CONTENTS

CONTENTS |

INTRODUCTION

|

2

|

|

|

|

||

|

SHAREHOLDER

LETTER

|

3

|

|

|

|

||

|

REDWOOD

BUSINESS AND STRATEGY

|

7

|

|

|

|

||

|

FINANCIAL

MODULES

|

|

|

|

|

||

|

►

|

GAAP

Earnings and Core Earnings

|

14

|

|

|

||

|

►

|

Taxable

Income

|

16

|

|

►

|

Book

Value Per Share

|

18

|

|

|

||

|

►

|

Return

on Equity

|

20

|

|

|

||

|

►

|

Dividends

|

22

|

|

|

||

|

►

|

Residential

CES

|

24

|

|

|

||

|

►

|

Residential

Loans

|

28

|

|

|

||

|

►

|

Residential

IGS

|

32

|

|

|

||

|

►

|

Commercial

CES

|

34

|

|

|

||

|

►

|

Commercial

Loans

|

38

|

|

|

||

|

►

|

Commercial

IGS

|

40

|

|

|

||

|

►

|

CDO

CES

|

42

|

|

|

||

|

►

|

CDO

IGS

|

44

|

|

|

||

|

►

|

Capital

|

46

|

|

|

||

|

►

|

Redwood

Debt

|

48

|

|

|

||

|

►

|

Acacia

CDO ABS Issued

|

50

|

|

|

||

|

►

|

Sequoia

ABS Issued

|

52

|

|

|

||

|

APPENDIX

|

|

|

|

|

||

|

►

|

Glossary

|

54

|

|

|

||

|

►

|

Financial

Tables

|

61

|

INTRODUCTION

INTRODUCTION

SHAREHOLDER

LETTER

SHAREHOLDER

LETTER  SHAREHOLDER

LETTER

SHAREHOLDER

LETTER  SHAREHOLDER

LETTER

SHAREHOLDER

LETTER  SHAREHOLDER

LETTER

SHAREHOLDER

LETTER

|

|

||

|

George

E. Bull, III

|

Douglas

B. Hansen

|

||

|

Chairman

and CEO

|

President

|

ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST  ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST  ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST  ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST  ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST  ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST  ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST  FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

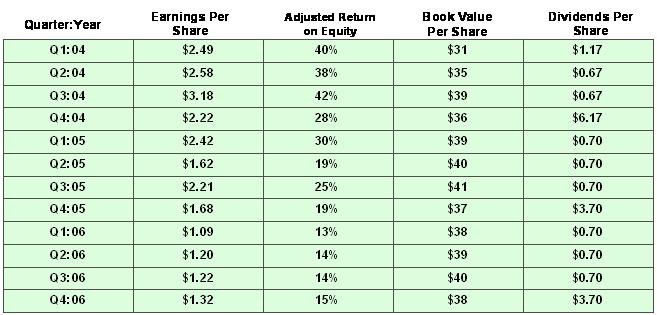

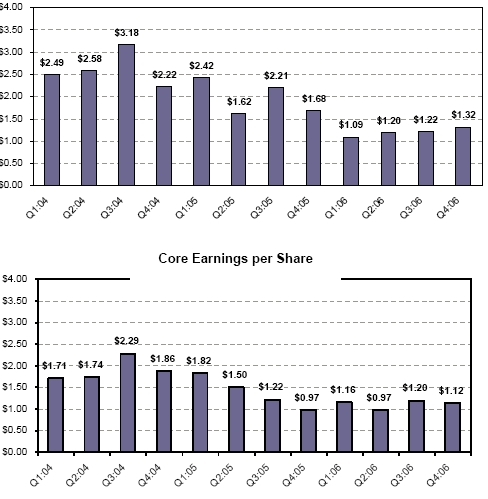

Our

GAAP earnings were

$36 million, or $1.32

per share, for the

fourth quarter

of 2006. In the fourth

quarter of 2005, GAAP

earnings were $42 million,

or

$1.68 per share.

|

| Ø |

Core

earnings were $30 million,

or $1.12 per share,

for the fourth quarter

of

2006. This is an increase

from $25 million, or

$0.97 per share core

earnings in the fourth

quarter of 2005.

|

| Ø |

Our

GAAP earnings in the

fourth quarter were

$6 million lower than

fourth

quarter 2005. The largest

factor was a $12 million

decline from gains

generated from sales

and calls of assets.

Gains were $7 million

in the

fourth quarter of 2006

compared to $19 million

in the fourth quarter

of

2005. This decline

was partially offset

by a $4 million increase

in net

interest income, which

was $45 million in

the fourth quarter

of 2006

compared to $41 million

in the fourth quarter

of 2005. This increase

reflects rising yields

from our credit-enhancement

portfolio being driven

by strong credit performance

and rapid prepayments.

|

| Ø |

Operating

expenses were $13 million

in the fourth quarter

of 2006, the same

as the fourth quarter

a year ago.

|

| Ø |

Income

taxes were negligible

in the fourth quarter

of this year, compared

to a $4

million expense in

the fourth quarter

of last year. This

decreased expense

reflects the reduction

in our loan securitization

activities over the

past

few years.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

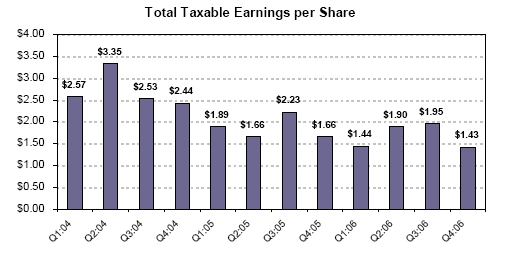

| Ø |

Total

taxable

income

was $38

million,

or $1.43

per share,

in the

fourth

quarter

of 2006.

This was

a decrease

from the

total taxable

income

per share

we

generated

in recent

quarters.

This decrease

was primarily

due to

stock

option

exercises,

a non-cash

expense

that is

deductible

for

tax.

|

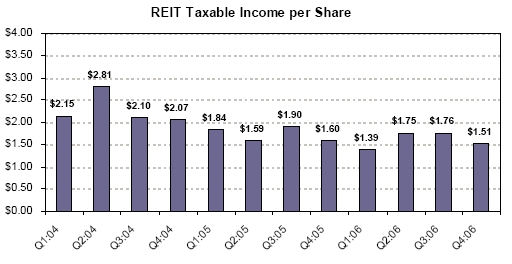

| Ø |

For

the same

reason,

our REIT

taxable

income

decreased

to $1.51

per share

in

the fourth

quarter

of 2006

from $1.60

per share

in the

fourth

quarter

of

2005.

|

| Ø |

Our

taxable

income

was higher

than our

GAAP income

in the

fourth

quarter

of

2006, and

for the

full year.

The primary

reason

is that

we are

not allowed

to establish

a credit

reserve

for our

CES for

tax accounting

purposes.

Thus, we

amortize

more discount

into income

and recognize

a higher

yield

for tax

purposes

until credit

losses

occur.

The cumulative

difference

in

the discount

amortization

between

tax and

GAAP for

residential,

commercial,

and CDO

CES was

$95 million

at year

end.

|

| Ø |

Total

taxable

income

and REIT

taxable

income

were reduced

by $1.9

million

($0.07

per share)

in the

fourth

quarter

as a result

of deductions

for actual

credit

losses.

This deduction

is less

than the

losses

incurred

on the

underlying

loans,

as we own

most of

our credit-sensitive

assets

at a tax

basis that

is substantially

less than

par (principal)

value.

Increased

credit

losses

would reduce

taxable

income

and our

dividend

distribution

requirements.

|

| Ø |

We

currently

expect

our REIT

taxable

income

per share

to continue

to exceed

our regular

quarterly

dividend

rate by

a comfortable

margin.

|

| Ø |

For

a variety

of reasons,

our total

taxable

income

and REIT

taxable

income

will

continue

to be

volatile

on a

quarter-to-quarter

basis.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

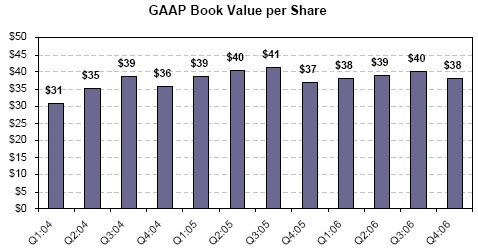

In

the

fourth

quarter

of

2006,

after

including

the

effect

of

declaring

$0.70

per

share

of

regular

dividends

and

$3.00

per

share

of

special

dividends,

GAAP

book

value

per

share

decreased

by

6%

from

$40.02

per

share

to

$37.51

per

share.

