|

|

|

TABLE

OF CONTENTS

|

|

Introduction

|

2

|

|

Shareholder

Letter

|

3

|

|

Quarterly

Overview

|

4

|

|

Financial

Insights

|

8

|

|

Financial

& Investments Modules

|

|

|

Financial

|

16

|

|

-

GAAP Income

|

16

|

|

-

Taxable Income

|

19

|

|

-

Capital & Liquidity

|

21

|

|

-

Dividends

|

23

|

|

Mark-to-Market

Adjustments

|

24

|

|

|

|

|

Residential

Real Estate Securities

|

28

|

|

Commercial

Real Estate Securities

|

40

|

|

Investments

in Sequoia

|

43

|

|

Investments

in Acacia

|

47

|

|

Appendix

|

|

|

Accounting

Discussion

|

52

|

|

Glossary

|

55

|

|

Financial

Tables

|

62

|

THE

REDWOOD REVIEW 2ND QUARTER 2008 1

|

|

|

INTRODUCTION

|

Note

to

Readers:

We

file annual

reports (on Form 10-K) and quarterly reports (on Form 10-Q)

with the Securities

and Exchange Commission. These filings and our earnings press

releases provide

information about our financial results in accordance with

generally accepted

accounting principles (GAAP). We urge you to review these

documents which are

available through our web site, www.redwoodtrust.com.

This

document,

called the Redwood Review, provides supplemental information

about Redwood

through a discussion of many GAAP as well as non-GAAP metrics,

such as taxable

income and economic book value. We believe that these figures

provide additional

insight into Redwood’s business and future prospects. In each case in which we

discuss a non-GAAP metric, you will find an explanation of

how it has been

calculated and why we think the figure is important, and

a reconciliation

between the GAAP and non-GAAP figures. We hope you find the

Redwood Review to be

helpful to your understanding of our business.

The

form and

content of the Redwood Review will likely continue to change

over time. We

welcome your input and suggestions.

|

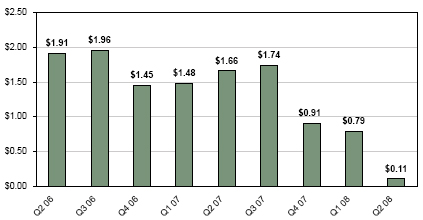

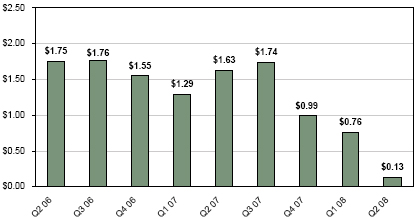

Selected

Financial Highlights

|

|||||||||||||||||||

|

Quarter:Year

|

GAAP

Income per Share

|

Total

Taxable Earnings per Share

|

Adjusted

Return on Equity

|

GAAP

Book Value per Share

|

Core

Book Value per Share

|

Total

Dividends per Share

|

|||||||||||||

|

Q206

|

$

|

1.20

|

$

|

1.91

|

14

|

%

|

$

|

39.13

|

$

|

35.58

|

$

|

0.70

|

|||||||

|

Q306

|

$

|

1.22

|

$

|

1.96

|

14

|

%

|

$

|

40.02

|

$

|

36.38

|

$

|

0.70

|

|||||||

|

Q406

|

$

|

1.32

|

$

|

1.45

|

15

|

%

|

$

|

37.51

|

$

|

34.02

|

$

|

3.70

|

|||||||

|

Q107

|

$

|

0.66

|

$

|

1.48

|

8

|

%

|

$

|

34.06

|

$

|

34.29

|

$

|

0.75

|

|||||||

|

Q207

|

$

|

0.41

|

$

|

1.66

|

5

|

%

|

$

|

31.50

|

$

|

34.40

|

$

|

0.75

|

|||||||

|

Q307

|

$

|

(2.18

|

)

|

$

|

1.74

|

(26

|

%)

|

$

|

5.32

|

$

|

31.58

|

$

|

0.75

|

||||||

|

Q407*

|

$

|

(36.49

|

)

|

$

|

0.91

|

(610

|

%)

|

$

|

23.18

|

$

|

26.24

|

$

|

2.75

|

||||||

|

Q108

|

$

|

(5.28

|

)

|

$

|

0.79

|

(83

|

%)

|

$

|

17.89

|

$

|

20.74

|

$

|

0.75

|

||||||

|

Q208

|

$

|

(1.40

|

)

|

$

|

0.11

|

(28

|

%)

|

$

|

17.00

|

$

|

19.05

|

$

|

0.75

|

||||||

|

*

The book

values per share are after giving retroactive effect

to the adoption of

FAS 159 on January 1, 2008.

|

|||||||||||||||||||

|

Without

giving

retroactive effect to FAS 159, the GAAP book value

per share and core book

value per share were a negative $22.18 and a negative

$4.46,

respectively.

|

|||||||||||||||||||

CAUTIONARY

STATEMENT: This Redwood Review contains forward-looking statements

within the

meaning of the safe harbor provisions of the Private Securities

Litigation

Reform Act of 1995. Forward-looking statements involve numerous

risks and

uncertainties. Our actual results may differ from our expectations,

estimates,

and projections and, consequently, you should not rely on these

forward-looking

statements as predictions of future events. Forward-looking

statements are not

historical in nature and can be identified by words such as

“anticipate,”

“estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan” and

similar expressions or their negative forms, or by references

to strategy,

plans, or intentions. These forward-looking statements are

subject to risks and

uncertainties, including, among other things, those described

in our Annual

Report on Form 10-K for the year ended December 31, 2007 under

the caption “Risk

Factors.” Other risks, uncertainties, and factors that could cause actual

results to differ materially from those projected are described

below and may be

described from time to time in reports we file with the Securities

and Exchange

Commission, including reports on Forms 10-K, 10-Q, and 8-K.

We undertake no

obligation to update or revise any forward-looking statements,

whether as a

result of new information, future events, or otherwise.

Important

factors, among others, that may affect our actual results include:

changes in

interest rates; changes in prepayment rates; general economic

conditions,

particularly as they affect the price of earning assets and

the credit status of

borrowers; legislative and regulatory actions affecting the

mortgage industry;

the availability of high quality assets for purchase at attractive

prices;

declines in home prices; increases in mortgage payment delinquencies;

changes in

the level of liquidity in the capital markets which may adversely

affect our

ability to finance our real estate asset portfolio; changes

in liquidity in the

market for real estate securities, the re-pricing of credit

risk in the capital

markets, rating agency downgrades of securities and increases

in the supply of

real estate securities available for sale, each of which may

adversely affect

the values of securities we own; the extent of changes in the

values of

securities we own and the impact of adjustments reflecting

those changes on our

income statement and balance sheet, including our stockholders’ equity; our

ability to maintain the positive stockholders’ equity necessary to enable us to

pay the dividends required to maintain our status as a real

estate investment

trust for tax purposes; and other factors not presently identified.

