|

|

|

|

|

TABLE OF

CONTENTS

|

|

Introduction

|

3

|

|

Shareholder

Letter

|

4

|

|

Quarterly

Overview

|

6

|

|

Financial

Insights

|

10

|

|

u

Book Value

|

10

|

|

u

Cash Flow

|

14

|

|

u

Balance Sheet

|

16

|

|

u

GAAP Income

|

17

|

|

u

Taxable Income

|

20

|

|

Dividends

|

21

|

|

Capital and

Liquidity

|

22

|

|

Residential

Real Estate Securities

|

23

|

|

Commercial

Real Estate Securities

|

33

|

|

Investments

in Securitization Entities

|

35

|

|

Appendix

|

|

|

Accounting

Discussion

|

38

|

|

Glossary

|

41

|

|

Financial

Tables

|

49

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

1

|

|

|

|

|

CAUTIONARY

STATEMENT

|

|

2

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

INTRODUCTION

|

|

Selected

Financial Highlights

|

||||||

|

Quarter:Year

|

GAAP

Income

(Loss)

per Share

|

Taxable

Income

(Loss)

per Share

|

Annualized

Return

on

Equity

|

GAAP

Book

Value

per

Share

(1)

|

Economic

Book

Value

per

Share

(2)

|

Total

Dividends

per

Share

|

|

Q307

|

($2.18)

|

$1.74

|

(29%)

|

$5.32

|

$27.55

|

$0.75

|

|

Q407

|

($36.49)

|

$0.92

|

(4419%)

|

$23.18

|

$22.29

|

$2.75

|

|

Q108

|

($5.28)

|

$0.79

|

(95%)

|

$17.89

|

$18.04

|

$0.75

|

|

Q208

|

($1.40)

|

$0.11

|

(30%)

|

$17.00

|

$16.72

|

$0.75

|

|

Q308

|

($3.34)

|

$0.07

|

(83%)

|

$12.40

|

$13.18

|

$0.75

|

|

Q408

|

($3.46)

|

($0.38)

|

(124%)

|

$9.02

|

$11.10

|

$0.75

|

|

Q109

|

($0.65)

|

($0.22)

|

(25%)

|

$8.40

|

$10.01

|

$0.25

|

|

Q209

|

$0.10

|

($0.16)

|

5%

|

$10.35

|

$11.30

|

$0.25

|

|

Q309

|

$0.35

|

($0.30)

|

13%

|

$11.68

|

$12.28

|

$0.25

|

|

(1)

The Q407 GAAP book value per share is after giving retroactive effect on

December 31, 2007 to the adoption of FAS 159 on January 1, 2008. Without

giving retroactive effect to FAS 159, the GAAP book value per share was

negative $22.18.

|

|

(2)

Economic book value per share is calculated using bid-side marks (or

estimated bid-side values) for our financial assets and offer-side marks

(or estimated offer-side values) for our financial liabilities and we

believe it more accurately reflects liquidation value than does GAAP book

value per share. Economic book value per share is reconciled to

GAAP book value per share in Table 4 in the Financial Tables in this

Review.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

3

|

|

|

|

|

SHAREHOLDER

LETTER

|

|

4

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

SHAREHOLDER

LETTER

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

5

|

|

|

|

|

QUARTERLY

OVERVIEW

|

” for a fast

recovery followed by a period of flat growth; a “W” for a double-dip

recession; and the dreaded bathtub “

” for a fast

recovery followed by a period of flat growth; a “W” for a double-dip

recession; and the dreaded bathtub “ ” for an extended

down cycle followed by eventual growth. The truth is that no one knows for sure

— even the experts have strong and disparate opinions on how and when this

enormous financial experiment of government intervention will end.

” for an extended

down cycle followed by eventual growth. The truth is that no one knows for sure

— even the experts have strong and disparate opinions on how and when this

enormous financial experiment of government intervention will end.|

u

|

GAAP earnings

were $27 million, or $0.35 per share in the third quarter, up from $7

million, or $0.10 per share in the second

quarter.

|

|

u

|

GAAP book

value was $11.68 per share at quarter-end, up $1.33 or 13% in the third

quarter over the prior quarter, while our non-GAAP estimate of economic

value was $12.28 per share at quarter-end, up $0.98 or 9% in the third

quarter over the prior quarter.

|

|

u

|

During the

third quarter, investment cash flow increased to $78 million, up $14

million from the second quarter, and business cash flow (after cash

operating expenses) increased to $68 million, up $13 million from the

second quarter.

|

|

u

|

We ended the

quarter with $217 million of cash.

|

|

6

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

7

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

8

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

QUARTERLY

OVERVIEW

|

|

|

|

Martin S.

