| | | | | | | | | | | | | | |

| Exhibit 99.2 |

T H E R E D W O O D R E V I E W

S E C O N D Q U A R T E R 2 0 2 1 |

R E D W O O D T R U S T |

| | | | |

|

| | | | |

| | |

|

| T A B L E O F C O N T E N T S |

| | | | | |

| Introduction | |

| |

| Shareholder Letter | |

| |

| Quarterly Results | |

| |

Ñ Second Quarter Financial Overview | |

| |

Ñ Quarterly Earnings and Analysis | |

| |

Ñ Book Value | |

| |

Ñ Analysis of Operating Results | |

| |

Ñ RWT Horizons Updates | |

| |

| Quarterly Positions | |

| |

Ñ Capital Allocations | |

| |

Ñ Financing Overview | |

| |

Ñ Credit Overview | |

| |

| Financial Tables | |

| |

| Appendix | |

| |

Ñ Segment Overview | |

| |

Ñ Dividends and Taxable Income | |

| |

Ñ Non-GAAP Measurements | |

| |

Ñ Forward-Looking Statements | |

| |

| Endnotes | |

| | |

|

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

1 |

Note to Readers:

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about Redwood and our financial results in accordance with generally accepted accounting principles (GAAP). These documents, as well as information about our business and a glossary of terms we use in this and other publications, are available through our website, www.redwoodtrust.com. We encourage you to review these documents.

Within this document, in addition to our GAAP results, we also present certain non-GAAP measures. When we present a non-GAAP measure, we provide a description of that measure and a reconciliation to the comparable GAAP measure within the Non-GAAP Measurement section of the Appendix.

References herein to “Redwood,” the “company,” “we,” “us,” and “our” include Redwood Trust, Inc. and its consolidated subsidiaries. Note that because we generally round numbers in the tables to millions, except per share amounts, some numbers may not foot due to rounding. References to the “second quarter” refer to the quarter ended June 30, 2021, and references to the “first quarter” refer to the quarter ended March 31, 2021, unless otherwise specified.

Forward-looking statements:

This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan,” "could" and similar expressions or their negative forms, or by references to strategy, plans, goals, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our Annual Report on Form 10-K under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: statements we make regarding Redwood’s business strategy and strategic focus, statements related to our financial outlook and expectations for 2021 and future years, statements regarding our available capital and sourcing additional capital both internally and from the capital markets, and other statements regarding pending business activities and expectations and estimates relating to our business and financial results. Additional detail regarding the forward-looking statements in this Redwood Review and the important factors that may affect our actual results in 2021 are described in the Appendix of this Redwood Review under the heading “Forward-Looking Statements.”

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

2 |

| | |

|

| S H A R E H O L D E R L E T T E R |

Dear Fellow Shareholders:

By now you’ve likely seen the highlights of our second quarter results – including strong GAAP earnings of $90 million ($0.66 per diluted share), and a 6.5% increase in book value to $11.46 at June 30, 2021. On an annualized basis, our first half GAAP return on equity was 31% and year-to-date our total economic return to shareholders, which includes growth in book value and dividends paid, was 19%.

Crisp execution made the second quarter another successful one, but in many ways the past few months have felt somewhat different, representing a threshold moment for our firm. The true potential of our business has come into sharper focus, particularly as our teams faced formidable challenges and responded with vigor. Indeed, our Residential team executed an improbably strong finish against the backdrop of severe declines in profitability for many other mortgage market participants. Additionally, our Business Purpose Lending (BPL) team, facing stiff competition, originated significant volumes this quarter, to levels we haven’t seen since before the Covid-19 pandemic began.

The “easy money” has already been made by many of the residential originators whose recent results were buoyed largely by direct Federal Reserve stimulus. With substantial progress in U.S. Covid-19 vaccinations, and a near-total economic reopening across the country, the Federal Reserve has begun reconsidering the size of its support to the Agency mortgage market. During the second quarter, the predictable rise in mortgage rates and corresponding decline in refinancing demand by consumers triggered an unceremonious contraction in margins across the industry. Nowhere was this more apparent than the residential wholesale mortgage channel, where lenders engaged in an all-out price war to preserve volumes, pushing record 2020 profit margins to near breakeven levels or worse in the span of only a few months. Exaggerating the effects of strong competition was a surge in pro-cyclical inflationary rhetoric, and a volatile yield curve driving significant hedging and execution costs for those managing large mortgage pipelines – including for us. Against this backdrop, in the second quarter we locked close to $4 billion in jumbo loans at margins towards the high-end of our historical target range, underscoring the durability of our earnings power.

During the quarter, the business purpose lending market also became more crowded, with new competitors using their rate sheet to buy their way into the space – particularly for lower-balance bridge and rental loan products that currently represent a small minority of our origination mix. The shift out of apartment living and towards single-family detached homes – a trend that has shown no sign of ebbing despite the recent reopening of most major metros – has led to a shortage of high-quality homes, coupled with aggressive demand from both investors and consumers alike. In many regions, rent growth has been significantly outstripped by home price appreciation, highlighting the scarcity value of quality housing and the multiple constituencies focused on acquiring single-family homes. Leveraging a well-earned reputation as a nimble and

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

3 |

| | |

|

| S H A R E H O L D E R L E T T E R |

reliable life-cycle lender, CoreVest – our BPL platform – eclipsed $500 million of fundings for the quarter on a balance of single-family rental and bridge originations.

Our sustained performance through this challenging backdrop showcased our strategic foundation and is the essence of what makes Redwood unique. Our mortgage banking businesses offer highly complementary products that drive durable earnings streams at the corporate level. And our investment portfolio continues to offer significant upside as the economy recovers, well beyond what many industry observers had modeled after such a tumultuous pandemic period. Our credit discipline and ability to create our own assets remain key differentiators. The scarcity value and optionality embedded in our portfolio - through both call rights and underlying refinance opportunities – offer upside beyond the current discount to face value of the underlying assets. Notably, this attractive profile is not a “one and done” scenario, and is linked to each new investment we create for ourselves through our platforms.

This foundation has facilitated returns that are significantly outpacing our growing dividends. Redwood’s revenue mix, on an adjusted basis, averaged 70% from our mortgage banking operations versus 30% from our investment portfolio for the first half of 2021 and we expect it will likely continue to migrate toward mortgage banking and by extension our taxable subsidiaries. This proportion is nearly double the percentage contribution of recent years and casts a spotlight on a shift in business model that had in many ways been hiding in plain sight. It also supports continued book value expansion over time, a zero-cost avenue for capital formation that has reduced our marginal need for funding and stands in contrast to how others in the space manage their balance sheets.

Our team continues to relentlessly target a segment of the mortgage market that many had ignored since the Covid-19 pandemic began, in large part due to the absence of Fed stimulus. The non-Agency market we serve represents the full residential mortgage universe outside of government-backed mortgage programs. While it may be significantly smaller than the government market, “small” is but a relative term, as the consumer non-Agency sector is forecasted to increase volumes in 2021 from the $435 billion of originations in 2020. Importantly, this estimate reflects a regulatory pullback in demand for loans on second homes and investor properties by Fannie Mae and Freddie Mac (the “GSEs”) that has the potential to nearly double volumes in our market in 2021 and beyond, a significant tailwind across our businesses going forward. By targeting a market rather than a specific borrower cohort, our fortunes aren’t tied to the direction of the homeownership rate. Instead, we’re focused on offering a comprehensive product mix that serves both consumers and housing investors. This approach allowed us to ramp quickly after the Covid-19 crisis ebbed, and our hands-on, solutions-based underwriting model (versus the more prescriptive approach favored by many) keeps us responsive to the customized needs of borrowers and to shifting external trends.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

4 |

| | |

|

| S H A R E H O L D E R L E T T E R |

We’re proud of the leadership we demonstrated in the non-Agency market across both our platforms during the second quarter. For our Residential business, strong home price appreciation across the country pushed homeowner equity to the highest levels in at least a decade and naturally drove consumers to loans outside of the conforming balance limits of the GSEs. This has begun to diversify our geographic footprint, and we are now seeing a rising percentage of loan volume coming from parts of the country other than the coasts. We recently refocused our expanded credit product offerings in response to evolving homebuying trends and changes to the CFPB’s Qualified Mortgage (“QM”) regulations. We expect these changes will substantially reduce the frictional costs for a certain cohort of higher “debt-to-income” borrowers, whose financing options remain relatively limited. Volumes in Redwood Choice – our expanded-prime offering – are once again building and represented close to 15% of our lock volume in the second quarter, up materially from 5% in the prior quarter. As a reminder, Choice represented as much as 40% of our lock volume pre-pandemic.

