UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant: | ý |

Filed by a Party other than the Registrant: | o |

Check the appropriate box:

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |

x | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

REDWOOD TRUST, INC.

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

ý | No fee required. | ||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

(1) | Title of each class of securities to which transaction applies: | ||

(2) | Aggregate number of securities to which transaction applies: | ||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) | Proposed maximum aggregate value of transaction: | ||

(5) | Total fee paid: | ||

o | Fee paid previously with preliminary materials. | ||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

(1) | Amount Previously Paid: | ||

(2) | Form, Schedule or Registration Statement No.: | ||

(3) | Filing Party: | ||

(4) | Date Filed: | ||

April 27, 2020

Dear Fellow Stockholders,

By all accounts, 2019 was a historic year for Redwood Trust as we achieved several major milestones while celebrating our 25-year anniversary. We made significant progress towards realizing our vision of expanding our reach across all major throughways of housing finance. This included two strategic acquisitions and the expansion of our best-in-class securitization platform. We ended 2019 with full year GAAP earnings of $1.46 per share, and in February 2020 achieved our highest market capitalization ever as a public company.

We entered the first quarter of 2020 building on the momentum we had gained over the past year. While January and February were filled with optimism and opportunities for growth, including record monthly loan volumes, dynamics quickly shifted as the spread of the novel coronavirus (COVID-19) accelerated into a global pandemic by mid-March. This resulted in a significant dislocation in the financial markets and, seemingly overnight, an evaporation of liquidity, resulting in one of the fastest market declines in history.

The spread of COVID-19 is having a significant impact on the U.S. economy, and while our sector was not the cause of the ensuing market turmoil in which we now find ourselves, the mortgage finance markets have been hit particularly hard nonetheless. In a very short period of time we’ve made significant progress managing our liquidity through this crisis and we continue to take significant and deliberate actions across our platform to support our franchise. On April 2, 2020, we published a company update, which outlined some of the actions we have taken in response to this shifting business and financial landscape. This update can be found as a Current Report on Form 8-K within the “Investor Information-SEC Filings” section of our website at www.redwoodtrust.com.

Redwood was founded on a culture of strong risk management, and that culture continues to be the cornerstone of how we are managing through these very difficult times. While it’s too early to say when Americans can safely get our economy fully functioning again, we remain fully committed to Redwood and its stockholders as we do everything in our power to navigate through this crisis and hopefully be in a position to rebuild upon the successes we enjoyed in 2019.

Thank you for your continued support.

|  | |||

Richard D. Baum | Christopher J. Abate | |||

Chairman | Chief Executive Officer | |||

REDWOOD TRUST, INC.

One Belvedere Place, Suite 300

Mill Valley, California 94941

(415) 389-7373

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Redwood Trust, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders of Redwood Trust, Inc., a Maryland corporation, to be held on June 11, 2020 at 8:30 a.m., local time, at the Acqua Hotel, 555 Redwood Highway, Mill Valley, California 94941, for the following purposes:

1. | To elect Richard D. Baum, Christopher J. Abate, Douglas B. Hansen, Debora D. Horvath, Greg H. Kubicek, Fred J. Matera, Jeffrey T. Pero, and Georganne C. Proctor to serve as directors until the Annual Meeting of Stockholders in 2021 and until their successors are duly elected and qualify; |

2. | To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2020; |

3. | To vote on a non-binding advisory resolution to approve named executive officer compensation; |

4. | To vote on an amendment to our charter to increase the number of shares authorized for issuance; |

5. | To vote on an amendment to our Amended and Restated 2014 Incentive Award Plan to increase the number of shares authorized for issuance thereunder; and |

6. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

We have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, stockholders will not receive paper copies of our proxy materials unless they specifically request them. We will send a Notice of Internet Availability of Proxy Materials (the Notice) on or about May 1, 2020 to our stockholders of record as of the close of business on March 20, 2020. We are also providing access to our proxy materials over the Internet beginning on May 1, 2020. Electronic delivery of our proxy materials will reduce printing and mailing costs relating to our Annual Meeting.

The Notice contains instructions for accessing the proxy materials, including the Proxy Statement and our annual report, and provides information on how stockholders may obtain paper copies free of charge. The Notice also provides the date and time of the Annual Meeting; the matters to be acted upon at the Annual Meeting and the Board’s recommendation with regard to each matter to be acted upon; and information on how to attend the Annual Meeting and vote online.

Our Board of Directors has fixed the close of business on March 20, 2020 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement of the Annual Meeting.

We would like your shares to be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we respectfully request that you authorize your proxy over the Internet following the voting procedures described in the Notice. In addition, if you have requested or received a paper or email copy of the proxy materials, you can authorize your proxy over the telephone or by signing, dating and returning the proxy card sent to you. We encourage you to authorize your proxy by any of these methods even if you currently plan to attend the Annual Meeting. By doing so, you will ensure that your shares are represented and voted at the Annual Meeting.

Due to the impact of the coronavirus (COVID-19) pandemic on the ability to hold in-person meetings, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a subsequent announcement by the Company and available at www.redwoodtrust.com.

By Order of the Board of Directors,

/s/ Andrew P. Stone

Secretary

April 27, 2020

YOUR VOTE IS IMPORTANT. |

PLEASE PROMPTLY AUTHORIZE A PROXY TO CAST YOUR VOTES THROUGH THE INTERNET FOLLOWING THE VOTING PROCEDURES DESCRIBED IN THE NOTICE OR, IF YOU HAVE REQUESTED AND RECEIVED PAPER COPIES OF THE PROXY MATERIALS, BY TELEPHONE OR BY SIGNING, DATING AND RETURNING THE PROXY CARD SENT TO YOU. |

TABLE OF CONTENTS

i

REDWOOD TRUST, INC.

One Belvedere Place, Suite 300

Mill Valley, California 94941

(415) 389-7373

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 11, 2020

INTRODUCTION

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Redwood Trust, Inc., a Maryland corporation (Redwood, the Company, we, or us), for exercise at the Annual Meeting of Stockholders (the Annual Meeting) to be held on June 11, 2020 at 8:30 a.m., local time, at the Acqua Hotel, 555 Redwood Highway, Mill Valley, California 94941, and at any adjournment or postponement thereof.

We have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the Notice) to our stockholders of record, while brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice of Internet Availability of Proxy Materials. All stockholders will have the ability to access proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this Proxy Statement available on the Internet on or about May 1, 2020 and to mail the Notice to all stockholders entitled to vote at the Annual Meeting on or about May 1, 2020. We intend to mail this Proxy Statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials on or about May 1, 2020 or within three business days of such request.

The address and telephone number of our principal executive office are as set forth above and our website is www.redwoodtrust.com. Information on our website is not a part of this Proxy Statement.

Due to the impact of the coronavirus (COVID-19) pandemic on the ability to hold in-person meetings, we are planning for the possibility that the Annual Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a subsequent announcement by the Company and available at www.redwoodtrust.com.

1

INFORMATION ABOUT THE ANNUAL MEETING

Who May Attend the Annual Meeting

Only stockholders who own our common stock as of the close of business on March 20, 2020, the record date for the Annual Meeting, will be entitled to attend the Annual Meeting. In the discretion of management, we may permit certain other individuals to attend the Annual Meeting, including members of the media and our employees.

Who May Vote

Each share of our common stock outstanding on the record date for the Annual Meeting entitles the holder thereof to one vote. The record date for determining stockholders entitled to notice of, and to vote at, the Annual Meeting is the close of business on March 20, 2020. As of March 20, 2020, there were 114,816,284 shares of common stock issued and outstanding. You can vote in person at the Annual Meeting or by proxy. You may authorize your proxy through the Internet by following the voting procedures described in the Notice or, if you have requested and received paper copies of the proxy materials, by telephone or by signing, dating, and returning the proxy card sent to you. To use a particular voting procedure, follow the instructions on the Notice or the proxy card that you request and receive by mail or email.

If your shares are held in the name of a bank, broker, or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted. If your shares are not registered in your own name and you plan to cast your votes in person at the Annual Meeting, you should contact your broker or agent to obtain a broker’s proxy card and bring it to the Annual Meeting in order to vote.

Voting by Proxy; Board of Directors’ Voting Recommendations

You may authorize your proxy over the Internet or, if you request and receive a proxy card by mail or email, over the phone or by signing, dating and returning the proxy card sent to you. If you vote by proxy, the individuals named on the proxy, or their substitutes, will cast your votes in the manner you indicate. If you date, sign, and return a proxy card without marking your voting instructions, your votes will be cast in accordance with the recommendations of Redwood’s Board of Directors, as follows:

• | For the election of each of the eight nominees to serve as directors until the Annual Meeting of Stockholders in 2021 and until their successors are duly elected and qualify; |

• | For the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for 2020; |

• | For the approval of the non-binding advisory resolution approving the compensation of our named executive officers; |

• | For the approval of the amendment to our charter to increase the number of shares authorized for issuance; |

• | For the approval of the amendment to the Amended and Restated 2014 Incentive Award Plan to increase the number of shares authorized for issuance; and |

• | In the discretion of the proxy holder on any other matter that properly comes before the Annual Meeting. |

You may revoke or change your proxy at any time before it is exercised by submitting a new proxy through the Internet or by telephone, delivering to us a signed proxy with a date later than your previously delivered proxy, by voting in person at the Annual Meeting, or by sending a written revocation of your proxy addressed to Redwood’s Secretary at our principal executive office.

2

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Under rules adopted by the Securities and Exchange Commission (SEC), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending the Notice to our stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce printing and mailing costs relating to our Annual Meeting.

Quorum Requirement

The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum for the transaction of business. Abstentions and broker non-votes are counted as present for purposes of establishing a quorum. A broker non-vote occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares.

