|

||

|

|

|

|

The

Redwood Review

3rd

Quarter 2007

|

||

|

||

|

||

|

|

|

|

The

Redwood Review

3rd

Quarter 2007

|

||

|

||

|

Table

of Contents

|

|

Introduction

|

|

|

2

|

|

|

Shareholder

Letter

|

|

|

3

|

|

|

Quarterly

Overview

|

|

|

5

|

|

|

Mark-to-Market

Adjustments

|

|

|

12

|

|

|

|

|

|

|

|

|

Financial

and Business Modules

|

|

|

|

|

|

|

|

|

|

|

|

•

Financial

|

|

|

22

|

|

|

•

Residential

|

|

|

32

|

|

|

•

Commercial

|

|

|

54

|

|

|

•

CDO

|

|

|

61

|

|

|

•

Capital

and

Liquidity

|

|

|

66

|

|

|

•

Debt

|

|

|

68

|

|

|

•

ABS

Issued

|

|

|

70

|

|

|

|

|

|

|

|

|

Appendix

|

|

|

|

|

|

•

Glossary

|

|

|

76

|

|

|

•

Financial

Tables

|

|

|

83

|

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

1 |

|

Introduction

|

|

Quarter:

Year

|

GAAP

Earnings

per

Share

|

Core

Earnings

per

Share

|

Total

Taxable

Earnings

per

Share

|

Adjusted

Return

on

Equity

|

GAAP

Book

Value

per

Share

|

Core

Book

Value

per

Share

|

Total

Dividends

per

Share

|

|

Q3:05

|

$2.21

|

$1.22

|

$2.23

|

25%

|

$41.03

|

$36.30

|

$0.70

|

|

Q4:05

|

$1.68

|

$0.97

|

$1.65

|

19%

|

$37.20

|

$34.27

|

$3.70

|

|

Q1:06

|

$1.09

|

$1.16

|

$1.44

|

13%

|

$38.11

|

$34.90

|

$0.70

|

|

Q2:06

|

$1.20

|

$0.97

|

$1.91

|

14%

|

$39.13

|

$35.58

|

$0.70

|

|

Q3:06

|

$1.22

|

$1.20

|

$1.96

|

14%

|

$40.02

|

$36.38

|

$0.70

|

|

Q4:06

|

$1.32

|

$1.12

|

$1.45

|

15%

|

$37.51

|

$34.02

|

$3.70

|

|

Q1:07

|

$0.66

|

$1.08

|

$1.48

|

8%

|

$34.06

|

$34.29

|

$0.75

|

|

Q2:07

|

$0.41

|

$1.35

|

$1.66

|

5%

|

$31.50

|

$34.40

|

$0.75

|

|

Q3:07

|

($2.18)

|

$1.43

|

$1.74

|

(26%)

|

$5.32

|

$31.58

|

$0.75

|

| 2 |

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Shareholder

Letter

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

3 |

|

Shareholder

Letter

|

|

|

|

|

George

E.

Bull, III

|

Douglas

B.

Hansen

|

|

|

Chairman

and CEO

|

President

|

| 4 |

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Quarterly

Overview

|

|

Net

Liquidity Position

($

in millions)

|

|||||||

|

Sept.

30, 2007

|

June

30, 2007

|

||||||

|

|

|

|

|||||

|

Unrestricted

cash

|

|

$310

|

|

$83

|

|||

|

Unsecuritized

residential loans

|

6

|

888

|

|||||

|

AAA-rated

residential securities

|

45

|

|

168

|

|

|||

|

Liquid

assets

|

361

|

1,139

|

|||||

|

Repo

and CP borrowings

|

(39

|

) |

(849

|

) | |||

|

|

|

|

|||||

|

Net

Liquidity Position

|

|

$322

|

|

$290

|

|||

|

The

Redwood

Review

3rd

Quarter

2007

|

|

5 |

|

Quarterly

Overview

|

|

6

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Quarterly

Overview

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

7 |

|

Quarterly

Overview

|

|

8

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Quarterly

Overview

|

| l |

We

believe

the easiest way to evaluate our consolidated balance sheet

is by

separately analyzing Redwood and Acacia. By separating

Acacia from Redwood, the

following balance sheet more clearly highlights and provides

insight

into where the vast majority of Redwood’s capital is invested.

|

| l |

The

pro forma balance sheet below shows Redwood at September 30,

2007

excluding the assets and liabilities of Acacia

entities.

|

|

Pro

Forma Balance Sheet

Redwood

Excluding Acacia

as

of September 30, 2007

($

in millions)

|

||||

|

|

|

|||

|

Real

estate loans

|

|

$7,630

|

||

|

Real

estate securities

|

429

|

|||

|

Cash

and cash equivalents

|

310

|

|||

|

Total

earning assets

|

8,369

|

|||

|

Restricted

cash

|

14

|

|||

|

Other

assets

|

95

|

|||

|

Total

Assets

|

|

$8,478

|

||

|

Redwood

debt

|

$39

|

|||

|

Asset-backed

securities issued

|

7,500

|

|||

|

Subordinated

notes

|

150

|

|||

|

Other

liabilities

|

60

|

|||

|

Total

Liabilities

|

7,749

|

|||

|

Total

Stockholders’ Equity

|

729

|

|||

|

Total

Liabilities & Stockholders’ Equity

|

|

$8,478

|

||

|

The

preceding pro forma presentation is not a GAAP measurement.

The pro forma

information is reconciled to our GAAP consolidated

balance sheet on a

table presented on page 14 of this Redwood Review under

Mark-to-Market

Adjustments; Impact on Redwood. The purpose is to show

information about

Redwood’s balance sheet without any investment in Acacia entities

at

September 30,

2007.

|

||||

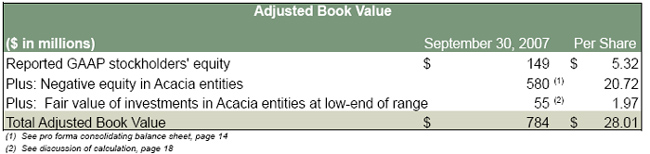

| l |

If

you valued our investment in Acacia entities at the low end

of the range

discussed on page 7 equaling $55 million, then our overall

adjusted book

value would be $784 million ($729 million plus $55 million).

Thus, 7% of

our capital is invested in Acacia entities and 93% is at

Redwood.

