|

||

|

|

|

|

The

Redwood Review

2nd

Quarter 2007

|

||

|

||

|

||

|

|

|

|

The

Redwood Review

2nd

Quarter 2007

|

||

|

||

|

Table

of Contents

|

|

Introduction

|

2

|

|||

|

Shareholder

Letter

|

3

|

|||

|

Quarterly

Overview

|

4

|

|||

|

Financial

and Business Modules

|

||||

|

|

||||

|

•

Financial

|

6

|

|||

|

•

Residential

|

16

|

|||

|

•

Commercial

|

41

|

|||

|

•

CDO

|

47

|

|||

|

•

Capital

|

52

|

|||

|

•

Debt

|

54

|

|||

|

•

ABS

Issued

|

56

|

|||

|

Redwood

Business and Strategy

|

64

|

|||

|

Appendix

|

||||

|

•

Glossary

|

70

|

|||

|

•

Financial

Tables

|

77

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

1 |

|

Introduction

|

|

Quarter:Year

|

GAAP

Earnings per Share |

Core

Earnings per Share |

Total

Taxable

Earnings per Share |

Adjusted

Return on Equity |

GAAP

Book

Value per Share |

Total

Dividends per Share |

|

Q2:05

|

$1.62

|

$1.50

|

$1.66

|

19%

|

$40.24

|

$0.70

|

|

Q3:05

|

$2.21

|

$1.22

|

$2.23

|

25%

|

$41.03

|

$0.70

|

|

Q4:05

|

$1.68

|

$0.97

|

$1.65

|

19%

|

$37.20

|

$3.70

|

|

Q1:06

|

$1.09

|

$1.16

|

$1.44

|

13%

|

$38.11

|

$0.70

|

|

Q2:06

|

$1.20

|

$0.97

|

$1.91

|

14%

|

$39.13

|

$0.70

|

|

Q3:06

|

$1.22

|

$1.20

|

$1.96

|

14%

|

$40.02

|

$0.70

|

|

Q4:06

|

$1.32

|

$1.12

|

$1.42

|

15%

|

$37.51

|

$3.70

|

|

Q1:07

|

$0.66

|

$1.08

|

$1.48

|

8%

|

$34.06

|

$0.75

|

|

Q2:07

|

$0.41

|

$1.35

|

$1.66

|

5%

|

$31.50

|

$0.75

|

| 2 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Shareholder

Letter

|

|

|

|

|

George

E.

Bull, III

|

Douglas

B.

Hansen

|

|

|

Chairman

and CEO

|

President

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

3 |

|

Quarterly

Overview

|

| 4 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Quarterly

Overview

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

5 |

|

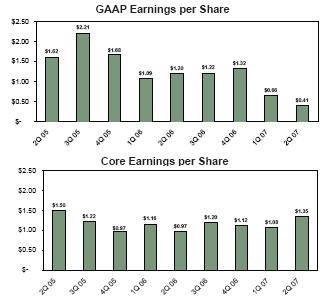

GAAP

Earnings and Core Earnings

|

| · |

GAAP

earnings

per share for the second quarter of $0.41 per share were lower

than recent

quarters primarily due to $29 million negative unrealized mark-to-market

valuation adjustments. Net interest income for the second quarter

was

strong.

|

| · |

For

the past

year and a half, quarterly core earnings have ranged from $0.97

to $1.35

per share. Our second quarter core earnings of $1.35 per share

were at the

top of this range.

|

|

For

the Quarter Ended

|

||||||||||

|

GAAP

Earnings

|

Jun-07

|

Mar-07

|

Jun-06

|

|||||||

|

Net

interest

income

|

$

|

53,901

|

$

|

47,009

|

$

|

44,719

|

||||

|

|

||||||||||

|

Operating

expenses

|

(12,772

|

)

|

(17,782

|

)

|

(16,037

|

)

|

||||

|

Gains

on

sales

|

1,428

|

303

|

8,241

|

|||||||

|

Gains

on

calls

|

1,310

|

843

|

747

|

|||||||

|

Valuation

adjustments, net

|

(29,430

|

)

|

(10,264

|

)

|

(2,995

|

)

|

||||

|

Provision

for

income taxes

|

(3,021

|

)

|

(1,800

|

)

|

(3,265

|

)

|

||||

|

|

||||||||||

|

GAAP

earnings

|

$

|

11,416

|

$

|

18,309

|

$

|

31,410

|

||||

|

|

||||||||||

|

GAAP

earnings

per share

|

$

|

0.41

|

$

|

0.66

|

$

|

1.20

|

||||

|

For

the Quarter Ended

|

||||||||||

|

Core

Earnings

|

Jun-07

|

Mar-07

|

Jun-06

|

|||||||

|

Net

interest

income

|

$

|

53,901

|

$

|

47,009

|

$

|

44,719

|

||||

|

|

||||||||||

|

Operating

expenses

|

(12,772

|

)

|

(15,402

|

)

|

(16,037

|

)

|

||||

|

Gains

on

sales

|

-

|

-

|

-

|

|||||||

|

Gains

on

calls

|

-

|

-

|

-

|

|||||||

|

Valuation

adjustments, net

|

-

|

-

|

-

|

|||||||

|

Provision

for

income taxes

|

(3,021

|

)

|

(1,800

|

)

|

(3,265

|

)

|

||||

|

|

||||||||||

|

Core

earnings

|

$

|

38,108

|

$

|

29,807

|

$

|

25,417

|

||||

|

|

||||||||||

|

Core

earnings

per share

|

$

|

1.35

|

$

|

1.08

|

$

|

0.97

|

||||

| 6 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

GAAP

Earnings and Core Earnings

|

|

Financial

|

| Ø |

Net

interest

income for the second quarter of 2007 increased by $7 million

over the

first quarter of 2007 and $9 million over the second quarter

of 2006.

Higher net interest income earnings from our CES and IGS portfolios

more

than offset a decrease in net interest income from a decline

in balance in

our residential loan portfolio. The average balance of our residential

loan portfolio continued to decline due to high prepayments on

adjustable-rate residential loans acquired and securitized under

our

Sequoia program.

|

| Ø |

Our

residential CES portfolio continues to benefit from strong credit

performance, and from rapid prepayments on those securities backed

by ARM

loans. The yield for the total CES portfolio was 24% in the second

quarter

of 2007, 22% in the first quarter of 2007, and 20% in the second

quarter

of 2006.

|

| Ø |

Operating

expenses in the second quarter of 2007 were $5 million lower than

the

first quarter of 2007. The primary reason for this decline was

lower

severance charges and lower bonus accruals. In comparison to the

second

quarter of last year, operating expenses declined by $3 million

primarily

due to lower due diligence expenses as a result of lower commercial

CES

acquisitions activity.

|

| Ø |

The

largest

factor causing a decline in our GAAP earnings was $29 million of

negative

unrealized mark-to-market (MTM) valuation adjustments. These adjustments

were $19 million higher than the first quarter of 2007 and $26

million

higher than the second quarter of 2006. The decrease in fair value

reflects the overall market decline in prices for real estate securities

(particularly, securities backed by subprime and low quality alt-a

loans)

that occurred during the second quarter. Of the $29 million income

statement MTM write-downs taken during the second quarter, $19

million

were impairments as defined by

GAAP.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

7 |

|

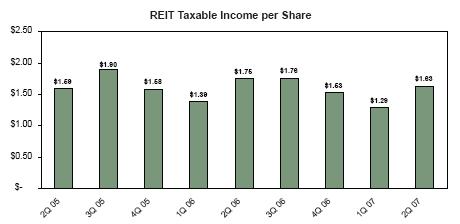

Taxable

Income

|

| · |

Total

taxable

income for the second quarter of 2007 was strong at $1.66 per

share, an

increase from the prior quarter due to reduced tax deductions

from stock

option exercises and lower overall operating

expenses.

|

| · |

REIT

taxable

income remained strong at $1.63 per share and continues to exceed

our

regular quarterly dividend by a comfortable

margin.

|

| 8 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Taxable

Income

|

| Ø |

Total

taxable

income was $46 million, or $1.66 per share, in the second quarter

of 2007.

