|

|

|

|

|

TABLE OF

CONTENTS

|

|

Introduction

|

3

|

|

Shareholder

Letter

|

4

|

|

Quarterly

Overview

|

6

|

|

Financial

Insights

|

10

|

|

Government

Initiatives

|

19

|

|

GAAP

Income

|

22

|

|

Taxable

Income

|

26

|

|

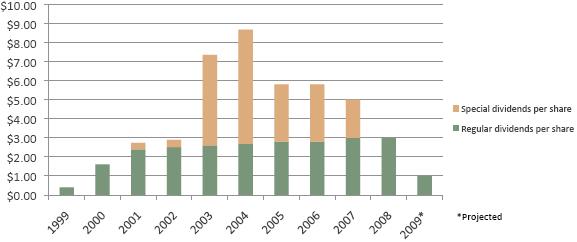

Dividends

|

28

|

|

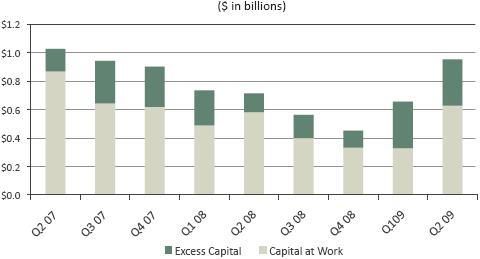

Capital and

Liquidity

|

29

|

|

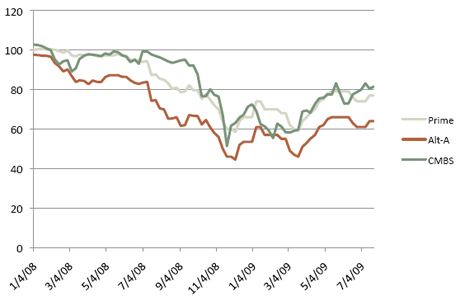

Mark-to-Market

Adjustments

|

30

|

|

Residential

Real Estate Securities

|

33

|

|

Commercial

Real Estate Securities

|

40

|

|

Investments

in Sequoia

|

42

|

|

Investments

in Acacia

|

44

|

|

Appendix

|

|

|

Accounting

Discussion

|

46

|

|

Glossary

|

49

|

|

Financial

Tables

|

57

|

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

1

|

|

|

|

|

CAUTIONARY

STATEMENT

|

Cautionary

Statement

This Redwood Review

contains forward-looking statements within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements involve numerous risks and uncertainties. Our actual

results may differ from our expectations, estimates, and projections and,

consequently, you should not rely on these forward-looking statements as

predictions of future events. Forward-looking statements are not historical in

nature and can be identified by words such as “anticipate,” “estimate,” “will,”

“should,” “expect,” “believe,” “intend,” “seek,” “plan,” and similar expressions

or their negative forms, or by references to strategy, plans, or intentions.

These forward-looking statements are subject to risks and uncertainties,

including, among other things, those described in our Annual Report on Form 10-K

for the year ended December 31, 2008 and in our Quarterly Report on Form 10-Q

for the three months ended June 30, 2009, in each case under the caption “Risk

Factors.” Other risks, uncertainties, and factors that could cause actual

results to differ materially from those projected are described below and may be

described from time to time in reports we file with the Securities and Exchange

Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no

obligation to update or revise forward-looking statements, whether as a result

of new information, future events, or otherwise.

Statements

regarding the following subjects, among others, are forward-looking by their

nature: (i) our view of future trends in the economy, the financial markets, the

housing markets, interest rates, unemployment, the prices for mortgage-backed

securities, and the affect of technical and fundamental factors on them; (ii)

our beliefs about future trends in the fundamental factors underlying the

performance of residential and commercial mortgage assets, such as credit

losses, delinquencies, foreclosures, and prepayment rates, and our beliefs

regarding the effects of these fundamental factors on the performance of our

investments; (iii) the potential effect of future legislation and regulations

and other government initiatives and programs on our investments and our

business, including, without limitation, the future role of government sponsored

enterprises (such as Fannie Mae and Freddie Mac) in mortgage financing and any

short-term measures that are taken with respect to the operations of these and

other government sponsored enterprises or agencies; (iv) our future role in the

mortgage financing industry and credit risk transfer markets as well as the

future of securitization as a means of financing mortgage debt and our ability

in the future to deploy capital in sponsoring securitizations of mortgage debt

and executing structured transactions relating to the transfer of credit risk;

(v) the extent to which we believe that existing and future investments will be

affected by loan modification and refinancing programs sponsored by the

government; (vi) the sufficiency of credit protection for our existing and

future investments and the potential for existing and future investments to

perform in-line with, or to exceed, our performance expectations; (vii) our

ability to continue to acquire real estate-related investments at prices and

with credit support and other characteristics that we believe will yield

long-term attractive cash flows and returns and our intention to maintain the

commercial sector as an important strategic area of investment; (viii) whether

and under what circumstances we would sell assets, our ability to free up

capital internally to meet short-term capital needs, and our expectation that

operating expenses are likely to increase to some extent in future quarters;

(ix) our expectations regarding the future effect of mark-to-market adjustments,

the strength and variability of future cash flows from our investments, and

our belief that future GAAP earnings may be inconsistent but should be largely

driven by the results of our recent investments in senior residential

mortgage-backed securities and by other future investments; and (x) the

intention of our board of directors to pay a regular dividend of $0.25 per share

per quarter in 2009 and our expectations: that dividends paid in 2009 will

constitute a return of capital, that tax losses will continue to increase in the

second half of 2009, that we will report a taxable loss for 2009, and that we do

not expect to pay a special dividend in 2009.

Important factors, among others, that

may affect our actual results include: changes in interest rates; changes in

mortgage prepayment rates; the timing of credit losses within our

portfolio; our exposure to adjustable-rate and negative amortization mortgage

loans; the state of the credit markets and other general economic conditions,

particularly as they affect the price of earning assets and the credit status of borrowers; the

concentration of the credit risks we are exposed to; the ability of

counterparties to satisfy their obligations to us; legislative and regulatory

actions, including those affecting the mortgage industry or our business; the

availability of high-quality assets for

purchase at attractive prices; declines in home prices and commercial real

estate prices; increases in mortgage payment delinquencies; changes in the level

of liquidity in the capital markets which may adversely affect our ability to finance our real estate

asset portfolio; changes in liquidity in the market for real estate securities,

the re-pricing of credit risk in the capital markets, inaccurate ratings of

securities by rating agencies, rating agency downgrades of securities, and increases in the supply of

real estate securities available-for-sale, each of which may adversely affect

the values of securities we own; the extent of changes in the values of

securities we own and the impact of adjustments reflecting those changes on our income statement and

balance sheet, including our stockholders’ equity; our ability to maintain our

status as a real estate investment trust (REIT) for tax purposes; our ability to

generate the amount of cash flow we expect from our investment portfolio; changes in our investment,

financing, and hedging strategies and the new risks that those changes may

expose us to; changes in the competitive landscape within our industry,

including changes that may affect our ability to retain or attract

personnel; our failure to manage various

operational risks associated with our business; our failure to maintain

appropriate internal controls over financial reporting; our failure to properly administer

and manage our securitization entities; risks we may be exposed to if we expand our business

activities, such as risks relating to significantly increasing our direct

holdings of loans; limitations imposed on our business due to our REIT status

and our status as exempt from registration under the Investment Company Act of 1940; our ability to

successfully deploy the proceeds from our recent common equity offering and

raise additional capital to fund our investing activity; and other factors not

presently identified. This Redwood Review may contain statistics and other data that in some cases have

been obtained from or compiled from information made available by servicers and

other third-party service providers.

|

2

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

INTRODUCTION

|

Note

to Readers:

We file annual

reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities

and Exchange Commission. These filings and our earnings press releases provide

information about Redwood and our financial results in accordance with generally

accepted accounting principles (GAAP). We urge you to review these documents,

which are available through our web site, www.redwoodtrust.com.

