CONTENTS

CONTENTS|

INTRODUCTION

|

2

|

|

|

SHAREHOLDER

LETTER

|

3

|

|

|

REDWOOD

BUSINESS AND STRATEGY

|

7

|

|

|

FINANCIAL

MODULES

|

|

|

|

►

|

Financial

|

14

|

|

►

|

Residential

|

28

|

|

►

|

Commercial

|

49

|

|

►

|

CDO

|

57

|

|

►

|

Capital

|

61

|

|

►

|

Debt

|

63

|

|

►

|

ABS

Issued

|

65

|

|

APPENDIX

|

|

|

|

►

|

Glossary

|

72

|

|

►

|

Financial

Tables

|

78

|

INTRODUCTION

INTRODUCTION

SHAREHOLDER

LETTER

SHAREHOLDER

LETTER SHAREHOLDER

LETTER

SHAREHOLDER

LETTER SHAREHOLDER

LETTER

SHAREHOLDER

LETTER SHAREHOLDER

LETTER

SHAREHOLDER

LETTER |

|

|||

| George E. Bull, III | Douglas B. Hansen | |||

| Chairman and CEO | President |

ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST ABOUT

REDWOOD TRUST

ABOUT

REDWOOD TRUST FINANCIAL

REVIEW

FINANCIAL

REVIEW| · |

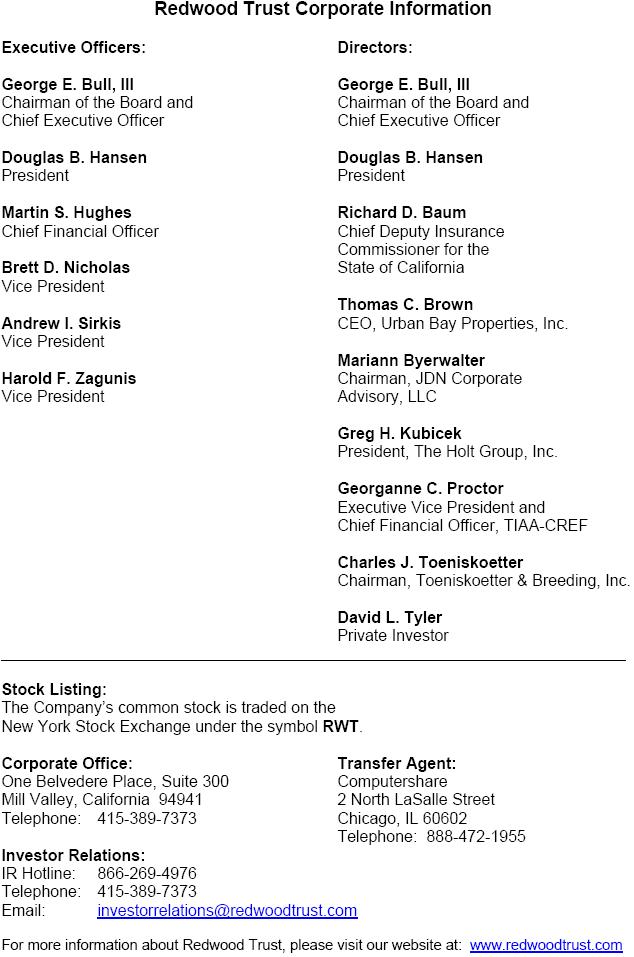

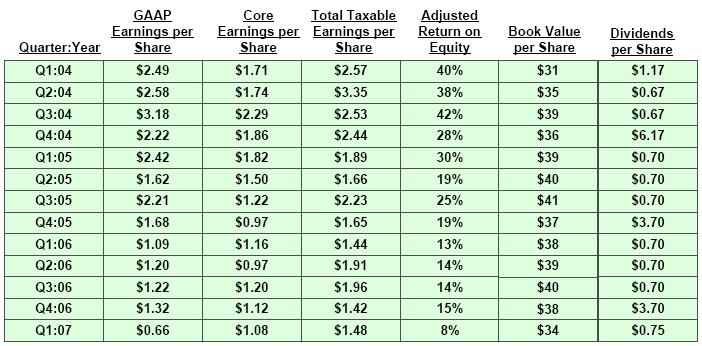

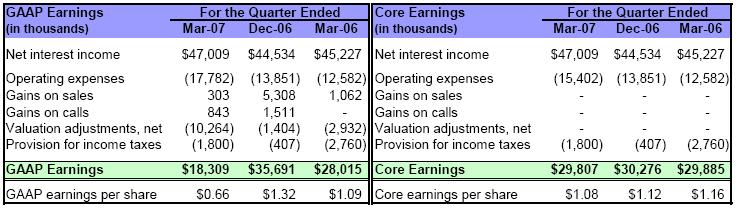

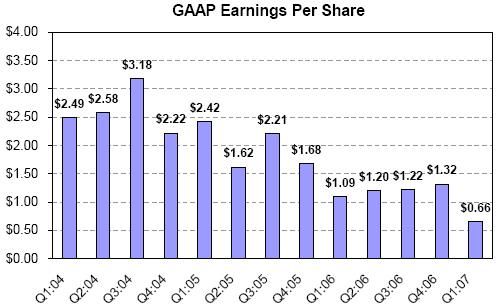

GAAP

earnings per share for the first quarter of $0.66 per share were

lower

than recent quarters primarily due to $10 million negative unrealized

mark-to-market

valuation adjustments, a $3 million charge against a commercial

real

estate loan, and $2 million severance costs. Net interest income

for the

first quarter was strong.

|

| · |

For

the past

year and a half, quarterly core earnings have ranged from $0.97

to $1.20

per share. Our first quarter core earnings of $1.08 per share were

near

the middle of this range.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW| Ø |

Net

interest income

for

the first quarter of 2007 increased by $2 million over the fourth

quarter

of 2006 and $2 million over the first quarter of 2006. Higher net

interest

income earnings from our CES and IGS portfolios more than offset

a

decrease in net interest income from our residential loan portfolio

and a

$3 million charge related to a commercial real estate loan. The

average

balance of our residential loan portfolio continued to decline

due to high

prepayments on adjustable-rate residential loans acquired and securitized

under our Sequoia program.

|

| Ø |

Our

residential CES portfolio continues to benefit from strong credit

performance and rapid prepayments on those securities backed by

ARM loans.

The yield for this portfolio was 22% in the first quarter of 2007,

22% in

the fourth quarter of 2006, and 20% in the first quarter of

2006.

|

| Ø |

Operating

expenses for the first quarter include $2 million of severance

charges.

Excluding this item, operating expenses increased by $2 million

(or 11%)

over the fourth quarter of 2006 as we have increased the number

of our

employees and increased pay levels at

year-end.

|

| Ø |

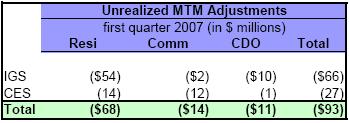

The

largest factor causing a decline in our GAAP earnings was $10 million

of

negative unrealized mark-to-market valuation adjustments. These

adjustments were $9 million or $0.32 per share higher than the

fourth

quarter of 2006 and $7 million or $0.26 per share higher than the

first

quarter of 2006. The

decrease

in fair value reflects the overall market decline in prices for

real

estate securities (particularly, securities backed by subprime

and alt-a

loans) that occurred during the first quarter. Of the $10 million,

$9

million related to securities accounted for as trading securities,

for

which quarterly mark-to-markets are a factor in GAAP net income.

We had no

securities classified as trading in the first quarter or fourth

quarter of

2006.

|

| Ø |

As

we expect

to increase the amount of securities we classify as trading for

accounting

purposes, our quarterly GAAP earnings going forward will become

increasingly volatile. Only certain types of market value changes

are

reported in our net income, so earnings changes will not reflect

the net

overall market value changes of our assets and

liabilities.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW| · |

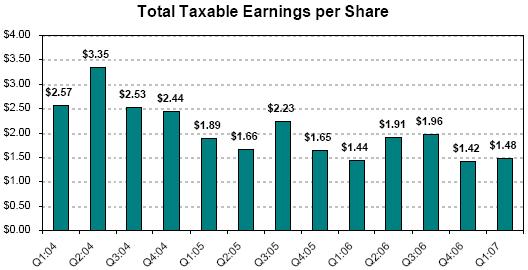

Total

taxable income for the first quarter of 2007 was strong at $1.48

per

share, an increase from the prior quarter due to reduced tax deductions

from stock option exercises.

|

| · |

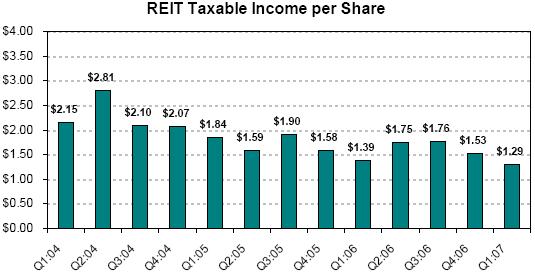

REIT

taxable income remained strong at $1.29 per share and continues

to exceed

our regular quarterly

dividend by a comfortable margin.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

| Ø |

Total

taxable

income was $40 million, or $1.48 per share, in the first quarter

of 2007.

This was an increase from the total taxable income we generated

in the

prior quarter of $38 million or $1.42 per share. In the prior quarter,

we

had more tax deductions relating to stock option

exercises.

|

| Ø |

Our

REIT

taxable income was $1.29 per share in the first quarter of 2007.

This was

lower than the fourth quarter of 2006 of $1.53 due primarily to

the timing

of the reallocation of expenses between REIT and taxable subsidiaries.