This was an increase from the total taxable income we generated

in the

prior quarter of $40 million, or $1.48 per share. In the prior

quarter, we

had more tax deductions relating to stock option exercises and

higher

overall operating expenses.

|

| Ø |

Our

REIT

taxable income was $1.63 per share in the second quarter of 2007.

This was

higher than first quarter taxable income of $1.29 for the same

reasons

total taxable income was higher.

|

| Ø |

Our

taxable

income continues to be higher than our GAAP income as we are not

permitted

to establish credit reserves for tax. As a result, we amortize

more of our

CES discount into income for tax and recognize a higher yield until

credit

losses occur. The cumulative difference at June 30, 2007 in the

discount

amortization between tax and GAAP for residential, commercial,

and CDO CES

was $115 million.

|

| Ø |

Another

reason for the difference between tax and GAAP income is that we

do not

recognize changes in market values of assets for tax until the

asset is

sold. Consequently, the negative $29 million of unrealized market

valuation adjustments included in our GAAP earnings this quarter

were not

included in our tax earnings.

|

| Ø |

Total

taxable

income and REIT taxable income were reduced by $2 million ($0.08

per

share) in the second quarter of 2007 as a result of deductions

for actual

credit losses. These deductions were less than the actual principal

losses

incurred on the underlying loans of $6 million, as we own most

of our

credit-sensitive assets at a tax basis that is substantially less

than par

(principal) value. We currently expect that realized credit losses

will

increase substantially relative to our recent experience. All realized

credit losses, after adjusting for our tax basis in the assets

we own,

will reduce our dividend distribution

requirements.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

9 |

|

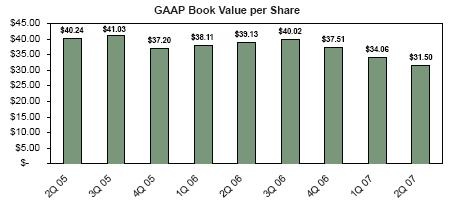

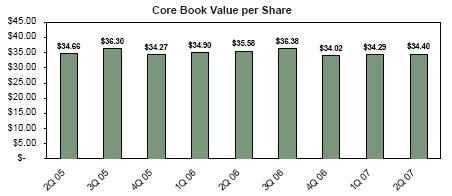

Book

Value per Share

|

| · |

GAAP

book

value declined by 8%, or $2.56 per share, during the second quarter

of

2007 from $34.06 per share to $31.50 per share primarily as a result

of

declining values for assets we own that are marked-to-market for

balance

sheet purposes.

|

| · |

Core

book

value rose by 0.3% during the second quarter of 2007 from $34.29

per share

to $34.40 per share as a result of accretive stock issuance through

our

direct stock purchase and dividend reinvestment

plan.

|

| · |

Under

GAAP,

we are required to carry our real estate securities on our balance

sheet

at their fair market value, but we are not permitted to adjust

paired ABS

issued liabilities to fair market value. Using the assumption described

in

footnote 14 of our June 30, 2007 quarterly financial statements,

we

estimate that if we had recorded our Acacia ABS issued at fair

market

value and adjusted for Acacia unamortized deferred bond issuance

costs of

$26 million, our book value as of June 30, 2007 would have been

higher

than reported by $75 million.

|

| 10 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Book

Value per Share

|

|

Financial

|

| Ø |

The

difference between core book value of $34.40 per share and GAAP

book value

of $31.50 per share at June 30, 2007 was cumulative mark-to-market

balance

sheet adjustments for GAAP of negative $81 million at

quarter-end.

|

| Ø |

For

the $3.7

billion of assets that were marked-to-market at June 30, 2007,

market

values declined by $124 million in the second quarter of 2007.

This

represents an average decline in value during the quarter of 3%

of

principal value.

|

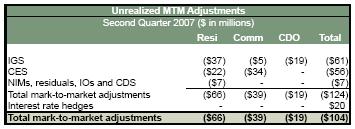

| Ø |

Market

spreads widened in the second quarter; that is, the yields the

market

required increased, so asset values dropped. For some assets, value

declines reflected a decline in economic value due to an increase

in

credit loss expectations. For other assets (including most of our

assets),

value declines reflect an increase in potential risks rather than

a change

in expected cash flows. The table below summarizes the change in

unrealized mark-to-market (MTM) adjustments during the second

quarter.

|

| Ø |

At

the end of

our first quarter of operations in September 1994, GAAP book value

was

$11.67 per share. Since that time, we have paid $41.93 per share

of

dividends while also increasing GAAP book value by $19.83 per

share.

|

| Ø |

Book

value

per share growth generally is not a direct indicator of our

market value

or an indicator of the returns available to our shareholders.

If you had

acquired Redwood stock at our initial public offering in August

1995 and

had reinvested all dividends back into Redwood stock, your

compounded

return as a shareholder would have been 20% per year through

June 30,

2007. Future results will

vary.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

11 |

|

Return

on Equity

|

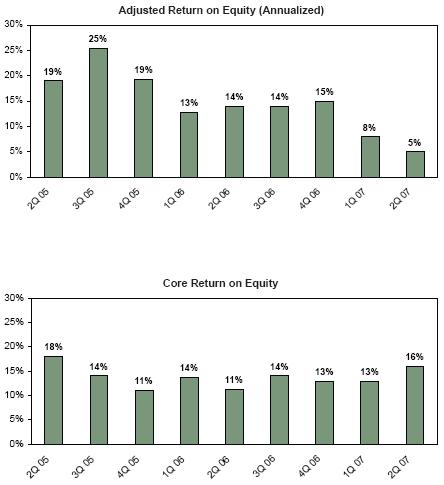

| · |

During

the

second quarter of 2007, our adjusted return on equity was 5%. The

return

was lower in the past two quarters primarily due to the amount

of

unrealized market valuation adjustments included our GAAP

earnings.

|

| · |

Core

return

on equity (core earnings divided by core equity) was 16% for the

second

quarter.

|

| · |

Over

the long

term, we expect to be able to generate annual adjusted returns

on equity

between 11% and 18%.

|

| 12 |

|

The

Redwood Review

2nd

Quarter 2007

|

|

Return

on Equity

|

|

Financial

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

13

|

|

Dividends

|

| · |

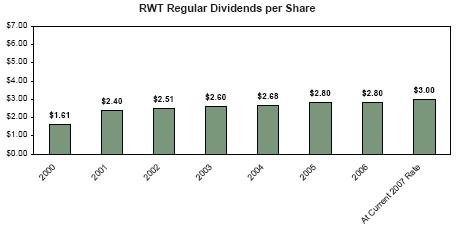

Our

current

regular dividend rate is $0.75 per share per

quarter.

|

|

14

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Dividends

|

|

Financial

|

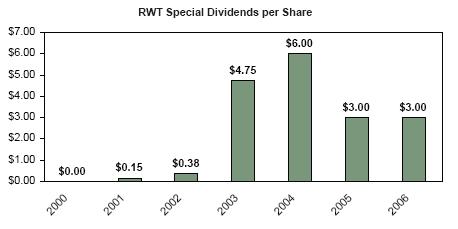

| Ø |

Total

dividend distributions over the last four quarters were $5.90 per

share.