This document,

called the Redwood Review, is an additional format for providing information

about Redwood through a discussion of many GAAP as well as non-GAAP metrics,

such as taxable income and economic book value. Supplemental information is also

provided in the Financial Tables in this Review to facilitate more detailed

understanding and analysis of Redwood. When we use non-GAAP metrics it is

because we believe that these figures provide additional insight into Redwood’s

business. In each case in which we discuss a non-GAAP metric you will find an

explanation of how it has been calculated, why we think the figure is important,

and a reconciliation between the GAAP and non-GAAP figures.

We

hope you find the Redwood Review to be helpful to your understanding of our

business. We thank you for your input and suggestions, which have resulted in

our changing the form and content of the Redwood Review over time. We welcome

your continued interest and comments.

|

Selected

Financial Highlights

|

||||||||||||

|

Quarter:Year

|

GAAP

Income

(Loss)

per

Share

|

Taxable

Income

(Loss)

per Share

|

Annualized

Return

on Equity

|

GAAP

Book

Value

per Share

|

Economic

Book

Value

per

Share (2)

|

Total

Dividends

per Share

|

||||||

|

Q207

|

$0.41

|

$1.66

|

5%

|

$31.50

|

$33.11

|

$0.75

|

||||||

|

Q307

|

($2.18)

|

$1.74

|

(29%)

|

$5.32

|

$27.55

|

$0.75

|

||||||

|

Q407

|

($36.49)

|

$0.92

|

(4,419%)

|

23.18 (1)

|

$22.29

|

$2.75

|

||||||

|

Q108

|

($5.28)

|

$0.79

|

(95%)

|

$17.89

|

$18.04

|

$0.75

|

||||||

|

Q208

|

($1.40)

|

$0.11

|

(30%)

|

$17.00

|

$16.72

|

$0.75

|

||||||

|

Q308

|

($3.34)

|

$0.07

|

(83%)

|

$12.40

|

$13.18

|

$0.75

|

||||||

|

Q408

|

($3.46)

|

($0.25)

|

(124%)

|

$9.02

|

$11.10

|

$0.75

|

||||||

|

Q109

|

($0.65)

|

($0.22)

|

(25%)

|

$8.40

|

$10.01

|

$0.25

|

||||||

|

Q209

|

$0.10

|

($0.16)

|

5%

|

$10.35

|

$11.30

|

$0.25

|

||||||

|

(1) The GAAP book value per share

is after giving retroactive effect on December 31, 2007 to the adoption of

FAS 159 on January 1, 2008. Without giving retroactive effect

to FAS 159, the GAAP book value per share was negative

$22.18.

|

||||||||||||

|

(2) Economic book value per share

is calculated using bid-side marks for our financial assets and offer-side

marks for our financial liabilities and we believe it more accurately

reflects liquidation value than does GAAP book value per

share. Economic book value is reconciled to GAAP book value in

Table 6 in the Financial Tables in this

Review.

|

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

3

|

|

|

|

|

SHAREHOLDER

LETTER

|

Dear

Fellow Shareholders:

Our second quarter

business activity and financial results were generally in line with our plans

and expectations. We recorded positive net income on a GAAP basis, generated

substantial cash flow, and made progress on several business initiatives,

including raising additional capital through a successful public equity

offering. We welcome those shareholders who are reading the Redwood Review for

the first time and look forward to your feedback about this publication, which

is a supplemental review of our business operations.

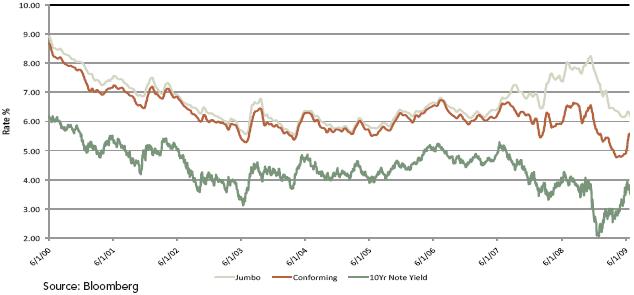

Turning to the

financial markets, there are several indicators that are showing signs of

improvement, including firming prices for senior mortgage securities. While we

are encouraged by this development, we would caution that there are still many

near-term obstacles that remain before housing and the economy can fully

stabilize and recover, including an oversupply of homes for sale and the high

cost of jumbo mortgage loans.

We commenced

operations in 1994 as a provider of credit support to the prime jumbo mortgage

market, and in that role assisted families in obtaining mortgage credit in high

cost areas of the country. We grew our market share to where we were providing

credit enhancement to more than $172 billion of prime mortgages before scaling

back in advance of the recent market disruptions. Our core competency in

analyzing residential credit continued to serve us well when we re-entered the

market in the fall of 2008 to acquire senior securities on the secondary market

at distressed prices. This same credit expertise, coupled with the capital and

operational infrastructure we have maintained throughout this disruption, will

be the foundation we once again rely on as we work to craft, and ultimately

participate in, the mortgage financing markets of the future.

Acquiring senior

securities at attractive prices has been our primary focus during this turbulent

time, but it will eventually run its course. In the long run, the focus of our

business continues to be Redwood’s role in facilitating mortgage financing and

credit risk transfers.

What will Redwood’s

role be in the future mortgage market? While we expect to remain a leading

participant in providing credit support, the final answer to that question will

be determined in large part by the role the government chooses to play once the

current economic crisis subsides. Given the $15 trillion size of the residential

and commercial mortgage markets, we believe that private capital will need to

play a significant role. The government sponsored enterprises (Fannie Mae,

Freddie Mac, and Ginnie Mae) along with the banks, which currently finance a

combined 80% of the market, do not have the capacity to finance the entire

market. We expect that entities such as Redwood, who finance the remaining 20%

of the market, will continue to have a critical role.

Redwood supports

government and trade group efforts to restart mortgage securitization. We have

suggested potential changes for the structure of securitizations and are working

diligently with our business partners on new securitization initiatives.

Securitization has proven to be a highly efficient mechanism for matching

investors with borrowers, and is still the largest source of capital for

residential mortgage credit, although to be sure, the mortgage origination,

securitization, and ratings process must be reformed.

|

4

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

SHAREHOLDER

LETTER

|

One impediment to

restarting securitization is the continuing decline of housing prices. In

addition to steps it is already taking to ensure the flow of low cost conforming

mortgage credit, we urge the federal government to work toward stabilizing

prices by reducing the supply of homes for sale. We know that allowing too many

homes to sit vacant and untended is bad public policy and depresses home prices.

We support initiatives to convert vacant housing into rental housing until the

demand from qualified homebuyers matches the supply of homes for sale. We have

shared our thoughts and specific suggestions about how to stabilize prices and

reform the securitization process with members of Congress as well as many other

market participants.

Regardless of the

extent to which private sector participation in securitization ultimately

resumes, we are confident in our ability to serve our shareholders by continuing

to be a patient, long-term focused investor and a leading provider of credit

enhancement.

We once again

welcome the many new shareholders who have joined us this year, and we thank

every shareholder for their continued trust and support.

