "Say-on-Pay" Support from Stockholders | 35 |

Section II - Performance-Based Compensation in 2016 | 36 |

Redwood's 2016 and Longer-Term Performance | 36 |

Elements of Compensation in 2016 | 36 |

Process for Compensation Determinations for 2016 | 38 |

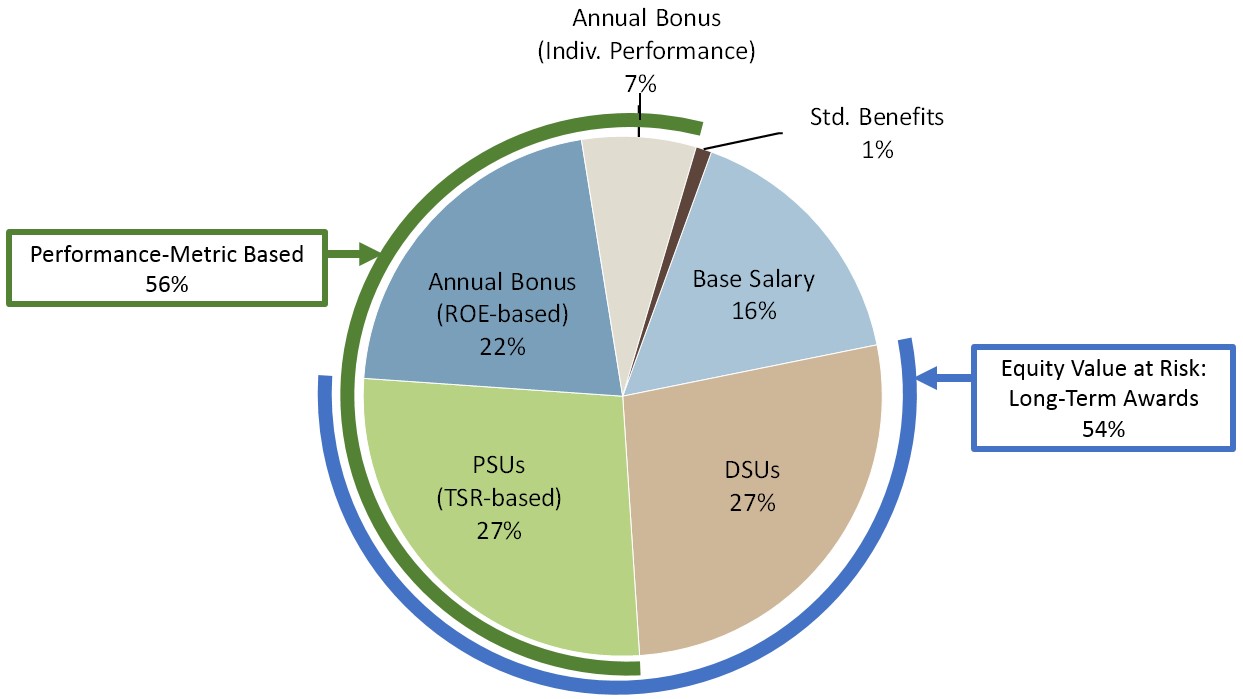

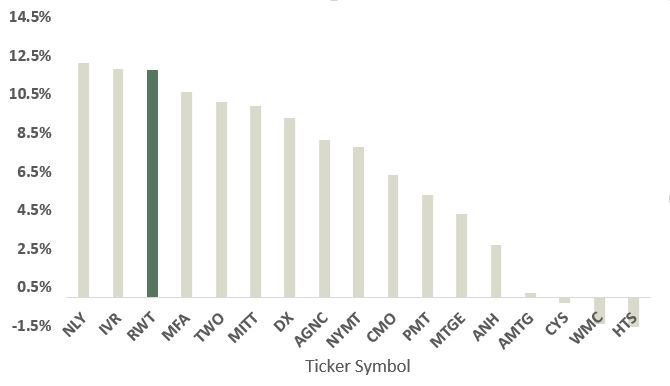

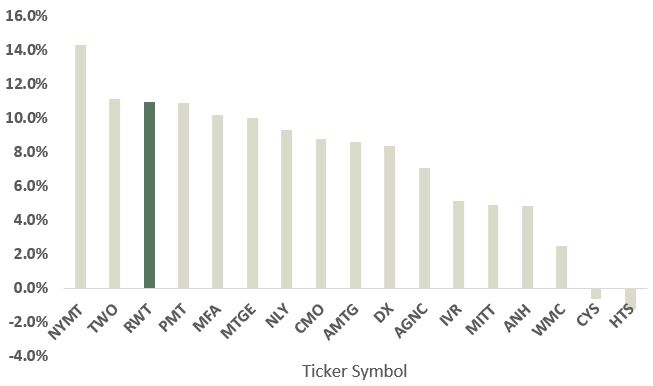

Compensation Benchmarking for 2016 | 39 |

2016 Base Salaries | 41 |

2016 Performance-Based Annual Bonus Compensation | 41 |

2016 Long-Term Equity-Based Incentive Awards | 49 |

Mandatory Holding Periods for 2016 Long-Term Equity-Based Incentive Awards | 53 |