Other Matters

Our Board of Directors knows of no other matters that may be presented for stockholder action at the Annual Meeting. If other matters properly come before the Annual Meeting, however, it is intended that the persons named in the proxies will vote on those matters in their discretion.

Information About the Proxy Statement and the Solicitation of Proxies

Your proxy is solicited by our Board of Directors and we will bear the costs of this solicitation. Proxy solicitations will be made by mail, and also may be made by our directors, officers, and employees in person or by telephone, facsimile transmission, e-mail, or other means of communication. Banks, brokerage houses, nominees, and other fiduciaries will be requested to forward the proxy soliciting material to the beneficial owners of shares of our common stock entitled to be voted at the Annual Meeting and to obtain authorization for the execution of proxies on behalf of beneficial owners. We will, upon request, reimburse those parties for their reasonable expenses in forwarding proxy materials to their beneficial owners.

In addition, we have retained MacKenzie Partners, Inc., 1407 Broadway, 27th Floor, New York, NY 10018, to aid in the solicitation of proxies by mail, telephone, facsimile, e-mail and personal solicitation and to contact brokerage houses and other nominees, fiduciaries and custodians to request that such entities forward soliciting materials to beneficial owners of our common stock. For these services, we will pay MacKenzie Partners, Inc. a fee not expected to exceed $15,000, plus expenses.

Annual Report

Our 2019 Annual Report, consisting of our Annual Report on Form 10-K for the year ended December 31, 2019, is being made available to stockholders together with this Proxy Statement and contains financial and other information about Redwood, including audited financial statements for our fiscal year ended December 31, 2019. Certain sections of our 2019 Annual Report are incorporated into this Proxy Statement by reference, as described in more detail under “Information Incorporated by Reference” at the end of this Proxy Statement. Our 2019 Annual Report is also available on our website.

3

Householding

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name will receive only one copy of the Notice, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. This procedure reduces our printing and mailing costs.

Householding will not in any way affect dividend check mailings.

If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of the Notice, or if you hold stock in more than one account, and in either case you wish to receive only a single copy of this document for your household, please contact our transfer agent, Computershare Trust Company, N.A., either in writing at: Computershare Investor Services, 250 Royall Street, Canton, MA 02021; or by telephone at: (888) 472-1955.

If you participate in householding and wish to receive a separate copy of the Notice, or if you do not wish to participate in householding and prefer to receive separate copies of this document in the future, please contact Computershare as indicated above.

Beneficial owners can request information about householding from their banks, brokers, or other holders of record.

4

CORPORATE GOVERNANCE

Corporate Governance Standards

Our Board of Directors has adopted Corporate Governance Standards (Governance Standards). Our Governance Standards are available on our website as well as in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office. The Governance Standards contain general principles regarding the composition and functions of our Board of Directors and its committees.

Process for Nominating Potential Director Candidates

Identifying and Evaluating Nominees for Directors. Our Board of Directors nominates director candidates for election by stockholders at each annual meeting and elects new directors to fill vacancies on our Board of Directors between annual meetings of the stockholders. Our Board of Directors has delegated the selection and initial evaluation of potential director nominees to the Governance and Nominating Committee with input from the Chief Executive Officer and President. The Governance and Nominating Committee makes the final recommendation of candidates to our Board of Directors for nomination. Our Board of Directors, taking into consideration the assessment of the Governance and Nominating Committee, also determines whether a nominee would be an independent director.

Stockholders’ Nominees. Our Bylaws permit stockholders to nominate a candidate for election as a director at an annual meeting of the stockholders subject to compliance with certain notice and informational requirements, as more fully described below in this Proxy Statement under “Stockholder Proposals for the 2021 Annual Meeting.” A copy of the full text of our current Bylaws may be obtained by any stockholder upon written request addressed to Redwood’s Secretary at our principal executive office. Among other matters required under our Bylaws, any stockholder nominations should include the nominee’s name and qualifications for Board membership and should be addressed to Redwood’s Secretary at our principal executive office.

The policy of the Governance and Nominating Committee is to consider properly submitted stockholder nominations for candidates for election to our Board of Directors. The Governance and Nominating Committee evaluates stockholder nominations in connection with its responsibilities set forth in its written charter and applies the qualification and diversity criteria set forth in the Governance Standards.

Director Qualifications. Our Governance Standards contain Board membership criteria that apply to nominees for our Board of Directors. Each member of our Board of Directors must exhibit high standards of integrity, commitment, and independence of thought and judgment, and must be committed to promoting the best interests of Redwood. In addition, each director must devote the time and effort necessary to be a responsible and productive member of our Board of Directors. This includes developing knowledge about Redwood’s business operations and doing the work necessary to participate actively and effectively in Board and committee meetings.

Our Governance Standards also contain criteria that are intended to guide our Governance and Nominating Committee’s considerations of diversity in identifying nominees for our Board of Directors. In particular, our Governance Standards provide that the members of our Board of Directors should collectively possess a broad range of talent, skill, expertise, background, and life experience useful to effective oversight of our business and affairs and sufficient to provide sound and prudent guidance with respect to our operations and interests. The self-assessments that are conducted each year by our Board of Directors and our Governance and Nominating Committee include an assessment of whether the Board’s then current composition represents the broad range of talent, skill, expertise, background, and life experience that is called for by our Governance Standards.

5

We believe our directors have a well-rounded variety of diversity, skills, qualifications and experience, and represent an effective mix of deep company knowledge and outside perspectives. Additional information regarding the mix of experience, qualifications, attributes and skills of our directors is included under Item 1 Election of Directors on pages 11-16 of this Proxy Statement.

Director Independence

As required under Section 303A of the New York Stock Exchange (NYSE) Listed Company Manual and our Governance Standards, on February 26, 2020 our Board of Directors affirmatively determined that none of the following directors have a material relationship (either directly or as a partner, shareholder, or officer of an organization that has a relationship) with us and that each of them qualifies as “independent” under Section 303A: Richard D. Baum, Douglas B. Hansen, Mariann Byerwalter, Debora D. Horvath, Greg H. Kubicek, Fred J. Matera, Jeffrey T. Pero, and Georganne C. Proctor. The Board of Directors’ determination was made with respect to Mr. Pero after consideration of the following: Mr. Pero is a retired partner of Latham & Watkins LLP and has been a director of Redwood since November 2009; Latham & Watkins LLP provides legal services to Redwood; and retirement payments made by Latham & Watkins LLP to Mr. Pero during 2019 and prior years were adjusted to exclude any proportionate benefit received from the fees paid by Redwood to Latham & Watkins LLP.

One member of our Board of Directors, Mr. Abate, does not qualify as “independent” under Section 303A of the NYSE Listed Company Manual or our Governance Standards because he is Redwood's Chief Executive Officer.

Board Leadership Structure

At Redwood, there is a separation of the chairman and chief executive officer roles. The Chairman of the Board of Directors presides over meetings of the Board and serves as a liaison between the Board and management of Redwood. In addition, the Chairman provides input regarding Board agendas, materials, and areas of focus, and may represent Redwood to external constituencies such as investors, governmental representatives, and business counterparties. The Chairman is currently Richard D. Baum, who was elected Chairman in September 2012 and who has continuously served as an independent director of Redwood since 2001.

In addition, under the Governance Standards, each of the Audit Committee, Compensation Committee, and Governance and Nominating Committee of Redwood’s Board of Directors is comprised solely of independent directors as members.

The Board believes this leadership structure is appropriate for Redwood, as it provides for the Board to be led by, and its standing committees to be comprised of, independent directors. As an independent Chairman of the Board, Mr. Baum brings nearly two decades of experience of serving on Redwood’s Board along with the important perspective of an independent director to this leadership position.

Executive Sessions

Our Governance Standards require that our non-employee directors (i.e., the eight of our nine current directors who are not Redwood employees) meet in executive session at each regularly scheduled quarterly meeting of our Board of Directors and at such other times as determined by our Chairman. In addition, if any non-employee director is not also an independent director, then our Governance Standards require that our independent directors meet at least annually in executive session without any such non-independent directors.

6

Board of Directors’ Role in Risk Oversight

The Board of Directors takes a primary role in risk oversight. At its regular meetings, the Board of Directors reviews Redwood’s business and investment strategies and plans and seeks an understanding of the related risks as well as management’s approach to identifying and managing those risks. In carrying out its role in risk oversight, the Board of Directors receives and discusses quarterly reports from the Chief Executive Officer and Audit Committee, which also carries out a risk oversight function delegated by the Board of Directors.

Under its charter, the Audit Committee is specifically charged with (i) inquiring of management and Redwood’s independent registered public accounting firm about significant risks or exposures with respect to corporate accounting, reporting practices of Redwood, the quality and integrity of the financial reports and controls of Redwood, regulatory and accounting initiatives, and any off-balance sheet structures and (ii) assessing the steps management has taken to minimize such risks. In addition, the Audit Committee is specifically charged with regularly discussing with management Redwood’s policies with respect to risk assessment and risk management, including identification of Redwood’s major financial and operational risk exposures and the steps management has taken to monitor or control those exposures. For example, the Audit Committee receives quarterly reports from management regarding various financial risk management topics (such as interest rate risk, liquidity risk, and counterparty risk), and various operational risk management topics (such as cybersecurity, operations and regulatory compliance) and regularly discusses with management Redwood's exposure to, and management of, financial and operational risks.