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

9 |

|

Quarterly

Overview

|

|

Pro

Forma Balance Sheet Information

Securities:

Underlying Collateral Type by Vintage

Redwood

Excluding Acacia

as

of September 30, 2007

($

in millions)

|

||||||||||||||||

|

|

|

|

|

|

|

|||||||||||

|

|

2004

& Earlier

|

2005

|

2006

|

2007

|

Total

|

|||||||||||

|

Residential

IGS

|

|

|

|

|

|

|||||||||||

|

Prime

|

$

|

2

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

2

|

||||||

|

Alt-a

|

-

|

-

|

-

|

46

|

46

|

|||||||||||

|

Subprime

|

1

|

-

|

-

|

12

|

13

|

|||||||||||

|

Residential

IGS

|

3

|

-

|

-

|

58

|

61

|

|||||||||||

|

Residential

CES

|

||||||||||||||||

|

Prime

|

77

|

24

|

13

|

18

|

132

|

|||||||||||

|

Alt-a

|

7

|

10

|

9

|

18

|

44

|

|||||||||||

|

Subprime

|

1

|

-

|

-

|

-

|

1

|

|||||||||||

|

Residential

CES

|

85

|

34

|

22

|

36

|

177

|

|||||||||||

|

Residential

OREI

|

2

|

-

|

17

|

5

|

24

|

|||||||||||

|

Commercial

IGS

|

1

|

-

|

-

|

-

|

1

|

|||||||||||

|

Commercial

CES

|

26

|

35

|

75

|

21

|

157

|

|||||||||||

|

CDO

IGS

|

2

|

-

|

1

|

3

|

6

|

|||||||||||

|

CDO

CES

|

1

|

-

|

-

|

2

|

3

|

|||||||||||

|

Totals

|

$

|

120

|

$

|

69

|

$

|

115

|

$

|

125

|

$

|

429

|

||||||

|

The

preceding pro forma presentation is not a GAAP measurement.

The pro forma

information is reconciled to our GAAP consolidated balance

sheet on a

table presented on page 14 of this Redwood Review under

Mark-to-Market

Adjustments, Impact on Redwood. The purpose is to show

information about

Redwood’s balance sheet excluding Acacia at September 30,

2007.

|

||||||||||||||||

| · |

All

of the securities are financed with capital, except for $45 million

of

residential IGS, which are funded with Redwood debt of $39 million

and

capital of $6 million. The total capital invested in real estate

securities is $390 million.

|

|

10

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Quarterly

Overview

|

| · |

Our

potential GAAP earnings upside from good credit performance can

be

estimated by referencing the size of our credit reserves. In

the event we

experience no future credit losses, our GAAP earnings would benefit

by the

amount of these credit reserves as these loans pay off. Our current

earnings incorporate these loss estimates, so income from the

reversal of

credit reserves would add to our current GAAP earnings run rate

(all other

factors being equal).

|

| · |

Our

investments incorporate a high degree of credit risk, so high

credit loss

rates would reduce GAAP earnings, taxable income, and

dividends.

|

| · |

The

following table shows the components comprising the carrying

value of our

residential prime and alt-a CES and our commercial CES at Redwood.

This

table does not include securities owned by

Acacia.

|

|

Pro

Forma Balance Sheet Information

Credit

Enhancement Securities

Redwood

Excluding Acacia

as

of September 30, 2007

($

in millions)

|

||||||||||

|

|

Residential

|

|

||||||||

|

|

||||||||||

|

|

Prime

|

Alt-a

|

Commercial

|

|||||||

|

Current

face

|

|

$417

|

|

$244

|

|

$500

|

||||

|

Unamortized

discount, net

|

(64

|

)

|

(9

|

)

|

(10

|

) | ||||

|

Discount

designated as credit reserve

|

(223

|

)

|

(159

|

)

|

(310

|

) | ||||

|

Amortized

cost

|

130

|

76

|

180

|

|||||||

|

Gross

unrealized market value gains

|

29

|

1

|

8

|

|||||||

|

Gross

unrealized market value losses

|

(27

|

)

|

(33

|

)

|

(31

|

) | ||||

|

Carrying

value

|

|

$132

|

|

$44

|

|

$157

|

||||

|

The

preceding pro forma presentation is not a GAAP measurement.

The pro forma

information is reconciled to our GAAP consolidated balance

sheet on a

table presented on page 14 of this Redwood Review under Mark-to-Market

Adjustments, Impact on Redwood. The purpose is to show information

about

Redwood’s balance sheet as if there was no investment in Acacia at

September 30,

2007.

|

||||||||||

|

The

Redwood

Review

3rd

Quarter

2007

|

|

11 |

|

Mark-to-Market

Adjustments

|

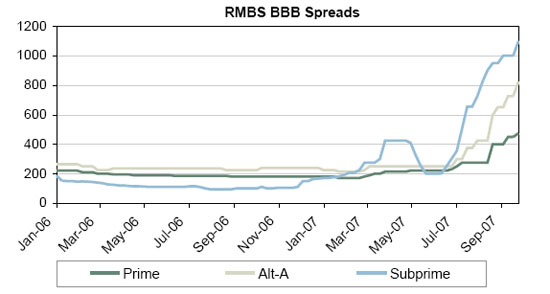

| Ø |

The

mortgage market faced adversity in the third quarter of 2007

as the

continued broad re-pricing of mortgage credit risk led to

a severe

contraction in market liquidity. The most dramatic price

adjustments

involved residential mortgage-backed securities (RMBS) and

CDO securities

backed by subprime and alt-a mortgages originated in 2006

and

2007.

|

| Ø |

We

believe several converging factors led to the broad re-pricing,

including

general concerns over the decline in home prices, the rapid

increase in

the number of delinquent subprime and alt-a loans, the reduced

willingness

of investors to acquire commercial paper backed by mortgage

collateral and

the resulting contraction in market liquidity and availability

of

financing lines, the numerous rating agency downgrades of

securities, and

an increase in the supply of securities potentially available

for sale.

|

| Ø |

The

downward spiraling of negative pricing adjustments on assets

had a

snowball effect as lower prices led to increased lender margin

calls for

some market participants, which in turn, forced additional

selling,

causing yet further declines in prices. These events continued

to feed off

each other through much of the quarter.

|

| Ø |

Normal

market trading activity during the quarter was unusually

light as

uncertainty related to future loss estimates made it difficult

for willing

buyers and sellers to agree on price. This condition is particularly

acute

with respect to RMBS and CDO securities backed by 2006 and

2007 subprime

and alt-a loans where market participants are setting price

levels based

on widely varied opinions about future loan performance and

loan loss

severity. While the early credit performance for these securities

has been

clearly far worse than initial expectations, the ultimate

level of

realized losses will largely be influenced by events that

will likely

unfold over the next 12 to 36 months, including the severity

of housing

price declines and the overall strength of the

economy.

|

| Ø |

The

actions taken late in the quarter by the Federal Reserve

to reduce the

federal funds and discount rates provided some temporary

market

confidence. We caution that Federal Reserve actions alone

are not likely

to result in price stability as the aforementioned market

concerns remain

largely unresolved. From the end of the third quarter through

the

beginning of November, prices for RMBS and CDO securities

continued to

decline, in particular for those securities backed by 2006

and 2007

subprime loans.

|

|

12

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Mark-to-Market

Adjustments

|

| Ø |

We

believe that, in the long run, the widening spreads (reduction

in asset

prices) will be advantageous to us as we are buying and will

continue to

buy high quality assets at more attractive prices than we have

seen in

recent years.

|

| Ø |

During

the quarter, we experienced no liquidity issues as all of our

credit-sensitive investments were financed with capital or through

our

Acacia securitization entities. Additionally, we only had a small

amount

of less credit sensitive assets borrowed on repo facilities.

Our cash

balances exceed our short-term

debt.

|

| Ø |

The

continued extensive price decline in real estate securities in

the third

quarter had a significant negative GAAP financial reporting impact

on

Redwood, as mark-to-market (MTM) adjustments to our real estate

securities

portfolio caused our GAAP book value and our GAAP earnings to

decline

significantly. We strongly believe that the real economic effect

of MTM is

significantly less than the impact shown under GAAP. The primary

reason

for the divergence between economics and GAAP is the accounting

treatment

required for our investments in Acacia

CDOs.