This Redwood

Review may contain statistics and other data that in some cases

have been

obtained from or compiled from information made available by

servicers and other

third-party service providers.

2

THE REDWOOD REVIEW 2ND QUARTER 2008

|

|

|

SHAREHOLDER

LETTER

|

Dear

Fellow

Shareholders:

Our

job as

management is to understand and address what is truly happening

in order to make

better decisions for Redwood shareholders. When communicating

with shareholders,

we do our best to pass on the unvarnished truth as we see

it. We don’t

sugar-coat and we don’t spin. We try not to err too far on the other side

either, which could cause unwarranted pessimism or despair.

Getting these

communications right is a tricky business, especially in

these times.

So

here is the

summary: In the short-term, we are suffering some credit

damage but overall we

are in good financial shape. Because of external events,

however, we are not

currently able to make much near-term progress towards

our long-term goals.

Nevertheless, as markets move into the correction phase

of the credit cycle, we

believe the longer-term prospects for Redwood have improved.

We are looking

forward to, over time, turning those improved prospects

into growth for the

company and improved levels of earnings and dividends for

shareholders.

Triage

and

emergency interventions continue for the economy and for

the real estate and

finance markets. We believe markets are still largely in

the denial stage,

although the first signs of capitulation are beginning

to appear. Unfortunately,

the housing market downturn has a long way to go before

it hits bottom. The

commercial real estate markets are far behind, but are

moving in the same

direction.

Redwood

is in the

business of pricing and taking credit risk. We expect to

take credit losses, and

we price in large losses when we make acquisitions. It

is important to note that

our business model limits our exposure to credit loss events

because our

exposure is capped at the amount we have invested in credit-enhancement

securities, which is usually a tiny fraction of the loan

amount. This differs

significantly from the degree of credit exposure to loans

that portfolio lenders

and insurance providers typically assume.

For

most of our

underperforming residential assets, we have written down

our remaining GAAP

exposure to a few cents on the dollar. There is not much

more to write off for

these assets. The bulk of our remaining assets should produce

reasonable

economic returns. Over 87% of the value of our residential

real estate assets is

in securities backed by loans that were originated before

or during 2004 or is

in securities that were acquired in 2008 or the fourth

quarter of 2007 at low

prices with extreme caution in mind. All of our commercial

real estate assets

are backed by loans originated in 2006 or earlier.

There

will again be

a healthy growing demand for credit enhancement of residential

jumbo and

commercial real estate loans. The banks, Fannie Mae, Freddie

Mac, and the

government are not able to provide all the capital required

to finance U.S.

residential and commercial real estate. There is a role

for the private sector,

and Redwood will continue to be a major player in that

sector.

Redwood

has the

freedom and capital to shape its own destiny. We have a

strong balance sheet,

ample liquidity, good cash flows, and virtually no exposure

to short-term debt

or to the liquidity issues that have plagued other market

participants. Redwood

is weathering this crisis and will continue to be a strong

player in the real

estate finance markets.

At

this challenging time, we particularly appreciate your

continued

support.

Sincerely,

|

|

|

George

E. Bull, III

|

Douglas

B. Hansen

|

|

Chairman

and CEO

|

President

|

THE

REDWOOD REVIEW 2ND QUARTER 2008 3

|

|

|

QUARTERLY OVERVIEW

|

Second

Quarter 2008

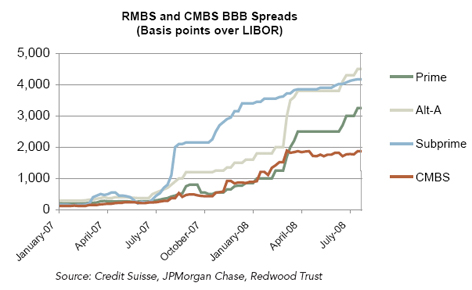

During

the second

quarter, the challenges facing the mortgage industry grew

larger and more

complex. The same incendiaries — rising credit costs, falling home prices,

contracting credit availability, deteriorating balance

sheet strength, and

escalating rating agency downgrades — are still front and center. As a

consequence, fear and uncertainty continue to inhibit the

normal functioning of

the mortgage capital markets.

Capable

folks in

the public and private sectors are dedicated to developing

wide-ranging

solutions; unfortunately, there are no quick fixes. It

seems to us that

borrowers and financial institutions will endure significantly

more pain before

the storm passes.

Considering

market

headwinds, our accomplishments, and our disappointments,

we would categorize our

performance for the second quarter as “mixed”. On the one hand, we invested $152

million of our excess capital in what we believe are safe

and attractive assets,

we generated $52 million of cash flow in excess of our

operating and interest

costs, and we continued to expand our asset management

business. Furthermore, we

maintained our strong balance sheet. At June 30, 2008,

we had $148 million of

unrestricted cash, of which $132 million was capital in

excess of our operating

requirements. On the other hand, we are humbled by continued

increases in our

future loss assumptions for residential credit costs, particularly

for the 2006

and 2007 vintages. Additionally, we have materially reduced

our future cash flow

expectations from our Acacia equity investments due to

a barrage of rating

agency downgrades of Acacia assets in June and July of

2008 that were more

severe and more rapid than our expectations. During the

second quarter, the cash

flow we received from our Acacia equity investments was

$5 million, but we now

expect this cash flow to diminish rapidly over the next

few quarters. This topic

is discussed in more detail in the Investments in Acacia

module.

We

continue to

actively, yet patiently, pursue residential credit investments.

Credit

investment opportunities that we find attractive, however,

remain scarce. New

residential non-agency securitization activity is effectively

shut down, and

secondary trading of existing securities remains light.

Additionally, our

progress in completing other forms of credit risk transfers

with large financial

institutions has been impeded by the slow, deliberate pace

of their balance

sheet restructuring and capital reallocation process. As

a result, we only

invested $3 million in residential credit enhancement securities

(CES) during

the quarter.

Our

investing

activity at Redwood during the quarter was limited almost

entirely to

residential investment grade securities (IGS), securities

that provide a greater

certainty of the range of expected cash flows. We invested

$147 million in

residential IGS, $64 million of which was rated AAA and

AA and backed by prime

mortgage collateral and $62 million of which was AAA-rated

and backed by

non-prime mortgage collateral. We also acquired $21 million

of A and BBB-rated

securities backed by prime mortgage collateral from 2003

and 2004. The majority

(72%) of our acquisitions of IGS consisted of securities

backed by 2005 and

earlier mortgage collateral. The weighted average purchase

price for our

acquisitions was 75% of face value. The base case yields

range from 12% to 16%.

Although we can provide no assurance as to the future credit

performance of

these securities, we currently do not expect to incur any

material principal

credit losses on these newly acquired IGS. We acquired

these securities with

safety in mind. We take comfort in the fact that our recent

non-prime IGS

investments had on average over 30 points of credit enhancement.

