The

Redwood Review

3rd

Quarter 2006

|

The

Redwood Review

3rd

Quarter 2006

|

|

CONTENTS |

|

INTRODUCTION

|

2

|

|

|

SHAREHOLDER

LETTER

|

3

|

|

|

ABOUT

REDWOOD TRUST

|

7

|

|

|

BUSINESS

GROUP DISCUSSION

|

|

|

|

►

|

Residential

Group

|

12

|

|

►

|

Commercial

Group

|

17

|

|

►

|

CDO

Group

|

21

|

|

FINANCIAL

REVIEW

|

|

|

|

►

|

Finance

Group

Overview

|

24

|

|

►

|

GAAP

Earnings

|

28

|

|

►

|

Core

Earnings

|

29

|

|

►

|

Taxable

Income

|

30

|

|

►

|

Book

Value

per Share

|

34

|

|

►

|

Return

on

Equity

|

36

|

|

►

|

Residential

Credit Results

|

38

|

|

►

|

Credit

Reserves

|

42

|

|

►

|

Dividends

|

44

|

|

APPENDIX

|

|

|

|

►

|

Glossary

|

46

|

|

►

|

Financial

Tables

|

53

|

|

INTRODUCTION |

|

SHAREHOLDER LETTER |

|

SHAREHOLDER LETTER |

|

SHAREHOLDER LETTER |

|

SHAREHOLDER LETTER |

|

|

|

George

E.

Bull, III

|

Douglas

B.

Hansen

|

|

Chairman

and CEO

|

President

|

|

ABOUT REDWOOD TRUST |

| 1. |

We

are an entrepreneurial specialty finance

company.

|

|

2.

|

Our

primary business is credit-enhancing securitized residential

and

commercial real estate

loans.

|

|

3.

|

We

credit-enhance loans by acquiring and owning credit-enhancement

securities.

|

|

ABOUT REDWOOD TRUST |

| 4. |

Our

primary focus is on credit-enhancing high-quality real

estate

assets.

|

| 5. |

We

use securitization to finance most of our

assets.

|

|

ABOUT REDWOOD TRUST |

| 6. |

We

maintain a strong balance

sheet.

|

| 7. |

We

are leaders in our market

segments.

|

|

ABOUT REDWOOD TRUST |

| 8. |

We

have some interesting competitive

advantages.

|

| 9. |

We

pay a regular dividend and we may pay a special

dividend.

|

| 10. |

We

are a growth company.

|

|

ABOUT REDWOOD TRUST |

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

|

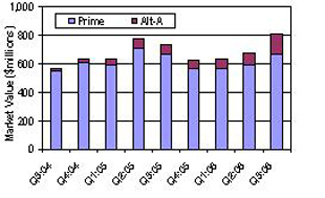

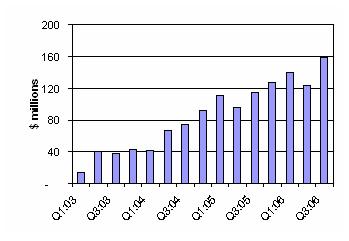

Chart

1: Total Residential CES

|

Chart 2: Residential 1st Loss CES Portfolio by Vintage | |||

|

|

|||

| Source: Redwood Trust |

Source:

Redwood Trust

|

|||

| Ø |

Our

residential CES assets are growing at a measured

|

Ø |

Our

residential first-loss portfolio remains very

|

|

| pace. | seasoned,with 62% of assets originated prior | |||

|

to

2005.

|

||||

| Ø | Measured by market value. | |||

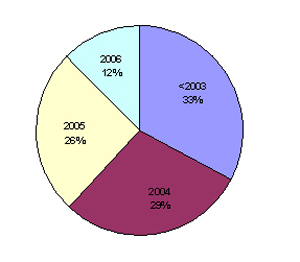

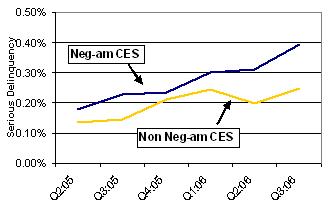

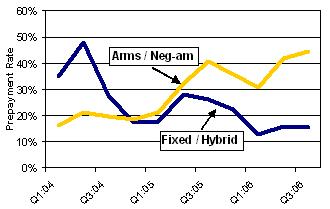

| Chart 3: Seriously Delinquent Trends for Neg-Am Residential CES | Chart 4: Prepayments Trends for Residential CES | |||

|

|

|||

| Source: Redwood Trust |

Source:

Redwood Trust

|

|||

| Ø |

Neg-am and non neg-am

CES

delinquencies remain low

|

Ø |

We continue to benefit

from

higher than expected

|

|

|

on an absolute

basis.

|

prepayment rates

on our ARM

and neg-am CES.

|

|||

| Ø |

Neg-am CES delinquencies

are

performing well relative to

|

|||

|

our higher expected

loss

assumptions.

|

||||

| Ø |

Delinquencies are

measured as

a percentage of current

|

|||

|

pool

balances.

|

||||

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

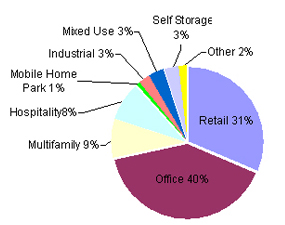

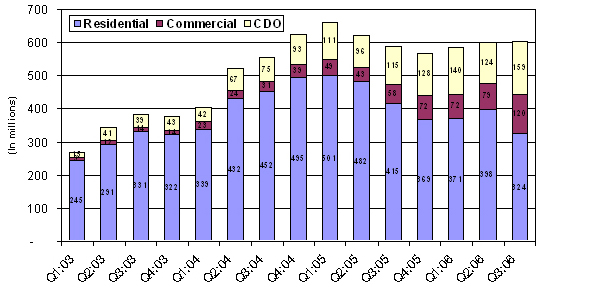

| Chart 5: Redwood’s First-Loss Commercial CES and CRE CDO Equity | Chart 6: Commercial Property Type Distribution | |||

|

|

|||

| Source: Redwood Trust |

Source:

September 2006 Remittance Reports

|

|||

| Ø | Our first-loss CES portfolio continues to grow at a steady | Ø | Given the potential outlook for slower GDP growth and the | |

| pace. | slowdown in the residential housing market, we are paying | |||

| Ø | In 2007, we expect to match our current pace. |

particular attention

to the

retail exposure we are taking on.

|

||

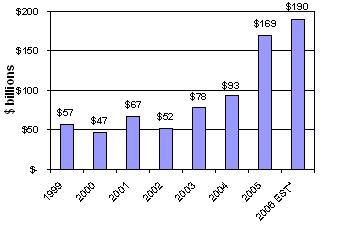

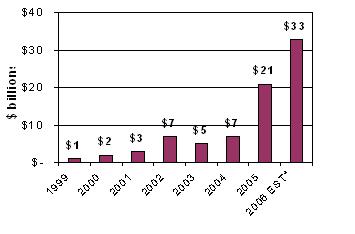

| Chart 7: Domestic CMBS Historical Issuance | Chart 8: CRE CDO Historical Issuance | |||

|

|

|||

|

Source:

Commercial Mortgage Alert 10/6/05*

Redwood

Trust estimate

|

Source:

CRE CDO 201 CMSA Investor Conference

9/28/06. *

Redwood

Trust estimate

|

|||

| Ø | The last few years have seen tremendous growth in CMBS | Ø |

CRE CDO issuance

is growing

rapidly and we expect this

|

|

| issuance. | trend to continue through 2007. | |||

| Ø | Though issuance may slow down in coming years, we | Ø |

We

expect to

issue more CRE CDOs to

|

|

| expect it to stay above the $150 billion level. |

fund

our

growing commercial assets.

