|

|

|

|

|

TABLE

OF CONTENTS

|

|

Introduction

|

2

|

|||

|

Shareholder

Letter

|

3

|

|||

|

Quarterly

Overview

|

4

|

|||

|

Financial

Insights

|

8

|

|||

|

Financial

& Investments Modules

|

||||

|

Financial

|

13

|

|||

|

-

GAAP Income

& Core Earnings

|

13

|

|||

|

-

Taxable

Income

|

17

|

|||

|

-

Capital

& Liquidity

|

19

|

|||

|

-

Dividends

|

21

|

|||

|

Mark-to-Market

Adjustments

|

23

|

|||

|

Residential

Real Estate Securities

|

28

|

|||

|

Commercial

Real Estate Securities

|

39

|

|||

|

CDO

Securities

|

42

|

|||

|

Investments

in Sequoia

|

43

|

|||

|

Investments

in Acacia

|

47

|

|||

|

Appendix

|

||||

|

Accounting

Discussion

|

54

|

|||

|

Glossary

|

57

|

|||

|

Financial

Tables

|

65

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

1

|

|

|

|

|

INTRODUCTION

|

|

Quarter:

Year

|

GAAP

Income per Share |

Core

Earnings per Share |

Total

Taxable Earnings per

Share |

Adjusted

Return on Equity |

GAAP

Book

Value per Share |

Core

Book

Value per Share |

Total

Dividends per Share |

|

Q106

|

$1.09

|

$1.16

|

$1.44

|

13%

|

$38.11

|

$34.90

|

$0.70

|

|

Q206

|

$1.20

|

$0.97

|

$1.91

|

14%

|

$39.13

|

$35.58

|

$0.70

|

|

Q306

|

$1.22

|

$1.20

|

$1.96

|

14%

|

$40.02

|

$36.38

|

$0.70

|

|

Q406

|

$1.32

|

$1.12

|

$1.45

|

15%

|

$37.51

|

$34.02

|

$3.70

|

|

Q107

|

$0.66

|

$1.08

|

$1.48

|

8%

|

$34.06

|

$34.29

|

$0.75

|

|

Q207

|

$0.41

|

$1.35

|

$1.66

|

5%

|

$31.50

|

$34.40

|

$0.75

|

|

Q307

|

($2.18)

|

$1.43

|

$1.74

|

(26%)

|

$5.32

|

$31.58

|

$0.75

|

|

Q407*

|

($36.49)

|

$1.21

|

$0.91

|

(610%)

|

$23.18

|

$26.24

|

$2.75

|

|

Q108

|

($5.28)

|

$0.68**

|

$0.79

|

(83%)

|

$17.89

|

$20.74

|

$0.75

|

|

*

The book

values per share are after giving retroactive effect to the adoption

of

FAS 159 on January 1, 2008. Without giving retroactive effect to

FAS 159,

the GAAP book value per share and core book value per share were

a

negative $22.18 and a negative $4.46, respectively.

|

|

**

Core

earnings for this quarter are not directly comparable to core earnings

for

prior periods due to the adoption of FAS

159.

|

|

2

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

SHAREHOLDER

LETTER

|

|

|

|||

|

George

E.

Bull, II

|

Douglas

B.

Hansen

|

|||

|

Chairman

and CEO

|

President

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

3

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

4

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

5

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

6

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

|

|||

|

Martin

S.

Hughes

|

Brett

D.

Nicholas

|

|||

|

Chief

Financial Officer

Co-Chief

Operating Officer

|

Chief

Investment Officer

Co-Chief

Operating Officer

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

7

|

|

|

|

|

FINANCIAL

INSIGHTS

|

| ► |

The

following

supplemental non-GAAP balance sheet presents our assets and

liabilities as

calculated under GAAP and as adjusted to reflect our estimate

of economic

value. We show our investments in the Sequoia and Acacia securitization

entities in separate line items, similar to the equity method

of

accounting, reflecting the reality that the underlying assets

and

liabilities owned by these entities are legally not ours. We

own only the

securities that we have acquired from these entities. This

table, except

for our estimates of economic value, is derived from

the consolidating balance sheet presented on page 11.

|

|

Components

of Book Value

|

|||||||||

|

March

31, 2008

|

|||||||||

|

($

in millions, except per share data)

|

|||||||||

|

|

Management’s

Estimated

Economic

|

|||||||||

|

As

Reported

|

Adj

|

Value

|

||||||||

|

Real

estate

securities (excluding Sequoia and Acacia)

|

||||||||||

|

Residential

|

$

|

$126

|

$

|

126

|

||||||

|

Commercial

|

100

|

100

|

||||||||

|

CDO

|

42

|

42

|

||||||||

|

Subtotal

real

estate securities

|

268

|

268

|

||||||||

|

Cash

and cash

equivalents

|

257

|

257

|

||||||||

|

Investments

in

Sequoia

|

146

|

(54

|

)(a)

|

92

|

||||||

|

Investments

in

Acacia

|

68

|

(19

|

)(b)

|

49

|

||||||

|

Other

assets/liabilities, net (d)

|

(4

|

)

|

|

(4

|

)

|

|||||

|

Subordinated

notes

|

(150

|

)

|

78

|

(c) |

(72

|

)

|

||||

|

Stockholders'

Equity

|

$

|

585

|

$

|

590

|

||||||

|

Book

Value Per Share

|

$

|

17.89

|

$

|

18.04

|

||||||

| (a) |

Our

actual Sequoia investments consist of CES, IGS, and IOs acquired

by

Redwood from the Sequoia entities. We calculated the $92 million

estimate

of economic value for these securities using the same valuation

process

that we followed to fair value all other real estate securities.

In

contrast, the $146 million of GAAP carrying value of these investments

represents the difference between residential real estate loans

owned by

the Sequoia entities and the asset-backed securities (ABS) issued

by those

entities to third party investors. We account for these loans

and ABS

issued at cost, not at fair value. This is the primary reason

for the $54

million disparity between the GAAP carrying value and our estimate

of

economic value.

|

| (b) |

Our

actual Acacia investments consist of equity interests, and to

a lesser

extent ABS issued, that we acquired from the Acacia entities.

The $49

million estimate of economic value of our investment interests

in the

Acacia entities represents the net present value of projected

cash flows

from our Acacia investments and management fees discounted at

45%, except

for the CDO ABS that we recently repurchased at substantial discounts

from

face value, which are valued at cost. The reason for the difference

between economic and GAAP carrying values is complex and relates

to a

significant difference in valuation methodology. This difference

is

discussed in detail in the Investments in Acacia section in this

Review.

|

| (c) |

We

have

issued $150 million of 30-year subordinated notes at an interest

rate of

LIBOR plus 225 basis points. Under GAAP, these notes are carried

at cost.