This means for

example, that the underlying loan pools could withstand

a 50% default rate and a

40% loss severity and we would still have 10 points of

credit protection

remaining.

4

THE REDWOOD REVIEW 2ND QUARTER 2008

|

|

|

QUARTERLY

OVERVIEW

|

Second

Quarter 2008 (continued)

We

did not make any

new commercial or collateralized debt obligation (CDO)

investments at Redwood

during the quarter. We acquired $2 million of previously

issued Sequoia ABS.

The

Opportunity

Fund (the Fund) closed at the end of the first quarter

with $96 million of

commitments ($46 million from third-party investors and

$50 million from

Redwood). The offer and sale of interests in this private

fund were not

registered under the federal securities laws. The fund

was formed to capitalize

on dislocations in the non-prime residential mortgage-backed

securities (RMBS)

and CDO markets. As of June 30, 2008, the Fund had invested

$82 million, mainly

in seasoned residential non-prime IGS and CDOs. It is

managed by Redwood Asset

Management, one of our taxable subsidiaries. The expansion

of our asset

management business is an important part of our long-term

business strategy.

Rising

credit costs

remain our biggest challenge. We believe we established

adequate credit reserves

for GAAP purposes of $976 million, or $29.41 per share,

at the end of the

quarter. We are not, however, allowed to establish reserves

for tax purposes.

Our realized credit loss deductions for tax purposes

were $30 million in the

second quarter, up from $14 million in the prior quarter.

We expect credit

losses will increase in subsequent quarters, perhaps

not peaking until 2009 or

2010. A portion of these losses may be recoverable from

third parties and our

loss mitigation team is focused on recovering losses

where appropriate.

The

commercial real

estate market is facing economic headwinds with a slowing

economy, resulting in

rising vacancies across property types. In general, we

expect conditions to

worsen. We have not purchased and do not own commercial

assets that have

underlying loans originated in 2007 or 2008. So far,

our seasoned portfolio

continues to perform generally within our expectations.

We believe there will be

attractive opportunities to expand our commercial business

in the future.

Our

reported GAAP

loss for the second quarter of 2008 was $46 million (negative

$1.40 per share).

This loss includes $60 million (negative $1.84 per share)

of net negative market

valuation adjustments. Please note that we no longer

highlight core earnings as

recent accounting changes incorporating mark-to-market values have rendered

current results under that calculation that are not consistent

across asset

classes nor are comparable to prior core earnings results, and

thus core

earnings are no longer particularly useful in our view.

Estimated

taxable

earnings for this quarter were $4 million ($0.11 per

share). These taxable

earnings included $30 million (negative $0.92 per share)

of taxable income

deductions related to credit losses.

Our

economic, or

total rate of return, earnings during the second quarter

were a loss of $0.57

per share. This non-GAAP measure represents the change

in our economic book

value per share during the quarter after giving effect

to the payment of

dividends for the quarter. We caution that economic earnings

are heavily

influenced by short-term movements in market prices.

THE

REDWOOD REVIEW 2ND QUARTER 2008 5

|

|

|

QUARTERLY OVERVIEW

|

Second

Quarter 2008 (continued)

Our

GAAP book value

at June 30, 2008 was $17.00 per share. Our quarter-end

estimate of our economic

book value was $16.72 per share. Economic book

value is calculated using

bid-side or exit price marks. This value approximates

liquidation value and in

our opinion does not reflect the cost, or offered-side

values, we would have to

pay to replace our assets. Based on our estimate

of the future loss-adjusted

cash flows underlying our calculation of economic

book value at June 30, 2008,

the overall projected cash flow yield for our $624

million market value of

financial assets was 21% (including $147 million

of cash yielding 2%) and 26%

(excluding cash). The implied yield for our $81

million market value of

financial liabilities was 14%.

Details

and caveats

regarding the use and determination of these calculations,

and the

reconciliation of non-GAAP measures to GAAP, are

found later in this Review.

We

expect that GAAP

earnings will remain volatile. Early into the third

quarter, prices for many

real estate securities have continued to trend

down. It is still too early to

project whether this trend will continue throughout

the quarter. We will likely

continue to encounter mark-to-market (MTM) volatility

from our consolidation of

the Acacia entities due to the technical valuation

methodologies required under

FAS 159. In addition, we may recognize additional

GAAP impairment losses on

residential, commercial, and CDO securities held

at Redwood. Negative MTM

balance sheet write-downs that have not yet been

realized through the income

statement totaled $53 million at June 30, 2008.

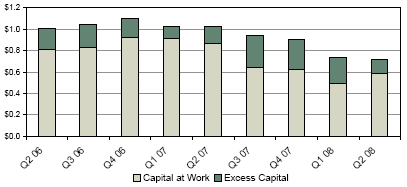

During

the second

quarter, we raised $14 million through equity issuance

under our direct stock

purchase and dividend reinvestment plan. We ended

the second quarter with

reported capital of $714 million, including excess

capital of $132 million

available to make new investments. Our reported

capital base consists of $564

million of common equity and $150 million of subordinated

debt due in 2037. The

calculation of our excess capital is discussed

in the Capital and Liquidity

module that follows later in this Review.

Our

current capital

deployment plan is fluid and may include acquiring

or selling assets as well as

issuing or repurchasing equity shares. Our actions

will depend on:

| u |

The

level and

attractiveness of new investment opportunities;

|

| u |

Our

ability

to raise capital at a price that is accretive

to

earnings;

|

| u |

The

relative

attractiveness of investing in Redwood’s assets through the repurchase of

shares; and

|

| u |

The

amount of

cash we believe we should hold in reserve

to take advantage of potential

extraordinary investment opportunities

that may appear in the future.

|

As

these

considerations are in some respects competing,

and as market conditions remain

unclear and volatile, it is difficult to indicate

in advance what actions we

will likely take. We are keeping our options open.

We have not made any asset

acquisitions nor have we repurchased stock this

quarter through August 5, 2008.

You

can take

comfort in the fact that we are also shareholders

and we take capital decisions

personally. Suffice it to say, we will maintain

an appropriate amount of

liquidity, we will raise capital only if it is

accretive to earnings, and we are

prepared to buy back shares if we determine that

is our best investment

opportunity. To remind shareholders, from 1997

through 1999, we repurchased over

40% of the outstanding shares of Redwood.

6

THE REDWOOD REVIEW 2ND QUARTER 2008

|

|

|

QUARTERLY

OVERVIEW

|

Second

Quarter 2008 (continued)

We

expect that REIT

taxable income will continue to be pressured by

the realization of credit losses

through 2009 and into 2010. Actual REIT taxable

income will depend on the timing

of the credit losses and the level of taxable income

generated by our new and

existing investments. On a quarterly basis, we

expect taxable income generation

will be volatile.

As

a REIT, our

minimum dividend distribution requirements are

determined by our REIT taxable

income. Currently, our estimate is that the REIT

taxable income generated in

2008, together with the undistributed REIT taxable

income carried over from

2007, could fall somewhat short of full-year distributions

at our regular

dividend rate. We caution that the timing of credit

losses can be difficult to

project in the current environment and that our

estimates of taxable income

could change.