|

|||

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

|

BUSINESS GROUP DISCUSSION |

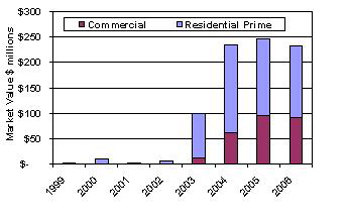

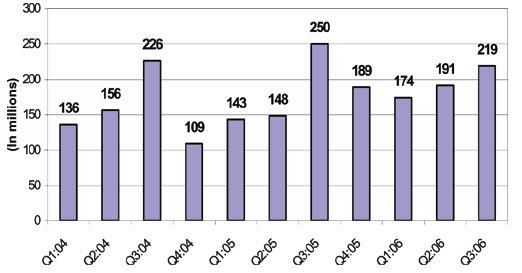

| Chart 9: Acacia’s Non-Investment Grade Assets by Vintage | Chart 10: Acacia Equity Invested | |||

|

|

|||

| Source: Redwood Trust |

Source:

Redwood Trust

|

|||

| Ø | Commercial assets are 1/3 and Prime residential assets | Ø | Acacia equity is a significant part of Redwood’s | |

| are 2/3 of the total non-investment grade portfolio. | investments. | |||

| Ø | Returns to date have exceeded our hurdle rate. | |||

| Ø | Returns are expected to remain above our hurdle rate. | |||

| Ø | The market value of Acacia equity has grown since we | |||

| initially invested. | ||||

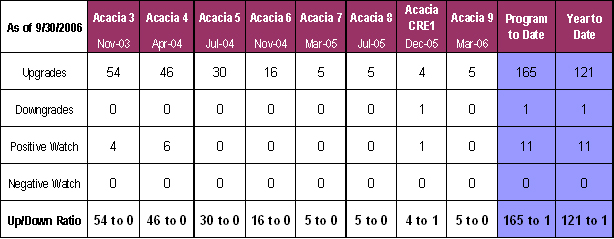

| Chart 11: Acacia Collateral Rating History | ||||

|

||||

| Source: Redwood Trust | ||||

| Ø Upgrades of securities owned by Acacia are a sign that Acacia CDO equity may continue to perform well. | ||||

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

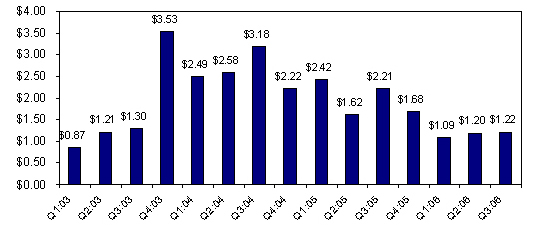

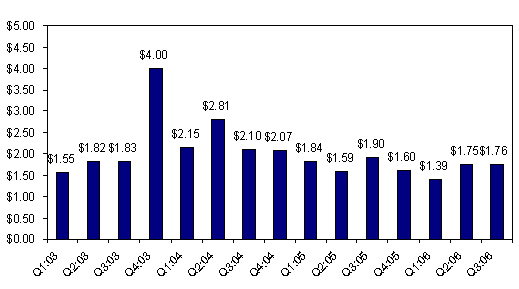

| a) |

Graph

|

| b) |

Quarterly

Update

|

|

Ø

|

Our

GAAP

earnings were $32 million, or $1.22 per share, for the third

quarter of

2006. This was a slight increase over the previous quarter. In

the third

quarter of 2005, GAAP earnings were $56 million, or $2.21 per

share.

|

|

Ø

|

The

reduction

in net income of $24 million from the third quarter of 2005 resulted

substantially from a reduced amount of gains generated from selling

assets

and asset calls.

|

|

Ø

|

Net

interest

income was $49 million in the current quarter, an increase of

$4 million

from the previous quarter and an increase of $1 million from

the third

quarter of last year. This reflects rising yields from our residential

credit-enhancement portfolio resulting from strong credit performance

and

rapid prepayments.

|

|

Ø

|

The

yield on

our residential credit-enhancement securities improved from 17%

in the

third quarter of 2005 to 19% in the second quarter of 2006, to

22% in the

third quarter of 2006. The performance of yields generated by

our

credit-enhancement investments in neg-am loans have been particularly

favorable.

|

|

FINANCIAL REVIEW |

|

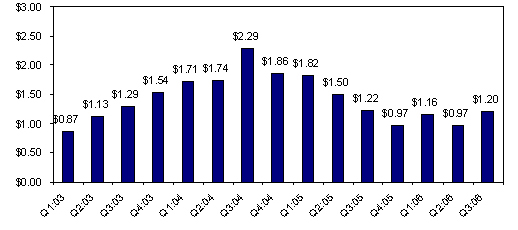

a)

|

Graph

|

|

b)

|

Quarterly

Update

|

|

Ø

|

Core

earnings

were $32 million, or $1.20 per share, for the third quarter of

2006. This

is the highest level of core earnings since the third quarter

of

2005.

|

|

Ø

|

An

additional

boost in core earnings could come as we invest our excess capital.

Other

factors, of course, could cause

volatility.

|

|

FINANCIAL REVIEW |

|

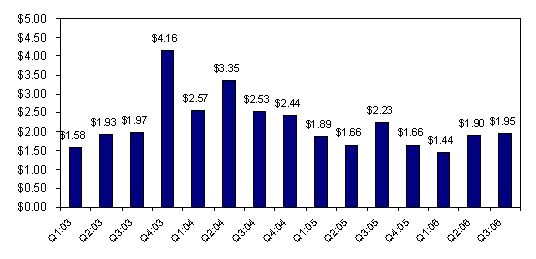

a)

|

Graphs

|

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

|

b)

|

Quarterly

Update

|

|

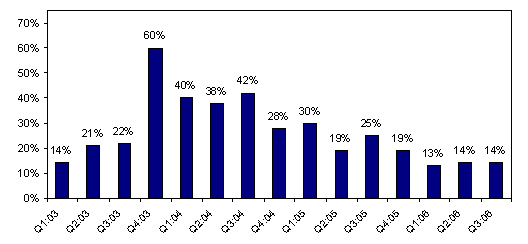

Ø

|

Taxable

income results continue to be favorable. Total taxable income

was $51

million, or $1.95 per share, in the third quarter of

2006.

|

|

Ø

|

Our

REIT

taxable income per share continues to exceed our regular

quarterly

dividend rate of $0.70 per share by quarter by a comfortable

margin.

|

|

Ø

|

Taxable

income exceeds GAAP for a variety of reasons, the largest

of which is that

we are not able to establish credit reserves for tax. Currently,

our

actual credit losses are minimal. Taxable income was reduced

by $1.1

million ($0.04 per share) in the third quarter as a result

of deductions

for actual credit losses. This deduction is less than the

losses incurred

on the underlying loans, as we own most of our credit-sensitive

assets at

a tax basis that is substantially less than par (principal)

value.

Increased credit losses would reduce taxable income and our

dividend

distributions.

|

|

Ø

|

For

a variety

of reasons, including but not limited to stock option exercises

and

distributions from deferred compensation plans, our taxable

income results

can be volatile on a quarter-to-quarter

basis.

|

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

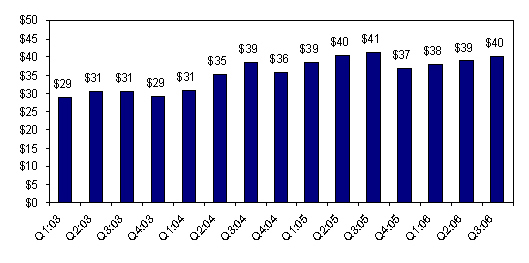

| a) |

Graph

|

|

FINANCIAL REVIEW |

|

Ø

|

For

the third

quarter of 2006, after including the effect of declaring $0.70

per share

of regular dividends, GAAP book value per share increased by

2% from

$39.13 per share to $40.02 per

share.

|

|

Ø

|

Over

time,

our GAAP book value per share has been increasing because of

retention of

a portion of our income, increases in the market value of our

assets, and

issuance of stock at prices in excess of book

value.

|

|

Ø

|

At

September

30, 2006, core book value was $36.38 per share and adjusted

core book

value was $32.11 per share.

|

|

Ø

|

At

the end of

our first quarter of operations in September 1994, GAAP book

value was

$11.67 per share. Since that time, we have paid $36.73 per

share of

dividends while also increasing GAAP book value by $28.35 per

share.