Assuming the August 6, 2007 Redwood stock price of $36.04, the

indicated

dividend yield would be 16.4% based on the last twelve months of

dividends

and would be 8.3% based on the current regular dividend rate of

$3.00 per

share.

|

| Ø |

Based

on our

estimates of REIT taxable income through the second quarter of

2007, at

quarter end, we had $80 million ($2.86 per share) undistributed

REIT

taxable income that we anticipate distributing in 2007 and 2008

through

our regular quarterly dividend and a 2007 special dividend.

|

| Ø |

We

generally

distribute 100% of REIT capital gains income and 90% of REIT ordinary

income, retaining 10% of the ordinary REIT income. We generally

retain

100% of the after-tax income we generate in taxable subsidiaries.

|

| Ø |

As

has been

our recent policy, we currently intend to carry over two to three

quarters

worth of regular dividends into

2008.

|

|

15

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

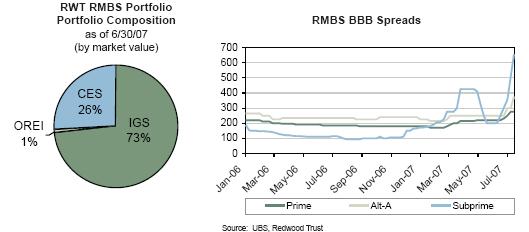

| · |

Total

residential securities increased by 4% in the second quarter from

$2.8

billion to $2.9 billion as a result of $307 million of acquisitions,

$23

million of discount amortization, $56 million of sales, $89 million

of

calls and principal pay downs, and $59 million of market value

declines.

Our primary focus during the quarter was buying IGS for our two

Acacia CDO

securitizations that closed in May and June.

|

| · |

Of

the $2.9

billion residential securities we owned at June 30, 2007, $2.4

billion

were financed through re-securitization via Acacia CDO transactions

and

$0.5 billion were financed with Redwood debt and capital.

|

| · |

Future

residential IGS investment will largely depend on the availability

and

pricing of future Acacia CDO financing. If today’s turbulent environment

persists, it is unlikely that we would complete another CDO transaction

this year. This will require us to look to other potential sources

of

financing, such as Redwood debt or capital, to fund acquisitions,

or else

slow the pace of our IGS acquisitions.

|

|

16

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

| · |

In

light of

generally rising residential mortgage delinquencies and the continued

slide in home prices, we are closely monitoring the collateral

performance

underlying our CES and IGS portfolios. During the quarter we sold

$49

million of subprime collateral. We may make additional targeted

sales in

the third quarter.

|

| · |

Our

CES

portfolio backed by prime assets as well as our alt-a option ARM

loans

continue to perform better than, or within, our range of expectations.

Prime represents 74% and alt-a option ARMS represent 22% of our

residential CES portfolio by market value. At June 30, our credit

reserves

associated with these securities were $293 million for prime and

$151

million for alt-a.

|

| · |

Credit

performance on alt-a securities backed by hybrids is now worse

than we had

projected. These securities represent 1% of our total residential

portfolio. During the quarter we took a mark-to-market valuation

charge

against these assets of $7 million.

|

| · |

Prices

for

residential mortgage-backed securities (RMBS) declined across the

credit

spectrum with the most severe drops impacting 2006 and early 2007

vintage

subprime and alt-a securities. Prices continued to fall further

in July

and August as the market continued to weaken amid increased supply

and

reduced demand for RMBS.

|

| · |

In

the RMBS

market, trading volume is light since willing buyers and sellers

cannot

agree on price. Until a market clearing level develops, it is difficult

to

accurately know true RMBS market values.

|

| · |

Overall

we

believe this disruption will be good for Redwood since the likely

result

will be an improvement in loan credit quality and heightened appreciation

for credit risk. This would create more opportunities to invest

capital in

our core residential credit business over the next year and the

disruption

may also lead to exceptional distressed buying

opportunities.

|

| · |

We

are

particularly pleased that Andy Sirkis, who has successfully led

our CDO

group for the past 5 years, will take on the added responsibility

of

leading our expanding high-grade investment efforts. Recently,

we changed

the name of our wholly-owned qualified REIT subsidiary to Juniper

Trust

due to potential identity confusion with another financial company

using

the prior name, Cypress. Juniper currently intends to expand in

high-grade

spread lending product lines such as high-quality residential whole

loans

funded through securitization, high-grade CDOs backed by AAA and

AA rated

collateral, and AAA securities funded with repo borrowings. We

are pleased

with our team’s progress in the development of business strategies and the

establishment of supporting systems for Juniper. Initially, Juniper

will

be funded by Redwood. In the future, we may raise additional capital

to

accommodate growth for this strategy by selling new shares in Juniper.

Our

asset management subsidiary, Redwood Asset Management, Inc., would

manage

Juniper as an external REIT.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

17

|

|

Residential

Real Estate Securities

|

|

RWT

Residential IGS Portfolio

|

||||

|

Activity

|

||||

|

as

of

06/30/07

|

||||

|

(by

market

value, $ in millions)

|

|

Prime

|

Alt-A

|

Subprime

|

Total

|

|

|

Market

Value 3/31/07

|

$789

|

$766

|

$471

|

$2,026

|

|

Acquisitions

|

114

|

106

|

47

|

267

|

|

Upgrades

/

Downgrades

|

2

|

-

|

-

|

2

|

|

Sales

|

(3)

|

-

|

(49)

|

(52)

|

|

Principal

Payments

|

(29)

|

(1)

|

(16)

|

(46)

|

|

Discount

/

(Premium) Amortization

|

1

|

-

|

1

|

2

|

|

Gains

on

Sales/Calls

|

-

|

-

|

1

|

1

|

|

Net

Mark-to-Market Adjustment

|

(4)

|

(16)

|

(17)

|

(37)

|

|

Market

Value 6/30/07

|

$870

|

$855

|

$438

|

$2,163

|

|

18

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

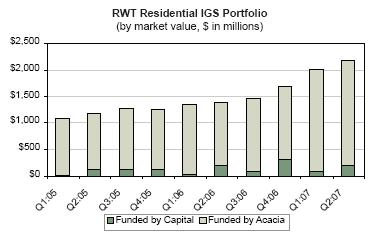

| Ø |

Our

residential IGS portfolio increased by 7% in the second quarter from

$2.0

billion to $2.2 billion.

|

| Ø |

Of

the $37

million in market value declines, $13 million were related to interest

rate increases that were largely offset by hedge

gains.

|

| Ø |

The

majority

of our residential IGS acquisitions for the quarter were designated

investments for two Acacia securitizations that closed in May and

June.

|

| Ø |

During

the

second quarter, our residential IGS acquisitions were 43% prime,

40%

alt-a, and 17% subprime. By interest rate type, these acquisitions

were

33% option ARMs, 47% hybrids, and 20%

fixed-rate.

|

| Ø |

At

June 30,

2007, $2.0 billion residential IGS were financed via securitization

in our

Acacia CDO program and $0.2 billion were financed with Redwood debt

and

capital.

|

| Ø |

At

June 30,

2007, the interest rate characteristics of our residential IGS portfolio

were 46% adjustable-rate, 35% hybrid, and 19% fixed-rate. We use

interest

rate agreements to generally match the interest rate characteristics

of

these assets to their corresponding funding

sources.

|

| Ø |

Interest

income generated by residential IGS was $36 million for the second

quarter. The yield for the second quarter was 6.80%, an increase

from

6.56% the previous quarter.

|

| Ø |

Net

discount

amortization income (which is included in interest income) for the

second

quarter was $2 million. At quarter-end, our net discount balance

for these

assets was $32 million, giving us an average amortized balance sheet

cost

basis for residential IGS of 98.59% of principal

value.

|

| Ø |

In

the second

quarter, our residential prime IGS portfolio grew by $81 million

(or 10%)

to $870 million. Our residential alt-a IGS portfolio grew by $90

million

(or 12%) to $856 million.

|

| Ø |

Our

subprime

IGS portfolio declined by $33 million (or 7%) to $438 million. Sales

of

$49 million subprime IGS in the second quarter exceeded new

acquisitions of $47 million. Although $36 million of these sales

were due

to increased credit risk of underperforming securities, $13 million

were

not credit related. The sales of these securities generated a GAAP

income

statement net gain of $2 million in the second

quarter.