We

are working to further develop this process so it does not cause

large

quarter-to-quarter variations.

|

| Ø |

Our

taxable

income continues to be higher than our GAAP income as we are not

permitted

to establish credit reserves for tax. As a result, we amortize

more of our

CES discount into income for tax and recognize a higher yield until

credit

losses occur. The cumulative difference at March 31, 2007 in the

discount

amortization between tax and GAAP for residential, commercial,

and CDO CES

was $99 million.

|

| Ø |

Another

reason for the difference between tax and GAAP income is that we

do not

recognize changes in market values of assets for tax until the

asset is

sold. Consequently, the negative $10 million of unrealized market

valuation adjustments included in our GAAP earnings this quarter

were not

included in our tax earnings.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW| Ø |

Total

taxable

income and REIT taxable income were reduced by $2.2 million ($0.08

per

share) in the first quarter of 2007 as a result of deductions

for actual

credit losses. The components of the $2.2 million in losses were

$1.8

million on residential assets and $0.4 million on commercial

assets. These

deductions were less than the actual principal losses

incurred on the underlying loans of $5.9 million ($4.6 million

residential

and $1.3 million commercial), as we own most of our credit-sensitive

assets at a tax basis that is substantially less than par (principal)

value. We currently expect that realized credit losses will increase

substantially relative to our recent experience. We believe there

is a

reasonable chance that cumulative losses could remain less than

the

assumptions we have used for our pricing, GAAP reserve, and effective

yield calculations. All realized credit losses, after adjusting

for our

tax basis in the assets we own, will reduce our dividend distribution

requirements

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW| · |

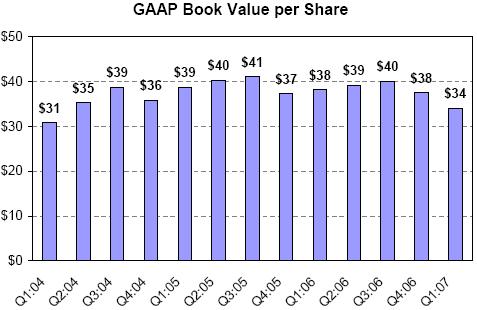

GAAP

book value declined by 9%, or $3.45 per share, during

the first quarter

from $37.51 per share to $34.06 per share as a result

of declining asset

values for those particular assets we own that are

marked-to-market for

balance sheet purposes.

|

| · |

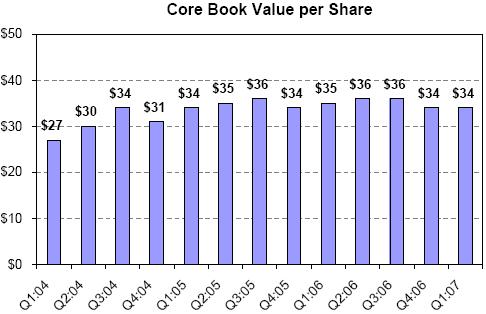

Core

book value rose by 1% during the first quarter of 2007

from $34.02 per

share to $34.29 per share.

|

| · |

The

disruption in the capital markets also impacted liability

spreads. Under

GAAP, we are required to carry our real estate securities

on our balance

sheet at their current market value, but we are not

permitted to adjust

paired Acacia ABS issued liabilities or other liabilities

to market value.

We estimate that if we had reported our Acacia ABS

issued at fair value,

our book value at March 31, 2007 would have been higher

than reported by

$41

million

(or $1.51 per share).

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW| Ø |

The

difference between core book value of $34.29 per share and GAAP

book value

of $34.06 per share at March 31, 2007 was cumulative mark-to-market

balance sheet adjustments for GAAP of negative $6 million at

quarter-end.

|

| Ø |

For

the $3.6

billion of assets that were marked-to-market for balance sheet

purposes at

March 31, 2007, market values declined by $93 million in the first

quarter

of 2007. This represents an average decline in value during the

quarter of

2% of principal value.

|

| Ø |

Market

spreads widened in March—the yields the market requires increased, so

asset values dropped. For some assets, value declines reflect a

decline in

economic value due to an increase in credit loss expectations.

For other

assets (including most of our assets), value declines reflect an

increase

in potential risks rather than a change in expected cash flows.

The table

below summarizes the change in unrealized mark-to-market

(MTM) adjustments during the first

quarter.

|

| Ø |

On

the

positive side, our consolidated liabilities increased in value

during the

quarter, meaning we could buy back the securities we issued at

a lower

price than their issuance price. The interest expense we are incurring

on

the securities we issued is less than the interest expense we would

have

to pay if we had issued these liabilities in the first quarter

of

2007.

|

| Ø |

Relative

to

the last few years, because asset prices are down, we earn more

income on

assets we buy today, but we also pay a higher interest expense

on the

securities we create and issue to finance our acquisitions. Overall,

as of

this writing, the resulting spread earning potential still appears

attractive. The markets are volatile, however, and the cost to

finance

future asset acquisitions through securitization cannot be known

until

each transaction is completed. The overall situation is characterized

by

uncertainty, which, on average, we believe should benefit us relative

to

our competitors.

|

| Ø |

Changes

in

market values for our existing assets and liabilities have had

little

effect on our operations or actual and expected cash flows. On

average, we

see the increase in spreads (lower asset prices, more expensive

liabilities) as a positive trend. Part of our business is being

paid to

assume credit risk, and it appears we are likely to be paid more

in the

future to take this risk than we have been in the recent

past.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW| Ø |

At

the end of

our first quarter of operations in September 1994, GAAP book

value was

$11.67 per share. Since that time, we have paid $41.18 per share

of

dividends while also increasing GAAP book value by $22.39 per

share.

|

| Ø |

Book

value

per share growth generally is not a direct indicator of our market

value

or an indicator of the returns available to our shareholders.

If you had

acquired Redwood stock at our initial public offering in August

1995 and

had reinvested all dividends back into Redwood stock, your compounded

return as a shareholder would have been 21% per year through

March 31,

2007. Future results will vary.

|

FINANCIAL

REVIEW

FINANCIAL

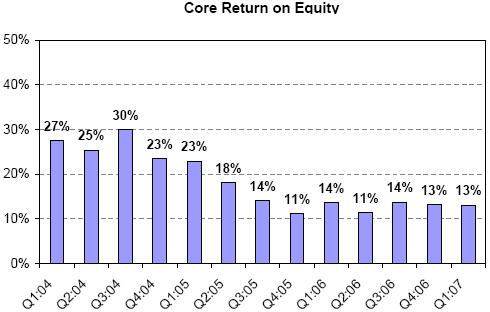

REVIEW| · |

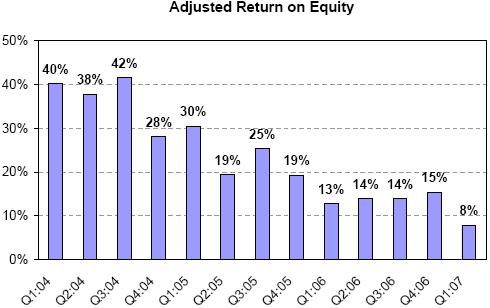

During

the first quarter of 2007, our adjusted return on equity dropped

to 8%

primarily due to the negative impact of unrealized market valuation

adjustments on our GAAP earnings.

|

| · |

Over

the long term, we expect to be able to generate annual adjusted

returns on

equity between 11% and 18%.

|

| · |

Core

return on equity (core earnings divided by core equity) was 13%

for the

quarter.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

REVIEW

FINANCIAL

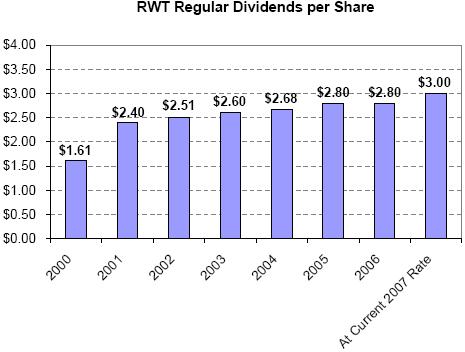

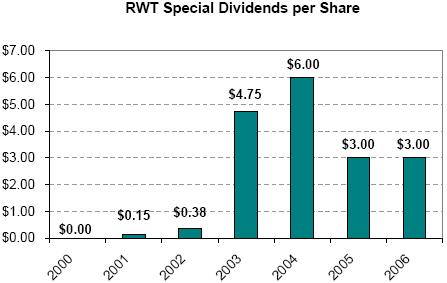

REVIEW| · |

We

increased our regular quarterly dividend rate to $0.75 per share

in

2007.

|

FINANCIAL

REVIEW

FINANCIAL

REVIEW

| Ø |

Total

dividend distributions over the last four quarters were $5.85 per

share.

Assuming the recent Redwood stock price of $51, the indicated dividend

yield would be 11.5% based on the last twelve months of dividends

and 5.9%

based on the current regular dividend rate of $3.00 per share for

2007.

|

| Ø |

Based

on our

estimates of REIT taxable income through the first quarter of 2007,

at

quarter end, we had $60 million ($2.20 per share) undistributed

REIT

taxable income that we anticipate distributing in 2007 through

our

regularly quarterly dividend and a special dividend.

|

| Ø |

We

generally

distribute 100% of REIT capital gains income and 90% of REIT ordinary

income, retaining 10% of the ordinary REIT income. We generally

retain

100% of the after-tax income we generate in taxable subsidiaries.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| · |

Total

residential

securities increased by 15% in the first quarter, from $2.4 billion

to

$2.8 billion, as a result of $609 million acquisitions, $20 million

discount amortization, $114 million sales, $4 million calls,

$63 million

principal pay downs, and $70 million market value declines. Our

primary

emphasis during the first quarter was acquiring investment-grade

rated

securities.

|

| · |

For

the most

part, we believe the trend towards lower market values is good

for us - it

allows us to buy new assets more cheaply while not affecting

our business

in a material way. We are much more concerned about the cash

flows our

assets will generate than we are about market value

fluctuations.

|

| · |

We

have had

increasing concerns about the credit performance of the loan

pools

underlying a small number of our residential securities. We have

sold most

of these securities. In the second quarter through May 4, we

sold $6

million residential securities generating a de minimis GAAP loss

in the

second quarter.

|

| · |

We

own some

assets that would appear to be higher risk assets in the current

environment. Using March 31, 2007 values and adjusting for subsequent

second quarter sales, we currently own $17 million subprime securities

of

the 2006 vintage rated BBB- or lower and $78 million alt-a securities

of

the 2006 vintage rated BB+ or lower. We bought some of these

assets at

very low prices, some have higher-than-average loan quality for

their

type, some have very short average lives, and others generate

returns

driven primarily by prepayment rates rather than credit losses.

Most of

these remaining higher-risk assets are currently performing better

than or

equal to our expectations. We expect that cash flow returns from

many of

these assets will be attractive relative to similar assets of

the same

vintage and rating. Although certainly not free from risk, for

the most

part they have the potential to generate reasonable investment

returns in

a housing environment even more difficult than currently appears

to be

indicated. The upside potential from some of these assets is

quite large

if the environment does not worsen. Market values will

fluctuate.

|

| · |

Our

credit

reserves for residential securities were $393 million, or $14.48

per

share, at March 31, 2007. Reserves associated with prime assets

were $264

million; reserves associated with alt-a assets were $129 million;

no

reserves were associated with our $9 million investment in subprime

BB-rated securities.

|

| · |

Of

the $2.8

billion residential securities we owned at March 31, 2007,

$1.8 billion

were financed through re-securitization via Acacia CDO transactions

and

$1.0 billion were financed with Redwood debt and

capital.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| · |

We

plan to continue to acquire new residential securities

of all types.

Although we expect to incur some credit losses, overall

we believe the

longer-term outlook for investing in residential securities

is

increasingly positive. We expect underwriting quality

to improve and we

expect pricing and spreads between assets and liabilities

to become

somewhat more attractive than they have been in the recent

past.

|

| · |

In

the

short-term, our biggest issue with respect to investing

in additional

residential IGS securities is that our CDO financing

costs are unknown

because the CDO issuance market is experiencing substantial

disruption.