George E. Bull,

III

Chairman

and CEO

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

5

|

|

|

|

|

QUARTERLY

OVERVIEW

|

Second

Quarter 2009

It appears that the

worst of the systemic financial crisis is behind us (knock on wood) and, as a

nation, we are moving into a phase of fully assessing the damage and defining

the new financial rules of the road. The various stakeholders — investors,

borrowers, financial intermediaries, and the government — need to work out how

to properly balance the roles of the public and private sectors. If the early

debates are any indication, it will be a lively, passionate, and lengthy

process.

To us, one of the

most crucial questions that has not been answered is what long-term role Fannie

Mae, Freddie Mac, and the Federal Housing Administration will play in

facilitating mortgage financing – and it may be some time before we get a

definitive answer. Ultimately, our business tactics may need to adjust to what

emerges from this process, but we are ready for the challenge and feel that our

progress so far in 2009 is a strong foundation from which to move forward.

For Redwood, the

second quarter is probably best described as one in which we began to realize

the benefits of our patience and discipline and of the strategies that we put in

place to adapt to new market realities. Our GAAP and economic book value were

up, as was our cash flow, and we reported a second quarter GAAP profit. Over the

course of the quarter we invested a significant portion of our capital in

residential senior mortgage securities that we believe will yield long-term

attractive cash flows and returns. In addition, we continued to take steps to

restart our core residential credit risk franchise. The specifics on the key

metrics by which we measure our performance are highlighted below (please see

the tables in this Review for reconciliations between GAAP and non-GAAP

metrics):

|

•

|

Investment

cash flow increased to $64 million, up from $57 million in the first

quarter of 2009, and our business cash flow after operating and interest

expenses increased to $55 million, compared to $45 million in the prior

quarter;

|

|

•

|

GAAP book

value per share at the end of the second quarter was $10.35 per share, an

increase of $1.95 or 23% from the end of the first quarter, and economic

book value per share increased to $11.30, up $1.29 or 13% from the end of

the prior quarter;

|

|

•

|

GAAP net

income was $7 million, or $0.10 per share, compared with a net loss of

$0.65 per share in the first quarter (see the GAAP Income module of this

Review for more detail); and

|

|

•

|

We invested

$341 million during the second quarter and an additional $158 million in

July, primarily in selected senior seasoned RMBS, bringing total capital

invested thus far in 2009 to $597

million.

|

As a backdrop to

the discussion that follows, let us start by giving you our thoughts on the

factors impacting the residential mortgage market.

From a fundamental

standpoint, the underpinnings of the residential mortgage markets continue to

deteriorate. Housing prices continue to decline, delinquencies are still rising,

and unemployment is still heading in the wrong direction. There is some good

news — the overall rate of housing price decline is slowing and select housing

markets are showing signs of bottoming. Prepayments ticked up in the second

quarter, but that was attributable to low mortgage rates early in the year and

prepayments are beginning to moderate as mortgage rates have recently climbed.

However, and most importantly, current levels and trends in credit losses,

housing prices, and prepayment speeds continue to remain in line with the

parameters we have been using for our recent investment decisions.

|

6

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

QUARTERLY

OVERVIEW

|

Second

Quarter 2009 (continued)

In the second

quarter, prices for senior RMBS rose by approximately 10% to 15%. This trend

continued early into the third quarter, as prices have moved significantly and

steadily higher. So, what is behind the dramatic move in prices? In

our opinion, it is best explained by looking back to early March 2009 when

prices were at their nadir. At that time, buyers were scarce, extremely

cautious, and were looking for attractive yields on an unlevered basis.

A lot has changed

in five months.

Buyers are now more

plentiful − and include major banks, hedge funds, broker-dealers, and new REITs

(and there are others looking to raise capital to enter this market). The

negative investment psychology has turned positive and, in some cases, is

showing signs of animal spirits. Additionally, some buyers are now willing to

pay higher prices in anticipation of enhancing yields by employing leverage that

may be available under the government’s PPIP and TALF programs (more on those

programs in the new Government Initiatives module in this Review).

The upward movement

in prices for senior RMBS has “raised all boats” — in some cases deservedly

so, and in others not. We have stuck to our game plan of buying those seasoned

senior securities that we believe are well protected on the downside, have the

potential to pay off at par, and offer the best long-term cash flow value.

Guessing where

prices might go in a volatile market is a tricky business. No one knows for

sure, especially as the run up appears to have been largely driven by technical

market and psychological factors and not fundamentals. If we had to hazard a

guess, it seems to us that the forces driving up prices have a good head of

steam. So, unless there is a change in these factors — e.g., PPIP does not play

out the way the markets are expecting — we would anticipate prices could stay at

elevated levels for some time.

So if prices stay

elevated, what would this mean for Redwood? First, it would be good

news for the overall value of our existing

portfolio. Furthermore, it could mean we may, in certain cases, sell some

securities as part of our normal portfolio management process. In fact, during

the second quarter, we sold $50 million of securities for a gain of $7 million,

and during July we sold an additional $9 million of securities for a gain

of $3 million. As far as new investments are concerned, however, we

believe it would be increasingly difficult to find senior secondary RMBS that

both meet our investment criteria and exceed our investment hurdle rates of

returns.

At the end of July,

we had $182 million of uninvested cash. You may wonder, are we concerned about

how to put it to work in this new environment? In short, the answer

is no. You can also rest assured we have no intention of relaxing our investment

discipline. We believe our long term track record over the years speaks for

itself. We are internally managed and get paid on the investment performance we

achieve for our shareholders, unlike others in our industry. We believe we could

still find select attractive investments, even if prices for RMBS in general

remain high. In addition, there is no guarantee that prices will remain

elevated. If they fall, there may, once again, be attractive opportunities for

investment.

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

7

|

|

|

|

|

QUARTERLY

OVERVIEW

|

Second

Quarter 2009 (continued)

We also expect that

in the near term our investment focus will move more toward structured

credit-risk transfer transactions. We believe customized long-term credit risk

transfers are well suited to Redwood’s credit and structuring expertise. These

are highly illiquid, long-term investments that are appropriate for an unlevered

financing structure — a good fit for Redwood’s permanent capital. We deployed

$56 million into these types of investments during the second quarter. (Please

see the re-REMIC section of the Residential Real Estate Securities module for

details.)

Customized credit

risk transfer transactions have some characteristics that are similar to the

jumbo prime mortgage securitizations we did in the past, and we believe we are

getting closer to the day when we will be able to re-enter that business. There

is still a lot more work to do before that market begins to function again, but

seeing credit risk spreads tighten as they have during this rally gives us hope

that one of the economic barriers to the return of a healthy securitization

market may be starting to fall. We also feel that the Obama Administration’s

Financial Reform Plan reflects the government’s commitment to rehabilitating,

rather than eliminating, this financing mechanism. We are participating in the

conversations about securitization that are occurring among regulators, members

of Congress, banks, rating agencies, and other market participants, but needless

to say, there are no easy answers or quick solutions.

On the commercial

side, real estate fundamentals are in rapid decline and we believe that things

will continue to get worse before they get better. Debt holders are experiencing

rapidly rising delinquency rates. Commercial real estate owners are struggling

with plummeting property values and negative trends in rental and occupancy

rates. There is also a lack of financing alternatives (in the face of large

and looming bullet maturities) that could be a further accelerant to the

downside. Suffice to say, until we get clarity on how these issues will sort

themselves out, we will remain on the sidelines. Going forward, however, we

would like to reiterate that the commercial mortgage market remains an important

strategic area of investment for us.