Economic value is difficult to estimate with precision as the

market of

the notes is currently inactive. We estimated the $72 million

economic

value using the same valuation process used to fair value our

other

financial assets and liabilities. Estimated economic value is

$78 million

lower than our GAAP carrying value because given the significant

overall

contraction in credit availability and re-pricing of credit risk,

if we

had issued these subordinated notes at March 31, 2008, investors

would

have required a substantially higher interest rate.

|

| (d) |

Other

assets/liabilities, net are comprised of real estate loans of

$5 million,

restricted cash of $11 million, and other assets of $24 million,

less

Redwood debt of $2 million, dividend payable of $25 million,

and other

liabilities of $17

million.

|

|

8

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

| ► |

Total

real

estate securities (excluding our investments in Sequoia and Acacia)

were

$268 million at March 31, 2008, of which $232 million were held

at Redwood

and $36 million were held in the Opportunity Fund.

|

| ► |

The

table

below provides product type and vintage information regarding

the $232

million of securities at Redwood at March 31, 2008.

|

|

Real

Estate Securities at Redwood

|

||||||||||||||||||

|

Excludes

Investments in Sequoia and Acacia and Securities at Opportunity

Fund

|

||||||||||||||||||

|

March

31, 2008

|

||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||

|

|

2004

&

|

|

|

|

|

|

|||||||||||||

|

|

Earlier

|

2005

|

2006

|

2007

|

2008

|

Total

|

|||||||||||||

|

Residential

|

|||||||||||||||||||

|

Prime

|

|||||||||||||||||||

|

IGS

|

$

|

4

|

$

|

1

|

$

|

9

|

$

|

-

|

$

|

6

|

$

|

20

|

|||||||

|

CES

|

48

|

15

|

5

|

8

|

2

|

78

|

|||||||||||||

|

Prime

Total

|

52

|

16

|

14

|

8

|

8

|

98

|

|||||||||||||

|

Alt-a

|

|||||||||||||||||||

|

IGS

|

-

|

-

|

1

|

4

|

-

|

5

|

|||||||||||||

|

CES

|

1

|

4

|

1

|

3

|

-

|

9

|

|||||||||||||

|

OREI

|

-

|

-

|

2

|

1

|

-

|

3

|

|||||||||||||

|

Alt-a

Total

|

1

|

4

|

4

|

8

|

-

|

17

|

|||||||||||||

|

Subprime

|

|||||||||||||||||||

|

IGS

|

1

|

-

|

-

|

-

|

-

|

1

|

|||||||||||||

|

CES

|

-

|

-

|

-

|

1

|

-

|

1

|

|||||||||||||

|

Subprime

Total

|

1

|

-

|

-

|

1

|

-

|

2

|

|||||||||||||

|

Residential

Total

|

$

|

54

|

$

|

20

|

$

|

18

|

$

|

17

|

$

|

8

|

$

|

117

|

|||||||

|

Commercial

CES

|

$

|

16

|

$

|

21

|

$

|

48

|

$

|

15

|

$

|

-

|

$

|

100

|

|||||||

|

CDO

IGS

|

$

|

7

|

$

|

7

|

$

|

-

|

$

|

1

|

$

|

-

|

$

|

15

|

|||||||

|

Total

at Redwood

|

$

|

77

|

$

|

48

|

$

|

66

|

$

|

33

|

$

|

8

|

$

|

232

|

|||||||

| ► |

In

the first

quarter, we acquired $38 million of securities for Redwood's

portfolio.

These included $10 million of prime residential credit-enhancement

securities (CES) and $28 million of prime residential investment

grade

securities (IGS). We acquired these securities at attractive

prices equal

to an average of 37% of face value.

|

| ► |

For

GAAP

balance sheet purposes, we are required to value securities using

bid-side

marks (an exit price). Bid/offer spreads are generally wide for

these

illiquid securities, and in today’s turbulent market, spreads are

particularly wide. We reduced the carrying (market) value of

the $38

million of our new investments by $11 million below our investment

cost at

March 31, 2008 primarily as a result of the bid/offer spread

difference.

|

| ► |

Over

80% of

our investments in real estate securities at March 31, 2008 were

residential and commercial CES. These securities bear most of

the credit

risk with respect to the underlying loans that were securitized.

We

acquire CES at a significant discount to principal value as credit

losses

could reduce or totally eliminate the principal value of these

bonds. Our

return on these investments is based on how much principal and

interest we

receive and how quickly we receive it. In an ideal environment

we would

experience fast prepayments and low credit losses allowing us

to recover a

substantial part of the discount as income. Conversely, in the

least

beneficial environment, we would experience slow prepayments

and high

credit losses.

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

9

|

|

|

|

|

FINANCIAL

INSIGHTS

|

| ► |

We

provide

additional discussion and analysis regarding the adequacy of

our credit

reserves and the potential earnings upside from an increase

in prepayments

in the residential and commercial real estate securities modules

that

follow.

|

| ► |

The

following

table presents the components of GAAP carrying value (which

equals fair

value determined in accordance with GAAP) for residential

and commercial

CES at Redwood.

|

|

Excludes

Investments in Sequoia and Acacia and Securities at Opportunity

Fund

|

||||||

|

March

31, 2008

|

||||||

|

($

in millions)

|

||||||

|

|

Residential

|

|

||||||||

|

|

Prime

|

Alt-a

|

Commercial

|

|||||||

|

Current

face

|

$

|

538

|

$

|

217

|

523

|

|||||

|

Unamortized

discount, net

|

(61

|

)

|

(1

|

) |

(37

|

)

|

||||

|

Discount

designated as credit reserve

|

(358

|

)

|

(205

|

)

|

(378

|

)

|

||||

|

Amortized

cost

|

119

|

11

|

108

|

|||||||

|

Unrealized

gains

|

3

|

0

|

2

|

|||||||

|

Unrealized

losses

|

(44

|

)

|

(2

|

)

|

(10

|

)

|

||||

|

Total

Carrying value of CES at Redwood

|

$

|

78

|

$

|

9

|

$

|

100

|

||||

|

Carrying

value as a percentage of face

|

14

|

%

|

4

|

%

|

19

|

%

|

||||

| ► | We also own $1 million subprime CES with a face value of $36 million. |

| ► |

The

table

below provides product type and vintage information regarding

the $36

million of securities held by the Opportunity Fund at March

31,

2008.

|

|

Securities

at Opportunity Fund

|

|||||||||

|

March

31, 2008

|

|||||||||

|

($

in millions)

|

|||||||||

|

|

2004

&

|

|

|

|||||||

|

|

Earlier

|

2005

|

Total

|

|||||||

|

Residential

Subprime IGS

|

$

|

9

|

$

|

-

|

$

|

9

|

||||

|

CDO

IGS

|

$

|

17

|

$

|

10

|

$

|

27

|

||||

|

Total

at Opportunity Fund

|

$

|

26

|

$

|

10

|

$

|

36

|

||||

| ► |

In

the first

quarter, we acquired $20 million of IGS for the Opportunity

Fund, which

included $12 million CDO IGS and $8 million in subprime IGS.