The Audit Committee carries out this function by, among other things, receiving a quarterly risk management report from Redwood’s Chief Executive Officer and other Redwood officers, and a quarterly internal audit report from Redwood’s head of internal audit, reviewing these reports, and discussing them by asking questions and providing direction to management. In addition, as noted below under “Audit Committee Matters — Audit Committee Report,” the Audit Committee also receives and discusses regular and required communications from Redwood’s independent registered public accounting firm regarding, among other things, Redwood’s internal controls. In addition to discussion of these reports during Audit Committee meetings, as circumstances merit, the Audit Committee holds separate executive sessions with one or more of the Chief Executive Officer, Redwood’s head of internal audit, and representatives of Redwood’s independent registered public accounting firm to discuss any matters that the Audit Committee or these persons believe should be discussed in the absence of other members of management. Redwood's head of internal audit and the Chair of the Audit Committee also regularly communicate between Audit Committee meetings.

In addition, when appropriate, the Board of Directors may delegate to the Compensation Committee and Governance and Nominating Committee risk oversight responsibilities with respect to certain matters or request that other committees review certain risk oversight matters. For example, the Compensation Committee has been delegated the responsibility for determining, on an annual basis, whether Redwood’s compensation policies and practices are reasonably likely to have a material adverse effect on Redwood. As another example, the Governance and Nominating Committee reports to the Board of Directors the results of its analysis of potential risks related to board leadership and composition, board structure, and executive succession planning.

The Board of Directors believes that this manner of administering the risk oversight function effectively integrates oversight into the Board of Directors’ leadership structure, because the risk oversight function is carried out both at the Board level as well as through delegation to the Audit Committee, which consists solely of independent directors, and when appropriate to the Compensation Committee and Governance and Nominating Committee, which also consist solely of independent directors.

7

Corporate Responsibility

Corporate responsibility and sustainability are foundational to Redwood’s ability to grow and deliver attractive risk-adjusted returns to stockholders over the long term. The sustainability of Redwood’s business depends on a broad array of factors, including a continuing focus on investments in our people, ethics and integrity, and corporate responsibility. Taking these factors into consideration in making strategic and operational decisions is a key principle in continuing to position Redwood as a best-in-class specialty finance company that addresses the liquidity needs of all homebuyers – homeowners and investors alike. Strong corporate governance, coupled with sound financial and operational risk management, are also essential pillars that support Redwood’s growth and sustainability. Redwood’s leaders and managers collaborate to develop and maintain corporate responsibility and sustainability initiatives, measure their impact, and provide regular updates to Redwood’s Board of Directors and its standing committees. Additional information about Redwood’s corporate responsibility and sustainability programs and initiatives may be provided from time to time on Redwood’s corporate website at www.redwoodtrust.com.

Board of Directors’ Self-Evaluation Process

The Board believes it is important to periodically assess its own performance and effectiveness in carrying out its strategic and oversight role with respect to the Company. The Board evaluates its performance through annual self-assessments at the Board and Committee levels, as well as through annual individual director self-assessments that include one-on-one meetings conducted by the Chairman with each of the other directors (or, with respect to the Chairman, the Chair of the Governance and Nominating Committee). These self-assessments include analysis of the effectiveness of the Board, its Committees and its directors, how they are functioning and areas of potential improvement. The results of these performance reviews are also considered, among other things, by the Governance and Nominating Committee and the Board when considering whether to recommend a director for re-election and whether to consider new director candidates.

Communications with the Board of Directors

Stockholders and other interested parties may communicate with our Board of Directors by e-mail addressed to [email protected]. The Chairman has access to this e-mail address and provides access to other directors as appropriate. Communications that are intended specifically for non-employee directors should be addressed to the Chairman.

Director Attendance at Annual Meetings of Stockholders

Pursuant to our Governance Standards, our directors are expected to attend annual meetings of stockholders in person or telephonically. All of our directors attended last year’s annual meeting of stockholders in person. We currently expect all directors nominated for election to attend in person, or telephonically, at this year's Annual Meeting.

Code of Ethics

Our Board of Directors has adopted a Code of Ethics that applies to all of our directors, officers, and employees. Our Code of Ethics is available on our website as well as in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office.

We intend to post on our website and disclose in a Current Report on Form 8-K, to the extent required by applicable regulations, any change to the provisions of our Code of Ethics and any waiver of a provision of the Code of Ethics.

8

STOCK OWNERSHIP REQUIREMENTS

Required Stock Ownership by Directors

Pursuant to our Governance Standards, non-employee directors are required to purchase from their own funds at least $50,000 of our common stock within three years from the date of commencement of their Board membership. Vested deferred stock units (DSUs) acquired by a director under our Executive Deferred Compensation Plan through the voluntary deferral of cash compensation that otherwise would have been paid to that director are counted towards this requirement. Any director whose status has changed from being an employee director to being a non-employee director is not subject to this requirement if that director held at least $50,000 of our common stock at the time of that change in status.

Additionally, non-employee directors are required to own at least $425,000 of our common stock, including vested DSUs acquired through both voluntary and involuntary deferred compensation, within five years from the date of commencement of their Board membership. Beginning May 2020, this requirement will increase to $450,000 in connection with an increase in the annual cash retainer payable to non-employee directors (described below under the heading "Director Compensation") to ensure that ownership guidelines remain five times the annual retainer. Stock and DSUs acquired with respect to the $50,000 stock purchase requirement count toward the attainment of this additional stock ownership requirement. Compliance with the ownership requirements is measured on a purchase/acquisition cost basis.

As of the date of this Proxy Statement, all of our non-employee directors were in compliance with these requirements either due to ownership of the requisite number of shares or because the director was within the time period permitted to attain the required level of ownership.

Required Stock Ownership by Executive Officers

The Compensation Committee of our Board of Directors has set the following executive stock ownership requirements with respect to our executive officers:

• | Each executive officer is required to own stock with a value at least equal to (i) six times current salary for the Chief Executive Officer, (ii) three times current salary for the President, and (iii) two times current salary for the other executive officers; |

• | Three years are allowed to initially attain the required level of ownership and three years are allowed to acquire additional incremental shares if promoted to a position with a higher requirement or when a salary increase results in a higher requirement (if not in compliance at the indicated times, then the executive officer is required to retain net after-tax shares delivered as compensation or from the Executive Deferred Compensation Plan until compliance is achieved); |

• | All shares owned outright are counted, including those held in trust for the executive officer and his or her immediate family, as well as vested DSUs and any other vested shares held pursuant to other employee plans; and |

• | Compliance with the guidelines is measured on a purchase/acquisition cost basis, and includes DSUs acquired through both voluntary and involuntary deferred compensation. |

9

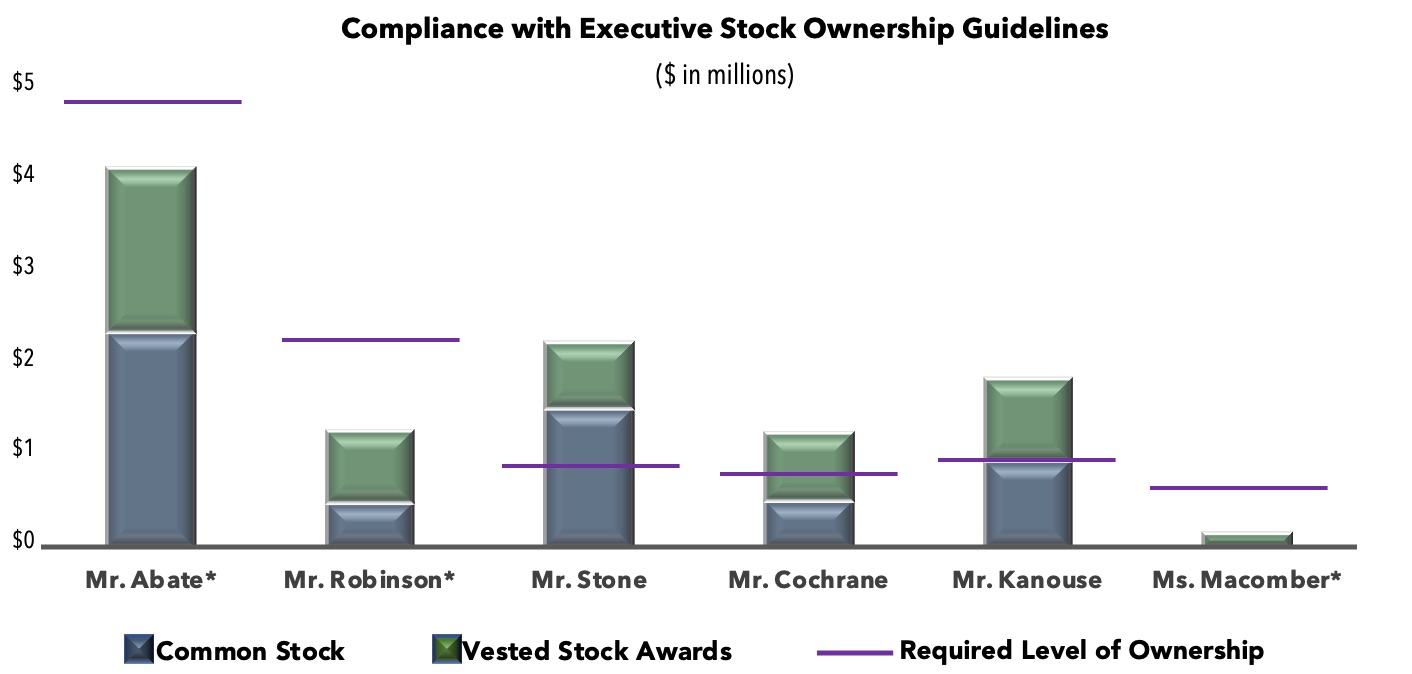

As of the date of this Proxy Statement, all of Redwood’s executive officers were in compliance with these requirements either due to ownership of the requisite number of shares or because he or she was within the time period permitted to attain the required level of ownership. The chart below illustrates the stock ownership level relative to the applicable requirement for each of our executive officers and Mr. Kanouse (who served as an executive officer in 2019).

|

Stock ownership is calculated on a purchase/acquisition price cost basis in accordance to Executive Ownership Requirements as of April 15, 2020.