For

2006,

GAAP

book

value

increased

by

1%

from

$37.20

per

share.

|

| Ø |

At

December

31,

2006,

core

book

value

was

$34.02

per

share.

Core

book

value

decreased

by

1%

during

2006,

from

$34.27

per

share

at

the

beginning

of

the

year.

|

| Ø |

At

the

end

of

our

first

quarter

of

operations

in

September

1994,

GAAP

book

value

was

$11.67

per

share.

Since

that

time,

we

have

paid

$40.43

per

share

of

dividends

while

also

increasing

GAAP

book

value

by

$25.84

per

share.

|

| Ø |

Book

value

per

share

growth

is

generally

not

a

direct

indicator

of

our

market

value

or

an

indicator

of

the

returns

available

to

our

shareholders.

If

you

had

acquired

Redwood

stock

at

our

initial

public

offering

in

August

1995,

and

had

reinvested

all

dividends

back

into

Redwood

stock,

your

compounded

return

as

a

shareholder

would

have

been

23%

per

year

through

December

31,

2006.

Future

results

may

vary.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

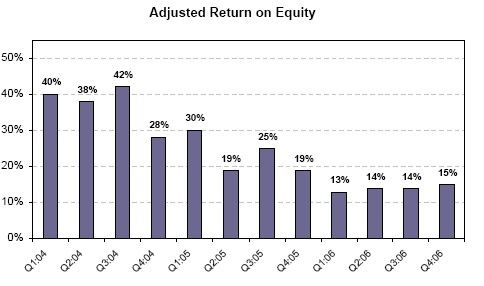

GAAP

ROE

was

14%

for

the

fourth

quarter

of

2006

as

compared

to

12%

for

the

previous

quarter

and

18%

in

the fourth

quarter

of

2005.

|

| Ø |

Adjusted

ROE

was

15%

for

the

fourth

quarter

of

2006

as

compared

to

14%

for

the

previous

quarter

and

19%

for

the

fourth

quarter

of

2005.

|

| Ø |

Adjusted

ROE

is

higher

than

GAAP

ROE

for

these

periods

as

we

have

unrealized

market

value

gains

on

our

assets.

This

has

the

effect

of

increasing

our

GAAP

equity

and

thus

reducing

our

GAAP

ROE

relative

to

our

adjusted

ROE.

|

| Ø |

Over

the

last

four

years,

our

adjusted

return

on

equity

has

ranged

from

14%

to

36%.

Over

the

long

term,

we

expect

to

be

able

to

generate

annual

adjusted

returns

on

equity

between

11%

and

18%.

|

| Ø |

Return

on

equity

exceeded

our

target

range

in

2003,

2004,

and

2005.

We

were

able

to

acquire

CES

assets

at

attractive

prices

following

the

1998

capital

markets/liquidity

crisis.

In

the

following

years,

excellent

credit

results,

combined

with

rapid

prepayments,

produced

extraordinary

profits.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

| Ø |

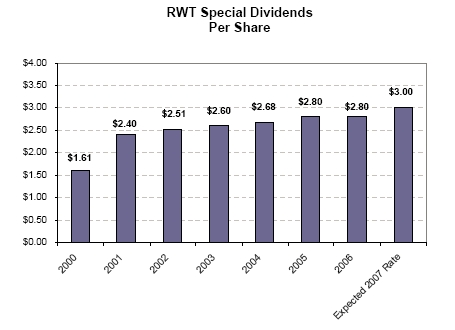

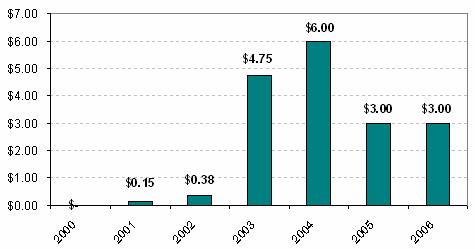

We

declared a regular quarterly dividend of $0.70 per share in the

fourth

quarter of 2006.

|

| Ø |

The

Board of Directors has declared its intent to raise the quarterly

dividend

rate to $0.75 per share in 2007.

|

| Ø |

We

paid a special dividend of $3.00 per share in the fourth quarter

of 2006.

The annual special dividend, if any, is likely to vary from year

to

year.

|

| Ø |

Total

2006 dividend distributions were $5.80 per share. Assuming a

Redwood stock

price of $62, the indicated dividend yield would be 9.4% based

on the last

twelve months of dividends and 4.8% based on expected regular

dividends of

$3.00 per share for 2007.

|

| Ø |

Based

on our estimates of REIT taxable income during 2006, we entered

2007 with

$50 million ($1.85 per share) of undistributed REIT taxable

income that we

will distribute in 2007. This should be sufficient to fund

at least the

first two regular quarterly dividends in

2007.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

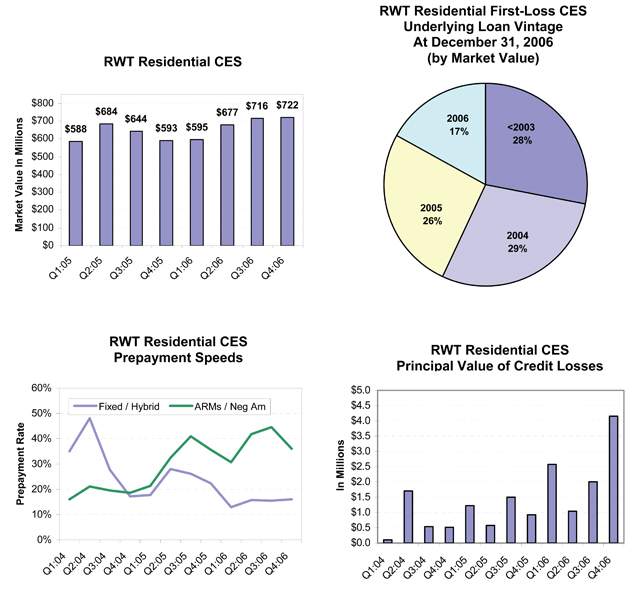

Our

residential CES portfolio grew in the fourth

quarter of 2006 by $6 million

(or 1%) to $722 million as a result of

acquisitions of $21 million, market

value adjustment increases of $1 million,

sales of $1 million, calls of $1

million, discount amortization of $18 million,

and principal pay downs of

$32 million.

|

| Ø |

For

2006, our residential CES portfolio increased

22% from $593 million to

$722 million.

|

| Ø |

Interest

income generated by residential CES was

$36 million for the fourth

quarter. The yield for the fourth quarter

was 22%, the same as the

previous quarter. Yields are high due to

fast prepayment speeds and

continued good credit performance for underlying

loans. The residential

CES yield for 2006 was 21%.

|

| Ø |

At

December 31, 2006, $716 million of our

residential CES were structured to

benefit from faster mortgage prepayment

rates, as they are discount bonds

purchased from senior/subordinated securitizations,

and $6 million were

structured in the form of residuals where

slower prepayment rates are

generally beneficial.

|

| Ø |

Prepayments

on loans underlying CES averaged 27% CPR

for the quarter and 24% CPR for

2006. Many of these CES will become callable

by the issuer when the loan

balance pays down to 10% of the original

balance. If credit results remain

strong, we may realize income gains if

these CES are called. At current

prepayment rates, we expect few calls in

2007 or 2008. Approximately 25%

of these CES will become callable by 2009

and an additional 50% by 2014.

On average in the past, CES have been called

within 6 months following the

month in which they first become

callable.

|

| Ø |

The

balance of residential loans underlying

these CES decreased from $225

billion to $210 billion during the fourth

quarter as a result of

relatively rapid mortgage prepayment rates

as well as a slower rate of net

acquisitions.

|

| Ø |

By

market value, 77% of our CES were backed

by pools of primarily prime

quality loans, 22% of our CES were backed

by pools of primarily alt-a

quality loans, and 1% of our CES were backed

by pools of primarily

subprime quality loans. The manner in which

alt-a and subprime CES are

structured and priced allows for the potential

for attractive economic

returns even if losses and delinquencies

in the underlying loans are many

times those of prime CES. For the market

as a whole, subprime loans

originated in 2006 are demonstrating very

poor initial credit performance.