We acquired

these securities at an average price of 43% of face

value.

|

|

10

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

| ► |

GAAP

requires

us to produce a balance sheet that consolidates the assets

and liabilities

of the Sequoia and Acacia securitization entities (which

had a combined

$8.1 billion of assets and $7.9 billion of liabilities) even

though the

assets are owned by the securitization entities and the liabilities

are

obligations of the securitization entities payable only from

the cash

flows generated by the assets owned by the entities.

|

| ► |

The

table

below shows the consolidating components of our consolidated

balance sheet

at March 31, 2008. The purpose of this presentation is

to show the effect

each of the components had on our consolidated shareholders'

equity at

March 31, 2008. The Acacia and Sequoia components represent

investments and are not separate business

segments.

|

|

Consolidating

Balance Sheet

|

|

March

31, 2008

|

|

($

in millions)

|

|

Redwood

|

||||||||||||||||

|

and

|

Redwood

|

|||||||||||||||

|

Opportunity

Fund

|

Sequoia

|

Acacia

|

Intercompany

|

Consolidated

|

||||||||||||

|

Real

estate

loans

|

$

|

5

|

$

|

6,751

|

$

|

19

|

$

|

-

|

$

|

6,775

|

||||||

|

Real

estate

securities

|

268

|

-

|

1,014

|

(88

|

)

|

1,194

|

||||||||||

|

Non-real

estate investments

|

-

|

-

|

79

|

-

|

79

|

|||||||||||

|

Cash

and cash

equivalents

|

257

|

-

|

-

|

-

|

257

|

|||||||||||

|

Total

earning

assets

|

530

|

6,751

|

1,112

|

(88

|

)

|

8,305

|

||||||||||

|

Investment

in

Sequoia

|

146

|

-

|

-

|

(146

|

)

|

-

|

||||||||||

|

Investment

in

Acacia

|

68

|

-

|

-

|

(68

|

)

|

-

|

||||||||||

|

Other

assets

|

35

|

49

|

157

|

-

|

241

|

|||||||||||

|

Total

Assets

|

$

|

779

|

$

|

6,800

|

$

|

1,269

|

$

|

(302

|

)

|

$

|

8,546

|

|||||

|

Redwood

debt

|

$

|

2

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

2

|

||||||

|

Asset-backed

securities issued - Sequoia

|

-

|

6,632

|

-

|

(88

|

)

|

6,544

|

||||||||||

|

Asset-backed

securities issued - Acacia

|

-

|

-

|

1,046

|

-

|

1,046

|

|||||||||||

|

Other

liabilities

|

42

|

22

|

155

|

-

|

219

|

|||||||||||

|

Subordinated

notes

|

150

|

-

|

-

|

-

|

150

|

|||||||||||

|

Total

Liabilities

|

194

|

6,654

|

1,201

|

(88

|

)

|

7,961

|

||||||||||

|

Total

Stockholders’ Equity

|

585

|

146

|

68

|

(214

|

)

|

585

|

||||||||||

|

Total

Liabilities and Stockholders’ Equity

|

$

|

779

|

$

|

6,800

|

$

|

1,269

|

$

|

(302

|

)

|

$

|

8,546

|

|||||

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

11

|

|

|

|

|

FINANCIAL

INSIGHTS

|

| ► |

As

a

supplement to our Consolidated Statement of Cash Flows included

in our

Quarterly Report on Form 10-Q, we have included the table below

that

details the sources and uses of our cash for the first quarter.

This table

excludes the gross cash flows generated by our securitization

entities,

but does include the cash flow generated by our investments in

those

entities.

|

|

Redwood

|

||||

|

Sources

and Uses of Cash

|

||||

|

First

Quarter 2008 Activity

|

|

Sources:

|

||||

|

Cash

from

investments

|

$

|

70

|

||

|

Equity

raised

|

10

|

|||

|

Acacia

management fees

|

2

|

|||

|

3rd

party

funds (Opp Fund)

|

8

|

|||

|

Total

Sources

|

90

|

|||

|

Uses:

|

||||

|

Acquisitions

|

(65

|

)

|

||

|

Dividends

paid

|

(25

|

)

|

||

|

Operating

expenses paid

|

(15

|

)

|

||

|

Subordinated

notes interest expense

|

(3

|

)

|

||

|

Redwood debt

paydown

|

(6

|

)

|

||

|

Changes

in

working capital

|

(3

|

)

|

||

|

Restricted

cash held by Opp. Fund

|

(6

|

)

|

||

|

Total

Uses

|

(123

|

)

|

||

|

Net

Uses of Cash

|

$

|

(33

|

)

|

|

|

Beginning

Cash Balance at 12/31/07

|

$

|

290

|

||

|

Ending

Cash Balance at 03/31/08

|

$

|

257

|

| ► |

The

cash

generated by our investments is one of the financial metrics

on which we

focus. In the first quarter our investments generated cash

from principal

and interest payments of $70 million. The net investment

cash flow after

deducting subordinated note interest expense of $3 million

and cash

operating expenses of $15 million was $52 million.

|

| ► |

Our

investments at Redwood generated $40 million of cash,

and our direct

investments in Sequoia and Acacia generated $23 million

and $7 million of

cash, respectively.

|

| ► |

Other

sources

of cash included $10 million of equity sales

under our direct stock

purchase and dividend reinvestment plan, $2

million of management fees,

and $8 million from the Opportunity Fund’s third-party investors.

|

| ► |

The

primary

uses of cash this quarter were $65 million

for acquisitions and $25

million for the payment of

dividends.

|

|

12

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

GAAP

INCOME & CORE

EARNINGS

|

| ► |

The

GAAP loss

of $172 million for the first quarter, or $5.28 per share, was

primarily

due to $194 million ($5.96 per share) of negative market valuation

adjustments. Market valuation adjustments are discussed in detail

in the

Mark-to-Market Adjustments module later in this

Review.

|

| ► |

The

table

below provides a summary of our GAAP (loss) income for the first

quarter

of 2008, the fourth quarter of 2007, and the first quarter of

2007.