Nevertheless, we priced an option ARM CDO transaction

in April at

attractive economic levels. We expect to price another

CDO transaction in

the second quarter; if we can achieve currently indicated

CDO pricing

levels, this will also be a profitable

transaction.

|

| · |

We

have

established and initiated the funding of a wholly-owned

qualified REIT

subsidiary - Cypress Trust, Inc. - to hold some of our

investments in

high-quality investment-grade residential securities

and high-quality

prime residential loans. These assets will be funded

initially with debt,

although Cypress will likely also utilize securitization

as a form of

financing in the future. We believe spread lending opportunities

with high

credit quality securities and loans are becoming increasingly

attractive.

In order to raise capital to accommodate growth in this

low credit risk

strategy, we may sell new shares in Cypress at some point.

Our asset

management subsidiary, Redwood Asset Management, Inc.,

would manage

Cypress as an external REIT.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| a) |

Residential

Investment-Grade Securities

|

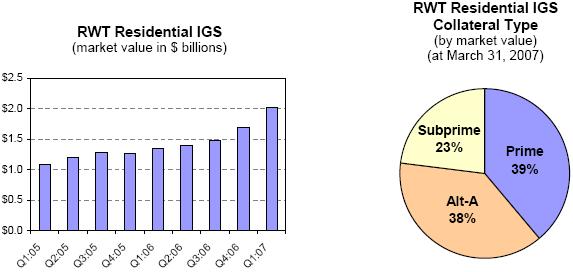

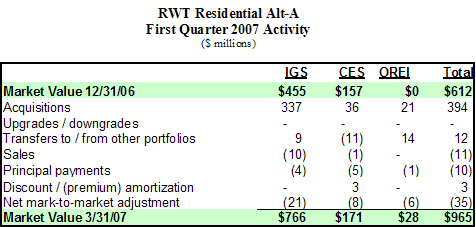

| Ø |

Our

residential IGS portfolio increased by 19% in the first quarter

from $1.7

billion to $2.0 billion as a result of acquisitions of $535 million,

market value declines of $54 million, sales of $108 million,

calls of $2

million, transfers to other portfolios of $14 million, and principal

pay

downs of $30 million.

|

| Ø |

The

majority

of our residential IGS acquisitions for the quarter were designated

investments for two upcoming Acacia securitizations. One of these

securitizations is predominately focused on option ARMs; the

other is our

more typical mezzanine CDO with a broader range of underlying

mortgage

collateral types.

|

| Ø |

During

the

first quarter, our residential IGS acquisitions were 25% prime,

63% alt-a,

and 12% subprime. By interest rate type, these acquisitions were

60%

option ARMs, 20% hybrids, and 20% fixed.

|

| Ø |

At

March 31,

2007, $1.3 billion residential IGS were financed via securitization

in our

Acacia CDO program and $0.7 billion were financed with Redwood

debt and

capital. We are holding most of these $0.7 billion of securities

in

anticipation of selling them to future Acacia

securitizations.

|

| Ø |

At

March 31,

2007, the interest rate characteristics of residential IGS were

46%

adjustable-rate, 35% hybrid, and 19% fixed rate. We use interest

rate

agreements to generally match the interest rate characteristics

of these

assets to their corresponding funding

sources.

|

| Ø |

We

have never

incurred a principal loss on residential IGS. We do not have

credit

reserves for these assets.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| Ø |

Interest

income generated by residential IGS was $29 million for the first

quarter.

The yield for the first quarter was 6.56%, a decline from 6.77%

the

previous quarter as we purchased higher-rated securities with lower

yields.

|

| Ø |

Net

discount

amortization income (which is included in interest income) for

the first

quarter was $1 million. At quarter-end, our net discount balance

for these

assets was $20 million, giving us an average amortized balance

sheet cost

basis for residential IGS of 99.06% of principal

value.

|

| Ø |

We

purchased

$33 million residential IGS in April at significantly higher expected

yields.

|

| Ø |

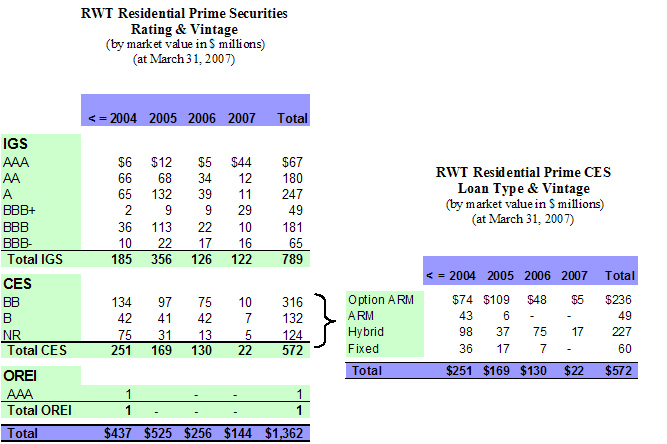

In

the first

quarter, our residential prime IGS portfolio grew by $66 million

(or 9%)

to $789 million. Our residential alt-a IGS portfolio grew by $311

million

(or 68%) to $766 million as we acquired collateral for an option

ARM

CDO.

|

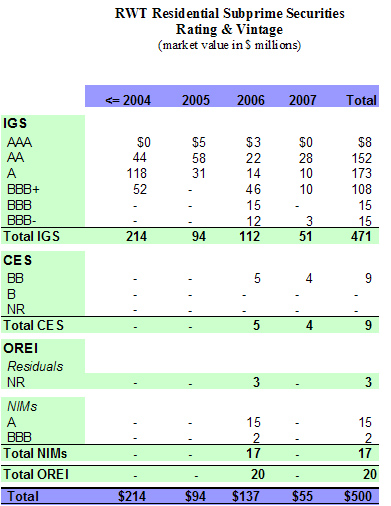

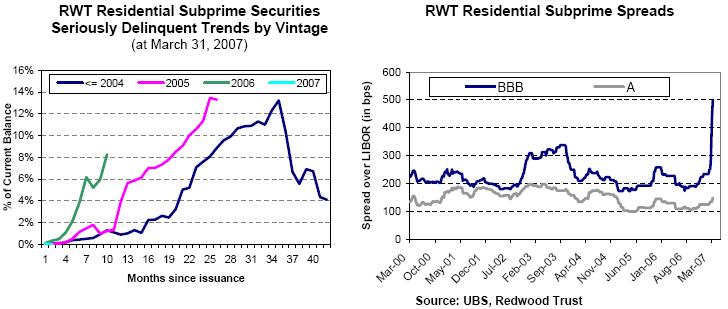

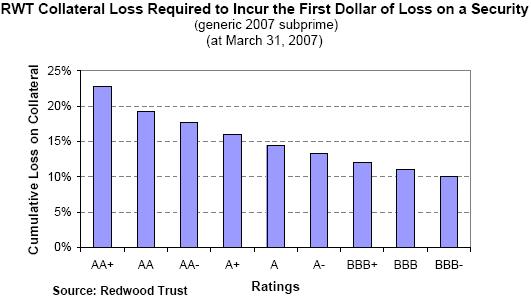

| Ø |

Our

subprime

IGS portfolio declined by $48 million (or 9%) to $471 million as

sales

exceeded new acquisitions of $66 million. We sold $84 million subprime

IGS

in the first quarter - $53 million of which was older subprime

IGS that we

reacquired through the call of Acacia 4. The remaining $31 million

were

credit risk sales of underperforming 2006 securities; sales of

these

securities generated a GAAP income statement loss of $1 million

in the

first quarter.

|

| Ø |

Additional

information on our residential IGS can be found in Tables 9, 10,

and 18 of

the Appendix.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| b) |

Residential

Credit-Enhancement Securities

|

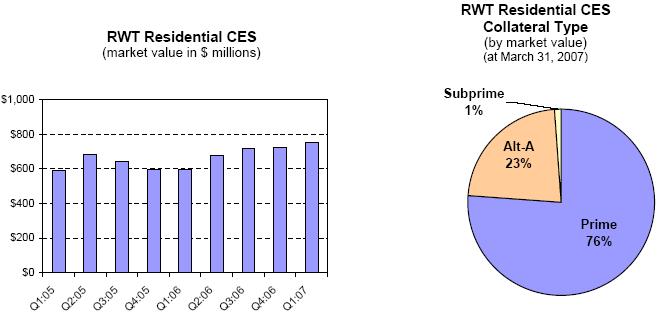

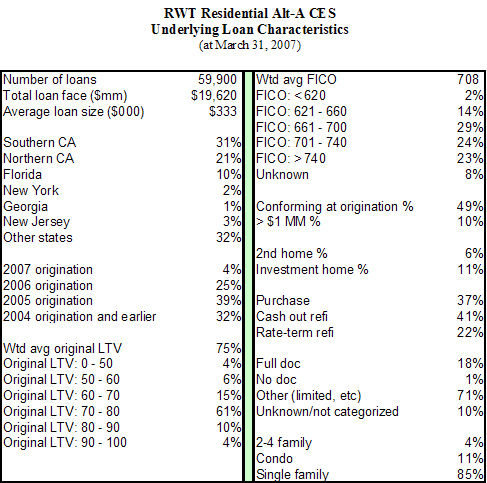

| Ø |

The

total

value of our residential CES portfolio increased by 4% from $722

million

to $752 million in the first quarter as a result of $74 million

acquisitions, $15 million market value declines, $2 million EITF

99-20

impairment write-downs, $5 million sales, $1 million calls, $19

million

discount amortization, $5 million transfers out to other portfolios,

and

$35 million principal pay downs.

|

| Ø |

The

balance

of residential loans underlying our residential CES increased by

13% from

$210 billion to $237 billion during the first

quarter.

|

| Ø |

During

the

quarter, the loans underlying our residential CES acquisitions

were 45%

prime, 49% alt-a, and 6% subprime. By interest rate type, the loans

underlying these acquisitions were 58% option ARMs, 33% hybrids,

and 9%

fixed.

|

| Ø |

Interest

income generated by residential CES was $38 million for the first

quarter.

The yield for the first quarter was 22%, the same as the previous

quarter.

Yields for the first quarter were 24% for prime CES, 19% for alt-a

CES,

and 10% for subprime CES. Interest income was $30 million, $7 million,

and

$1 million for these sub-portfolios, respectively. CES yields remain

high

due to fast prepayment speeds and continued good credit performance

for

underlying loans.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| Ø |

Overall,

our

alt-a and prime CES portfolios are performing well from a credit

perspective. Our subprime CES portfolio has limited seasoning;

early

credit performance results are within our

expectations.

|

| Ø |

Principal

value credit losses for loans underlying CES were $3.8 million

for the

quarter, a decrease from $4.2 million in the previous quarter.

As assets

season, we expect losses to increase substantially in percentage

terms,

while perhaps remaining relatively low in absolute numbers. Cumulative

losses and the current loss rate remain lower than our original

pricing

expectations.

|

| Ø |

For

tax

purposes, realized credit losses were $1.5 million ($0.06 per share)

for

residential CES for the first quarter. This deduction is less than

the

principal value losses incurred on the underlying loans of $3.8

million,

as we own most of our credit-sensitive assets at a tax basis that

is

substantially less than par (principal)

value.

|

| Ø |

Our

GAAP

credit reserves for residential CES were $393 million ($14.48 per

share)

at March 31, 2007, an increase of $21 million for the quarter.