Now that we have

explained where we think things are going on the investment side of our

business, you may be asking yourself about our plans to raise additional capital

in the near term. Never say never, but it seems highly unlikely that we would

raise additional common equity in 2009. We believe the cash flow from our

existing investments, together with our ability to free up capital internally

(through asset sales or other means), is sufficient to meet our short-term

capital needs.

Before you dig in

to the rest of this Review, here are some of our forward-looking thoughts on

income (GAAP and tax) and cash flow to keep in mind.

While GAAP earnings

may be bumpy for a couple of quarters, as accounting effects from our legacy

portfolio work themselves through, our future GAAP earnings will be largely

driven by our recent investments in senior RMBS. Legacy assets, including our

investments in the Fund, Sequoia, and Acacia (which have been the principal

source of pressure on earnings over the past two years as a result of impairment

charges) now represent only 12% of our total cash and investments. We look

forward to communicating our future performance through GAAP results, as GAAP

and the economics of our business track more in-line. Having said that, we would

not be Redwood if there was not a decent chance that we will do complex

transactions that result in our GAAP financials and our underlying business

economics once again diverging.

|

8

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

QUARTERLY

OVERVIEW

|

Second

Quarter 2009 (continued)

As we have

explained in prior Reviews, in contrast to GAAP accounting, we are not permitted

to establish credit reserves for tax purposes. Instead, since we can only

recognize credit losses as they occur, there is a timing difference that results

in significant differences between these two earnings metrics. We expect to

report a taxable loss in 2009. Even if GAAP income remains positive, it would be

difficult to predict with precision when taxable income would turn positive, as

it would depend on the timing and inter-relationship of taxable income

generated from new investments and the recognition of taxable losses as credit

losses are realized on our legacy portfolio.

During the second

quarter, cash flow from our residential senior securities exceeded cash flow

from our subordinate securities for the first time, reflecting what we have been

communicating about the changing composition of our investment portfolio. We

expect to continue to produce strong cash flows from our

existing investments, as well as from the uninvested cash we held at the

end of July and the reinvestment of future cash flows.

In closing, we want

to say how proud we are of the Redwood team and the way they have handled the

extraordinary circumstances of the past two years. There has been a lot of

carnage on Wall Street and at financial institutions around the world, and many

formerly solid institutions have proven unable to withstand the market forces

that have shaken the global economy. In contrast, Redwood has stood firm, going

about our business in a deliberate manner, while acting aggressively to

capitalize on market opportunities and build our franchise for the future.

As always, we

appreciate your continued support.

|

|

|

Martin S.

Hughes

President,

Chief Financial Officer,

and

Co-Chief Operating Officer

|

Brett D.

Nicholas

Chief

Investment Officer and

Co-Chief

Operating Officer

|

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

9

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Book

Value

Summary

|

u

|

The following

supplemental non-GAAP balance sheet presents our assets and liabilities as

calculated under GAAP and adjusted to reflect our estimate of economic

value. We show our investments in the Redwood Opportunity Fund, L.P. (the

Fund) and the Sequoia and Acacia securitization entities in separate line

items, similar to the equity method of accounting, reflecting the reality

that the underlying assets and liabilities owned by these entities are

legally not ours. We own only the securities and interests that we have

acquired from these entities.

|

|

u

|

This table,

except for our estimates of economic value and the related adjustments, is

derived from the consolidating balance sheet presented on page 15. Our

estimate of economic value of $11.30 per share is calculated using

bid-side asset marks and offer-side marks for our financial liabilities,

as required to determine fair value under GAAP. This method of calculating

economic value more closely represents liquidation value and does not

represent the higher amount we would have to pay at the offered-side to

replace our existing assets.

|

|

Components

of Book Value

|

|||||||||||||

|

June

30, 2009

|

|||||||||||||

|

($

in millions, except per share data)

|

|||||||||||||

|

As

Reported

|

Adj.

|

Management's

Estimate of Economic Value

|

|||||||||||

|

Cash and cash

equivalents

|

$ | 337 | $ | 337 | |||||||||

|

Real estate securities at

Redwood

|

|||||||||||||

|

Residential

|

499 | 499 | |||||||||||

|

Commercial

|

16 | 16 | |||||||||||

|

CDO

|

2 | 2 | |||||||||||

|

Total real estate securities at

Redwood

|

517 | 517 | |||||||||||

|

Investments in the

Fund

|

22 | 22 | |||||||||||

|

Investments in

Sequoia

|

82 | (26 | ) | (a) | 56 | ||||||||

|

Investments in

Acacia

|

4 | 1 | (b) | 5 | |||||||||

|

Total securities and

investments

|

$ | 625 | $ | 600 | |||||||||

|

Long-term

debt

|

(150 | ) | 99 | (c) | (51 | ) | |||||||

|

Other assets/liabilities, net

(d)

|

(10 | ) | (10 | ) | |||||||||

|

Stockholders'

equity

|

$ | 802 | $ | 876 | |||||||||

|

Book value per

share

|

$ | 10.35 | $ | 11.30 | |||||||||

(a)

Our Sequoia investments consist of senior and subordinate securities and

interest-only securities issued by Sequoia entities. We calculated the $56

million estimate of economic value for these securities using the same valuation

process that we followed to fair value our other real estate securities. In

contrast, the $82 million of GAAP carrying value of these investments represents

the difference between residential real estate loans owned by the Sequoia

entities and the asset-backed securities (ABS) issued by these entities to

third-party investors. Under GAAP, we account for these loans and ABS issued at

cost.

(b)

Our $5 million estimate of economic value represents the fair value of our

investment in ABS issued by Acacia using the same valuation process we followed

to value our other real estate securities, plus the net present value of

projected cash flows from our Acacia management fees. In contrast, the $4

million of GAAP carrying value of these investments represents the difference

between real estate securities owned by the Acacia entities and the ABS issued

by these entities to third-party investors. Under GAAP, we account for these

securities and ABS issued at fair value.

(c)

As of June 30, 2009, we had $150 million of 30-year long-term debt that matures

in 2037 at an interest rate of LIBOR plus 225 basis points. Under GAAP, this

debt is carried at cost. Economic value can be difficult to estimate due to a

generally inactive trading market for this debt. In July 2009, we repurchased

$10 million of this debt at a market price equal to 34% of face value and

utilized this price to calculate our $51 million estimate of economic value.