In the context of a sustained supply/demand imbalance for high-quality affordable housing, our BPL business greatly benefited from the diversity and flexibility of its products in the second quarter and continued execution of the growth plan we outlined to start the year. The longevity and depth of CoreVest’s borrower relationships create a powerful multiplier effect as new borrowers become recurring customers. This intangible was clearly on display in the second quarter as the team posted over a 50% jump in mortgage banking income. We also advanced several strategic initiatives to expand CoreVest’s product reach – most notably an investment in Churchill Finance, from whom we began purchasing bridge loans and smaller-balance rental loans early in the third quarter.

By continuing to re-invest in our infrastructure, both organically and through partnerships, we see a path to realizing transformative scale. Across our enterprise, we’ve cultivated a talented and inspired workforce and have embraced technology to serve our customers more quickly than ever before. By combining enhanced systems and process improvements with the requisite amount of shoe leather, our teams have driven significant gains in output and efficiency thus far in 2021, and now operate safely at much higher volumes and lower headcount than before the pandemic began. Last quarter’s launch of RWT Horizons continues to drive an abundance of early-stage investment opportunities. As a substantial technology end-user, Redwood is a natural strategic source of capital and intellectual collaboration for entrepreneurs standing on the frontier of mortgage and real estate innovation. We are thrilled to join them.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

5 |

| | |

|

| S H A R E H O L D E R L E T T E R |

As we enter the third quarter, the Federal Reserve has reiterated its support for the economy, supply chains have begun to adapt to a post Covid-19 world, and interest rates have once again fallen. We’re optimistic that this presents a potential tailwind for our businesses in the third quarter, to the extent the economic recovery builds and demand for housing remains robust. The uncertain outlook for rates and inflation underscores the balance of our business model, through which we comprehensively serve both homeowners and housing investors that would otherwise be inefficiently financed.

We believe Redwood can generate an attractive total return profile going forward from strong earnings, dividends, and sustained book value growth. We continue to grow market share in expanding markets, and are doing so profitably. We see significant upside in book value from here, both from our investment portfolio and our ability to grow and retain earnings at our taxable REIT subsidiary. In our supplemental quarterly materials, we have provided more detailed and refreshed guidance for 2021 to highlight some of the key inputs that support our financial narrative. We believe that the valuation frameworks used by external market participants will continue to evolve to reflect both our diversified earnings mix and attractive overall total return profile.

While we are excited about our performance this quarter and the growth story ahead for shareholders, what ultimately differentiates our team is the quality of our people, and that our business provides meaningful benefits to our broader set of stakeholders. The impact our financing solutions have on local communities is palpable, and our experience and scale have enabled us to provide attractively priced debt to both owner-occupants and housing investors nationwide. But there remain cohorts of strong borrowers – particularly in underserved communities – who still don’t have access to financing at an attractive rate. Redwood’s mission is to offer solutions to all borrowers not well served by government loan programs, something our people are focused on and will hold ourselves accountable to in the months and years ahead.

Thanks for your continued support.

| | | | | | | | |

| | |

| Christopher J. Abate | | Dashiell I. Robinson |

| Chief Executive Officer | | President |

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

6 |

| | |

|

| Q U A R T E R L Y R E S U L T S |

Second Quarter Financial Overview

| | | | | | | | | | | | | | | | | |

|

Key Financial Results and Metrics |

| | | |

| Three Months Ended | | | | |

| 6/30/2021 | | 3/31/2021 | | | | |

| | | | | | | |

| Earnings per Share | $ | 0.66 | | | $ | 0.72 | | | | | |

| Return on Equity (annualized) | 29 | % | | 34 | % | | | | |

| | | | | | | |

| Book Value per Share | $ | 11.46 | | | $ | 10.76 | | | | | |

| Dividend per Share | $ | 0.18 | | | $ | 0.16 | | | | | |

Economic Return on Book Value (1) | 8.2 | % | | 10.2 | % | | | | |

| | | | | | | |

| Available Capital (in millions) | $ | 175 | | | $ | 225 | | | | | |

Recourse Leverage Ratio (2) | 2.2x | | 1.9x | | | | |

| | | | | | | |

Ñ Our second quarter 2021 results benefited from continued strength in our operating platforms, most notably increased business purpose mortgage banking revenues on higher volume and strong margins. These results, along with an increase in the value of our securities portfolio, contributed to a 6.5% increase in our book value per share during the quarter.

Ñ In June, we announced a 13% increase in our quarterly dividend to $0.18 per share.

Ñ We originated $527 million of business purpose loans in the second quarter (a 37% increase from the first quarter), including $312 million of single-family rental (SFR) loans and $215 million of bridge loans.

Ñ We locked $3.9 billion of jumbo loans (representing our second highest volume on record, though down 16% from record volumes in the first quarter of 2021) with over 110 discrete sellers and purchased $3.5 billion of jumbo loans.

Ñ We securitized $1.8 billion of loans through four securitizations across Residential and Business Purpose Lending, and distributed $1.8 billion of jumbo loans through whole loan sales.

Ñ We settled call rights on three Sequoia securitizations and one CAFL securitization, acquiring $83 million of seasoned jumbo loans at par and $45 million of seasoned SFR loans at par, resulting in an aggregate benefit to book value of $0.05 per share.

Ñ We added over $750 million of financing capacity to support growth of our operating platforms, and refinanced and amended various borrowing facilities, reducing the cost of funds for our investment portfolio by approximately 100 basis points.

Ñ At June 30, 2021, our unrestricted cash was $421 million, and our estimated available capital was $175 million (which does not include approximately $100 million of available capital generated from a non-marginable secured term financing we closed in early July).

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

7 |

| | |

|

| Q U A R T E R L Y R E S U L T S |

Quarterly Earnings and Analysis

Below we present GAAP net income for the second and first quarters of 2021.

| | | | | | | | | | | | | | |

| |

GAAP Net Income |

($ in millions, except per share data) |

| Three Months Ended | |

| 6/30/2021 | | 3/31/2021 | |

| | | | |

| | | | |

| Net interest income | | | | |

| Investment portfolio | $ | 33 | | | $ | 31 | | |

| Mortgage banking | 7 | | | 4 | | |

| Corporate | (9) | | | (9) | | |

| Total net interest income | 31 | | | 26 | | |

| | | | |

| Non-interest income | | | | |

| Residential mortgage banking activities, net | 21 | | | 61 | | |

| Business purpose mortgage banking activities, net | 33 | | | 21 | | |

| Investment fair value changes, net | 49 | | | 45 | | |

| Other income, net | 2 | | | 4 | | |

| Realized gains, net | 8 | | | 3 | | |

| Total non-interest income, net | 114 | | | 134 | | |

| | | | |

| General and administrative expenses | (41) | | | (44) | | |

| Loan acquisition costs | (4) | | | (4) | | |

| Other expenses | (4) | | | (4) | | |

| Provision for income taxes | (7) | | | (12) | | |

| | | | |

| Net income | $ | 90 | | | $ | 97 | | |

| | | | |

| Earnings per diluted common share | $ | 0.66 | | | $ | 0.72 | | |

| | | | |

GAAP Net Income by Segment |

($ in millions) |

| Three Months Ended | |

| 6/30/2021 | | 3/31/2021 | |

| | | | |

| | | | |

| Residential Lending | $ | 31 | | | $ | 53 | | |

| Business Purpose Lending | 33 | | | 21 | | |

| Third-Party Investments | 54 | | | 50 | | |

| Corporate | (27) | | | (27) | | |

| Net income | $ | 90 | | | $ | 97 | | |

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

8 |

| | |

|

| Q U A R T E R L Y R E S U L T S |

Analysis of Earnings

Ñ Net interest income increased from the first quarter of 2021, primarily due to a higher average balance of loans in inventory at our operating businesses, higher yield maintenance income from SFR securities, and growth in our bridge loan portfolio.

Ñ Income from residential mortgage banking activities decreased from record first quarter levels, as loan purchase commitments of $2.7 billion in the second quarter were 22% lower from the first quarter and margins normalized towards the high end of our historic target range.

Ñ Income from business purpose mortgage banking activities increased in the second quarter of 2021, benefiting from a 37% increase in origination volume from the first quarter and strong execution on our first broadly-syndicated SFR securitization of the year.

Ñ Positive investment fair value changes in the second quarter reflected continuing improvement in credit performance and spread tightening across our investment portfolio during the quarter, particularly in our third-party re-performing loan ("RPL") and retained Sequoia and CAFL securities.

Ñ Realized gains in the second quarter included $7 million from securities we owned in Sequoia securitizations that we called during the second quarter, and $1 million from security sales.

Ñ General and administrative expenses and loan acquisition costs decreased from the first quarter, as variable compensation declined commensurate with lower overall GAAP earnings relative to the first quarter.

Ñ Other expenses were primarily comprised of acquisition-related intangible amortization expense.