New

acquisitions increased this reserve by $48 million. As a result

of the

strong credit performance of underlying loans, we transferred $22

million

residential CES credit reserves to unamortized discount that will

be

amortized into income over time. Unamortized discount balances

for

residential CES were $159 million at

quarter-end.

|

| Ø |

At

March 31,

2007, $286 million residential CES were financed with equity and

Redwood

debt, and $466 million were financed through our Acacia CDO

program.

|

| Ø |

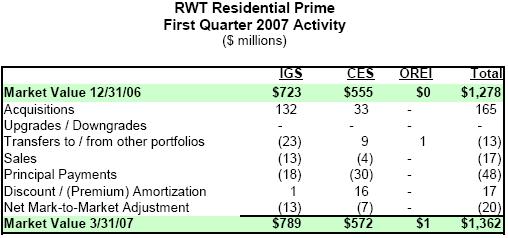

Our

total

residential prime CES portfolio increased by $16 million (3%) to

$571

million during the first quarter. Overall,

our

prime CES portfolio is performing well from a credit perspective

and

continues to benefit from fast

prepayments.

|

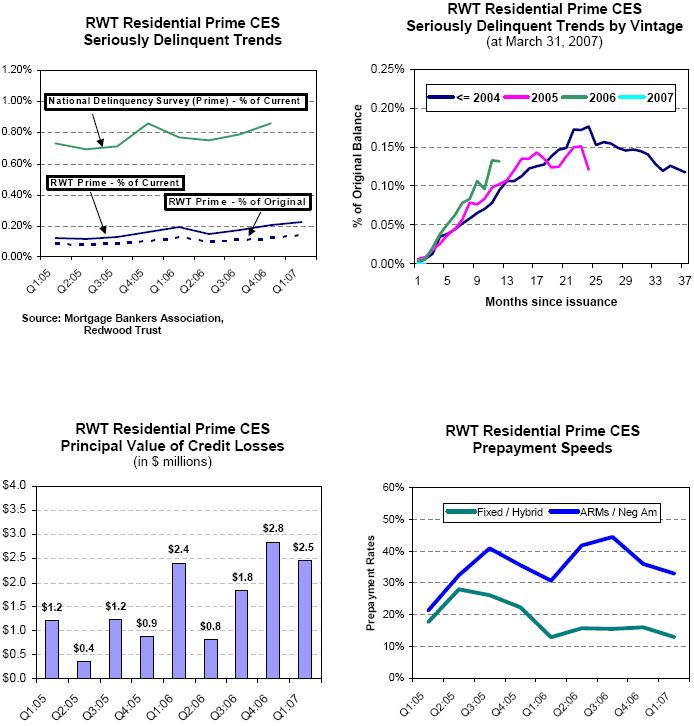

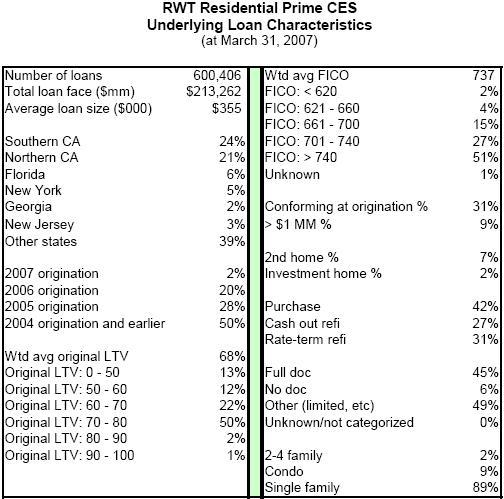

| Ø |

The

balance

of seriously delinquent loans underlying prime residential CES

increased

from $381 million to $485 million during the quarter, an increase

from

0.12% to 0.14% of original balances and 0.20% to 0.23% of current

balances. These increases remain in line with normal seasoning

and remain

well below our initial modeling

expectations.

|

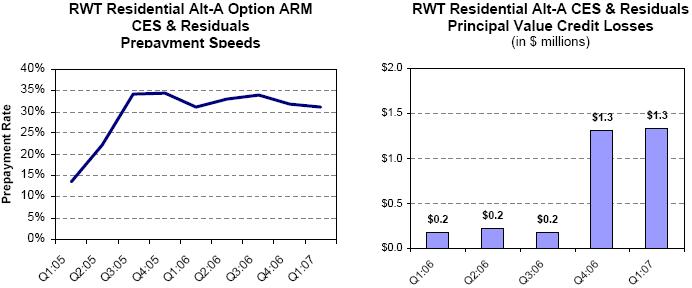

| Ø |

Securities

backed by option ARM and traditional ARM loans continued to prepay

significantly faster than our original expectations at a weighted

average

CPR of 40%. These securities represent 50% of our prime CES, and

they are

priced and structured to benefit from fast prepayment speeds in

addition

to low losses.

|

| Ø |

The

principal

value of credit losses for loans underlying our prime CES was $2.5

million, which is less than one basis point (0.01%) per

year.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| Ø |

Fifty

percent

of our prime portfolio is composed of securities backed by hybrid

and

fixed-rate mortgages. The loans underlying these securities prepaid

at a

weighted average CPR of 13% in the first quarter. This is slower

than our

original expectations. Cumulatively over time, however, prepayment

rates

for these assets have been more rapid than we originally

assumed.

|

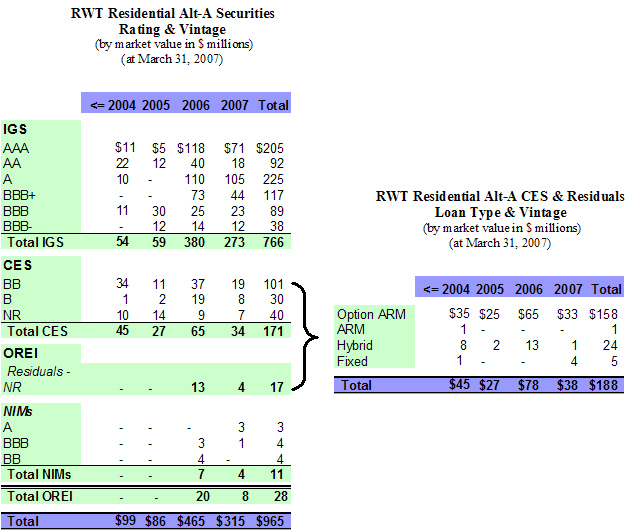

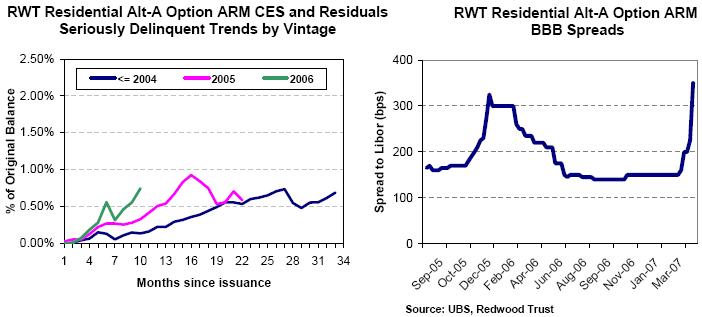

| Ø |

Our

residential alt-a CES portfolio increased by $15 million (10%)

to $172

million during the first quarter. Option ARM collateral makes

up 92% of

this portfolio. We sold $5 million underperforming alt-a CES

in April for

a minimal loss.

|

| Ø |

We

generally

acquire these alt-a securities backed by option ARMs with loss

expectations that are six times greater than we expect for our

prime

hybrid CES. To date, the performance of our CES backed by option

ARMs

continues to exceed our expectations.

|

| Ø |

The

balance

of seriously delinquent loans underlying alt-a residential CES

increased

from $187 million to $296 million during the quarter, an increase

from

0.60% to 0.82% of original balances and 1.03% to 1.51% of current

balances. These increases remain below our initial modeling

expectations.

|

| Ø |

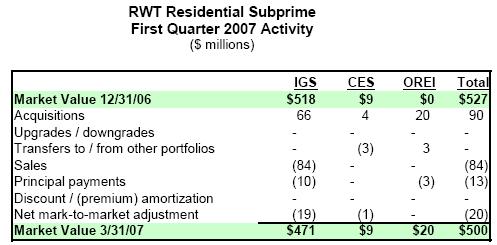

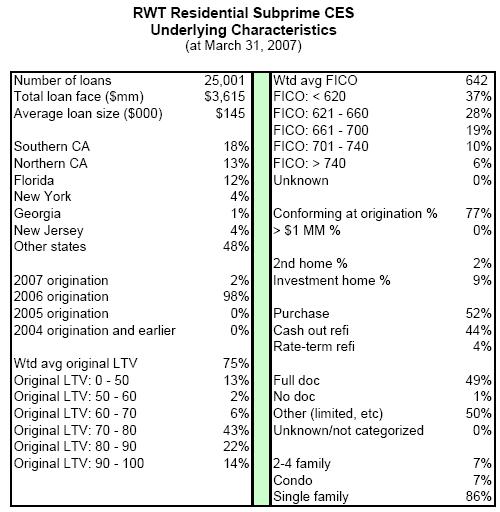

Our

subprime

CES portfolio remained nearly flat for the quarter at $9 million,

with $4

million acquisitions and $3 million of transfers from other portfolios.

Our subprime CES portfolio has limited seasoning; however, the

early

credit performance continues to be within our

expectations.

|

| Ø |

In

April

2007, we purchased $21 million deep-discounted subprime BBB and

BBB-

securities.

|

| Ø |

We

continue

to search for subprime credit investment opportunities, and we

expect to

make additional investments in distressed assets as well as in

assets

backed by new loans as quality improves. In addition, we expect

to create

new assets by buying and securitizing loans. At this point, we

believe the

subprime sector is still far from recovery, so we currently expect

the

volume of our subprime CES and residual investments will remain

limited

for some time. We do not originate or service subprime loans,

nor at this

point, do we intend to.

|

| Ø |

The

subprime

markets are very large in terms of potential capital employed

and we

believe they offer ongoing opportunities for Redwood, potentially

on a

large scale. So as to not change the essential nature of Redwood

as an

investor in higher quality loans, we are considering raising

capital

though a separately managed vehicle in order to fund our future

growth in

the subprime markets.

|

| Ø |

Additional

information on our residential CES can be found in Tables 9,

10, 11, and

12 of the Appendix.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| c) |

Other

Residential Real Estate

Investments

|

| Ø |

Other

real

estate investments (OREI) are assets that we mark-to-market for

income

statement purposes, in many cases because they may otherwise

be deemed to

contain embedded derivatives for accounting purposes under FAS

155. We

expect to acquire additional OREI assets. Unrealized mark-to-market

fluctuations will affect GAAP income but will not directly affect

core or

taxable income.

|

| Ø |

OREI

are a

new reporting category we established in the first quarter of

2007. We

transferred $18 million of assets that were held in other portfolios

at

December 31, 2006 into this category. Total OREI at March 31,

2007 was $50

million. This included $19 million residuals, $29 million net

interest

margin securities (NIMs), and $2 million

IOs.

|

| Ø |

The

collateral type underlying our OREI was $2 million prime, $28

million

alt-a, and $20 million subprime at March 31,

2007.

|

| Ø |

Our

OREI

portfolio generated a 26 % yield for the first quarter, producing

$2

million interest income. Mark-to-market charges to income were

negative $5

million for the quarter, as a result of the substantial bid-ask

spread on

these new purchases plus the general decline in market values

towards

quarter-end.

|

| Ø |

Residuals

are

first-loss securities that are not rated by a rating agency.