(d)

Other assets/liabilities, net are comprised of $3 million of real estate loans,

$2 million of deferred taxes, $7 million of accrued interest receivable, and $13

million of other assets, less dividends payable of $19 million and accrued

interest and other liabilities of $16 million.

|

10

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Book

Value (continued)

Summary

(continued)

|

u

|

During the

second quarter, our GAAP book value increased by $1.95 per share to

$10.35. The increase resulted from $1.22 per share of accretion from our

June equity offering, $0.52 per share from positive MVA, $0.46 per share

from positive earnings before MVA, less $0.25 per share of dividends.

|

|

u

|

During the

second quarter, our economic book value increased by $1.29 per share to

$11.30. The increase resulted from $0.86 per share of accretion from our

June equity offering, $0.82 per share from net cash flows and net positive

MVA on our investments, less $0.14 per share of cash operating and

interest expenses and $0.25 per share of dividends.

|

Quarterly

Activity

|

u

|

The table

below highlights the components that led to an increase in the fair value

of securities at Redwood (which is the same as GAAP carrying value) from

$191 million at December 31, 2008 to $517 million at June 30, 2009.

|

|

Real

Estate Securities at Redwood

|

||||||||

|

($ in

millions)

|

||||||||

|

Three

months ended,

|

||||||||

|

June

30,

2009

|

March

31, 2009

|

|||||||

|

Beginning fair

value

|

$ | 221 | $ | 191 | ||||

|

Acquisitions

|

341 | 98 | ||||||

|

Sales

|

(50 | ) | (1 | ) | ||||

|

Effect of principal

payments

|

(13 | ) | (5 | ) | ||||

|

Change in fair value,

net

|

18 | (62 | ) | |||||

|

Ending fair

value

|

$ | 517 | $ | 221 | ||||

|

u

|

During the

second quarter, we acquired $341 million in residential securities,

consisting of $283 million of prime and Alt-A senior securities, $56

million of prime re-REMIC securities, and $2 million of prime subordinate

securities. Further information on these acquisitions and an explanation

of re-REMIC securities can be found in the Residential Real Estate

Securities module later in this

Review.

|

|

u

|

In July 2009,

we acquired $158 million in residential senior securities.

|

|

u

|

We sold $50

million of securities in the second quarter and generated a gain of $7

million. The sales consisted of securities which had increased in market

value to a price we did not believe was justified by the underlying

fundamentals. In July, we sold $9 million of securities and generated a

gain of $3 million. We continually manage our portfolio and may sell

additional assets as conditions

merit.

|

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

11

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Book

Value (continued)

Cash,

Securities, and Investments

|

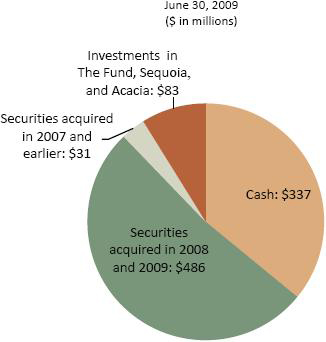

u

|

Our future

earnings are now largely dependent upon how well the senior securities we

have been purchasing perform and on the performance of future acquisitions

as we deploy our existing cash balance. This point is highlighted in the

chart below, which shows our cash, securities, and investments at June 30,

2009, with our securities segmented by acquisition dates.

|

Cash,

Securities, and Investments at Redwood

|

u

|

Securities

acquired in 2008 and 2009, which are predominately residential senior

securities, combined with cash, represent 88%, or $10.62 per share, of

total cash, securities, and investments at June 30,

2009.

|

|

u

|

Securities

acquired in 2007 and earlier, which are predominately subordinated

residential and commercial securities, and investments in the Fund,

Sequoia, and Acacia, represent 12%, or $1.47 per share, of total cash,

securities, and investments at June 30, 2009.

|

|

12

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Book

Value (continued)

Components

Cash

and Cash Equivalents

|

u

|

At June 30,

2009, we had $337 million in cash and cash equivalents. All of our cash is

currently invested in U.S. Treasury Bills or bank deposits insured by the

Federal Deposit Insurance

Corporation.

|

Real

Estate Securities at Redwood

|

u

|

As we

forewarned in prior quarters, the rating agencies have now issued a

substantial number of downgrades and the large majority of mortgage-backed

securities issued from 2005 through 2008 have now been downgraded. Many of

the downgrades have been severe (i.e., from AAA-rated to below investment

grade). These downgrades have provided investment opportunities for us as

investors who have ratings-based investment limitations or regulatory

risk-based capital requirements have, in some cases, been under pressure

to sell securities.

|

|

u

|

We do not

rely on credit ratings as part of our investment decision process. Our

investment decisions are based on our projection of the underlying

collateral cash flows, the level of subordination protecting against

projected future losses, and the priority of cash flow received by the

security. If, for example, a security originally rated AAA is downgraded

to below investment grade, it is still in the most senior position with

respect to cash flows.

|

|

u

|

The following

table presents the components of fair value (which equals GAAP carrying

value) for real estate securities at Redwood at June 30, 2009. Consistent

with our presentation last quarter, we now segment our securities

portfolio by senior and subordinate cash flow categories. We also break

out the re-REMIC securities we acquired in the second quarter.

|

|

Real

Estate Securities at Redwood

|

||||||||||||||||||||

|

June 30,

2009

|

||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||

|

%

of Total

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006-2008

|

Total

|

Securities

|

||||||||||||||||

|

Residential

|

||||||||||||||||||||

|

Seniors

|

||||||||||||||||||||

|

Prime

|

$ | 11 | $ | 153 | $ | 19 | $ | 183 | 35 | % | ||||||||||

|

Non-prime

|

113 | 102 | 16 | 231 | 44 | % | ||||||||||||||

|

Total

Seniors

|

$ | 124 | $ | 255 | $ | 35 | $ | 414 | 79 | % | ||||||||||

|

Re-REMIC

|

||||||||||||||||||||

|

Prime

|

$ | - | $ | 2 | $ | 53 | $ | 55 | 11 | % | ||||||||||

|

Total

Re-REMIC

|

$ | - | $ | 2 | $ | 53 | $ | 55 | 11 | % | ||||||||||

|

Subordinates

|

||||||||||||||||||||

|

Prime

|

$ | 19 | $ | 4 | $ | 3 | $ | 26 | 5 | % | ||||||||||

|

Non-prime

|

1 | 1 | 2 | 4 | 1 | % | ||||||||||||||

|

Total

Subordinates

|

$ | 20 | $ | 5 | $ | 5 | $ | 30 | 6 | % | ||||||||||

|

Total

Residential

|

$ | 144 | $ | 262 | $ | 93 | $ | 499 | 96 | % | ||||||||||

|

Commercial

Subordinates

|

$ | 8 | $ | 2 | $ | 6 | $ | 16 | 3 | % | ||||||||||

|

CDO

Subordinates

|

$ | - | $ | 2 | $ | - | $ | 2 | 1 | % | ||||||||||

|

Total

|

$ | 152 | $ | 266 | $ | 99 | $ | 517 | 100 | % | ||||||||||

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

13

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Book

Value (continued)

Components

(continued)

Investments

in the Fund, Sequoia, and Acacia

|

u

|

Our

investments in the Fund, Sequoia, and Acacia totaled $108 million, or 14%

of our securities and investments at June 30,

2009.

|

|

•

|

The fair

value (which equals GAAP carrying value) of our investments in the Fund

was $22 million at June 30, 2009. This investment represents a 52%

interest in the Fund, which closed in March 2008 and is fully invested,

primarily in non-prime RMBS. The Fund is managed by a subsidiary of

Redwood.

|

|

•

|

At June 30,

2009, the fair value of our investments in Sequoia was $56 million and the

GAAP carrying value was $82 million. These investments consist primarily

of interest-only securities (IOs) and to a lesser extent senior and

subordinate securities. Our returns on these IOs are most sensitive to

prepayments and faster prepayments would negatively impact returns.

Material changes in interest rates also have a short-term impact on cash

flows received from these assets.

|

|

•

|

At June 30,

2009, the fair value of our investments in Acacia was $5 million and the

GAAP carrying value (which equals fair value) was $4 million. These

investments consist of equity interests and securities in the Acacia CDO

entities we sponsor. We value the management fees at $4 million, which

equals our projected management fees discounted at a 45%

rate.

|

Debt

|

u

|

We had no

short-term debt at June 30, 2009. We currently believe that it is prudent

to fund our investments with permanent capital (equity and long-term debt)

that is not subject to margin calls and financial

covenants.

|

|

u

|

As of June

30, 2009, we had $150 million of long-term debt at Redwood due in 2037.

