|

|

|

|

|

TABLE OF

CONTENTS

|

|

Introduction

|

3

|

|

Shareholder

Letter

|

4

|

|

Quarterly

Overview

|

6

|

|

Financial

Insights

|

11

|

|

GAAP Income

|

24

|

|

Taxable

Income

|

28

|

|

Dividends

|

31

|

|

Capital and

Liquidity

|

32

|

|

Mark-to-Market

Adjustments

|

33

|

|

Residential Real Estate

Securities

|

36

|

|

Commercial Real Estate

Securities

|

41

|

|

Investments in

Sequoia

|

43

|

|

Investments in

Acacia

|

45

|

|

Appendix

|

|

|

Accounting

Discussion

|

47

|

|

Glossary

|

52

|

|

Financial

Tables

|

59

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

1

|

|

|

|

|

CAUTIONARY

STATEMENT

|

|

2

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

INTRODUCTION

|

|

Selected

Financial Highlights

|

||||||

|

Quarter:Year

|

GAAP

Income (Loss) per Share

|

Taxable

Income (Loss) per Share

|

Annualized

Return on Equity

|

GAAP

Book Value per Share

|

Economic Book Value per Share

(2)

|

Total

Dividends per Share

|

|

Q107

|

$0.66

|

$1.48

|

8%

|

$34.06

|

$32.22

|

$0.75

|

|

Q207

|

$0.41

|

$1.66

|

5%

|

$31.50

|

$33.11

|

$0.75

|

|

Q307

|

($2.18)

|

$1.74

|

(26%)

|

$5.32

|

$27.55

|

$0.75

|

|

Q407(1)

|

($36.49)

|

$0.92

|

(610%)

|

$23.18

|

$22.29

|

$2.75

|

|

Q108

|

($5.28)

|

$0.79

|

(83%)

|

$17.89

|

$18.04

|

$0.75

|

|

Q208

|

($1.40)

|

$0.11

|

(28%)

|

$17.00

|

$16.72

|

$0.75

|

|

Q308

|

($3.34)

|

$0.07

|

(80%)

|

$12.40

|

$13.18

|

$0.75

|

|

Q408

|

($3.46)

|

($0.25)

|

(103%)

|

$9.02

|

$11.10

|

$0.75

|

|

Q109

|

($0.65)

|

($0.22)

|

(31%)

|

$8.40

|

$10.01

|

$0.25

|

|

(1) The GAAP

book value per share is after giving retroactive effect on December 31,

2007 to the adoption of FAS 159 on January 1, 2008. Without

giving retroactive effect to FAS 159, the GAAP book value per share was

negative $22.18.

|

||||||

|

(2) Economic

book value per share is calculated using bid-side marks for our financial

assets and offer-side marks for our financial liabilities and we believe

it more accurately reflects liquidation value than does GAAP book value

per share. Economic book value is reconciled to GAAP book value

in Table 6 in the Appendix of this

Review.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

3

|

|

|

|

|

SHAREHOLDER

LETTER

|

|

4

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

SHAREHOLDER

LETTER

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

5

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

6

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

7

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

8

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

9

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

|

|

Martin S.

Hughes

President,

Co-Chief Operating Officer

and

Chief Financial Officer

|

Brett D.

Nicholas

Chief

Investment Officer and

Co-Chief

Operating Officer

|

|

10

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following supplemental

non-GAAP balance sheet presents our assets and liabilities as calculated

under GAAP and adjusted to reflect our estimate of economic value. We show

our investments in the Redwood Opportunity Fund, L.P. (the Fund) and the

Sequoia and Acacia

securitization entities in separate line items, similar to the equity

method of accounting, reflecting the reality that the underlying assets

and liabilities owned by these entities are legally not ours. We own only

the securities or interests that we have acquired from these

entities.

|

|

u

|

This table, except for our

estimates of economic value, is derived from the consolidating balance

sheet presented on page 20. Our estimate of economic value of $10.01 per

share is calculated using bid-side asset marks, and offer-side marks for

our financial

liabilities, as required to determine fair value under GAAP. This method

of calculating economic value more closely represents liquidation value

and does not represent the higher amount we would have to pay at the

offered-side to replace our existing assets.

|

|

Components

of Book Value

|

||||||||

|

March

31, 2009

|

||||||||

|

($

in millions, except per share data)

|

||||||||

|

As

Reported

|

Adj.

|

Management's

Estimate of

Economic Value |

||||||

|

Cash and cash

equivalents

|

$

|

333

|

|

$

|

$

|

333

|

||

|

Real estate

securities at Redwood

|

||||||||

|

Residential

|

195

|

195

|

||||||

|

Commercial

|

23

|

23

|

||||||

|

CDO

|

3

|

3

|

||||||

|

Total real

estate securities at Redwood

|

221

|

221

|

||||||

|

Investments

in the Fund

|

22

|

22

|

||||||

|

Investments

in Sequoia

|

70

|

(9)

|

61

|

|||||

|

Investments

in Acacia

|

7

|

(2)

|

5

|

|||||

|

Total

securities and investments

|

$

|

320

|

$

|

309

|

||||

|

Long-term

debt

|

(150)

|

108

|

(42)

|

|||||

|

Other

assets/liabilities, net (d)

|

3

|

3

|

||||||

|

Stockholders'

equity

|

$

|

506

|

$

|

603

|

||||

|

Book

value per share

|

$

|

8.40

|

$

|

10.01

|

||||

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

11

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

During the first quarter, our GAAP

book value declined by $0.62 per share to $8.40, primarily due to negative

market value adjustments of $1.25 per share (of which $0.80 was reflected

as a charge on our income statement and $0.45 as reduced shareholders’ equity on

our balance sheet), and the declaration of a first quarter dividend of

$0.25 per share. These items were partially offset by $0.15 per share of

positive earnings before market valuation adjustments and $0.73 of

accretion resulting from the equity offering we

completed in January.

|

|

u

|

During the first quarter, our

economic book value declined by $1.09 per share to $10.01, also primarily

due to negative market value adjustments of $1.36 per share (including

those on our Sequoia and Acacia investments). Our dividend of $0.25 per

share and cash

operating and interest expenses of $0.21 per share also contributed to the

decline in economic book value. The net proceeds of our equity offering

were below our economic value and had a negative $0.21 per share impact.

These factors were partially offset by the positive impact of

$0.94 per share of cash flow generated by our investments during this

period.

|

|

u

|

Despite a rally in March, security

prices were lower at the end of the first quarter than at the end of last

year. This resulted in total mark-to-market adjustments during this period

of negative $75 million. As discussed further in the Mark-to-Market

Adjustments module in

this Review, the securities at Redwood recorded a negative adjustment of

$54 million, of which $25 million was on senior securities, $13 million on

subordinate securities, and $16 million on commercial and CDO securities.