|

|

|

For

the Quarter Ended

|

|||||||||

|

GAAP

Income ($ millions)

|

Mar-08

|

Dec-07

|

Mar-07

|

|||||||

|

Interest

income

|

$

|

168

|

$

|

202

|

$

|

215

|

||||

|

Interest

expense

|

(128

|

)

|

(153

|

)

|

(168

|

)

|

||||

|

Net

interest

income before market valuation adjustments

|

40

|

49

|

47

|

|||||||

|

Market

valuation adjustments, net

|

(194

|

)

|

(1,119

|

)

|

(10

|

)

|

||||

|

Net

Interest

(loss) Income

|

(154

|

)

|

(1,070

|

)

|

37

|

|||||

|

Operating

expenses

|

(16

|

)

|

(16

|

)

|

(18

|

)

|

||||

|

Realized

gains

(losses) on sales

|

-

|

7

|

-

|

|||||||

|

Realized

gains

on calls

|

-

|

-

|

1

|

|||||||

|

Credit

(provision) for taxes

|

(2

|

)

|

2

|

(2

|

)

|

|||||

|

GAAP

(loss) income

|

$

|

(172

|

)

|

$

|

(1,077

|

)

|

$

|

18

|

||

|

GAAP

(loss)

income per share

|

$

|

(5.28

|

)

|

$

|

(36.49

|

)

|

$

|

0.66

|

||

| ► |

Net

interest

income before market valuation adjustments for the first quarter

decreased

by $9 million from the previous quarter. The decline resulted

from slower

prepayments on residential loans underlying our CES, increased

credit

provisions on loans owned by Sequoia, and the impact of our adoption

of a

new accounting standard, FAS 159, on January 1,

2008.

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

13

|

|

|

|

|

GAAP

INCOME & CORE EARNINGS

|

| ► |

Total

market

valuation adjustments were $194 million in the first quarter,

down

significantly from $1.1 billion in the fourth quarter. The

primary reason

for the reduction in the level of negative market valuation

adjustments

was the fair value option election under FAS 159 which now

permits us to

MTM both the assets and liabilities of

Acacia.

|

| ► |

Operating

expenses remained at the same level as in the prior quarter.

|

| ► |

We

accrue for

income taxes throughout the year based on our estimates of taxable

income

and our planned distribution and retention of this

income.

|

| ► |

The

following

tables detail the components of our consolidated income statements

for the

first quarter of 2008 and the fourth quarter of

2007.

|

|

Consolidating

Income Statement

|

||||||||||||||||

|

Three

Months Ended March 31, 2008

|

||||||||||||||||

|

($

in millions)

|

||||||||||||||||

|

|

|

|

Redwood

|

|||||||||||||||

|

|

Redwood

|

Sequoia

|

Acacia

|

Elimination

|

Consolidated

|

|||||||||||

|

Interest

income

|

$

|

24

|

$

|

94

|

$

|

48

|

$

|

(2

|

)

|

$

|

164

|

|||||

|

Net

discount

(premium) amortization

|

12

|

(7

|

)

|

-

|

-

|

5

|

||||||||||

|

Total

interest

income

|

36

|

87

|

48

|

(2

|

)

|

169

|

||||||||||

|

Management

fees

|

-

|

-

|

1

|

-

|

1

|

|||||||||||

|

Interest

expense

|

(3

|

)

|

(83

|

)

|

(45

|

)

|

2

|

(129

|

)

|

|||||||

|

Net

interest

income before market valuation adjustments

|

$

|

33

|

$

|

4

|

$

|

4

|

$

|

-

|

$

|

41

|

||||||

|

Market

valuation adjustments, net

|

(167

|

)

|

-

|

(27

|

)

|

-

|

(194

|

)

|

||||||||

|

Net

interest

(loss) income

|

(134

|

)

|

4

|

(23

|

)

|

-

|

(153

|

)

|

||||||||

|

Operating

expenses

|

(17

|

)

|

-

|

-

|

-

|

(17

|

)

|

|||||||||

|

Realized

gains

on sales and calls, net

|

-

|

-

|

-

|

-

|

-

|

|||||||||||

|

Income

from

Sequoia

|

4

|

-

|

-

|

(4

|

)

|

-

|

||||||||||

|

Loss

from

Acacia

|

(23

|

)

|

-

|

-

|

23

|

-

|

||||||||||

|

Provision

for

income taxes

|

(2

|

)

|

-

|

-

|

-

|

(2

|

)

|

|||||||||

|

Net

(Loss) Income

|

$

|

(172

|

)

|

$

|

4

|

$

|

(23

|

)

|

$

|

19

|

$

|

(172

|

)

|

|||

|

Consolidating

Income Statement

|

||||||||||||||||

|

Three

Months Ended December 31, 2007

|

||||||||||||||||

|

($

in millions)

|

||||||||||||||||

|

|

|

|

Redwood

|

|||||||||||||||

|

|

Redwood

|

Sequoia

|

Acacia

|

Elimination

|

Consolidated

|

|||||||||||

|

Interest

income

|

$

|

26

|

$

|

110

|

$

|

55

|

$

|

(2

|

)

|

$

|

189

|

|||||

|

Net

discount

(premium) amortization

|

11

|

(7

|

)

|

7

|

-

|

11

|

||||||||||

|

Total

interest

income

|

37

|

103

|

62

|

(2

|

)

|

200

|

||||||||||

|

Management

fees

|

-

|

-

|

2

|

-

|

2

|

|||||||||||

|

Interest

expense

|

(3

|

)

|

(96

|

)

|

(56

|

)

|

2

|

(153

|

)

|

|||||||

|

Net

interest

income before market valuation adjustments

|

34

|

7

|

8

|

-

|

49

|

|||||||||||

|

Market

valuation adjustments, net

|

(130

|

)

|

-

|

(989

|

)

|

-

|

(1,119

|

)

|

||||||||

|

Net

interest

(loss) income

|

(96

|

)

|

7

|

(981

|

)

|

-

|

(1,070

|

)

|

||||||||

|

Operating

expenses

|

(16

|

)

|

-

|

-

|

-

|

(16

|

)

|

|||||||||

|

Realized

gains

on sales and calls, net

|

9

|

-

|

(2

|

)

|

-

|

7

|

||||||||||

|

Income

from

Sequoia

|

7

|

-

|

-

|

(7

|

)

|

-

|

||||||||||

|

Loss

from

Acacia

|

(983

|

)

|

-

|

-

|

983

|

-

|

||||||||||

|

Provision

for

income taxes

|

2

|

-

|

-

|

-

|

2

|

|||||||||||

|

Net

(Loss) Income

|

$

|

(1,077

|

)

|

$

|

7

|

$

|

(983

|

)

|

$

|

976

|

$

|

(1,077

|

)

|

|||

|

14

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

GAAP

INCOME & CORE

EARNINGS

|

| ► |

Market

valuation adjustments were greater in the first quarter on

securities we

hold as available-for-sale (AFS) than the prior quarter as

credit

performance continued to deteriorate and we no longer believe

some of the

valuations will return to cost on many of these illiquid

securities within

a reasonable period. We expect the amount of future impairments

at Redwood

to decline since we have permanently impaired the majority

of our earning

assets. Our CES have been written down to 15% of face value

at March 31,

2008. More detailed information about our accounting impairments

is found

in the Mark-to-Mark Adjustments section of this Review.

|

| ► |

Market

valuation adjustments at Acacia were negative $27 million

in the first

quarter reflecting the net changes in the fair values of

the assets and

liabilities within these securitization entities. Under FAS

159

accounting, these changes flow through the income statement.