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

13 |

|

Mark-to-Market

Adjustments

|

| Ø |

As

a result of this accounting treatment, our investments in Acacia

CDO

entities, in which we have a net cash investment of $113 million,

are

carried in our reported GAAP consolidated statement of stockholders’

equity

as having $580 million of negative book value at September 30,

2007. (See

the consolidating balance sheet below). However, economically

this

investment cannot be worth less than zero, because in the worst

case, we

cannot lose more than the amount we invested. Nonetheless, GAAP

requires

us to prepare our financials in a manner that could cause readers

to

conclude that market values declined by more than we invested.

The debt of

Acacia is not an obligation of Redwood and we have not provided

Acacia

with any guarantees. Therefore, even if you assume that our investment

in

Acacia is worthless, our reported GAAP book value is understated

by $580

million. Furthermore, we believe that our investments in Acacia

have

positive value and will continue to generate cash flow. Our calculation

of

the present value of the future cash flows (adjusted for projected

credit

losses) from Acacia entities discounted at 45% and 14% range

from $55

million to $145 million. Due to the current market illiquidity

for CDO

equity, we would expect that the fair value of our Acacia investments

at

the end of the quarter to be on the lower end of the

range.

|

|

Pro

Forma Consolidating Balance Sheet

as

of September 30, 2007

($

in millions)

|

|||||||||||||

|

|

Redwood

Excluding Acacia

|

Acacia

|

Intercompany

|

Redwood

Consolidated

|

|||||||||

|

Real

estate loans

|

|

$7,630

|

|

$26

|

|

$0

|

|

$7,656

|

|||||

|

Real

estate & other securities

|

429

|

2,715

|

(113

|

)

|

3,031

|

||||||||

|

Cash

and cash equivalents

|

310

|

-

|

-

|

310

|

|||||||||

|

Total

earning assets

|

8,369

|

2,741

|

(113

|

)

|

10,997

|

||||||||

|

Restricted

cash

|

14

|

123

|

-

|

137

|

|||||||||

|

Other

assets

|

95

|

54

|

-

|

149

|

|||||||||

|

Total

Assets

|

|

$8,478

|

|

$2,918

|

($113

|

)

|

|

$11,283

|

|||||

|

Redwood

debt

|

|

$39

|

|

$0

|

|

$0

|

|

$39

|

|||||

|

Asset-backed

securities issued

|

7,500

|

3,416

|

(113

|

)

|

10,803

|

||||||||

|

Subordinated

notes

|

150

|

-

|

-

|

150

|

|||||||||

|

Other

liabilities

|

60

|

82

|

-

|

142

|

|||||||||

|

Total

Liabilities

|

7,749

|

3,498

|

(113

|

)

|

11,134

|

||||||||

|

Total

Stockholders’ Equity

|

729

|

(580

|

)

|

-

|

149

|

||||||||

|

Total

Liabilities & Stockholders’ Equity

|

|

$8,478

|

|

$2,918

|

($113

|

)

|

|

$11,283

|

|||||

|

The

purpose of this pro forma presentation is to show the

consolidating

components to our balance sheet and to highlight the

negative impact that

Acacia has on our consolidated stockholders’ equity at quarter end. The

Redwood excluding Acacia column reflects Redwood without

any investment in

Acacia entities. While the components reconcile to our

consolidated GAAP

balance sheet, this is a non-GAAP presentation. In a

GAAP presentation,

the Redwood excluding Acacia balance sheet shown above

would have

reflected an investment in Acacia and reflected the negative

equity of

Acacia.

|

|||||||||||||

| Ø |

Unless

RMBS and CDO securities prices recover from early November levels, we would be required to record

additional negative mark-to-market valuation adjustments in the

fourth

quarter. These adjustments could cause our GAAP stockholders’ equity at

December 31, 2007 to be negative. We are considering adopting

FAS 159 on

January 1, 2008, which would enable us to mark-to-market the

Acacia

liabilities. These rules would allow us to better conform our

GAAP

stockholders’ equity and what we believe economic reality to

be.

|

|

14

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Mark-to-Market

Adjustments

|

| Ø |

From

an income statement perspective, MTM adjustments reduced our

third quarter

earnings by $103 million, of which $85 million were related

to assets

owned by Acacia.

|

|

Pro Forma Consolidating

Income Statement

Three

Months Ended September 30, 2007

($

in millions)

|

||||||||||

|

Redwood

Excluding Acacia

|

Acacia

|

Redwood

Consolidated

|

||||||||

|

|

|

|

|

|||||||

|

Net interest income

|

$42

|

$12

|

$54

|

|||||||

|

Operating

expenses

|

(12

|

)

|

-

|

(12

|

)

|

|||||

|

Realized gains on sales and

calls,

net

|

2

|

-

|

2

|

|||||||

|

Market valuation adjustments,

net

|

(18

|

)

|

(85

|

)

|

(103

|

)

|

||||

|

Provision

for income taxes

taxes

|

(2

|

)

|

-

|

(2

|

)

|

|||||

|

|

||||||||||

|

Net Income

(Loss)

|

$12

|

($73

|

)

|

($61

|

)

|

|||||

|

Nine

Months Ended September 30, 2007

($

in millions)

|

||||||||||

|

|

Redwood

Excluding Acacia

|

Acacia

|

Redwood

Consolidated

|

|||||||

|

Net interest income

|

$120

|

$34

|

$154

|

|||||||

|

Operating expenses

|

(42

|

)

|

-

|

(42

|

) | |||||

|

Realized gains on sales and

calls,net

|

6

|

-

|

6

|

|||||||

|

Market valuation adjustments, net

|

(44

|

)

|

(98

|

)

|

(142

|

) | ||||

|

Provision

for income taxes

|

(7

|

)

|

-

|

(7

|

) | |||||

|

Net Income (Loss)

|

$33

|

($64

|

)

|

($31

|

) | |||||

|

The

purpose of this pro forma presentation is to show the consolidating

components to our income statement and to highlight the negative

impact

that Acacia had on our consolidated net loss for the three and

nine months

ended September 30, 2007. While components reconciled to our

consolidated

GAAP income statement, this is a non-GAAP presentation. In a

GAAP

presentation, the Redwood excluding Acacia income statement shown

above

would have reflected the loss from

Acacia.

|

||||||||||

|

The

Redwood

Review

3rd

Quarter

2007

|

|

15 |

|

Mark-to-Market

Adjustments

|

| Ø |

Total

MTM adjustments taken during the three and nine months ended

September 30,

2007 were $757 million and $969 million, respectively. The tables

below

show the breakdown of these MTM adjustments between Redwood and

Acacia.