Within our CES portfolio, our exposure

to 2006 vintage subprime is $10

million market value of CES.

|

| Ø |

Statistics

for loans underlying CES by dollar balance

at December 31, 2006: $331,181

average loan size; 63% jumbo, 37% conforming

balance at origination; 47%

located in California, 6% Florida, 5% New

York, 4% Virginia; 59%

originated in 2004 or earlier, 28% originated

in 2005, 13% originated in

2006; 69% average loan-to-property-value

at origination, 5% loans with

loan-to-value over 80% (many of which have

mortgage insurance or

additional pledged assets); 730 average

FICO credit score, 15% FICO under

680; 91% owner-occupied, 6% second home,

3% investor properties; 38% fixed

rate, 39% hybrid rate, 23% adjustable-rate;

57% fully-amortizing

principal, 24% interest-only, 19% negative

amortization

option.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

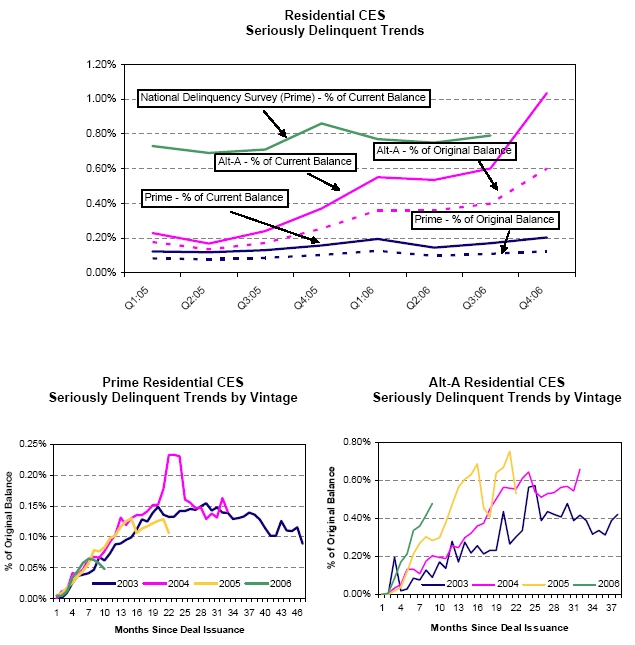

Principal

value credit losses for the loans underlying

residential CES were $4.2

million for the fourth quarter, a loss

rate of less than one basis point

(0.01%) per year. As assets

season, we expect losses to increase.

Losses remain lower than our

original

expectations.

|

| Ø |

Our

GAAP credit reserves for residential CES were $372 million

($13.92 per

share) at December 31, 2006, a decrease of $18 million

for the quarter. At

year-end, credit reserves for CES (plus external credit

enhancement we

benefit from) were 0.32% of underlying loan balances.

As a result of

strong credit performance during the year, we transferred

$73 million

residential CES credit reserves to unamortized discount

that will be

amortized into income over time. Unamortized discount

balances for

residential CES were $145 million at

year-end.

|

| Ø |

For

tax purposes, realized credit losses were $1.6 million

for the fourth

quarter. This deduction is less than the principal value

losses incurred

on the underlying loans, as we own most of our credit-sensitive

assets at

a tax basis that is substantially less than par (principal)

value.

|

| Ø |

For

the $187 billion of our CES loans in pools consisting

primarily of prime

quality loans, at December 31, 2006 serious delinquencies

were $381

million, a 13% increase from the third quarter balance

of $337 million and

a 50% increase from the beginning 2006 balance of $254

million. At

December 31, 2006, serious delinquencies for prime CES

pools were 0.12% of

original balances and 0.20% of current balances. Principal

value credit

losses for the fourth quarter were $2.8 million.

|

| Ø |

For

the $18 billion of our CES loans in pools consisting

primarily

of alt-a quality loans, at December 31, 2006 serious

delinquencies were

$187 million, a 41% increase from the third quarter balance

of $133

million and a 224% increase from the beginning of 2006

balance of $58

million. At December 31, 2006, serious delinquencies

for alt-a CES pools

were 0.60% of original balances and 1.03% of current

balances. Principal

value credit losses for the fourth quarter were $1.3

million.

|

| Ø |

For

the $5 billion of our CES loans in pools consisting primarily

of

subprime quality loans, at December 31, 2006 serious

delinquencies were

$210 million, a 65% increase from the third quarter balance

of $127

million. Prior to the third quarter of 2006, the residential

CES portfolio

did not contain any subprime assets. At December 31,

2006, serious

delinquencies for subprime CES pools were 2.78% of original

balances and

3.87% of current balances. There were no credit losses

for the fourth

quarter.

|

| Ø |

At

December 31, 2006, $230 million of residential CES was

financed with

equity and $492 million was financed through our Acacia

CDO securitization

program.

|

| Ø |

Additional

information on our residential CES can be found in

Tables 9, 10, 11, and

12 of the Appendix.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

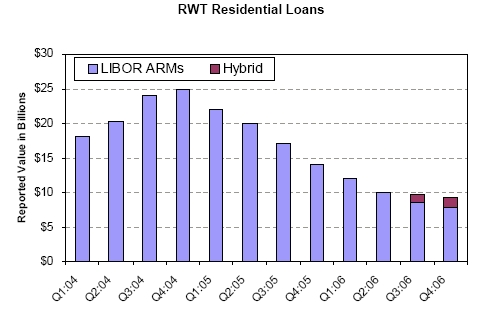

In

the fourth quarter, our residential

loan portfolio declined from $9.8

billion to $9.3 billion. We acquired

$0.7 billion loans and had no sales.

Principal pay downs were $1.2

billion.

|

| Ø |

For

2006, our residential loan portfolio

decreased by $4.6 billion, or 33%,

as

prepayments exceeded acquisitions.

The average annual prepayment rate

(CPR) was 41% for the fourth quarter

and 43% for 2006. Most of these loans

are adjustable-rate loans that tend

to prepay rapidly when the yield

curve

is flat or inverted. Acquisitions

for 2006 were $2.0

billion.

|

| Ø |

Interest

income was $138 million in the fourth

quarter, a decrease from $149

million in the previous quarter.

This portfolio yielded 5.97%, similar

to

the yield of 5.97% in the previous

quarter. The yield for 2006 for

residential loans was 5.71%.

|

| Ø |

Premium

amortization expenses, a

component of interest income, were

$15 million for the fourth quarter

and

$48 million for 2006. We started

2006 with $13.9 billion principal

value

of loans and a loan premium balance

of $178 million for an average basis

of 101.30% of principal value. We

finished 2006 with $9 billion principal

value of loans and a premium balance

of $132 million for an average basis

of 101.43% of principal value. For

various technical accounting reasons,

for several years we have not been

able to amortize premium expense

balances as quickly as the loans

prepaid. If short-term interest rates

decline, under these accounting rules

we would expect premium amortization

expenses to increase significantly.

Largely because premium amortization

expenses have not kept pace with

prepayments in the past, we estimate

the

book value of residential loans exceeded

their market value by $83 million

at year-end.

|

| Ø |

Statistics

for residential loans by dollar balance

at December 31, 2006: 100% prime

quality loans; $332,624 average loan

size; 62% jumbo, 38% conforming

balance at origination; 23% located

in California, 12% Florida, 6% New

York, 3% Virginia; 78% originated

in 2004 or earlier, 17% originated

in

2006; 68% average loan-to-property-value

at origination, 8% loans with

loan-to-value over 80% (many of which

have other pledged assets); 733

average FICO credit score, 14% FICO

under 680; 86% owner-occupied, 11%

second home, 3% investor properties; 15% hybrid rate, 85%

adjustable-rate; 3% fully-amortizing,

97%

interest-only.

|

| Ø |

Realized

credit losses were $0.7

million for the fourth quarter, an

annual loss rate of three basis points

(0.03%) for the quarter. Losses for

2006 were $2.1 million, an annual

loss

rate of 0.02%. The loss for tax purposes

was $0.2 million for the fourth

quarter and $0.5 million for the

year. Cumulative losses have been

far

lower than our original expectations.