Hughes

President,

Chief Financial Officer,

and

Co-Chief Operating Officer

|

Brett D.

Nicholas

Chief

Investment Officer and

Co-Chief

Operating Officer

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

9

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

table shows the components of our GAAP Book Value and Management’s

Estimate of Economic Value at September 30,

2009.

|

|

Components

of Book Value

|

||||||||||||

|

September

30, 2009

|

||||||||||||

|

($

in millions, except per share data)

|

||||||||||||

|

GAAP

Book

Value

|

Adj.

|

Management's

Estimate of Economic Value*

|

||||||||||

|

Cash and cash

equivalents

|

$ | 217 | $ | 217 | ||||||||

|

Real estate securities at

Redwood

|

||||||||||||

|

Residential

|

732 | 732 | ||||||||||

|

Commercial

|

17 | 17 | ||||||||||

|

CDO

|

2 | 2 | ||||||||||

|

Total real estate securities at

Redwood

|

$ | 751 | $ | 751 | ||||||||

|

Investments in the

Fund

|

24 | 24 | ||||||||||

|

Investments in

Sequoia

|

76 | (29 | ) | 47 | ||||||||

|

Investments in

Acacia

|

2 | 2 | ||||||||||

|

Total cash, securities, and

investments

|

$ | 1,070 | $ | 1,041 | ||||||||

| - | ||||||||||||

|

Long-term

debt

|

(140 | ) | 76 | (64 | ) | |||||||

| - | ||||||||||||

|

Other assets/liabilities,

net

|

(23 | ) | (23 | ) | ||||||||

|

Stockholders'

equity

|

$ | 907 | $ | 954 | ||||||||

|

Book value per

share

|

$ | 11.68 | $ | 12.28 | ||||||||

|

u

|

During the

third quarter, our GAAP book value increased by $1.33 per share to $11.68.

The increase resulted from $1.09 per share of positive market valuation

adjustments and $0.49 per share from earnings before market valuation

adjustments, less $0.25 per share of dividends.

|

|

u

|

Our estimate

of economic value increased by $0.98 per share to $12.28. Economic value

is a non-GAAP measure determined by calculating the fair value of our

investments in consolidated entities directly as opposed to deriving their

reported GAAP values by netting their consolidated assets and liabilities.

We also value our long-term debt at its estimated fair value rather than

its amortized cost basis as reported for GAAP. See page 13 for a detailed

explanation of these adjustments.

|

|

10

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

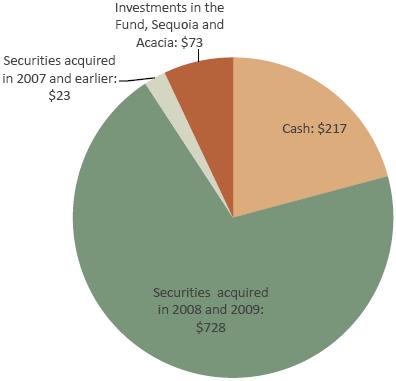

The following

chart summarizes the $1 billion economic value of our cash, securities,

and investments at September 30,

2009.

|

|

u

|

We have

segmented our securities portfolio by acquisition date in the above chart

to highlight that 91% of the economic value of the cash, securities and

investments are currently held in cash or in recently acquired securities.

Our future earnings will be driven primarily by the performance of these

recent investments along with how we deploy our existing cash and future

cash flows.

|

|

u

|

Our cash and

cash equivalents amounted to $217 million at September 30, 2009, and $240

million at the end of October. All of our cash is currently invested in

U.S. Treasury Bills or bank deposits insured by the Federal Deposit

Insurance Corporation.

|

|

u

|

Our primary

source of cash during the third quarter was $78 million from principal and

interest payments on our investments. Our primary use of cash was $246

million for acquisitions of residential securities. See the Cash Flow

section on pages 14 and 15 for detailed activity related to sources and

uses of cash.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

11

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

table presents the fair value of real estate securities at Redwood at

September 30, 2009. We segment our securities portfolio by priority of

cash flows — senior, re-REMIC, and subordinate — and, for residential

securities, by quality of underlying loans — prime and non-prime.