The value of

residual securities can vary widely and is highly dependent on

prepayment

speeds. The value is also dependent on the level and timing of

credit

losses, but often is not as sensitive to losses as it is to prepayment

speeds. These securities perform poorly when prepayments are

fast and

losses are higher than expected.

|

| Ø |

Due

to early,

poor credit performance, we sold one residual security in April.

We sold

the security at the market value reflected in our first quarter

financial

statements.

|

| Ø |

Our

NIMs are

structured in such a way that they mature quickly (typically

less than two

years). The majority of the NIMs we have acquired have an investment-grade

rating.

|

| Ø |

OREI

at March

31, 2007 consisted of $8 million of investment-grade alt-a

NIMs with an

average life of 2.5 years.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

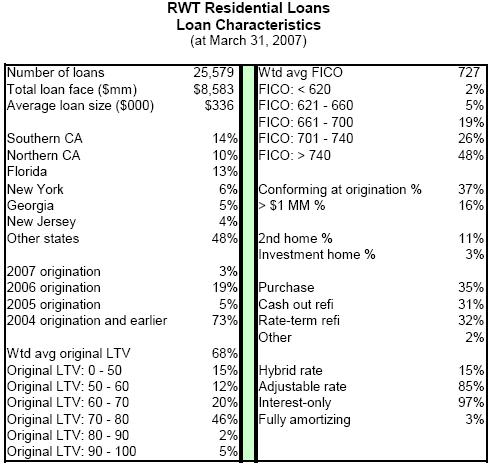

REVIEW| · |

Our

loan acquisition activity through our conduit is increasing. Our

primary

focus has been hybrids, as ARMs are out of favor in the current

yield

curve environment. We purchased $415 million residential hybrid

loans this

quarter. All our loans were prime-quality loans at

origination.

|

| · |

Seriously

delinquent loans and credit losses on residential loans are increasing

due

to normal seasoning, but remain well below our initial

expectations.

|

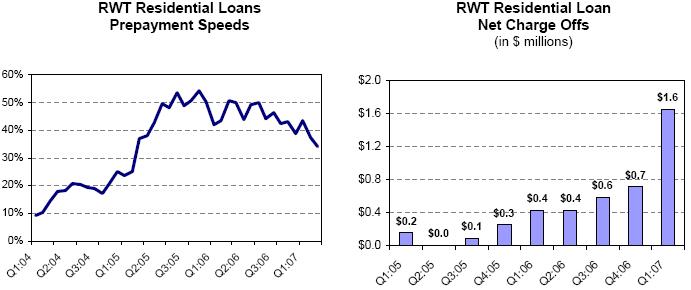

| · |

Prepayment

speeds on our loan portfolio, consisting mostly of ARM loans, continued

to

be fast, prepaying at a CPR of nearly 37% for the first quarter.

|

| · |

We

completed one securitization in the first quarter, financing $885

million

hybrid loans. In April, we priced another Sequoia securitization

that will

close in May. We called one older Sequoia securitization during

the first

quarter. The cost of financing loans has risen as market spreads

for ABS

have widened. Nevertheless, the two Sequoia transactions we have

priced in

2007 have been profitable.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW| Ø |

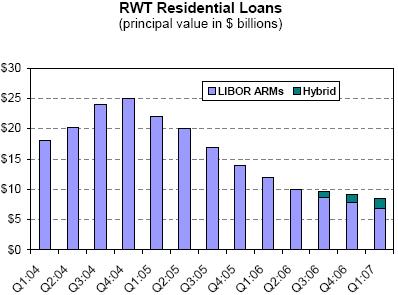

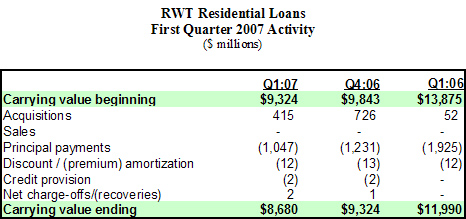

In

the first quarter, our residential loan portfolio declined

from

$9.3

billion to $8.7 billion. We acquired $415 million loans and

had no

sales. Principal pay downs were $1.0 billion.

The average

annual prepayment rate (CPR) was 37% for the first quarter

versus 34% for

all of 2006. Most of these loans are adjustable-rate loans

that tend to

prepay rapidly when the yield curve is flat or

inverted.

|

| Ø |

Interest

income was $129 million in the first quarter, a decrease from

$138 million

in the previous quarter. This portfolio yielded 5.93%. The

yield in the

previous two quarters was 5.97%.

|

| Ø |

Premium

amortization expenses, a component of interest income, were

$12 million

for the first quarter. We ended the first quarter with $8.6

billion

principal value of loans and a loan premium balance of $117

million for an

average basis of 101.37% of principal value. For various technical

accounting reasons, for several years we have not been able

to amortize

premium expense balances as quickly as the loans prepaid. If

short-term

interest rates decline, under these accounting rules we would

expect

premium amortization expenses to increase significantly. Largely

because

premium amortization expenses have not kept pace with prepayments

in the

past, we estimate the book value of residential loans exceeded

their

market value by $65 million at

quarter-end.

|

| Ø |

Realized

credit losses were $1.6 million for the first quarter, an annual

loss rate

of eight basis points (0.08%)

of

the reduced loan balances. The loss for tax purposes was $0.3

million.

Cumulative losses have been far lower than our original expectations.

We

expect losses to continue to increase as these loans season.

Credit

reserves for this portfolio were $20 million (or 0.23%) at

quarter-end.

|

| Ø |

The

balance

of seriously delinquent loans increased from $74 million to

$79 million

during the quarter, an increase from 0.24% to 0.26% of original

balances

and an increase from 0.81% to 0.92% of current balances.

|

| Ø |

At

the end of

the first quarter, $7.4 billion residential loans were financed

via

securitization (“Sequoia”) and $1.3 billion were financed with Redwood

debt and equity.

|

| Ø |

We

are

planning to acquire and securitize alt-a and subprime loans

in the future

in addition to our current business of acquiring and securitizing

prime-quality loans.

|

| Ø |

Additional

information on our residential loans can be found in Tables

9, 10,

11, and 14 of the Appendix.

|

RESIDENTIAL

REVIEW

RESIDENTIAL

REVIEW

COMMERCIAL

REVIEW

COMMERCIAL

REVIEW| · |

Total

commercial securities declined

by

3% in the first quarter, from $568 million to $551 million,

as a result of

$6 million acquisitions, $6 million sales, $1 million principal

pay downs,

and $14 million negative market value changes. We did not acquire

or sell

any commercial loans.

|

| · |

Spreads

for

commercial securities widened (asset prices declined) somewhat

in the

first quarter as market participants became more risk-averse

and markets

became less liquid. Problems in subprime residential lending,

developing

problems in CDO markets, and record volumes of new CMBS issuance

were part

of the cause.

|

| · |

In

the first

quarter, we did not invest in any CMBS transactions as the

first-loss

buyer. We invested in a new transaction in the second quarter,

making a

new investment of $42 million in these commercial

CES.

|

| · |

For

2007, we

now expect to slow our pace of commercial CES acquisitions

relative to

last year. Although the commercial property market is healthy,

our

concerns for the longer-term are growing, given elevated property

prices

and increasingly aggressive underwriting. We are satisfied

with our

current assets, but we are not currently looking to add substantial

new

assets. Our current focus is primarily on building our surveillance

and

special servicing capabilities. Over time, we also expect to

expand our

capacity to acquire, originate, and finance commercial real

estate

loans.

|

| · |

We

are

committed to building a complete commercial real estate finance

business

with more fully developed capabilities and a broader product

line. We are

not in any hurry to do so, however. Given current market dynamics,

building slowly seems the prudent course of

action.

|

COMMERCIAL

REVIEW

COMMERCIAL

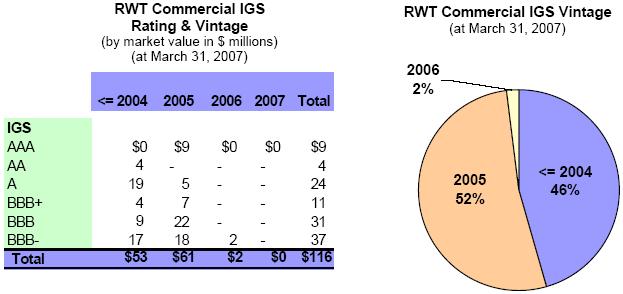

REVIEW| a) |

Commercial

Investment-Grade

Securities

|

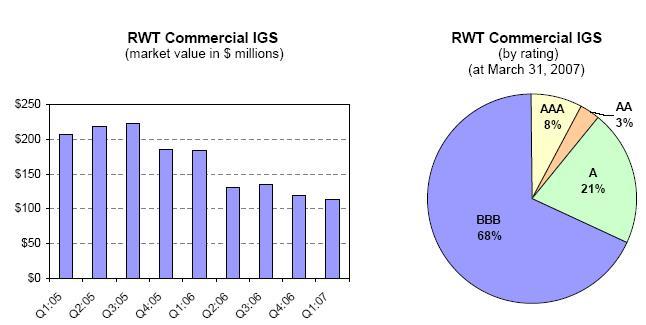

| Ø |

Our

commercial IGS declined

by

$4 million (or 3%) in the first quarter. Acquisitions were

$3 million,

sales were $6 million, principal pay downs were $1 million,

upgrades of

commercial CES securities to IGS were $4 million, and market

value

declines were $2 million. Sales were the result of our call

of Acacia 4

and the subsequent sale of some of Acacia 4’s assets. We recognized $0.1

million of gains from these sales of commercial

IGS.

|

| Ø |

Anticipating

spread widening, we have not been acquiring significant volumes

of

investment-grade CMBS for some time. We may seek to complete

our second

commercial real estate CDO (CRE CDO) in 2008, in which case

we may acquire

additional commercial IGS.

|

| Ø |

Interest

income generated by commercial IGS was $2 million for the first

quarter.