|

|

Ø

|

Book

value

per share growth is not a direct indicator of our market value

or an

indicator of the returns available to our shareholders. If

you had

acquired Redwood stock at our initial public offering in August

1995, and

had reinvested all dividends back into Redwood stock, your

annualized

compounded return as a shareholder through the third quarter

of 2006 would

have been 21% through October 31, 2006. Future results may

vary.

|

|

FINANCIAL REVIEW |

| a) |

Graph

|

|

FINANCIAL REVIEW |

|

Ø

|

GAAP

ROE was

13% for the third quarter of 2006 as compared to 22% in the third

quarter

of 2005.

|

|

Ø

|

Adjusted

ROE

was 14% for the third quarter of 2006 and 25% for the third quarter

of

2005. Adjusted ROE is greater than GAAP ROE due to the appreciation

of the

market values of assets that are marked-to-market through our

GAAP balance

sheet. This increases our GAAP equity and thus lowers GAAP

ROE.

|

|

Ø

|

Over

the very

long term, we expect to generate an average adjusted annual return

on

equity between 11% and 18%.

|

|

FINANCIAL REVIEW |

| a) |

Graphs

|

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

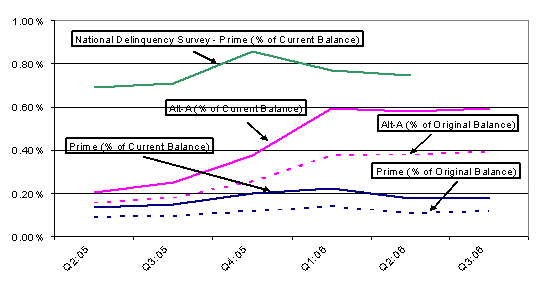

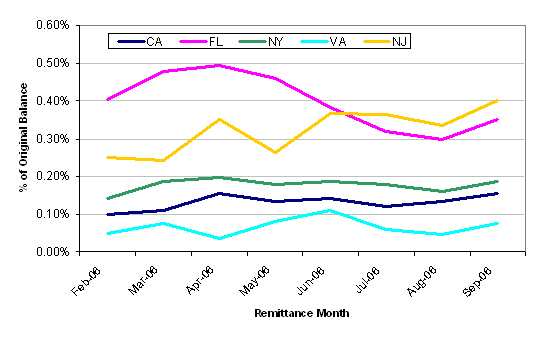

| Ø |

At

September

30, 2006, through ownership of credit-enhancement securities

and whole

loans, we were exposed to credit risk on $235 billion in

residential real

estate loans (excluding loans underlying investment-grade

rated

securities). Of this total, prime-quality loans were $210

billion.

|

| Ø |

For

the third

quarter of 2006, realized credit losses within these loan

pools were $2.6

million of principal value, a rate that is less than one

basis point

(0.01%) on an annualized basis of the current balance of

loans. Principal

value losses were $2.4 million for loans in prime pools and

$0.2 million

for Alt-A. There were no sub-prime losses, as these loans

are

new.

|

| Ø |

Realized

credit losses for residential assets for tax purposes were

$1.1 million

for the third quarter. This deduction is less than the principal

value

losses incurred on the underlying loans, as we own most of

our

credit-sensitive assets at a tax basis that is substantially

less than par

(principal) value.

|

| Ø |

Serious

delinquencies at September 30, 2006 were 0.23% of current

balances and

0.14% of original balances. For loans in prime pools, delinquencies

were

0.19% of current balance and 0.12% of original balance. Alt-A

pools had

delinquencies of 0.60% of current balance and 0.40% of original

balance.

Although delinquency ratios were generally stable for the

quarter, total

serious residential delinquencies increased from $467 million

to $528

million.

|

| Ø |

For

prime

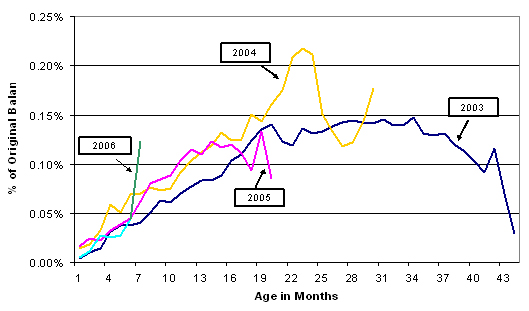

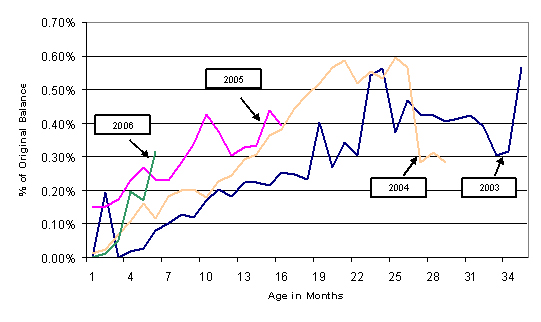

loans, the delinquency performance as a percentage of original

balance of

the 2005 and 2006 vintages has been generally similar (as

measured at

similar months since origination) to earlier vintages. The

latest month

jumped up slightly, but the last several months of data on

vintage charts

needs to be interpreted with caution—this portion of vintage data is

volatile as it is based on a very small sample set. It is

too early to

conclude that the increase in the delinquency ratio for 6-month-old

loans

originated in 2006 is indicative of a real trend.

|

| Ø |

For

Alt-A

loans, delinquency results appear to be deteriorating slightly

with each

subsequent vintage, although it is too early to draw definitive

conclusions.

|

| Ø |

We

closely

monitor early payment defaults, defined as loans that become

seriously

delinquent within three months of loan origination, for the

673,000

residential loans we credit-enhance or own. Early payment

defaults remain

very low. We have averaged 14 new early payment defaults

per month in

2006, compared to 10 per month in

2005.

|

|

FINANCIAL REVIEW |

|

FINANCIAL REVIEW |

| a) |

Graph

|

| b) |

Quarterly

Update

|

|

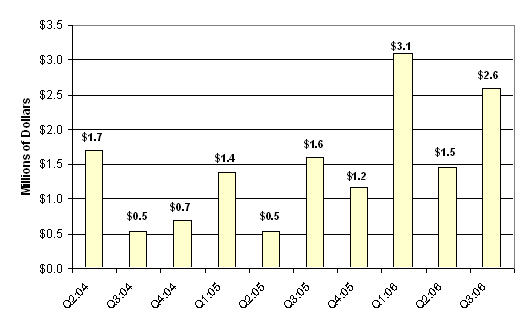

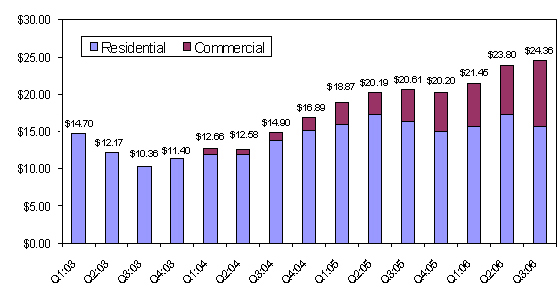

Ø

|

Our

GAAP

credit reserves at September 30, 2006 were $635 million, or $24.36

per

share.

|

|

Ø

|

At

September

30, 2006, our residential real estate credit reserves were $384

million

($14.76 per share) for CES and $19 million ($0.74 per share) for

residential whole loans. The principal value of actual credit losses

underlying our residential loans and securities were $3 million

for the

third quarter of 2006 and $8 million for the last 12 months. Third

quarter

residential credit losses reduced taxable income by $1

million.

|

|

Ø

|

At

September

30, 2006, our commercial real estate credit reserves were $223

million

($8.55 per share) for CES and $8 million ($0.31 per share) for

commercial

whole loans. We incurred principal value commercial credit losses

of $0.5

million ($0.1 million tax losses) in the third quarter of 2006

and for the

last 12 months.