|

|

Real

Estate Securities at Redwood

|

||||||||||||||||||||

|

September 30,

2009

|

||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||

|

%

of Total

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006-2009

|

Total

|

Securities

|

||||||||||||||||

|

Residential

|

||||||||||||||||||||

|

Seniors

|

||||||||||||||||||||

|

Prime

|

$ | 15 | $ | 264 | $ | 58 | $ | 337 | 45 | % | ||||||||||

|

Non-prime

|

110 | 155 | 14 | 279 | 37 | % | ||||||||||||||

|

Total

Seniors

|

$ | 125 | $ | 419 | $ | 72 | $ | 616 | 82 | % | ||||||||||

|

Re-REMIC

|

||||||||||||||||||||

|

Prime

|

$ | 2 | $ | 9 | $ | 82 | $ | 93 | 12 | % | ||||||||||

|

Total

Re-REMIC

|

$ | 2 | $ | 9 | $ | 82 | $ | 93 | 12 | % | ||||||||||

|

Subordinates

|

||||||||||||||||||||

|

Prime

|

$ | 16 | $ | 3 | $ | 3 | $ | 22 | 3 | % | ||||||||||

|

Non-prime

|

- | 1 | - | 1 | 0 | % | ||||||||||||||

|

Total

Subordinates

|

$ | 16 | $ | 4 | $ | 3 | $ | 23 | 3 | % | ||||||||||

|

Total

Residential

|

$ | 143 | $ | 432 | $ | 157 | $ | 732 | 97 | % | ||||||||||

|

Commercial

Subordinates

|

$ | 7 | $ | 2 | $ | 8 | $ | 17 | 2 | % | ||||||||||

|

CDO

Subordinates

|

$ | - | $ | 2 | $ | - | $ | 2 | 1 | % | ||||||||||

|

Total

|

$ | 150 | $ | 436 | $ | 165 | $ | 751 | 100 | % | ||||||||||

|

u

|

The table

below details the net increase in the fair value of securities at Redwood

during the third and second quarters of

2009.

|

|

Real

Estate Securities at Redwood

|

||||||||

|

($ in

millions)

|

||||||||

|

Three

Months Ended

|

||||||||

|

9/30/2009

|

6/30/09

|

|||||||

|

Beginning fair

value

|

$ | 517 | $ | 221 | ||||

|

Acquisitions

|

246 | 341 | ||||||

|

Sales

|

(63 | ) | (50 | ) | ||||

|

Effect of principal

payments

|

(25 | ) | (13 | ) | ||||

|

Change in fair value,

net

|

76 | 18 | ||||||

|

Ending fair

value

|

$ | 751 | $ | 517 | ||||

|

12

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

During the

third quarter, we acquired $246 million of residential securities,

consisting of $220 million of prime and non-prime senior securities, $25

million of prime re-REMIC securities, and $1 million of subordinate

securities. We also sold $74 million residential securities and realized

gains of $11 million. We continue to prudently manage our portfolio and

may sell additional assets as conditions

merit.

|

|

u

|

In October

2009, we acquired $6 million in prime residential senior securities, and

sold $34 million of prime residential senior securities and $8 million of

commercial subordinate securities.

|

|

u

|

Principal

payments reduced the fair value of our securities by $25 million during

the third quarter compared to $13 million in the second quarter. The

increase in principal payments primarily reflects the increase in size of

our portfolio. The rate of unscheduled prepayments on our securities was

generally unchanged from the prior

quarter.

|

|

u

|

Our

securities increased in value by $76 million during the third quarter.

This increase was primarily due to increased demand for residential senior

and re-REMIC securities.

|

|

u

|

Our

investments in the Fund, Sequoia, and Acacia totaled $102 million, or 12%

of our securities and investments at September 30,

2009.

|

|

u

|

The fair

value (which equals GAAP carrying value) of our investment in the Fund was

$24 million. The Fund is primarily invested in non-prime residential

securities and is managed by a subsidiary of Redwood. Our investment

represents a 52% interest in the

Fund.

|

|

u

|

Our Sequoia

investments consist predominately of AAA-rated interest-only securities

issued by Sequoia, and to a smaller extent, senior and subordinate

securities. We calculated the $47 million estimate of economic value for

these securities using the same valuation process that we follow to fair

value our other real estate securities. In contrast, the $76 million of

GAAP carrying value of these investments represents the difference between

the assets and liabilities owned by the Sequoia

entities.

|

|

u

|

The fair

value of our investments in Acacia was $2 million and the GAAP carrying

value was $2 million. These investments consist of equity interests and

securities in the Acacia CDO entities we sponsor, which have minimal

value, as well as management fees. We valued the management fees at $2

million, which equals our projected management fees discounted at a 45%

rate.