The yield for the quarter was 6.14%, a decrease from 8.77%

in the previous

quarter. The decrease in yield was primarily the result of

our sale of

higher-yielding commercial interest-only securities during

the fourth

quarter of 2006.

|

| Ø |

The

market

value decline of $2 million in commercial IGS was largely the

result of

credit spread widening in BBB-rated securities, reflecting

increased

supply of CMBS amidst credit concerns across all mortgage ABS

sectors.

|

| Ø |

The

credit

performance of our commercial IGS portfolio remains

strong.

|

| Ø |

We

have never

incurred a principal loss on a commercial IGS security and

we do not

currently maintain GAAP credit reserves against our commercial

IGS

securities, as we expect external credit enhancement (primarily

structural

credit subordination) will sufficiently protect our investments

from

principal losses.

|

| Ø |

The

interest

rate characteristics of commercial IGS

were 80%

fixed rate and 20% floating rate. We use interest rate agreements

to

reduce interest rate mismatches that may occur between assets

and their

associated liabilities.

|

| Ø |

At

March 31,

2007, 92% of our commercial IGS were financed via our Acacia

CDO program.

|

| Ø |

Additional

information on this portfolio can be found in Tables 9, 10,

and 18 of the

Appendix.

|

COMMERCIAL

REVIEW

COMMERCIAL

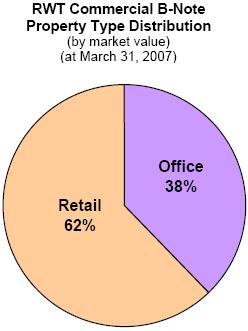

REVIEW| b) |

Commercial

IGS Tables & Graphs

|

COMMERCIAL

REVIEW

COMMERCIAL

REVIEW| c) |

Commercial

Credit-Enhancement Securities

|

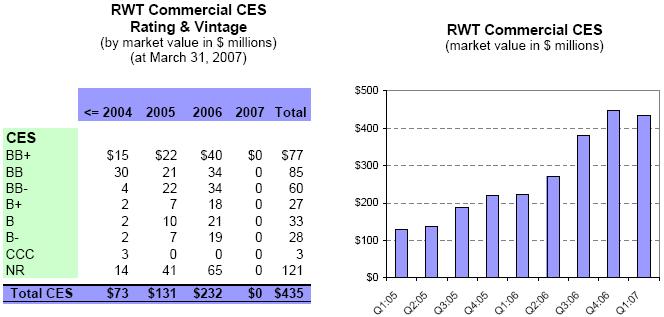

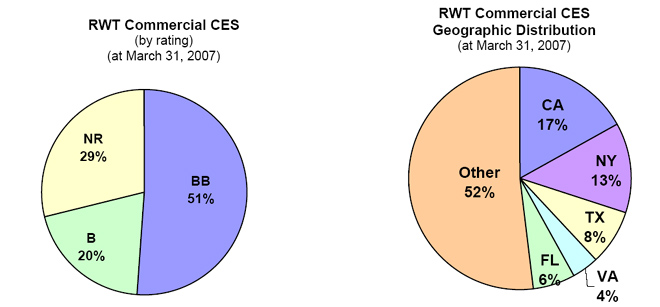

| Ø |

Our

commercial CES decreased

by

$13 million (or 3%) in the first quarter. Acquisitions were

$3 million,

commercial CES upgrades to IGS were $4 million, and market

value

depreciation was $12 million. There were no sales during the

quarter.

|

| Ø |

Interest

income generated by commercial CES was $10 million for the

first quarter.

The yield for the quarter was 9.52%, an increase from 8.97%

in the

previous quarter. The level of current yield we recognize on

these assets

is largely a function of the amount and timing of our future

credit loss

assumptions. All of our commercial CES pay fixed monthly coupon

rates of

interest.

|

| Ø |

For

the first

quarter of 2007, the market value of our commercial CES declined

by $12

million as market spreads widened. This decrease was recognized

on our

balance sheet and not through our income statement.

|

| Ø |

During

April

2007, Moody’s announced it was revising its credit rating standards on

commercial CES, effectively increasing capital required to

credit-enhance

future CMBS transactions through higher subordination levels.

The other

two rating agencies, S&P and Fitch, are also expected to increase

subordination levels somewhat for commercial securitizations.

The revised

credit standards address the perceived erosion of protection

to CMBS

investors due to aggressive underwriting on underlying commercial

mortgages. As a long-term investor in commercial CES, we expect

this

change will have a positive effect on our ability to invest

profitably in

future CMBS transactions. However, tougher ratings criteria

may reduce

market valuations on our existing investments.

|

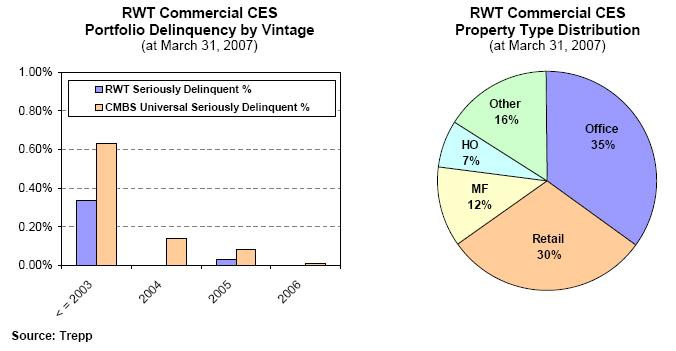

| Ø |

Our

GAAP

credit reserves for commercial CES were $294 million ($10.85

per share) at

March 31, 2007, or 0.51% of underlying loan balances. Credit

reserves

decreased by $1 million upon realization of an anticipated

credit loss

that occurred during the quarter. The credit performance of

our commercial

CES securities remains strong. Credit losses on this portfolio

to date

total less than one basis point (0.1%).

|

| Ø |

Most

of our

commercial CES ($311 million or 71%) are in a second-loss or

more senior

position in the securitization and thus are protected from

initial credit

losses within the underlying loan pool. For the remaining $124

million of

securities that are in a direct first loss position, 44% share

losses with

other CES investors.

|

| Ø |

For

loans

underlying CES, serious delinquencies at March 31, 2007 were

$78 million,

an increase of $14 million from the previous quarter. These

delinquencies

were 0.14 % of current balances at quarter-end versus 0.24%

for the

industry. We expect that our delinquency rates will not stay

at such low

levels over time. Of the $78 million in serious delinquencies,

$57 million

are contained within one security that we deemed impaired during

a prior

period. We currently have a zero cost basis in this security,

with no risk

of future write downs affecting our income

statement.

|

| Ø |

For

tax

purposes, realized credit losses were $0.4 million. This

deduction is less

than the principal value losses incurred on the underlying

loans of $1.3

million, as we own most

of our

commercial CES at a tax basis that is substantially less

than par

(principal) value.

|

COMMERCIAL

REVIEW

COMMERCIAL

REVIEW| Ø |

At

March 31, 2007, $196

million

(or 45%) commercial CES were funded with Redwood capital

and $239 million

(or 55%) were financed through our Acacia CDO program.

We are currently

planning to complete a CRE CDO transaction in 2008 to finance

many of the

commercial CES assets we are now funding with capital.

In the interim, we

are seeking financing facilities for our unsecuritized

commercial CES that

would allow us to recycle some of the Redwood capital currently

employed

by these assets.

|

| Ø |

Additional

information on commercial CES can be found in Tables 9, 10, 15,

16, and 18

of the Appendix.

|

| d) |

Commercial CES

Tables &

Graphs

|

COMMERCIAL

REVIEW

COMMERCIAL

REVIEW

COMMERCIAL

REVIEW

COMMERCIAL

REVIEW| e) |

Commercial

Loans

|

| Ø |

Our

commercial loan portfolio decreased by $2 million (or 8%) to

$26 million

in the first quarter as a result of a write-down of a mezzanine

loan

investment. There were no acquisitions or sales during the

quarter. With

the write-off of this investment, all of our remaining commercial

loan

investments on our GAAP books are b-notes, which are the junior

portion of

a commercial loan that has been restructured to create a senior

and a

junior ownership investment in that loan.

|

| Ø |

Our

mezzanine

loan investment was part of the financing on a residential

condominium

conversion project. This loan accrued interest but did not

require payment

until completion of the project and subsequent sale of the

condominium

units. During the quarter, we fully reserved against the outstanding

principal balance of this loan based upon our updated cash

flow

assumptions. These assumptions reflect the softening residential

condominium market, cost increases required to complete the

project, and

our subordinate position in the principal repayment structure.

This

mezzanine loan investment was the remaining part of a broader

distressed

asset investment we made at a discounted price in 2003. The

other assets

we acquired at that time paid off profitably during prior

quarters.

|

| Ø |

Commercial

b-note loan investments did not change during the quarter.

One b-note loan

was downgraded by a credit rating agency from BBB- to BB+ in

March 2007;

however, this loan is still current and is performing as

expected.

|

| Ø |

Of

our $26

million b-note investments, 99% are financed through Acacia

CDO

securitizations.

|

| Ø |

Additional

information on our commercial loans can be found in Tables

9, 10, 15, and

17 of the Appendix.

|

COMMERCIAL

REVIEW

COMMERCIAL

REVIEW| f) |

Commercial

Loan Charts

|

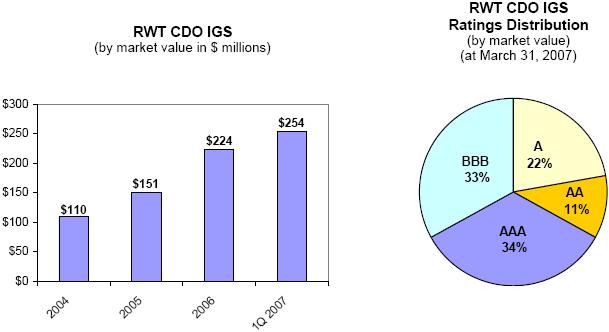

CDO

REVIEW

CDO

REVIEW| · |

Our

total investment in CDO securities increased 10% during the first

quarter,

from $246 million to $270 million as a result of $35 million

acquisitions

offset

by

principal pay downs of $0.4 million and market value decreases

totaling

$11 million.

|

| · |

Of

our total

investment in CDO assets of $270 million, $254 million (94%)

were

investment-grade rated securities and $16 million (6%) were below

investment-grade credit-enhancement securities (CDO

equity).

|

| · |

Recently,

spreads on CDO securities have widened dramatically, reducing

asset

prices. Many CDOs are backed by collateral pools containing high

concentrations of 2006-vintage subprime securities rated BBB

and BBB-. As

a result of expected poor subprime performance, many such CDO

securities

will likely experience credit rating downgrades and credit

losses.

|

| · |

Although

the

market value of our CDO assets has declined, we have generally

avoided

investing in transactions backed by heavy concentrations of the

types of

assets that now appear to be most at risk. Our CDO assets continue

to

perform well. We remain diligent in our monitoring of these assets

and we

will take action to sell underperforming assets where

appropriate.