In

early August

2008, our Board of Directors reaffirmed its intention

to maintain the regular

quarterly dividend rate of $0.75 per share for

both the third and fourth

quarters of 2008. We do not expect to pay a special

dividend for 2008. Further,

we expect that the amount of undistributed taxable

income carried over into

2009, if any, will be minimal. The Board plans

to discuss dividend policy for

2009 at its regularly scheduled November board

meeting.

|

|

|

Martin

S. Hughes

|

Brett

D. Nicholas

|

|

Chief

Financial Officer

|

Chief

Investment Officer

|

|

Co-Chief

Operating Officer

|

Co-Chief

Operating Officer

|

THE

REDWOOD REVIEW 2ND QUARTER 2008 7

|

|

|

FINANCIAL INSIGHTS

|

Components

of Book Value

| u |

The

following

supplemental non-GAAP balance sheet

presents our assets and liabilities

as

calculated under GAAP and as adjusted

to reflect our estimate of economic

value. We show our investments in the

Opportunity Fund and the Sequoia and

Acacia securitization entities in separate

line items, similar to the

equity method of accounting, reflecting

the reality that the underlying

assets and liabilities owned by these

entities are legally not ours. We

own only the securities or interests

that we have acquired or retained

from these entities.

|

| u |

This

table,

except for our estimates of economic

value, is derived from the

consolidating balance sheet presented

on page 10. Our estimate of economic

value of $16.72 is calculated using the

bid-side asset marks as required

to determine fair value under GAAP. This

method of calculating economic

value more closely relates to liquidation

value and does not represent the

higher amount we would have to pay at

the offered-side to replace our

existing assets.

|

|

Components

of Book Value

|

|||||||||||

|

June

30, 2008

|

|||||||||||

|

($

in millions, except per share data)

|

|||||||||||

|

As

Reported

|

|

Adj.

|

|

|

Management's

Estimate of Economic Value

|

||||||

|

Real

estate

securities at Redwood

|

|||||||||||

|

Residential

|

$

|

247

|

$

|

247

|

|||||||

|

Commercial

|

91

|

91

|

|||||||||

|

CDO

|

15

|

15

|

|||||||||

|

Total

real

estate securities at Redwood

|

353

|

353

|

|||||||||

|

Cash

and cash

equivalents

|

148

|

148

|

|||||||||

|

Investments

in

Opportunity Fund

|

47

|

47

|

|||||||||

|

Investments

in

Sequoia

|

140

|

(65)

|

|

(a)

|

75

|

||||||

|

Investments

in

Acacia

|

41

|

(22)

|

|

(b)

|

19

|

||||||

|

Other

assets/liabilities, net (d)

|

(15

|

)

|

|

(15

|

)

|

||||||

|

Long-term

debt

- Redwood

|

(150

|

)

|

78

|

(c)

|

(72

|

)

|

|||||

|

Stockholders'

equity

|

$

|

564

|

$

|

555

|

|||||||

|

Book

value per share

|

$

|

17.00

|

$

|

16.72

|

|||||||

| (a) |

Our

actual

Sequoia investments consist of CES,

IGS, and IOs acquired by Redwood from

the Sequoia entities. We calculated

the $75 million estimate of economic

value for these securities using the

same valuation process that we

followed to fair value all other real

estate securities. In contrast, the

$140 million of GAAP carrying value

of these investments represents the

difference between residential real

estate loans owned by the Sequoia

entities and the asset-backed securities

(ABS) issued by those entities to

third party investors. We account for

these loans and ABS issued at cost,

not at fair value.

|

| (b) |

Our

actual

Acacia investments consist of equity

interests, and to a lesser extent ABS

issued, that we acquired from the Acacia

entities. The $19 million

estimate of economic value of our investment

interests in the Acacia

entities represents the value of the

ABS acquired or retained using

bid-side marks from third parties,

plus the net present value of projected

cash flows from our Acacia management

fees discounted at 45%. We valued

our equity interests at the amount

of cash we received in July and expect

to receive in August and September

2008. We are not valuing any future

cash flows from equity distributions

beyond the third quarter. The

difference between the GAAP and economic

values is discussed in detail in

the Investments in Acacia section in

this Review.

|

| (c) |

We

issued

$150 million of 30-year long-term debt

at Redwood at an interest rate of

LIBOR plus 225 basis points. Under

GAAP, these notes are carried at cost.

Economic value is difficult to estimate

with precision as the market for

the notes is currently inactive. We

estimated the $72 million economic

value using the same valuation process

used to fair value our other

financial assets and liabilities. Estimated

economic value is $78 million

lower than our GAAP carrying value

because given the significant overall

contraction in credit availability

and re-pricing of credit risk, if we

had issued this long-term debt at Redwood

at June 30, 2008, investors

would have required a substantially

higher interest rate.

|

| (d) |

Other

assets/liabilities, net are comprised

of real estate loans of $4 million,

restricted cash of $2 million, $8 million

of deferred taxes, $5 million of

accrued interest, and other assets

of $11 million, less Redwood debt of

$9

million, accruals of $8 million, dividends

payable of $25 million, and

other liabilities of $3 million.

|

8

THE REDWOOD REVIEW 2ND QUARTER 2008

|

|

|

FINANCIAL

INSIGHTS

|

Components

of Book Value (continued)

| u |

The

following

table highlights the components of the overall change

in economic book

value per share that occurred during the quarter. It

is intended to

highlight the performance of our different investment

categories and show

other sources and uses of cash that impacted economic

value. Our

investment performance, expressed below as the change

in the economic

value of investments, gives effect to MTM adjustments,

new investments,

and principal and interest collected. As an example,

the $30 million

decline in economic value of our Acacia investments

from $49 million at

March 31, 2008 to $19 million at June 30, 2008, was

partially offset by

our receipt of $5 million in cash from our Acacia investments.

Therefore,

the net decrease in the economic value of our investments

in Acacia during

the quarter was $25 million ($0.75 per share).

|

| u |

The

changes

in the components of economic book value per

share is a non-GAAP measure.

Management’s estimate of economic value at March 31, 2008

is reconciled to

GAAP on Table 18 in the Financial Tables section.