Mark-to-market adjustments on securities at the Fund were negative

$8 million. Loans owned by Sequoia had mark-to-market adjustments of

negative $1 million. The net adjustments on the assets and liabilities at

Acacia were negative $12 million.

|

|

u

|

Based on our estimate of the

future loss-adjusted cash flows underlying our calculation of economic

book value at March 31, 2009, the overall cash flow yield for our $309

million in economic value of securities and investments is 38%. We had

$333 million of cash

yielding less than 1%. The implied yield for our $42 million of market

value of financial liabilities was 19%.

|

|

u

|

At March 31, 2009, our cash

position of $333 million represented $5.53 of economic book value per

share and the value of total securities and investments of $309

million represented $5.13 of economic book value per share. This

relationship highlights the fact that our future earnings and cash flows

will be significantly impacted by future

investments.

|

|

12

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

As presented in the table below, the fair

value of securities at Redwood (which is the same as GAAP carrying value)

increased during the first quarter by $30 million to $221 million.

|

|

Real

Estate Securities at Redwood

|

|||

|

Three

Months Ended March 31, 2009

|

|||

|

($

in millions)

|

|||

|

Fair

value at December 31, 2008

|

$

|

191

|

|

|

Acquisitions

|

98

|

||

|

Sales

|

(1)

|

||

|

Principal

payments

|

(15)

|

||

|

Discount

amortization

|

2

|

||

|

Mark-to-market

adjustments, net

|

(54)

|

||

|

Fair

value at March 31, 2009

|

$

|

221

|

|

|

u

|

In the first quarter, we invested

$98 million in senior residential mortgage-backed securities (RMBS) at a

weighted average price of 63% of face value and with average credit

support of 11 percentage points. Thus far in the second quarter of 2009,

through April 30, 2009, we have invested $141 million in senior securities

at a weighted average price of 61% of face

value and with average credit support of 11 percentage points, and $1

million in subordinate securities at a weighted average price of 15% of

face value.

|

|

u

|

Principal payments received from

securities at Redwood totaled $15 million, an increase of $5 million from

the fourth quarter, reflecting an uptick of prepayment activity for

mortgage loans in the first

quarter.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

13

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

At March 31, 2009, we had $333

million in cash and cash equivalents. All of our cash is currently

invested in U.S. Treasury Bills or bank deposits insured by the Federal

Deposit Insurance

Corporation.

|

|

u

|

As we

forewarned last quarter,

the rating agencies issued a substantial number of downgrades during the

first quarter and we expect more to come. Most of the downgrades targeted

prime and non-prime AAA RMBS from 2005 through 2008. The overall credit

performance of loans underlying these

vintages has been significantly worse than the rating agency’s original

expectations. Downgrades may provide future investment opportunities for

us if credit sensitive investors are pressured to

sell.

|

|

u

|

Our investment decisions are based

on our projection of the underlying collateral cash flows, the level of

subordination protecting against future losses, and the priority of cash

flow received by the security. We do not rely on credit ratings as part

of our investment

decision process. If, for example, a security currently rated AAA is

downgraded to below investment grade, it is still in the most senior

position with respect to cash flows. We care more about where this

security sits with regard to seniority of the cash flows than to any

credit rating.

|

|

u

|

As we mentioned in last

quarter’s Review, we believe that

presenting our holdings, based on subjective ratings (i.e., investment

grade securities (IGS) and credit-enhancement securities (CES)), is less

meaningful than the seniority of cash flows. Thus, we now categorize our securities

by their senior or subordinate cash flows priority.

|

|

14

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

For comparability purposes, we

present data on our securities using the new senior and subordinate cash

flow categories as well as the credit rating categories we

have used in the

past. The first table reflects our prior presentation categories of IGS

and CES and the second table reflects our new presentation using senior

and subordinate securities categories. The differences are not that

dramatic this quarter, but could be significant in future

quarters depending on the volume of future

downgrades.

|

|

Real

Estate Securities at Redwood

|

||||||||||||||||||||

|

March

31, 2009

|

||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||

|

%

of Total

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006-2008

|

Total

|

Securities

|

||||||||||||||||

|

Residential

|

||||||||||||||||||||

|

IGS

|

||||||||||||||||||||

|

Prime

|

$ | 13 | $ | 67 | $ | 17 | $ | 97 | 44% | |||||||||||

|

Non-prime

|

26 | 20 | 11 | 57 | 26% | |||||||||||||||

|

Total

IGS

|

$ | 39 | $ | 87 | $ | 28 | $ | 154 | 70% | |||||||||||

|

CES

|

||||||||||||||||||||

|

Prime

|

$ | 13 | $ | 5 | $ | 1 | $ | 19 | 9% | |||||||||||

|

Non-prime

|

1 | 18 | 3 | 22 | 10% | |||||||||||||||

|

Total

CES

|

$ | 14 | $ | 23 | $ | 4 | $ | 41 | 19% | |||||||||||

|

Total

Residential

|

$ | 53 | $ | 110 | $ | 32 | $ | 195 | 89% | |||||||||||

|

Commercial

CES

|

$ | 9 | $ | 4 | $ | 10 | $ | 23 | 10% | |||||||||||

|

CDO

|

$ | - | $ | 3 | $ | - | $ | 3 | 1% | |||||||||||

|

Total

|

$ | 62 | $ | 117 | $ | 42 | $ | 221 | 100% | |||||||||||

|

Real

Estate Securities at Redwood

|

||||||||||||||||||||

|

March

31, 2009

|

||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||

|

%

of Total

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006-2008

|

Total

|

Securities

|

||||||||||||||||

|

Residential

|

||||||||||||||||||||

|

Seniors

|

||||||||||||||||||||

|

Prime

|

$ | 5 | $ | 67 | $ | 16 | $ | 88 | 40% | |||||||||||

|

Non-prime

|

26 | 37 | 11 | 74 | 34% | |||||||||||||||

|

Total

Seniors

|

$ | 31 | $ | 104 | $ | 27 | $ | 162 | 74% | |||||||||||

|

Subordinates

|

||||||||||||||||||||

|

Prime

|

$ | 21 | $ | 5 | $ | 3 | $ | 29 | 13% | |||||||||||

|

Non-prime

|

1 | 1 | 2 | 4 | 2% | |||||||||||||||

|

Total

Subordinates

|

$ | 22 | $ | 6 | $ | 5 | $ | 33 | 15% | |||||||||||

|

Total

Residential

|

$ | 53 | $ | 110 | $ | 32 | $ | 195 | 89% | |||||||||||

|

Commercial

Subordinates

|

$ | 9 | $ | 4 | $ | 10 | $ | 23 | 10% | |||||||||||

|

CDO

Subordinates

|

$ | - | $ | 3 | $ | - | $ | 3 | 1% | |||||||||||

|

Total

|

$ | 62 | $ | 117 | $ | 42 | $ | 221 | 100% | |||||||||||

|

u

|

All subsequent tables with

securities-related information reflect the senior and subordinate

categories rather than the credit rating

categories.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

15

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

Our investment strategy has

shifted over the past year towards acquiring residential senior securities with

a comfortable margin of safety to protect against escalating credit

losses. As a result, the fair value of our residential senior securities

at March 31, 2009 was $162 million, representing 74% of our total

securities portfolio, up from 49% at the end of

the fourth quarter and 2% at the end of the first quarter of 2008.

|

|

u

|

The following table presents the

components of fair value (which equals GAAP carrying value) for

residential prime and non-prime senior securities at Redwood at March 31,

2009.

|

|

Residential

Senior Securities at Redwood

|

||||||||||||

|

March

31, 2009

|

||||||||||||

|

($

in millions)

|

||||||||||||

|

Available

for sale (AFS)

|

Prime

|

Non-Prime

|

Total

|

|||||||||

|

Current

face

|

$ | 160 | $ | 174 | $ | 334 | ||||||

|

Credit

reserve

|

(1 | ) | (4 | ) | (5 | ) | ||||||

|

Net

unamortized discount

|

(64 | ) | (69 | ) | (132 | ) | ||||||

|

Amortized

cost

|

95 | 101 | 197 | |||||||||

|

Unrealized

gains

|

- | - | - | |||||||||

|

Unrealized

losses

|

(7 | ) | (28 | ) | (35 | ) | ||||||

|

Fair

value of AFS securities

|

$ | 88 | $ | 73 | $ | 161 | ||||||

|

Fair

value of trading senior securities

|

- | 1 | 1 | |||||||||

|

Total

senior securities fair value

|

$ | 88 | 74 | 162 | ||||||||

|

u

|

Due to the dislocations in the

credit markets, we are able to buy senior securities at significant

discounts to principal value. Our returns on these investments will be

based on how much principal and interest we ultimately receive and how

quickly we receive it. As these investments primarily represent senior

cash flows, we generally expect few credit losses.