|

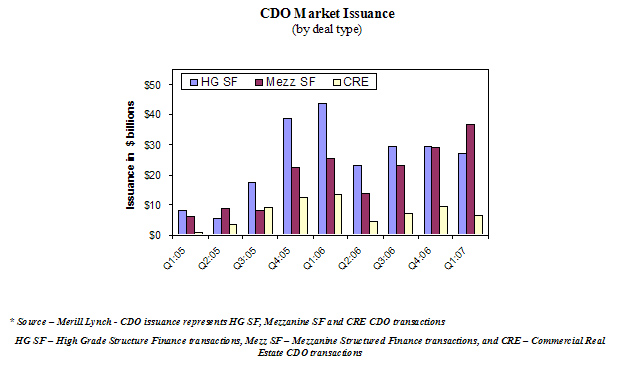

| · |

The

CDO

markets are currently experiencing price dislocations and swelling

inventories of bonds and collateral. Liquidity is poor, as many

investors

have stopped buying CDO bonds. The volume of new issuance is

expected to

drop rapidly.

|

| · |

As

subprime

losses are realized, we expect that turmoil within the CDO markets

will

increase. We are directing additional resources towards evaluating

acquisitions of CDO assets, as we believe selected acquisition

opportunities are attractive now and may become more so in the

future.

|

CDO

REVIEW

CDO

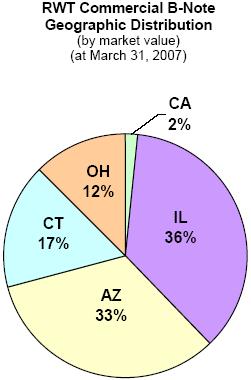

REVIEW| a) |

CDO

Investment-Grade Securities

|

| Ø |

Our

CDO IGS portfolio increased

by

13%, from $224 million to $254 million, in the first quarter of 2007.

This

increase was the result of acquisitions of $35, offset by principal

pay

downs of $0.4 million and market value decreases of $10

million.

|

| Ø |

Interest

income generated by the CDO IGS portfolio during the first quarter

was

$3.9 million, an increase of 16% over the $3.3 million generated

in the

fourth quarter of 2006. The yield for the first quarter was 6.70%,

consistent with the previous quarter, as LIBOR rates have remained

relatively stable. Substantially all of these assets earn a floating

rate

of interest based on the LIBOR interest

rate.

|

| Ø |

We

have never

incurred a principal loss on a CDO IGS security and we do not currently

have credit reserves for these assets.

|

| Ø |

At

March 31,

2007, we had a total of $254 million CDO IGS. Of this amount, $191

million

was financed via securitization in our Acacia CDO program. We funded

$20

million CDO IGS assets with capital with the remaining $43 million

currently financed in warehouse facilities as they await future

re-securitization.

|

| Ø |

We

use

interest rate agreements to reduce mismatches of interest rate

characteristics between the fixed-rate CDO IGS we own and the

floating-rate CDO securities issued by Acacia to finance these

assets.

|

CDO

REVIEW

CDO

REVIEW| b) |

CDO

IGS Tables & Graphs

|

CDO

REVIEW

CDO

REVIEW| c) |

CDO

Credit-Enhancement

Securities

|

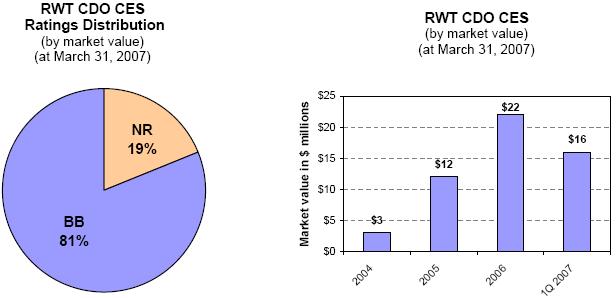

| Ø |

Our

CDO CES portfolio decreased during the first quarter by $6 million

or 26%

over the fourth quarter of 2006 to $16

million.

|

| Ø |

We

did not

acquire additional CDO CES in the quarter and the decrease of $6

million

was predominately due a $5 million bond being upgraded from BB to

BBB and

moving out of the CDO CES portfolio and into our CDO IGS portfolio.

An

additional $0.7 million decrease was due to mark-to-market adjustments

on

these securities based on spread widening for the

quarter.

|

| Ø |

Interest

income generated by CDO CES was $0.5 million for the first quarter.

The

yield for the quarter was 10.84%, a decline over the previous quarter‘s

yield of 11.67%. The underlying securities supporting our CES CDO

investments continue to perform well.

|

| Ø |

We

did not

incur credit losses on CDO CES in the first quarter and we have no

credit

reserves for these assets.

|

| Ø |

At

March 31,

2007, $12 million of CDO CES was financed via our Acacia CDO program

and

$4 million was financed with capital.

|

| d) |

CDO

CES Tables & Graphs

|

CAPITAL

REVIEW

CAPITAL

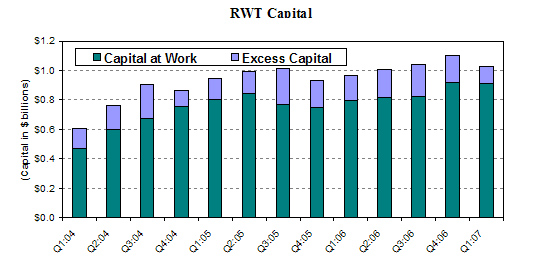

REVIEW| · |

We

had $114

million

excess capital at March 31, 2007, a decrease from $182 million at

the

beginning of the quarter. We expect excess capital to increase to

approximately $140 million to $170 million by the end of May, in

part

because we expect to complete a Sequoia

securitization.

|

| · |

We

anticipated net capital absorption of $200 million to $400 million

for

2007. At this point, the outlook for capital absorption is uncertain

due

to market turmoil. Given our current acquisition plans, it is possible

that we will finish the year at the lower end of that

range.

|

| · |

Our

current

plan is to continue to invest in new assets but also to hold some

excess

capital in reserve to fund several quarters of future acquisitions.

To

accomplish both of these objectives to their full extent, we may

need to

raise additional capital (long-term debt or equity) in 2007 and may

also

take advantage of opportunities to recycle capital currently employed

on

our balance sheet through re-securitizations and other secure

financings.

|

CAPITAL

REVIEW

CAPITAL

REVIEW

| Ø |

Excess

capital declined by $68 million during the quarter. In the first

quarter,

uses of

capital

included new asset acquisitions ($182 million) and dividends ($21

million). Sources of capital included asset sales ($39 million),

principal

payments ($64 million), and equity issuance ($24 million). Other

elements,

including cash from earnings, the (relatively small) effect on excess

capital of market value declines, and changes in financings netted

to an

increase of $8 million of available capital for the

quarter.

|

| Ø |

Capital

employed decreased slightly in the first quarter from $914 million

to $910

million.

|

| Ø |

Some

of the

capital utilized during the quarter is currently used on a temporary

basis

in an inefficient manner to fund assets that would be more efficiently

financed with debt or via securitization or to fund delinquent loans

from

called Sequoia securitizations. Over time, we will employ this capital

more efficiently, freeing capital to support future

growth.

|

| Ø |

Market

declines did not have a large effect on excess capital, since, for

the

most part, asset value declines result in an equal reduction of both

total

capital and also of capital required under our internal risk-adjusted

capital guidelines.

|

| Ø |

Our

total

capital base decreased by $79 million during the quarter, from $1.1

billion to $1.0 billion, due to $99 million market value declines

for

assets and derivatives that were recorded for GAAP. We estimate that

if we

had reported our Acacia ABS issued at market value, our book value

at

March 31, 2007 would have been higher than reported by $41 million

(or

$1.51 per share). Market value changes to our liabilities (and market

value changes for certain other assets) are not recognized for GAAP

purposes and we do not include them in our capital calculations.

In any

event, changes in market values of any of these assets or liabilities

generally have little effect on our cash flows.

|

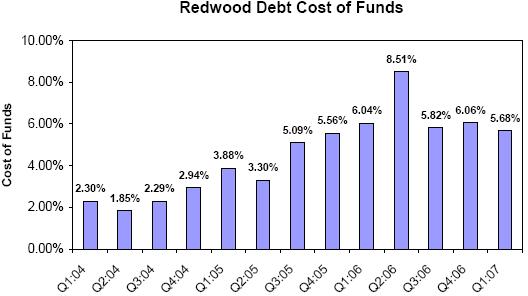

DEBT

REVIEW

DEBT

REVIEW

DEBT

REVIEW

DEBT

REVIEW| Ø |

Redwood

debt balances started and finished the first quarter of 2007 at $1.9

billion.

|

| Ø |

At

March 31, 2007, Redwood debt funded $0.9 billion residential whole

loans

and $1.0 billion securities.

|

| Ø |

The

cost of funds for Redwood’s debt was 5.68% for the first quarter and 6.06%

for the fourth quarter. Interest expense for Redwood debt was $31

million

for the first quarter. Our debt expense varies by the rate of short-term

interest rates, the type of facility used, and the type of collateral

financed.

|

| Ø |

At

March 31, 2007, all Redwood debt was short-term debt collateralized

by the

pledge of assets. Maturities are generally one year or less, and

the

interest rate usually adjusts to market levels each

month.

|

| Ø |

When

we fund fixed-rate or hybrid-rate assets with Redwood debt, we may

use

interest rate agreements to reduce the interest rate mismatch between

the

asset and the liability.

|

| Ø |

Commercial

paper borrowings under our Madrona program are rated the highest

CP rating

of A1+/P1 and represent our lowest cost borrowings. At March 31,

2007, CP

outstanding

was $250 million. We expect to use CP more extensively in the

future.

|

| Ø |

Redwood’s

debt obligations of $2.0 billion (including $100 million of junior

subordinated notes) were 2.1 times Redwood’s equity of $924 million at

March 31, 2007.

|

ABS

ISSUED

ABS

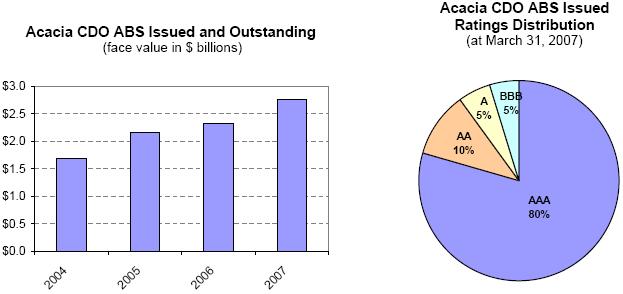

ISSUED| · |

We

believe we should be

able to

benefit from the current turmoil in the new issuance market for

CDO

securities. Our competitive advantages in the CDO business include

a large

permanent capital base, the ability to acquire and hold CDO CES,

a

well-developed real estate investment infrastructure, access

to

collateral, access to warehouse and other inventory financings,

a strong

track record, and a good reputation.

|

| · |

In

addition,

given our modeling and collateral evaluation capabilities, in

the current

environment we believe we will be able to source an new opportunities

to

invest in CDO assets issued from securitizations sponsored by

others.

|

ABS

ISSUED

ABS

ISSUED

ABS

ISSUED

ABS

ISSUED| Ø |

Acacia

CDO ABS outstanding increased from $2.3 billion to $2.8

billion during the

first quarter of 2007, an increase of 19%. Acacia issued

one new CDO ABS

during the quarter, Acacia 11, which experienced very

good investor

participation and attractive funding costs for Redwood.