* Mr. Abate, Mr. Robinson and Ms. Macomber are within the time period permitted to attain the increased level of ownership required for their executive officer roles, respectively. Initial ownership levels must be attained by May 2021 for Mr. Abate and Mr. Robinson and by December 2021 for Ms. Macomber. Incremental ownership levels due to the base salary increases made by the Compensation Committee in December 2019 for 2020 must be attained by January 2023.

10

ITEM 1 — ELECTION OF DIRECTORS

The nominees for the eight director positions are set forth below. In the event we are advised prior to the Annual Meeting that any nominee will be unable to serve or for good cause will not serve as a director if elected at the Annual Meeting, the proxies will cast votes for any person who shall be nominated by the present Board of Directors to fill such directorship. On April 9, 2020, Mariann Byerwalter announced that she is retiring from the Board of Directors, effective as of the 2020 Annual Meeting of Stockholders. Effective upon Ms. Byerwalter's retirement, the Board of Directors is expected to reduce the size of the Board from nine to eight directors. The nominees listed below currently are serving as directors of Redwood.

Vote Required

If a quorum is present, the election of each nominee as a director requires a majority of the votes cast with respect to such nominee at the Annual Meeting. For purposes of the election of directors, a majority of the votes cast means that the number of votes cast “for” a nominee for election as a director exceeds the number of votes cast “against” that nominee. Cumulative voting in the election of directors is not permitted. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the results of the vote in the election of directors. In accordance with Redwood’s Bylaws and its Policy Regarding Majority Voting, any incumbent nominee for director must offer to resign from the Board if he or she fails to receive the required number of votes for re-election.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE NOMINEES IDENTIFIED BELOW.

Nominees to Board of Directors

Name | Position with Redwood | |

Richard D. Baum | Chairman of the Board | |

Christopher J. Abate | Director and Chief Executive Officer | |

Douglas B. Hansen | Director | |

Debora D. Horvath | Director | |

Greg H. Kubicek | Director | |

Fred J. Matera | Director | |

Jeffrey T. Pero | Director | |

Georganne C. Proctor | Director | |

Set forth on the following pages is a summary of the experience, qualifications, attributes and skills of each of the nominees for election at the Annual Meeting, as well as certain biographical information regarding each of these individuals.

11

Summary of Director Nominees’ Experience, Qualifications, Attributes and Skills

Director Nominees | ||||||||

Baum | Abate | Hansen | Horvath | Kubicek | Matera | Pero | Proctor | |

Leadership | ü | ü | ü | ü | ü | ü | ü | ü |

Real Estate Industry | ü | ü | ü | ü | ü | ü | ||

Accounting/Finance | ü | ü | ü | ü | ü | ü | ||

Insurance Industry | ü | ü | ü | |||||

Government | ü | |||||||

Capital Markets | ü | ü | ü | ü | ü | |||

Corporate / Institutional Governance | ü | ü | ü | ü | ||||

Banking / Investment Management | ü | ü | ü | |||||

Technology | ü | |||||||

Richard D. Baum, age 73, is Chairman of the Board and has been a director of Redwood since 2001. Mr. Baum is currently the President and Managing Partner of Atwater Retirement Village LLC (a private company). From 2008 to mid-2009, Mr. Baum served as Executive Director of the California Commission for Economic Development. He also served as the Chief Deputy Insurance Commissioner for the State of California from 1991 to 1994 and 2003 to 2007. Mr. Baum served from 1996 to 2003 as the President and CEO of Care West Insurance Company, a worker’s compensation insurance company, and prior to 1991 as Senior Vice President of Amfac, Inc., a diversified operating company engaged in various businesses, including real estate development and property management. Mr. Baum holds a B.A. from Stanford University, an M.A. from the State University of New York, and a J.D. from George Washington University, National Law Center.

The Board of Directors concluded that Mr. Baum should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

• | Leadership attributes and management experience |

• | Experience as a chief executive officer |

• | Experience in government service and financial regulation |

• | Expertise and experience relating to the insurance industry |

• | Expertise and experience relating to the real estate development industry and property management business |

• | Expertise and experience relating to institutional governance |

• | Professional and educational background |

12

Christopher J. Abate, age 40, has served as Chief Executive Officer since May 2018 and as a director since December 2017. Mr. Abate has been employed with Redwood since April 2006, previously serving as Redwood’s President from July 2016 to May 2018, Chief Financial Officer from March 2012 to August 2017, and Controller from January 2009 to March 2013. Before joining Redwood, Mr. Abate was employed by PricewaterhouseCoopers LLP. He holds a B.A. in accounting and finance from Western Michigan University, an M.B.A. from the University of California at Berkeley and Columbia University.

The Board of Directors concluded that Mr. Abate should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

• | Leadership attributes and management experience, including experience as President, Chief Financial Officer, and Controller of Redwood |

• | Skill and experience in managing balance sheet exposures and managing risks |

• | Skill and experience in executing capital markets transactions |

• | Finance and accounting expertise and experience |

• | Professional and educational background |

Douglas B. Hansen, age 62, is a founder of Redwood, and served as Redwood’s President from 1994 through 2008. Mr. Hansen retired from his position as President of Redwood at the end of 2008. Mr. Hansen has been a director of Redwood since 1994. Mr. Hansen serves on the Board of Directors of Four Corners Property Trust, Inc., a publicly traded real estate investment trust. Mr. Hansen also serves on the board of River of Knowledge, a not-for-profit institution. Mr. Hansen holds a B.A. in Economics from Harvard College and an M.B.A. from Harvard Business School.

The Board of Directors concluded that Mr. Hansen should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

• | Leadership attributes and management experience, including experience as President of Redwood Trust since its founding in 1994 through 2008 |

• | Skill and experience in investing in real estate-related assets and managing portfolios of such investments |

• | Skill and experience in managing balance sheet exposures and managing risks |

• | Skill and experience in executing capital markets transactions |

• | Experience in finance and accounting matters |

• | Professional and educational background |

Debora D. Horvath, age 65, has been a director of Redwood since 2016. Ms. Horvath is Principal of Horvath Consulting LLC, which she founded in 2010. From 2008 to 2010, Ms. Horvath served as an Executive Vice President for JP Morgan Chase & Co. Ms. Horvath served as an Executive Vice President and Chief Information Officer for Washington Mutual, Inc. from 2004 to 2008. Ms. Horvath, a 25-year veteran from General Electric Company (“GE”), served 12 years as a Senior Vice President and Chief Information Officer for the GE insurance businesses. Ms. Horvath has been a Director of StanCorp Financial Group, Inc. since 2013. She was a director of the Federal Home Loan Bank of Seattle from 2012 to January 2014. Ms. Horvath holds a B.A. from Baldwin Wallace University.

The Board of Directors concluded that Ms. Horvath should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

• | Leadership attributes and management experience |

• | Experience as a chief information officer |

• | Expertise and experience relating to information technology and technology risk management |

• | Expertise and experience relating to institutional governance |

• | Professional and educational background |

13

Greg H. Kubicek, age 63, has been a director of Redwood since 2002. Mr. Kubicek is President of The Holt Group, Inc., a real estate company and associated funds that purchase, develop, own, and manage real estate properties. Mr. Kubicek has also served as Chairman of the Board of Cascade Corporation, an international manufacturing corporation. Mr. Kubicek holds a B.A. in Economics from Harvard College.

The Board of Directors concluded that Mr. Kubicek should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

• | Leadership attributes |

• | Management and entrepreneurial experience |

• | Expertise and experience in the real estate development industry |

• | Experience and expertise in the property management business |

• | Professional and educational background |

Fred J. Matera, age 56, has been a director of Redwood since March 2019. Mr. Matera is currently Co-Founder and Managing Partner of MoVi Partners, LLC, an advisory firm focused on the fintech industry. Prior to this, Mr. Matera served as President of EquiFi Corporation, a startup developer of home equity-based financing solutions for homeowners, from October 2018 to March 2019. Between September 2016 and October 2017, Mr. Matera served as Chief Operating Officer and Chief Investment Officer of LendUS, LLC, which does business as RPM Mortgage, and engages in mortgage origination and servicing. From 2008 to May 2016, Mr. Matera was employed by Redwood, serving in various capacities, including: as Executive Vice President-Commercial Investments and Finance, responsible for the commercial mortgage banking and investments business Redwood was engaged in during that time; as Chief Investment Officer, responsible for Redwood’s investment and capital markets activities; and as a Managing Director. Prior to joining Redwood, beginning in 2001, Mr. Matera was a Managing Director and Co-Head of Structured Credit at RBS Greenwich Capital. He began his career in finance in 1989 as a mortgage trader, and has held a number of fixed income trading positions in financial services firms, including Goldman Sachs, DLJ, and First Boston. Prior to graduating from business school, Mr. Matera was an analyst at the Federal Reserve Bank of New York. Mr. Matera has a B.A. in economics from Tufts University, and an M.B.A. in finance from The Wharton School of the University of Pennsylvania.