Over time, our credit expectations may change. If they do, we will

designate the appropriate amount of our discount as credit

reserve.

|

|

u

|

The returns on our senior

securities are generally more sensitive to changes in prepayment rates

than they are to credit risk. An increase in refinance activity

either from lower non-agency mortgage rates or from the

government’s initiatives to

stimulate refinancing

would benefit the returns on our senior securities as we would recognize

the discount more quickly.

|

|

16

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The $33 million fair value of our

residential subordinate securities represented 4% of face value at

March 31, 2009. As a

percentage of the total securities portfolio, subordinate securities

represented 15% of the portfolio at March 31, 2009, down from 49% a year

ago. This decline resulted from a combination of credit losses, a

reduction in market values due to negative mark-to-market

adjustments, and our decision to redirect our investment focus to senior

securities.

|

|

u

|

The table below presents the

components of fair value (which equals GAAP carrying value) of residential

subordinate securities at Redwood at March 31,

2009.

|

|

Residential

Subordinate Securities at Redwood

|

||||||||||||

|

March

31, 2009

|

||||||||||||

|

($

in millions)

|

||||||||||||

|

Vintage

|

||||||||||||

|

Available

for sale (AFS)

|

<=2004

|

>=2005

|

Total

|

|||||||||

|

Current

face

|

$ | 253 | $ | 473 | $ | 726 | ||||||

|

Credit

reserve

|

(157 | ) | (440 | ) | (597 | ) | ||||||

|

Net

unamortized discount

|

(65 | ) | (22 | ) | (87 | ) | ||||||

|

Amortized

cost

|

31 | 11 | 42 | |||||||||

|

Unrealized

gains

|

1 | 2 | 3 | |||||||||

|

Unrealized

losses

|

(11 | ) | (2 | ) | (13 | ) | ||||||

|

Fair

value of AFS securities

|

$ | 21 | $ | 11 | $ | 32 | ||||||

|

Fair

value of trading senior securities

|

1 | - | 1 | |||||||||

|

Total

subordinate securities fair value

|

$ | 22 | $ | 11 | $ | 33 | ||||||

|

u

|

The fair value of our subordinate

securities from 2004 and prior vintages totals $22 million, representing 9% of the $255

million of face value ($253 million on AFS securities and $2 million in

trading securities). From a credit standpoint, these vintages are

generally performing in line with or better than our initial expectations.

We believe there is still potential earnings

upside from these investments if actual credit losses are below our credit

reserves of $157 million. These investments would also benefit from an

increase in refinance

activity.

|

|

u

|

The fair value of our subordinate

securities from 2005 to 2008 vintages totals $11 million, representing 2%

of face value. Based on the poor credit trends underlying these vintages,

we expect future credit losses to eliminate nearly all the face amount

of these securities.

Therefore, the fair value ascribed to these securities primarily

represents the present value of future interest we expect to collect

before actual credit losses are realized. Even if prepayments increase, it

will be too late to benefit these securities to any material

extent.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

17

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

Due to a continuing deterioration

in fundamentals (increasing vacancies, falling rents, and difficulty in

refinancing) and an increasingly weakening economy, the value of our

commercial securities, all of which are subordinate securities, declined

by $19 million to $23

million, and were reported at 4% of face value at the end of the first

quarter.

|

|

u

|

Our commercial subordinate

securities represent 10% of our securities portfolio, down from 22% in the

prior period, and 43% a year

ago.

|

|

u

|

We have not purchased commercial securities since

the second quarter of 2007. However, given existing prices and the

resulting risk/return profile, we may acquire commercial assets in the

future.

|

|

|

u

|

The table below presents the

components of fair value (which equals GAAP carrying value) of commercial

securities at Redwood at March 31, 2009. Based on the quarterly cash flow

run rate of $5 million per quarter, the value of our commercial securities

is effectively equal to five quarters of cash flow.

|

|

Commercial

Subordinate Securities at Redwood

|

||||||||||||||||

|

March

31, 2009

|

||||||||||||||||

|

($

in millions)

|

||||||||||||||||

|

Vintage

|

||||||||||||||||

|

<=2004

|

2005

|

>=2006

|

Total

|

|||||||||||||

|

Current

face

|

$ | 48 | $ | 123 | $ | 341 | $ | 512 | ||||||||

|

Credit

reserve

|

(34 | ) | (123 | ) | (341 | ) | (498 | ) | ||||||||

|

Net

unamortized (discount) premium

|

(6 | ) | 5 | 15 | 14 | |||||||||||

|

Amortized

cost

|

8 | 5 | 15 | 28 | ||||||||||||

|

Unrealized

gains

|

2 | - | - | 2 | ||||||||||||

|

Unrealized

losses

|

(1 | ) | (1 | ) | (5 | ) | (7 | ) | ||||||||

|

Fair

value

|

$ | 9 | $ | 4 | $ | 10 | $ | 23 | ||||||||

|

Fair

value as a percentage of face

|

19% | 3% | 3% | 4% | ||||||||||||

|

u

|

Our $498 million of credit reserve on commercial

securities reflects our belief that we will not receive much principal

from these investments. Since commercial securities do not prepay like

residential securities, our returns will be based on our receiving

interest on the outstanding face value until the

anticipated credit losses occur.

|

|

18

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The fair value (which equals GAAP

carrying value) of our investments in the Fund was $22 million at March

31, 2009. This investment represents a 52% interest in the Fund, which

closed in March 2008 and is fully invested, primarily in non-prime RMBS.

The Fund is managed

by a subsidiary of Redwood.

|

|

u

|

At March 31, 2009, the fair value

of our investments in Sequoia was $61 million and the GAAP carrying value

was $70 million. These investments consist primarily of interest-only

securities (IOs) and

to a lesser extent senior and subordinate securities. Our returns on these

IOs are most sensitive to prepayments and faster prepayments would

negatively impact returns. Material changes in interest rates also have a

short-term impact on cash flows received from these

assets.

|

|

u

|

At March 31, 2009, the fair value

of our investments in Acacia was $5 million and the GAAP carrying value

was $7 million. These investments represent equity interests and ABS

issued from our Acacia CDO securitization entities and the management fees

we receive from those

entities. Due to various provisions in each CDO securitization, all but

one of our equity interests are cut off from cash flows and we only expect

limited returns on the ABS issued we own. We value the management fees at

$4 million, which equals our projected management

fees discounted at a 45%

rate.

|

|

u

|

We had no short-term debt at March

31, 2009. We believe that it is currently prudent to fund our investments

with permanent capital (equity and long-term debt) that is not subject to

margin calls and financial

covenants.

|

|

u

|

In 2006 and 2007, we issued $150 million of

30-year long-term debt at Redwood (due in 2037) at an interest rate of

LIBOR plus 2.25%. Under GAAP, this debt is carried at cost. At March 31,

2009, we estimated a $42 million fair value for this liability using the

same valuation process used to fair value

our other financial assets and liabilities. Estimated economic value is

lower than our GAAP carrying value because we believe that investors would

have required a 19% yield on this debt (currently equal to LIBOR +

16.80%) had we issued it at March 31,

2009.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

19

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

GAAP requires us to consolidate

all of the assets and liabilities of the Sequoia and Acacia securitization

entities (which had a combined $5.0 billion of assets and $4.9 billion of

liabilities at March

31, 2009), even though the assets are owned by securitization entities and

the liabilities are obligations of these securitization entities payable

only from the cash flows generated by the assets owned by these entities.