|

|

u

|

We had no

short-term debt at September 30, 2009. We currently fund our investments

with permanent capital (equity and long-term debt) that is not subject to

margin calls and financial

covenants.

|

|

u

|

At September

30, 2009, we had $140 million of long-term debt outstanding at an interest

rate of LIBOR plus 225 basis points due in 2037. We estimated the $64

million economic value of this debt using the same valuation process used

to fair value our other financial assets and liabilities. Economic value

is difficult to estimate with precision as the market for this debt is

largely inactive.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

13

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The sources

and uses of cash in the table below are derived from our GAAP Consolidated

Statement of Cash Flows for the third and second quarters of 2009 by

aggregating and netting all items in a manner consistent with the way

management analyzes them. This table excludes the gross cash flows

generated by our Sequoia and Acacia securitization entities and the Fund

(cash flows that are not available to Redwood), but does include the cash

flows distributed to Redwood as a result of our investments in these

entities. The beginning and ending cash balances presented in the table

below are GAAP amounts.

|

|

Redwood

|

||||||||

|

Sources

and Uses of Cash

|

||||||||

|

($

in millions)

|

||||||||

|

Three

Months Ended

|

||||||||

|

9/30/2009

|

6/30/2009

|

|||||||

|

Beginning Cash

Balance

|

$ | 337 | $ | 333 | ||||

|

Business cash

flows:

|

||||||||

|

Cash flow from securities and

investments

|

$ | 78 | $ | 64 | ||||

|

Asset management

fees

|

1 | 1 | ||||||

|

Cash operating

expenses

|

(10 | ) | (8 | ) | ||||

|

Interest expense

on long-term debt

|

(1 | ) | (2 | ) | ||||

|

Total business cash

flows

|

68 | 55 | ||||||

| 0 | ||||||||

|

Other sources and

uses:

|

||||||||

|

Proceeds from asset

sales

|

74 | 57 | ||||||

|

Proceeds from equity

issuance

|

- | 238 | ||||||

|

Changes in working

capital

|

6 | 4 | ||||||

|

Acquistions

|

(246 | ) | (334 | ) | ||||

|

Repurchase of long-term

debt

|

(3 | ) | - | |||||

|

Dividends

|

(19 | ) | (16 | ) | ||||

|

Net other

uses

|

(188 | ) | (51 | ) | ||||

|

Net (uses) sources of

cash

|

$ | (120 | ) | $ | 4 | |||

|

Ending Cash

Balance

|

$ | 217 | $ | 337 | ||||

|

u

|

Third quarter

business cash flow totaled $68 million, an increase of $13 million from

the second quarter, primarily due to a $14 million increase in cash flow

from our securities and investments, reflecting the growth in the

securities portfolio from increased acquisitions in the second and third

quarters. In addition, we generated $74 million of cash flow from asset

sales.

|

|

u

|

Our primary

uses of cash in the third quarter were $246 million for acquisitions, $19

million for dividends, and $3 million for the repurchase of $10 million of

our long-term debt.

|

|

u

|

Third quarter

cash flow from securities and investments included $32 million of coupon

interest and $46 million of principal. Given the nature of our investments

(senior securities acquired at discounts, deep discount subordinate

securities, IOs, equity investments in Acacia, and other types) it is

difficult to draw conclusions in any one period about what portion of

our cash flow represents “income” and what represents a “return of

capital.” It is only at the end of an asset’s life that we can accurately

determine what portion of the cumulative cash received (whether principal

or interest) was income and what was a return of

capital.

|

|

14

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The table

below presents the components of our cash flow from securities and

investments for the third and second quarters of

2009.

|

|

Redwood

|

||||||||

|

Cash

Flow from Securities and Investments

|

||||||||

|

($ in

millions)

|

||||||||

|

Three Months

Ended

|

||||||||

|

9/30/2009

|

6/30/2009

|

|||||||

|

Securities at

Redwood

|

||||||||

|

Residential

Senior

|

$ | 45 | $ | 26 | ||||

|

Residential

Re-REMIC

|

3 | - | ||||||

|

Residential

Subordinate

|

14 | 18 | ||||||

|

Commercial and

CDO

|

3 | 4 | ||||||

|

Total Cash Flow from Securities

at Redwood

|

65 | 48 | ||||||

|

Investments in the

Fund

|

2 | 2 | ||||||

|

Investments in

Sequoia

|

11 | 13 | ||||||

|

Investments in

Acacia

|

- | 1 | ||||||

|

Total Cash Flow from Securities

and Investments

|

$ | 78 | $ | 64 | ||||

|

u

|

Since we are

acquiring more senior securities, the variability of the cash flows we

receive every quarter is primarily dependent on prepayment speeds, and

since prepayments will vary, there will be some volatility in the cash

flows generated by our senior securities

portfolio.