|

| Ø |

Additional

information on our residential IGS can be found in Tables 9, 10,

and 18 of

the Appendix.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

19

|

|

Residential

Real Estate Securities

|

|

RWT

Residential CES Portfolio

|

|

Activity

|

|

as

of

06/30/07

|

|

(by

market

value, $ in millions)

|

|

Prime

|

Alt-A

|

Subprime

|

Total

|

|

|

Market

Value 3/31/07

|

$571

|

$172

|

$9

|

$752

|

|

Acquisitions

|

25

|

15

|

-

|

40

|

|

Upgrades

/

Downgrades

|

-

|

-

|

-

|

-

|

|

Sales

|

(1)

|

(2)

|

-

|

(3)

|

|

Principal

Payments

|

(35)

|

(7)

|

(1)

|

(43)

|

|

Discount

/

(Premium) Amortization

|

17

|

4

|

-

|

21

|

|

Net

Mark-to-Market Adjustment

|

(8)

|

(10)

|

(5)

|

(23)

|

|

Market

Value 6/30/07

|

$570

|

$173

|

$3

|

$745

|

|

20

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

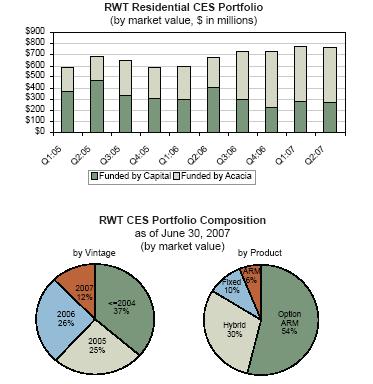

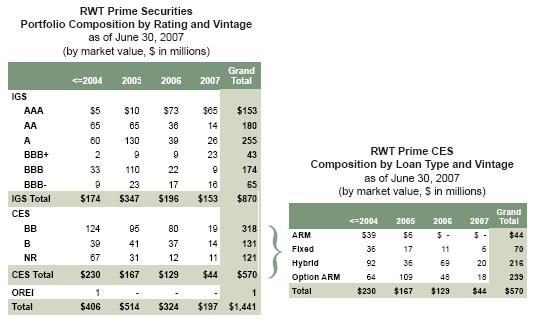

| Ø |

Our

residential CES portfolio decreased by 1% from $752 million to $745

million during the quarter.

|

| Ø |

At

June 30,

2007, $259 million residential CES were financed with equity and

$486

million were financed through our Acacia CDO

program.

|

| Ø |

The

balance

of residential loans underlying our residential CES decreased by

7% from

$237 billion to $220 billion during the second

quarter.

|

| Ø |

The

loans

underlying our residential CES acquisitions made during the quarter

were

62% prime and 38% alt-a by market value. Option ARM CES represented

72% of

our second quarter acquisitions while hybrids and fixed represented

13%

and 15%, respectively, by market value.

|

| Ø |

Interest

income generated by residential CES was $41 million for the second

quarter. The yield for the second quarter was 24%. Yields for the

second

quarter were 24% for prime CES, 22% for alt-a CES, and 16% for subprime

CES. Interest income was $31 million, $10 million, and $0.3 million

for

these sub-portfolios, respectively. CES yields remain high due to

fast

prepayment speeds and continued good credit performance for underlying

loans.

|

| Ø |

Principal

value credit losses for loans underlying CES were $6 million for

the

quarter, an increase from $4 million in the previous quarter. As

assets

season, we expect losses to increase substantially in percentage

terms.

Cumulative losses and the current loss rate remain lower than our

original

pricing expectations.

|

| Ø |

For

tax

purposes, realized credit losses were $2 million ($0.08 per share)

for

residential CES for the second quarter. This deduction is less than

the

principal value losses incurred on the underlying loans of $6 million,

as

we own most of our credit-sensitive assets at a tax basis that is

substantially less than par (principal) value.

|

| Ø |

Our

GAAP

credit reserves for residential CES were $453 million ($16.29 per

share)

at June 30, 2007, an increase of $60 million for the quarter. New

acquisitions increased this reserve by $46 million while the reallocation

of $22 million of unamortized purchase discount to reserve as some

loss

expectations increased for some assets less $6 million of

actual losses accounted for the remaining

change.

|

| Ø |

Our

total

residential prime CES portfolio decreased by $1 million (0.2%) to

$570

million during the second quarter. Overall, our prime CES portfolio

is

performing well from a credit perspective and continues to benefit

from

fast prepayments.

|

| Ø |

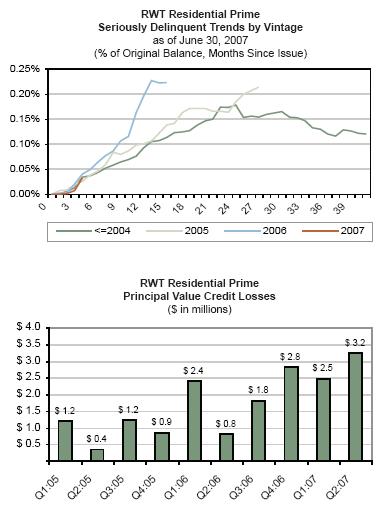

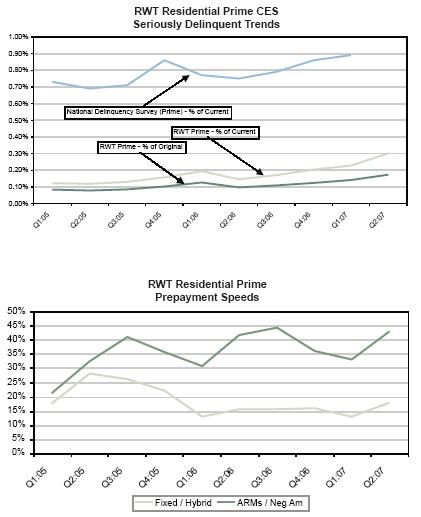

The

balance

of seriously delinquent loans underlying prime residential CES increased

from $485 million to $589 million during the quarter, an increase

from

0.14% to 0.17%, respectively, of original balances and 0.23% to 0.30%

of

current balances, respectively. These increases remain in line with

normal

seasoning and remain below our initial modeling

expectations.

|

| Ø |

Securities

backed by option ARM and traditional ARM loans continued to prepay

significantly faster than our original expectations at a weighted

average

CPR of 43%. These securities represent 50% of our prime CES and they

are

priced and structured to benefit from fast prepayment speeds in addition

to low losses.

|

| Ø |

The

principal

value of credit losses for loans underlying our prime CES was $3

million,

which is an annualized rate of loss of less than one basis point

per

year.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

21

|

|

Residential

Real Estate Securities

|

| Ø |

Fifty

percent

of our prime portfolio is composed of securities backed by hybrid

and

fixed-rate mortgages by market value. The loans underlying these

securities prepaid at a weighted average CPR of 18% in the second

quarter.

|

| Ø |

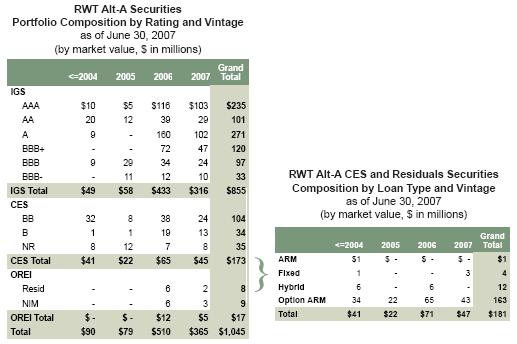

Our

residential alt-a CES portfolio held flat at $172 million during

the

second quarter. Option ARM collateral makes up 95% of this portfolio

by

market value.