Under GAAP, this debt is carried at cost. In July 2009, we repurchased $10

million of this debt at a market price equal to 34% of face value and

utilized this price to calculate our $51 million estimate of economic

value for these obligations.

|

|

14

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Book

Value (continued)

Consolidating

Balance Sheet

|

u

|

GAAP requires

us to consolidate all of the assets and liabilities of the Sequoia and

Acacia securitization entities (which had a combined $4.4 billion of

assets and $4.3 billion of liabilities at June 30, 2009), even though the

assets are owned by securitization entities and the liabilities are

obligations of these securitization entities payable only from the cash

flows generated by the assets owned by these entities. Additionally, we

are required to consolidate all of the assets and liabilities of the Fund,

since Redwood owns the general partnership interest in the Fund and just

over half of the limited partnership

interests.

|

|

u

|

The table

below shows the consolidating components of our consolidated balance sheet

at June 30, 2009. The purpose of this presentation is to show the effect

each of the components had on our consolidated shareholders’ equity. The

Fund, Sequoia, and Acacia components represent investments and are not

separate business segments.

|

|

Consolidating Balance

Sheet

|

||||||||||||||||||||||||

|

June

30, 2009

|

||||||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||||||

|

Redwood

|

||||||||||||||||||||||||

|

Redwood

|

The

Fund

|

Sequoia

|

Acacia

|

Intercompany

|

Consolidated

|

|||||||||||||||||||

|

Real estate

loans

|

$ | 3 | $ | - | $ | 3,955 | $ | 8 | $ | - | $ | 3,966 | ||||||||||||

|

Real estate

securities

|

517 | 38 | - | 304 | (55 | ) | 804 | |||||||||||||||||

|

Investments in the

Fund

|

22 | - | - | - | (22 | ) | - | |||||||||||||||||

|

Investments in

Sequoia

|

82 | - | - | - | (82 | ) | - | |||||||||||||||||

|

Investments in

Acacia

|

4 | - | - | - | (4 | ) | - | |||||||||||||||||

|

Other

investments

|

- | - | - | 47 | - | 47 | ||||||||||||||||||

|

Cash and cash

equivalents

|

337 | - | - | - | - | 337 | ||||||||||||||||||

|

Total earning

assets

|

965 | 38 | 3,955 | 359 | (163 | ) | 5,154 | |||||||||||||||||

|

Other

assets

|

22 | 4 | 27 | 78 | - | 131 | ||||||||||||||||||

|

Total

assets

|

$ | 987 | $ | 42 | $ | 3,982 | $ | 437 | $ | (163 | ) | $ | 5,285 | |||||||||||

|

Short-term

debt

|

$ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||

|

Other

liabilities

|

35 | 2 | 2 | 146 | - | 185 | ||||||||||||||||||

|

Asset-backed securities issued -

Sequoia

|

- | - | 3,898 | - | (55 | ) | 3,843 | |||||||||||||||||

|

Asset-backed securities issued -

Acacia

|

- | - | - | 287 | - | 287 | ||||||||||||||||||

|

Long-term

debt

|

150 | - | - | - | - | 150 | ||||||||||||||||||

|

Total

liabilities

|

185 | 2 | 3,900 | 433 | (55 | ) | 4,465 | |||||||||||||||||

|

Stockholders’

equity

|

802 | 22 | 82 | 4 | (108 | ) | 802 | |||||||||||||||||

|

Noncontrolling

interest

|

- | 18 | - | - | - | 18 | ||||||||||||||||||

|

Total equity

|

802 | 40 | 82 | 4 | (108 | ) | 820 | |||||||||||||||||

|

Total liabilities and

stockholders’ equity

|

$ | 987 | $ | 42 | $ | 3,982 | $ | 437 | $ | (163 | ) | $ | 5,285 | |||||||||||

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

15

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Cash

Flow

|

u

|

The sources

and uses of cash in the table below are derived from our GAAP Consolidated

Statement of Cash Flows for the second quarter of 2009 by aggregating and

netting all items in a manner consistent with the way management analyzes

them. This table excludes the gross cash flows generated by our Sequoia

and Acacia securitization entities and the Fund (cash flows that are not

available to Redwood), but does include the cash flows distributed to

Redwood as a result of our investments in these entities. The beginning

and ending cash balances presented in the table below are GAAP

amounts.

|

|

Redwood

|

||||||||

|

Sources

and Uses of Cash

|

||||||||

|

($

in millions)

|

||||||||

|

Three

Months Ended

|

||||||||

|

6/30/09

|

3/31/09

|

|||||||

|

Beginning cash

balance

|

$ | 333 | $ | 126 | ||||

|

Business Cash

Flows:

|

||||||||

|

Cash flow from securities and

investments

|

$ | 64 | $ | 57 | ||||

|

Asset management

fees

|

1 | 1 | ||||||

|

Operating

expenses

|

(8 | ) | (11 | ) | ||||

|

Interest expense on

long-term debt

|

(2 | ) | (2 | ) | ||||

|

Total business cash

flows

|

55 | 45 | ||||||

|

Other Sources and

Uses:

|

||||||||

|

Proceeds from asset

sales

|

57 | 1 | ||||||

|

Proceeds from equity

issuance

|

238 | 285 | ||||||

|

Changes in working

capital

|

4 | 1 | ||||||

|

Acquistions

|

(334 | ) | (98 | ) | ||||

|

Dividends

|

(16 | ) | (27 | ) | ||||

|

Net other (uses)

sources

|

(51 | ) | 162 | |||||

|

Net sources (uses) of

cash

|

$ | 4 | $ | 207 | ||||

|

Ending cash

balance

|

$ | 337 | $ | 333 | ||||

|

u

|

Second

quarter business cash flow totaled $55 million, up $10 million from the

first quarter, as cash flow from our investment portfolio increased by $7

million and cash operating expenses declined by $3 million. Our operating

expenses are likely to increase to some extent in future quarters as we

enhance our platform and focus on long-term business initiatives.

|

|

u

|

Second

quarter acquisitions were $341 million. The table above reflects

acquisitions of $334 million, as $7 million of these acquisitions were

executed in June, but settled in July.

|

|

u

|

Second

quarter cash flow from securities and investments of $64 million included

$31 million of coupon interest and $33 million of principal. We caution

readers that given the nature of our investments (deep discount

subordinated securities, senior securities acquired at discounts, IOs,

equity investments in Acacia, and other types) it is difficult to draw

conclusions in any one period about what portion of our cash flow

represents “income” and what is a “return of capital.” It is only at the

end of an asset’s life that we can accurately determine what portion of

the cumulative cash received (whether principal or interest) was truly

income and what was a return of

capital.

|

|

16

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Cash

Flow (continued)

|

u

|

The table

below presents the components of our cash flow from securities and

investments for the first and second quarters of

2009.