Section III - Other Compensation Plans and Benefits | 55 |

Deferred Compensation | 55 |

Employee Stock Purchase Plan | 55 |

401(k) Plan and Other Matching Contributions | 56 |

Other Benefits | 56 |

Severance and Change of Control Arrangements | 56 |

Section IV - Compensation-Related Policies and Tax Considerations | 58 |

Mandatory Executive Stock Ownership Requirements | 58 |

Prohibition on Use of Margin, Pledging, and Hedging in Respect of Redwood Shares | 58 |

Clawback Policy with Respect to Bonus and Incentive Compensation | 59 |

Tax Considerations | 59 |

Accounting Standards | 60 |

Section V - Conclusion | 61 |

Certain Compensation Determinations Relating to 2017 | 61 |

Compensation Committee Report | 62 |

Executive Compensation Tables | 63 |

Potential Payments Upon Termination or Change of Control | 74 |

Compensation Risks | 78 |

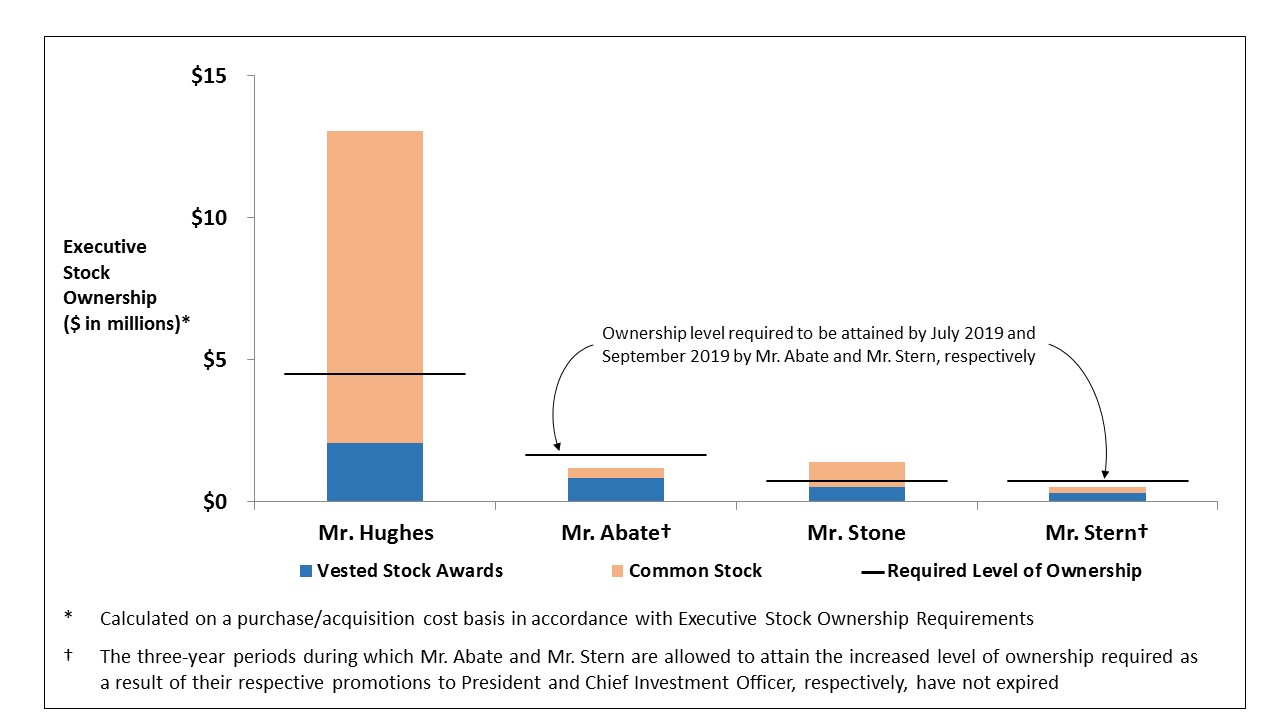

Executive Summary of Compensation Discussion and Analysis

Introduction

| |

Ø | Redwood has a performance-based executive compensation program where pay delivery appropriately adjusts up or down to reflect both short- and long-term results |