|

|

u

|

We generated

$3 million in cash (all interest) from our investments in re-REMICs in the

third quarter.

|

|

u

|

Cash flow

generated from our residential subordinate securities totaled $14 million

in the third quarter, compared to $18 million in the second quarter, and

totaled $52 million in the first nine months of 2009. In the third

quarter, we received $8 million from principal payments and $6 million

from interest. The cash flow we receive on subordinate securities is

heavily dependent upon the timing and amount of credit losses. See the

Residential Real Estate Securities module of this Review for a detailed

analysis of credit reserves on these

securities.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

15

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

table shows the

components of our balance sheet at September 30,

2009.

|

|

Consolidating

Balance Sheet

|

||||||||||||||||||||

|

September

30, 2009

|

||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||

|

Redwood

|

The

Fund

|

Securitization Entities

|

Intercompany

|

Redwood

Consolidated

|

||||||||||||||||

|

Real estate

loans

|

$ | 3 | $ | - | $ | 3,828 | $ | - | $ | 3,831 | ||||||||||

|

Real estate

securities

|

751 | 41 | 270 | - | 1,062 | |||||||||||||||

|

Investments in the

Fund

|

24 | - | - | (24 | ) | - | ||||||||||||||

|

Investment in Securitization

Entities

|

78 | - | - | (78 | ) | - | ||||||||||||||

|

Other

investments

|

- | - | 29 | - | 29 | |||||||||||||||

|

Cash and cash

equivalents

|

217 | - | - | - | 217 | |||||||||||||||

|

Total earning

assets

|

1,073 | 41 | 4,127 | (102 | ) | 5,139 | ||||||||||||||

|

Other

assets

|

24 | 4 | 118 | - | 146 | |||||||||||||||

|

Total

assets

|

$ | 1,097 | $ | 45 | $ | 4,245 | $ | (102 | ) | $ | 5,285 | |||||||||

|

Short-term

debt

|

$ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Other

liabilities

|

50 | 2 | 151 | - | 203 | |||||||||||||||

|

Asset-backed securities

issued

|

- | - | 4,016 | - | 4,016 | |||||||||||||||

|

Long-term

debt

|

140 | - | - | - | 140 | |||||||||||||||

|

Total

liabilities

|

190 | 2 | 4,167 | - | 4,359 | |||||||||||||||

|

Stockholders’

equity

|

907 | 24 | 78 | (102 | ) | 907 | ||||||||||||||

|

Noncontrolling

interest

|

- | 19 | - | - | 19 | |||||||||||||||

|

Total equity

|

907 | 43 | 78 | (102 | ) | 926 | ||||||||||||||

|

Total liabilities and

stockholders’ equity

|

$ | 1,097 | $ | 45 | $ | 4,245 | $ | (102 | ) | $ | 5,285 | |||||||||

|

u

|

We are

required under GAAP to consolidate all of the assets, liabilities, and

noncontrolling interest of the Fund, due to our significant general and

limited partnership interests and ongoing asset management

responsibilities.

|

|

u

|

We are also

required to consolidate the assets and liabilities of Sequoia and Acacia

securitization entities that are considered to be secured borrowing

transactions under GAAP. However, the securitized assets of these entities

are not available to Redwood. Similarly, the liabilities of these entities

are obligations payable only from the cash flows generated by the

securitized assets and are not obligations of

Redwood.

|

|

u

|

We collapsed

the securitization entities (Sequoia and Acacia) in our third quarter

consolidating balance sheet to reflect our declining level of investment

in these entities, and our anticipation of consolidating additional

securitizations created by third parties as a result of potential

acquisitions due to the new accounting standards (FAS 166 and 167) that

are taking effect on January 1,

2010.

|

|

u

|

At Redwood,

the only debt with recourse is our $140 million of long-term debt, which

is due in 2037.

|

|

16

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

table provides a summary of our GAAP income for the third and second

quarters of 2009.