In the fourth

quarter of 2007, prior to the adoption of FAS 159, the market

valuation

adjustments of negative $1.0 billion consisted only of impairments

on

certain of Acacia's assets and did not reflect any offsetting

change in

value of the associated Acacia

liabilities.

|

| ► |

Net

interest

income from Sequoia securitization entities was $3 million

lower in the

first quarter than the prior quarter as a result of a $4

million increase

in provisions for credit losses partially offset by lower

premium

amortization from slower prepayment

speeds.

|

| ► |

For

Acacia,

net interest income before market valuation adjustments in

the first

quarter declined by $4 million from the previous quarter,

primarily as the

result of the adoption of FAS 159. We now only include the

cash coupon on

the assets less the cash expense on the ABS issued in net

interest income.

Previously, net interest income included discount amortization,

which in

the fourth quarter of 2007, totaled $7 million. Under FAS

159, this amount

is effectively included in the market valuation adjustments

of these

assets.

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

15

|

|

|

|

|

GAAP

INCOME & CORE EARNINGS

|

| ► |

The

table

below provides a summary of our core earnings for the first

quarter of

2008, the fourth quarter of 2007, and the first quarter of

2007.

|

|

|

For

the Quarter Ended

|

|||||||||

|

Core

Earnings

|

Mar-08

|

Dec-07

|

Mar-07

|

|||||||

|

Interest

income

|

$

|

168

|

$

|

202

|

$

|

215

|

||||

|

Interest

expense

|

(128

|

)

|

(153

|

)

|

(168

|

)

|

||||

|

Net

interest

income

|

40

|

49

|

47

|

|||||||

|

Market

valuation adjustments, net

|

-

|

-

|

-

|

|||||||

|

Net

interest

(loss) income

|

40

|

49

|

47

|

|||||||

|

Operating

expenses

|

(16

|

)

|

(15

|

)

|

(15

|

)

|

||||

|

Realized

gains

(losses) on sales

|

-

|

-

|

-

|

|||||||

|

Realized

gains

on calls

|

-

|

-

|

-

|

|||||||

|

Credit

(provision) for taxes

|

(2

|

)

|

2

|

(2

|

)

|

|||||

|

Core

earnings

|

$

|

22

|

$

|

36

|

$

|

30

|

||||

|

Core

earnings

per share

|

$

|

0.68

|

$

|

1.21

|

$

|

1.08

|

||||

| ► |

Our

first

quarter core earnings were $0.68 per share. The reasons for

the decrease

in the level of core earnings from prior periods include

the impact of the

adoption of FAS 159, higher loan loss provisions, and slower

prepayments

on residential loans underlying our CES.

|

| ► |

Core

earnings

for this quarter of 2008 are not directly comparable to

core earnings for

prior quarters due to the adoption of FAS 159 for Acacia

entities. Prior

to the first quarter, purchase discount amortization on

Acacia assets

($0.21 per share in the fourth quarter of 2007) was included

in core

income. This component of income is now excluded from core

income. We no

longer calculate purchase discount amortization for securities

in the

Acacia entities since it has become, in effect, one of

the components of

the FAS 159 mark-to-market

adjustments.

|

|

16

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

TAXABLE

INCOME

|

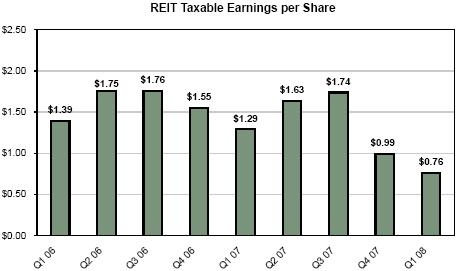

| ► |

Total

taxable

income for the first quarter of 2008 was $26 million,

or $0.79 per share.

REIT taxable income was $25 million, or $0.76 per share,

in the first

quarter of 2008.

|

| ► |

Our

taxable

income decreased from the prior quarter by $3 million.

Our first quarter

taxable earnings included $14 million of charges related

to credit losses,

an increase of $9 million over the previous quarter.

In addition, discount

amortization for tax purposes decreased by $8 million

from the fourth

quarter to the first quarter primarily as the result

of slower prepayments

speeds. Offsetting these decreases in income was the

fact that the fourth

quarter included $14 million of write downs of assets for tax

purposes.

|

| ► |

Our

REIT

taxable income for 2008 will depend on, among other

things, our ability to

deploy our excess capital effectively and on the

level of realized credit

losses. We anticipate that credit losses, as measured

for tax purposes,

will increase substantially in 2008 relative to our

recent experience. If

the realization of credit losses becomes concentrated

in time, taxable

income alone in any one quarter or series of quarters

may be less than our

regular dividend rate.

|

| ► |

Our

taxable

income continues to be higher than our GAAP income

as we are not permitted

to establish credit reserves for tax purposes and

we do not generally

recognize changes in market values of assets for

tax purposes until the

asset is sold. As a result of these differences

at March 31, 2008, the tax

basis of our residential, commercial, and CDO CES

at Redwood was $377

million higher than our GAAP basis. Future credit

losses will have a more

significant impact on our taxable income than on

our GAAP income.

|

| ► |

The

tax basis

on Sequoia IOs we own is $55 million. Most of

the underlying pools of

loans have paid down or will pay down within

the next year to levels where

they are callable. When these are called, losses

on these IOs will be

incurred and our taxable income and dividend

distribution requirements

will decrease. The actual losses will depend

on the tax basis at the time

of any calls as the monthly cash flows received

on these IOs in the

interim will reduce their cost basis. At this

time, we do not anticipate

calling Sequoia deals in 2008.

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

17

|

|

|

|

|

TAXABLE

INCOME

|

| ► |

The

charts

below provide a summary of our total taxable income per

share and REIT

taxable income per share for each for the nine most recently

completed

fiscal quarters.

|

|

18

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

CAPITAL

& LIQUIDITY

|

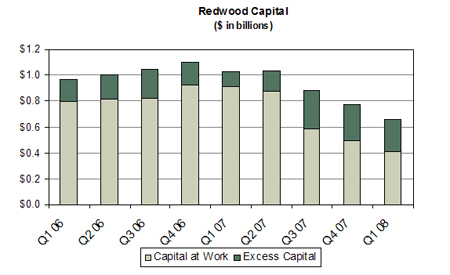

| ► |

At

March 31,

2008, we had $247 million of excess capital, a decrease

from $282 million

at December 31, 2007, and an increase from the $114 million

we had a year

ago. The decrease in excess capital over the past quarter

reflects our

investment activity in the first quarter.

|

| ► |

Our

net

liquid assets at March 31, 2008 totaled $263 million

and included $257 of

unrestricted cash, $4 million of unsecuritized

residential real estate

loans at fair value, and $4 million of AAA-rated

securities at fair value,

less $2 million of Redwood debt.