Additionally, we are required to consolidate all of

the assets and liabilities of the Fund since Redwood owns the general

partnership interest in the Fund and just over half of the limited

partnership interests.

|

|

u

|

The table below shows the

consolidating components of our consolidated balance sheet at March 31,

2009. The purpose of this presentation is to show the effect each of the

components had on our consolidated shareholders’ equity. The Fund, Sequoia, and

Acacia components

represent investments and are not separate business

segments.

|

|

Consolidating

Balance Sheet

|

||||||||||||||||||||||||

|

March

31, 2009

|

||||||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||||||

|

Redwood

|

The

Fund

|

Sequoia

|

Acacia

|

Intercompany

|

Redwood

Consolidated

|

|||||||||||||||||||

|

Real estate

loans

|

$ | 3 | $ | - | $ | 4,528 | $ | 10 | $ | - | $ | 4,541 | ||||||||||||

|

Real estate

securities

|

221 | 38 | - | 332 | (72 | ) | 519 | |||||||||||||||||

|

Investments in

the Fund

|

22 | - | - | - | (22 | ) | - | |||||||||||||||||

|

Investments in

Sequoia

|

70 | - | - | - | (70 | ) | - | |||||||||||||||||

|

Investments in

Acacia

|

7 | - | - | - | (7 | ) | - | |||||||||||||||||

|

Other

investments

|

- | - | - | 62 | - | 62 | ||||||||||||||||||

|

Cash and cash

equivalents

|

333 | - | - | - | - | 333 | ||||||||||||||||||

|

Total earning

assets

|

656 | 38 | 4,528 | 404 | (171 | ) | 5,455 | |||||||||||||||||

|

Other

assets

|

25 | 4 | 38 | 59 | - | 126 | ||||||||||||||||||

|

Total

assets

|

$ | 681 | $ | 42 | $ | 4,566 | $ | 463 | $ | (171 | ) | $ | 5,581 | |||||||||||

|

Short-term

debt

|

$ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||

|

Other

liabilities

|

25 | 2 | 6 | 165 | - | 198 | ||||||||||||||||||

|

Asset-backed

securities issued - Sequoia

|

- | - | 4,490 | - | (72 | ) | 4,418 | |||||||||||||||||

|

Asset-backed

securities issued - Acacia

|

- | - | - | 291 | - | 291 | ||||||||||||||||||

|

Long-term

debt

|

150 | - | - | - | - | 150 | ||||||||||||||||||

|

Total

liabilities

|

175 | 2 | 4,496 | 456 | (72 | ) | 5,057 | |||||||||||||||||

|

Stockholders’

equity

|

506 | 22 | 70 | 7 | (99 | ) | 506 | |||||||||||||||||

|

Noncontrolling

interest

|

- | 18 | - | - | - | 18 | ||||||||||||||||||

|

Total equity

|

506 | 40 | 70 | 7 | (99 | ) | 524 | |||||||||||||||||

|

Total

liabilities and stockholders’ equity

|

$ | 681 | $ | 42 | $ | 4,566 | $ | 463 | $ | (171 | ) | $ | 5,581 | |||||||||||

|

20

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

Our sources and uses of cash in

the table below is derived from our GAAP Consolidated Statement of Cash

Flows for the first quarter of 2009 by aggregating and netting all

items in a manner

consistent with the way management analyzes them. This table excludes the

gross cash flows generated by our Sequoia and Acacia securitization

entities and the Fund (cash flows that are not available to Redwood), but

does include the cash flows distributed to Redwood as a

result of our investments in these entities. The beginning and ending cash

balances presented in the table below are GAAP

amounts.

|

|

Redwood

|

||||||||

|

Sources

and Uses of Cash

|

||||||||

|

($

in millions)

|

||||||||

|

Three

Months Ended

|

||||||||

|

3/31/2009

|

12/31/2008

|

|||||||

|

Beginning

cash balance

|

$ | 126 | $ | 177 | ||||

|

Business Cash

Flows:

|

||||||||

|

Cash flow

from investments

|

$ | 57 | $ | 40 | ||||

|

Asset

management fees

|

1 | 1 | ||||||

|

Operating

expenses

|

(11 | ) | (12 | ) | ||||

|

Interest

expense on debt

|

(2 | ) | (2 | ) | ||||

|

Total

business cash flows

|

45 | 27 | ||||||

|

Other Sources

and Uses:

|

||||||||

|

Proceeds from

asset sales

|

1 | 1 | ||||||

|

Proceeds from

equity issuance

|

285 | 2 | ||||||

|

Changes in

working capital

|

1 | 2 | ||||||

|

Acquistions

|

(98 | ) | (50 | ) | ||||

|

Dividends

|

(27 | ) | (26 | ) | ||||

|

Repayment of

debt

|

- | (7 | ) | |||||

|

Net other

sources (uses)

|

162 | (78 | ) | |||||

|

Net

sources (uses) of cash

|

$ | 207 | $ | (51 | ) | |||

|

Ending

cash balance

|

$ | 333 | $ | 126 | ||||

|

u

|

First quarter business cash flow

totaled $45 million, up $18 million from the fourth quarter as cash flow

from our investment portfolio increased by $17 million and cash operating

expenses declined by $1

million.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

21

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The table below

presents the components of our

investment cash flow for the fourth quarter of 2008 and the first quarter

of 2009.

|

|

Redwood

|

||||||||

|

Cash

Flow From Investments

|

||||||||

|

($

in millions)

|

||||||||

|

Three

Months Ended

|

||||||||

|

3/31/2009

|

12/31/2008

|

|||||||

|

Securities at

Redwood

|

||||||||

|

Residential

principal

|

$ | 15 | $ | 10 | ||||

|

Residential

interest

|

15 | 11 | ||||||

|

Commercial

and CDO interest

|

5 | 5 | ||||||

|

Total

Securities at Redwood

|

35 | 26 | ||||||

|

Investments

in Sequoia

|

18 | 9 | ||||||

|

Investments

in Acacia

|

1 | 2 | ||||||

|

Investments

in the Fund

|

3 | 3 | ||||||

|

Total

Cash Flow from Securities and Investments

|

$ | 57 | $ | 40 | ||||

|

u

|

Our cash flow from investments

increased by $17 million in the first quarter from the prior quarter due

to:

|

|

•

|

$9 million increase in cash flow

from our investments

in Sequoia, as our IO securities benefited from the reset timing

differences between the loans and ABS issued (as previously described in

our fourth quarter Review). Our IO securities generated $16 million of the

$18 million in Sequoia cash flow in the first

quarter.

|

|

•

|

$5 million increase in principal

payments received from our investment securities as prepayment speeds

increased during the period, including $3 million of principal from new

investments.

|

|

•

|

$4 million increase in interest

received from our

investment securities, due in part to earning a full quarter from our

fourth quarter acquisitions, as well as $1 million from first quarter

investments.