Management’s estimate of

economic value at June 30, 2008 is reconciled

to GAAP on the previous

page.

|

|

Changes

in the Components of Economic Value Per Share

|

||||

|

Three

Months Ended June 30, 2008

|

||||

|

(in

$ per share)

|

||||

|

Management's

estimate of economic value at 3/31/08

|

$

|

18.04

|

||

|

Change

in

economic value of investments

|

||||

|

Real

estate

securities at Redwood

|

0.30

|

|||

|

Investments

in

Opportunity Fund

|

0.09

|

|||

|

Investments

in

Sequoia

|

-

|

|||

|

Investments

in

Acacia

|

(0.75

|

)

|

||

|

Total

change

in economic value of investments

|

(0.36

|

)

|

||

|

Operating

and

interest expenses

|

(0.36

|

)

|

||

|

Dividends

|

(0.75

|

)

|

||

|

Equity

issuance

|

0.15

|

|||

|

Total

changes to economic value

|

(1.32

|

)

|

||

|

Management's

estimate of economic value at 6/30/08

|

$

|

16.72

|

||

| u |

To

us, the

most important take-away from this presentation is

that our investments in

real estate securities held at Redwood and our investment

in the

Opportunity Fund showed a positive increase in economic

value despite the

extremely difficult market conditions, and that the

primary drag on our

overall investment performance during the second

quarter was our

investments in Acacia, which were significantly impacted

by rating agency

downgrades occurring late in the quarter at a rate

that exceeded our

expectations. Downgrades cut off cash flows to our

Acacia equity

interests. At June 30, 2008, our investments in Acacia

represent less than

4% of our invested capital.

|

THE

REDWOOD REVIEW 2ND QUARTER 2008 9

|

|

|

FINANCIAL INSIGHTS

|

Consolidating

Balance Sheet

| u |

GAAP

requires

us to consolidate all of the assets and liabilities

of the Sequoia and

Acacia securitization entities (which had a combined

$7.5 billion of

assets and $7.3 billion of liabilities at June 30,

2008) even though the

assets are owned by the securitization entities and

the liabilities are

obligations of the securitization entities payable

only from the cash

flows generated by the assets owned by the entities.

Additionally, we are

required to consolidate all of the assets and liabilities

of the

Opportunity Fund. Redwood owns the general partnership

interest in the

Opportunity Fund and just over half of the limited

partnership interests.

|

| u |

The

table

below shows the consolidating components of our consolidated

balance sheet

at June 30, 2008. The purpose of this presentation

is to show the effect

each of the components had on our consolidated shareholders’ equity at

June 30, 2008. The Opportunity Fund, Sequoia, and

Acacia components

represent investments and are not separate business

segments.

|

|

Consolidating

Balance Sheet

|

|||||||||||||||||||

|

June

30, 2008

|

|||||||||||||||||||

|

($

in millions)

|

|||||||||||||||||||

|

Redwood

|

|

Opportunity

Fund

|

|

Sequoia

|

|

Acacia

|

|

Intercompany

|

|

Redwood

Consolidated

|

|||||||||

|

Real

estate

loans

|

$

|

4

|

$

|

-

|

$

|

6,354

|

$

|

19

|

$

|

-

|

$

|

6,377

|

|||||||

|

Real

estate

securities

|

353

|

66

|

-

|

906

|

(84

|

)

|

1,241

|

||||||||||||

|

Other

investments

|

-

|

-

|

-

|

79

|

-

|

79

|

|||||||||||||

|

Cash

and cash

equivalents

|

148

|

-

|

-

|

-

|

-

|

148

|

|||||||||||||

|

Total

earning

assets

|

505

|

66

|

6,354

|

1,004

|

(84

|

)

|

7,845

|

||||||||||||

|

Investment

in

Opportunity Fund

|

47

|

-

|

-

|

-

|

(47

|

)

|

-

|

||||||||||||

|

Investment

in

Sequoia

|

140

|

-

|

-

|

-

|

(140

|

)

|

-

|

||||||||||||

|

Investment

in

Acacia

|

41

|

-

|

-

|

-

|

(41

|

)

|

-

|

||||||||||||

|

Other

assets

|

26

|

29

|

60

|

86

|

-

|

201

|

|||||||||||||

|

Total

assets

|

$

|

759

|

$

|

95

|

$

|

6,414

|

$

|

1,090

|

$

|

(312

|

)

|

$

|

8,046

|

||||||

|

Short-term

debt - Redwood

|

$

|

9

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

9

|

|||||||

|

Asset-backed

securities issued - Sequoia

|

-

|

-

|

6,259

|

-

|

(84

|

)

|

6,175

|

||||||||||||

|

Asset-backed

securities issued - Acacia

|

-

|

-

|

-

|

935

|

-

|

935

|

|||||||||||||

|

Other

liabilities

|

36

|

1

|

15

|

114

|

-

|

166

|

|||||||||||||

|

Long-term

debt

- Redwood

|

150

|

-

|

-

|

-

|

-

|

150

|

|||||||||||||

|

Total

Liabilities

|

195

|

1

|

6,274

|

1,049

|

(84

|

)

|

7,435

|

||||||||||||

|

Minority

Interest in Opportunity Fund

|

-

|

47

|

-

|

-

|

-

|

47

|

|||||||||||||

|

Total

Stockholders’ Equity

|

564

|

47

|

140

|

41

|

(228

|

)

|

564

|

||||||||||||

|

Total

liabilities and stockholders’ equity

|

$

|

759

|

$

|

95

|

$

|

6,414

|

$

|

1,090

|

$

|

(312

|

)

|

$

|

8,046

|

||||||

10

THE REDWOOD REVIEW 2ND QUARTER 2008

|

|

|

FINANCIAL

INSIGHTS

|

Real

Estate

Securities at Redwood

| u |

This

quarter

we reclassified our residential securities portfolio

into prime and

non-prime categories. The non-prime portfolio includes

securities backed

by alt-a and subprime loans and all option adjustable-rate

mortgages

(ARMs). As a result of establishing these new categories,

we reclassified

$4 million of option ARMs from prime to non-prime.

|

| u |

The

table

below provides a breakout of our real estate securities

portfolio by

residential, commercial, and CDO by vintage. The

residential and

commercial securities are further detailed by rating

in separate modules

later in this Review.

|

|

Real

Estate Securities at Redwood

|

|||||||||||||||||||

|

June

30, 2008

|

|||||||||||||||||||

|

($

in millions)

|

|||||||||||||||||||

|

<=

2004

|

2005

|

|

2006

|

|

2007

|

2008

|

|

Total

|

|||||||||||

|

Residential

|

|

||||||||||||||||||

|

Prime

|

|||||||||||||||||||

|

IGS

|

$

|

43

|

$

|

27

|

$

|

21

|

$

|

4

|

$

|

7

|

$

|

102

|

|||||||

|

CES

|

56

|

12

|

4

|

6

|

1

|

79

|

|||||||||||||

|

Non-prime

|

|||||||||||||||||||

|

IGS

|

-

|

29

|

13

|

16

|

-

|

58

|

|||||||||||||

|

CES

|

3

|

2

|

1

|

2

|

-

|

8

|

|||||||||||||

|

Total

Residential

|

102

|

70

|

39

|

28

|

8

|

247

|

|||||||||||||

|

Commercial

CES

|

15

|

18

|

45

|

13

|

-

|

91

|

|||||||||||||

|

CDO

IGS

|

8

|

6

|

-

|

1

|

-

|

15

|

|||||||||||||

|

Market

value

|

$

|

125

|

$

|

94

|

$

|

84

|

$

|

42

|

$

|

8

|

$

|

353

|

|||||||

| u |

Of

the total

$353 million of capital invested in real estate securities

at June 30,

2008, $211 million has been invested since the beginning

of the fourth

quarter of 2007.