Ñ Our income tax provision decreased in the second quarter, compared to the first quarter, consistent with the aggregate decrease in income from our mortgage banking operations during the second quarter, which are conducted within our taxable REIT subsidiary.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

9 |

| | |

|

| Q U A R T E R L Y R E S U L T S |

Book Value

| | | | | | | | | | | | | | |

| |

Changes in Book Value per Share |

($ in per share) |

| Three Months Ended | |

| 6/30/2021 | | 3/31/2021 | |

| | | | |

| Beginning book value per share | $ | 10.76 | | | $ | 9.91 | | |

| Basic earnings per share | 0.77 | | | 0.84 | | |

Investment fair value changes in comprehensive income (1) | 0.03 | | | 0.07 | | |

| Dividends | (0.18) | | | (0.16) | | |

| Equity compensation, net | 0.05 | | | 0.02 | | |

| | | | |

| Other, net | 0.03 | | | 0.08 | | |

| | | | |

| Ending book value per share | $ | 11.46 | | | $ | 10.76 | | |

Ñ Our GAAP book value increased $0.70 per share during the second quarter of 2021, as basic earnings per share significantly exceeded our second quarter dividend of $0.18 per share.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

10 |

| | |

|

| Q U A R T E R L Y R E S U L T S |

Analysis of Operating Results

This section provides additional information on quarterly activity within each of our business segments. A full description of our segments is included in the Appendix of this Redwood Review, and detailed segment income statements are presented in Table 2 within the Financial Tables section of this Redwood Review.

Mortgage Banking Operations

Below we present a summary of the key operating metrics of each of our mortgage banking operations, by segment.

| | | | | | | | | | | | | | | | | | | | |

|

Mortgage Banking Key Operating Metrics |

| ($ in millions) |

| | | | | | |

| Q2 2021 | |

| Business Purpose Mortgage Banking | | Residential Mortgage Banking | | Total | |

| | | | | | |

Mortgage banking income (1) | $ | 35 | | | $ | 27 | | | $ | 62 | | |

| Net contributions (GAAP) | $ | 15 | | | $ | 14 | | | $ | 29 | | |

Add back: acquisition amortization expenses (2) | 5 | | | — | | | 5 | | |

| After-tax net operating contribution (non-GAAP) | $ | 20 | | | $ | 14 | | | $ | 34 | | |

| | | | | | |

Capital utilized (average for quarter) (3) | $ | 151 | | | $ | 332 | | | $ | 483 | | |

| | | | | | |

After-tax operating return on capital (non-GAAP) (4) | 52 | % | | 17 | % | | 28 | % | |

| | | | | | |

| Production Volumes | | | | | | |

| SFR loan originations | $ | 312 | | | | | | |

| Bridge loan originations | $ | 215 | | | | | | |

| Residential loan locks | | | $ | 3,897 | | | | |

| Residential loan purchase commitments (fallout adjusted) | | | $ | 2,743 | | | | |

| | | | | | |

Business Purpose Mortgage Banking

Ñ Business purpose mortgage banking income increased in the second quarter on higher loan origination volume and modest spread tightening on securitization execution, which also benefited the $333 million of SFR loans held in inventory at the beginning of the quarter.

Ñ During the second quarter, we originated $312 million of SFR loans and $215 million of bridge loans, representing increases of 23% and 61%, from respective first quarter volumes.

Ñ Approximately 34% of SFR origination volume in the second quarter was generated from borrowers that previously had a bridge loan with CoreVest and 67% of total origination volumes were from repeat borrowers.

| | |

| See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

11 |

| | |

|

| Q U A R T E R L Y R E S U L T S |

Ñ At June 30, 2021, we had $418 million of SFR loans held-for-sale in inventory on our balance sheet. All bridge loans originated during the quarter were transferred into our investment portfolio.

Ñ In late July 2021, we completed our second broadly-distributed SFR securitization of the year, which included approximately $300 million of loans.

Ñ In April 2021, we announced a strategic investment in Churchill Finance, expanding our BPL sourcing channels, and closed our first purchases of bridge loans and smaller balance SFR loans from Churchill in July.

Residential Mortgage Banking

Ñ During the second quarter, we locked $3.9 billion of loans ($2.7 billion adjusted for expected pipeline fallout – i.e., loan purchase commitments), including $3.3 billion of Select loans and $0.6 billion of Choice loans, and purchased $3.5 billion of loans.

Ñ Approximately 60% of loans locked in the second quarter were purchase-money loans and 40% were refinancings. First quarter locks were comprised of 38% purchase-money loans and 62% refinancings.

Ñ During the second quarter, we distributed $1.8 billion of loans through whole loan sales and completed three securitizations for a total of $1.5 billion.

Ñ At June 30, 2021, we had $1.2 billion of loans in inventory on our balance sheet and our loan pipeline included $2.5 billion of loans identified for purchase (locked loans, unadjusted for expected fallout). Additionally, at quarter-end we had entered into forward sale agreements for $1.2 billion of loans.

Ñ Our gross margin(1) for the second quarter was 98 basis points, down from 183 basis points in the first quarter of 2021. Gross margin in the second quarter was near the high end of our historical range, despite a challenging macro backdrop that impacted securitization execution and increased hedging costs relative to the first quarter.

| | |

| See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

12 |

| | |

|

| Q U A R T E R L Y R E S U L T S |

Investment Portfolio

Below we present key financial results for our investment portfolio organized by segment for the second quarter of 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Investment Portfolio Key Financial Results |

| ($ in millions) |

| Q2 2021 | |

| Business Purpose Lending | | Residential Lending | | Third-Party Investments | | Total(1) | |

| | | | | | | | |

| Net interest income | $ | 15 | | | $ | 6 | | | $ | 12 | | | $ | 33 | | |

| Net contribution (GAAP) | $ | 18 | | | $ | 16 | | | $ | 54 | | | $ | 88 | | |

Less: realized gains (2) | — | | | (7) | | | (1) | | | (8) | | |

Less: investment fair value changes (2) | (4) | | | (4) | | | (42) | | | (50) | | |

| Adjusted net contribution (non-GAAP) | $ | 14 | | | $ | 6 | | | $ | 10 | | | $ | 30 | | |

| | | | | | | | |

| Capital utilized (average for quarter) | | | | | | | $ | 1,150 | | |

| | | | | | | | |

Adjusted return on capital (non-GAAP) (3) | | | | | | | 11 | % | |

| | | | | | | | |

| At period end | | | | | | | | |

| Carrying values of assets | | | | | | | $ | 2,330 | | |

Secured debt balances (4) | | | | | | | (1,093) | | |

| Capital invested | | | | | | | $ | 1,237 | | |

Leverage ratio (5) | | | | | | | 0.9x | |

| | | | | | | | |

| | | | | | | | |

Ñ Portfolio net interest income increased to $33 million in the second quarter from $31 million in the first quarter of 2021, driven by our business purpose lending investments, which benefited from a combination of increased yield maintenance income resulting from faster prepayments on our SFR securities and an increase in the average balance of our bridge loan portfolio, as originations outpaced loan payoffs.

Ñ Adjusted return on capital (a non-GAAP measure that excludes realized gains and investment fair value changes) was 11% in the second quarter on an annualized basis, consistent with the first quarter of 2021.

Ñ During the second quarter, we repaid one of our non-recourse facilities used to finance our bridge loans and entered into a new non-recourse facility for bridge loans. As a result of these activities and other changes to our borrowing facilities, we reduced the overall cost of funds for our investment portfolio by approximately 100 basis points during the second quarter.

Ñ Positive investment fair value changes in the second quarter reflected continuing improvement in credit performance and spread tightening within our investment portfolio during the quarter – particularly for our RPL, CAFL and Sequoia securities (see Table 5 in the Financial Tables section for additional detail).

| | |

| See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

13 |

| | |

|

| Q U A R T E R L Y R E S U L T S |

RWT Horizons Updates

RWT Horizons was launched in December 2020, as a venture investment strategy focused on early and mid-stage companies driving innovation in financial and real estate technology, and digital infrastructure. Investments made through RWT Horizons are designed to support companies whose technologies are accretive to our businesses, including our residential and business-purpose lending platforms. New partnerships forged through RWT Horizons will enhance our technology roadmap and drive innovation that focuses on how we can make the lending process less redundant, more seamless and more transparent to our originators, borrowers and investors.

We seeded the initiative with an initial capital allocation of $25 million, which we believe gives us ample room to make meaningful investments during the first phase of deployment. We will continuously evaluate our progress and expect to increase this allocation over time.

Since inception, we have completed investments in five technology companies, including two in the second quarter of 2021. Our second quarter investments included our previously-announced investment in Liquid Mortgage, a platform focused on applying blockchain technology to the non-agency mortgage market, and an early-stage investment in a tech-enabled residential construction management firm.