The Board of Directors concluded that Mr. Matera should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

• | Leadership attributes |

• | Management and entrepreneurial experience |

• | Expertise as a chief investment officer |

• | Expertise and experience relating to residential and commercial mortgage finance, originations and operations |

• | Expertise and experience in structuring and negotiating debt and equity financings |

• | Professional and educational background |

14

Jeffrey T. Pero, age 73, has been a director of Redwood since November 2009. Mr. Pero retired in October 2009, after serving as a partner for more than 23 years, from the international law firm of Latham & Watkins LLP. At Latham & Watkins LLP, Mr. Pero’s practice focused on advising clients regarding corporate governance matters, debt and equity financings, mergers and acquisitions, and compliance with U.S. securities laws; Mr. Pero also served in various firm management positions. Mr. Pero served on the Board of Directors of BRE Properties, Inc. from 2009 to 2014. Mr. Pero holds a B.A. from the University of Notre Dame and a J.D. from New York University School of Law.

The Board of Directors concluded that Mr. Pero should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

• | Expertise and experience relating to corporate governance |

• | Management experience |

• | Expertise and experience relating to real estate investment trusts |

• | Expertise and experience in structuring and negotiating debt and equity financings |

• | Expertise and experience relating to the U.S. securities laws |

• | Professional and educational background |

Georganne C. Proctor, age 63, has been a director of Redwood since March 2006. Ms. Proctor is the former Chief Financial Officer of TIAA-CREF, and served in that position from June 2006 to July 2010. Additionally, Ms. Proctor served jointly as Chief Financial Officer and Executive Vice President for Enterprise Integration at TIAA-CREF from January 2010 to July 2010. From July 2010 to October 2010, she continued to serve as Executive Vice President for Enterprise Integration at TIAA-CREF. From 2003 to 2005, Ms. Proctor was Executive Vice President of Golden West Financial Corporation, a thrift institution. From 1994 to 1997, Ms. Proctor was Vice President of Bechtel Group, a global engineering firm, and also served as its Senior Vice President and Chief Financial Officer from 1997 to 2002 and as a director from 1999 to 2002. From 1991 to 1994, Ms. Proctor served as finance director of certain divisions of The Walt Disney Company, a diversified worldwide entertainment company. Ms. Proctor currently serves on the Board of Directors of Sculptor Capital Management Group Inc. and Blucora, Inc., serving as Blucora’s Board Chair. Ms. Proctor previously served on the Board of Directors of Kaiser Aluminum Corporation from 2006 to 2009 and SunEdison, Inc. from 2013 to 2017. Ms. Proctor holds a B.S. in Business Management from the University of South Dakota and an M.B.A. from California State University East Bay.

The Board of Directors concluded that Ms. Proctor should be nominated to continue to serve as a director on account of, among other things, the following experience, qualifications, attributes, and skills:

• | Management experience |

• | Experience as a chief financial officer |

• | Expertise and experience in the banking, insurance, and investment management industries |

• | Professional and educational background |

15

Current Director — Retirement Scheduled for June 2020

Mariann Byerwalter, age 59, has been a director of Redwood since 1998. Ms. Byerwalter is Chairman Emeritus of the Board of Directors of SRI International, an independent nonprofit technology research and development organization, and Chairman of JDN Corporate Advisory, LLC, a privately held advisory services firm. Ms. Byerwalter served as interim CEO and President of Stanford Health Care from January 1, 2016 to July 4, 2016. Ms. Byerwalter served as the Chief Financial Officer and Vice President for Business Affairs of Stanford University from 1996 to 2001. She was a partner and co-founder of America First Financial Corporation from 1987 to 1996, and she served as Chief Operating Officer, Chief Financial Officer, and a director of America First Eureka Holdings, a publicly traded institution and the holding company for Eureka Bank, from 1993 to 1996. She also serves on the Board of Directors of Pacific Life Corp., Franklin Resources, Inc., the Lucile Packard Children’s Hospital, and the Stanford Hospital and Clinics Board of Directors (Chair, 2006-2013). In April 2012, she completed her third term on the Board of Trustees of Stanford University. Ms. Byerwalter holds a B.A. from Stanford University and an M.B.A. from Harvard Business School.

On April 9, 2020, Ms. Byerwalter announced that she is retiring from the Board of Directors, effective as of the 2020 Annual Meeting of Stockholders, and will not stand for reelection at the 2020 Annual Meeting. Ms. Byerwalter's retirement follows more than 20 years of service as a member of the Board of Directors.

The Board of Directors concluded that Ms. Byerwalter's long-time service as a director was supported by, among other things, the following experience, qualifications, attributes, and skills:

• | Leadership attributes and management and entrepreneurial experience |

• | Experience as a chief financial officer |

• | Expertise and experience in the banking and insurance industries |

• | Expertise and experience relating to corporate and institutional governance |

• | Professional and educational background |

16

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board of Directors currently consists of 9 directors. On April 9, 2020, Mariann Byerwalter announced that she is retiring from the Board of Directors, effective as of the 2020 Annual Meeting of Stockholders. Effective upon Ms. Byerwalter's retirement, our Board of Directors is expected to reduce the size of the Board from nine to eight directors.

Our Board of Directors has established three standing committees of the Board: the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee. The membership of each committee and the function of each committee are described below. Each of the committees has adopted a charter and the charters of all committees are available on our website and in print at the written request of any stockholder addressed to Redwood’s Secretary at our principal executive office.

Our Board of Directors held a total of 10 meetings during 2019. The non-employee directors of Redwood met in executive session at five meetings during 2019. Mr. Baum presided at executive sessions of the non-employee directors, as well as at executive sessions of the independent directors. No director attended fewer than 75% of the meetings of the Board of Directors and the committees on which he or she served and all of our directors attended last year’s annual meeting of stockholders in person.

Audit Committee

We have a separately-designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The Audit Committee provides oversight regarding accounting, auditing, risk management, and financial reporting practices of Redwood. The Audit Committee consists solely of non-employee directors, all of whom our Board of Directors has determined are independent within the meaning of the listing standards of the NYSE and the rules of the SEC. Our Board of Directors has determined that all members of the Audit Committee are “financially literate” within the meaning of the applicable regulations and standards and has designated Ms. Proctor as an “audit committee financial expert” within the meaning of the applicable regulations and standards. The Audit Committee met seven times in 2019 in order to carry out its responsibilities, as discussed below under “Audit Committee Matters — Audit Committee Report.”

Compensation Committee

The Compensation Committee reviews and approves Redwood’s compensation philosophy, reviews the competitiveness of Redwood’s compensation practices, as well as risks that may arise from those practices, determines and approves the annual base salaries and incentive compensation paid to our executive officers, approves the terms and conditions of proposed incentive plans applicable to our executive officers and other employees, approves and oversees the administration of Redwood’s employee benefit plans, and reviews and approves hiring and severance arrangements for our executive officers. The Compensation Committee consists solely of non-employee directors, each of whom our Board of Directors has determined is independent within the meaning of the listing standards of the NYSE, are “non-employee directors” within the meaning of the rules of the SEC, and are “outside directors” within the meaning of the rules of the Internal Revenue Service (the IRS). The Compensation Committee met eight times in 2019 in order to carry out its responsibilities, as discussed below under “Executive Compensation — Compensation Discussion and Analysis.”

Governance and Nominating Committee

The Governance and Nominating Committee reviews and considers corporate governance guidelines and principles, evaluates potential director candidates and recommends qualified candidates to the full Board, reviews the management succession plan and evaluates executives in connection with succession planning, and oversees the evaluation of the Board of Directors. The Governance and Nominating Committee consists solely of non-employee directors, each of whom our Board of Directors has determined is independent within the meaning of the listing standards of the NYSE. The Governance and Nominating Committee met five times in 2019 in order to carry out its responsibilities.

17

Committee Members

The current members of each of the three standing committees are listed below, with the Chair appearing first.

Audit | Compensation | Governance and Nominating | ||

Greg H. Kubicek | Georganne C. Proctor | Jeffrey T. Pero | ||

Mariann Byerwalter | Richard D. Baum | Richard D. Baum | ||

Debora D. Horvath | Debora D. Horvath | Mariann Byerwalter | ||

Georganne C. Proctor | Jeffrey T. Pero | Greg H. Kubicek | ||

DIRECTOR COMPENSATION

Information on our non-employee director cash compensation paid (or to be paid) during the annual periods commencing in May 2018, May 2019, and May 2020, is set forth in the tables below. Director cash compensation is paid quarterly, in arrears.

Director Cash Compensation - Prior to May 2020 | ||||||||||

Annual Period Commencing: | ||||||||||

May 2018 | May 2019 | |||||||||

Annual Retainer * | $ | 85,000 | $ | 85,000 | ||||||

Committee Meeting Fee (in-person attendance) | $ | 2,000 | $ | 2,000 | ||||||

Committee Meeting Fee (telephonic attendance) | $ | 1,000 | $ | 1,000 | ||||||

———— | ||||||||||

* The Chairs of the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee each receive an additional annual cash retainer of $20,000, and the additional annual cash retainer payable to the Chairman of the Board of the Directors is $75,000. | ||||||||||

Commencing in May 2020, non-employee directors that are members of Board Committees will receive a retainer for their service on each Committee, and will no longer receive committee meeting attendance fees. In cases where a non-employee director is formally invited to participate in a committee meeting of which he or she is not a member of, he or she will be paid the committee meeting attendance fee for either in-person or telephonic attendance as outlined below.

Director Cash Compensation - Beginning May 2020 | ||||||

Annual Period Commencing: | ||||||

May 2020 | ||||||

Annual Retainer * | $ | 85,000 | ||||

Retainer for Service as a Committee Member (per Committee)** | $ | 12,500 | ||||

———— | ||||||

* The Chairs of the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee will each receive an additional annual cash retainer of $20,000, and the additional annual cash retainer payable to the Chairman of the Board of the Directors will be $75,000. | ||||||

**For the annual period commencing May 2020, non-employee directors who are members of Board Committees will receive a retainer for their service on each Committee and will no longer receive committee meeting attendance fees. In cases where a non-employee director is formally invited to participate in a committee meeting of which he or she is not a member, he or she will be paid $2,000 per meeting for in-person attendance and $1,000 per meeting for telephonic attendance. | ||||||

18

After submission of appropriate documentation on a timely basis, non-employee directors are also reimbursed for reasonable out-of-pocket expenses incurred in attending Board and committee meetings, as well as for their and, in some cases, their guests’ attendance at other Redwood-related meetings or events. Non-employee directors may also be reimbursed for out-of-pocket expenses incurred in attending conferences or educational seminars that relate to their Board service and are approved by the Chair of the Governance and Nominating Committee.