Paydowns of Acacia

CDO securities were $44 million for the first

quarter.

|

| Ø |

In

April, we priced

Acacia

Option ARM CDO 1, and we expect to close this $500 million

transaction in

May. These CDO bonds priced at wider spreads (higher

cost of funds) than

Acacia 11 and consequently the CDO CES securities Redwood

acquired from

this transaction will likely have lower returns than

initially expected.

Since we have acquired and continue to acquire investment-grade

rated

option ARM-backed assets at wide spreads as collateral

for this

transaction, we still expect to earn attractive returns

on our investment

in the CDO CES from this transaction (even though some

of the collateral

we acquired for this transaction was accumulated in a

tighter spread

environment and we have had to mark down the value of

these assets for

GAAP reporting).

|

| Ø |

We

currently

expect to price an additional $500 million CDO bonds

in the second

quarter. While our cost of funds for this transaction

will not be known

until pricing, we expect that our economics on this transaction

will be

favorable if we can price at today’s spreads (which already reflect

substantial illiquidity and turmoil in the CDO markets),

although it is

possible that the transaction could be priced with wider

spreads less

favorable to Redwood, delayed, or even cancelled due

unfavorable market

conditions.

|

| Ø |

Spreads

have

widened (yields increased) for both collateral assets

and CDO liabilities.

We believe the resulting spread that can be earned for

new assets and new

liabilities is attractive, although there is substantial

uncertainty as to

where CDO liabilities will actually

price.

|

| Ø |

The

cost of funds of issued Acacia CDO ABS was 6.20% in the

first quarter of

2007 as compared to 6.08% for the fourth quarter of 2006.

Interest

expense, net of interest rate agreements, for Acacia

ABS issued was $39

million for the first quarter of 2007.

|

| Ø |

At

March 31, 2007, the credit ratings for Acacia bonds outstanding

were $2.2

billion AAA, $292 million AA, $172 million A, and $151

million BBB. In

addition, Acacia has sold a portion of its unrated CDO

CES (CDO equity) to

third parties, of which $21 million was outstanding at

March 31,

2007.

|

| Ø |

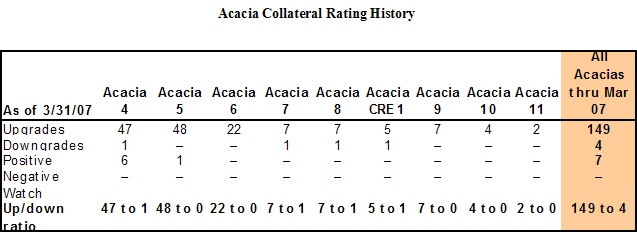

Our

collateral rating history continues to be strong. To

date, we have had 149

rating upgrades and four rating downgrades on all collateral

within the

existing Acacia program.

|

| Ø |

Relative

to most

other real estate CDO programs, Acacia has limited

subprime risk. We have

concentrated our subprime investments for Acacia collateral

in AA and A

rated securities, with limited exposure to BBB and

BBB- rated securities

from recent vintages. We sold some assets that appeared

they might

under-perform and losses related to these sales were

de minimis. Overall,

we believe Acacia’s CDO bonds are likely to perform well for their

investors, on an absolute basis

and

also relative to other CDO bonds. This should allow

us to continue to use

the sale of Acacia bonds as a form of financing except

in the most

difficult markets.

|

ABS

ISSUED

ABS

ISSUED| Ø |

The

Acacia CDO CES Redwood has acquired from Acacia had a

market value of $135

million at March 31, 2007. Redwood’s economic risk with respect to

Acacia’s assets and liabilities is generally limited to our

cost

basis in these assets, which at March 31, 2007 totaled

$82 million. For

accounting purposes, we account for Acacia transactions

as financings, so

the assets owned by Acacia are consolidated with our

assets and the CDO

bonds issued by Acacia are consolidated with our liabilities.

As a result,

the Acacia CDO CES securities we issue and then acquire

do not appear on

our GAAP balance sheet, but rather are implicitly represented

as the

excess of consolidated Acacia assets over consolidated

Acacia

liabilities.

|

| Ø |

For

GAAP balance

sheet

purposes, we mark-to-market most of the assets and derivatives

owned by

the Acacia entities, but none of Acacia’s liabilities. For GAAP purposes,

if market values for Acacia’s $2.8 billion assets declined sufficiently,

we could be required to record balance sheet charges

in excess of the

total maximum economic amount ($82 million) that Redwood

actually has

invested. Conversely, we would not be permitted to reflect

an offsetting

improvement in Acacia liability MTM results in our GAAP

financials. None

of these market value changes would affect the cash flows

we expect to

earn from our Acacia investments, however. The net balance

sheet market

value markdown for assets and derivatives in closed Acacia

transactions

was $49 million for the first

quarter.

|

| Ø |

For

managing the outstanding

Acacia transactions, Redwood’s taxable asset management subsidiaries

earned $1.2 million asset management fees in the first

quarter of 2007.

This income was sourced from the assets owned by Acacia,

and these assets

are consolidated on our GAAP balance sheet, for GAAP

purposes so we

currently include this asset management income as part

of the interest

income generated by those assets.

|

| Ø |

Additional

information about Acacia CDO ABS issued can be found

in Table 21 of the

Appendix.

|

ABS

ISSUED

ABS

ISSUED| · |

We

completed one Sequoia securitization in the first quarter

and have priced

another Sequoia securitization that will close in

May.

|

| · |

Recent

Sequoia ABS debt issued has been backed by prime hybrid

mortgages, as

prime ARMs have gone out of favor.

|

| · |

We

called an older Sequoia transaction that was issued

in 2004 and we expect

to call more transactions in 2007 and

2008.

|

| · |

We

expect to expand our residential conduit’s activities and commence

acquiring alt-a and subprime loans to be funded primarily

through

securitization.

|

ABS

ISSUED

ABS

ISSUED| Ø |

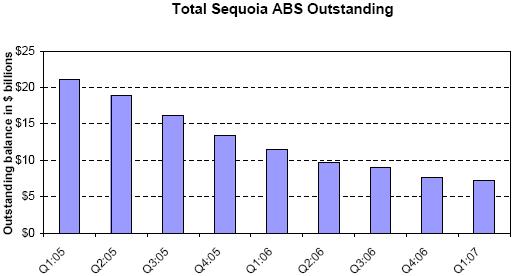

Sequoia

ABS outstanding

decreased from $7.7 billion to $7.2 billion in the first

quarter, a

decline of 6%. The primary reason for the decline in

the outstanding

balance was fast prepayment speeds on the underlying

Sequoia loans. In the

first quarter, the CPR for the loans owned by Sequoia

entities was

37%.

|

| Ø |

We

completed

one

securitization during the first quarter, financing $885

million prime

hybrid mortgages. In conjunction with the securitization,

Sequoia issued

$850 million AAA-rated ABS debt and another $25 million

of

investment-grade ABS debt. The ABS debt had similar interest

rate

characteristics to the underlying loans, thus minimizing

our interest rate

risk. The cost of funds on the newly issued ABS debt

was 5.91%.

|

| Ø |

We

called and retired $0.3 billion ABS debt associated with

a Sequoia

securitization issued in early 2004. When we exercise

the call option,

Redwood acquires all the ABS debt that remains outstanding

at the par

value. This debt is canceled, the Sequoia entity is collapsed,

and Redwood

reacquires the underlying loans.

|

| Ø |

Interest

expense for Sequoia ABS issued was $96 million for the

first quarter for a

cost of funds of 5.60%.

|

| Ø |

Redwood’s

economic risk with respect to Sequoia’s assets and liabilities is

generally limited to the value of Sequoia ABS we have

acquired, which

included $21 million market value IO securities rated

AAA, $88 million

CES, and $76 million investment-grade securities at March

31, 2007. For

GAAP accounting purposes, we account for Sequoia transactions

as

financings, so the assets owned by Sequoia are consolidated

with our

assets and the ABS bonds issued by Sequoia are consolidated

with our

liabilities. As a result, the Sequoia ABS we acquire

do not appear on our

GAAP balance sheet, but rather are implicitly represented

as the excess of

consolidated Sequoia assets over consolidated Sequoia

liabilities.

|

| Ø |

Total

ABS

issued on

our March 31, 2007 balance sheet included $7.2 billion

Sequoia ABS, $2.7

billion Acacia CDO ABS, and $5 million ABS issued by

our Madrona CP

issuance facility.

|

| Ø |

Additional

information about Sequoia ABS issued can be found in

Tables 19 and 20 of

the Appendix.

|

APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX APPENDIX

APPENDIX|

|

|

|

|

|

|

|

|

|

|

Full

Year

|

Full

year

|

|||||||||||||||||||||||

|

|

Q1:2007

|

Q4:2006

|

Q3:2006

|

Q2:2006

|

Q1:2006

|

Q4:2005

|

Q3:2005

|

Q2:2005

|

Q1:2005

|

2006

|

2005

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Interest

income

|

$

|

207,906

|

$

|

213,504

|

$

|

217,504

|

$

|

214,544

|

$

|

224,795

|

$

|

234,531

|

$

|

246,810

|

$

|

248,786

|

$

|

237,714

|

$

|

870,347

|

$

|

967,840

|

||||||||||||

|

Net

securities

discount amortization income

|

20,268

|

18,665

|

17,842

|

13,234

|

13,245

|

10,971

|

11,523

|

8,049

|

8,908

|

62,986

|

39,451

|

|||||||||||||||||||||||

|

Other

real

estate investment interest income

|

2,465

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||||||||||||||||||||

|

Net

loan

premium amortization expense

|

(11,705

|

)

|

(13,272

|

)

|

(11,232

|

)

|

(12,046

|

)

|

(11,982

|

)

|

(13,486

|

)

|

(14,507

|

)

|

(9,857

|

)

|

(7,674

|

)

|

(48,532

|

)

|

(45,524

|

)

|

||||||||||||

|

(Provision

for) reversal of credit reserve

|

(3,829

|

)

|

(1,506

|

)

|

(465

|

)

|

2,506

|

(176

|

)

|

(877

|

)

|

805

|

1,527

|

(1,025

|

)

|

359

|

430

|

|||||||||||||||||

|

Total

GAAP

interest income

|

215,105

|

217,391

|

223,649

|

218,238

|

225,882

|

231,139

|

244,631

|

248,505

|