We expect losses to continue to

increase as these loans season. Credit

reserves for this portfolio were

$20 million at year-end.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

The

balance of seriously

delinquent loans increased from $61 million to

$73 million during the

quarter, an increase from 0.21% to 0.24% of original

balances and from

0.63% to 0.79% of current balances. During 2006,

serious residential loan

delinquencies increased from $37 million to $73

million and REO (a

component of serious delinquencies) increased from

$3 million to $9

million. We believe delinquencies are increasing

both as a result of a

weaker housing market and the seasoning of the

portfolio. Loans originated

in 2004 or earlier were 78% of the portfolio at

December 31, 2006, and

seasoned loans generally have higher delinquency

rates.

|

| Ø |

At

year-end, $8

billion residential loans were financed via securitization

(“Sequoia”) and

$1.3 billion were financed with Redwood debt. The

remainder were funded

with capital.

|

| Ø |

Additional

information on our residential loans can be found

in Tables 9, 10, 11, and

13 of the Appendix.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

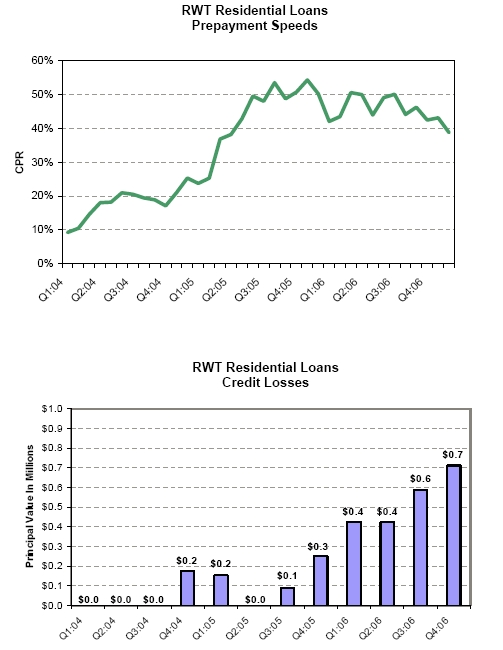

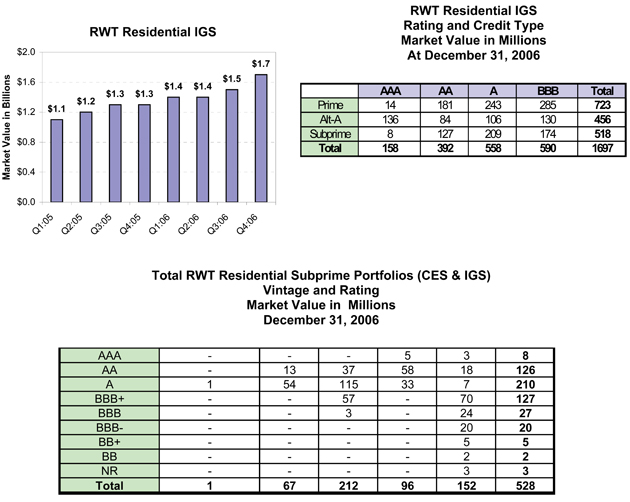

Our

residential IGS portfolio increased by 15%

in the fourth quarter from $1.5

billion to $1.7 billion. Acquisitions were

$352 million, market value

declined $2 million, EITF 99-20 market value

write-downs were $1 million,

sales were $97 million, calls were $6 million,

and principal pay downs

were $25 million.

|

| Ø |

For

2006, growth of our residential IGS portfolio

was 35%, from $1.3 billion

to $1.7 billion.

|

| Ø |

Interest

income generated by residential IGS was $26

million for the fourth

quarter. The yield for the fourth quarter was

6.77%, a decline from 7.11%

the previous quarter as we purchased higher

rated securities with lower

yields. The residential IGS yield for 2006

was

6.67%.

|

| Ø |

Net

discount amortization income (which is included

in interest income) for

the fourth quarter was $1 million. At year-end,

our net discount balance

for these assets was $16 million giving us

an average income statement

basis of 99.04% of principal value.

|

| Ø |

We

have never incurred a principal loss on a residential IGS security.

We do not have credit reserves for these assets.

There were no credit

rating upgrades or downgrades of IGS for the

fourth quarter of

2006.

|

| Ø |

At

year-end, residential IGS backed by subprime

loans totaled $518 million,

or 31% of the residential IGS portfolio. IGS

backed by subprime loans that

were originated in 2006 and that had BBB credit

ratings totaled $114

million at year-end. We sold $24 million of

these in January 2007 at a

slight loss. After these sales, we owned $90

million 2006 vintage subprime

BBBs, including $15 million bonds rated BBB-,

$19 million bonds rated BBB,

and $56 million bonds rated BBB+. The performance

of the loans underlying

these bonds has been satisfactory to date,

but we are monitoring them

closely as the industry-wide performance of subprime loans originated

in 2006 has generally been poor so far.

|

| Ø |

At

December 31, 2006, $1.4 billion of residential

IGS were financed via

securitization in our Acacia CDO program and

$0.3 billion were financed

with Redwood debt and capital. At December

31, 2006, the interest rate

characteristics of residential IGS were 60%

adjustable-rate, 23% hybrid,

and 17% fixed rate. We use interest rate agreements

to generally match the

interest rate characteristics of these assets

to their corresponding

funding sources.

|

| Ø |

Additional

information on our residential IGS can be found

in Tables 9 and 10 of the

Appendix.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

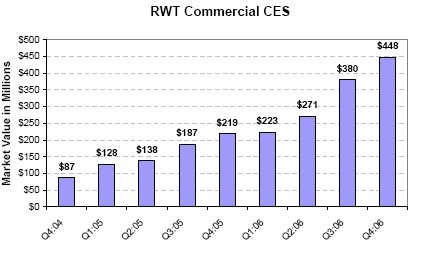

Our

commercial CES portfolio increased

by $68 million (or 18%) in the fourth

quarter as a result of $76 million

acquisitions, $2 million market value

appreciation, and sales of $10 million.

|

| Ø |

Our

commercial CES portfolio grew by 105%

during 2006, from $219 million to

$448 million.

|

| Ø |

Interest

income generated by commercial CES

was $8 million for the fourth quarter.

The yield for the quarter was 8.97%,

a small decrease from 9.00% in the

previous quarter. The yield for 2006

was 8.73%. The level of current yield

we recognize on these assets is largely

a function of our future credit

loss assumptions.

|

| Ø |

For

the fourth quarter of 2006, we generated

$0.4 million income from sales

and calls of commercial CES. Market

value appreciation on our commercial

CES portfolio was $2 million; all of

this unrealized appreciation was

recognized on our balance sheet but

none through our income

statement.

|

| Ø |

The

balance of commercial real estate loans

underlying these CES remained at

$58 billion during the fourth quarter.

We acquired $76 million CES from

two CMBS transactions with underlying

loans of $5 billion and sold $10

million CES from two CMBS transactions

with underlying loans of $5.2

billion.

|

| Ø |

We

do not own all the first-loss CES issued

from the securitizations in which

we are currently in a first-loss position.

We own 40-49% of the first-loss

CES issued from transactions completed

prior to the first quarter of 2006.

For transactions completed after that

date, we own 50-100% of the issued

first-loss CES.

|

| Ø |

On

a principal value basis, for all the

transactions in which we have

invested, commercial first-loss CES

have averaged 1.35% of the underlying

loan balances at origination.

|

| Ø |

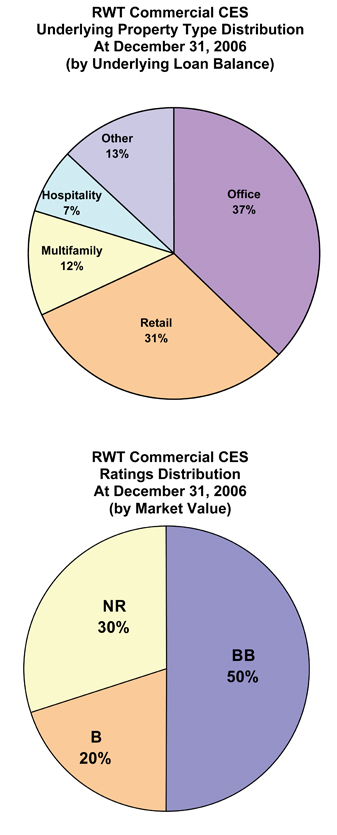

Statistics

for the loans underlying commercial

CES by dollar balance at December 31,

2006: 37% office, 31% retail, 12% multifamily,

7% hospitality, 13% other;

17% located in California, 13% in New

York, 8% in Texas, 4% in Virginia;

33% originated in 2006, 36% originated

in 2005, 31% originated in 2004 or

earlier.

|

| Ø |

There

were $0.5 million principal value of

credit losses for loans underlying

our commercial CES in the fourth quarter,

the first such credit losses

during 2006. The 2006 annual credit

loss rate was less than one basis

point (0.01%).

|

| Ø |

Our

GAAP credit reserves for commercial

CES were $295 million ($11.05 per

share) at December 31, 2006, an increase

of $66 million for the quarter.