|

| Ø |

We

acquire

alt-a securities backed by option ARMs with loss expectations that

are

significantly greater than we expect for our prime hybrid CES. To

date,

the performance of our CES backed by option ARMs continues to exceed

our

expectations.

|

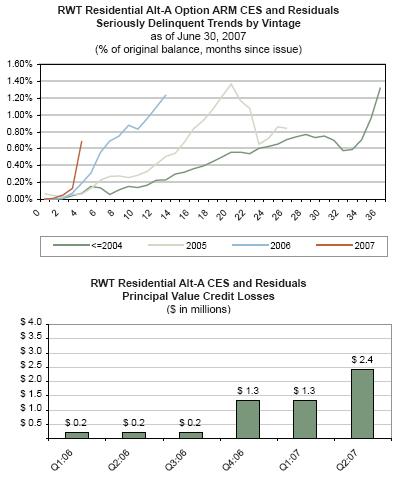

| Ø |

The

balance

of seriously delinquent loans underlying alt-a residential CES increased

from $296 million to $399 million during the quarter, an increase

from

0.82% to 1.04% of original balances, respectively, and 1.51% to 1.95%

of

current balances, respectively.

|

| Ø |

Our

subprime

CES portfolio decreased 69% from $9 million to $3 million for the

quarter

as a result of $5 million in market value declines and $1 million

in

principal repayments. Our subprime CES portfolio has limited seasoning;

however, the early credit performance is

disappointing.

|

| Ø |

We

continue

to explore opportunities to invest in subprime residuals through

joint

venture partnerships or whole loan securitizations. We believe that

once

the market rationalization is complete the subprime business will

be

viable for the long term and presents an excellent opportunity to

expand

the Redwood franchise.

|

| Ø |

For

the

foreseeable future we expect subprime originations to continue to

decline

in volume, however the nature of subprime residuals will provide

sufficient opportunities for investment given the required size of

CES

created in each deal.

|

| Ø |

Additional

information on our residential CES can be found in Tables 9, 10,

11, and

12 of the Appendix.

|

|

22

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

| Ø |

Other

real

estate investments (OREI) are assets that we mark-to-market for income

statement purposes, because they may otherwise be deemed to contain

embedded derivatives for accounting purposes under FAS 155. We expect

to

acquire additional OREI assets. Mark-to-market fluctuations affect

GAAP

income.

|

| Ø |

OREI

is a new

reporting category we established in the first quarter of 2007. Total

OREI

at June 30, 2007 was $34 million. This included $22 million net interest

margin securities (NIMs), $10 million residuals, and $2 million IOs.

|

| Ø |

Residuals

are

first-loss securities that are not rated by a rating agency. The

value of

residual securities can vary widely and is highly dependent on prepayment

speeds. The value is also dependent on the level and timing of credit

losses, and often is not as sensitive to losses as it is to prepayment

speeds. These securities perform poorly when prepayments are fast

and

losses are higher than expected.

|

| Ø |

By

market

value, our OREI was 4% prime, 50% alt-a, and 46% subprime at June

30,

2007.

|

| Ø |

Mark-to-market

charges in our OREI portfolio were negative $6 million for the quarter

and

were included in our income statement. Valuations decline were a

result of

credit performance below our expectations, and a general spread widening

in the mortgage market. Although the reported yield has averaged

15% after

the first two quarters, our total reported return equals the cash

income

and any change in market value, and will continue to be

volatile.

|

| Ø |

Our

NIMs are

structured in such a way that they mature quickly (typically less

than two

years). The majority of the NIMs we have acquired have an investment-grade

rating.

|

| Ø |

OREI

at June

30, 2007 consisted of $9 million of investment-grade NIMs with an

average

life of 0.6 years.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

23

|

|

Residential

Real Estate Securities

|

|

24

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

25 |

|

Residential

Real Estate Securities

|

|

26

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

|

RWT

Residential Prime Securities

|

|

Activity

|

|

as

of June

30, 2007

|

|

(by

market

value, $ in millions)

|

|

IGS

|

CES

|

OREI

|

Total

|

|

|

Market

Value 3/31/07

|

$789

|

$571

|

$2

|

$1,362

|

|

Acquisitions

|

114

|

25

|

-

|

139

|

|

Upgrades

/

Downgrades

|

2

|

(2)

|

-

|

-

|

|

Sales

|

(3)

|

(1)

|

-

|

(4)

|

|

Principal

Payments

|

(29)

|

(35)

|

-

|

(63)

|

|

Discount

/

(Premium) Amortization

|

1

|

17

|

-

|

18

|

|

Net

Mark-to-Market Adjustment

|

(4)

|

(7)

|

-

|

(11)

|

|

Market

Value 6/30/07

|

$870

|

$570

|

$2

|

$1,442

|

|

RWT

Residential Prime Securities

|

|

Underlying

Loan Characteristics

|

|

as

of June

30, 2007

|

|

Number

of

loans

|

554,494

|

Wtd

Avg

FICO

|

737

|

|

|

Total

loan

face ($ in millions)

|

195,757

|

FICO:

<=

620

|

2%

|

|

|

Average

loan

size ($ in 1000's)

|

353

|

FICO:

621 -

660

|

4%

|

|

|

|

FICO:

661 -

700

|

16%

|

||

|

Southern

CA

|

24%

|

|

FICO:

701 -

740

|

26%

|

|

Northern

CA

|

21%

|

FICO:

>

740

|

51%

|

|

|

Florida

|

6%

|

Unknown

|

1%

|

|

|

New

York

|

5%

|

|||

|

Georgia

|

2%

|

Conforming

at

origination %

|

31%

|

|

|

New

Jersey

|

3%

|

>

$1

MM

%

|

9%

|

|

|

Other

states

|

39%

|

|

|

|

|

|

2nd

home

%

|

7%

|

||

|

2007

origination

|

4%

|

|

Investment

home %

|

3%

|

|

2006

origination

|

20%

|

|

|

|

|

2005

origination

|

27%

|

Purchase

|

41%

|

|

|

2004

origination and earlier

|

49%

|

Cash

out

refi

|

27%

|

|

|

|

Rate-term

refi

|

30%

|

||

|

Wtd

Avg

Original LTV

|

68%

|

|

|

|

|

Original

LTV:

0 - 50

|

13%

|

Full

doc

|

45%

|

|

|

Original

LTV:

50 - 60

|

12%

|

No

doc

|

6%

|

|

|

Original

LTV:

60. - 70

|

22%

|

Other

(limited, etc)

|

49%

|

|

|

Original

LTV:

70 - 80

|

51%

|

|

||

|

Original

LTV:

80 - 90

|

2%

|

|

|

|

|

Original

LTV:

90 - 100

|

1%

|

2-4

family

|

2%

|

|

|

Condo

|

9%

|

|||

|

Single

family

|

89%

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

27

|

|

Residential

Real Estate Securities

|

|

28

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

29

|

|

Residential

Real Estate Securities

|

|

30

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

|

RWT

Residential Alt-A Securities

|

|

Activity

|

|

as

of June

30, 2007

|

|

(by

market

value, $ in millions)

|

|

IGS

|

CES

|

OREI

|

Total

|

|

|

Market

Value 3/31/07

|

$766

|

$172

|

$28

|

$966

|

|

Acquisitions

|

106

|

15

|

-

|

121

|

|

Sales

|

-

|

(2)

|

(2)

|

(4)

|

|

Principal

payments

|

(1)

|

(7)

|

(1)

|

(9)

|

|

Discount

/

(premium) amortization

|

-

|

4

|

(3)

|

1

|

|

Net

mark-to-market adjustment

|

(16)

|

(10)

|

(6)

|

(32)

|

|

Market

Value 6/30/07

|

$856

|

$173

|

$16

|

$1,045

|

|

RWT

Residential Alt-A Securities

|

|

Underlying

Loan Characteristics

|

|

as

of June

30, 2007

|

|

Number

of

loans

|

59,767

|

Wtd

avg

FICO

|

707

|

|

|

Total

loan

face ($ in millions)

|

20,523

|

FICO:

<=

620

|

2%

|

|

|

Average

loan

size ($ in 1000's)

|

$343

|

FICO:

621 -

660

|

14%

|

|

|

FICO:

661 -

700

|

29%

|

|||

|

Southern

CA

|

31%

|

FICO:

701 -

740

|

24%

|

|

|

Northern

CA

|

21%

|

FICO:

>

740

|

23%

|

|

|

Florida

|

10%

|

Unknown

|

8%

|

|

|

New

York

|

2%

|

|

||

|

Georgia

|

1%

|

Conforming

at

origination %

|

47%

|

|

|

New

Jersey

|

3%

|

>

$1

MM

%

|

12%

|

|

|

Other

states

|

32%

|

|

|

|

|

2nd

home

%

|

6%

|

|||

|

2007

origination

|

14%

|

Investment

home %

|

11%

|

|

|

2006

origination

|

23%

|

|

|

|

|

2005

origination

|

33%

|

Purchase

|

34%

|

|

|

2004

origination and earlier

|

30%

|

Cash

out

refi

|

43%

|

|

|

Rate-term

refi

|

22%

|

|||

|

Wtd

avg

original LTV

|

75%

|

|

|

|

|

Original

LTV:

0 - 50

|

4%

|

Full

doc

|

17%

|

|

|

Original

LTV:

50 - 60

|

6%

|

No

doc

|

1%

|

|

|

Original

LTV:

60 - 70

|

16%

|

Other

(limited, etc)

|

74%

|

|

|

Original

LTV:

70 - 80

|

61%

|

Unknown/not

categorized

|

8%

|

|

|

Original

LTV:

80 - 90

|

9%

|

|

|

|

|

Original

LTV:

90 - 100

|

3%

|

2-4

family

|

4%

|

|

|

Condo

|

11%

|

|||

|

Single

family

|

85%

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

31

|

|

Residential

Real Estate Securities

|

|

RWT

Subprime Securities

|

|

Portfolio

Composition by Rating and Vintage

|

|

as

of June

30, 2007

|

|

(by

market

value, $ in millions)

|

|

|

<=2004

|

2005

|

2006

|

2007

|

Grand

Total

|

|

IGS

|

|

|

|

|

|

|

AAA

|

$

-

|

$5

|

$9

|

$

-

|

$14

|

|

AA

|

43

|

57

|

25

|

29

|

154

|

|

A

|

95

|

27

|

13

|

15

|

149

|

|

BBB+

|

36

|

-

|

39

|

9

|

85

|

|

BBB

|

-

|

-

|

8

|

6

|

15

|

|

BBB-

|

-

|

-

|

10

|

10

|

20

|

|

IGS

Total

|

$174

|

$88

|

$106

|

$70

|

$438

|

|

CES

|

|

|

|

|

|

|

BB

|

-

|

-

|

1

|

2

|

3

|

|

CES

Total

|

$

-

|

$

-

|

$1

|

$2

|

$3

|

|

OREI

|

|

|

|

|

|

|

Resid

|

-

|

-

|

2

|

-

|

2

|

|

NIM

|

-

|

-

|

-

|

13

|

13

|

|

OREI

Total

|

$

-

|

$

-

|

$2

|

$13

|

$15

|

|

Total

|

$174

|

$88

|

$109

|

$85

|

$456

|

|

32

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

33

|

|

Residential

Real Estate Securities

|

|

|

7/10

|

7/13

|

7/19

|

|

|

|

1st

Lien

|

1st

Lien

|

2nd

Lien

|

|

|

|

Moodys

|

S&P

|

S&P

|

Total

|

|

Total

Activity

|

|

|

|

|

|

Negative

Watch

|

32

|

26

|

0

|

58

|

|

Downgraded

|

399

|

498

|

418

|

1315

|

|

Redwood

Exposure

|

|

|

|

|

|

Negative

Watch

|

1

|

0

|

0

|

1

|

|

Downgrade

|

2

|

2

|

2

|

6*

|

|

*

The

same two bonds were downgraded by Moodys and by S&P (7/13). Redwood

had a total of four bonds downgraded and one placed on negative

watch

|

||||

|

34

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Securities

|

|

Residential

|

|

RWT

Residential Subprime Securities

|

|

Activity

|

|

as

of June

30, 2007

|

|

(by

market

value, $ in millions)

|

|

IGS

|

CES

|

OREI

|

Total

|

|

|

Market

Value 3/31/07

|

$471

|

$9

|

$20

|

$500

|

|

Acquisitions

|

47

|

-

|

-

|

47

|

|

Sales

|

(49)

|

-

|

-

|

(49)

|

|

Principal

payments

|

(16)

|

(1)

|

(4)

|

(21)

|

|

Discount

/

(premium) amortization

|

1

|

-

|

1

|

2

|

|

Net

mark-to-market adjustment

|

(17)

|

(5)

|

-

|

(22)

|

|

Market

Value 6/30/07

|

$438

|

$3

|

$17

|

$457

|

|

RWT

Residential CES Subprime Securities

|

|

Underlying

Loan Characteristics

|

|

as

of June

30, 2007

|

|

Number

of

loans

|

23,662

|

Wtd

avg

FICO

|

640

|

|

|

Total

loan

face ($ in millions)

|

3,436

|

FICO:

<=

620

|

36%

|

|

|

Average

loan

size ($ in 1000's)

|

145

|

FICO:

621 -

660

|

29%

|

|

|

|

FICO:

661 -

700

|

19%

|

||

|

Southern

CA

|

19%

|

FICO:

701 -

740

|

10%

|

|

|

Northern

CA

|

14%

|

FICO:

>

740

|

6%

|

|

|

Florida

|

12%

|

Unknown

|

0%

|

|

|

New

York

|

4%

|

|||

|

Georgia

|

1%

|

Conforming

at

origination %

|

77%

|

|

|

New

Jersey

|

3%

|

>

$1

MM

%

|

0%

|

|

|

Other

states

|

47%

|

|

||

|

2nd

Home

%

|

2%

|

|||

|

2007

origination

|

1%

|

Investment

Home %

|

9%

|

|

|

2006

origination

|

98%

|

|

||

|

2005

origination

|

0%

|

Purchase

|

52%

|

|

|

2004

origination and earlier

|

0%

|

|

Cash

out

refi

|

44%

|

|

Rate-term

refi

|

4%

|

|||

|

Wtd

avg

original LTV

|

69%

|

|

||

|

Original

LTV:

0 - 50

|

20%

|

Full

doc

|

50%

|

|

|

Original

LTV:

50 - 60

|

3%

|

No

doc

|

1%

|

|

|

Original

LTV:

60 - 70

|

6%

|

Other

(limited, etc)

|

49%

|

|

|

Original

LTV:

70 - 80

|

44%

|

Unknown/not

categorized

|

0%

|

|

|

Original

LTV:

80 - 90

|

22%

|

|

|

|

|

Original

LTV:

90 - 100

|

6%

|

2-4

family

|

8%

|

|

|

Condo

|

7%

|

|||

|

Single

family

|

85%

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

35

|

|

Residential

Real Estate Loans

|

| · |

Recently,

our

primary focus has been prime hybrids, as prime ARMs are out of favor

among

borrowers in the current yield environment. We purchased $675 million

residential loans this quarter. All our loans were prime-quality

loans at

origination.

|

| · |

Seriously

delinquent loans and credit losses on residential loans are increasing

due

to normal seasoning, but remain well below our initial

expectations.

|

| · |

Prepayment

speeds on our loan portfolio, consisting mostly of ARM loans, continued

to

be fast, prepaying at a CPR of nearly 37% for the second quarter.