|

|

FINANCIAL REVIEW |

|

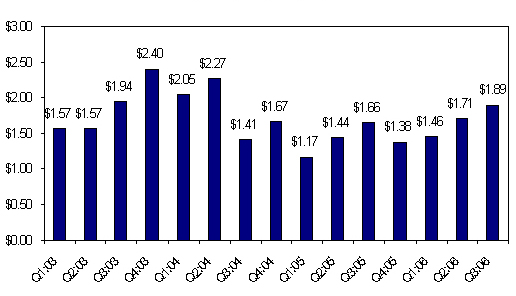

a)

|

Graphs

|

|

FINANCIAL REVIEW |

| b) |

Quarterly

Update

|

|

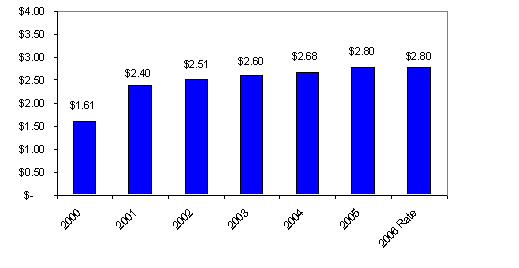

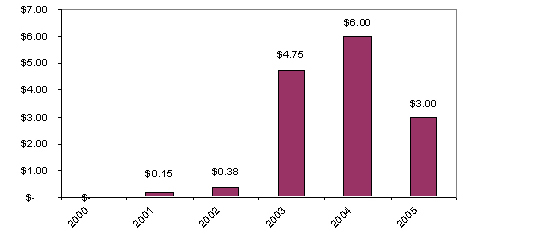

Ø

|

We

declared a

regular quarterly dividend of $0.70 per share in the third quarter

of

2006.

|

|

Ø

|

Based

on the

Redwood stock price of $54.97 on October 31, 2006, the dividend

yield on

Redwood stock based regular dividends distributed over the last

12 months

of $2.80 per share was 5%. The dividend yield based on the $5.80

per share

of total dividends (including the special dividend) distributed

over the

last 12 months was 11%.

|

|

Ø

|

We

plan to

permanently retain approximately 10% of the ordinary REIT taxable

income

we earn during 2006, and to retain 100% of the after-tax taxable

income we

earn at our taxable subsidiaries. By retaining a portion of our

income, we

seek to build book value per share, and thus potential earnings

and

dividends per share, over time.

|

|

Ø

|

We

also plan

to defer distribution of a portion of this year’s taxable income into the

following year.

|

|

Ø

|

Based

on our

estimates of REIT taxable income during 2005 and the first three

quarters

of 2006, we entered the fourth quarter of 2006 with $111 million

($4.28

per share) of undistributed REIT taxable

income.

|

|

Ø

|

We

expect to

distribute a special dividend in the fourth quarter of 2006.

Our special

dividend declaration will depend on our evolving projection of

fourth

quarter REIT taxable income performance. Although subject to

change, it

currently appears that the special dividend this year will exceed

$2.50

per share and could be close to the $3.00 per share special dividend

we

paid in December 2005.

|

|

APPENDIX |

|

APPENDIX |

|

APPENDIX |

|

APPENDIX |

|

APPENDIX |

|

APPENDIX |

| · |

More

than 60%

of loans with FICO < 680

|

| · |

Weighted

average LTV over 85%

|

| · |

More

than 70%

of loans with LTV over 75%

|

| · |

Loans

with

LTV over 80% with no mortgage

insurance

|

|

APPENDIX |

|

APPENDIX |

|

APPENDIX |

|

Table

1: GAAP Earnings (in thousands, except per share

data)

|

||||||||||||||||||||||||||||||||||

|

Nine

Months

|

Nine

Months

|

|||||||||||||||||||||||||||||||||

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

Q4:2004

|

Q3:2004

|

Q3:2006

|

Q3:2005

|

||||||||||||||||||||||||

|

Interest

income

|

$

|

217,504

|

$

|

214,544

|

$

|

224,795

|

$

|

234,531

|

$

|

246,810

|

$

|

248,786

|

$

|

237,714

|

$

|

205,125

|

$

|

174,072

|

$

|

656,843

|

$

|

733,309

|

||||||||||||

|

Discount

amortization income

|

19,530

|

14,381

|

14,661

|

11,936

|

12,714

|

8,395

|

9,316

|

9,146

|

9,012

|

48,572

|

30,425

|

|||||||||||||||||||||||

|

Premium

amortization expense

|

(12,920

|

)

|

(13,193

|

)

|

(13,398

|

)

|

(14,451

|

)

|

(15,698

|

)

|

(10,203

|

)

|

(8,082

|

)

|

(7,105

|

)

|

802

|

(39,511

|

)

|

(33,983

|

)

|

|||||||||||||

|

Provision

for

(reversal of) credit reserve

|

(465

|

)

|

2,506

|

(176

|

)

|

(877

|

)

|

805

|

1,527

|

(1,025

|

)

|

(1,697

|

)

|

(1,528

|

)

|

1,865

|

1,307

|

|||||||||||||||||

|

Total

GAAP

interest income

|

223,649

|

218,238

|

225,882

|

231,139

|

244,631

|

248,505

|

237,923

|

205,469

|

182,358

|

667,769

|

731,058

|

|||||||||||||||||||||||

|

Interest

expense on Redwood debt

|

(9,422

|

)

|

(1,822

|

)

|

(2,072

|

)

|

(3,520

|

)

|

(3,789

|

)

|

(1,789

|

)

|

(2,694

|

)

|

(2,527

|

)

|

(2,299

|

)

|

(13,316

|

)

|

(8,272

|

)

|

||||||||||||

|

ABS

expenses

consolidated from trusts

|

(165,177

|

)

|

(171,659

|

)

|

(178,182

|

)

|

(186,433

|

)

|

(190,996

|

)

|

(191,966

|

)

|

(173,146

|

)

|

(143,024

|

)

|

(108,249

|

)

|

(515,018

|

)

|

(556,108

|

)

|

||||||||||||

|

ABS

issuance

expense amortization

|

(5,786

|

)

|

(6,079

|

)

|

(5,907

|

)

|

(6,069

|

)

|

(5,162

|

)

|

(5,386

|

)

|

(5,273

|

)

|

(4,783

|

)

|

(4,197

|

)

|

(17,772

|

)

|

(15,821

|

)

|

||||||||||||

|

ABS

interest

agreement expense

|

3,317

|

3,678

|

2,980

|

3,573

|

623

|

876

|

1,469

|

606

|

(2,888

|

)

|

9,975

|

2,968

|

||||||||||||||||||||||

|

ABS

issuance

premium amortization income

|

2,395

|

2,363

|

2,526

|

2,793

|

2,733

|

3,140

|

3,747

|

2,644

|

2,823

|

7,284

|

9,620

|

|||||||||||||||||||||||

|

Total

consolidated ABS expense

|

(165,251

|

)

|

(171,697

|

)

|

(178,583

|

)

|

(186,136

|

)

|

(192,802

|

)

|

(193,336

|

)

|

(173,203

|

)

|

(144,557

|

)

|

(112,511

|

)

|

(515,531

|

)

|

(559,341

|

)

|

||||||||||||

|

GAAP

net

interest income

|

48,976

|

44,719

|

45,227

|

41,483

|

48,040

|

53,380

|

62,026

|

58,385

|

67,547

|

138,922

|

163,445

|

|||||||||||||||||||||||

|

Fixed

compensation expense

|

(3,437

|

)

|

(3,309

|

)

|

(3,437

|

)

|

(2,879

|

)

|

(2,802

|

)

|

(2,623

|

)

|

(2,778

|

)

|

(2,009

|

)

|

(1,959

|

)

|

(10,183

|

)

|

(8,203

|

)

|

||||||||||||

|

Variable

compensation expense

|

(5,209

|

)

|

(4,891

|

)

|

(4,208

|

)

|

(5,005

|

)

|

(4,241

|

)

|

(5,174

|

)

|

(4,565

|

)

|

(3,204

|

)

|

(3,789

|

)

|

(14,308

|

)