|

|

u

|

Our cash flow from investments

included $39 million of coupon interest and $18 million of

principal. We caution

readers that given the nature of our investments (deep discount

subordinated securities, senior securities at discounts, IOs, equity

investments in Acacia, and other types) it is difficult to draw

conclusions in any one period about what portion of our cash flow represents

“income” and what is a “return of capital.” It is only at the end of an

asset’s life that we can accurately

determine what portion of the cumulative cash received (whether principal

or interest) was truly income and what was a return of

capital.

|

|

22

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following table provides

information regarding the source and vintage of cash flows from our

investments. As shown, most of our cash flows are generated by assets from

earlier vintages, which we believe provides a level of comfort about our ongoing ability

to generate cash, as these assets generally continue to perform within our

expectations.

|

|

Cash

Flow from Investments by Vintage

|

||||||||||||||||||||||||

|

Three

Months Ended March 31, 2009

|

||||||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||||||

|

|

||||||||||||||||||||||||

|

<=2004

|

2005

|

2006

|

2007

|

2008

|

Total

|

|||||||||||||||||||

|

Redwood

|

$ | 13 | $ | 8 | $ | 5 | $ | 9 | $ | - | $ | 35 | ||||||||||||

|

The

Fund

|

2 | 1 | - | - | - | 3 | ||||||||||||||||||

|

Sequoia

|

12 | - | - | 6 | - | 18 | ||||||||||||||||||

|

Acacia

|

1 | - | - | - | - | 1 | ||||||||||||||||||

|

Total

|

$ | 28 | $ | 9 | $ | 5 | $ | 15 | $ | - | $ | 57 | ||||||||||||

|

u

|

A majority of the cash flow

generated from our investments at Redwood ($25 million of the $35 million

in the first quarter) was from our subordinated securities.

Thus, even though our subordinate securities represent a small percentage

of the market value of our portfolio, they are still contributing strong

cash flows.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

23

|

|

|

|

|

GAAP INCOME

|

|

u

|

Our reported GAAP loss was $35

million ($0.65 per share) for the first quarter of 2009, as compared to a

loss of $116 million ($3.46 per share) for the fourth quarter of 2008.

Negative market valuation adjustments (MVA) recognized through our income

statement continue to

be the primary driver of our results.

|

|

u

|

The following table provides a

summary of our GAAP loss for the first quarter of 2009 and the fourth

quarter of 2008.

|

|

GAAP

(Loss) Income

|

||||||||

|

($

in millions, except per share data)

|

||||||||

|

Three

Months Ended

|

||||||||

|

3/31/2009

|

12/31/2008

|

|||||||

|

Interest

income

|

$ | 82 | $ | 123 | ||||

|

Interest

expense

|

(48 | ) | (99 | ) | ||||

|

Net interest

income

|

34 | 24 | ||||||

|

Provision for

loan losses

|

(16 | ) | (19 | ) | ||||

|

Market

valuation adjustments, net

|

(43 | ) | (111 | ) | ||||

|

Net interest

income (loss) after provision and market valuation

adjustments

|

(25 | ) | (106 | ) | ||||

|

Operating

expenses

|

(11 | ) | (14 | ) | ||||

|

Realized

gains on sales

|

- | 6 | ||||||

|

Realized

gains on calls

|

- | - | ||||||

|

Noncontrolling

interest

|

1 | 2 | ||||||

|

Benefit from

(provision for) income taxes

|

- | (4 | ) | |||||

|

GAAP

(loss) income

|

$ | (35 | ) | $ | (116 | ) | ||

|

GAAP

(loss) income per share

|

$ | (0.65 | ) | $ | (3.46 | ) | ||

|

24

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

GAAP INCOME

|

|

u

|

The table below shows the

consolidating components of our consolidated income statements for the first

quarter of 2009 and the fourth quarter of 2008. The purpose of this

presentation is to show the effect each of the components had on our

reported loss for these periods. The Fund, Sequoia, and Acacia components

represent investments and are not separate

business segments.

|

|

Consolidating

Income Statement

|

||||||||||||||||||||||||

|

Three

Months Ended March 31, 2009

|

||||||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||||||

|

Redwood

|

The

Fund

|

Sequoia

|

Acacia

|

Intercompany

Adjustments

|

Redwood

Consolidated

|

|||||||||||||||||||

|

Interest

income

|

$ | 19 | $ | 1 | $ | 41 | $ | 22 | $ | 1 | $ | 84 | ||||||||||||

|

Net discount

(premium) amortization

|

3 | 2 | (7 | ) | - | - | (2 | ) | ||||||||||||||||

|

Total interest

income

|

22 | 3 | 34 | 22 | 1 | 82 | ||||||||||||||||||

|

Management

fees

|

1 | - | - | - | (1 | ) | - | |||||||||||||||||

|

Interest

expense

|

(2 | ) | - | (25 | ) | (21 | ) | - | (48 | ) | ||||||||||||||

|

Net interest

income

|

21 | 3 | 9 | 1 | - | 34 | ||||||||||||||||||

|

Provision for

loan losses

|

- | - | (16 | ) | - | - | (16 | ) | ||||||||||||||||

|

Market

valuation adjustments, net

|

(26 | ) | (4 | ) | (1 | ) | (12 | ) | - | (43 | ) | |||||||||||||

|

Net interest

income (loss) after provision and market valuation

adjustments

|

(5 | ) | (1 | ) | (8 | ) | (11 | ) | - | (25 | ) | |||||||||||||

|

Operating

expenses

|

(11 | ) | - | - | - | - | (11 | ) | ||||||||||||||||

|

Realized gains

on sales and calls, net

|

- | - | - | - | - | - | ||||||||||||||||||

|

Loss from the

Fund, Sequoia, and Acacia

|

(19 | ) | - | - | - | 19 | - | |||||||||||||||||

|

Noncontrolling

interest

|

- | 1 | - | - | - | 1 | ||||||||||||||||||

|

Benefit from

(provision for) income taxes

|

- | - | - | - | - | - | ||||||||||||||||||

|

Net

(loss) income

|

$ | (35 | ) | $ | - | $ | (8 | ) | $ | (11 | ) | $ | 19 | $ | (35 | ) | ||||||||

|

Consolidating

Income Statement

|

||||||||||||||||||||||||

|

Three

Months Ended December 31, 2008

|

||||||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||||||

|

Redwood

|

The

Fund

|

Sequoia

|

Acacia

|

Intercompany

Adjustments

|

Redwood

Consolidated

|

|||||||||||||||||||

|

Interest

income

|

$ | 18 | $ | 2 | $ | 71 | $ | 36 | $ | (1 | ) | $ | 126 | |||||||||||

|

Net discount

(premium) amortization

|

(3 | ) | 1 | (1 | ) | - | - | (3 | ) | |||||||||||||||

|

Total interest

income

|

15 | 3 | 70 | 36 | (1 | ) | 123 | |||||||||||||||||

|

Management

fees

|

1 | - | - | - | - | 1 | ||||||||||||||||||

|

Interest

expense

|

(2 | ) | - | (64 | ) | (35 | ) | 1 | (100 | ) | ||||||||||||||

|

Net interest

income

|

14 | 3 | 6 | 1 | - | 24 | ||||||||||||||||||

|

Provision for

loan losses

|

- | - | (19 | ) | - | - | (19 | ) | ||||||||||||||||

|

Market

valuation adjustments, net

|

(103 | ) | (7 | ) | (3 | ) | (4 | ) | 6 | (111 | ) | |||||||||||||

|

Net interest

income (loss) after provision and market valuation

adjustments

|

(89 | ) | (4 | ) | (16 | ) | (3 | ) | 6 | (106 | ) | |||||||||||||

|

Operating

expenses

|

(13 | ) | (1 | ) | - | - | - | (14 | ) | |||||||||||||||

|

Realized gains

on sales and calls, net

|

- | - | 12 | - | (6 | ) | 6 | |||||||||||||||||

|

Loss from the

Fund, Sequoia, and Acacia

|

(10 | ) | - | - | - | 10 | - | |||||||||||||||||

|

Noncontrolling

interest

|

- | 2 | - | - | - | 2 | ||||||||||||||||||

|

Benefit from

(provision for) income taxes

|

(4 | ) | - | - | - | - | (4 | ) | ||||||||||||||||

|

Net

(loss) income

|

$ | (116 | ) | $ | (3 | ) | $ | (4 | ) | $ | (3 | ) | $ | 10 | $ | (116 | ) | |||||||