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

19

|

|

|

|

|

CAPITAL

& LIQUIDITY

|

| ► |

At

March 31,

2008, our total available capital, defined as the sum

of our excess

capital plus our invested capital, amounted to $660 million,

compared to

$793 million at January 1, 2008 upon the adoption of

FAS 159. The decline

reflects market value adjustments on our employed capital.

Our total

available capital of $660 million differs from our GAAP

capital (equity

plus long-term debt) of $735 million because we adjust

our GAAP capital

for "economic" value changes to our investments in Sequoia

and Acacia (as

discussed on page 8) and we deduct net other assets and

liabilities.

|

| ► |

Capital

employed decreased in the first quarter by $83

million to $413 million

mainly as a result of market value declines that were partially

offset by $65 million of new acquisitions.

|

| ► |

We

are

long-term investors and we fund most

of our investments with equity. We

acquire our securities at discounts,

and in many cases substantial

discounts to face value, and we model

a range of expected cash flows that

we expect to collect over the life of

each security. To the extent the

fair values of our investments are lower

or higher from time to time is of

little consequence to us provided the

cash flows remain within our range

of expectations.

|

| ► |

The

high

level of excess capital and liquidity

over the past several quarters

reflects our intention to maintain

a strong balance sheet during

a time of

market distress and our strategic

decision to sell lower yielding,

higher

rated assets to position us to

acquire higher yielding assets

with the

potential for more upside return.

Over time, we expect our excess

capital

and net liquidity to decline

as we fund new investments. However,

as most

of our investments are funded

with equity, we have less need

to maintain a

large liquidity position.

|

|

20

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

DIVIDENDS

|

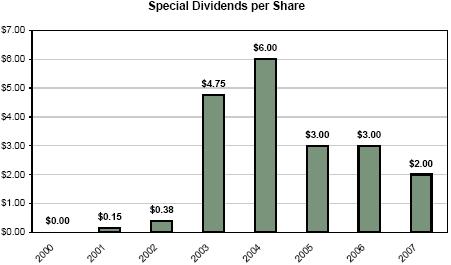

| ► |

On

March 5,

2008, we declared a regular dividend of $0.75 per share

for the second

quarter payable on April 21, 2008 to shareholders of

record on March 31,

2008.

|

|

*

Projected

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

21

|

|

|

|

|

DIVIDENDS

|

| ► |

Total

dividend

distributions over the last four quarters were $5.00

per share, which

included a $2.00 special dividend paid to shareholders on December

7,

2008.

|

| ► |

The

amount of

special dividends in 2008, if any, will

depend upon the level of taxable

income. With rising credit losses (for

which there are no credit reserves

for tax accounting), we do not currently

anticipate paying a special

dividend in 2008.

|

| ► |

Our

dividend

yield at the current regular

annual dividend rate of $3.00

per share at

the close of the market on May 1, 2008, was 8.26%.

|

| ► |

Over

the past

several years,

we have distributed

100% of REIT capital

gains income and

90% of REIT ordinary

income, retaining

10% of the ordinary

REIT income. We

retain 100% of

the after-tax income

we generate in

taxable subsidiaries.

All of our dividend

distributions in

2007 were ordinary

income and we do

not expect any

capital gain distributions

in

2008.

|

| ► |

As

in

prior

periods,

we

are

currently

planning

to

retain

a portion

and

defer

the

distribution

of

all

or

a portion

of

any

excess

REIT

taxable

income

earned

in

2008.

At

March

31,

2008,

we

had

$47

million

($1.43

per

outstanding

share)

of

undistributed

REIT

taxable

income

that

we

anticipate

distributing in

2008.

|

|

22

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

MARK-TO-MARKET

ADJUSTMENTS

|

| ► |

During

the

first quarter of 2008, residential and commercial real

estate prices

remained under pressure and borrower delinquencies

and defaults escalated.

Additionally, banks and Wall Street firms substantially

reduced their

extension of credit and slashed advance rates for collateralized

borrowings, even for repurchase borrowings backed by

Fannie Mae and

Freddie Mac securities. The combination of deteriorating

credit

fundamentals together with the contraction in market

liquidity caused

prices for real estate securities to record their steepest

quarterly

decline since the mortgage credit crisis began over

a year ago.

|

| ► |

The

capital

markets for non-agency residential and

commercial mortgages essentially

shut down during the quarter. New residential

non-agency securitizations

were at their lowest level in several

years and trading activity of

existing securities through the mortgage

capital markets remained

extremely light.

|

| ► |

Market unrest

peaked in early March.

The actions by the Fed

and the Treasury to reduce

systemic financial risk,

the 75 basis point rate

cut in the federal funds

rate, the opening of the

Fed discount window to

certain broker/dealers,

and the reduction in the

excess capital requirements

for Fannie Mae and

Freddie Mac appear to have

reduced the substantial

pressure that had built

up and restored some stability

to the markets. Trading

remains light, but

prices for real estate

securities seem to be holding.

We would caution

that it is still early

in this credit cycle and

this stability may be

temporary.

|

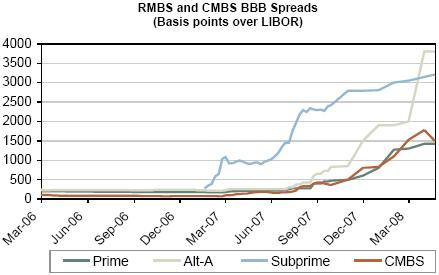

| ► |

The

table

below illustrates

the additional

interest

rate spread

that investors

have

required

to compensate

for the perceived

credit risk

of various

types of

residential

mortgage-backed

securities

(RMBS) and

commercial

mortgage-backed

securities

(CMBS).

|

| ► |

For

some

assets,

declines

in

fair

values

reflect

the

near-certainty

of

serious

credit

losses

being

realized.

For

others,

significant

future

losses

may

not

occur,

but

there

is

a

perceived

increase

in

the

risk

of

loss

resulting

in

a

lower

value.

Finally,

many

assets

are

not

at

serious

risk

of

loss

but

their

declining

value

largely

reflects

a

limited

number

of

observed

sales

in

the

market.

Many

of

the

sales

that

did

occur

were

by

distressed

sellers

resulting

in

further

downward

pressure

on

market

prices.