They also detail the amounts that flowed through our income statement

and

stockholders’ equity.

|

|

Pro

Forma Balance Sheet and Income Statement Information

Mark-to-Market

Adjustments

Three

Months Ended September 30, 2007

($

in millions)

|

||||||||||

|

Redwood

Excluding Acacia

|

Acacia

|

Redwood

Consolidated

|

||||||||

|

|

|

|

|

|||||||

|

Balance

Sheet Impact

|

|

|

|

|||||||

|

Reduction

in stockholders' equity

|

($98

|

)

|

($556

|

)

|

($654

|

) | ||||

|

Income

Statement Impact

|

||||||||||

|

Market

Valuation adjustments

|

||||||||||

|

Impairment

valuation on AFS securities

|

(15

|

)

|

(68

|

)

|

(83

|

) | ||||

|

Fair

value adjustment on trading assets

|

(3

|

)

|

(17

|

)

|

(20

|

) | ||||

|

Total

income statement impact

|

(18

|

)

|

(85

|

)

|

(103

|

) | ||||

|

Total

Mark-to-Market Adjustments

|

($116

|

)

|

($641

|

)

|

($757

|

) | ||||

|

Nine

Months Ended September 30, 2007

($

in millions)

|

||||||||||

|

Redwood

Excluding Acacia

|

Acacia

|

Redwood

Consolidated

|

||||||||

|

Balance

Sheet Impact

|

|

|

|

|||||||

|

Reduction

in stockholders' equity

|

($132

|

)

|

($696

|

)

|

($828

|

)

|

||||

|

Income

Statement Impact

|

||||||||||

|

Market valuation

adjustments

|

||||||||||

|

Impairment

valuation on AFS securities

|

(28

|

)

|

(79

|

)

|

(107

|

)

|

||||

|

Fair

value adjustment on trading assets

|

(28

|

)

|

(79

|

)

|

(34

|

)

|

||||

|

Total

income statement impact

|

(43

|

)

|

(98

|

)

|

(141

|

)

|

||||

|

Total

Mark-to-Market Adjustments

|

($175

|

)

|

($794

|

)

|

($969

|

)

|

||||

|

The

purpose of this pro forma presentation is to show the consolidating

components for total mark-to-market adjustments for the three

and nine

months ended September 30, 2007. These mark-to-market adjustments

are

further detailed by the balance sheet (stockholders’ equity) and income

statement impact. This is a non-GAAP presentation. The total

stockholders’

equity impact of $654 million and $828 million for the three

and nine

months ended September 30, 2007, respectively, agree to our

consolidated

statement of comprehensive income for those periods. The

total income

statement impact of $103 million and $141 million for the

three and nine

month periods ended September 30, 2007, respectively, agree

to our

consolidated income statement for those

periods.

|

||||||||||

| Ø |

MTM

adjustments on securities can result from a decline in the economic

value

of the securities (i.e., increased credit loss estimates reduce

expected

future cash flows), or from changes in market discount rates

(i.e., the

market requires a greater risk premium and/or interest rates

rise), or a

combination of both. A summary of the accounting rules regarding

MTMs is

provided below.

|

| Ø |

If

the change

in fair value for available-for-sale securities (AFS) is due

solely to

changes in market discount rates, then the entire MTM adjustment

is flowed

through our balance sheet as an adjustment to stockholders’ equity. These

adjustments can go back and forth (positive or negative) from

period to

period.

|

|

16

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Mark-to-Market

Adjustments

|

| Ø |

If

the change

in fair value for AFS is accompanied by an adverse change in

projected

cash flows, then the entire MTM adjustment is flowed through

the income

statement. This is required even if the change in projected cash

flows is

small relative to the resulting MTM income statement charge.

We offer the

following example: Assume Redwood acquired a security for $100

and the

value of this acquisition was based on $150 of future expected

cash flows

discounted at 12%. If at the end of an accounting period, the

market value

of the security was $50 and that value was based on $149 of future

expected cash flows discounted at 25% (the prevailing market

rates), the

entire $50 change in value is considered “permanently impaired” for

accounting purposes. AFS deemed permanently impaired for accounting

purposes cannot be written back up through market valuation adjustments

in

our income statement. This does not mean the underlying security

could not

recover in economic or market value. If the economic value of

an impaired

security does recover, we would recognize this benefit through

higher

interest yields over time. It is often difficult to separate

with

precision how much of the change in fair value is driven by changes

in

expected cash flows versus changes in required market discount

rates, but

during periods of market illiquidity and uncertainty, the market

discount

rate component can be significant. Therefore, some of our securities

classified as permanently impaired for accounting purposes during

the

third quarter may eventually prove to have significant economic

value to

us.

|

| Ø |

All

changes

in fair value for trading securities or derivative instruments

flow

through the income statement. These adjustments can be either

positive or

negative from period to period.

|

| Ø |

The

table below details the total MTM adjustments by the underlying

collateral

type.

|

|

Total

Mark-To-Market Adjustments

|

||||||||||||||||

|

By

Underlying Collateral Type

|

||||||||||||||||

|

Three

Months Ended September 30, 2007

|

||||||||||||||||

|

($

in millions)

|

||||||||||||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

OREI

&

|

|

MTM

|

|||||||||||

|

|

IGS

|

CES

|

Derivatives

|

Total

|

Percent

(1)

|

|||||||||||

|

|

||||||||||||||||

|

Residential

|

||||||||||||||||

|

Prime

|

$

|

(82

|

)

|

$

|

(131

|

)

|

$

|

-

|

$

|

(213

|

)

|

(16

|

)%

|

|||

|

Alt-a

|

(197

|

)

|

(67

|

)

|

(13

|

)

|

(277

|

)

|

(22

|

)%

|

||||||

|

Subprime

|

(92

|

)

|

(11

|

)

|

(5

|

)

|

(108

|

)

|

(24

|

)%

|

||||||

| Residential total |

(371

|

)

|

(209

|

)

|

(18

|

)

|

(598

|

)

|

||||||||

|

|

||||||||||||||||

|

Commercial

|

(6

|

)

|

(56

|

)

|

-

|

(62

|

)

|

(11

|

)%

|

|||||||

|

CDO

|

(57

|

)

|

(9

|

)

|

-

|

(66

|

)

|

(26

|

)%

|

|||||||

|

Derivatives

|

-

|

-

|

(31

|

)

|

(31

|

)

|

||||||||||

|

|

||||||||||||||||

|

Total

mark-to-market adjustments

|

$

|

(434

|

)

|

$

|

(274

|

)

|

$

|

(49

|

)

|

$

|

(757

|

)

|

||||

|

Nine

Months Ended September 30, 2007

|

||||||||||||||||

|

($

in millions)

|

||||||||||||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

OREI

&

|

|

MTM

|

|||||||||||

|

|

IGS

|

CES

|

Derivatives

|

Total

|

Percent

(1)

|

|||||||||||

|

|

||||||||||||||||

|

Residential

|

||||||||||||||||

|

Prime

|

$

|

(100

|

)

|

$

|

(146

|

)

|

$

|

1

|

$

|

(245

|

)

|

(19

|

)%

|

|||

|

Alt-a

|

(234

|

)

|

(85

|

)

|

(28

|

)

|

(347

|

)

|

(29

|

)%

|

||||||

|

Subprime

|

(128

|

)

|

(18

|

)

|

(6

|

)

|

(152

|

)

|

(32

|

)%

|

||||||

| Residential total |

(462

|

)

|

(249

|

)

|

(33

|

)

|

(744

|

)

|

||||||||

|

|

||||||||||||||||

|

Commercial

|

(13

|

)

|

(101

|

)

|

-

|

(114

|

)

|

(20

|

)%

|

|||||||

|

CDO

|

(86

|

)

|

(11

|

)

|

-

|

(97

|

)

|

(36

|

)%

|

|||||||

|

Derivatives

|

-

|

-

|

(14

|

)

|

(14

|

)

|

||||||||||

|

|

|

|

|

|

|

|||||||||||

|

Total

mark-to-market adjustments

|

$

|

(561

|

)

|

$

|

(361

|

)

|

$

|

(47

|

)

|

$

|

(969

|

)

|

||||

|

(1)