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

25

|

|

|

|

|

GAAP INCOME

|

|

u

|

At Redwood, net interest income

before provision and market valuation adjustments was $21 million for the

first quarter of 2009, as compared to $14 million for the fourth quarter

of 2008. The increase was primarily due to faster prepayments, which

resulted in greater

discount amortization during the first quarter. Negative market valuation

adjustments at Redwood were $26 million for the first quarter as compared

to $103 million for the fourth quarter, reflecting fewer impairments of

securities. A detailed analysis of market valuation

adjustments is included in the Mark-to-Market Adjustments module of this

Review.

|

|

u

|

Operating expenses were $11

million for the first quarter of 2009, as compared to $13 million for the

fourth quarter, a decrease of $2 million. The decrease was due to lower

compensation expense as a result of a reduction in the number of employees

and lower consulting

and legal expenses.

|

|

u

|

We recognized a $1 million loss

this quarter, down from a $3 million loss in the prior quarter as there

were fewer impairments on securities owned by the

Fund.

|

|

u

|

We recorded an $8 million

first quarter loss

related to the Sequoia entities as compared to a $4 million loss in the

prior quarter. The primary reason for the difference was that there were

no gains arising from deconsolidation events in the first quarter whereas

Sequoia recognized a net $12 million deconsolidation

gain in the fourth quarter. Deconsolidation gains and related accounting

principles are discussed in detail in the Investments in Sequoia module

later in the Review.

|

|

u

|

Net interest income was slightly

higher in the first quarter as a result of falling short-term interest

rates, and our credit provision was slightly lower in part due to the

deconsolidation event in the fourth quarter (i.e., we have fewer loans on

which to establish a

credit reserve). We are required for financial reporting purposes to consolidate the loans

owned by Sequoia and establish credit reserves for anticipated credit

losses. At March 31, 2009 we have an aggregate $48 million Sequoia loan

loss reserve. Reserves are established

for each specific pool of loans and in one case the reserve exceeds our

investment in a Sequoia entity by $15 million. In a future period (maybe

as soon as the second quarter), we may be able to reverse this reserve as

we deconsolidate our investment in this

Sequoia entity.

|

|

u

|

A $11 million loss was recorded at

Acacia, which was greater than the $3 million loss recorded in the prior

quarter primarily because net market value adjustments (MVA) was negative

$12 million this

quarter as compared to a negative $4 million in the fourth quarter. All

the assets and liabilities of Acacia are reported at fair value with

changes in value reported through the income statement. As previously

discussed, the fair values of the securities owned by Acacia may not

necessarily move in tandem with the fair values of the Acacia ABS issued.

The reported equity in Acacia is currently $7 million and we expect the

market value adjustments to have a smaller impact in future periods.

|

|

26

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

GAAP INCOME

|

|

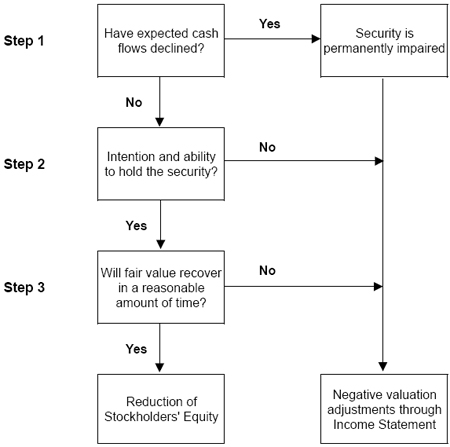

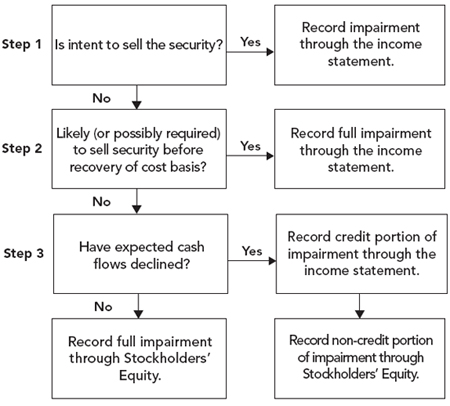

u

|

On April 9, 2009, the Financial

Accounting Standards Board issued two new financial statement positions

(FSPs) addressing the determination of fair values in an inactive market

and the assessment of other-than-temporary impairment. We will apply these new FSPs beginning

in the second quarter of 2009. These FSPs will have no effect on our cash

flows, book value, or economic returns. The fair value FSP will have

little impact on us and the impairment FSP will impact our future

earnings, as summarized below and further

discussed in the Accounting Discussion module later in this Review.

|

|

u

|

As a result of the impairment FSP,

only that portion of an other-than-temporary impairment that is based on

adverse cash flow changes and not the portion reflecting changes in market

discount rates will be recognized through our income statement. This

could lead to fewer

impairment charges being recognized in the future. For example, if the

fair value of an asset decreased by $10 and the reason for this decrease

was due to a $1 adverse change in future cash flows (e.g., an increase in

credit loss forecast), we would deem this asset to be

other-than-temporarily impaired and historically, recognize the entire $10

decrease in market value through our income statement. Under the new FSP,

beginning in the second quarter, only the $1 decrease attributed to

the change in cash flow would be

recognized through the income statement with the remaining $9 decrease in

market value recorded through the balance

sheet.

|

|

u

|

There is also provision in the

impairment FSP that will have a negative impact on our future

earnings. The new FSP

requires a reclassification of prior impairments, as a result of which we

will not be allowed to recognize in future earnings the impairment charges

we have taken in the past that related to changes in market discount

rates. Referring back to the example in the previous

paragraph, assume we had impaired this asset in the first quarter of 2009

(or any time prior to this quarter). Our historical income would include a

$10 loss due to the impairment of this asset. Upon adoption of this FSP

next quarter, we would reclassify $9

(the amount not due to credit) into other comprehensive income from

retained earnings and increase the cost basis in this asset by the same

$9. As a result, our earnings in future periods will not include $9 of

income as this asset recovers in value and pays

down. Instead, we will recognize the benefit through positive equity

adjustments, which will be reflected in book value. The amount of the

reclassification of prior impairments on our securities will be determined

and reported upon adoption of this FSP in

the second quarter of 2009.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

27

|

|

|

|

|

TAXABLE

INCOME

|

|

|

Taxable income is our pre-tax

income as calculated for tax purposes. Taxable income differs materially

from GAAP income. Table 3 in the Appendix reconciles these two earnings

measures.

|

|

|

REIT taxable income is pre-tax

profit, as calculated for tax purposes, excluding taxable income earned at

our taxable subsidiaries. REIT taxable income is the primary determinant

of the minimum amount of dividends we must distribute in order to maintain our

tax status as a REIT and we must distribute at least 90% of our REIT

taxable income as dividends.