At year-end, GAAP credit reserves were

0.51% of underlying loan balances.

|

| Ø |

For

tax purposes, realized credit losses

were $0.14 million for 2006. This

deduction is less than the principal

value losses incurred on the

underlying loans, as we own most of

our commercial CES at a tax basis that

is substantially less than par (principal)

value. In addition, we shared

these loan losses with other CES

investors.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

For

loans underlying CES, serious delinquencies at December 31, 2006

were $64

million, remaining flat for the quarter. These delinquencies

were 0.11% of

current balances at year-end.

|

| Ø |

At

December 31, 2006, $224 million commercial CES were funded with

capital

and $224 million were financed through our Acacia CDO securitization

program.

|

| Ø |

Additional

information on our commercial CES can be found in Tables 9, 10,

14, and 15

of the Appendix.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

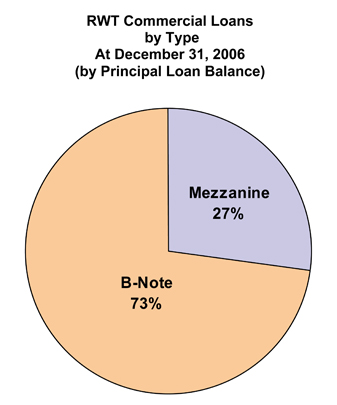

Our

commercial loan portfolio at December

31, 2006 was $28 million. To date,

these loans are performing well.

|

| Ø |

We

successfully originated commercial

whole loans from 1998 to 2003. We

shut

down this production largely because

we were not able to develop a secure

source of financing for these assets.

|

| Ø |

Since

then, CDO securitization technology

has evolved so that some types of

commercial real estate whole loans

can be securitized and funded via

CDOs.

|

| Ø |

Although

our immediate focus is on further

developing our commercial CES business,

in the longer-run we will be evaluating

the possibility of rebuilding our

commercial whole loan business using

CDO securitization for funding. We

could buy loans, originate them,

or both.

|

| Ø |

Additional

information on our commercial loans

can be found in Tables 9, 10, 14,

and

16 of the Appendix.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

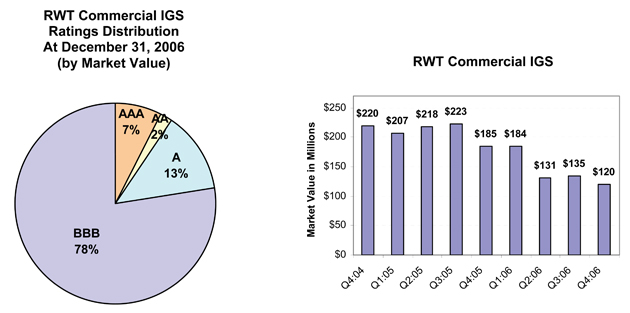

Our

commercial IGS portfolio

decreased by 11% in the fourth

quarter, from $135

million to $120 million.

Acquisitions were $9 million,

sales were $24

million, principal pay downs

were $0.7 million, and market

value

appreciation was $0.7 million.

Sales were the result of

our call of Acacia

3 and subsequent sale of

most of Acacia 3’s

assets.

|

| Ø |

For

2006, our commercial IGS

portfolio declined by 35%

from $185 million to

$120 million, largely as

a result of sales subsequent

to CDO calls. We

intend to acquire additional

commercial IGS in

2007.

|

| Ø |

Interest

income generated by commercial

IGS was $2 million for the

fourth quarter.

The yield on the fourth quarter

was 8.77%, an increase from

7.30% in the

previous quarter. Yields

increased as a result of

rising interest rates.

The commercial IGS yield

for 2006 was

7.01%.

|

| Ø |

At

year-end, our income statement

basis for commercial IGS

assets was 97.35%

of principal value, with

a total unamortized discount

of $3 million. Net

discount amortization income

(which is included in interest

income) was

$0.1 million for the fourth

quarter.

|

| Ø |

Market

value gains recognized in

the income statement during

the fourth quarter

were $1 million on sales

of $24 million.

|

| Ø |

We

have never incurred a principal loss on a commercial

IGS security and

we do not have credit reserves

for these assets. Credit

rating upgrades

for the quarter were $4 million

and there were no

downgrades.

|

| Ø |

At

December 31, 2006, all of

our commercial IGS were financed

via Acacia CDO

securitization. The interest

rate characteristics of commercial

CDO IGS

were 78% fixed rate and 22% floating rate. We

use interest rate

agreements to reduce any

interest rate mismatches

that may occur between

assets and their associated

liabilities.

|

| Ø |

Additional

information on our commercial

IGS can be found in Tables

9 and 10 of the

Appendix.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

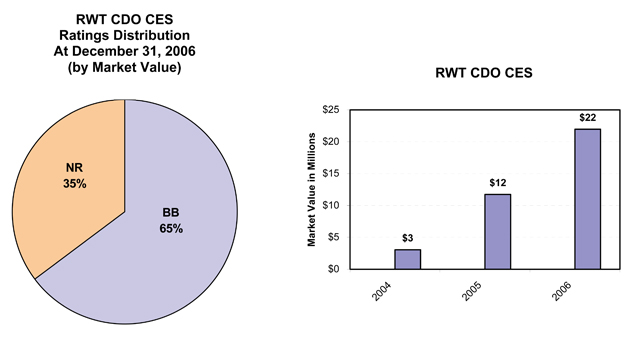

Our

CDO CES portfolio remained constant in

size in the fourth quarter at $22

million.

|

| Ø |

For

2006, growth of our CDO CES portfolio

was 97%, an increase from $11

million to $22 million.

|

| Ø |

Interest

income generated by CDO CES was $0.6

million for the fourth quarter. The

yield for the fourth quarter was 11.67%.

The CDO CES yield for 2006 was

10.75%. The increase in yield during

the fourth quarter was the result of

rising LIBOR rates and continued good

performance of the underlying

securities.

|

| Ø |

We

did not incur credit losses on CDO CES

in 2006, and we have no credit

reserves for these assets.

|

| Ø |

At

December 31, 2006, $13 million of CDO

CES was financed via securitization

in our Acacia CDO program and $9 million

was financed with

capital.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

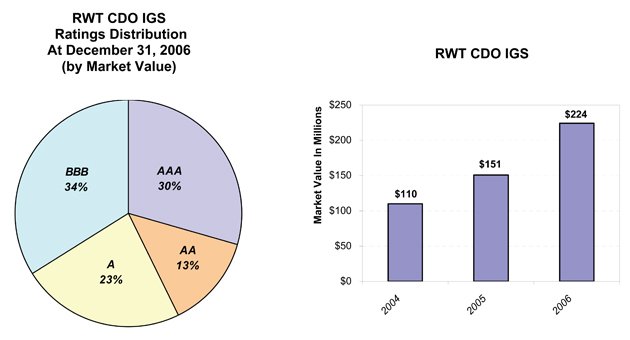

Our

CDO IGS portfolio increased by

21%, from $185 million to $224

million, in

the fourth quarter of 2006. This

increase was the result of acquisitions

of $45 million which were offset

by principal paydowns, mark-to-market

adjustments, and sales of assets

to third parties of $5.3

million.

|

| Ø |

For

2006, growth of our CDO IGS portfolio

was 48%, from $151 million to

$224

million.

|

| Ø |

Interest

income generated by the CDO IGS

portfolio during the fourth quarter

was

$3.3 million, an increase of

14% over the $2.9 million generated

in the

third quarter. The yield for

the fourth quarter was 7.20%.

The CDO IGS

yield for 2006 was 6.16%. The

yield has been increasing as

a result of

rising LIBOR rates. Substantially

all of these assets earn a floating

rate

of interest based on the LIBOR

interest rate.

|

| Ø |

We

own these assets at a cost basis

near par

value.

|

| Ø |

At

December 31, 2006, CDO IGS assets

backed primarily by residential

real

estate collateral were $152 million

and those backed primarily by

commercial real estate collateral

were $72 million. Most

of the underlying collateral

securities have investment-grade

credit

ratings.

|

| Ø |

We

have never incurred a principal loss on a CDO IGS security

and we do

not currently have credit reserves

for these

assets.

|

| Ø |

At

December 31, 2006, $210 million

of CDO IGS were financed via

securitization in our Acacia

CDO securitization program. We

funded $14

million of CDO IGS assets with

capital. We use interest rate

agreements to

reduce any mismatch of interest

rate characteristics between

the

fixed-rate CDO IGS we own and

the floating-rate CDO securities

issued by

Acacia to finance these assets.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

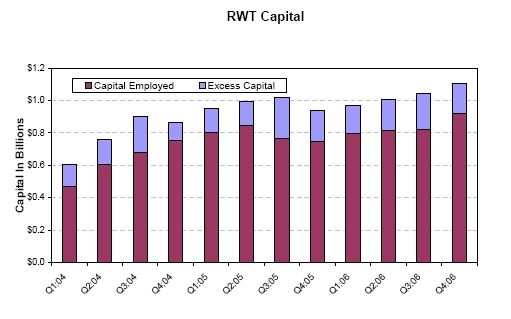

Our

capital

base

increased

by

$60

million

during

the

fourth

quarter

to

$1.1

billion.