|

(13,980

|

)

|

||||||||||||

|

Other

operating expense

|

(4,425

|

)

|

(5,150

|

)

|

(4,505

|

)

|

(4,583

|

)

|

(4,246

|

)

|

(3,542

|

)

|

(3,698

|

)

|

(2,487

|

)

|

(2,813

|

)

|

(14,080

|

)

|

(11,486

|

)

|

||||||||||||

|

Due

diligence

expenses

|

(384

|

)

|

(2,687

|

)

|

(432

|

)

|

(298

|

)

|

(1,075

|

)

|

(117

|

)

|

(757

|

)

|

(291

|

)

|

(2,268

|

)

|

(3,503

|

)

|

(1,949

|

)

|

||||||||||||

|

Total

GAAP

operating expenses

|

(13,455

|

)

|

(16,037

|

)

|

(12,582

|

)

|

(12,765

|

)

|

(12,364

|

)

|

(11,456

|

)

|

(11,798

|

)

|

(7,991

|

)

|

(10,829

|

)

|

(42,074

|

)

|

(35,618

|

)

|

||||||||||||

|

Realized

gains

on calls

|

723

|

747

|

-

|

4,266

|

2,914

|

4,421

|

7,548

|

11,205

|

20,472

|

1,470

|

14,883

|

|||||||||||||||||||||||

|

Realized

gains

on sales

|

4,967

|

2,027

|

1,059

|

11,654

|

23,053

|

516

|

8,347

|

-

|

488

|

8,053

|

31,916

|

|||||||||||||||||||||||

|

Securities

and

loans valuation adjustments

|

(484

|

)

|

(2,305

|

)

|

(3,226

|

)

|

(1,111

|

)

|

(1,158

|

)

|

(1,710

|

)

|

(391

|

)

|

(1,948

|

)

|

(421

|

)

|

(6,015

|

)

|

(3,259

|

)

|

||||||||||||

|

Derivatives

valuation adjustments

|

(4,773

|

)

|

5,524

|

297

|

3,066

|

107

|

(182

|

)

|

(492

|

)

|

(411

|

)

|

47

|

1,048

|

(567

|

)

|

||||||||||||||||||

|

Net

gains and

valuation adjustments

|

433

|

5,993

|

(1,870

|

)

|

17,875

|

24,916

|

3,045

|

15,012

|

8,846

|

20,586

|

4,556

|

42,973

|

||||||||||||||||||||||

|

Deferred

tax

benefit

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||||

|

Provision

for

income taxes

|

(3,538

|

)

|

(3,265

|

)

|

(2,760

|

)

|

(4,097

|

)

|

(4,693

|

)

|

(4,054

|

)

|

(4,677

|

)

|

(4,826

|

)

|

(4,962

|

)

|

(9,563

|

)

|

(13,424

|

)

|

||||||||||||

|

GAAP

net

income

|

$

|

32,416

|

$

|

31,410

|

$

|

28,015

|

$

|

42,496

|

$

|

55,899

|

$

|

40,915

|

$

|

60,563

|

$

|

54,414

|

$

|

72,342

|

$

|

91,841

|

$

|

157,376

|

||||||||||||

|

Diluted

average shares

|

26,625

|

26,109

|

25,703

|

25,311

|

25,314

|

25,196

|

25,021

|

24,491

|

22,728

|

26,132

|

25,160

|

|||||||||||||||||||||||

|

GAAP

earnings

per share

|

$

|

1.22

|

$

|

1.20

|

$

|

1.09

|

$

|

1.68

|

$

|

2.21

|

$

|

1.62

|

$

|

2.42

|

$

|

2.22

|

$

|

3.18

|

$

|

3.51

|

$

|

6.26

|

||||||||||||

|

Table

2: Core Earnings (in thousands, except per share

data)

|

||||||||||||||||||||||||||||||||||

|

Nine

Months

|

Nine

Months

|

|||||||||||||||||||||||||||||||||

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

Q4:2004

|

Q3:2004

|

Q3:2006

|

Q3:2005

|

||||||||||||||||||||||||

|

GAAP

net

income

|

$

|

32,416

|

$

|

31,410

|

$

|

28,015

|

$

|

42,496

|

$

|

55,899

|

$

|

40,915

|

$

|

60,563

|

$

|

54,414

|

$

|

72,342

|

$

|

91,841

|

$

|

157,377

|

||||||||||||

|

GAAP

income

items not included in core earnings

|

||||||||||||||||||||||||||||||||||

|

Realized

gains

on calls

|

$

|

723

|

$

|

747

|

$

|

-

|

$

|

4,266

|

$

|

2,914

|

$

|

4,421

|

$

|

7,548

|

$

|

11,205

|

$

|

20,472

|

$

|

1,470

|

$

|

14,883

|

||||||||||||

|

Realized

gains

on sales

|

4,967

|

2,027

|

1,059

|

11,654

|

23,053

|

516

|

8,347

|

-

|

488

|

8,053

|

31,916

|

|||||||||||||||||||||||

|

Securities

and

loans valuation adjustments

|

(484

|

)

|

(2,305

|

)

|

(3,226

|

)

|

(1,111

|

)

|

(1,158

|

)

|

(1,710

|

)

|

(391

|

)

|

(1,948

|

)

|

(421

|

)

|

(6,015

|

)

|

(3,259

|

)

|

||||||||||||

|

Derivatives

valuation adjustments

|

(4,773

|

)

|

5,524

|

297

|

3,066

|

107

|

(182

|

)

|

(492

|

)

|

(411

|

)

|

47

|

1,048

|

(567

|

)

|

||||||||||||||||||

|

Variable

stock

option market value change

|

-

|

-

|

-

|

25

|

16

|

(2

|

)

|

84

|

3

|

(213

|

)

|

-

|

98

|

|||||||||||||||||||||

|

Total

GAAP /

Core earnings differences

|

433

|

5,993

|

(1,870

|

)

|

17,900

|

24,932

|

3,043

|

15,096

|

8,849

|

20,373

|

4,556

|

43,071

|

||||||||||||||||||||||

|

Core

earnings

|

$

|

31,983

|

$

|

25,417

|

$

|

29,885

|

$

|

24,596

|

$

|

30,967

|

$

|

37,872

|

$

|

45,467

|

$

|

45,565

|

$

|

51,969

|

$

|

87,285

|

$

|

114,306

|

||||||||||||

| Per share analysis | ||||||||||||||||||||||||||||||||||

|

GAAP

earnings

per share

|

$

|

1.22

|

$

|

1.20

|

$

|

1.09

|

$

|

1.68

|

$

|

2.21

|

$

|

1.62

|

$

|

2.42

|

$

|

2.22

|

$

|

3.18

|

$

|

3.51

|

$

|

6.26

|

||||||||||||

|

GAAP

income

items not included in core earnings

|

||||||||||||||||||||||||||||||||||

|

Realized

gains

on calls

|

$

|

0.03

|

$

|

0.03

|

$

|

0.00

|

$

|

0.17

|

$

|

0.12

|

$

|

0.18

|

$

|

0.30

|

$

|

0.46

|

$

|

0.90

|

$

|

0.06

|

$

|

0.60

|

||||||||||||

|

Realized

gains

on sales

|

0.19

|

0.08

|

0.04

|

0.46

|

0.92

|

0.02

|

0.34

|

-

|

0.02

|

0.30

|

1.27

|

|||||||||||||||||||||||

|

Securities

and

loans valuation adjustments

|

(0.02

|

)

|

(0.09

|

)

|

(0.12

|

)

|

(0.04

|

)

|

(0.05

|

)

|

(0.07

|

)

|

(0.02

|

)

|

(0.08

|

)

|

(0.02

|

)

|

(0.23

|

)

|

(0.13

|

)

|

||||||||||||

|

Derivatives

valuation adjustments

|

(0.18

|

)

|

0.21

|

0.01

|

0.12

|

-

|

(0.01

|

)

|

(0.02

|

)

|

(0.02

|

)

|

-

|

0.04

|

(0.02

|

)