This

percentage represents the MTMs taken as a percentage of the reported

market values at the beginning of the period, or purchase price

if

acquired during the period. It is intended to highlight the price

declines

by collateral type for the three and nine month periods ended

September

30, 2007. These price declines are for our specific portfolio

and may not

be indicative of price declines in the market in

general.

|

||||||||||||||||

|

The

Redwood

Review

3rd

Quarter

2007

|

|

17 |

|

Mark-to-Market

Adjustments

|

| Ø |

Under

our Acacia program we re-securitize real estate securities using

bankruptcy remote CDO entities that sell ABS (asset backed securities)

to

independent third-party debt investors. We typically retain an

equity

interest in the Acacia CDOs. This allows us to generate asset

management

fees and what we believe to be attractive assets for our portfolio.

Our

equity investments are entitled to the net cash flows (i.e.,

the net cash

flows generated by the assets after deducting the money owed

to the ABS

debt holders) of the Acacia entities. Our share of any credit

losses

generated by the underlying Acacia assets is capped for us at

the amount

of our net equity investment, with the remainder of losses borne

by the

ABS holders.

|

| Ø |

As

a hypothetical example, an Acacia CDO transaction might have

$300 million

of assets, $285 million of liabilities (ABS issued), and $15

million of

equity. If in any year the assets earned 6% or $18 million, and

the ABS

were paid interest of 5% or $14.25 million, our equity would

be entitled

to a distribution of $3.75 million in that year. In certain circumstances,

our equity cash distributions can be disrupted based on rating

agency

down-grades or due to a deterioration in collateral performance.

|

| Ø |

We

have ten Acacia CDO transactions outstanding. Our investment

in each of

these transactions are separate and independent, thus diminished

cash flow

generated by any one of our CDO equity investments would have

no effect on

our other CDO equity investments. During the three and nine months

ended

September 30, 2007, we collected $5.3 million and $14.6 million,

respectively, of cash flow distributions from our Acacia investments.

Currently, we are continuing to receive distributions from all

Acacias. We

are closely monitoring the four Acacia transactions issued since

August

2006 as further rating agency down-grades or further deterioration

in

collateral performance could disrupt cash distributions from

these Acacia

entities. During the three and nine months ended September 30,

2007, we

received cash distributions of $1.5 million and $3.4 million,

respectively, from these four Acacia entities (Acacia’s 10, 11, 12, and

option ARM).

|

| Ø |

We

believe the best measure of economic value for our Acacia equity

investment is the net present value of the future cash flow distributions,

though we would caution that in this environment it is particularly

difficult to predict future cash flows with much certainty given

the

potential for future rating agency down-grades and the uncertainties

around future credit performance and the problems in the housing

market

that we discussed above. Our calculation of the present value

of the

future cash flows (adjusted for projected credit losses) from

Acacia

entities discounted at 45% and 14% range from $55 million to

$145 million.

Due to the current market illiquidity for CDO equity, we would

expect that

the fair value of our Acacia investments to be on the lower end

of the

range rather than the higher end. Our initial cash investment

in these

Acacia transactions was $140 million. Cumulatively, we have received

cash

distributions of $27 million on our investments in these Acacia

entities.

In addition, we have received management fees of $8 million.

|

|

18

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Mark-to-Market

Adjustments

|

| Ø |

The

assets, liabilities, and earnings from the Acacia entities are

consolidated for GAAP purposes with Redwood. Over time, the economic

and

GAAP results of Acacia will be the same. However, there can be

interim

periods when GAAP and economic losses diverge significantly.

This results

from the fact that under GAAP we are not permitted to adjust

the carrying

values of our Acacia liabilities until actual losses are passed

through to

debt holders or the securitization is called (which may not occur

for a

significant period of time), but we are required to mark-to-market

all of

the Acacia assets on a quarterly basis. This GAAP accounting

treatment

resulted in the carrying value of Acacia to be negative $580

million.

However, since the economic value of our equity investment cannot

be less

than zero, our September 30, 2007 consolidated GAAP book value

of $149

million understates the value of Acacia by at least $580 million.

|

| Ø |

The

divergence between economic and accounting results,

is highlighted by Acacia OA (option ARM) in the table below. We made an

initial $14

million cash investment. We have already recognized $20 million

of losses

through the income statement ($6 million more than our investment).

In

addition we have further reduced stockholders’ equity by $149 million for

negative MTM adjustments. Thus, our $14 million investment, in

which our

maximum loss is $14 million, is carried at a $155 million negative

book

value on our consolidated balance sheet at September 30,

2007.

|

|

Acacia

Balance Sheets

|

||||||||||||||||||||||||||||||||||

|

as

of September 30, 2007

|

||||||||||||||||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

|

|||||||||||||||||||||||

|

|

5

|

6

|

7

|

8

|

CRE1

|

9

|

10

|

11

|

OA

|

12

|

Total

|

|||||||||||||||||||||||

|

Issue

Date

|

Jul-04

|

Nov-04

|

Mar-05

|

Jul-05

|

Dec-05

|

Mar-06

|

Aug-06

|

Feb-07

|

May-07

|

Jun-07

|

Acacia

|

|||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

|

Real

estate

investments

|

|

|||||||||||||||||||||||||||||||||

|

Current

face

|

$247

|

$283

|

$293

|

$288

|

$300

|

$301

|

$503

|

$499

|

$424

|

$484

|

$3,622

|

|||||||||||||||||||||||

|

Unamortized

discount, net

|

(6

|

)

|

(9

|

)

|

(8

|

)

|

(18

|

)

|

(32

|

)

|

(10

|

)

|

(43

|

)

|

(29

|

)

|

(5

|

)

|

(35

|

)

|

(195

|

)

|

||||||||||||

|

Designated

credit reserve

|

(2

|

)

|

(3

|

)

|

(2

|

)

|

(5

|

)

|

-

|

(3

|

)

|

(37

|

)

|

(32

|

)

|

-

|

(15

|

)

|

(99

|

)

|

||||||||||||||

|

Unrealized

(losses)

|

(26

|

)

|

(35

|

)

|

(33

|

)

|

(45

|

)

|

(41

|

)

|

(50

|

)

|

(88

|

)

|

(109

|

)

|

(149

|

)

|

(92

|

)

|

(668

|

)