We

issued

$100

million

junior

subordinated

notes

(in

the

form

of

trust

preferred

certificates),

issued

680,444

shares

of

common

stock

raising

$29

million,

and

earned

$36

million

profits.

Market

values

for

assets

marked-to-market

through

the

balance

sheet

declined

by

$2

million.

Our

capital

base

was

reduced

by

the

declaration

of

$103

million

regular

and

special

dividends.

|

| Ø |

Capital

employed

at

year-end

was

$914

million,

a

net

increase

of

11%

($90

million)

for

the

fourth

quarter.

We

closed

on

a

large

commercial

CES

transaction

in

the

fourth

quarter

and

acquired

new

assets

in

most

of

our

other

portfolios.

In

addition,

by

calling

two

Sequoia

securitizations,

we

replaced

ABS

issued

with

Redwood

debt,

thus

using

more

capital.

|

| Ø |

For

2006,

capital

employed

increased

by

23%

from

$746

million

to

$914

million.

|

| Ø |

We

ended

the

year

with

$182

million

of

excess

capital,

a

decrease

of

$37

million

from

the

beginning

of

the

quarter

and

$7

million

from

the

beginning

of

the

year.

|

| Ø |

We

issued

$100

million

unsecured

junior

subordinated

notes

in

December

2006.

These

notes

had

minimal

covenants

and

carried

an

interest

expense

of

2.25%

over

three

month

LIBOR.

At

year-end,

three

month

LIBOR

was

5.36%.

Maturity

is

in

30

years

(January

2037).

We

have

the

right

to

call

these

notes

without

any

prepayment

penalty

beginning

in

five

years

(January

2012).

|

| Ø |

We

currently

anticipate

that

growth

of

our

business

will

absorb

$200

million

to

$400

million

net

capital

in

2007.

Since

this

exceeds

our

year-end

excess

capital

of

$182

million,

we

anticipate

seeking

to

raise

additional

capital

in

2007.

We

will

issue

new

common

shares

through

our

direct

stock

purchase

plan

which

allows

new

or

existing

shareholders

to

acquire

shares

from

us

(as

a

new

investment

or

to

reinvest

their

dividends).

We

may

also

do

a

public

or

private

offering

of

shares

or

issue

long-term

junior

debt

that

we

would

consider

capital.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

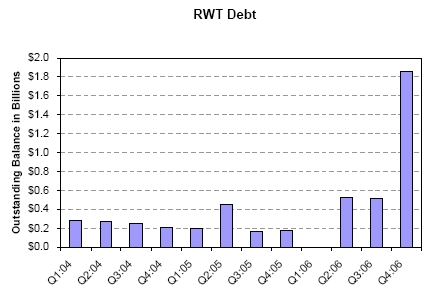

Redwood

debt

balances

increased

in

the

fourth

quarter

from

$0.5

billion

to

$1.9

billion

as

we

increasingly

used

debt

to

fund

residential

whole

loans

that

we

intend

to

own

on

an

ongoing

basis.

|

| Ø |

The

cost

of

funds

for

Redwood’s

debt

has

been

rising

with

short-term

interest

rates

-

it

was

6.06%

for

the

fourth

quarter

and

5.82%

in

the

third

quarter.

Interest

expense

for

Redwood

debt

was

$17

million

for

the

fourth

quarter

and

$30

million

for

2006.

|

| Ø |

At

December

31,

2006,

all

Redwood

debt

was

short-term

debt

collateralized

by

the

pledge

of

assets.

Maturities

are

generally

one

year

or

less,

and

the

interest

rate

usually

adjusts

to

market

levels

each

month.

|

| Ø |

In

the

fourth

quarter,

we

started

using

a

new

form

of

Redwood

debt

-

collateralized

commercial

paper

(CP)

issued

from

our

Madrona

CP

facility.

Madrona

CP

outstanding

at

year-end

was

$300

million.

Borrowings

under

our

Madrona

program

are

rated

the

highest

CP

rating

of

A1+/P1

and

represent

our

lowest

cost

borrowings.

At

year-end,

CP

collateral

was

limited

to

whole

loans.

In

2007,

we

expect

to

expand

our

Madrona

program

to

allow

for

funding

of

securities.

|

| Ø |

At

December

31,

2006,

Redwood

debt

funded

$1.3

billion

residential

whole

loans

and

$0.6

billion

securities.

|

| Ø |

When

we

fund

fixed-rate

or

hybrid-rate

assets

with

Redwood

debt,

we

generally

use

interest

rate

agreements

to

reduce

the

interest

rate

mismatch

between

the

asset

and

the

liability.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

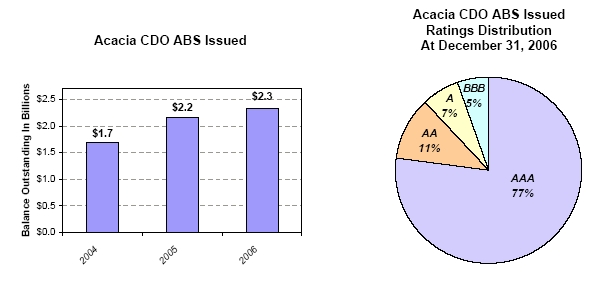

Acacia

CDO ABS outstanding

decreased from

$2.6 billion to

$2.3 billion during

the

fourth quarter,

a decrease of 12%.

Acacia did not

issue new CDO ABS

during

the quarter. We

exercised our call

rights with respect

to Acacia 3,

purchasing and

retiring $0.3 billion

CDO ABS and regaining

control of the

underlying collateral

assets. Pay downs

of Acacia CDO securities

were

negligible for

the quarter.

|

| Ø |

In

2006, Acacia issued

$700 million CDO

ABS securities

in two transactions.

Net of calls, Acacia

CDO bonds outstanding

grew by 5% in 2006,

from $2.2

billion to $2.3

billion. Acacia

issued $450 million

additional CDO

ABS in

February 2007 (via

Acacia 11), most

of which were rated

AAA. The Acacia

11

AAA-rated CDO ABS

were issued with

a coupon of three-month

LIBOR plus

0.30%.

|

| Ø |

At

December 31, 2006,

99% of Acacia bonds

outstanding were

floating rate

bonds with coupons

adjusting as a

function of the

LIBOR interest

rate.

|

| Ø |

The

cost of funds of

issued Acacia CDO

ABS was 6.08% in

the fourth quarter

of

2006 and 5.85%

for the full year

2006. The cost

of funds has been

rising

in conjunction

with short-term

interest rates.

Interest expense,

net of

interest rate agreements,

for Acacia ABS

issued was $39

million for the

fourth quarter

and $139 million

for 2006.

|

| Ø |

At

December 31, 2006,

the credit ratings

for Acacia bonds

outstanding were

$1.9 billion AAA,

$303 million AA,

$156 million A,

and $135 million

BBB.

In addition, Acacia

has sold a portion

of its unrated

CDO CES to third

parties, of which

$15 million was

outstanding at

December 31,

2006.

|

| Ø |

The

collateral underlying

each Acacia transaction

is typically rated

BBB on

average, with 7-15%

of assets rated

below

investment-grade.

|

| Ø |

The

Acacia CDO CES

Redwood has acquired

from Acacia had

a market value

of $127

million at December

31, 2006. Redwood’s economic risk

with respect to

Acacia’s assets and liabilities

is generally limited

to this amount.

For

accounting purposes,

we account for

Acacia transactions

as financings,

so

the assets owned

by Acacia are consolidated

with our assets

and the CDO

bonds issued by

Acacia are consolidated

with our liabilities.

As a result,

the Acacia CDO

CES assets we acquire

do not appear on

our GAAP balance

sheet, but rather

are implicitly

represented as

the excess of consolidated

Acacia assets over

consolidated Acacia

liabilities.

|

| Ø |

For

managing the outstanding

Acacia transactions,

Redwood’s asset management

(taxable) subsidiaries

earned $1.0 million

asset management

fees in the

fourth quarter

of 2006 and $3.2

million asset management

fees in 2006.