|

||||||||||||||||||

|

Variable

stock

option market value change

|

-

|

-

|

-

|

0.00

|

-

|

-

|

-

|

-

|

(0.01

|

)

|

-

|

0.00

|

||||||||||||||||||||||

|

GAAP

/ Core

earnings differences per share

|

0.02

|

0.23

|

(0.07

|

)

|

0.71

|

0.99

|

0.12

|

0.60

|

0.36

|

0.89

|

0.17

|

1.72

|

||||||||||||||||||||||

|

Core

earnings

per share

|

$

|

1.20

|

$

|

0.97

|

$

|

1.16

|

$

|

0.97

|

$

|

1.22

|

$

|

1.50

|

$

|

1.82

|

$

|

1.86

|

$

|

2.29

|

$

|

3.34

|

$

|

4.53

|

||||||||||||

|

Table

3: GAAP / TAX Differences (in thousands, except per share

data)

|

||||||||||||||||||||||||||||||||||

|

Estimated

|

Actual

|

|||||||||||||||||||||||||||||||||

|

Estimated

|

Actual

|

Actual

|

Nine

Months

|

Nine

Months

|

||||||||||||||||||||||||||||||

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

Q4:2004

|

Q3:2004

|

Q3:2006

|

Q3:2005

|

||||||||||||||||||||||||

|

GAAP

net

income

|

$

|

32,416

|

$

|

31,410

|

$

|

28,015

|

$

|

42,496

|

$

|

55,899

|

$

|

40,915

|

$

|

60,563

|

$

|

54,414

|

$

|

72,342

|

$

|

91,841

|

$

|

157,377

|

||||||||||||

| GAAP/Tax differences: | ||||||||||||||||||||||||||||||||||

|

Interest

income and expense

|

11,062

|

15,048

|

6,216

|

(1,590

|

)

|

1,353

|

(4,868

|

)

|

(20,091

|

)

|

(7,519

|

)

|

(23,527

|

)

|

32,326

|

(23,606

|

)

|

|||||||||||||||||

|

Provision

for

credit losses

|

465

|

(2,506

|

)

|

176

|

876

|

(805

|

)

|

(1,527

|

)

|

1,025

|

1,697

|

1,528

|

(1,865

|

)

|

(1,307

|

)

|

||||||||||||||||||

|

Deductions

for

realized credit losses

|

(1,100

|

)

|

(686

|

)

|

(1,002

|

)

|

34

|

(562

|

)

|

(737

|

)

|

(438

|

)

|

(247

|

)

|

(127

|

)

|

(2,788

|

)

|

(1,737

|

)

|

|||||||||||||

|

Long-term

compensation

|

2,137

|

(165

|

)

|

2,520

|

944

|

2,892

|

2,138

|

1,969

|

(1,775

|

)

|

402

|

4,492

|

6,999

|

|||||||||||||||||||||

|

Stock

option

exercise deduction

|

(92

|

)

|

(7

|

)

|

(1,126

|

)

|

(202

|

)

|

(2,944

|

)

|

(143

|

)

|

(477

|

)

|

(3,094

|

)

|

(745

|

)

|

(1,225

|

)

|

(3,564

|

)

|

||||||||||||

|

Depreciation

of fixed assets

|

98

|

14

|

176

|

154

|

60

|

166

|

151

|

(176

|

)

|

(589

|

)

|

288

|

377

|

|||||||||||||||||||||

|

Other

operating expenses

|

75

|

(425

|

)

|

(261

|

)

|

(780

|

)

|

283

|

(31

|

)

|

69

|

(2,495

|

)

|

(34

|

)

|

(611

|

)

|

321

|

||||||||||||||||

|

Sale

of assets

to third parties

|

(5,362

|

)

|

(1,189

|

)

|

(798

|

)

|

(4,615

|

)

|

(8,041

|

)

|

(2,476

|

)

|

(967

|

)

|

1,428

|

(576

|

)

|

(7,349

|

)

|

(11,484

|

)

|

|||||||||||||

|

Call

income of

residential CES

|

-

|

-

|

204

|

(1,505

|

)

|

(319

|

)

|

120

|

(2,324

|

)

|

(2,872

|

)

|

(3,961

|

)

|

204

|

(2,523

|

)

|

|||||||||||||||||

|

(Loss)/gain

on

securitizations

|

2,266

|

-

|

-

|

-

|

(392

|

)

|

808

|

2,558

|

10,749

|

11,153

|

2,266

|

2,974

|

||||||||||||||||||||||

|

(Loss)/gain

on

intercompany sales and transfers

|

1,955

|

490

|

(19

|

)

|

(446

|

)

|

170

|

2,371

|

3,260

|

3,256

|

28

|

2,426

|

5,801

|

|||||||||||||||||||||

|

Market

valuation write downs

|

484

|

2,305

|

3,226

|

1,110

|

2,048

|

820

|

391

|

1,572

|

422

|

6,015

|

3,259

|

|||||||||||||||||||||||

|

Interest

rate

agreements

|

2,131

|

923

|

(451

|

)

|

799

|

216

|

53

|

202

|

(688

|

)

|

(278

|

)

|

2,603

|

471

|

||||||||||||||||||||

|

Provision

for

excise tax

|

327

|

295

|

295

|

280

|

285

|

308

|

307

|

(165

|

)

|

301

|

917

|

900

|

||||||||||||||||||||||

|

Provision

for

income tax

|

4,123

|

3,265

|

(703

|

)

|

4,096

|

5,013

|

3,035

|

134

|

4,827

|

2,834

|

6,685

|

8,182

|

||||||||||||||||||||||

|

Total

differences

|

18,569

|

17,362

|

8,453

|

(845

|

)

|

(743

|

)

|

37

|

(14,231

|

)

|

4,498

|

(13,169

|

)

|

44,384

|

(14,937

|

)

|

||||||||||||||||||

|

Total

taxable

income (pre-tax)

|

$

|

50,985

|

$

|

48,772

|

$

|

36,468

|

$

|

41,651

|

$

|

55,156

|

$

|

40,952

|

$

|

46,332

|

$

|

58,912

|

$

|

59,173

|

$

|

136,225

|

$

|

142,440

|

||||||||||||

|

Shares

outstanding at period end

|

26,053

|

25,668

|

25,382

|

25,133

|

24,764

|

24,647

|

24,514

|

24,154

|

23,346

|

26,053

|

24,764

|

|||||||||||||||||||||||

|

Total

taxable

income per share

|

$

|

1.95

|

$

|

1.90

|

$

|

1.44

|

$

|

1.66

|

$

|

2.23

|

$

|

1.66

|

$

|

1.89

|

$

|

2.44

|

$

|

2.53

|

$

|

5.29

|

$

|

5.78

|

||||||||||||

|

Table

4: Taxable Income (in thousands, except per share

data)

|

||||||||||||||||||||||||||||||||||

|

Estimated

|

Actual

|

|||||||||||||||||||||||||||||||||

|

Estimated

|

Actual

|

Actual

|

Nine

Months

|

Nine

Months

|

||||||||||||||||||||||||||||||

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

Q4:2004

|

Q3:2004

|

Q3:2006

|

Q3:2005

|

||||||||||||||||||||||||

|

Total

taxable

income (pre-tax)

|

$

|

50,985

|

$

|

48,772

|

$

|

36,468

|

$

|

41,651

|

$

|

55,156

|

$

|

40,952

|

$

|

46,331

|

$

|

58,912

|

$

|

59,173

|

$

|

136,225

|

$

|

142,439

|

||||||||||||

|

Less:

net

gains (losses) from calls, sales and stock option

exercises

|

1,659

|

4,826

|

(630

|

)

|

6,863

|

14,160

|

5,365

|

17,586

|

18,553

|

26,176

|

5,855

|

37,111

|

||||||||||||||||||||||

|

Total

core

taxable income

|

$

|

49,326

|

$

|

43,946

|

$

|

37,098

|

$

|

34,788

|

$

|

40,996

|

$

|

35,587

|

$

|

28,745

|

$

|

40,359

|

$

|

32,997

|

$

|

130,370

|

$

|

179,550

|

||||||||||||

|

Total

taxable

income (pre-tax)

|

$

|

50,985

|

$

|

48,772

|

$

|

36,468

|

$

|

41,651

|

$

|

55,156

|

$

|

40,952

|

$

|

46,331

|

$

|

58,912

|

$

|

59,173

|

$

|

136,225

|

$

|

142,439

|

||||||||||||

|

Less:

REIT

taxable income (pre-tax)

|

45,751

|

45,040

|

35,382

|

39,957

|

47,118

|

39,237

|

45,161

|

50,009

|

49,030

|

126,173

|

131,516

|

|||||||||||||||||||||||

|

Taxable

income

in taxable subs (pre-tax)

|

$

|

5,234

|

$

|

3,732

|

$

|

1,086

|

$

|

1,694

|

$

|

8,038

|

$

|

1,715

|

$

|

1,170

|

$

|

8,903

|

$

|

10,143

|

$

|

10,052

|

$

|

10,923

|

||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Core

REIT

taxable income

|

$

|

44,795

|

$

|

40,504

|

$

|

36,011

|

$

|

35,234

|

$

|

33,065

|

$

|

36,198

|

$

|

30,741

|

$

|

42,544

|

$

|

34,272

|

$

|

121,310

|

$

|

100,004

|

||||||||||||

|

Other

ordinary

REIT taxable income (expense)

|

1,054

|

4,370

|

(1,068

|

)

|

2,232

|

(2,160

|

)

|

3,166

|

(565

|

)

|

(3,094

|

)

|

(745

|

)

|

4,356

|

441

|

||||||||||||||||||

|

Ordinary

REIT

taxable income

|

45,849

|

44,874

|

34,943

|

37,466

|

30,905

|

39,364

|

30,176

|

39,450

|

33,527

|

125,666

|

100,445

|

|||||||||||||||||||||||

|

Net

long-term

capital gains

|

(98

|

)

|

166

|

439

|

2,491

|

16,213

|

(127

|

)

|

14,985

|

10,559

|

15,503

|

507

|

31,071

|

|||||||||||||||||||||

|

REIT

taxable

income (pre-tax)

|

$

|

45,751

|

$

|

45,040

|

$

|

35,382

|

$

|

39,957

|

$

|

47,118

|

$

|

39,237

|

$

|

45,161

|

$

|

50,009

|

$

|

49,030

|

$

|

126,173

|

$

|

131,516

|

||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

REIT

taxable

income (pre-tax)

|

$

|

45,751

|

$

|

45,040

|

$

|

35,382

|

$

|

39,957

|

$

|

47,118

|

$

|

39,237

|

$

|

45,161

|

$

|

50,009

|

$

|

49,030

|

$

|

126,173

|

$

|

131,516

|

||||||||||||

|

Excise

taxes

|

(327

|

)

|

(295

|

)

|

(295

|

)

|

(280

|

)

|

(285

|

)

|

(308

|

)

|

(307

|

)

|

293

|

(301

|

)

|

(917

|

)

|

(900

|

)

|

|||||||||||||

|

Income

taxes

|

(1,529

|

)

|

(1,802

|

)

|

(1,712

|

)

|

(867

|

)

|

(1,641

|

)

|

(1,830

|

)

|

(1,450

|

)

|

14

|

(1,537

|

)

|

(5,043

|

)

|

(4,921

|

)

|

|||||||||||||

|

REIT

taxable

income available for distribution

|

$

|

43,895

|

$

|

42,943

|

$

|

33,375

|

$

|

38,810

|

$

|

45,192

|

$

|

37,099

|

$

|

43,404

|

$

|

50,316

|

$

|

47,192

|

$

|

120,213

|

$

|

125,695

|

||||||||||||

|

Core

income

(loss) in taxable subs (pre-tax)

|

$

|

4,531

|

$

|

3,442

|

$

|

1,086

|

($445

|

)

|

$

|

7,931

|

($611

|

)

|

($1,996

|

)

|

($2,185

|

)

|

($1,275

|

)

|

$

|

9,059

|

$

|

5,324

|

||||||||||||

|

Income

from

calls and sales in taxable subs (pre-tax)

|

703

|

290

|

-

|

2,139

|

107

|

2,326

|

3,166

|

11,088

|

11,418

|

993

|

5,599

|

|||||||||||||||||||||||

|

Taxable

income

in taxable subs (pre-tax)

|

5,234

|

3,732

|

1,086

|

1,694

|

8,038

|

1,715

|

1,170

|

8,903

|

10,143

|

10,052

|

$

|

10,923

|

||||||||||||||||||||||

|

Income

tax for

taxable subs (actual tax due)

|

(2,078

|

)

|

(1,700

|

)

|

(530

|

)

|

(456

|

)

|

(3,652

|

)

|

(870

|

)

|

(830

|

)

|

(5,773

|

)

|

(4,574

|

)

|

(4,308

|

)

|

(5,352

|

)

|

||||||||||||

|

After-tax

income in taxable subs

|

$

|

3,156

|

$

|

2,032

|

$

|

556

|

$

|

1,238

|

$

|

4,386

|

$

|

845

|

$

|

340

|

$

|

3,130

|

$

|

5,569

|

$

|

5,744

|

$

|

5,571

|

||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

REIT

taxable

income available for distribution

|

$

|

43,895

|

$

|

42,943

|

$

|

33,375

|

$

|

38,810

|

$

|

45,192

|

$

|

37,099

|

$

|

43,404

|

$

|

50,316

|

$

|

47,192

|

$

|

120,213

|

$

|

125,695

|

||||||||||||

|

After-tax

income in taxable subs

|

3,156

|

2,032

|

556

|

1,238

|

4,386

|

845

|

340

|

3,130

|

5,569

|

5,744

|

5,571

|

|||||||||||||||||||||||

|

Total

taxable

income (after-tax)

|

$

|

47,051

|

$

|

44,975

|

$

|

33,931

|

$

|

40,048

|

$

|

49,578

|

$

|

37,944

|

$

|

43,744

|

$

|

53,446

|

$

|

52,761

|

$

|

125,957

|

$

|

131,266

|

||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Taxable

income

(after-tax) retained in tax subs

|

$

|

3,156

|

$

|

2,032

|

$

|

556

|

$

|

1,238

|

$

|

4,386

|

$

|

845

|

$

|

340

|

$

|

3,130

|

$

|

5,569

|

$

|

5,744

|

$

|

5,571

|

||||||||||||

|

REIT

retained

taxable income (after-tax) (1)

|

2,500

|

2,166

|

1,313

|

1,910

|

1,164

|

1,798

|

1,261

|

4,252

|

1,515

|

5,978

|

4,223

|

|||||||||||||||||||||||

|

Total

retained

taxable earnings (after-tax)

|

$

|

5,656

|

$

|

4,198

|

$

|

1,869

|

$

|

3,148

|

$

|

5,551

|

$

|

2,643

|

$

|

1,601

|

$

|

7,382

|

$

|

7,084

|

$

|

11,722

|

$

|

9,794

|

||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Shares

outstanding at period end (000)

|

26,053

|

25,668

|

25,382

|

25,133

|

24,764

|

24,647

|

24,514

|

24,154

|

23,346

|

26,053

|

24,764

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Per

share outstanding at quarter end

|

||||||||||||||||||||||||||||||||||

|

Total

taxable

income (pre-tax)

|

$

|

1.95

|

$

|

1.90

|

$

|

1.44

|

$

|

1.66

|

$

|

2.23

|

$

|

1.66

|

$

|

1.89

|

$

|

2.44

|

$

|

2.53

|

$

|

5.29

|

$

|

5.78

|

||||||||||||

|

Core

taxable

income (pre-tax)

|

$

|

1.89

|

$

|

1.71

|

$

|

1.46

|

$

|

1.38

|

$

|

1.66

|

$

|

1.44

|

$

|

1.17

|

$

|

1.67

|

$

|

1.41

|

$

|

5.06

|

$

|

4.27

|

||||||||||||

|

REIT

taxable

income (pre-tax)