| |

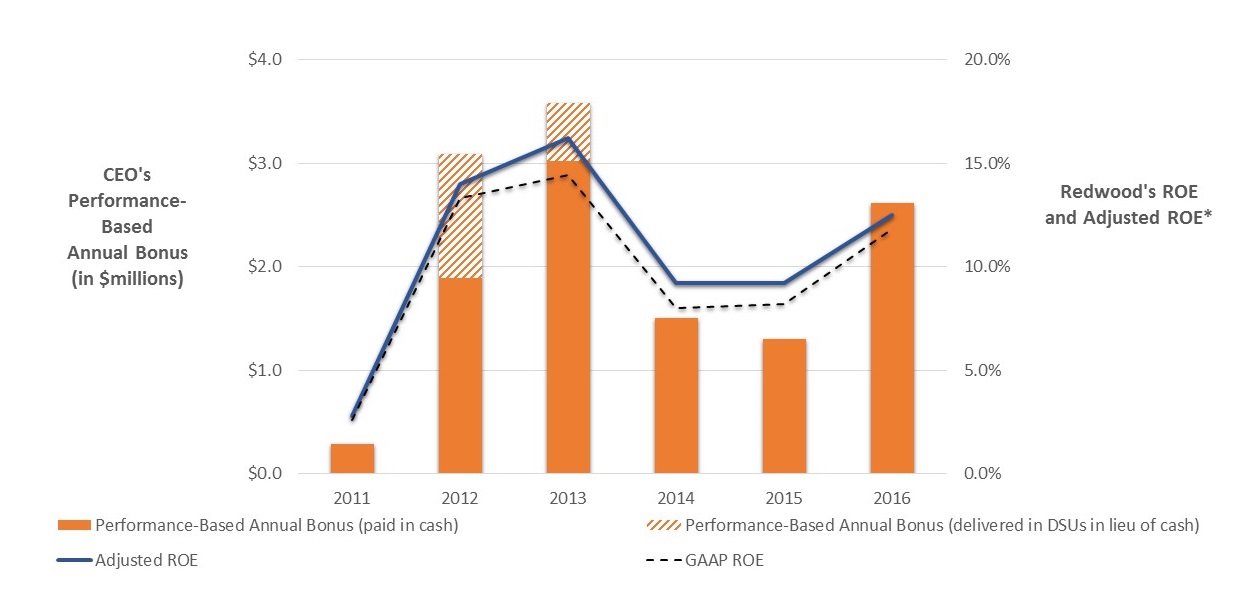

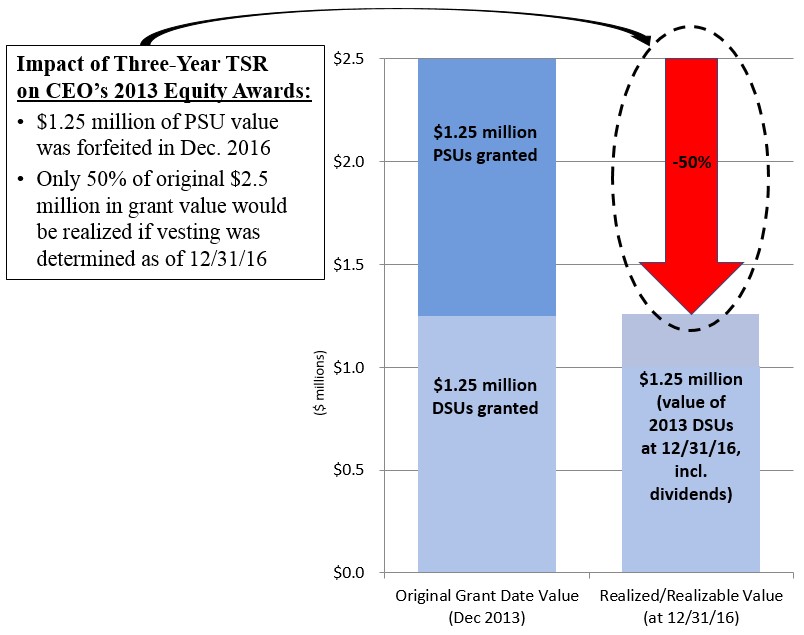

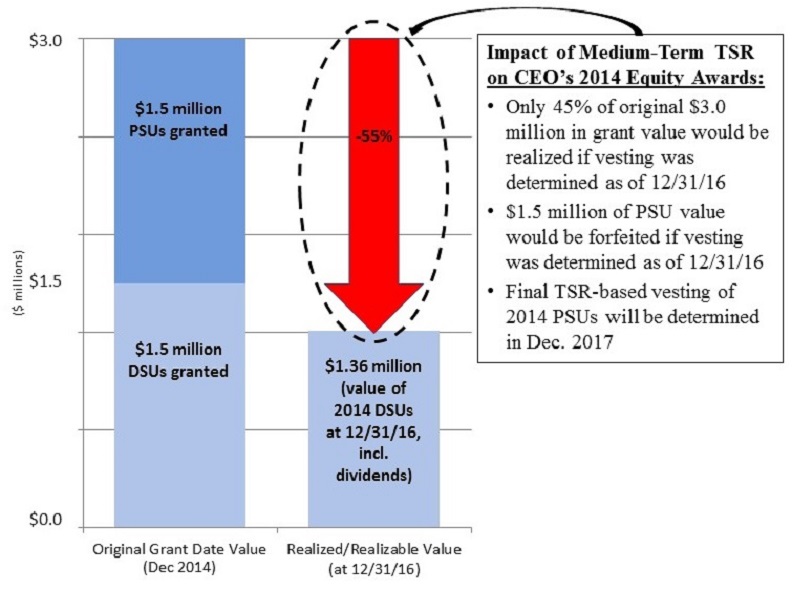

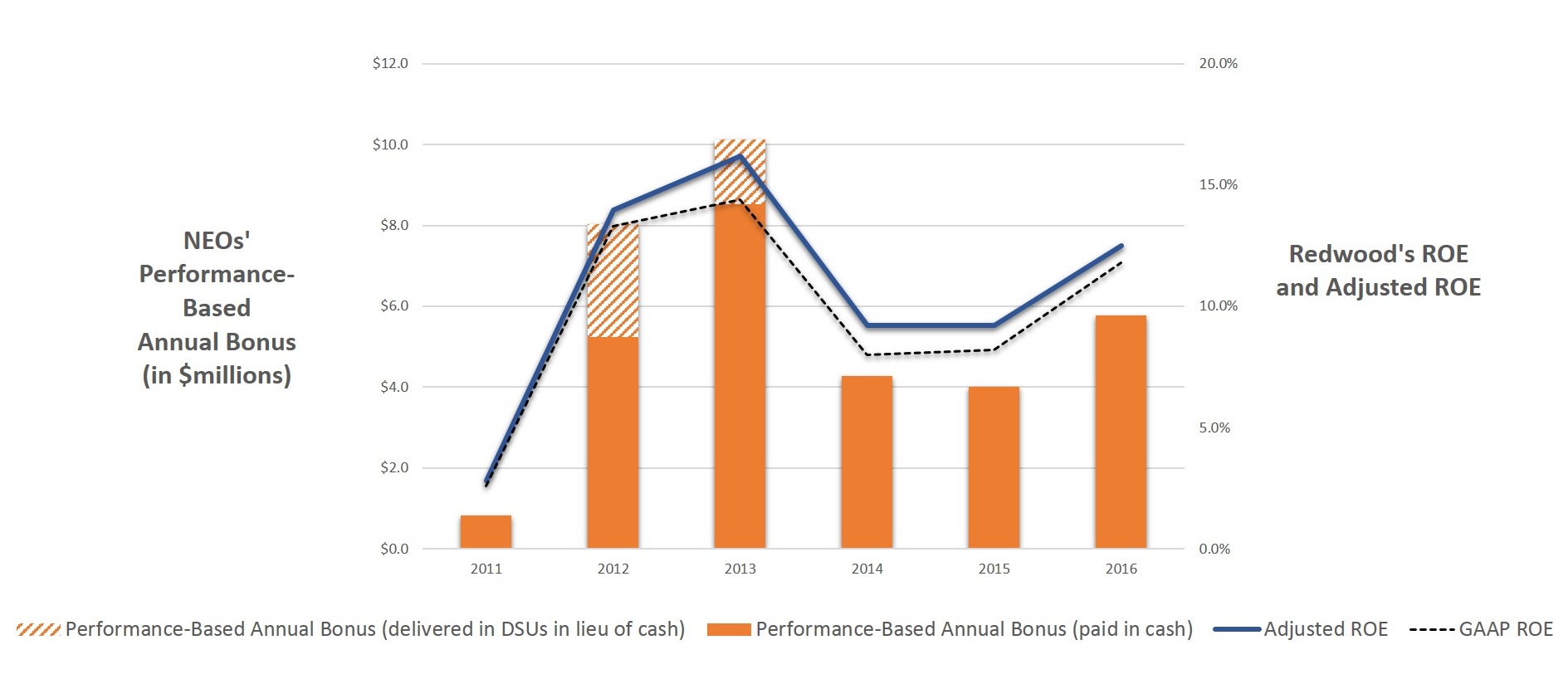

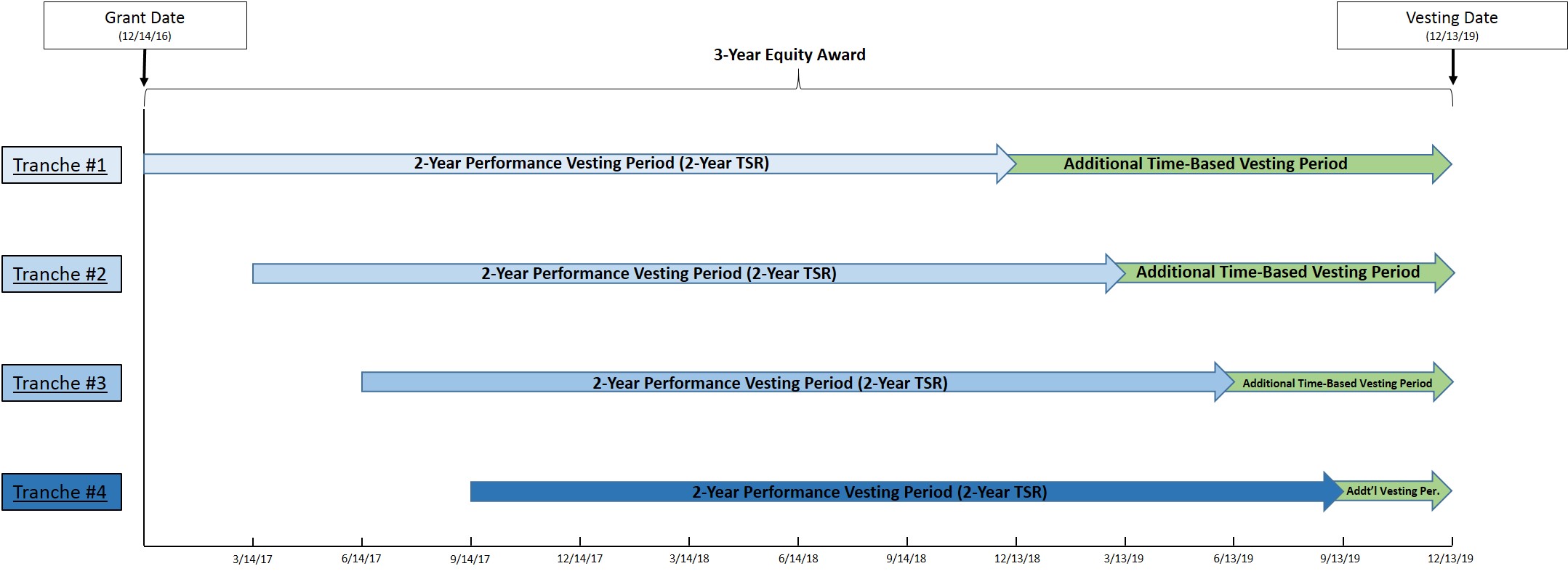

◦ | For 2016, executives’ above-target annual bonuses were the result of very strong financial performance, while the value of prior years’ equity awards were realized (or forfeited) based on longer-term total stockholder return (TSR) |

| |

Ø | The philosophy and key elements of the program have remained consistent in recent years, based on the: |

| |

◦ | Compensation Committee’s annual comprehensive review of the structure and results of application of the program, which is conducted in consultation with the Committee’s independent compensation consultant |

| |

◦ | Feedback received as part of an ongoing outreach with stockholders, as well as consistently strong "Say-on-Pay" support (92% average annual stockholder approval over the 2011 - 2016 period) |

| |

Ø | Covered in this Executive Summary are the following: |

| |

▪ | Overview of the executive compensation philosophy and key elements of the compensation program |

| |

▪ | Review of Redwood’s 2016 and longer-term performance |

| |

▪ | Illustrations of how the value of annual bonuses and long-term equity awards appropriately track Redwood’s performance, using the CEO as an example |