|

| · |

We

completed

one securitization during the second quarter, financing $407 million

prime

hybrid mortgages and $654 million prime ARM mortgages and priced

another

Sequoia securitization that closed in July. We called one older Sequoia

securitization during the second quarter. Although we completed this

latest Sequoia transaction on overall favorable economic terms, in

general

the cost of financing loans through securitization has risen as market

spreads for ABS have widened.

|

| 36 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Loans

|

|

Residential

|

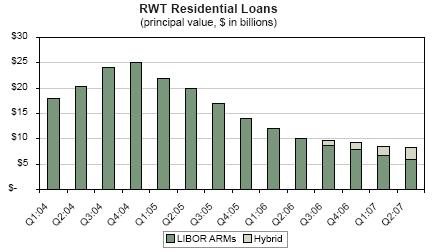

| Ø |

In

the second

quarter, our residential loan portfolio declined from $8.7 billion

to $8.4

billion. We acquired $675 million loans and sold $2 million seriously

delinquent loans. Principal pay downs were $1.0 billion. The average

CPR

was 37% for the second quarter versus 44% for all of 2006. Most of

these

loans are ARM loans that tend to prepay rapidly when the yield curve

is

flat or inverted.

|

| Ø |

Interest

income on our residential loans was $119 million in the second quarter,

a

decrease from $129 million in the previous quarter. This portfolio

yielded

5.79%. The yield in the previous quarter was 5.93%. The primary reason

for

the decrease in yields was an increase in the provision for credit

losses.

|

| Ø |

Premium

amortization expenses, a component of interest income, were $11 million

for the second quarter. We ended the second quarter with $8.3 billion

principal value of loans and a loan premium balance of $99 million

for an

average basis of 101.19% of principal value. For accounting reasons,

for

several years we have not been able to amortize premium expense balances

as quickly as the loans prepaid. If short-term interest rates decline,

under these accounting rules we would expect premium amortization

expenses

to increase significantly. Largely because premium amortization expenses

have not kept pace with prepayments in the past, we estimate the

book

value of residential loans exceeded their market value by $82 million

at

quarter-end.

|

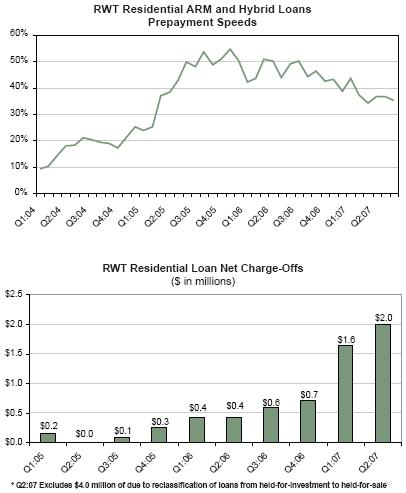

| Ø |

Net

charge-offs were $6 million for the second quarter. We reclassified

$13

million of seriously delinquent loans from held-for-investment to

held-for-sale. This increased our net charge-offs by $4 million and

reduced our credit reserve by $4 million. Adjusting for this

reclassification, net charge-offs would have otherwise been $2 million,

an

annual loss rate of ten basis points (0.10%) of the current loan

balances.

|

| Ø |

Cumulative

losses have been far lower than our original expectations. We expect

losses to continue to increase as loans season. Credit reserves for

this

portfolio were $16.4 million (or 0.20%) of current loan balances

at

quarter-end. In July, we had a recovery of $0.6 million of a previously

realized loss on a loan we were able to put back to the originator.

This

event will be reflected in our Q3 financial

statements.

|

| Ø |

The

balance

of seriously delinquent loans decreased from $69 million to $56 million

during the quarter, a decrease from 0.22% to 0.20% of original

balances, and a decrease from 0.80% to 0.67% of current balances.

|

| Ø |

At

the end of

the second quarter, $7.5 billion of residential loans were financed

via

Sequoia securitizations and $878 million were financed with Redwood

debt

and equity. As a result of the July Sequoia transaction, unsecuritized

whole loans at the end of July were $195

million.

|

| Ø |

Additional

information on our residential loans can be found in Tables 9, 10,

11, and

14 of the Appendix.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

37 |

|

Residential

Real Estate Loans

|

| 38 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Residential

Real Estate Loans

|

|

Residential

|

|

RWT

Residential Loan Portfolio

|

|

Activity

|

|

as

of June

30, 2007

|

|

(by

market

value, $ in millions)

|

|

Q207

|

Q107

|

Q206

|

||

|

Carrying

Value Beginning

|

|

$8,680

|

$9,324

|

$11,990

|

|

Acquisitions

|

|

675

|

415

|

273

|

|

Sales

|

|

(2)

|

-

|

-

|

|

Principal

Payments

|

|

(989)

|

(1,047)

|

(1,800)

|

|

Discount

/

(Premium) Amortization

|

|

(11)

|

(12)

|

(12)

|

|

Credit

provision

|

|

(3)

|

(2)

|

3

|

|

Net

charge-offs/(recoveries)

|

|

2

|

2

|

-

|

|

Carrying

Value Ending

|

|

$8,352

|

$8,680

|

$10,454

|

|

RWT

Residential Portfolio

|

|

Loan

Characteristics

|

|

as

of June

30, 2007

|

|

Number

of

loans

|

24,452

|

Wtd

Avg

FICO

|

732

|

|

|

Total

loan

face ($ in millions)

|

8,256

|

FICO:

<=

620

|

2%

|

|

|

Average

loan

size ($ in 1000's)

|

338

|

FICO:

621 -

660

|

5%

|

|

|

FICO:

661 -

700

|

19%

|

|||

|

Southern

CA

|

14%

|

FICO:

701 -

740

|

27%

|

|

|

Northern

CA

|

11%

|

FICO:

>

740

|

47%

|

|

|

Florida

|

12%

|

|||

|

New

York

|

6%

|

Conforming

at

origination %

|

35%

|

|

|

Georgia

|

4%

|

>

$1

MM

%

|

15%

|

|

|

New

Jersey

|

4%

|

|

|

|

|

Other

states

|

48%

|

2nd

home

%

|

11%

|

|

|

Investment

home %

|

3%

|

|||

|

2007

origination

|

11%

|

|

|

|

|

2006

origination

|

18%

|

Purchase

|

35%

|

|

|

2005

origination

|

5%

|

Cash

out

refi

|

31%

|

|

|

2004

origination and earlier

|

66%

|

Rate-term

refi

|

32%

|

|

|

Other

|

2%

|

|||

|

Wtd

avg

original LTV

|

68%

|

|

||

|

Original

LTV:

0 - 50

|

15%

|

Hybrid

|

28%

|

|

|

Original

LTV:

50 - 60

|

11%

|

Adjustable

|

71%

|

|

|

Original

LTV:

60 - 70

|

19%

|

Interest

Only

|

95%

|

|

|

Original

LTV:

70 - 80

|

47%

|

Fully-Amortizing

|

5%

|

|

|

Original

LTV:

80 - 90

|

2%

|

|||

|

Original

LTV:

90 - 100

|

5%

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

39 |

|

|

| 40 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Commercial

Real Estate Securities

|

|

Commercial

|

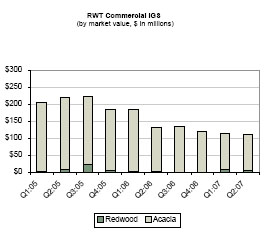

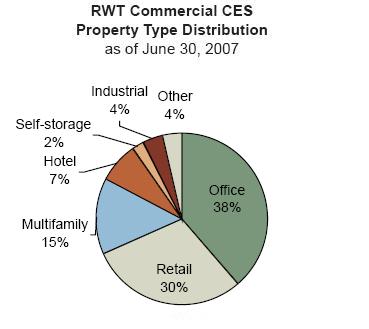

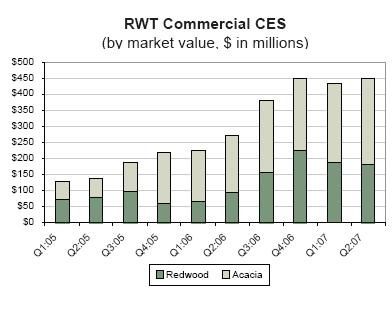

| · |

Total

commercial securities increased by 2% in the second quarter, from

$552

million to $562 million, as a result of $49 million acquisitions

and $39

million negative market value changes. Increases in interest rates

accounted for $12 million of these negative adjustments, which

were

largely offset by our use of interest rate derivatives. Less than

$1

million of the total market value decline was due to credit deterioration

on CES, which we expensed as impairments through our GAAP income

statement.