|

|

GAAP

Income (Loss)

|

||||||||

|

($

in millions, except per share data)

|

||||||||

|

Three

Months Ended

|

||||||||

|

9/30/2009

|

6/30/2009

|

|||||||

|

Interest

income

|

$ | 70 | $ | 74 | ||||

|

Interest

expense

|

(25 | ) | (39 | ) | ||||

|

Net interest

income

|

45 | 35 | ||||||

|

Provision for loan

losses

|

(10 | ) | (15 | ) | ||||

|

Market valuation adjustments,

net

|

(11 | ) | (29 | ) | ||||

|

Net interest income (loss) after

provision and market valuation adjustments

|

24 | (9 | ) | |||||

|

Operating

expenses

|

(15 | ) | (11 | ) | ||||

|

Realized gains,

net

|

18 | 26 | ||||||

|

Noncontrolling

interest

|

- | - | ||||||

|

Benefit from (provision for)

income taxes

|

- | 1 | ||||||

|

GAAP income

(loss)

|

$ | 27 | $ | 7 | ||||

|

GAAP income (loss) per

share

|

$ | 0.35 | $ | 0.10 | ||||

|

u

|

Our reported

GAAP income was $27 million ($0.35 per share) for the third quarter of

2009, as compared to $7 million ($0.10 per share) for the second quarter

of 2009. Our third quarter earnings benefited from an $10 million increase

in net interest income primarily due to interest earned on senior

securities acquired in 2009. Additionally, there were fewer impairment

charges on subordinate securities as prices have stabilized and less

credit provision expense on residential loans as loan balances have

declined. Credit trends on securities and loans have generally followed

our expectations.

|

|

u

|

Our earnings

for the third quarter of 2009 also reflect an $11 million ($0.14 per

share) gain from the sale of securities, and a $7 million

($0.09 per share) gain from the repurchase of $10 million principal amount

of our long term debt in July. In the second quarter, we realized a $7

million gain from the sale of securities and a gain of $19 million

resulting from the deconsolidation of a Sequoia securitization

trust.

|

|

u

|

Operating

expenses increased primarily as a result of higher variable compensation

accruals. We currently anticipate that operating expenses will be lower in

the fourth quarter than the third

quarter.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

17

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The tables

below show the effect that Redwood, the Fund, and Securitization Entities

had on our reported income for the third and second quarters of 2009.

These components of our income statement represent investments and are not

separate business segments.

|

|

Consolidating

Income Statement

|

||||||||||||||||||||

|

Three Months Ended September 30,

2009

|

||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||

|

Redwood

|

The

Fund

|

Securitization

Entities

|

Intercompany

Adjustments

|

Redwood

Consolidated

|

||||||||||||||||

|

Interest

income

|

$ | 21 | $ | - | $ | 43 | $ | - | $ | 64 | ||||||||||

|

Net discount (premium)

amortization

|

8 | 2 | (4 | ) | - | 6 | ||||||||||||||

|

Total interest

income

|

29 | 2 | 39 | - | 70 | |||||||||||||||

|

Management

fees

|

1 | - | - | (1 | ) | - | ||||||||||||||

|

Interest

expense

|

(1 | ) | - | (24 | ) | - | (25 | ) | ||||||||||||

|

Net interest

income

|

29 | 2 | 15 | (1 | ) | 45 | ||||||||||||||

|

Provision for loan

losses

|

- | - | (10 | ) | - | (10 | ) | |||||||||||||

|

Market valuation adjustments,

net

|

(8 | ) | (1 | ) | (2 | ) | - | (11 | ) | |||||||||||

|

Net interest income (loss) after

provision and market valuation adjustments

|

21 | 1 | 3 | (1 | ) | 24 | ||||||||||||||

|

Operating

expenses

|

(15 | ) | (1 | ) | - | 1 | (15 | ) | ||||||||||||

|

Realized gains,

net

|

18 | - | - | - | 18 | |||||||||||||||

|

Gain from the

Fund

|

- | - | - | - | - | |||||||||||||||

|

Gain from Securitization

Entities

|

3 | - | - | (3 | ) | - | ||||||||||||||

|

Noncontrolling

interest

|

- | - | - | - | - | |||||||||||||||

|

Benefit from (provision for)

income taxes

|

- | - | - | - | - | |||||||||||||||

|

Net income

(loss)

|

$ | 27 | $ | - | $ | 3 | $ | (3 | ) | $ | 27 | |||||||||

|

Consolidating

Income Statement

|

||||||||||||||||||||

|

Three Months Ended June 30,

2009

|

||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||

|

Redwood

|

The

Fund

|

Securitization

Entities

|

Intercompany

Adjustments

|

Redwood

Consolidated

|

||||||||||||||||

|

Interest

income

|

$ | 18 | $ | 1 | $ | 56 | $ | (1 | ) | $ | 74 | |||||||||

|

Net discount (premium)