|

| u |

Total

real

estate securities at Redwood increased during the

second quarter by 51% to

$353 million at June 30, 2008. The table below presents

our activity

during the second quarter.

|

|

Real

Estate Securities at Redwood

|

||||

|

Three

Months Ended June 30, 2008

|

||||

|

($

in millions)

|

||||

|

Market

value at March 31, 2008

|

$

|

234

|

||

|

Acquisitions

|

||||

|

Residential

IGS

|

||||

|

Prime

|

85

|

|||

|

Non-prime

|

62

|

|||

|

Total

Residential IGS

|

147

|

|||

|

Residential

Prime CES

|

3

|

|||

|

Principal

payments

|

(22

|

)

|

||

|

Discount

amortization

|

5

|

|||

|

Changes

in

fair value, net

|

(14

|

)

|

||

|

Market

value at June 30, 2008

|

$

|

353

|

||

THE

REDWOOD REVIEW 2ND QUARTER 2008 11

|

|

|

FINANCIAL INSIGHTS

|

Real

Estate

Securities at Redwood (continued)

| u |

During

the

second quarter, Redwood’s primary investment focus (exclusive of the

Opportunity Fund) was the acquisition of residential

IGS. With the

securitization market effectively shut down,

we invested a substantial

amount of our excess capital in seasoned securities

that are higher up in

the capital structure and where the range of

expected cash flows is more

certain. We acquired $147 million of IGS out

of total acquisitions of $152

million. We acquired $85 million of IGS securities

backed by prime

mortgage loans and $62 million backed by non-prime

mortgage loans. The

table below shows the detail by rating and vintage

for our prime and

non-prime residential IGS acquisitions during

the second quarter.

|

|

Residential

IGS Acquisitions

|

|||||||||||||||||||

|

at

Redwood by Type, Rating & Vintage

|

|||||||||||||||||||

|

Three

Months Ended June 30, 2008

|

|||||||||||||||||||

|

($

in millions)

|

|||||||||||||||||||

|

<=2004

|

|

2005

|

|

2006

|

|

2007

|

|

2008

|

|

Total

|

|||||||||

|

Prime

IGS

|

|||||||||||||||||||

|

AAA

|

$

|

-

|

$

|

4

|

$

|

14

|

$

|

-

|

$

|

-

|

$

|

18

|

|||||||

|

AA

|

19

|

22

|

-

|

5

|

-

|

46

|

|||||||||||||

|

A

|

15

|

-

|

-

|

-

|

-

|

15

|

|||||||||||||

|

BBB

|

6

|

-

|

-

|

-

|

-

|

6

|

|||||||||||||

|

Total

Prime

IGS

|

40

|

26

|

14

|

5

|

-

|

85

|

|||||||||||||

|

Non-prime

IGS

|

|||||||||||||||||||

|

AAA

|

-

|

34

|

14

|

14

|

-

|

62

|

|||||||||||||

|

Total

acquisitions

|

$

|

40

|

$

|

60

|

$

|

28

|

$

|

19

|

$

|

-

|

$

|

147

|

|||||||

| u |

Although

for

illustrative purposes we show the credit ratings

for our investments made

during the quarter, we emphasize that we do not

rely on credit ratings as

part of our investment decision process. Our

acquisition decisions are

based on the strength of the underlying collateral cash flows and the

level of subordination to protect against projected

credit losses. Of the

$62 million of non-prime acquisitions, $48 million

were backed by option

ARMs and $14 million were backed by subprime

loans. The option ARM IGS we

acquired have a weighted average credit support

of 29 points and were

acquired at 73% of face value. The subprime IGS

we acquired have a

weighted average credit support of 41 points

and were acquired at 83% of

face value.

|

| u |

The

percentage of IGS in our securities portfolio increased

to 50% at June 30,

2008 from 18% at the end of the first quarter.

|

12

THE REDWOOD REVIEW 2ND QUARTER 2008

|

|

|

FINANCIAL

INSIGHTS

|

Real

Estate

Securities at Redwood (continued)

| u |

For

GAAP

balance sheet purposes, we are required to

determine the carrying value of

our real estate securities using prices that

we can support as an “exit”

or bid-side price. Bid/offer spreads remain

wide for many of these

securities and, consequently, we reduced the

carrying value of our second

quarter acquisitions by $12 million below our

cost at June 30, 2008.

|

| u |

The

following

table presents the components of GAAP carrying

value (which equals fair

value determined in accordance with GAAP) for

residential and commercial

CES at Redwood. The carrying values as a percentage

of face value are all

equal to or less than 20%, with our non-prime

CES carried at 3% of face

value. In total, the carrying value of our

CES as a percentage of face

value is 15%.

|

|

Credit

Enhancement Securities at Redwood

|

||||||||||

|

June

30, 2008

|

||||||||||

|

($

in millions)

|

||||||||||

|

Residential

|

||||||||||

|

Prime

|

Non-Prime

|

|

Commercial

|

|||||||

|

Current

face

|

$

|

390

|

$

|

319

|

$

|

518

|

||||

|

Unamortized

discount, net

|

(49

|

)

|

(17

|

)

|

(33

|

)

|

||||

|

Discount

designated as credit reserve

|

(252

|

)

|

(297

|

)

|

(384

|

)

|

||||

|

Amortized

cost

|

89

|

5

|

101

|

|||||||

|

Unrealized

gains

|

9

|

4

|

3

|

|||||||

|

Unrealized

losses

|

(19

|

)

|

(1

|

)

|

(13

|

)

|

||||

|

Total

carrying value

|

$

|

79

|

$

|

8

|

$

|

91

|

||||

|

Carrying

value as a percentage of face

|

20

|

%

|

3

|

%

|

18

|

%

|

||||

| u |

We

acquire

CES at a significant discount to principal

value as credit losses could

reduce or eliminate the principal value of

these bonds. Our return on

these investments is based on how much principal

and interest we receive

and how quickly we receive it. Typically we

assume that most or all of the

principal will be written off due to credit

losses, so the timing of

credit losses is more of a factor than the

amount of credit losses when

looking at downside scenarios. In an ideal

environment, we would

experience fast prepayments and low credit

losses allowing us to recover a

substantial part of the discount as income.

Conversely, in the least

beneficial environment, we would experience

slow prepayments and high

credit losses.

|

| u |

We

provide

additional discussion and analysis regarding

the adequacy of our credit

reserves and the potential earnings upside

from an increase in prepayments

in the residential and commercial real estate

securities modules that

follow.

|

THE

REDWOOD REVIEW 2ND QUARTER 2008 13

|

|

|

FINANCIAL INSIGHTS

|

Cash

Flow

| u |

As

a

supplement to our Consolidated Statement

of Cash Flows included in our

Quarterly Report on Form 10-Q, we have included

the table below that

summarizes the sources and uses of our cash

during the second quarter.