|

||||||||||||

|

Other

investments

|

-

|

-

|

-

|

-

|

-

|

-

|

1

|

-

|

80

|

-

|

81

|

|||||||||||||||||||||||

|

Total

earning

assets

|

213

|

236

|

250

|

220

|

227

|

238

|

336

|

329

|

350

|

342

|

2,741

|

|||||||||||||||||||||||

|

Restricted

cash

|

17

|

15

|

18

|

12

|

6

|

6

|

5

|

5

|

14

|

25

|

123

|

|||||||||||||||||||||||

|

Other

assets

|

2

|

3

|

4

|

5

|

9

|

4

|

5

|

6

|

9

|

7

|

54

|

|||||||||||||||||||||||

|

Total

Assets

|

$232

|

$254

|

$272

|

$237

|

$242

|

$248

|

$346

|

$340

|

$373

|

$374

|

$2,918

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

ABS

issued

|

$242

|

$269

|

$279

|

$250

|

$262

|

$277

|

$412

|

$472

|

$495

|

$458

|

$3,416

|

|||||||||||||||||||||||

|

Other

liabilities

|

2

|

8

|

10

|

2

|

4

|

4

|

7

|

3

|

33

|

9

|

82

|

|||||||||||||||||||||||

|

Total

Liabilities

|

244

|

277

|

289

|

252

|

266

|

281

|

419

|

475

|

528

|

467

|

3,498

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Initial

investment

|

8

|

8

|

11

|

18

|

14

|

11

|

29

|

5

|

14

|

22

|

140

|

|||||||||||||||||||||||

|

Cummulative

Earnings

|

10

|

8

|

5

|

13

|

7

|

8

|

(6

|

)

|

(27

|

)

|

(20

|

)

|

(21

|

)

|

(23

|

)

|

||||||||||||||||||

|

Cummulative

Distributions

|

(6

|

)

|

(6

|

)

|

(3

|

)

|

(4

|

)

|

(2

|

)

|

(2

|

)

|

(3

|

)

|

(1

|

)

|

-

|

-

|

(27

|

)

|

||||||||||||||

|

OCI

|

(24

|

)

|

(33

|

)

|

(30

|

)

|

(42

|

)

|

(43

|

)

|

(50

|

)

|

(93

|

)

|

(112

|

)

|

(149

|

)

|

(94

|

)

|

(670

|

)

|

||||||||||||

|

Total

Equity

|

(12

|

)

|

(23

|

)

|

(17

|

)

|

(15

|

)

|

(24

|

)

|

(33

|

)

|

(73

|

)

|

(135

|

)

|

(155

|

)

|

(93

|

)

|

(580

|

)

|

||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Total

Liabilities & Equity

|

$232

|

$254

|

$272

|

$237

|

$242

|

$248

|

$346

|

$340

|

$373

|

$374

|

$2,918

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Summary

of

Cash Activity

|

||||||||||||||||||||||||||||||||||

|

Initial

Investment

|

($8

|

)

|

($8

|

)

|

($11

|

)

|

($18

|

)

|

($14

|

)

|

($11

|

)

|

($29

|

)

|

($5

|

)

|

($14

|

)

|

($22

|

)

|

($140

|

)

|

||||||||||||

|

Cash

received

*

|

6

|

6

|

3

|

4

|

2

|

2

|

3

|

1

|

-

|

-

|

27

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

Net

cash flow to date

|

($2

|

)

|

($2

|

)

|

($8

|

)

|

($14

|

)

|

($12

|

)

|

($9

|

)

|

($26

|

)

|

($4

|

)

|

($14

|

)

|

($22

|

)

|

($113

|

)

|

||||||||||||

|

The

Redwood

Review

3rd

Quarter

2007

|

|

19 |

|

Mark-to-Market

Adjustments

|

| Ø |

With

respect to the four Acacia transactions that currently concern

us, our net

cash investment as of September 30, 2007 was $66 million. From

a GAAP

income statement standpoint, we have already collectively recognized

losses of $74 million. Therefore, we have already effectively

taken $8

million of write-offs through the income statement in excess

of the

maximum loss value of these

investments.

|

| Ø |

On

January 1, 2008, FASB Statement No. 159, The Fair Value Option

for

Financial Assets and Financial Liabilities Including an Amendment

of FASB

Statement No. 115 (FAS 159) becomes effective. If adopted by

us, FAS 159

will enable us to mark-to-market the Acacia liabilities. We are

considering adopting FAS 159 for valuing the assets and liabilities

owned

by Acacia on January 1, 2008. These rules may allow us to better

conform

our book value and GAAP income results more closely to what we

believe

economic reality to be. However, we do not believe the new rules

will

address all of the related mark-to-market challenges and our

reported

numbers are likely to remain

volatile.

|

| Ø |

The

following table details Acacia’s exposure to different collateral types

owned by Acacia entities.

|

|

Acacia

Balance Sheet Information

|

||||||||||||||||||||||||||||||||||

|

Underlying

Collateral Type

|

||||||||||||||||||||||||||||||||||

|

as

of September 30, 2007

|

||||||||||||||||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

Acacia

|

|

|||||||||||||||||||||||

|

|

5

|

6

|

7

|

8

|

CRE1

|

9

|

10

|

11

|

OA

|

12

|

|

|||||||||||||||||||||||

|

Issue

Date

|

Jul-04

|

Nov-04

|

Mar-05

|

Jul-05

|

Dec-05

|

Mar-06

|

Aug-06

|

Feb-07

|

May-07

|

Jun-07

|

Total

|

|||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||

|

Resi

IGS

|

|

|||||||||||||||||||||||||||||||||

|

Prime

Sequoia

|

$15

|

$15

|

$11

|

$6

|

$1

|

$3

|

$4

|

$3

|

$8

|

$21

|

$87

|

|||||||||||||||||||||||

|

Prime

Other

|

43

|

57

|

73

|

77

|

52

|

133

|

115

|

52

|

9

|

60

|

671

|

|||||||||||||||||||||||

|

Alt-a

|

27

|

18

|

25

|

23

|

5

|

23

|

44

|

124

|

244

|

125

|

658

|

|||||||||||||||||||||||

|

Subprime

|

62

|

81

|

66

|

8

|

-

|

12

|

11

|

31

|

2

|

39

|

312

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

Resi

CES

|

||||||||||||||||||||||||||||||||||

|

Prime

Sequoia

|

3

|

5

|

4

|

7

|

-

|

2

|

5

|

-

|

-

|

-

|

26

|

|||||||||||||||||||||||

|

Prime

Other

|

28

|

23

|

16

|

42

|

-

|

25

|

102

|

26

|

-

|

15

|

277

|

|||||||||||||||||||||||

|

Alt-a

|

1

|

6

|

3

|

16

|

-

|

3

|

3

|

25

|

-

|

10

|

67

|

|||||||||||||||||||||||

|

Subprime

|

-

|

-

|

-

|

-

|

-

|

-

|

5

|

4

|

-

|

3

|

12

|

|||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||

|

COMM

IGS

|

12

|

11

|

8

|

9

|

56

|

3

|

1

|

-

|

-

|

3

|

103

|

|||||||||||||||||||||||

|

COMM

CES

|

2

|

5

|

16

|

24

|

86

|

15

|

29

|

26

|

-

|

35

|

238

|

|||||||||||||||||||||||

|

COMM

Loans

|

4

|

-

|

9

|

4

|

9

|

-

|

-

|

-

|

-

|

-

|

26

|

|||||||||||||||||||||||

|

CDO:

CMBS

|

3

|

2

|

2

|

-

|

18

|

12

|

10

|

20

|

7

|

9

|

83

|

|||||||||||||||||||||||

|

CDO:

RMBS

|

13

|

13

|

17

|

4

|

-

|

7

|

6

|

18

|

-

|

22

|

100

|

|||||||||||||||||||||||

|

GIC

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

80

|

-

|

80

|

|||||||||||||||||||||||

|

Other

|

-

|

-

|

-

|

-

|

-

|

-

|

1

|

-

|

-

|

-

|

1

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

Totals

|

$213

|

$236

|

$250

|

$220

|

$227

|

$238

|

$336

|

$329

|

$350

|

$342

|

$2,741

|

|||||||||||||||||||||||

| Ø |

Net interest income earned on Acacia’s 5-9, and Acacia CRE 1 was $7 million and $21 million, respectively, for the three

month and nine month periods ended September 30, 2007. After market valuation adjustments, on Acacia’s

5-9 and CRE 1 our net loss was $3 million and our net income was $9 million, respectively, for the three month and nine month periods ended September

30, 2007.

|

| Ø |

Net interest income earned on Acacia’s 10, 11, 12, and OA 1 was $5 million and $13 million, respectively, for the three

month and nine month periods ended September 30, 2007. Our net loss, after market valuation adjustments, on Acacia’s 10,

11, 12, and OA 1 was $70 million and $74 million, respectively, for the three month and nine month periods ended

September 30, 2007.

|

|

20

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Mark-to-Market

Adjustments

|

| Ø |

Our

fair market values reflect what we believe we could realize if

we chose to

sell our securities. However, most of our securities (in particular

our

CES and CDO investments) are generally illiquid. Consequently,

establishing fair market values for these securities is inherently

subjective and is dependent upon modeling assumptions and indications

of

value obtained from brokers or

dealers.

|

| Ø |

As

a consequence of limited trading visibility during the quarter

and the

significant uncertainties regarding credit loss levels, the fair

market

values underpinning our market valuation adjustments are based

on facts

that are far less certain than has historically been the case

in prior

periods. We expect that the market valuations will continue to

be highly

volatile over time.

|

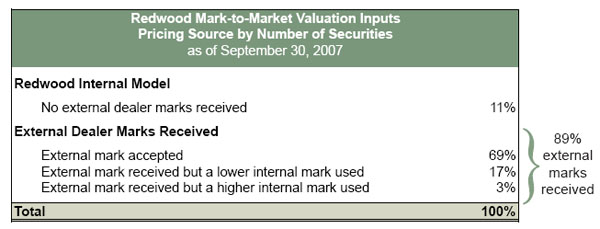

| Ø |

To

establish fair market values at September 30, 2007, we relied

heavily on

indications of value (marks) from dealers, and to a lesser extent,

on

values derived from our internal cash flow modeling. We received

third-party dealer marks on 89% of the number of securities reflected

on

our balance sheet, and with respect to the remaining 11% for

which we did

not receive third party dealer marks, we used our internal model

to

establish fair value.

|

| Ø |

We

compared all of the dealers’ marks to our internal model for

reasonableness. As a result of this process, we accepted some

of these

marks as an indication of fair value and rejected others. If

we rejected

the dealer mark, we used our internal model. The table below

details the

breakdown of internal and external inputs used.

|

| Ø |

In

only 3% of the cases in which we had a third-party dealer mark

did we

value securities above the dealer mark. For these 3%, the difference

between the lower dealer marks and our higher internal marks

was $9.6

million at September 30, 2007.

|

| Ø |

Our

internal pricing model calculates fair value based on the net

present

value of projected future cash flows of each individual security.

This

calculation is dependent on a number of assumptions including:

future

interest rates, prepayment rates, market discount rates, and

timing and

amount of future credit losses. The valuation parameters of these

models

are calibrated to what we believe are bid-side fair market

assumptions.

|

| Ø |

The

dealers we received marks from are active participants in the

capital

markets. However, it is likely that most of the dealer marks

we received

this period were based on their pricing models and not on actual

trade

information. Their indications of value are based on a variety

of

assumptions they do not share and may prove to be

inaccurate.

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

21 |

|

GAAP

Earnings and Core Earnings

|

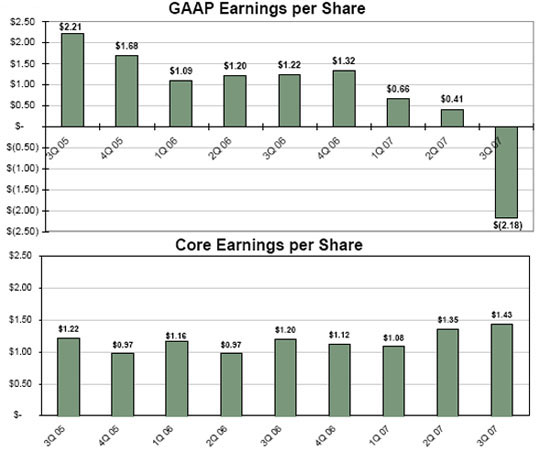

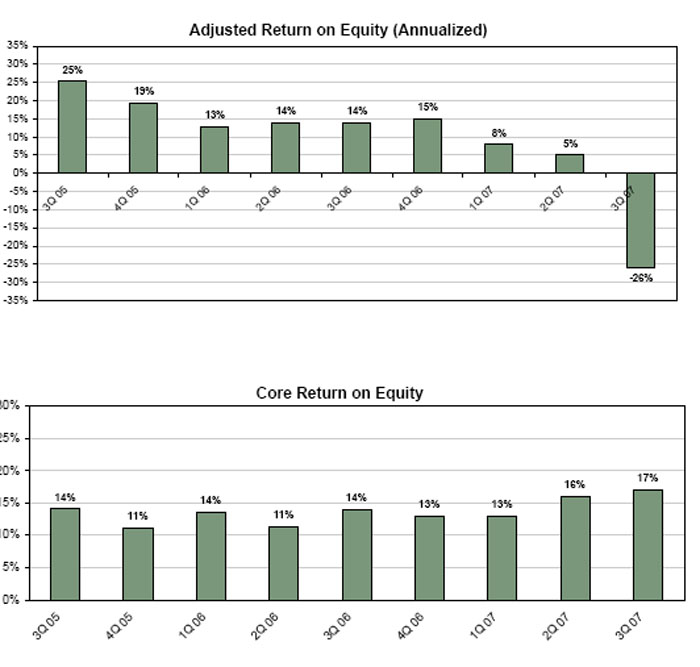

| Ø |

GAAP

loss per share for the third quarter of $2.18 per share was primarily

due

to $103 million negative unrealized mark-to-market valuation

adjustments.