|

|

|

For our quarterly taxable earnings

estimates, we project our taxable earnings for the year based upon various

assumptions of events

that will occur during the year. However, some of the events that could

have significant impact on our taxable earnings are difficult to project,

including the amount and timing of credit losses, prepayments, and

employee stock option exercises. Thus, our quarterly taxable earnings

are likely to remain

volatile.

|

|

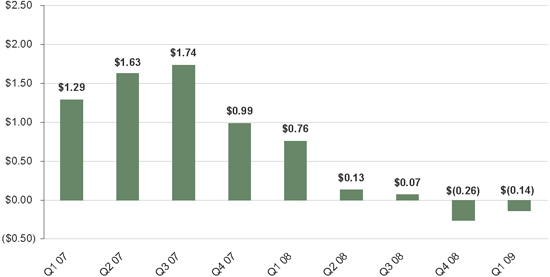

u

|

Our first quarter estimated

taxable earnings were negative $14 million ($0.22 per share) and included

$53 million in credit losses. This compares to estimated taxable

earnings in the

fourth quarter of negative $8 million ($0.25 per share), which included

$40 million of credit losses. We continue to expect that credit losses

will be the primary factor in generating a taxable loss in

2009.

|

|

u

|

The charts below provide a

summary of our

taxable income per share and REIT taxable income per share for each of the

last nine quarters.

|

|

28

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

TAXABLE INCOME

|

|

u

|

Our first quarter estimated REIT

taxable earnings were negative $9 million ($0.14 per share) and included

$48 million in credit losses. This compares to estimated REIT taxable

earnings in the prior quarter of negative $9 million ($0.26 per share),

which included $39 million of credit losses. The higher credit losses in

the first quarter were offset by higher net interest income from recent

acquisitions and lower operating expenses.

The reduction in the per share loss relates to the increase in the number

of shares outstanding resulting from the equity offering in the first

quarter.

|

|

u

|

We incurred $5 million of credit

losses on securities owned at our taxable subsidiaries which accounted for

the additional negative taxable

earnings.

|

|

u

|

Since, for tax purposes, we are

neither permitted to establish credit reserves nor recognize

market valuation

adjustments, the tax basis of our residential, commercial, and CDO

subordinate securities at Redwood (excluding investments in Sequoia and

Acacia) was $501 million higher than our GAAP basis. As a result, future

credit losses will have a more significant impact on our taxable

income than on our GAAP income. Over time, cumulative GAAP and taxable

income will converge. Given our projected losses, we expect 2009 taxable

income to be less than GAAP income before market valuation adjustments.

|

|

u

|

The tax basis on Sequoia IOs we

own is $33 million. Many of the underlying pools of loans have paid down

or will pay down within the next year to levels where they are callable.

When these are called, tax losses on these IOs are incurred and our

taxable income and

dividend distribution requirements decrease. We do not anticipate calling

any Sequoia deals in the foreseeable future.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

29

|

|

|

|

|

TAXABLE

INCOME

|

|

u

|

The table below reconciles our

GAAP and estimated taxable income for the first quarter of

2009.

|

|

GAAP

and Taxable Income (Loss)

|

||||||||||||

|

Three

Months Ended March 31, 2009

|

||||||||||||

|

GAAP

|

Tax

|

Differences

|

||||||||||

|

Net interest

income

|

$ | 34 | $ | 49 | $ | 15 | ||||||

|

GAAP

provision for loan losses

|

(16 | ) | - | 16 | ||||||||

|

Realized

credit losses

|

- | (53 | ) | (53 | ) | |||||||

|

Market

valuation adjustments, net

|

(43 | ) | - | 43 | ||||||||

|

Operating

expenses

|

(11 | ) | (10 | ) | 1 | |||||||

|

Realized

gains on sales and calls, net

|

- | - | - | |||||||||

|

Provision for

income taxes

|

- | - | - | |||||||||

|

Less: Net

loss attributable to noncontrolling interest

|

1 | - | 1 | |||||||||

|

Net

loss

|

$ | (35 | ) | $ | (14 | ) | $ | 21 | ||||

|

Estimated

taxable earnings per share

|

$ | (0.65 | ) | $ | (0.22 | ) | $ | 0.43 | ||||

|

u

|

There are significant differences between GAAP and

tax accounting, as illustrated in the table above, including:

|

|

•

|

Net interest income for tax is

higher due to the fact we cannot anticipate future credit losses in

determining the current period yield for an asset. Thus, we generally amortize more of an

asset’s purchase discount into income

for tax than for GAAP prior to anticipated credit losses

occurring.

|

|

•

|

For GAAP, we take credit

provisions for loan losses while for tax we cannot establish loan loss

reserves for future anticipated

events.

|

|

•

|

Realized credit losses are

expensed when incurred for tax. For GAAP, these losses are anticipated

through lower yields on assets or through the loan loss

provisions.

|

|

•

|

The timing, and for some expenses,

the amount, of some of our compensation expenses are different

under GAAP accounting than for tax accounting. In this quarter, these

differences were not significant, but could be in future

periods.

|

|

•

|

For tax purposes, we do not

consolidate noncontrolling interests as we do under GAAP.

|

|

30

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

DIVIDENDS

|

|

|

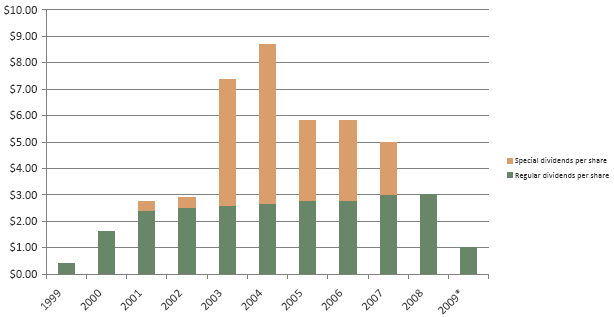

As a REIT, we are required to

distribute at least 90% of our REIT taxable income in the form of

dividends to shareholders. Our board of directors can declare dividends in

excess of this minimum

requirement.

|

|

|

The

chart below shows

the regular and special dividends per share paid to shareholders for the

indicated periods and our projected regular dividend for 2009.

|

|

u

|

On November 10, 2008, our board of

directors announced its intention to pay a regular dividend of $0.25 per

share per quarter in 2009.

|

|

u

|

On March 18, 2009, our board of

directors declared a regular dividend of $0.25 per share for the first

quarter, which was

paid on April 21, 2009 to shareholders of record on March 31,

2009.

|

|

u

|

We expect to report a taxable loss

at the REIT level for 2009 due to the expected realization of credit

losses. We currently expect that Redwood’s 2009 regular dividend will

constitute a return

of capital and, as such, will not be taxable to

shareholders.

|

|

u

|

There was no undistributed REIT

taxable income at March 31,

2009.

|

|

u

|

We do not expect to pay a special

dividend in 2009.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

31

|

|

|

|

|

CAPITAL AND

LIQUIDTY

|

|

|

We use capital to fund our operations,

invest in earning assets that are generally illiquid, fund working

capital, and meet lender capital requirements with respect to

collateralized borrowings, if

any.

|

|

|

Through our internal risk-adjusted

capital policy, we allocate a prudent level of capital for

our earning assets to meet liquidity needs that may arise. In most cases,

the amount of allocated capital is equal to 100% of the fair value of the

asset. The amount of capital that exceeds our risk-adjusted capital

guideline, less short-term debt,

pending investment settlements, operating expense allocations, and other

miscellaneous capital allocations, is excess capital that can be invested

to support business growth.