This table excludes the gross cash flows

generated by our Sequoia and

Acacia securitization entities and the Opportunity

Fund (cash flows that

are not available to Redwood), but does include

the cash flows paid to

Redwood as a result of our investments in

these entities.

|

| u |

In

the second

quarter, our investments generated cash from

principal and interest of $65

million, compared to $70 million in the first

quarter. We also received $1

million of asset management fees in the second

quarter. The net investment

cash flow, after deducting long and short-term

Redwood debt interest

expense of $2 million and cash operating

expenses of $12 million, was $52

million, compared to $54 million in the first

quarter.

|

|

Redwood

|

||||

|

Sources

and Uses of Cash

|

||||

|

Three

Months Ended June 30, 2008

|

||||

|

($

in millions)

|

||||

|

Sources:

|

||||

|

Cash

from

investments

|

$

|

65

|

||

|

Equity

raised

|

14

|

|||

|

Management

fees

|

1

|

|||

|

Short-term

borrowings

|

7

|

|||

|

Changes

in

working capital

|

5

|

|||

|

Total

Sources

|

92

|

|||

|

Uses:

|

||||

|

Acquisitions

|

(152

|

)

|

||

|

Additional

investment in Opportunity Fund

|

(10

|

)

|

||

|

Dividends

paid

|

(25

|

)

|

||

|

Operating

expenses paid

|

(12

|

)

|

||

|

Interest

expense

|

(2

|

)

|

||

|

Total

Uses

|

(201

|

)

|

||

|

Net

uses of cash

|

$

|

(109

|

)

|

|

|

Beginning

cash balance at 3/31/08

|

$

|

257

|

||

|

Ending

cash balance at 6/30/08

|

$

|

148

|

||

| u |

The

primary

reason for the decline in net investment

cash flow was lower interest

income resulting from slower prepayments

and the decline in short-term

interest rates during recent quarters,

which has lowered the coupon rates

we earn on adjustable-rate

assets.

|

14

THE REDWOOD REVIEW 2ND QUARTER 2008

|

|

|

FINANCIAL

INSIGHTS

|

Cash

Flow

(continued)

| u |

The

$65

million of cash flow from our investments

included $40 million of coupon

interest and $25 million of principal.

We caution readers that given the

nature of our investments (deep discount

credit-sensitive securities, IGS

at discounts, IOs, equity investments in

Acacia, and other types) it is

difficult to draw conclusions in any one

period about what portion of our

cash flow represents “income” and what is a “return of capital.” It is

only at the end of an asset’s life that we can accurately determine

what portion of the cumulative cash received

(whether principal or

interest) was truly income and what was

a return of capital.

|

| u |

The

following

table provides information regarding the

investment source and vintage of

our cash flow.

|

|

Cash

Flow by Vintage

|

|||||||||||||||||||

|

Three

Months Ended June 30, 2008

|

|||||||||||||||||||

|

($

in millions)

|

|||||||||||||||||||

|

<=2004

|

2005

|

|

2006

|

|

2007

|

|

2008

|

|

Total

|

||||||||||

|

Redwood

|

$

|

17

|

$

|

10

|

$

|

6

|

$

|

5

|

$

|

1

|

$

|

39

|

|||||||

|

Opportunity

Fund

|

1

|

1

|

-

|

-

|

-

|

2

|

|||||||||||||

|

Sequoia

|

14

|

1

|

-

|

4

|

-

|

19

|

|||||||||||||

|

Acacia

|

2

|

2

|

1

|

-

|

-

|

5

|

|||||||||||||

|

Total

|

$

|

34

|

$

|

14

|

$

|

7

|

$

|

9

|

$

|

1

|

$

|

65

|

|||||||

| u |

We

note that

credit losses on securities have no immediate

impact on our cash flow at

the time a loss is realized, although they

will result in a reduction in

the principal balance of the security.

Cash flow receipts will therefore

be reduced in future periods since interest

payments will be based on a

reduced principal balance. Also the upside

potential to recover the full

purchase discount from face value is reduced

by the amount of the loss.

|

| u |

We

caution

that the amount of cash flow from existing

investments could be volatile

from quarter to quarter depending on prepayment

patterns, changes in

interest rates, and the level of credit

losses. Overall, we expect cash

flow from existing investments to trend

lower over time. Future cash flows

could increase should our new investment

activity be successful.

|

THE

REDWOOD REVIEW 2ND QUARTER 2008 15

|

|

|

GAAP INCOME

|

Summary

What

is

this?

GAAP

income is

income calculated under generally accepted accounting

principles in the United

States.

Quarterly

Update

| u |

The

table

below provides a summary of our GAAP (loss)

income for the second quarter

of 2008, the first quarter of 2008, and

the second quarter of 2007.

|

|

GAAP

Income

|

||||||||||

|

Three

Months Ended

|

||||||||||

|

($

in millions, except per share data)

|

||||||||||

|

6/30/08

|

3/31/08

|

|

6/30/07

|

|||||||

|

Interest

income

|

$

|

127

|

$

|

169

|

$

|

220

|

||||

|

Management

fees

|

1

|

2

|

1

|

|||||||

|

Interest

expense

|

(99

|

)

|

(130

|

)

|

(167

|

)

|

||||

|

Net

interest

income before market valuation adjustments

|

29

|

41

|

54

|

|||||||

|

Market

valuation adjustments, net

|

(60

|

)

|

(194

|

)

|

(29

|

)

|

||||

|

Net

interest

(loss) income

|

(31

|

)

|

(153

|

)

|

25

|

|||||

|

Operating

expenses

|

(15

|

)

|

(17

|

)

|

(13

|

)

|

||||

|

Realized

gains

(losses) on sales

|

3

|

-

|

1

|

|||||||

|

Realized

gains

on calls

|

-

|

-

|

1

|

|||||||

|

Minority

interest allocation

|

(2

|

)

|

-

|

-

|

||||||

|

Provision

for

income taxes

|

(1

|

)

|

(2

|

)

|

(3

|

)

|

||||

|

GAAP

(loss) income

|

$

|

(46

|

)

|

$

|

(172

|

)

|

$

|

11

|

||

|

GAAP

(loss) income per share

|

$

|

(1.40

|

)

|

$

|

(5.28

|

)

|

$

|

0.41

|

||

| u |

Our

reported

GAAP loss for the second quarter of 2008

was $46 million ($1.40 per share)

compared to a GAAP loss of $172 million

($5.28 per share) for the first

quarter of 2008. The improvement in the

second quarter was primarily a

result of substantially lower negative

market valuation adjustments (MVA).

|

| u |

Net

interest

income before MVA in the second quarter

totaled $29 million, a $12 million

decrease from the first quarter. More detailed

information on the

components of the changes in our net interest

income is found below.