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

23

|

|

|

|

|

MARK-TO-MARKET

ADJUSTMENTS

|

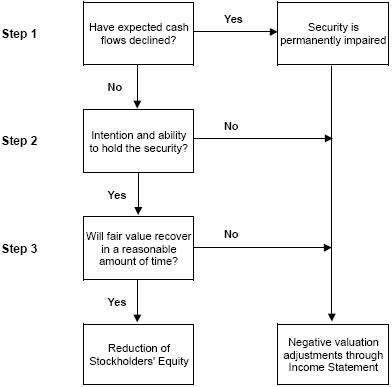

| ► |

The

accounting

rules regarding MTM accounting are complex and may not

clearly reflect the

underlying economics. This topic is more fully discussed

in the Accounting

Discussion module in the Appendix.

|

| ► |

At

Redwood,

where we hold most of our securities as

available-for-sale for accounting

purposes, MTM changes that are other-than-temporary

flow through our

income statement while MTM changes that are temporary are charged

to

equity.

|

| ► |

For

accounting purposes, we consolidate

the balance sheets and income

statements of the Acacia

securitization entities.

On January 1, 2008, we

adopted a new accounting

standard, FAS 159, and elected

to fair value both

the assets and liabilities

of the Acacia entities. In

accordance with FAS

159, we recorded a one-time,

cumulative-effect adjustment

to our January

1, 2008 opening balance sheet

that decreased the carrying

value of Acacia

liabilities by $1.5 billion

and increased equity. This

new standard

significantly reduces the

disparity that existed between

GAAP carrying

value and our previous estimates

of economic value.

|

| ► |

For

Sequoia,

we are required

to consolidate

the assets

and liabilities,

which we report

at amortized

cost. Thus,

there was no

effect on our

financial statements

from changes

in fair values

of Sequoia's

loans or ABS

issued.

|

| ► |

Financial

Tables

19A,

19B,

and

19C

in

the

back

of

this

Review

detail

the

fair

value

of

residential,

commercial,

and

CDO

securities

at

Redwood,

the

Opportunity

Fund,

and

Acacia

as

a

percentage

of

their

face

value

as

of

March

31,

2008.

|

|

24

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

MARK-TO-MARKET

ADJUSTMENTS

|

| ► |

The

tables

below detail the MTM adjustments on securities held

at Redwood and the

Opportunity Fund (excluding Sequoia and Acacia) by

underlying collateral

type and by vintage. Net MTM adjustments were a negative

$146 million in

the first quarter of 2008.

|

|

Mark-To-Market

Adjustments on Securities

|

||||||||||||||||

|

at

Redwood and Opportunity Fund (Excluding

Sequoia and

Acacia)

|

||||||||||||||||

|

By

Underlying Collateral Type

|

||||||||||||||||

|

Three

Months Ended March 31, 2008

|

||||||||||||||||

|

($

in millions)

|

|

Loans,

OREI &

|

MTM

|

|||||||||||||||

|

IGS

|

CES

|

Derivatives

|

Total

|

Percent

(a)

|

||||||||||||

|

Residential

|

||||||||||||||||

|

Prime

|

$

|

(10

|

)

|

$

|

(56

|

)

|

$

|

(1

|

)

|

$

|

(67

|

)

|

(40

|

)%

|

||

|

Alt-a

|

(5

|

)

|

(13

|

)

|

(2

|

)

|

(20

|

)

|

(53

|

)%

|

||||||

|

Subprime

|

(1

|

)

|

(1

|

)

|

(1

|

)

|

(3

|

)

|

(21

|

)%

|

||||||

|

Residential

total

|

(16

|

)

|

(70

|

)

|

(4

|

)

|

(90

|

)

|

||||||||

|

Commercial

|

-

|

(47

|

)

|

-

|

(47

|

)

|

(32

|

)%

|

||||||||

|

CDO

|

(1

|

)

|

(2

|

)

|

-

|

(3

|

)

|

(6

|

)%

|

|||||||

|

Interest

rate

agreements & other derivatives

|

- | - |

(6

|

)

|

(6

|

)

|

||||||||||

|

Total

mark-to-market adjustments

|

$

|

(17

|

)

|

$

|

(119

|

)

|

$

|

(10

|

)

|

$

|

(146

|

)

|

||||

|

By

Vintage & Equity

|

||||||||||||||||||||||

|

Loans

&

|

||||||||||||||||||||||

|

<=

2004

|

2005

|

2006

|

2007

|

2008

|

Derivatives

|

Total

|

||||||||||||||||

|

Total

mark-to-market adjustments

|

$

|

(35

|

)

|

$

|

(22

|

)

|

$

|

(34

|

)

|

$

|

(38

|

)

|

$

|

(10

|

)

|

$

|

(7

|

)

|

$

|

(146

|

)

|

|

|

MTM

percent (a)

|

(22

|

)%

|

(22

|

)%

|

(27

|

)%

|

(34

|

)%

|

(43

|

)%

|

||||||||||||

| (a) |

This

percentage represents the MTMs taken as

a percentage of the reported fair

values at the beginning of the period,

or purchase price if acquired

during the period. It is intended to highlight

the price declines by

collateral type for the three months ended

March 31, 2008. These price

declines are specific to our portfolio

and may not be indicative of price

declines in the market in

general.

|

| ► |

Under

GAAP,

we value securities using bid-side markets (an exit

price). Bid/offer

spreads are generally wide for illiquid securities,

and in today's

turbulent market, spreads are especially wide. This

difference in

bid/offer spreads is the primary reason we recorded

$11 million of

negative MTM adjustments on purchases made in the first

quarter.

|

| ► | The following table shows the MTM impact on our balance sheet and income statement in the first quarter. |

|

Mark-to-Market

Adjustments on Securities

|

||||

|

at

Redwood and Opportunity Fund

(Excluding Sequoia and

Acacia)

|

||||

|

Balance

Sheet and Income Statement

Effect

|

||||

|

Three

Months Ended March 31, 2008

|

||||

|

($

in millions)

|

||||

|

|

Redwood

|

|||

|

Balance

Sheet Effect

|

||||

|

Adjustment

to

OCI

|

$

|

21

|

||

|

Income

Statement Effect

|

||||

|

Market

valuation adjustments

|

||||

|

FVO

assets

|

(13

|

)

|

||

|

Impairment

on

AFS securities

|

(144

|

)

|

||

|

Changes

in

fair value on trading instruments

|

(10

|

)

|

||

|

Total

income

statement effect

|

(167

|

)

|

||

|

Total

mark-to-market adjustments

|

$

|

(146

|

)

|

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

25

|

|

|

|

|

MARK-TO-MARKET

ADJUSTMENTS

|

| ► |

During

the

first quarter, there were gross negative market value

adjustments of $167

million, and net adjustments of negative $146 million

after reversing $21

million of prior period temporary adjustments from equity

(other

comprehensive income) as shown in the table above.

|

| ► |

The

table

below shows the first quarter MTM adjustments

for the assets and

liabilities at Acacia subesquent to the

adoption of FAS 159 on January 1,

2008.