amortization

|

3 | 1 | (4 | ) | - | - | ||||||||||||||

|

Total interest

income

|

21 | 2 | 52 | (1 | ) | 74 | ||||||||||||||

|

Management

fees

|

1 | - | - | (1 | ) | - | ||||||||||||||

|

Interest

expense

|

(2 | ) | - | (39 | ) | 2 | (39 | ) | ||||||||||||

|

Net interest

income

|

20 | 2 | 13 | - | 35 | |||||||||||||||

|

Provision for loan

losses

|

- | - | (15 | ) | - | (15 | ) | |||||||||||||

|

Market valuation adjustments,

net

|

(31 | ) | (2 | ) | 4 | - | (29 | ) | ||||||||||||

|

Net interest income (loss) after

provision and market valuation adjustments

|

(11 | ) | - | 2 | - | (9 | ) | |||||||||||||

|

Operating

expenses

|

(11 | ) | - | - | - | (11 | ) | |||||||||||||

|

Realized gains,

net

|

7 | - | 19 | - | 26 | |||||||||||||||

|

Gain from the

Fund

|

- | - | - | - | - | |||||||||||||||

|

Gain from Securitization

Entities

|

21 | - | - | (21 | ) | - | ||||||||||||||

|

Noncontrolling

interest

|

- | - | - | - | - | |||||||||||||||

|

Benefit from (provision for)

income taxes

|

1 | - | - | - | 1 | |||||||||||||||

|

Net income

(loss)

|

$ | 7 | $ | - | $ | 21 | $ | (21 | ) | $ | 7 | |||||||||

|

18

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

At Redwood,

net interest income was $29 million for the third quarter of 2009, as

compared to $20 million

for the second quarter of 2009. The acquisition of $685 million of

securities funded with equity over the first three quarters of 2009 has

driven the 45% increase in net interest

income.

|

|

u

|

Looking

forward, our net interest income will be driven by our recently acquired

residential senior and re-REMIC securities, which currently comprise 68%

of our total earning assets. During the third quarter, these securities

generated $22 million interest income, or a 14.5% effective annual yield

that was comprised of 8.5% cash coupon interest and 6.0% non-cash discount

amortization income. Future interest income will also be largely affected

by how we deploy our remaining cash balances (which currently comprise 20%

of our total earning assets) and future cash

flows.

|

|

u

|

Negative

market valuation adjustments were $8 million, a significant decrease from

the second quarter reflecting lower impairments as security prices have

climbed and credit deterioration has generally remained consistent with

our assumptions. Additionally, the predominance of senior cash flows in

our portfolio makes our future returns less sensitive to credit than in

the past. To the extent our loss expectations do not significantly change

and we continue to hold fewer subordinate securities, we expect

impairments to remain at or below current period

levels.

|

|

u

|

We recognized

income of $3 million in the third quarter from our investments in the

Fund, Sequoia, and Acacia.

|

|

u

|

Net interest

income was $17 million in the third quarter, as compared to $15 million in

the second quarter. The increase reflects a wider spread between fixed

rate assets and floating rate liabilities at Acacia. Net income or expense

from hedging instruments that are used to offset this variance are

reflected as a component of market valuation adjustments,

net.

|

|

u

|

The provision

for loan losses totaled $10 million in the third quarter, down from $15

million in the prior quarter. Although serious delinquencies (90+ days

past due) continued to rise in the third quarter, we note that the rate of

increase has been declining in recent quarters. There are

currently no Sequoia trusts in which we had previously expensed loan loss

provisions in excess of our

investment.

|

|

u

|

Market

valuation adjustments were negative $3 million, reflecting declining

values for REO properties at Sequoia, and a slight decrease in the

net values of assets and liabilities at the Fund and

Acacia.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

19

|

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

Taxable

income is pre-tax profit as calculated for tax purposes. REIT taxable

income excludes taxable income earned at our taxable subsidiaries. We must

distribute at least 90% of our REIT taxable income as dividends in order

to maintain our tax status as a

REIT.

|

|

u

|

Estimated

taxable income for the third quarter was negative $23 million ($0.30 per

share), as compared to negative $12 million ($0.16 per share) for the

second quarter. Our estimated taxable income for the first nine months of

2009 was a negative $49 million ($0.68 per share). Since we anticipate a

taxable loss at the REIT for the 2009 tax year, we expect all of this

year’s dividends to be characterized as a return of

capital.

|

|

u

|

Our quarterly

taxable income is likely to remain volatile as it is difficult to

accurately project the quarter in which anticipated credit losses will

occur.

|

|

u

|

There are

differences in accounting for GAAP and tax that can lead to significant

timing differences in the recognition of income and losses.