Non-employee directors are also granted deferred stock units (or comparable equity-based awards) each year at the time of the annual meeting of stockholders. The number of deferred stock units granted is determined by dividing the dollar value of the grant by the closing price of Redwood’s common stock on the NYSE on the day of grant (and rounding to the nearest whole share amount). In May 2019, non-employee directors received an annual DSU award valued at $110,000. Non-employee directors may also be granted equity-based awards upon their initial election to the Board. These initial and annual DSU awards are fully vested upon grant, and they are generally subject to a mandatory three-year holding period. Dividend equivalent rights on DSUs are generally paid in cash to directors on each dividend distribution date. DSUs may be credited under our Executive Deferred Compensation Plan.

Each director may elect to defer receipt of cash compensation or dividend equivalent rights through Redwood's Executive Deferred Compensation Plan. Cash balances in the Executive Deferred Compensation Plan are unsecured liabilities of Redwood and are utilized by Redwood as available capital to fund investments and operations. Based on each director’s election, deferred compensation can either be deferred into a cash account and earn a rate of return that is equivalent to 120% of the applicable long-term federal rate published by the IRS compounded monthly or be deferred into deferred stock units which will, among other things, entitle them to receive dividend equivalent rights related to those units.

At an April 16, 2020 meeting of the Board of Directors, the Board approved certain changes to non-employee director compensation for the May 2020 to May 2021 annual period. In connection with these changes, in 2019 the Compensation Committee's independent compensation consultant, Frederic W. Cook & Co., Inc. (FW Cook) conducted an independent review of Redwood's non-employee director compensation program at the request of the Compensation Committee. The review conducted by FW Cook included benchmarking against non-employee director compensation at the companies that comprise Redwood's executive compensation benchmarking peer group. The changes for the program commencing in May 2020 are intended to keep Redwood's total average annual compensation for non-employee directors near the middle of the compensation benchmarking peer group. Further details regarding the executive compensation benchmarking peer group and benchmarking practices are provided on pages 44 to 47 of this Proxy Statement under the heading "Executive Compensation - Compensation Benchmarking for 2019". Set forth below is a list of the changes approved, in each case, commencing in May 2020:

• | Committee meeting attendance fees for Committee members were replaced with a $12,500 retainer for service on each Committee. |

• | Committee meeting attendance fees for a non-employee director formally invited to participate in a committee meeting of which he or she is not a member continued to be $2,000 (in person attendance) and $1,000 (telephonic attendance). |

Update Regarding 2020 Director Compensation in Response to Impacts of COVID-19 Pandemic

As part of its response to the impact of the COVID-19 pandemic on Redwood and the market price of Redwood’s common stock, the Board of Directors determined on April 24, 2020 to reduce directors’ annual compensation for the upcoming year. In particular, the Board of Directors is reducing the value of the above-described annual grant of DSUs that non-employee directors are scheduled to receive in 2020 by 30%, to $77,000. As a result, on the 2020 Annual Meeting date, non-employee directors who are re-elected will receive an annual grant of vested DSUs determined by dividing $77,000 by the closing price of Redwood’s common stock on the meeting date.

19

Non-Employee Director Compensation — 2019

The following table provides information on non-employee director compensation for the 2019 calendar year. Director compensation is set by the Board and is subject to change. Directors who are employed by Redwood do not receive any compensation for their Board activities.

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | All Other Compensation ($) | Total ($) | ||||||||||

Richard D. Baum | $ | 180,000 | $ | 109,988 | — | $ | 289,988 | |||||||

Mariann Byerwalter | $ | 102,000 | $ | 109,988 | — | $ | 211,988 | |||||||

Douglas B. Hansen | $ | 95,000 | $ | 109,988 | — | $ | 204,988 | |||||||

Debora D. Horvath | $ | 106,000 | $ | 109,988 | — | $ | 215,988 | |||||||

Greg H. Kubicek | $ | 124,000 | $ | 109,988 | — | $ | 233,988 | |||||||

Fred J. Matera (4) | $ | 78,833 | $ | 130,531 | — | $ | 209,364 | |||||||

Jeffrey T. Pero | $ | 125,000 | $ | 109,988 | — | $ | 234,988 | |||||||

Georganne C. Proctor | $ | 130,000 | $ | 109,988 | — | $ | 239,988 | |||||||

(1) | Fees earned are based on the non-employee director compensation policy in place for 2019: (i) annual cash retainer of $85,000 for 2019; (ii) additional annual retainer for the Chairman of the Board of $75,000 for 2019; (iii) additional annual retainer for Audit Committee Chair, Compensation Committee Chair, and Governance and Nominating Committee Chair of $20,000; (iv) committee meeting fee (in person attendance) of $2,000 per meeting; and (v) committee meeting fee (telephonic attendance) of $1,000 per meeting. |

(2) | Stock awards consisted of an annual grant of vested deferred stock units. The value of deferred stock units awarded was determined in accordance with FASB Accounting Standards Codification Topic 718. The value of dividend equivalent rights associated with deferred stock units was taken into account in establishing the value of these deferred stock units and previously granted deferred stock units. Therefore, dividend equivalent rights payments made during 2019 to non-employee directors are not considered compensation or other amounts reported in the table above. Information regarding the assumptions used to value our non-employee directors' deferred stock units is provided in Note 18 to our consolidated financial statements included in our Annual Report on Form 10‑K for the year ended December 31, 2019, filed with the Securities and Exchange Commission on March 2, 2020. |

(3) | As of December 31, 2019, the aggregate number of stock awards outstanding for each non-employee director was as follows: Richard D. Baum had 18,596 vested DSUs; Douglas B. Hansen had 18,596 vested DSUs; Mariann Byerwalter had 18,596 vested DSUs; Debora D. Horvath had 18,596 vested DSUs; Greg H. Kubicek had 192,988 vested DSUs; Fred J. Matera had 8,142 vested DSUs; Jeffrey T. Pero had 35,372 vested DSUs; and Georganne C. Proctor had 102,823 vested DSUs. |

(4) | Mr. Matera joined Redwood's Board on March 1, 2019 and, at his appointment, received a prorated grant of deferred stock units in addition to the annual non-employee director grant of deferred stock units in May 2019. |

20

The following table provides information on stock unit distributions in common stock to non-employee directors from our Executive Deferred Compensation Plan in 2019. Stock units distributed represent compensation previously awarded in prior years and were reported as director or executive compensation in those prior years.

Name | Stock Units Distributed (#)(1) | Aggregate Value of Stock Units Distributed ($)(2) | |||||

Richard D. Baum | 6,310 | $ | 102,033 | ||||

Douglas B. Hansen | 6,310 | $ | 102,033 | ||||

Mariann Byerwalter | 6,310 | $ | 102,034 | ||||

Debora Horvath | 7,310 | $ | 118,393 | ||||

Jeffrey T. Pero | 6,310 | $ | 102,034 | ||||

(1)Deferred stock units distributed in 2019 originally were awarded in 2016.

(2) | The aggregate value of stock units distributed is calculated by multiplying the number of stock units distributed by the fair market value of Redwood common stock on the date of distribution. |

21

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

Executive officers of Redwood as of April 15, 2020 are listed in the table below. For purposes of this Proxy Statement, each of Mr. Abate, Mr. Robinson, Mr. Stone, Mr. Cochrane, and Mr. Kanouse (who served as an executive officer in 2019) were Named Executive Officers (NEOs) in 2019.

Name | Position with Redwood as of April 15, 2020 | Age | ||

Christopher J. Abate | Chief Executive Officer | 40 | ||

Dashiell I. Robinson | President | 40 | ||

Andrew P. Stone | Executive Vice President, General Counsel & Secretary | 49 | ||

Collin L. Cochrane | Chief Financial Officer | 43 | ||

Sasha G. Macomber | Chief Human Resource Officer | 51 | ||

Biographical information regarding these executive officers and Mr. Kanouse (who served as an executive officer in 2019) is set forth below.

Christopher J. Abate, age 40, serves as Chief Executive Officer of Redwood Trust, Inc. and as a director. Mr. Abate has been employed with Redwood since April 2006, previously serving as Redwood’s President from July 2016 to May 2018, Chief Financial Officer from March 2012 to August 2017, and Controller from January 2009 to March 2013. Before joining Redwood, Mr. Abate was employed by PricewaterhouseCoopers LLP. He holds a B.A. in accounting and finance from Western Michigan University, and an M.B.A. from the University of California at Berkeley and Columbia University.

Dashiell I. Robinson, age 40, serves as President of Redwood Trust, Inc. He joined the company as Executive Vice President in September 2017. Prior to joining Redwood, Mr. Robinson was employed at Wells Fargo Securities, serving as the Head of Mortgage Finance within the Asset-Backed Finance Group. In that role, Mr. Robinson led a team of banking professionals responsible for financing and distributing an array of residential mortgage products, and serving a broad suite of the firm's operating and investing clients. Prior to his employment at Wells Fargo, Mr. Robinson was employed within the Structured Credit Products Group at Wachovia Capital Markets from 2001 to 2008, serving in banking, structuring and risk mitigation roles. Mr. Robinson holds a B.A. in English from Georgetown University.