In July, Liquid Mortgage was issued a U.S. Patent for its distributed ledger technology, supporting its vision for the future of debt markets. U.S. Patent 11,068,978 entitled, "Decentralized Systems and Methods for Managing Loans and Securities," aims to make debt markets more efficient and transparent, while lowering overall ecosystem costs. The patent encompasses a significant portion of the Liquid Mortgage business model, including: creating loan-backed digital assets, multi-signature loan-level blockchain accounts, lender portfolio accounts to hold loan-backed digital assets, borrower payment information and distribution mechanics, and loan balance management.

| | |

| See Appendix for details on non-GAAP measures. Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

14 |

| | |

|

| Q U A R T E R L Y P O S I T I O N S |

Capital Allocations

The following table presents our allocations of capital by segment and by investment type as of June 30, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Capital Allocation Detail by Segment |

| By Investment Type |

| June 30, 2021 |

| ($ in millions) |

| | | | | | | | |

| Fair Value of Assets (1) | | Recourse Debt | | Non-Recourse Debt (2) | | Total Capital | |

| | | | | | | | |

| Residential Lending | | | | | | | | |

| Sequoia securities | $ | 391 | | | $ | (213) | | | $ | — | | | $ | 178 | | |

| Called Sequoia loans | 97 | | | (88) | | | — | | | 8 | | |

| Other investments | 34 | | | — | | | — | | | 34 | | |

Capital allocated to mortgage banking operations(3) | 1,275 | | | (961) | | | — | | | 315 | | |

| Total Residential Lending | 1,797 | | | (1,262) | | | — | | | 535 | | |

| | | | | | | | |

| Business Purpose Lending | | | | | | | | |

| SFR securities | 268 | | | (102) | | | — | | | 166 | | |

| Bridge loans | 741 | | | (380) | | | (103) | | | 258 | | |

Capital allocated to mortgage banking operations(3) | 381 | | | (281) | | | — | | | 100 | | |

| Platform premium | 49 | | | — | | | — | | | 49 | | |

| Total Business Purpose Lending | 1,439 | | | (763) | | | (103) | | | 573 | | |

| | | | | | | | |

| Third-Party Investments | | | | | | | | |

| RPL securities | 513 | | | — | | | (179) | | | 334 | | |

| Other third-party securities | 86 | | | — | | | — | | | 86 | | |

| Multifamily securities | 73 | | | (28) | | | — | | | 45 | | |

| Other investments | 127 | | | — | | | — | | | 127 | | |

| Total Third-Party Investments | 799 | | | (28) | | | (179) | | | 592 | | |

| | | | | | | | |

| Corporate capital | 349 | | | | | | | 349 | | |

| Other assets/(liabilities), net | (94) | | | | | | | (94) | | |

| Corporate debt | — | | | (660) | | | — | | | (660) | | |

| | | | | | | | |

| Totals | $ | 4,290 | | | $ | (2,714) | | | $ | (282) | | | $ | 1,295 | | |

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

15 |

| | |

|

| Q U A R T E R L Y P O S I T I O N S |

The following table presents our allocations between our operating platforms and our investment portfolios at June 30, 2021 and March 31, 2021.

| | | | | | | | | | | | | | |

|

| Capital Allocation Summary |

| ($ in millions) |

| | | | |

| June 30, 2021 | | March 31, 2021 | |

| | | | |

| Operating Platforms | | | | |

| Redwood Residential working capital | $ | 315 | | | $ | 315 | | |

| CoreVest working capital | 100 | | | 100 | | |

CoreVest platform premium (1) | 49 | | | 53 | | |

| Total | 464 | | | 468 | | |

| | | | |

| Investment Portfolio | | | | |

| Residential | 220 | | | 202 | | |

| Business Purpose | 424 | | | 377 | | |

| Third Party | 592 | | | 561 | | |

| Total | 1,237 | | | 1,140 | | |

| | | | |

| Available Capital | 175 | | | 225 | | |

| | | | |

| Corporate | 79 | | | 44 | | |

| Total Capital | 1,955 | | | 1,877 | | |

| | | | |

| Unsecured Debt | (660) | | | (661) | | |

| Total Equity | $ | 1,295 | | | $ | 1,215 | | |

| | | | |

Ñ During the second quarter, the increase in capital allocated to our investment portfolios was driven primarily by a $40 million net increase in capital allocated to bridge loans, $14 million of securities retained from a CoreVest securitization, $8 million of securities retained from Sequoia securitizations and $2 million of third-party securities purchases. These increases were partially offset by sales of $10 million of securities. See Table 5 in the Financial Tables section of this Redwood Review for additional detail on investment portfolio activities.

Ñ At June 30, 2021, we estimate we had approximately $175 million of available capital.

Ñ The difference between our unrestricted cash and our available capital is generally attributable to risk capital that we retain to manage liquidity risk in our operations, and can also be comprised of temporarily unutilized working capital allocated to our mortgage banking operations, which can fluctuate based on the timing of loan acquisitions and dispositions.

Ñ In early July 2021, we completed a new $100 million non-marginable secured term facility collateralized by retained CAFL securities. This financing will marginally increase the direct leverage on our investment portfolio and improve our return on capital for the investment portfolio. The proceeds from this financing will also serve to increase our available capital.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

16 |

| | |

|

| Q U A R T E R L Y P O S I T I O N S |

Financing Overview

We finance our business with a diversified mix of secured recourse and non-recourse debt, as well as unsecured corporate debt. Following is an overview of our current financing structure.

Recourse Debt

The following summaries present the composition of our recourse debt and its characteristics as of June 30, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Recourse Debt Balances at June 30, 2021 |

($ in millions) |

| | | | | | | | | | | | | | |

| | | Secured Debt | | | | | | | |

| Fair Value of Secured Assets | | Non-Marginable Debt (1) | | Marginable Debt (1) | | Total Secured Debt | | Unsecured Debt | | Total Debt | | Average Borrowing Cost (2) | |

| | | | | | | | | | | | | | |

| Corporate debt | N/A | | $ | — | | | $ | — | | | $ | — | | | $ | 660 | | | $ | 660 | | | 4.7 | % | |

| Securities portfolio | 478 | | | 263 | | | 81 | | | 344 | | | — | | | 344 | | | 3.6 | % | |

| SFR loans | 369 | | | 281 | | | — | | | 281 | | | — | | | 281 | | | 3.2 | % | |

| Bridge loans | 491 | | | 380 | | | — | | | 380 | | | — | | | 380 | | | 3.4 | % | |

| Residential loans | 1,152 | | | 385 | | | 664 | | | 1,049 | | | — | | | 1,049 | | | 1.9 | % | |

| | | | | | | | | | | | | | |

| Total | $ | 2,491 | | | $ | 1,309 | | | $ | 745 | | | $ | 2,054 | | | $ | 660 | | | $ | 2,714 | | | 3.1 | % | |

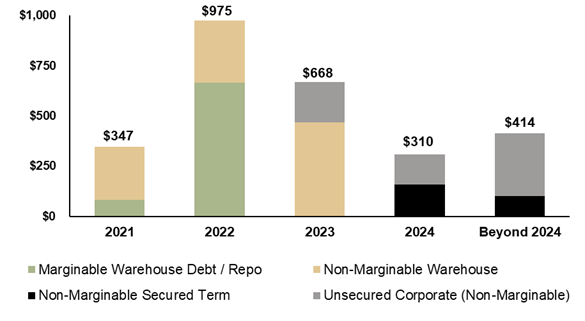

Recourse Debt Scheduled Maturities

($ in millions)

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

17 |

| | |

|

| Q U A R T E R L Y P O S I T I O N S |

Leverage

Ñ Our recourse leverage ratio(1) was 2.2x at June 30, 2021 and 1.9x at March 31, 2021. The increase in leverage was primarily driven by additional warehouse borrowings incurred to finance higher loan inventories at June 30, 2021.

Ñ Additionally, our non-marginable, recourse debt on our bridge loan portfolio increased during the second quarter, as we utilized capacity on these facilities to refinance assets previously financed under a non-recourse facility that was repaid during the second quarter (see below for additional detail). While this refinancing increased our mix of non-marginable borrowings, there was a minimal impact to our overall leverage, and we benefited from a meaningful reduction in our borrowing costs.

Ñ Our warehouse debt coming due in 2021 and 2022 is used to finance residential and business purpose loans that we generally expect to sell over a one to three month time frame, as well as business purpose bridge loan investments with shorter durations that are generally matched with their associated borrowings.

Warehouse Capacity

Ñ At June 30, 2021, we had residential warehouse facilities outstanding with six different counterparties, with $2.4 billion of total capacity and $1.3 billion of available capacity. These included non-marginable facilities with $800 million of total capacity and marginable facilities with $1.6 billion of total capacity.

Ñ At June 30, 2021, we had business purpose warehouse facilities outstanding with five different counterparties, with $1.4 billion of total capacity and $0.6 billion of available capacity (inclusive of capacity on non-recourse facilities). All of these facilities are non-marginable.

Non-Recourse Debt

In addition to our secured recourse debt, we also utilize secured, non-recourse term debt to finance certain of our business purpose bridge loans and the majority of our RPL investments. Unlike the non-recourse securitization debt we consolidate on our balance sheet that is associated with subordinate securities that we own in those securitizations, these financings generally have prepayment and other provisions allowing for repayment over a shorter term.