This income was

sourced from the

assets owned by

Acacia for GAAP,

and

these assets are

consolidated on

our GAAP balance

sheet, so we include

this asset management

income as part

of the interest

income generated

by

those assets.

|

| Ø |

Additional

information about

Acacia CDO ABS

issued can be

found in Table

20 of the

Appendix.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW | Ø |

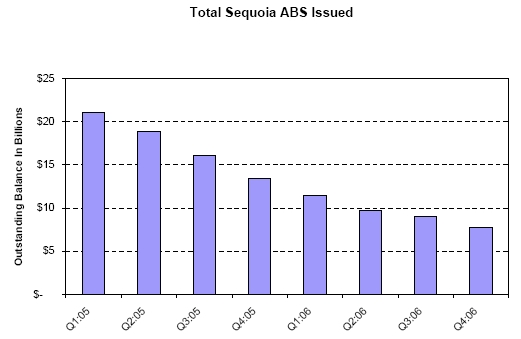

Sequoia

ABS

outstanding

decreased

from

$9.0

billion

to

$7.5

billion

in

the

fourth

quarter,

a

decline

of

17%.

There

was

no

new

issuance

for

the

quarter.

For

2006,

total

issuance

was

$0.7

billion.

During

2006,

Sequoia

ABS

outstanding

decreased

by

44%,

from

$13.4

billion

to

$7.5

billion.

Outstanding

amounts

are

reduced

as

the

underlying

loans

pay

down

and

also

as

a

result

of

calls.

We

called

$0.2

billion

Sequoia

ABS

in

2006.

|

| Ø |

Most

of

Sequoia’s

ABS

outstanding

are

rated

AAA.

For

Sequoia’s

last

issuance

in

August,

the

AAA-rated

ABS

issued

were

96%

of

the

total

issued.

These

AAA-rated

ABS

carry

a

coupon

of

5.98%.

|

| Ø |

The

cost

of

funds

of

issued

Sequoia

ABS

was

5.72%

in

the

fourth

quarter

of

2006

and

5.26%

for

the

full

year

2006.

The

cost

has

been

rising

in

conjunction

with

short-term

interest

rates.

Interest

expense

for

Sequoia

ABS

issued

was

$118

million

for

the

fourth

quarter

and

$533

million

for

2006.

|

| Ø |

Redwood’s

economic

risk

with

respect

to

Sequoia’s

assets

and

liabilities

is

generally

limited

to

the

value

of

Sequoia

ABS

we

have

acquired,

which

included

$26

million

market

value

IO

securities

rated

AAA,

$108

million

CES,

and

$154

million

investment-grade

securities

at

December

31,

2006.

For

GAAP

accounting

purposes,

we

account

for

Sequoia

transactions

as

financings,

so

the

assets

owned

by

Sequoia

are

consolidated

with

our

assets

and

the

ABS

bonds

issued

by

Sequoia

are

consolidated

with

our

liabilities.

As

a

result,

the

Sequoia

ABS

we

acquire

do

not

appear

on

our

GAAP

balance

sheet,

but

rather

are

implicitly

represented

as

the

excess

of

consolidated

Sequoia

assets

over

consolidated

Sequoia

liabilities.

|

| Ø |

Total

ABS

Issued

on

our

December

31,

2006

balance

sheet

included

$7.5

billion

Sequoia

ABS,

$2.3

billion

Acacia

CDO

ABS,

and

$5

million

ABS

issued

by

our

Madrona

CP

issuance

facility.

|

| Ø |

Additional

information

about

Sequoia

ABS

issued

can

be

found

in

Tables

18

and

19

of

the

Appendix.

|

APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX|

Table

1: GAAP Earnings (in thousands, except per share

data)

|

||||||||||||||||||||||||||||||||||

|

Q4:2006

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

Full

Year 2006 |

Full

year 2005 |

Full

year 2004 |

||||||||||||||||||||||||

|

Interest

income

|

$

|

213,504

|

$

|

217,504

|

$

|

214,544

|

$

|

224,795

|

$

|

234,531

|

$

|

246,810

|

$

|

248,786

|

$

|

237,714

|

$

|

870,347

|

$

|

967,840

|

$

|

655,195

|

||||||||||||

|

Discount

amortization income

|

20,323

|

19,530

|

14,381

|

14,661

|

11,936

|

12,714

|

8,395

|

9,316

|

68,895

|

42,361

|

36,071

|

|||||||||||||||||||||||

|

Premium

amortization expense

|

(14,930

|

)

|

(12,920

|

)

|

(13,193

|

)

|

(13,398

|

)

|

(14,451

|

)

|

(15,698

|

)

|

(10,203

|

)

|

(8,082

|

)

|

(54,441

|

)

|

(48,434

|

)

|

(32,412

|

)

|

||||||||||||

|

Provision

for (reversal of) credit reserve

|

(1,506

|

)

|

(465

|

)

|

2,506

|

(176

|

)

|

(877

|

)

|

805

|

1,527

|

(1,025

|

)

|

359

|

430

|

(7,236

|

)

|

|||||||||||||||||

|

Total

GAAP interest income

|

217,391

|

223,649

|

218,238

|

225,882

|

231,139

|

244,631

|

248,505

|

237,923

|

885,160

|

962,197

|

651,618

|

|||||||||||||||||||||||

|

Interest

expense on Redwood debt

|

(16,520

|

)

|

(9,422

|

)

|

(1,822

|

)

|

(2,072

|

)

|

(3,521

|

)

|

(3,789

|

)

|

(1,789

|

)

|

(2,694

|

)

|

(29,836

|

)

|

(11,793

|

)

|

(9,764

|

)

|

||||||||||||

|

ABS

interest expense consolidated from trusts

|

(152,043

|

)

|

(165,177

|

)

|

(171,659

|

)

|

(178,182

|

)

|

(186,433

|

)

|

(190,996

|

)

|

(191,966

|

)

|

(173,146

|

)

|

(667,061

|

)

|

(742,541

|

)

|

(398,865

|

)

|

||||||||||||

|

ABS

issuance expense amortization

|

(7,898

|

)

|

(5,786

|

)

|

(6,079

|

)

|

(5,907

|

)

|

(6,069

|

)

|

(5,162

|

)

|

(5,386

|

)

|

(5,273

|

)

|

(25,670

|

)

|

(21,890

|

)

|

(16,829

|

)

|

||||||||||||

|

ABS

interest agreement expense

|

2,497

|

3,317

|

3,678

|

2,980

|

3,573

|

623

|

876

|

1,469

|

12,472

|

6,541

|

(13,235

|

)

|

||||||||||||||||||||||

|

ABS

issuance premium amortization income

|

1,530

|

2,395

|

2,363

|

2,526

|

2,793

|

2,733

|

3,140

|

3,747

|

8,814

|

|

12,413

|

7,272

|

||||||||||||||||||||||

|

Total

consolidated ABS expense

|

(155,914

|

)

|

(165,251

|

)

|

(171,697

|

)

|

(178,583

|

)

|

(186,136

|

)

|

(192,802

|

)

|

(193,336

|

)

|

(173,203

|

)

|

(671,445

|

)

|

(745,477

|

)

|

(421,657

|

)

|

||||||||||||

|

Junior

subordinated notes

|

(423

|

)

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

(423

|

)

|

-

|

-

|

|||||||||||||||||||||

|

GAAP

net interest income

|

44,534

|

48,976

|

44,719

|

45,227

|

41,481

|

48,040

|

53,380

|

62,026

|

183,456

|

204,927

|

220,197

|

|||||||||||||||||||||||

|

Fixed

compensation expense

|

(3,688

|

)

|

(3,437

|

)

|

(3,309

|

)

|

(3,437

|

)

|

(2,879

|

)

|

(2,802

|

)

|

(2,623

|

)

|

(2,778

|

)

|

(13,871

|

)

|

(11,082

|

)

|

(8,040

|

)

|

||||||||||||

|

Variable

compensation expense

|

(4,899

|

)

|

(5,209

|

)

|

(4,891

|

)

|

(4,208

|

)

|

(5,005

|

)

|

(4,241

|

)

|

(5,174

|

)

|

(4,565

|

)

|

(19,207

|

)

|

(18,985

|

)

|

(16,794

|

)

|

||||||||||||

|

Other

operating expense

|

(4,732

|

)

|

(4,425

|

)

|

(5,150

|

)

|

(4,505

|

)

|

(4,583

|

)

|

(4,246

|

)

|

(3,542

|

)

|

(3,698

|

)

|

(18,812

|

)