|

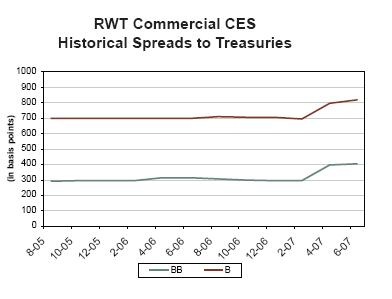

| · |

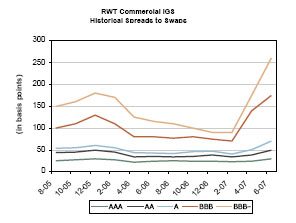

Turmoil

in

the CDO markets, as well as uncertainty surrounding credit rating

agency methodology changes, has caused spreads for commercial

securities to widen and asset prices to decline. Investor sentiment

in the

commercial capital markets has been clearly affected by defaults

and

credit rating downgrades in the residential subprime mortgage

sector.

|

| · |

Commercial

real estate fundamentals remain strong, with historically low

delinquencies across all major property types. Total serious delinquencies

in our commercial CES portfolio were $73 million, or 0.10% of the

$70

billion in loans that we

credit-enhance.

|

| · |

We

have

slowed the pace of our commercial CES acquisitions. We feel that

underwriting standards for late 2006 and 2007 vintage commercial

loans

became overly aggressive, and that yields on recent issue CES are

not

commensurate with this risk. Though spread widening and forthcoming

increases in subordination levels may make future commercial CES

attractive, we do not anticipate deploying capital in this sector

for the

remainder of the year.

|

| · |

We

continue

to analyze new investments, especially commercial IGS and seasoned

CES.

Our focus will remain on underwriting quality and attractive pricing

levels. We anticipate using CRE CDO financing to efficiently match-fund

our investments once the CDO market

stabilizes.

|

| · |

Our

near-term

objectives are to enhance our surveillance capabilities and to

build an

asset management business. Our long-term strategy is to establish

a

vertically integrated commercial real estate platform, enabling

us to

invest across a broader range of commercial product types. Though

this

will take time, we believe it will establish Redwood’s position as a

strong long-term competitor in the commercial real estate

markets.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

41 |

|

Commercial

Real Estate Securities

|

|

|

|

|

| 42 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Commercial

Real Estate Securities

|

|

Commercial

|

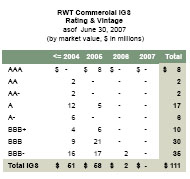

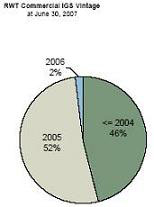

| Ø |

Our

commercial IGS declined by $5 million (or 4%) to $111 million in

the

second quarter. This decrease was due to negative market value changes.

There were no purchases or sales during the quarter.

|

| Ø |

Interest

income generated by commercial IGS was $2 million for the second

quarter.

The yield for the quarter was 6.18%, an increase from 6.14% in the

previous quarter.

|

| Ø |

The

market

value decline of $5 million in commercial IGS was largely the result

of

credit spread widening in BBB-rated securities, reflecting increased

supply of CMBS amidst credit concerns across all mortgage ABS

sectors.

|

| Ø |

We

are

exploring opportunities to take on synthetic exposure with derivatives

that reference commercial IGS collateral. Through synthetic technology,

we

can seek out exposure to seasoned vintages that are not otherwise

available.

|

| Ø |

We

have never

incurred a principal loss on any commercial IGS. We do not maintain

GAAP

credit reserves against our commercial IGS, since we expect external

credit-enhancement (primarily structural credit subordination) to

protect

our investments from principal losses.

|

| Ø |

The

interest

rate characteristics of commercial IGS were 80% fixed-rate and 20%

adjustable-rate. We use interest rate agreements to reduce interest

rate

mismatches that may occur between assets and their associated liabilities.

Interest rate agreements offset $1 million, or 25%, of the market

value

declines on commercial IGS during the

quarter.

|

| Ø |

At

June 30,

2007, 95% of our commercial IGS were financed via our Acacia CDO

program.

|

| Ø |

Additional

information on this portfolio can be found in Tables 9, 10, and 18

of the

Appendix.

|

|

The

Redwood

Review

2nd

Quarter

2007

|

|

43 |

|

Commercial

Real Estate Securities

|

|

|

|

|

|

|

|

| 44 |

|

The

Redwood

Review

2nd

Quarter

2007

|

|

Commercial

Real Estate Securities

|

|

Commercial

|

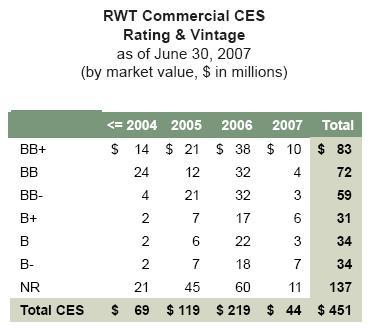

| Ø |

Our

commercial CES increased by $15 million (or 4%) in the second quarter

to

$451 million. Acquisitions were $49 million and market value declines

were

$34 million. There were no sales during the

quarter.

|

| Ø |

The

market

value of our commercial CES declined by $34 million during the second

quarter. Approximately $12 million of this decline was due to increases

in

interest rates, which was largely offset through our use of interest

rate

swaps. The remaining $22 million decline was due to widening credit

spreads amidst declining market liquidity.

|

| Ø |

Of

the $34

million in total market value decline, $33 million was unrealized

and

recorded on our balance sheet, as the underlying credit performance

of

these securities remains strong. The remaining $1 million was recorded

as

an impairment to our income statement during the second

quarter.

|

| Ø |

Interest

income generated by commercial CES was $11 million for the second

quarter.

The yield for the quarter was 9.75%, an increase from 9.52% in the

previous quarter. The level of current yield we recognize on these

assets

is largely a function of the amount and timing of our future credit

loss

assumptions. All of our commercial CES pay fixed rate of

interest.

|

| Ø |

Seriously

delinquent loans underlying commercial CES were $73 million, a decrease

of

$5 million from the previous quarter. Of the $73 million in serious

delinquencies, $57 million are contained within one security that

we

deemed impaired during a prior period. We currently have a zero cost

basis

in this security, with no risk of future write-downs affecting our

GAAP

income statement.

|

| Ø |

There

were

$0.1 million in realized credit losses during the quarter. Credit

losses

on this portfolio to date total less than one basis point (0.01%).

|

| Ø |

Our

GAAP

credit reserves for commercial CES were $311 million ($11.17 per

share) at

June 30, 2007, or 0.44% of underlying loan balances. Total credit

reserves

increased by $26 million upon acquisition of new commercial CES during

the

second quarter, offset by reserve releases on seasoned CES totaling

$10

million.

|

| Ø |

Most

of our

commercial CES ($314 million or 70%) are in a second-loss or more

senior

position, and thus are protected from initial credit losses within

the

underlying loan pool. For the remaining $137 million of securities

that

are in a direct first-loss position, 42% share losses with other

CES

investors.

|

| Ø |

The

geographical distribution of our underlying loans is very diverse.

The top