During the second quarter of 2021, we repaid one of our non-recourse facilities used to finance bridge loans that had a balance of $242 million at March 31, 2021, and we also entered into a new non-recourse facility to finance bridge loans, with a total borrowing capacity of $250 million.

As this debt is non-recourse, our net economic exposure represents the difference between the fair value of the investment collateral, and the associated non-recourse debt. At June 30, 2021, we had $192 million of bridge loans financed with $103 million of non-recourse debt, for a net economic exposure of approximately $89 million to these assets. Additionally, at June 30, 2021, we had $450 million of RPL securities financed with $179 million of non-recourse debt, for a net economic exposure of approximately $271 million to these assets.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

18 |

| | |

|

| Q U A R T E R L Y P O S I T I O N S |

Credit Overview

This section presents select credit characteristics for our major investment types, with current information as of June 30, 2021.

| | | | | | | | | | | | | | | | | | | | |

|

Residential Investments Credit Characteristics (1) |

June 30, 2021 | |

($ in millions, except where noted) | |

| Sequoia Select Securities(2) | | Sequoia Choice Securities(2) | | Re-Performing Loan Securities | |

| | | | | | |

| Market value | $ | 142 | | | $ | 222 | | | $ | 513 | | |

| Average FICO (at origination) | 768 | | | 739 | | | 608 | | |

HPI updated LTV (3) | 42 | % | | 58 | % | | 68 | % | |

| Average loan size (in thousands) | $ | 643 | | | $ | 704 | | | $ | 164 | | |

| Gross weighted average coupon | 4.0 | % | | 4.9 | % | | 4.5 | % | |

| Current 3-month prepayment rate | 51 | % | | 57 | % | | 13 | % | |

90+ days delinquency (as a % of UPB)(4) | 0.8 | % | | 3.9 | % | | 12.1 | % | |

Investment thickness (5) | 6 | % | | 24 | % | | 24 | % | |

| | | | | | |

Ñ Sequoia Select Securities — As of June 30, 2021, we had securitized $24.4 billion of Sequoia Select loans since 2010. Our securitized Select portfolio includes fully documented loans to prime borrowers with an average FICO score (at loan origination) of 768, maximum loan-to-value (at origination) of 80%, and a maximum debt-to-income ratio (at origination) of 43%. We retain all first-loss securities from our Sequoia Select securitizations, and on average we currently have exposure to the first 6% of credit losses resulting from loans underlying the securities.

Ñ Sequoia Choice Securities — As of June 30, 2021, we had securitized $3.7 billion of Sequoia Choice loans since 2017. Our securitized Choice portfolio includes fully documented loans to prime borrowers with an average FICO score (at loan origination) of 739, maximum loan-to-value (at origination) of 90%, and a maximum debt-to-income ratio (at origination) of 49.9%. We retain all of the first-loss securities issued as part of our Sequoia Choice program, and on average we currently have exposure to the first 24% of credit losses resulting from loans underlying the securities.

Ñ Re-Performing Loan Securities — As of June 30, 2021, we held $513 million of securities collateralized by re-performing loans, and on average we currently have exposure to the first 24% of the credit losses resulting from loans underlying the securities. The collateral underlying these securities are seasoned re-performing, and to a lesser extent non-performing, loans. In most cases, these loans experienced a credit event leading up to the securitization and were modified in order to keep the borrower in their home and current in their payments under recast loan terms.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

19 |

| | |

|

| Q U A R T E R L Y P O S I T I O N S |

| | | | | | | | | | | | | | | | | | | | |

|

Business Purpose and Multifamily Investments Credit Characteristics |

June 30, 2021 | |

($ in millions, except where noted) | |

| SFR Securities | | BPL Bridge Loans(1) | | Multifamily

B-Pieces | |

| | | | | | |

| Market value | $ | 268 | | | $ | 741 | | | $ | 73 | | |

Average current DSCR (2) | 1.4x | | N/A | | 1.5x | |

LTV (at origination) (3) | 68 | % | | 70 | % | | 72 | % | |

| Average loan size (in thousands) | $ | 2,781 | | | $ | 296 | | | $ | 23,513 | | |

| Gross weighted average coupon | 5.4 | % | | 7.6 | % | | 3.4 | % | |

90+ days delinquency (as a % of UPB) (4) | 1.7 | % | | 4.9 | % | | — | % | |

Investment thickness (5) | 10 | % | | N/A | | 10 | % | |

| | | | | | |

Ñ SFR Securities — As of June 30, 2021, CoreVest had securitized $4.2 billion of SFR loans across 16 CAFL securitizations since 2015. We own and retain the first-loss securities from CAFL securitizations, and on average have exposure to the first 10% of credit losses resulting from loans underlying the securities.

Ñ BPL Bridge Loans — Our business purpose bridge loans and investments are collateralized by residential and multifamily properties, many of which are being rehabilitated or constructed for either re-sale or rental purposes. The average loan term at origination ranges between 12 to 24 months.

Ñ Multifamily B-Pieces — As of June 30, 2021, we owned $73 million of multifamily b-piece securities, which represent first-loss risk on $1.1 billion of underlying multifamily loan collateral across three separate Freddie Mac sponsored securitizations. On average, we have exposure to the first 10% of credit losses resulting from loans underlying these securities.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

20 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 1: GAAP Earnings (in thousands, except per share data) | |

| | | | | | | | | | | | | |

| 2021

Q2 | | 2021

Q1 | | 2020

Q4 | | 2020

Q3 | | 2020

Q2 | | | Six

Months 2021 | |

| Net interest income | | | | | | | | | | | | | |

| From investments | $ | 32,555 | | | $ | 30,564 | | | $ | 29,156 | | | $ | 29,651 | | | $ | 34,556 | | | | $ | 63,119 | | |

| From mortgage banking activities | 7,133 | | | 4,088 | | | 3,502 | | | 729 | | | 2,330 | | | | 11,221 | | |

| Corporate debt expense | (9,058) | | | (8,899) | | | (9,008) | | | (8,809) | | | (9,606) | | | | (17,957) | | |

| Net interest income | 30,630 | | | 25,753 | | | 23,650 | | | 21,571 | | | 27,280 | | | | 56,383 | | |

| Non-interest income | | | | | | | | | | | | | |

| Residential mortgage banking activities, net | 21,265 | | | 61,435 | | | 22,943 | | | 11,864 | | | (8,005) | | | | 82,700 | | |

| Business purpose mortgage banking activities, net | 33,154 | | | 21,172 | | | 31,018 | | | 47,531 | | | 2,023 | | | | 54,326 | | |

| Investment fair value changes, net | 49,480 | | | 45,087 | | | 23,119 | | | 107,047 | | | 152,228 | | | | 94,567 | | |

| Realized gains, net | 8,384 | | | 2,716 | | | 5 | | | 602 | | | 25,965 | | | | 11,100 | | |

| Other income (loss), net | 2,126 | | | 3,843 | | | 209 | | | (114) | | | 1,165 | | | | 5,969 | | |

| Total non-interest income, net | 114,409 | | | 134,253 | | | 77,294 | | | 166,930 | | | 173,376 | | | | 248,662 | | |

| Compensation expense | (29,459) | | | (34,643) | | | (19,572) | | | (18,624) | | | (18,358) | | | | (64,102) | | |

Acquisition-related equity compensation expense (1) | (1,212) | | | (1,212) | | | (1,212) | | | (1,212) | | | (1,212) | | | | (2,424) | | |

| Other general and administrative expense | (9,923) | | | (7,696) | | | (9,588) | | | (7,794) | | | (8,950) | | | | (17,619) | | |

| Total general and administrative expenses | (40,594) | | | (43,551) | | | (30,372) | | | (27,630) | | | (28,520) | | | | (84,145) | | |

| Loan acquisition costs (including commissions) | (3,748) | | | (3,559) | | | (3,307) | | | (2,158) | | | (1,572) | | | | (7,307) | | |

| Other expenses | (3,985) | | | (4,096) | | | (4,499) | | | (7,788) | | | (5,083) | | | | (8,081) | | |

| Provision for income taxes | (6,687) | | | (11,543) | | | (8,471) | | | (9,113) | | | (37) | | | | (18,230) | | |

| Net income | $ | 90,025 | | | $ | 97,257 | | | $ | 54,295 | | | $ | 141,812 | | | $ | 165,444 | | | | $ | 187,282 | | |

Diluted average shares (2) | 141,761 | | 141,039 | | 140,641 | | 141,970 | | 147,099 | | | 141,139 | |

| Diluted earnings per common share | $ | 0.66 | | | $ | 0.72 | | | $ | 0.42 | | | $ | 1.02 | | | $ | 1.00 | | | | $ | 1.38 | | |

(1)Acquisition-related equity compensation expense relates to shares of restricted stock that were issued to members of CoreVest management as a component of the consideration paid to them for our purchase of their interests in CoreVest.