Andrew P. Stone, age 49, serves as Executive Vice President, General Counsel, and Secretary of Redwood Trust, Inc. Mr. Stone has been employed by Redwood since December 2008. Prior to joining Redwood, he served as Deputy General Counsel of Thomas Weisel Partners Group, Inc. from 2006 to 2008 and between 1996 and 2006 practiced corporate and securities law at Sullivan & Cromwell LLP and Brobeck, Phleger & Harrison LLP. Mr. Stone holds a B.A. in mathematics and history from Kenyon College and a J.D. from New York University School of Law.

Collin L. Cochrane, age 43, serves as Chief Financial Officer of Redwood Trust, Inc. Mr. Cochrane has also served as Redwood's Controller and Managing Director since March of 2013. Prior to joining Redwood in 2013, Mr. Cochrane served as Chief Accounting Officer and Controller for iStar Financial Inc., where he was employed from 2001 to March 2013. Prior to joining iStar Financial, Mr. Cochrane was employed as an auditor by Ernst & Young LLP from 1999 to 2001. Mr. Cochrane is a certified public accountant and holds a B.S. in Accounting from the Leventhal School of Accounting at the University of Southern California.

Sasha G. Macomber, age 51, has serves as Chief Human Resource Officer of Redwood Trust, Inc.. Prior to joining Redwood, Ms. Macomber spent 11 years with Peet’s Coffee in the San Francisco Bay Area, leading various aspects of human resources including talent acquisition, talent management, HR business partnerships, employee engagement, and leadership communications. Ms. Macomber has also held HR leadership roles within consumer goods and technology companies, including The North Face, Room & Board, and QRS Corporation. Ms. Macomber has a B.A. in English Literature from Mills College and a M.S. in Organizational Development from the University of San Francisco.

22

Garnet W. Kanouse, age 47, serves as Managing Director and Head of the Residential business at Redwood Trust, Inc. He has been with Redwood since 2005 and has held a variety of capital markets, business development and portfolio management roles at the company. Prior to joining Redwood, Mr. Kanouse spent 10 years in Chicago at Bank One and predecessor entities in various fixed income capacities, primarily as a member of the team responsible for a portfolio of mezzanine asset-backed and first-loss residential and commercial mortgage-backed securities. Mr. Kanouse holds a B.S. in Accounting from the University of Colorado and an M.B.A. in Finance from the University of Chicago.

23

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information, as of April 15, 2020, on the beneficial ownership of our common stock by our current directors and executive officers, our NEOs and by all of our current directors and executive officers as a group. As indicated in the notes, the table includes common stock equivalents held by these individuals through Redwood-sponsored benefits programs. Except as otherwise indicated and for such power that may be shared with a spouse, each person has sole investment and voting power with respect to the shares shown to be beneficially owned. Beneficial ownership is determined in accordance with the rules of the SEC.

Executive Officers | Number of Shares of Common Stock Beneficially Owned(1) | Percent of Class(2) | ||

Christopher J. Abate(3) | 259,042 | * | ||

Dashiell I. Robinson(4) | 78,717 | * | ||

Andrew P. Stone(5) | 130,435 | * | ||

Collin L. Cochrane(6) | 75,506 | * | ||

Garnet W. Kanouse(7) | 113,864 | * | ||

Sasha G. Macomber(8) | 9,246 | * | ||

Non-Employee Directors | ||||

Richard D. Baum(9) | 60,211 | * | ||

Douglas B. Hansen(10) | 363,476 | * | ||

Mariann Byerwalter(11) | 30,566 | * | ||

Debora D. Horvath(12) | 31,941 | * | ||

Greg H. Kubicek(13) | 307,260 | * | ||

Fred J. Matera(14) | 20,934 | * | ||

Jeffrey T. Pero(15) | 104,303 | * | ||

Georganne C. Proctor(16) | 111,468 | * | ||

All directors and executive officers as a group (14 persons)(17) | 1,696,969 | 1.47% | ||

* Less than 1%.

(1) | Represents shares of common stock outstanding and common stock underlying performance stock units and deferred stock units that have vested or will vest within 60 days of April 15, 2020. |