|

|

Redwood

|

||||||||

|

Cash

Flow From Securities and Investments

|

||||||||

|

($ in

millions)

|

||||||||

|

Three Months

Ended

|

||||||||

|

6/30/09

|

3/31/09

|

|||||||

|

Securities at

Redwood

|

||||||||

|

Residential

Senior

|

$ | 26 | $ | 10 | ||||

|

Residential

Subordinate

|

18 | 20 | ||||||

|

Commercial and

CDO

|

4 | 5 | ||||||

|

Total Cash Flow from Securities

at Redwood

|

48 | 35 | ||||||

|

Investments in the

Fund

|

2 | 3 | ||||||

|

Investments in

Sequoia

|

13 | 18 | ||||||

|

Investments in

Acacia

|

1 | 1 | ||||||

|

Total Cash Flow from Securities

and Investments

|

$ | 64 | $ | 57 | ||||

|

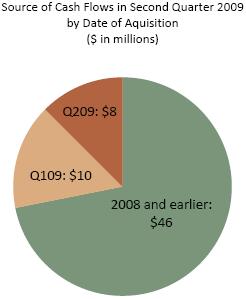

u

|

As expected,

with new acquisitions, primarily in senior securities, our quarterly cash

flow continued to increase. The chart below shows how much of our cash

flow in the second quarter was derived from the portfolio we owned at the

beginning of the year, how much was derived from first quarter

acquisitions, and how much was derived from second quarter

acquisitions.

|

Cash

Flow from Securities and Investments

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

17

|

|

|

|

|

FINANCIAL

INSIGHTS

|

Cash

Flow (continued)

|

u

|

Depending on

the timing of acquisitions within a quarter and the cash remittance cycle

between trustees and investors, it could take one to two months before we

are generating cash flows from acquisitions. This is illustrated by our

second quarter acquisitions of $341 million that generated only $2 million

in cash interest in the quarter. (These second quarter acquisitions also

generated $6 million of principal payments.) We expect to receive closer

to $9 million in cash interest in the third quarter since the face value

of these acquisitions was $706 million and the average coupon was 5.17%.

In addition, we will be receiving principal as the underlying mortgages

prepay. As a result, our cash flows in future quarters from these second

quarter acquisitions should increase

substantially.

|

|

u

|

Since we are

acquiring more senior securities, the cash flows we receive every quarter

will be increasingly dependent on prepayment speeds, and since prepayments

will vary, there will be some volatility in the cash flows generated by

our senior portfolio.

|

|

u

|

Cash flow

generated from our residential subordinated securities totaled $18 million

in the second quarter, compared to $20 million in the first quarter. In

the second quarter, we received $10 million from principal payments and $8

million from interest. We earn cash interest payments on the face value

($622 million at June 30, 2009), which is reduced by principal paydowns

and credit losses. Credit losses can vary significantly from period to

period and totaled $127 million in the second quarter, compared to $137

million in the first quarter. We expect credit losses will remain at

elevated levels and thus, cash flows will trend down, and, if the expected

credit losses occur quickly, the decline in cash flows from

this portfolio could be

rapid.

|

|

u

|

The decrease

in cash flow from our investments in Sequoia resulted from lower spread

income from the IO securities we own. The spread narrowed as the loan

coupons reset down in the second quarter following the downward resets on

the related debt in the first quarter. Our IO securities generated $12

million of the $13 million in Sequoia cash flow in the second

quarter.

|

|

18

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

GOVERNMENT

INITIATIVES

|

Summary

What

is this?

This

section provides a summary of the major government initiatives affecting our

business and industry and discusses how these initiatives may impact us. We have

added this section to this quarter’s Redwood Review in order to give you our

summary of, and analysis and observations about, these initiatives.

Public-Private

Investment Program (PPIP)

|

u

|

Description.

In March 2009, the FDIC, the Federal Reserve, and the Treasury Department

announced the PPIP, a program designed to facilitate the formation of

private investment funds to purchase so-called “toxic

assets”

from financial institutions. By providing equity capital to match

privately-raised capital, and with government provided leverage, PPIP was

designed to spur the purchase of up to $1 trillion of legacy real estate

assets (loans and securities), thereby freeing up bank balance sheets for

new lending. In July, the government announced the initial nine asset

managers it had selected for the program.

|

|

u

|

Observations

and Impact on Redwood. The program is currently expected to be $40

billion in size, which falls far short of the original goal. As a result,

the program appears able to address only a fraction of the approximately

$1.4 trillion of eligible outstanding RMBS. PPIP managers will be able to

use modest 2:1 leverage supplied by the government to buy RMBS, which we

believe has contributed to (but is not the sole cause of) the recent price

rally for senior RMBS. The program appears to be better suited for the

CMBS market, since PPIP investment funds can access TALF (see below) and

obtain 5:1 leverage for CMBS investments, and this has likely contributed

significantly to the stronger rally in prices for TALF-eligible CMBS.

Redwood decided not to participate as a PPIP manager in part because the

economics were not compelling, but more importantly, because there were

significant potential conflicts that could have put limitations on our

core business. In the future, PPIP investment funds may compete with us

when we are bidding on PPIP eligible assets. We may also sell assets to

these funds if we believe prices have outpaced the

fundamentals.

|

Term

Asset-Backed Securities Loan Facility (TALF)

|

u

|

Description.

In November 2008, the Federal Reserve announced the launch of this $200

billion non-recourse lending facility. TALF enables investors to borrow

from the Federal Reserve to finance the acquisition of eligible ABS.

Initially limited to ABS collateralized by new student loans, auto loans,

credit card loans, and Small Business Administration loans, TALF was

subsequently expanded to include legacy CMBS. There has been a high degree

of speculation that TALF will be expanded to include legacy RMBS, although

both legacy and newly issued RMBS currently remain ineligible.

|

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

19

|

|

|

|

|

GOVERNMENT

INITIATIVES

|

Term

Asset-Backed Securities Loan Facility (TALF) (continued)

|

u

|

Observations

and Impact on Redwood. The leveraged financing available under TALF

appears attractive for eligible assets. Although certain seasoned CMBS are

eligible collateral, we believe the commercial real estate fundamentals

are in rapid decline and will get worse before they get better and have

decided not to participate at this time. We remain skeptical that seasoned

RMBS will become eligible collateral, but we support making newly

originated RMBS eligible for TALF because it would help banks (by freeing

up capital) and provide additional credit for borrowers, which together

would be beneficial for the economy. We would consider using TALF as a

source of leverage for RMBS if — and these are big ifs — we can get

comfortable with the resulting liquidity risk and any operating

restrictions that may be imposed by the government. For the time being, we

will continue to acquire assets without assuming we will be able to

utilize TALF (i.e., based upon unlevered return expectations).

|

|

|

So far,

TALF’s primary impact on Redwood has been that it has somewhat contributed

to the rally in senior RMBS in anticipation of being able to access TALF.

Several competitors have announced plans to raise capital and invest in

RMBS — again, in advance of RMBS actually being eligible for TALF.

|

Loan

Modification and Refinancing Programs

|

u

|

Description.

Various loan modification and refinancing programs have been implemented

by the Bush and Obama Administrations and Congress over the past year.

These programs provide incentives and safe harbor protections for

servicers to modify interest rates, capitalize arrearages, and postpone

scheduled repayments of principal. The government has also permitted

borrowers to refinance Fannie Mae or Freddie Mac loans with up to a 125%

loan-to-value ratio if one of those two entities already owns the risk

associated with the borrower’s mortgage.

|

|

u

|

Observations

and Impact on Redwood. Modifications have always been a part of

securitization structures, but they were subject to strict parameters to

protect investors. The current loan modification programs, when coupled

with the statutory safe harbor for servicers, may be detrimental to

restarting the securitization markets, as they potentially undermine

contract law. In anticipation of an increase in the number of loan

modifications, Redwood has been investing in RMBS backed by loans that we

believe are less likely to be impacted (such as prime and seasoned Alt-A

loans). Since the beginning of 2008, 10% (by dollar amount) of non-Agency

securitized loans have been modified, and the large majority of the

modifications have been to subprime (52%) and option ARM (35%) loans,

while Alt-A (11%) and prime (2%) loans have experienced fewer

modifications (according to data from JPMorgan).

|

Obama

Administration’s Financial Regulatory Reform Proposal

|

u

|

On June 17,

2009, the Obama Administration unveiled its proposed plan for Financial

Regulatory Reform. Many aspects of the reform plan would impact Redwood’s

business if they are enacted and implemented as proposed. Two of the most

relevant portions of the plan relate to reforming securitization and the

future roles of Fannie Mae and Freddie Mac. We would note that while this

plan outlines the Administration's direction of financial reform, we

believe there will likely be significant changes after all the debates are

settled and the details ironed-out.

|

|

20

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

GOVERNMENT

INITIATIVES

|

Regulatory

Reform Plan – Securitization Reform

|

u

|

Description.