(2)Diluted average shares includes shares from the assumed conversion of our convertible and/or exchangeable debt in certain periods, in accordance with GAAP diluted EPS provisions. See Table 3 that follows for details of this calculation for the current and prior quarter and our respective Quarterly Reports on Form 10-Q and Annual Report on Form 10-K.

| | | | | | | | |

| THE REDWOOD REVIEW I 2ND QUARTER 2021 | | Table 1: GAAP Earnings 22 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 2: Segment Results ($ in thousands) | | |

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2021 | | |

| Residential Mortgage Banking | | Residential Investments | | Total Residential Lending | | Business Purpose Mortgage Banking | | Business Purpose Investments | | Total Business Purpose Lending | | Third-Party Investments | | Corporate / Other | | Total | | |

| | | | | | | | | | | | | | | | | | | |

| Net interest income (expense) | $ | 5,628 | | | $ | 6,349 | | | $ | 11,977 | | | $ | 1,505 | | | $ | 14,568 | | | $ | 16,073 | | | $ | 11,638 | | | $ | (9,058) | | | $ | 30,630 | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-interest income | | | | | | | | | | | | | | | | | | | |

| Mortgage banking activities, net | 21,265 | | | — | | | 21,265 | | | 33,154 | | | — | | | 33,154 | | | — | | | — | | | 54,419 | | | |

| Investment fair value changes, net | — | | | 3,927 | | | 3,927 | | | — | | | 3,782 | | | 3,782 | | | 42,018 | | | (247) | | | 49,480 | | | |

| Other income, net | — | | | 839 | | | 839 | | | 156 | | | 861 | | | 1,017 | | | 5 | | | 265 | | | 2,126 | | | |

| Realized gains, net | — | | | 6,687 | | | 6,687 | | | — | | | 390 | | | 390 | | | 1,307 | | | — | | | 8,384 | | | |

| Total non-interest income (loss), net | 21,265 | | | 11,453 | | | 32,718 | | | 33,310 | | | 5,033 | | | 38,343 | | | 43,330 | | | 18 | | | 114,409 | | | |

| | | | | | | | | | | | | | | | | | | |

| General and administrative expenses | (6,898) | | | (895) | | | (7,793) | | | (12,356) | | | (1,332) | | | (13,688) | | | (930) | | | (18,183) | | | (40,594) | | | |

| Loan acquisition costs | (1,887) | | | — | | | (1,887) | | | (1,861) | | | — | | | (1,861) | | | — | | | — | | | (3,748) | | | |

| Other expenses, net | — | | | — | | | — | | | (3,873) | | | — | | | (3,873) | | | (112) | | | — | | | (3,985) | | | |

| | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | (3,725) | | | (446) | | | (4,171) | | | (2,182) | | | — | | | (2,182) | | | (334) | | | — | | | (6,687) | | | |

| | | | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | 14,383 | | | $ | 16,461 | | | $ | 30,844 | | | $ | 14,543 | | | $ | 18,269 | | | $ | 32,812 | | | $ | 53,592 | | | $ | (27,223) | | | $ | 90,025 | | | |

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2021 | | |

| Residential Mortgage Banking | | Residential Investments | | Total Residential Lending | | Business Purpose Mortgage Banking | | Business Purpose Investments | | Total Business Purpose Lending | | Third-Party Investments | | Corporate / Other | | Total | | |

| | | | | | | | | | | | | | | | | | | |

| Net interest income (expense) | $ | 2,832 | | | $ | 5,679 | | | $ | 8,511 | | | $ | 1,256 | | | $ | 13,074 | | | $ | 14,330 | | | $ | 11,811 | | | $ | (8,899) | | | $ | 25,753 | | | |

| | | | | | | | | | | | | | | | | | | |

| Non-interest income | | | | | | | | | | | | | | | | | | | |

| Mortgage banking activities, net | 61,435 | | | — | | | 61,435 | | | 21,172 | | | — | | | 21,172 | | | — | | | — | | | 82,607 | | | |

| Investment fair value changes, net | — | | | 2,746 | | | 2,746 | | | — | | | 3,299 | | | 3,299 | | | 39,716 | | | (674) | | | 45,087 | | | |

| Other income, net | — | | | 2,853 | | | 2,853 | | | 122 | | | 721 | | | 843 | | | — | | | 147 | | | 3,843 | | | |

| Realized gains, net | — | | | 2,408 | | | 2,408 | | | — | | | 108 | | | 108 | | | 200 | | | — | | | 2,716 | | | |

| Total non-interest income (loss), net | 61,435 | | | 8,007 | | | 69,442 | | | 21,294 | | | 4,128 | | | 25,422 | | | 39,916 | | | (527) | | | 134,253 | | | |

| | | | | | | | | | | | | | | | | | | |

| General and administrative expenses | (12,689) | | | (1,068) | | | (13,757) | | | (10,194) | | | (965) | | | (11,159) | | | (1,131) | | | (17,504) | | | (43,551) | | | |

| Loan acquisition costs | (1,404) | | | (12) | | | (1,416) | | | (1,492) | | | (560) | | | (2,052) | | | (87) | | | (4) | | | (3,559) | | | |

| Other expenses | (6) | | | — | | | (6) | | | (3,777) | | | — | | | (3,777) | | | (330) | | | 17 | | | (4,096) | | | |

| | | | | | | | | | | | | | | | | | | |

| Provision for income taxes | (9,486) | | | (493) | | | (9,979) | | | (1,321) | | | — | | | (1,321) | | | (243) | | | — | | | (11,543) | | | |

| | | | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | 40,682 | | | $ | 12,113 | | | $ | 52,795 | | | $ | 5,766 | | | $ | 15,677 | | | $ | 21,443 | | | $ | 49,936 | | | $ | (26,917) | | | $ | 97,257 | | | |

| | | | | | | | |

| THE REDWOOD REVIEW I 2ND QUARTER 2021 | | Table 2: Segment Results 23 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 3: GAAP Basic and Diluted Earnings per Common Share (in thousands, except per share data) | |

| | | | | | | | | | | | | | | |

| 2021

Q2 | | 2021

Q1 | | 2020

Q4 | | 2020

Q3 | | 2020

Q2 | | | Six

Months 2021 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| GAAP Earnings per Common Share ("EPS"): | | | | | | | | | | | | | | | |

| Net income attributable to Redwood | $ | 90,025 | | | $ | 97,257 | | | $ | 54,295 | | | $ | 141,812 | | | $ | 165,444 | | | | $ | 187,282 | | | | |

| Adjust for dividends and undistributed earnings allocated to participating securities | (3,149) | | | (3,294) | | | (1,705) | | | (4,067) | | | (4,528) | | | | (6,458) | | | | |

| Net income allocated to common shareholders for GAAP basic EPS | 86,876 | | | 93,963 | | | 52,590 | | | 137,745 | | | 160,916 | | | | 180,824 | | | | |

| Incremental adjustment to dividends and undistributed earnings allocated to participating securities | 280 | | | 343 | | | 58 | | | 555 | | | 1,412 | | | | 629 | | | | |

Adjust for interest expense and gain on extinguishment on convertible notes for the period, net of tax (1) | 6,990 | | | 7,007 | | | 6,999 | | | 6,990 | | | (15,835) | | | | 13,971 | | | | |

| Net income allocated to common shareholders for GAAP diluted EPS | $ | 94,146 | | | $ | 101,313 | | | $ | 59,647 | | | $ | 145,290 | | | $ | 146,493 | | | | $ | 195,424 | | | | |

| | | | | | | | | | | | | | | |

| Basic weighted average common shares outstanding | 112,921 | | 112,277 | | 112,074 | | 113,403 | | 114,383 | | | 112,338 | | | |

| Net effect of dilutive equity awards | 273 | | | 196 | | | — | | | — | | | — | | | | 234 | | | | |

Net effect of assumed convertible notes conversion to common shares (1) | 28,567 | | | 28,567 | | | 28,567 | | | 28,567 | | | 32,716 | | | | 28,567 | | | | |

| Diluted weighted average common shares outstanding | 141,761 | | 141,040 | | 140,641 | | 141,970 | | 147,099 | | | 141,139 | | | |

| | | | | | | | | | | | | | | |

| GAAP Basic Earnings per Common Share | $ | 0.77 | | | $ | 0.84 | | | $ | 0.47 | | | $ | 1.21 | | | $ | 1.41 | | | | $ | 1.61 | | | | |

| GAAP Diluted Earnings per Common Share | $ | 0.66 | | | $ | 0.72 | | | $ | 0.42 | | | $ | 1.02 | | | $ | 1.00 | | | | $ | 1.38 | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Certain convertible notes were determined to be dilutive in the periods presented and were included in the calculation of diluted EPS under the "if-converted" method. Under this method, the periodic interest expense and gains on extinguishment of debt (net of applicable taxes) for dilutive notes is added back to the numerator and the number of shares that the notes are entitled to (if converted, regardless of whether they are in or out of the money) are included in the denominator.