|

| u |

MVA

in the

second quarter was a negative $60 million,

a significant difference from

negative MVA of $194 million in the first

quarter. MVA at Redwood totaled

$31 million, MVA at Acacia totaled $28

million, and MVA at Sequoia were $1

million. MVA are discussed in more detail

in the Mark-to-Market module

later in the Review.

|

| u |

Total

operating expenses decreased by $2 million

to $15 million from the prior

quarter, primarily due to lower variable

compensation accruals and a lower

headcount in the second quarter.

|

| u |

We

had

previously planned to distribute 90% of

our REIT taxable income for 2007

as dividends. As a result of the Board’s decision in August 2008 to

distribute the remaining 10% as a dividend

and to distribute 100% of our

2008 REIT taxable income as dividends,

rather than 90%, we expect to

record a $9 million reduction in our tax

provision during the third

quarter.

|

16

THE REDWOOD REVIEW 2ND QUARTER 2008

|

|

|

GAAP

INCOME

|

Quarterly

Update (continued)

| u |

The

following

tables detail the components of our

consolidated income statements for

the

second quarter and first quarters of

2008.

|

|

Consolidating

Income Statement

|

|||||||||||||||||||

|

Three

Months Ended June 30, 2008

|

|||||||||||||||||||

|

($

in millions)

|

|||||||||||||||||||

|

Redwood

|

Opportunity

Fund

|

Sequoia

|

Acacia

|

Intercompany

Adjustments

|

Redwood

Consolidated

|

||||||||||||||

|

Interest

income

|

$

|

20

|

$

|

1

|

$

|

72

|

$

|

40

|

$

|

(2

|

)

|

$

|

131

|

||||||

|

Net

discount

(premium) amortization

|

5

|

1

|

(10

|

)

|

-

|

-

|

(4

|

)

|

|||||||||||

|

Total

interest

income

|

25

|

2

|

62

|

40

|

(2

|

)

|

127

|

||||||||||||

|

Management

fees

|

1

|

-

|

-

|

-

|

-

|

1

|

|||||||||||||

|

Interest

expense

|

(2

|

)

|

-

|

(67

|

)

|

(32

|

)

|

2

|

(99

|

)

|

|||||||||

|

Net

interest

income (loss) before market valuation

adjustments

|

24

|

2

|

(5

|

)

|

8

|

-

|

29

|

||||||||||||

|

Market

valuation adjustments, net

|

(31

|

)

|

-

|

(1

|

)

|

(28

|

)

|

-

|

(60

|

)

|

|||||||||

|

Net

interest

(loss) income

|

(7

|

)

|

2

|

(6

|

)

|

(20

|

)

|

-

|

(31

|

)

|

|||||||||

|

Operating

expenses

|

(15

|

)

|

-

|

-

|

-

|

-

|

(15

|

)

|

|||||||||||

|

Realized

gains

on sales and calls, net

|

1

|

2

|

-

|

-

|

-

|

3

|

|||||||||||||

|

Income

from

Opportunity Fund

|

2

|

-

|

-

|

-

|

(2

|

)

|

-

|

||||||||||||

|

Loss

from

Sequoia

|

(6

|

)

|

-

|

-

|

-

|

6

|

-

|

||||||||||||

|

Loss

from

Acacia

|

(20

|

)

|

-

|

-

|

-

|

20

|

-

|

||||||||||||

|

Minority

interest allocation

|

-

|

(2

|

)

|

-

|

-

|

-

|

(2

|

)

|

|||||||||||

|

Provision

for

income taxes

|

(1

|

)

|

-

|

-

|

-

|

-

|

(1

|

)

|

|||||||||||

|

Net

(loss) income

|

$

|

(46

|

)

|

$

|

2

|

$

|

(6

|

)

|

$

|

(20

|

)

|

$

|

24

|

$

|

(46

|

)

|

|||

|

Consolidating

Income Statement

|

|||||||||||||||||||

|

Three

Months Ended March 31, 2008

|

|||||||||||||||||||

|

($

in millions)

|

|||||||||||||||||||

|

Redwood

|

Opportunity

Fund

|

Sequoia

|

Acacia

|

Intercompany

Adjustments

|

Redwood

Consolidated

|

||||||||||||||

|

Interest

income

|

$

|

23

|

$

|

1

|

$

|

94

|

$

|

48

|

$

|

(2

|

)

|

$

|

164

|

||||||

|

Net

discount

(premium) amortization

|

11

|

1

|

(7

|

)

|

-

|

-

|

5

|

||||||||||||

|

Total

interest

income

|

34

|

2

|

87

|

48

|

(2

|

)

|

169

|

||||||||||||

|

Management

fees

|

2

|

-

|

-

|

-

|

-

|

2

|

|||||||||||||

|

Interest

expense

|

(3

|

)

|

-

|

(83

|

)

|

(46

|

)

|

2

|

(130

|

)

|

|||||||||

|

Net

interest

income before market valuation adjustments

|

33

|

2

|

4

|

2

|

-

|

41

|

|||||||||||||

|

Market

valuation adjustments, net

|

(167

|

)

|

-

|

-

|

(27

|

)

|

-

|

(194

|

)

|

||||||||||

|

Net

interest

(loss) income

|

(134

|

)

|

2

|

4

|

(25

|

)

|

-

|

(153

|

)

|

||||||||||

|

Operating

expenses

|

(17

|

)

|

-

|

-

|

-

|

-

|

(17

|

)

|

|||||||||||

|

Income

from

Opportunity Fund

|

2

|

-

|

-

|

-

|

(2

|

)

|

-

|

||||||||||||

|

Income

from

Sequoia

|

4

|

-

|

-

|

-

|

(4

|

)

|

-

|

||||||||||||

|

Loss

from

Acacia

|

(25

|

)

|

-

|

-

|

-

|

25

|

-

|

||||||||||||

|

Provision

for

income taxes

|

(2

|

)

|

-

|

-

|

-

|

-

|

(2

|

)

|

|||||||||||

|

Net

(loss) income

|

$

|

(172

|

)

|

$

|

2

|

$

|

4

|

$

|

(25

|

)

|

$

|

19

|

$

|

(172

|

)

|

||||

THE

REDWOOD REVIEW 2ND QUARTER 2008 17

|

|

|

GAAP INCOME

|

Quarterly

Update (continued)

| u |

At

Redwood,

net interest income before MVA

declined by $9 million to $24 million

in

the second quarter from the prior

quarter. This decline was due to

higher

credit losses, slower prepayments,

and lower interest income as 69%

of our

investments are tied to short-term

interest rates. For securities

held at

Redwood, the second quarter annualized

interest income over our average

amortized cost was 25.99%.

|

| u |

At

Sequoia,

net interest income before MVA

declined by $9 million to negative

$5

million in the second quarter from

the prior quarter. Of this decline,

$2

million was due to higher credit

loss provisions, $4 million was

due to

lower interest rates, and $3 million