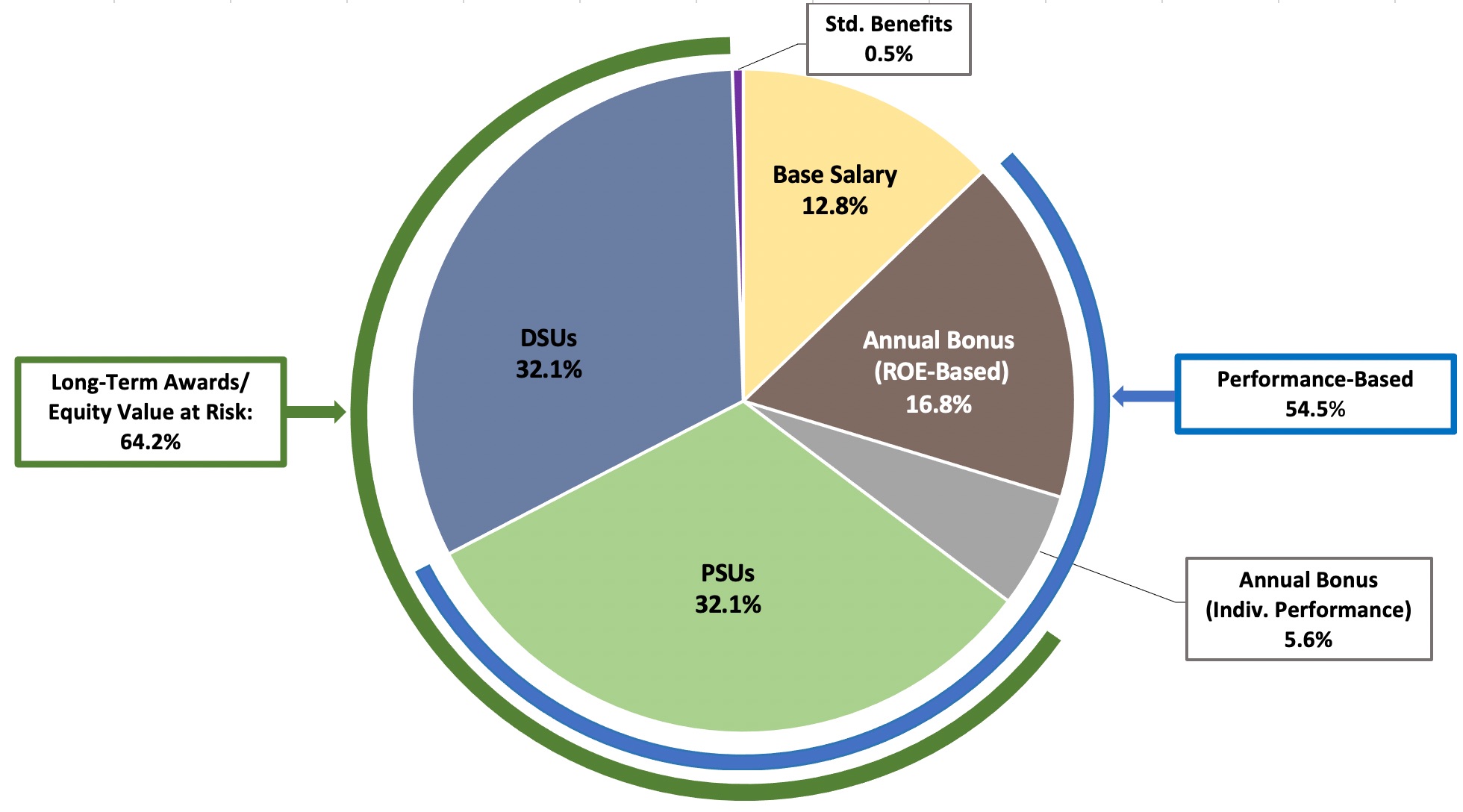

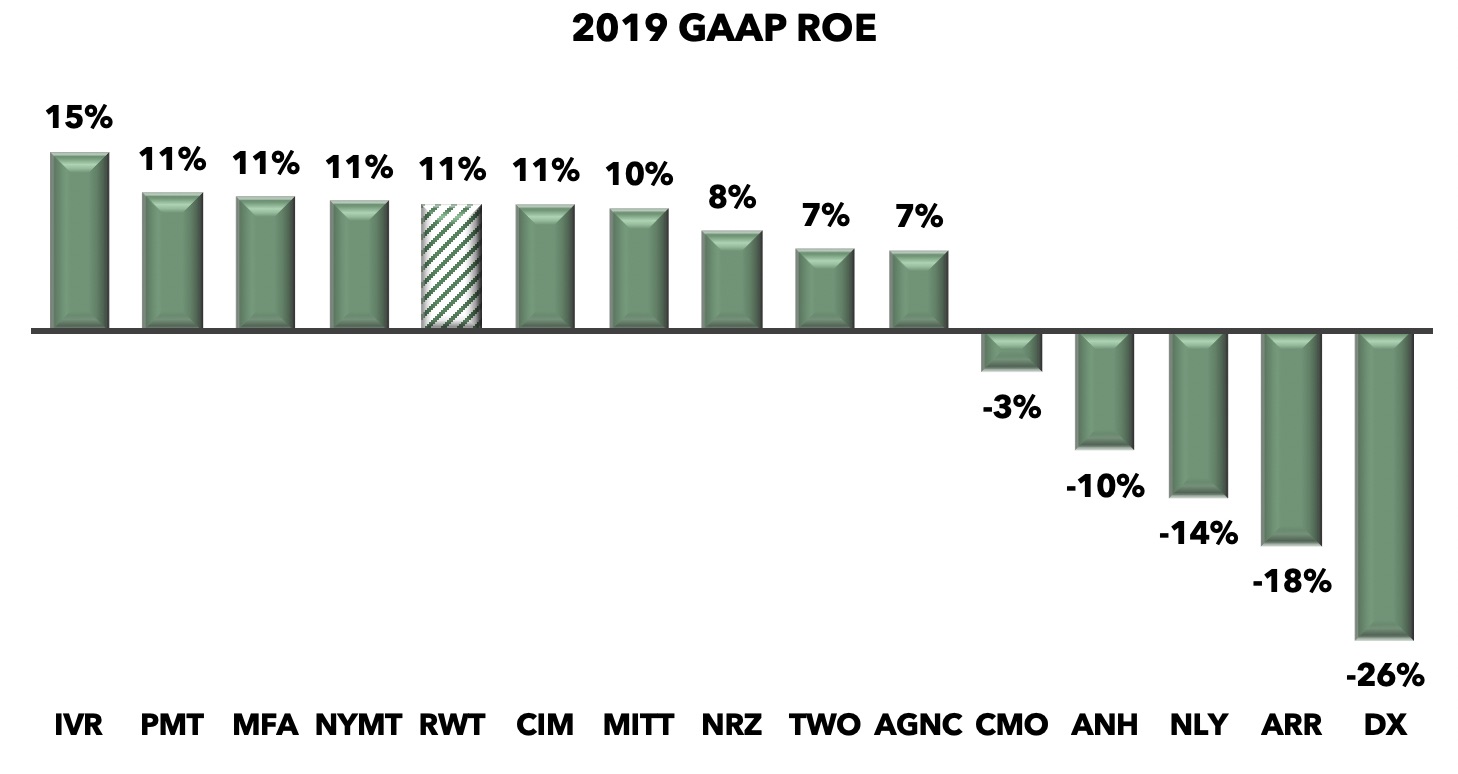

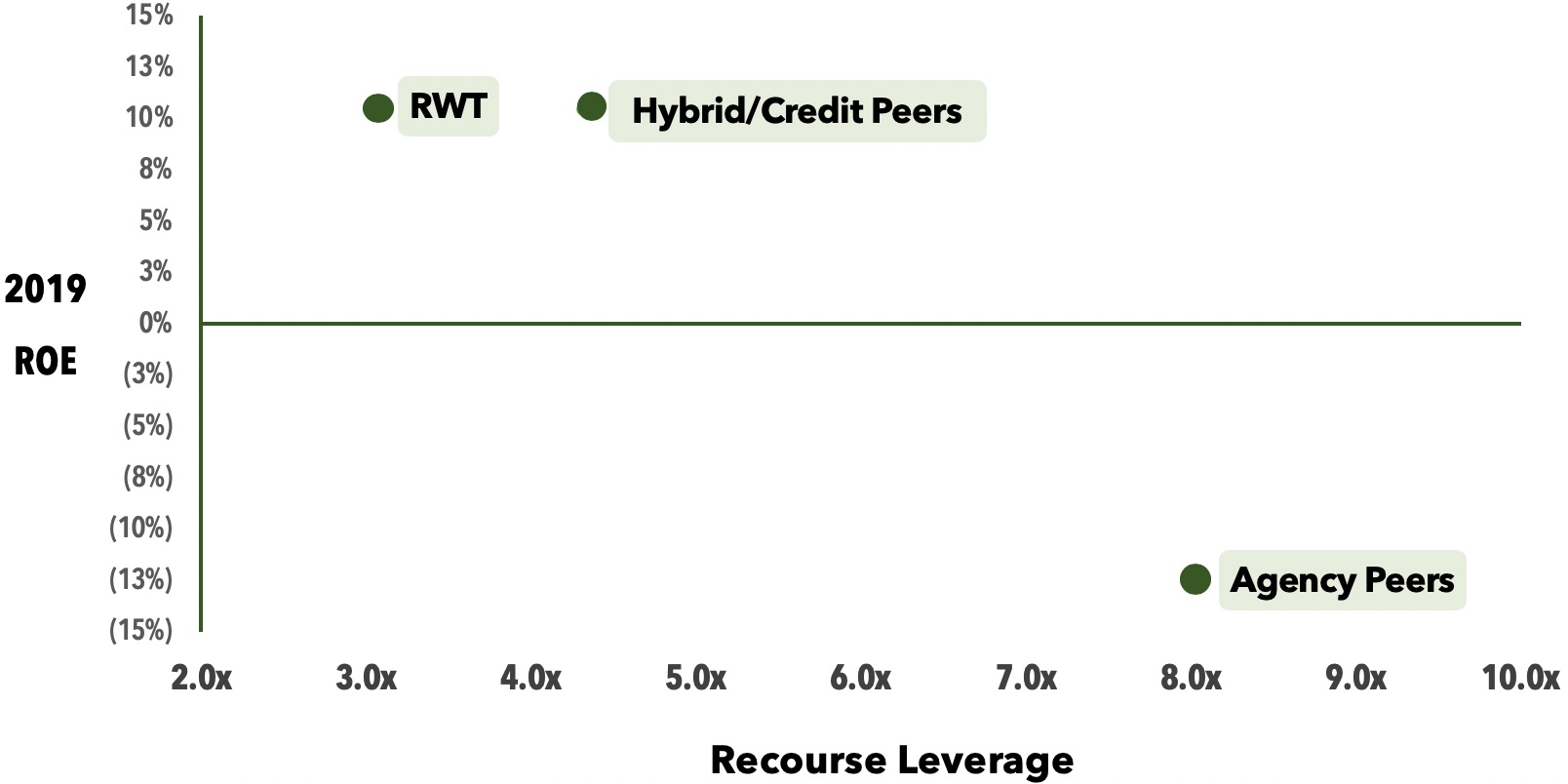

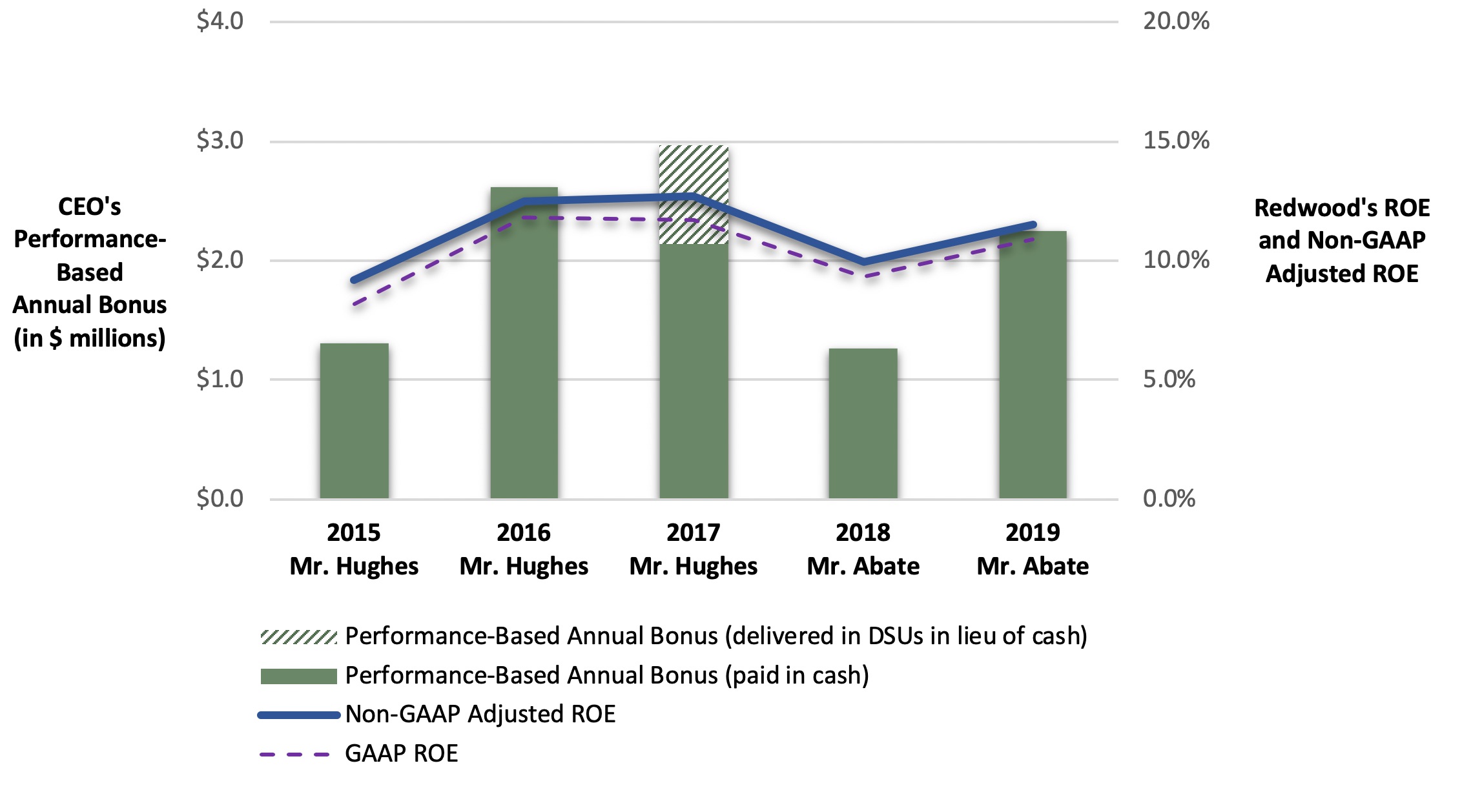

(2) | Based on 114,837,533 shares of our common stock outstanding as of April 15, 2020. |