| | | | | | | | |

| THE REDWOOD REVIEW I 2ND QUARTER 2021 | | Table 3: GAAP Earnings per Basic and Diluted Common Share 24 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 4: Financial Ratios and Book Value ($ in thousands, except per share data) | |

| | | | | | | | | | | | | |

| | 2021

Q2 | | 2021

Q1 | | 2020

Q4 | | 2020

Q3 | | 2020

Q2 | | Six

Months

2021 | |

| Financial performance ratios | | | | | | | | | | | | |

| GAAP net income | $ | 90,025 | | | $ | 97,257 | | | $ | 54,295 | | | $ | 141,812 | | | $ | 165,444 | | | $ | 187,282 | | |

| Corporate general and administrative expenses | $ | (18,183) | | | $ | (17,504) | | | $ | (15,176) | | | $ | (12,998) | | | $ | (13,818) | | | $ | (35,687) | | |

| Average total assets | $ | 11,649,799 | | | $ | 10,703,876 | | | $ | 10,362,681 | | | $ | 10,098,372 | | | $ | 10,410,067 | | | $ | 11,184,218 | | |

| Average total equity | $ | 1,255,621 | | | $ | 1,142,855 | | | $ | 1,079,952 | | | $ | 999,381 | | | $ | 808,896 | | | $ | 1,199,550 | | |

| Corporate general and administrative expenses / average total equity | 5.79 | % | | 6.13 | % | | 5.62 | % | | 5.20 | % | | 6.83 | % | | 5.95 | % | |

| GAAP net income / average equity (GAAP ROE) | 28.68 | % | | 34.04 | % | | 20.11 | % | | 56.76 | % | | 81.81 | % | | 31.23 | % | |

| | | | | | | | | | | | | |

| Leverage ratios and book value per share | | | | | | | | | | | | |

| Short-term recourse debt | $ | 1,321,629 | | | $ | 1,061,811 | | | $ | 314,234 | | | $ | 253,763 | | | $ | 418,370 | | | | |

| Long-term recourse debt | 1,392,322 | | | 1,126,147 | | | 1,074,529 | | | 1,094,950 | | | 1,402,688 | | | | |

| Total recourse debt | $ | 2,713,951 | | | $ | 2,187,958 | | | $ | 1,388,763 | | | $ | 1,348,713 | | | $ | 1,821,058 | | | | |

| At consolidated securitization and non-recourse entities | | | | | | | | | | | | |

| ABS issued | 7,536,995 | | | 6,671,678 | | | 7,100,662 | | | 7,172,398 | | | 6,856,086 | | | | |

| Other non-recourse debt | 267,179 | | | 518,365 | | | 576,176 | | | 688,656 | | | 600,356 | | | | |

| Total ABS issued and non-recourse debt | $ | 7,804,174 | | | $ | 7,190,043 | | | $ | 7,676,838 | | | $ | 7,861,054 | | | $ | 7,456,442 | | | | |

Consolidated debt (1) | $ | 10,518,125 | | | $ | 9,378,001 | | | $ | 9,065,601 | | | $ | 9,209,767 | | | $ | 9,277,500 | | | | |

Tangible stockholders' equity (non-GAAP) (2) | $ | 1,246,022 | | | $ | 1,162,583 | | | $ | 1,054,035 | | | $ | 992,727 | | | $ | 871,966 | | | | |

| Total stockholders' equity | $ | 1,295,142 | | | $ | 1,215,575 | | | $ | 1,110,899 | | | $ | 1,053,464 | | | $ | 936,576 | | | | |

Total capital (3) | $ | 1,946,177 | | | $ | 1,865,968 | | | $ | 1,760,658 | | | $ | 1,702,599 | | | $ | 1,585,096 | | | | |

Recourse leverage ratio (recourse debt at Redwood to tangible stockholders' equity)(4) | 2.2x | | 1.9x | | 1.3x | | 1.4x | | 2.1x | | | |

| Consolidated debt to tangible stockholders' equity | 8.4x | | 8.1x | | 8.6x | | 9.3x | | 10.6x | | | |

| Shares outstanding at period end (in thousands) | 113,053 | | | 112,999 | | | 112,090 | | | 111,904 | | | 114,940 | | | | |

| Book value per share | $ | 11.46 | | | $ | 10.76 | | | $ | 9.91 | | | $ | 9.41 | | | $ | 8.15 | | | | |

| | | | | | | | | | | | | |

(1)Amounts presented in Consolidated debt above do not include deferred issuance costs or debt discounts.

(2)At June 30, 2021, March 31, 2021, December 31, 2020, September 30, 2020, and June 30, 2020, tangible stockholders' equity excluded $49 million, $53 million, $57 million, $61 million, and $65 million, respectively, of intangible assets.

(3)Our total capital of $1.9 billion at June 30, 2021 included $1.3 billion of equity capital and $0.7 billion of unsecured corporate debt.

(4)Excludes ABS issued and non-recourse debt at consolidated entities. See Table 6 for additional detail on our ABS issued and short-term debt at consolidated entities.

| | | | | | | | |

| THE REDWOOD REVIEW I 2ND QUARTER 2021 | | Table 4: Financial Ratios and Book Value 25 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Table 5A: Combined Investment Portfolio Detail

($ in thousands) | | Table 5B: Combined Investment Portfolio Rollforward

($ in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 6/30/21 | | 3/31/21 | | 12/31/20 | | Asset Rollforward | | Sequoia Securities | | SFR Securities | | RPL Securities | | Multifamily Securities | | Other Third-Party Securities | | Bridge Loans | | Called

Sequoia Loans | | Other Investments | | Total |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investment Portfolio Assets | | | | | | Balance at 12/31/20 | | $ | 373 | | | $ | 239 | | | $ | 483 | | | $ | 78 | | | $ | 79 | | | $ | 663 | | | $ | — | | | $ | 178 | | | $ | 2,093 | |

| Sequoia securities | $ | 391 | | | $ | 383 | | | $ | 373 | | | New investments | | 8 | | | 22 | | | — | | | 5 | | | 11 | | | 133 | | | 19 | | | — | | | 198 | |

| SFR securities | 268 | | | 261 | | | 239 | | | Sales/Paydowns | | (7) | | | — | | | (12) | | | (14) | | | (10) | | | (149) | | | — | | | (3) | | | (195) | |

| RPL securities | 513 | | | 497 | | | 483 | | | MTM | | 12 | | | — | | | 27 | | | 9 | | | 4 | | | 3 | | | — | | | 3 | | | 58 | |

| Multifamily securities | 73 | | | 77 | | | 78 | | | Other, net | | (2) | | | — | | | (1) | | | (1) | | | (1) | | | (4) | | | — | | | — | | | (9) | |

| Other third-party securities | 86 | | | 83 | | | 79 | | | Balance at 3/31/21 | | $ | 383 | | | $ | 261 | | | $ | 497 | | | $ | 77 | | | $ | 83 | | | $ | 646 | | | $ | 19 | | | $ | 178 | | | $ | 2,144 | |

| Bridge loans | 741 | | | 646 | | | 663 | | | New investments | | 8 | | | 15 | | | 1 | | | — | | | 2 | | | 216 | | | 83 | | | — | | | 325 | |

| Called Sequoia loans | 97 | | | 19 | | | 45 | | | Sales/Paydowns | | (13) | | | (12) | | | (26) | | | (5) | | | (3) | | | (118) | | | (6) | | | (14) | | | (197) | |

Other investments (1) | 161 | | | 178 | | | 133 | | | MTM | | 13 | | | 4 | | | 41 | | | 1 | | | 4 | | | — | | | 1 | | | (3) | | | 61 | |

| Total investments | $ | 2,330 | | | $ | 2,144 | | | $ | 2,093 | | | Other, net | | — | | | — | | | — | | | — | | | — | | | (3) | | | — | | | — | | | (3) | |

| | | | | | | Balance at 6/30/21 | | $ | 391 | | | $ | 268 | | | $ | 513 | | | $ | 73 | | | $ | 86 | | | $ | 741 | | | $ | 97 | | | $ | 161 | | | $ | 2,330 | |

| Debt Secured by Portfolio Assets | | | | | | | | | | | | | | | | | | | | | | | | |

| Sequoia securities | $ | (213) | | | $ | (226) | | | $ | (226) | | | | | | | | | | | | | | | | | | | | | |

| SFR securities | (102) | | | (102) | | | (103) | | | | | | | | | | | | | | | | | | | | | |

| RPL securities | (179) | | | (200) | | | (205) | | | | | | | | | | | | | | | | | | | | | |

| Multifamily securities | (28) | | | (29) | | | (30) | | | | | | | | | | | | | | | | | | | | | |

| Other third-party securities | — | | | — | | | — | | | | | | | | | | | | | | | | | | | | | |

| Bridge loans | (483) | | | (428) | | | (456) | | | | | | | | | | | | | | | | | | | | | |

| Called Sequoia loans | (88) | | | — | | | — | | | | | | | | | | | | | | | | | | | | | |