Net interest income for the third quarter was

strong.

|

| Ø |

For

the past year and a half, quarterly core earnings have ranged

from $0.97

to $1.43 per share. Our third quarter core earnings of $1.43

per share

were at the top of this

range.

|

|

|

For

the Quarter Ended

|

|||||||||

|

GAAP

Earnings

|

Sep-07

|

Jun-07

|

Sep-06

|

|||||||

|

|

|

|||||||||

|

Net

interest

income

|

$53,594

|

$53,901

|

$48,976

|

|||||||

|

|

||||||||||

|

Operating

expenses

|

(11,732

|

)

|

(12,772

|

)

|

(13,455

|

)

|

||||

|

Gains

(losses) on sales

|

(1,460

|

)

|

1,428

|

4,967

|

||||||

|

Gains

(losses) on calls

|

3,284

|

1,310

|

723

|

|||||||

|

Valuation

adjustments, net

|

(102,766

|

)

|

(29,430

|

)

|

(5,257

|

)

|

||||

|

Provision

for

income taxes

|

(1,837

|

)

|

(3,021

|

)

|

(3,538

|

)

|

||||

|

|

||||||||||

|

GAAP

earnings (loss)

|

($60,917

|

)

|

$11,416

|

$32,416

|

||||||

|

|

||||||||||

|

GAAP

earnings

(loss) per share

|

$

(2.18

|

)

|

$

0.41

|

$

1.22

|

||||||

|

|

For

the Quarter Ended

|

|||||||||

|

Core

Earnings

|

Sep-07

|

Jun-07

|

Sep-06

|

|||||||

|

|

|

|||||||||

|

Net

interest

income

|

$53,594

|

$53,901

|

$48,976

|

|||||||

|

|

||||||||||

|

Operating

expenses

|

(11,732

|

)

|

(12,772

|

)

|

(13,455

|

)

|

||||

|

Gains

(losses) on sales

|

-

|

-

|

-

|

|||||||

|

Gains

(losses) on calls

|

-

|

-

|

-

|

|||||||

|

Valuation

adjustments, net

|

-

|

-

|

-

|

|||||||

|

Provision

for

income taxes

|

(1,837

|

)

|

(3,021

|

)

|

(3,538

|

)

|

||||

|

|

||||||||||

|

Core

earnings (loss)

|

$40,025

|

$38,108

|

$31,983

|

|||||||

|

|

||||||||||

|

Core

earnings

(loss) per share

|

$

1.43

|

$

1.35

|

$

1.20

|

|||||||

|

22

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

GAAP

Earnings and Core

Earnings

|

|

Financial

|

| Ø |

Net

interest income for the third quarter of 2007 was similar to

net interest

income in the second quarter of 2007 and $5 million higher

than the third

quarter of 2006. Higher net interest income earnings from our

securities

more than offset a decrease in net interest income from a decline

in

balance of the consolidated residential loan portfolio. The

average

balance of this residential loan portfolio continued to decline

due to

high prepayments on adjustable-rate residential loans acquired

and

securitized under our Sequoia

program.

|

| Ø |

Our

residential CES portfolio continues to benefit from strong credit

performance and from rapid prepayments on securities backed by

ARM loans.

The yield for the residential CES portfolio was 22% in the third

quarter

of 2007, 24% in the second quarter of 2007, and 22% in the third

quarter

of 2006. Prepayments have slowed by quarter end, which may lower

yields

going forward.

|

| Ø |

Operating

expenses in the third quarter of 2007 were $1 million lower than

the

second quarter of 2007 and $2 million lower in comparison to

third quarter

of last year. The primary reason for this decline was lower bonus

accruals.

|

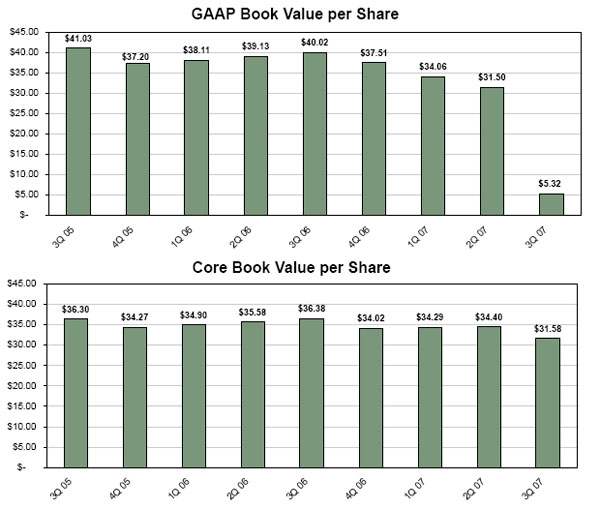

| Ø |

The

largest factor causing a decline in our GAAP earnings was $103

million of

negative unrealized mark-to-market (MTM) valuation adjustments.

These

negative adjustments were $73 million greater than the second

quarter of

2007 and $98 million greater than the third quarter of 2006.

The decrease

in fair value reflects the overall market decline in prices for

real

estate securities (particularly, securities backed by subprime

and low

quality alt-a loans) that occurred during the third quarter of

2007. Of

the $103 million income statement MTM write-downs taken during

the third

quarter, $83 million were impairments as defined by GAAP and

$20 million

were changes in fair value on assets accounted for as trading

investments.

|

|

The

Redwood

Review

3rd

Quarter

2007

|

|

23 |

|

Taxable

Income

|

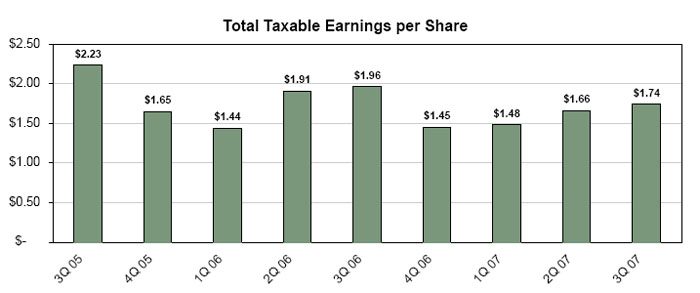

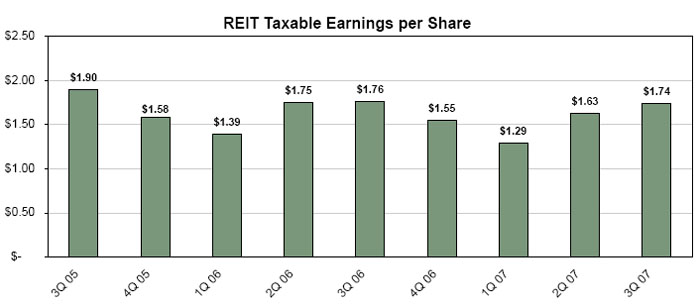

| · |

Total

taxable income for the third quarter of 2007 was strong at $1.74

per

share, an increase from the prior quarter due to continued strong

performance with relatively few credit losses on our

investments.

|

| · |

REIT

taxable income remained strong at $1.74 per share and continues

to exceed

our regular quarterly dividend by a comfortable

margin.

|

| 24 |

|

The

Redwood

Review

3rd

Quarter

2007

|

|

Taxable

Income

|

|

Financial

|

| Ø |

Total

taxable income was $49 million, or $1.74 per share, in the third

quarter

of 2007. This was an increase from the total taxable income we

generated

in the prior quarter of $46 million, or $1.66 per share. The

increase was

due to the continued strong performance with relatively few credit

losses

on our investments.

|

| Ø |

Our

REIT taxable income was $1.74 per share in the third quarter

of 2007. This