|

|

MTM

Adjustments on Acacia Assets and Liabilities

|

|||||||

|

Three

Months Ended March 31, 2008

|

|||||||

|

($

in millions)

|

|||||||

|

|

|

Assets

|

||||

|

Real

estate

securities and Loans

|

$

|

(787

|

)

|

|

|

Interest

rate

agreements and other derivatives

|

(50

|

)

|

||

|

Liabilities

|

||||

|

ABS

issued

|

810

|

|||

|

Net

mark-to-market adjustments

|

$

|

(27

|

)

|

| ► |

During

the

first quarter, market prices for the assets collateralizing

our CDOs and

the related debt declined further due to elevating

credit concerns and a

market in which there was very light trading volume.

|

| ► |

At

Acacia,

the entire net negative $27 million

of MTM adjustments were reflected in

the income statement as required by

FAS 159.

|

| ► |

As

a result

of the measurement

techniques required

by FAS 159, we expect

to encounter

some MTM earnings volatility

in the future as a

result of the

consolidation of Acacia

entities. We expect

this volatility to

be

significantly less

than we encountered

in prior periods. This

complex

topic is more fully

discussed in the Investments

in Acacia module later

in

this Review.

|

|

26

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

|

|

|

|

|

|

MARK-TO-MARKET

ADJUSTMENTS

|

| ► |

The

fair values

we use for our assets and liabilities reflect what we believe

we would

realize if we chose to sell our securities or would have

to pay if we

chose to buy back our asset-backed securities (ABS) issued

liabilities.

Establishing fair values is inherently subjective and is

dependent upon

many market-based inputs, including observable trades,

information on

offered inventories, bid lists, and indications of value

obtained from

dealers. Obtaining fair values for securities is especially

difficult for

illiquid securities (such as ours), and is made more difficult

when there

is limited trading visibility, as was the case in recent

months. Where

there are observable sales, many of them are from distressed

sellers, and

their sales tend to further depress asset prices. For these

reasons, we

expect market valuations to continue to be highly

volatile.

|

| ► |

Fair

values for

our securities and ABS issued are dependent upon a number

of market-based

assumptions, including future interest rates, prepayment

rates, discount

rates, credit loss rates, and the timing of credit losses.

We use these

assumptions to generate cash flow estimates and internal

values for each

individual security.

|

| ► |

We

request

indications of value (marks) from dealers

every quarter to assist in the

valuation process. For March 31, 2008,

we received dealer marks on 71% of

the assets and 82% of our liabilities

on our consolidated balance sheet.

One major dealer that we have used

in prior periods provided no marks.

|

| ► |

One

of the

factors we consider

in our valuation

process is our assessment

of the

quality of the dealer

marks we receive.

Dealers remain inundated

with

requests for quarter-end

marks, and there

continues to be limited

observable trading

information for them

to rely upon. Thus,

their marks

were most likely

generated by their

own pricing models

for which they did

not share their inputs

and we had little

insight into their

assumptions.

|

| ► |

Furthermore,

the

dealers

continue

to

heavily

qualify

the

information

they

send

to

us.

The

qualifications

include

statements

to

the

effect

that

the

markets

are

very

volatile

and

are

characterized

by

limited

trading

volume

and

poor

price

transparency,

and

in

many

cases,

an

increasing

number

of

valuations

are

model-based

due

to

a

lack

of

observable

trades.

|

| ► |

Our

valuation

process

relied

on

our

internal

values

to

estimate

the

fair

values

of

our

securities

at

March

31,

2008.

In

the

aggregate,

our

internal

valuations

of

the

securities

on

which

we

received

dealer

marks

were

29%

lower

than

the

aggregate

dealer

marks

at

March

31,

2008.

Our

internal

valuations

of

our

ABS

issued

on

which

we

received

dealer

marks

were

14%

lower

than

the

aggregate

dealer

marks

at

March

31,

2008.

|

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008

|

27

|

|

|

|

|

RESIDENTIAL

REAL ESTATE SECURITIES

|

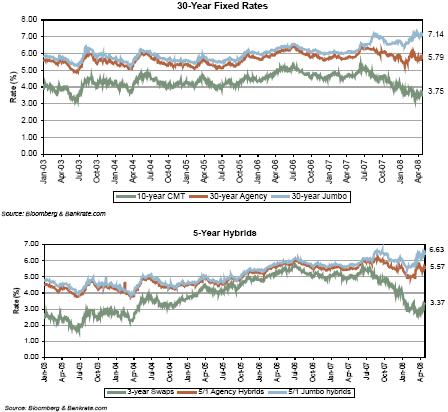

| ► |

Our

residential securities portfolio declined by $48 million

(or 30%) from

$160 million to $112 million in the first quarter.This

decrease was

primarily due to negative market value adjustments partially

offset by $38

million of residential prime securities

acquisitions.

|

| ► |

From

a total

market perspective, new securitizations of prime

jumbo residential loans totaled $6 billion in the first quarter,

a

71% decline from the fourth quarter, and a 91% decline

from the year-ago

period. Despite market conditions, we successfully

worked with our banking

partners to provide liquidity on three new prime securitizations.

We

purchased all of the CES securities ($5 million invested)

and part of the

IGS securities ($10 million invested) from these securitizations.

Our

base case

returns, which assume no price appreciation or leverage,

fall within our

equity hurdle rate range of 12% to

18%.

|

| ► |

We

remained

active participants in the secondary

mortgage markets, although market

liquidity was hindered by forced

liquidations and systemic credit

concerns. We acquired $10 million

of prime CES and $7 million of

prime IGS

from seasoned vintages during

the quarter. We also acquired

$1 million of

prime CES and $10 million of

prime IGS from 2006 and 2007

vintages at

significant discounts to face

value. While we are focused on

building our

prime credit enhancement business,

we plan to accelerate our investments

in new and seasoned prime IGS.

|

| ► |

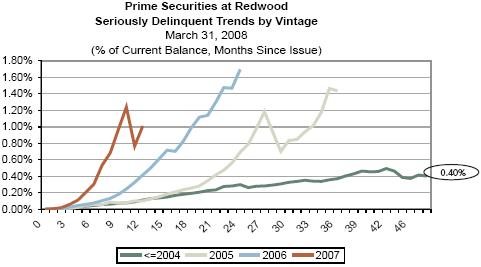

The

credit

performance

of our

residential

securities

worsened

during

the first

quarter.

Prime and

alt-a CES

originated

prior to

2005 continued

to perform

within

our range

of expectations,

while newer

vintage

CES (acquired

prior

to the

third quarter

of 2007)

continued

to perform

worse than

expected.

In

almost

all pools

of loans,

we are

experiencing

increases

in loan

delinquencies

and losses.

Our GAAP

credit

reserve

balances

are reassessed

quarterly

for changes

in our

loss

expectations.

|

|

28

|

THE

REDWOOD

REVIEW 1ST QUARTER 2008