Other investments (1) | — | | | — | | | — | | | | | | | | | | | | | | | | | | | | | |

| Total debt secured by investments | $ | (1,093) | | | $ | (985) | | | $ | (1,019) | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Capital Invested in Portfolio Assets | | | | | | | | | | | | | | | | | | | | | | |

| Sequoia securities | $ | 178 | | | $ | 157 | | | $ | 147 | | | | | | | | | | | | | | | | | | | | | |

| SFR securities | 166 | | | 159 | | | 136 | | | | | | | | | | | | | | | | | | | | | |

| RPL securities | 334 | | | 297 | | | 278 | | | | | | | | | | | | | | | | | | | | | |

| Multifamily securities | 45 | | | 48 | | | 48 | | | | | | | | | | | | | | | | | | | | | |

| Other third-party securities | 86 | | | 83 | | | 79 | | | | | | | | | | | | | | | | | | | | | |

| Bridge loans | 258 | | | 218 | | | 207 | | | | | | | | | | | | | | | | | | | | | |

| Called Sequoia loans | 9 | | | 45 | | | 45 | | | | | | | | | | | | | | | | | | | | | |

Other investments (1) | 161 | | | 133 | | | 133 | | | Notes | | | | | | | | | | | | | | | | | | |

| Total capital invested | $ | 1,237 | | | $ | 1,140 | | | $ | 1,073 | | | (1) Other investments is primarily comprised of servicing receivable investments, shared home appreciation options, excess MSRs and other residential and business purpose related investments.

(2) Total leverage is calculated by dividing the total debt secured by portfolio assets (both secured recourse and secured pre-payable non-recourse debt), by the total capital invested in portfolio assets. |

| | | | | | | |

Total leverage (2) | 0.88 | x | | 0.86 | x | | 0.95 | x | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| THE REDWOOD REVIEW I 2ND QUARTER 2021 | | Table 5: Combined Investment Portfolio 26 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Table 6: Consolidated Balance Sheet ($ in thousands) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | June 30, 2021 | | | |

| | | | | | | Consolidated VIEs (1) | | | | | | | | | | |

| | 6/30/2021 | | 3/31/2021 | | At Redwood (1) | | Sequoia | | CAFL | | Freddie Mac SLST | | Freddie Mac

K-Series | | Other VIEs (2) | | Other (3) | | Redwood

Consolidated | | | | | | | | | | | | | | | |

| Residential loans | | $ | 5,742,600 | | | $ | 4,701,836 | | | $ | 1,160,548 | | | $ | 2,222,553 | | | $ | — | | | $ | 2,098,624 | | | $ | — | | | $ | 260,875 | | | $ | — | | | $ | 5,742,600 | | | | | | | | | | | | | | | | |

| Business purpose loans | | 4,408,889 | | | 4,172,120 | | | 952,671 | | | — | | | 3,263,878 | | | — | | | — | | | — | | | 192,340 | | | 4,408,889 | | | | | | | | | | | | | | | | |

| Multifamily loans | | 485,157 | | | 489,545 | | | — | | | — | | | — | | | — | | | 485,157 | | | — | | | — | | | 485,157 | | | | | | | | | | | | | | | | |

| Real estate securities | | 354,886 | | | 364,320 | | | 354,886 | | | — | | | — | | | — | | | — | | | — | | | — | | | 354,886 | | | | | | | | | | | | | | | | |

| Other investments | | 308,732 | | | 322,579 | | | 106,363 | | | — | | | — | | | — | | | | | 202,369 | | | — | | | 308,732 | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | 421,223 | | | 426,019 | | | 408,764 | | | — | | | — | | | — | | | — | | | 12,459 | | | — | | | 421,223 | | | | | | | | | | | | | | | | |

Other assets (4) | | 274,904 | | | 420,429 | | | 204,384 | | | 7,559 | | | 25,698 | | | 7,961 | | | 1,326 | | | 27,976 | | | — | | | 274,904 | | | | | | | | | | | | | | | | |

| Total assets | | $ | 11,996,391 | | | $ | 10,896,848 | | | $ | 3,187,616 | | | $ | 2,230,112 | | | $ | 3,289,576 | | | $ | 2,106,585 | | | $ | 486,483 | | | $ | 503,679 | | | $ | 192,340 | | | $ | 11,996,391 | | | | | | | | | | | | | | | | |

| Short-term debt | | $ | 1,484,999 | | | $ | 1,253,882 | | | $ | 1,321,370 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 163,629 | | | $ | — | | | $ | 1,484,999 | | | | | | | | | | | | | | | | |

| Other liabilities | | 194,945 | | | 317,452 | | | 156,973 | | | 5,521 | | | 10,183 | | | 4,490 | | | 1,200 | | | 16,578 | | | — | | | 194,945 | | | | | | | | | | | | | | | | |

| ABS issued | | 7,536,997 | | | 6,671,677 | | | — | | | 1,990,548 | | | 3,007,596 | | | 1,826,318 | | | 454,324 | | | 258,211 | | | — | | | 7,536,997 | | | | | | | | | | | | | | | | |

| Long-term debt, net | | 1,484,308 | | | 1,438,262 | | | 1,381,110 | | | — | | | — | | | — | | | — | | | — | | | 103,198 | | | 1,484,308 | | | | | | | | | | | | | | | | |

| Total liabilities | | 10,701,249 | | | 9,681,273 | | | 2,859,453 | | | 1,996,069 | | | 3,017,779 | | | 1,830,808 | | | 455,524 | | | 438,418 | | | 103,198 | | | 10,701,249 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Equity | | 1,295,142 | | | 1,215,575 | | | 328,163 | | | 234,043 | | | 271,797 | | | 275,777 | | | 30,959 | | | 65,261 | | | 89,142 | | | 1,295,142 | | | | | | | | | | | | | | | | |

| Total liabilities and equity | | $ | 11,996,391 | | | $ | 10,896,848 | | | $ | 3,187,616 | | | $ | 2,230,112 | | | $ | 3,289,576 | | | $ | 2,106,585 | | | $ | 486,483 | | | $ | 503,679 | | | $ | 192,340 | | | $ | 11,996,391 | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)The format of this consolidating balance sheet is provided to more clearly delineate between the assets and liabilities belonging to securitization entities (Consolidated VIEs) that we are required to consolidate on our balance sheet in accordance with GAAP, and the assets that are legally ours and the liabilities of ours for which there is recourse to us. Each of these entities is independent of Redwood and of each other and the assets and liabilities of these entities are not owned by and are not legal obligations of ours. Our exposure to these entities is primarily through the financial interests we have retained or acquired in these entities (generally subordinate and interest-only securities), the fair value of which is represented by our equity in each entity, as presented in this table.

(2)Includes our consolidated Legacy Sequoia and Servicing Investment entities. At June 30, 2021, our equity in the Legacy Sequoia and Servicing Investment entities was $4 million and $62 million, respectively. At March 31, 2021, our equity in the Legacy Sequoia and Servicing Investment entities was $4 million and $65 million, respectively.

(3)Includes business purpose bridge loans and associated non-recourse secured financing.

(4)At June 30, 2021 and March 31, 2021, restricted cash and other assets at Redwood included a total of $34 million and $46 million of assets, respectively, held by third-party custodians and pledged as collateral to the GSEs in connection with credit risk-sharing arrangements. These pledged assets can only be used to settle obligations to the GSEs under these risk-sharing arrangements.

| | | | | | | | |

| THE REDWOOD REVIEW I 2ND QUARTER 2021 | | Table 6: Consolidated Balance Sheet 27 |

| | |

|

| S E G M E N T O V E R V I E W |

Segment Overview

We operate our business in three segments: Residential Lending, Business Purpose Lending and Third-Party Investments. Our two lending segments represent vertically integrated platforms and our third segment captures our investments in third-party assets.

Each segment includes all revenue and direct expense associated with the origination, acquisition and management of its associated financial assets. Our three business segments currently include:

Residential Lending – Comprised of our residential mortgage banking operations and investments created from these activities, including primarily securities retained from our residential loan securitization activities.

Business Purpose Lending – Comprised of our business purpose mortgage banking operations and investments created from these activities, including SFR securities retained from CoreVest-sponsored securitizations and investments in residential and small-balance multifamily bridge loans.

Third-Party Investments – Comprised of other investments not sourced through our residential or business purpose lending segments, including: re-performing loan securities, third-party RMBS (including CRT securities and legacy securities), multifamily securities and loans we have acquired, and other housing-related investments.

| | |

| Detailed endnotes are included at the end of this Redwood Review. |

|

| THE REDWOOD REVIEW I 2ND QUARTER 2021 |

29 |

| | |

|