|

(16,069

|

)

|

(10,324

|

)

|

||||||||||||

|

Due

diligence expenses

|

(532

|

)

|

(384

|

)

|

(2,687

|

)

|

(432

|

)

|

(298

|

)

|

(1,075

|

)

|

(117

|

)

|

(757

|

)

|

(4,035

|

)

|

(2,246

|

)

|

(3,534

|

)

|

||||||||||||

|

Total

GAAP operating expenses

|

(13,851

|

)

|

(13,455

|

)

|

(16,037

|

)

|

(12,582

|

)

|

(12,765

|

)

|

(12,364

|

)

|

(11,456

|

)

|

(11,798

|

)

|

(55,925

|

)

|

(48,382

|

)

|

(38,692

|

)

|

||||||||||||

|

Realized

gains on sales

|

5,308

|

4,968

|

8,239

|

1,062

|

14,815

|

23,053

|

516

|

8,346

|

19,577

|

|

46,730

|

7,639

|

||||||||||||||||||||||

|

Realized

gains on calls

|

1,511

|

722

|

747

|

-

|

4,265

|

2,914

|

4,421

|

7,548

|

2,980

|

19,149

|

58,739

|

|||||||||||||||||||||||

|

Valuation

adjustments

|

(1,404

|

)

|

(5,257

|

)

|

(2,993

|

)

|

(2,932

|

)

|

(1,205

|

)

|

(1,051

|

)

|

(1,892

|

)

|

(883

|

)

|

(12,586

|

)

|

(5,031

|

)

|

(7,251

|

)

|

||||||||||||

|

Net

gains and valuation adjustments

|

5,415

|

433

|

5,993

|

(1,870

|

)

|

17,875

|

24,916

|

3,045

|

15,011

|

9,971

|

60,848

|

59,127

|

||||||||||||||||||||||

|

Provision

for income taxes

|

(407

|

)

|

(3,538

|

)

|

(3,265

|

)

|

(2,760

|

)

|

(4,097

|

)

|

(4,693

|

)

|

(4,054

|

)

|

(4,677

|

)

|

(9,970

|

)

|

(17,521

|

)

|

(7,997

|

)

|

||||||||||||

|

GAAP

net income

|

$

|

35,691

|

$

|

32,416

|

$

|

31,410

|

$

|

28,015

|

$

|

42,495

|

$

|

55,899

|

$

|

40,915

|

$

|

60,563

|

$

|

127,532

|

$

|

199,872

|

$

|

232,635

|

||||||||||||

|

Diluted

average shares

|

27,122

|

26,625

|

26,109

|

25,703

|

25,311

|

25,314

|

25,196

|

25,021

|

26,314

|

25,121

|

22,229

|

|||||||||||||||||||||||

|

GAAP

earnings per share

|

$

|

1.32

|

$

|

1.22

|

$

|

1.20

|

$

|

1.09

|

$

|

1.68

|

$

|

2.21

|

$

|

1.62

|

$

|

2.42

|

$

|

4.85

|

$

|

7.96

|

$

|

10.47

|

||||||||||||

|

Table

2: Core Earnings (in thousands, except per share

data)

|

||||||||||||||||||||||||||||||||||

|

Q4:2006

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

Full

Year 2006 |

Full

Year 2005 |

Full

Year 2004 |

||||||||||||||||||||||||

|

GAAP

net income

|

$

|

35,691

|

$

|

32,416

|

$

|

31,410

|

$

|

28,015

|

$

|

42,495

|

$

|

55,899

|

$

|

40,915

|

$

|

60,563

|

$

|

127,532

|

$

|

199,872

|

$

|

232,635

|

||||||||||||

|

GAAP

income items not included in core earnings

|

||||||||||||||||||||||||||||||||||

|

Realized

gains on sales

|

5,308

|

4,968

|

8,239

|

1,062

|

14,815

|

23,053

|

516

|

8,346

|

19,577

|

46,730

|

7,639

|

|||||||||||||||||||||||

|

Realized

gains on calls

|

1,511

|

722

|

747

|

-

|

4,265

|

2,914

|

4,421

|

7,548

|

2,980

|

19,149

|

58,739

|

|||||||||||||||||||||||

|

Valuation

adjustments

|

(1,404

|

)

|

(5,257

|

)

|

(2,993

|

)

|

(2,932

|

)

|

(1,205

|

)

|

(1,051

|

)

|

(1,892

|

)

|

(883

|

)

|

(12,586

|

)

|

(5,031

|

)

|

(7,251

|

)

|

||||||||||||

|

Variable

stock option market value change

|

-

|

-

|

-

|

-

|

25

|

16

|

(2

|

)

|

84

|

-

|

123

|

98

|

||||||||||||||||||||||

|

Total

GAAP / core earnings differences

|

5,415

|

433

|

5,993

|

(1,870

|

)

|

17,900

|

24,932

|

3,043

|

15,095

|

9,971

|

60,971

|

59,225

|

||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Core

earnings

|

$

|

30,276

|

$

|

31,983

|

$

|

25,417

|

$

|

29,885

|

$

|

24,594

|

$

|

30,967

|

$

|

37,872

|

$

|

45,468

|

$

|

117,561

|

$

|

138,901

|

$

|

173,410

|

||||||||||||

|

Per

share analysis

|

||||||||||||||||||||||||||||||||||

|

GAAP

earnings per share

|

$

|

1.32

|

$

|

1.22

|

$

|

1.20

|

$

|

1.09

|

$

|

1.68

|

$

|

2.21

|

$

|

1.62

|

$

|

2.42

|

$

|

4.85

|

$

|

7.96

|

$

|

10.47

|

||||||||||||

|

GAAP

income items not included in core earnings

|

||||||||||||||||||||||||||||||||||

|

Realized

gains on sales

|

$

|

0.20

|

$

|

0.19

|

$

|

0.32

|

$

|

0.04

|

$

|

0.59

|

$

|

0.91

|

$

|

0.02

|

$

|

0.33

|

$

|

0.74

|

$

|

1.86

|

$

|

0.34

|

||||||||||||

|

Realized

gains on calls

|

0.06

|

0.03

|

0.03

|

-

|

0.17

|

0.12

|

0.18

|

0.30

|

0.11

|

0.76

|

2.64

|

|||||||||||||||||||||||

|

Valuation

adjustments

|

(0.05

|

)

|

(0.20

|

)

|

(0.11

|

)

|

(0.11

|

)

|

(0.05

|

)

|

(0.04

|

)

|

(0.08

|

)

|

(0.04

|

)

|

(0.48

|

)

|

(0.20

|

)

|

(0.33

|

)

|

||||||||||||

|

Variable

stock option market value change

|

-

|

-

|

-

|

-

|

0.00

|

0.00

|

(0.00

|

)

|

0.00

|

-

|

0.00

|

0.00

|

||||||||||||||||||||||

|

GAAP

/ Core earnings differences per share

|

$

|

0.20

|

$

|

0.02

|

$

|

0.23

|

($0.07

|

)

|

$

|

0.71

|

$

|

0.98

|

$

|

0.12

|

$

|

0.60

|

$

|

0.38

|

$

|

2.43

|

$

|

2.66

|

||||||||||||

|

Core

earnings per share

|

$

|

1.12

|

$

|

1.20

|

$

|

0.97

|

$

|

1.16

|

$

|

0.97

|

$

|

1.22

|

$

|

1.50

|

$

|

1.82

|

$

|

4.47

|

$

|

5.53

|

$

|

7.80

|

||||||||||||

|

Table

3: GAAP / TAX Differences (in thousands, except per share

data)

|

||||||||||||||||||||||||||||

|

2006

|

2005

|

2004

|

||||||||||||||||||||||||||

|

|

GAAP

|

|

Difference

|

Estimate

Tax

|

GAAP

|

Difference

|

Actual Tax |

GAAP

|

|

Difference

|

Actual Tax |

|||||||||||||||||

|

Interest

income

|

$

|

885,160

|

($516,673

|

)

|

$

|

368,487

|

$

|

962,197

|

($749,388

|

)

|

$

|

212,809

|

$

|

651,618

|

($394,571

|

)

|

$

|

257,047

|

||||||||||

|

Interest

expense

|

(701,281

|

)

|

573,331

|

(127,950

|

)

|

(757,270

|

)

|

721,895

|

(35,375

|

)

|

(431,421

|

)

|

373,935

|

(57,486

|

)

|

|||||||||||||

|

Junior

subordinated notes

|

(423

|

)

|

-

|

(423

|

)

|

-

|

-

|

-

|

-