The reform plan is aimed at strengthening supervision and regulation of

securitization markets and proposes several initiatives, including:

requiring originators to retain a 5% economic interest in the securitized

credit exposure, aligning compensation with longer term performance,

increasing transparency, and reforming the credit rating

process.

|

|

u

|

Observation

and Impact on Redwood. Restarting the securitization market would

be positive for Redwood and we generally support this part of the plan and

take comfort that the Administration recognizes the need to reform and

restart securitization, which has proven to be a highly efficient

mechanism for financing residential mortgage credit. While Redwood’s

business model includes retaining an economic interest in securitizations,

we think the proposed 5% retention rule should vary depending on the risk

of the underlying assets (which could result in a higher or lower

percentage of risk retention) and we expect that industry feedback will

result in a more tailored risk retention rule.

|

Regulatory

Reform Plan – Future of Fannie Mae and Freddie Mac

|

u

|

Description.

Another portion of the reform plan is aimed at determining the future role

of Fannie Mae and Freddie Mac, the two largest participants in the

residential mortgage financing market, both of which are currently

operating under conservatorship. The reform plan suggests several options

for consideration, including: winding down their activities, breaking up

their businesses into smaller companies, or having them operate in a

public utility model.

|

|

u

|

Observation

and Impact on Redwood. It is difficult to speculate on exactly what

the outcome will be for Fannie Mae and Freddie Mac, as their fate will

likely depend to a large extent on the state of the housing and credit

markets, the economy, and the budget deficit when, and if, any proposal is

eventually brought before Congress. Given the enormous size ($11 trillion)

of the residential mortgage market, there may not be support for

continuing to concentrate substantial mortgage risk within the government

through these entities. In fact, under current law and regulation, both

entities are required to begin shrinking by 10% per year starting in 2010.

On the other hand, they have been one of the primary means through which

the federal government has implemented policies aimed at expanding, and

making affordable, home ownership — goals which continue to have broad

appeal, but which have not necessarily been successfully implemented in

the past to the detriment of the housing market.

|

|

|

Because of

their current size and role, any change in Fannie Mae’s and Freddie Mac’s

purpose and mandate, or any change in the manner in which they operate and

finance themselves, will likely have broad implications for participants

in the industry, including potentially positive or negative implications

for Redwood.

|

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

21

|

|

|

|

|

GAAP INCOME

|

Summary

What

is this?

GAAP

income is income calculated under generally accepted accounting principles in

the United

States.

Quarterly

Update

|

u

|

Our reported

GAAP income was $7 million ($0.10 per share) for the second quarter of

2009, as compared to a loss of $35 million ($0.65 per share) for the first

quarter of 2009. Our second quarter earnings reflected $35 million of net

interest income before giving effect to a $15 million (or $0.23 per share)

loan loss provision at Sequoia and $29 million (or $0.44 per share) of

negative MVA. Our earnings benefited from a $19 million ($0.29 per share)

non-recurring gain related to the deconsolidation of a Sequoia

securitization trust as well as a $7 million ($0.11 per share) gain from

the sale of securities.

|

|

u

|

The following

table provides a summary of our GAAP income (loss) for the first and

second quarters of 2009.

|

|

GAAP

Income (Loss)

|

||||||||

|

($

in millions, except per share data)

|

||||||||

|

Three

Months Ended

|

||||||||

|

6/30/09

|

3/31/09

|

|||||||

|

Interest

income

|

$ | 74 | $ | 82 | ||||

|

Interest

expense

|

(39 | ) | (48 | ) | ||||

|

Net interest

income

|

35 | 34 | ||||||

|

Provision for loan

losses

|

(15 | ) | (16 | ) | ||||

|

Market valuation adjustments,

net

|

(29 | ) | (43 | ) | ||||

|

Net interest income (loss) after

provision and market valuation adjustments

|

(9 | ) | (25 | ) | ||||

|

Operating

expenses

|

(11 | ) | (11 | ) | ||||

|

Realized gains,

net

|

26 | - | ||||||

|

Noncontrolling

interest

|

- | 1 | ||||||

|

Benefit from (provision for)

income taxes

|

1 | - | ||||||

|

GAAP income

(loss)

|

$ | 7 | $ | (35 | ) | |||

|

GAAP income (loss) per

share

|

$ | 0.10 | $ | (0.65 | ) | |||

|

22

|

THE REDWOOD

REVIEW 2ND QUARTER 2009

|

|

|

|

|

|

|

GAAP INCOME

|

Quarterly

Update (continued)

|

u

|

The table

below shows the consolidating components of our income statements for the

second and first quarters of 2009. The purpose of this presentation is to

show the effect each of the components had on our reported income (loss)

for these periods. The Fund, Sequoia, and Acacia components represent

investments and are not separate business

segments.

|

|

Consolidating

Income Statement

|

||||||||||||||||||||||||

|

Three Months Ended June 30,

2009

|

||||||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||||||

|

Redwood

|

The

Fund

|

Sequoia

|

Acacia

|

Intercompany

Adjustments

|

Redwood

Consolidated

|

|||||||||||||||||||

|

Interest

income

|

$ | 18 | $ | 1 | $ | 34 | $ | 22 | $ | (1 | ) | $ | 74 | |||||||||||

|

Net discount (premium)

amortization

|

3 | 1 | (4 | ) | - | - | - | |||||||||||||||||

|

Total interest

income

|

21 | 2 | 30 | 22 | (1 | ) | 74 | |||||||||||||||||

| - | - | - | - | - | ||||||||||||||||||||

|

Management

fees

|

1 | - | - | - | (1 | ) | - | |||||||||||||||||

|

Interest

expense

|

(2 | ) | - | (23 | ) | (16 | ) | 2 | (39 | ) | ||||||||||||||

|

Net interest

income

|

20 | 2 | 7 | 6 | - | 35 | ||||||||||||||||||

| - | - | - | - | - | ||||||||||||||||||||

|

Provision for loan

losses

|

- | - | (15 | ) | - | - | (15 | ) | ||||||||||||||||

|

Market valuation adjustments,

net

|

(32 | ) | (1 | ) | (1 | ) | 5 | - | (29 | ) | ||||||||||||||

|

Net interest income (loss) after

provision and market valuation adjustments

|

(12 | ) | 1 | (9 | ) | 11 | - | (9 | ) | |||||||||||||||

| - | - | - | - | - | ||||||||||||||||||||

|

Operating

expenses

|

(11 | ) | - | - | - | - | (11 | ) | ||||||||||||||||

|

Realized gains,

net

|

7 | - | 19 | - | - | 26 | ||||||||||||||||||

|

Gain (loss) from the Fund,

Sequoia, and Acacia

|