|

$

|

1.76

|

$

|

1.75

|

$

|

1.39

|

$

|

1.60

|

$

|

1.90

|

$

|

1.59

|

$

|

1.84

|

$

|

2.07

|

$

|

2.10

|

$

|

4.90

|

$

|

5.33

|

||||||||||||

|

Taxable

income

at taxable subsidiaries

|

$

|

0.20

|

$

|

0.16

|

$

|

0.04

|

$

|

0.07

|

$

|

0.32

|

$

|

0.07

|

$

|

0.05

|

$

|

0.37

|

$

|

0.43

|

$

|

0.40

|

$

|

0.44

|

||||||||||||

|

Total

retained

taxable earnings (after-tax)

|

$

|

0.22

|

$

|

0.16

|

$

|

0.07

|

$

|

0.13

|

$

|

0.22

|

$

|

0.11

|

$

|

0.07

|

$

|

0.31

|

$

|

0.30

|

$

|

0.45

|

$

|

0.40

|

||||||||||||

|

Table

5: Retention and Distribution of Taxable Income (in thousands,

except per

share data)

|

||||||||||||||||||||||||||||||||||

|

Estimated

|

Actual

|

|||||||||||||||||||||||||||||||||

|

Estimated

|

Actual

|

Actual

|

Nine

Months

|

Nine

Months

|

||||||||||||||||||||||||||||||

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

Q4:2004

|

Q3:2004

|

Q3:2006

|

Q3:2005

|

||||||||||||||||||||||||

|

Dividends

declared

|

$

|

18,237

|

$

|

17,967

|

$

|

17,767

|

$

|

92,150

|

$

|

17,335

|

$

|

17,253

|

$

|

17,160

|

$

|

146,707

|

$

|

15,642

|

$

|

53,971

|

$

|

51,748

|

||||||||||||

|

Dividend

deduction on stock issued through DRIP

|

177

|

239

|

176

|

263

|

128

|

112

|

56

|

1,048

|

844

|

592

|

296

|

|||||||||||||||||||||||

|

Total

dividend

deductions

|

$

|

18,414

|

$

|

18,206

|

$

|

17,943

|

$

|

92,413

|

$

|

17,463

|

$

|

17,365

|

$

|

17,216

|

$

|

147,755

|

$

|

16,486

|

$

|

54,563

|

$

|

52,044

|

||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Regular

dividend per share

|

$

|

0.70

|

$

|

0.70

|

$

|

0.70

|

$

|

0.70

|

$

|

0.70

|

$

|

0.70

|

$

|

0.70

|

$

|

0.67

|

$

|

0.67

|

$

|

2.10

|

$

|

2.10

|

||||||||||||

|

Special

dividend per share

|

-

|

-

|

3.00

|

-

|

-

|

-

|

5.50

|

-

|

-

|

-

|

||||||||||||||||||||||||

|

Total

dividends per share

|

$

|

0.70

|

$

|

0.70

|

$

|

0.70

|

$

|

3.70

|

$

|

0.70

|

$

|

0.70

|

$

|

0.70

|

$

|

6.17

|

$

|

0.67

|

$

|

2.10

|

$

|

2.10

|

||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Undistributed

REIT taxable income at beginning of period (pre-tax):

|

$

|

88,422

|

$

|

65,851

|

$

|

51,732

|

$

|

106,719

|

$

|

80,166

|

$

|

62,218

|

$

|

37,291

|

$

|

138,981

|

$

|

109,790

|

$

|

51,732

|

$

|

37,291

|

||||||||||||

|

REIT

taxable

income (pre-tax)

|

45,751

|

45,040

|

35,382

|

39,957

|

47,118

|

39,237

|

45,161

|

50,009

|

49,030

|

126,173

|

131,516

|

|||||||||||||||||||||||

|

Permanently

retained (pre-tax)

|

(4,356

|

)

|

(4,263

|

)

|

(3,320

|

)

|

(2,531

|

)

|

(3,102

|

)

|

(3,924

|

)

|

(3,018

|

)

|

(3,944

|

)

|

(3,353

|

)

|

(11,939

|

)

|

(10,044

|

)

|

||||||||||||

|

Dividend

of

2003 income

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(14,413

|

)

|

-

|

-

|

||||||||||||||||||||||

|

Dividend

of

2004 income

|

-

|

-

|

-

|

-

|

(2,710

|

)

|

(17,365

|

)

|

(17,216

|

)

|

(147,755

|

)

|

(2,073

|

)

|

-

|

(37,291

|

)

|

|||||||||||||||||

|

Dividend

of

2005 income

|

(15,582

|

)

|

(18,206

|

)

|

(17,943

|

)

|

(92,413

|

)

|

(14,753

|

)

|

-

|

-

|

-

|

-

|

(51,731

|

)

|

(14,753

|

)

|

||||||||||||||||

|

Dividend

of

2006 income

|

(2,832

|

)

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(2,832

|

)

|

-

|

|||||||||||||||||||||

|

Undistributed

REIT taxable income at end of period (pre-tax):

|

$

|

111,403

|

$

|

88,422

|

$

|

65,851

|

$

|

51,732

|

$

|

106,719

|

$

|

80,166

|

$

|

62,218

|

$

|

37,291

|

$

|

138,981

|

$

|

111,403

|

$

|

106,719

|

||||||||||||

|

Undistributed

REIT taxable income (pre-tax)

|

||||||||||||||||||||||||||||||||||

|

From

2003's

income

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||||||||

|

From

2004's

income

|

-

|

-

|

-

|

-

|

-

|

2,710

|

20,075

|

37,291

|

138,981

|

-

|

-

|

|||||||||||||||||||||||

|

From

2005's

income

|

-

|

15,583

|

33,789

|

51,732

|

106,719

|

77,456

|

42,143

|

-

|

-

|

-

|

106,719

|

|||||||||||||||||||||||

|

From

2006's

income

|

111,403

|

72,839

|

32,062

|

-

|

-

|

-

|

-

|

-

|

-

|

111,403

|

-

|

|||||||||||||||||||||||

|

Total

|

$

|

111,403

|

$

|

88,422

|

$

|

65,851

|

$ |

51,732

|

$

|

106,719

|

$

|

80,166

|

$

|

62,218

|

$

|

37,291

|

$

|

138,981

|

$

|

111,403

|

$

|

106,719

|

||||||||||||

|

Table

6: Assets (in millions)

|

||||||||||||||||||||||||||||

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

Q4:2004

|

Q3:2004

|

||||||||||||||||||||

|

Residential

loans owned by Redwood

|

$

|

520

|

$

|

351

|

$

|

87

|

$

|

45

|

$

|

17

|

$

|

300

|

$

|

256

|

$

|

193

|

$

|

259

|

||||||||||

|

Residential

loans consolidated from entities

|

9,205

|

9,962

|

11,741

|

13,649

|

16,324

|

19,083

|

21,237

|

22,015

|

21,299

|

|||||||||||||||||||

|

Total

GAAP

residential loans

|

9,725

|

10,313

|

11,828

|

13,694

|

16,341

|

19,383

|

21,493

|

22,208

|

21,558

|

|||||||||||||||||||

|

HELOC

loans

owned by Redwood

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||

|

HELOC

loans

consolidated from entities

|

118

|

140

|

162

|

181

|

215

|

247

|

279

|

296

|

317

|

|||||||||||||||||||

|

Total

GAAP

HELOC loans

|

118

|

140

|

162

|

181

|

215

|

247

|

279

|

296

|

317

|

|||||||||||||||||||

|

Commercial

loans owned by Redwood

|

2

|

2

|

2

|

7

|

21

|

16

|

22

|

32

|

21

|

|||||||||||||||||||

|

Commercial

loans consolidated from entities

|

30

|

36

|

53

|

53

|

35

|

26

|

35

|

22

|

12

|

|||||||||||||||||||

|

Total

GAAP

commercial loans

|

32

|

38

|

55

|

60

|

56

|

42

|

57

|

54

|

33

|

|||||||||||||||||||

|

Residential

CES owned by Redwood

|

291

|