|

|

|

Our capital base includes common

equity plus $150 million of long-term debt at Redwood,

which is due in 2037.

|

|

|

Declines in the fair value of

assets generally do not have an effect on excess capital, as asset value

declines usually reduce both available capital and capital required for

these investments by an equal

amount.

|

|

u

|

In January 2009, we completed a

public offering of common stock to raise capital for investment and

growth, and issued 26.45 million shares for net proceeds of $283

million.

|

|

u

|

Our reported capital totaled $656

million at March 31,

2009, compared to $452 million at December 31,

2008.

|

|

u

|

At March 31, 2009, our

unrestricted cash totaled $333

million.

|

|

u

|

Our excess capital position was

$328 million at March 31, 2009, an increase of $207 million from $121

million at December

31, 2008. During the first quarter, our sources of capital were: $45

million from portfolio cash flows and management fees in excess of

operating costs and financing costs; $283 million from the public offering

of common stock; $2 million from the sale of shares pursuant to our dividend

reinvestment plan; $1 million from asset sales; and $1 million of net

changes in operating capital (in accordance with our internal

risk-adjusted guidelines). Uses of capital included the payment of $27

million in dividends and $98 million for asset

acquisitions.

|

|

32

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

MARK-TO-MARKET

ADJUSTMENTS

|

|

u

|

As previously discussed and as

illustrated in the chart below, prices in 2009 for senior securities have

been volatile. Thus far in the second quarter, there has been a partial recovery of prices

on senior securities backed by residential and commercial mortgages

following a large price decline in 2008.

|

|

u

|

Unlike prices for senior

securities, prices for subordinate securities have declined year to date

through April 2009.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

33

|

|

|

|

|

MARK-TO-MARKET

ADJUSTMENTS

|

|

u

|

The table below shows the

consolidating impact of mark-to-market (MTM) adjustments against

loans and securities

on our balance sheet and income statement in the first quarter.

|

|

Mark-to-Market

Adjustments on Assets and Liabilities

|

||||||||||||||||||||

|

Consolidated

Balance Sheet and Income Statement Effects

|

||||||||||||||||||||

|

Three

Months Ended March 31, 2009

|

||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||

|

The

|

||||||||||||||||||||

|

Redwood

|

Fund

|

Sequoia

|

Acacia

|

Total

|

||||||||||||||||

|

Balance sheet

effect

|

||||||||||||||||||||

|

Net

change in equity account

|

$ | (28 | ) | $ | (4 | ) | $ | - | $ | - | $ | (32 | ) | |||||||

|

Income

statement effect

|

||||||||||||||||||||

|

Market

valuation adjustments

|

||||||||||||||||||||

|

Fair

value assets and liabilities

|

(1 | ) | - | (1 | ) | (12 | ) | (14 | ) | |||||||||||

|

Impairment

on AFS securities

|

(25 | ) | (4 | ) | - | - | (29 | ) | ||||||||||||

|

Total income

statement effect

|

(26 | ) | (4 | ) | (1 | ) | (12 | ) | (43 | ) | ||||||||||

|

Total

mark-to-market adjustments

|

$ | (54 | ) | $ | (8 | ) | $ | (1 | ) | $ | (12 | ) | $ | (75 | ) | |||||

|

u

|

As noted previously, market prices

for securities declined in the first quarter. Despite improving liquidity,

forced liquidations and other distressed sales continue to account for a significant portion of

overall market activity.

|

|

u

|

The table below details the

negative $54 million of MTM adjustments during the first quarter on

securities held at Redwood by underlying collateral type and by vintage.

|

|

Mark-to-Market

Adjustments

|

||||||||||||||||||||

|

on

Assets at Redwood

|

||||||||||||||||||||

|

Three

Months Ended March 31, 2009

|

||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||

|

Loans

&

|

MTM

|

|||||||||||||||||||

|

Seniors

|

Subordinates

|

Derivatives

|

Total

|

Percentage (a)

|

||||||||||||||||

|

Residential

|

||||||||||||||||||||

|

Prime

|

$ | (9 | ) | $ | (11 | ) | $ | - | $ | (20 | ) | (14 | ) % | |||||||

|

Non-prime

|

(16 | ) | (2 | ) | - | (18 | ) | (18 | ) % | |||||||||||

|

Total

Residential

|

(25 | ) | (13 | ) | - | (38 | ) | |||||||||||||

|

Commercial

|

- | (15 | ) | - | (15 | ) | (37 | ) % | ||||||||||||

|

CDO

|

- | (1 | ) | - | (1 | ) | (21 | ) % | ||||||||||||

|

Interest rate

agreements & other derivatives

|

- | - | - | - | ||||||||||||||||

|

Total

mark-to-market adjustments

|

$ | (25 | ) | $ | (29 | ) | $ | - | $ | (54 | ) | |||||||||

|

34

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

|

|

|

|

|

|

MARK-TO-MARKET

ADJUSTMENTS

|

|

u

|

Total MTM adjustments at the Fund,

Sequoia, and Acacia were negative $21 million. During the first quarter,

net MTM adjustments for securities at the Fund were negative $8

million. Net MTM

adjustments for real estate owned (REO) at Sequoia were negative $1

million, reflecting market value declines for REO properties below their

cost basis. Net MTM adjustments at Acacia were negative $12 million, which

reflected market value declines on assets (loans and

securities) offset by declines on liabilities (derivatives and ABS

issued). These declines were due to a combination of the factors

previously discussed.

|

|

u

|

Market values reported for our

assets and liabilities (except for those held at historical cost) reflect

an “exit

price,” or the amount

we believe we would realize if we sold an asset or would pay if we

repurchased a liability in an orderly transaction. This is the required accounting

standard even if we have no intention to sell assets or repurchase

liabilities.

|

|

u

|

Establishing market values is

inherently subjective given the volatile and illiquid markets for our real

estate assets and liabilities and requires us to make a number of

market-based assumptions, including the future of interest rates,

prepayment rates, discount rates, credit loss rates, and the timing of

credit losses. The market assumptions we apply are specific to each asset

or liability.

|

|

u

|

Although we rely on our internal

calculations to compute the fair value of the securities we own, we

request and consider indications of value (marks) from third-party dealers

to assist us in our valuation process. The availability of third-party

marks continues to

decline, in part because some dealers no longer exist and others have

ceased providing client valuation services. For March 31, 2009, we

received dealer marks on 76% of our securities and 95% of our ABS issued.

In the aggregate, our internal valuations of the securities on

which we received dealer marks were 8% lower than the aggregate dealer

marks. Our internal valuations of our ABS issued on which we received

dealer marks were 6% higher than the aggregate dealer marks.

|

|

|

THE REDWOOD

REVIEW 1ST QUARTER 2009

|

35

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

|

Redwood invests in securities that

are backed by pools of residential real estate loans. Most of our

investments in residential real estate securities are backed by prime

residential loans and

some are backed by Alt-A, Option ARM, and subprime loans. Our primary

focus when investing in residential real estate securities is to

understand the credit risk. Thus, historically, we primarily acquired

subordinated securities. More recently, our credit risk analysis has

been appropriate in understanding the range of risks and returns

applicable to senior securities and our acquisitions have been heavily

weighted in this type of security. The following discussion refers only to

the residential securities owned by Redwood,

exclusive of the securities owned by Sequoia, Acacia, and the Fund, and

exclusive of Redwood’s investments in these entities.

|

|

u

|

During the first quarter, we

invested $98 million in senior securities at a weighted average price of

63% of the face value and with average credit support of 11 percentage