(Reconciliations of tax and GAAP income are shown in Table 2 in the

Financial Tables in this Review.) For example, we are not allowed to

anticipate credit losses for tax in a similar manner as for

GAAP.

|

|

u

|

As a result

of these differences, our taxable income is generally higher than our GAAP

income during the initial periods of owning high credit risk assets (e.g.,

our portfolio of subordinate securities.) Then, as we are realizing credit

losses on these subordinate securities, our taxable income is generally

less than GAAP income. This is the situation we are experiencing now and

we expect this relationship to continue as this portfolio continues to

experience credit losses.

|

|

u

|

During the

third quarter, we realized $67 million of credit losses on securities for

tax that we had previously provisioned for under GAAP. Realized credit

losses are based on our tax basis, which averaged 43%, on securities that

incurred principal face losses. After giving effect to sales of some of

our commercial mortgage-backed securities (CMBS) in October, we anticipate

an additional $0.3 billion of tax losses on securities, based on our

projection of face losses and assuming a similar tax basis as we have

recently experienced.

|

|

u

|

The makeup of

our investment portfolio has changed due to recent acquisitions of senior

securities that we expect will incur low levels of credit losses. Thus, we

expect overall timing differences between GAAP and taxable income to

decrease. However, this convergence may be prolonged due to recent efforts

by the government to promote loan modifications and reduce foreclosures —

thereby delaying the actual incurrence of credit losses on our subordinate

securities.

|

|

u

|

During the

third quarter, we sold securities resulting in net capital gains for tax

of less than $1 million, which were offset by prior capital losses. Also,

in October 2009 we sold CMBS that generated additional capital losses. The

REIT currently has $135 million in capital loss carry-forwards ($1.73

share) that can be used to offset future capital

gains.

|

|

20

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

DIVIENDS

|

|

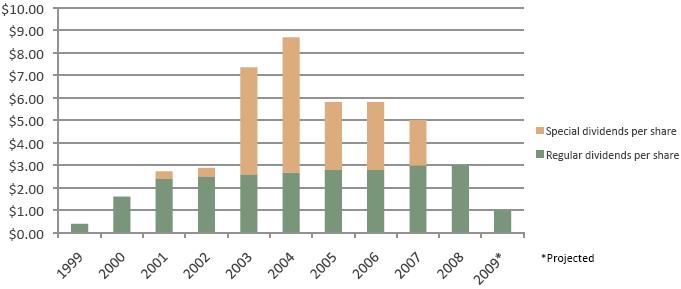

u

|

On November

10, 2008, our board of directors announced its intention to pay a regular

dividend of $0.25 per share per quarter in 2009.

|

|

u

|

On September

9, 2009, our board of directors declared a regular dividend of $0.25 per

share for the third quarter, which was paid on October 21, 2009 to

shareholders of record on September 30,

2009.

|

|

u

|

We expect to

report a taxable loss in 2009 due to the realization of credit losses. We

currently expect that Redwood’s 2009 regular dividend will constitute a

return of capital and, as such, will not be taxable to

shareholders.

|

|

u

|

There was no

undistributed REIT taxable income at September 30,

2009.

|

|

u

|

We do not

expect to pay a special dividend in

2009.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

21

|

|

|

|

|

CAPITAL AND

LIQUIDITY

|

|

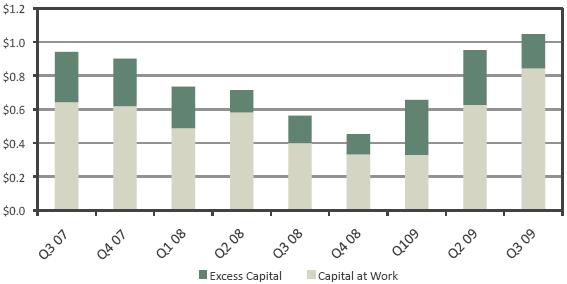

u

|

Our capital

totaled $1,047 million at September 30, 2009, an increase of $95 million

from $952 million at June 30, 2009. Capital increased primarily as a

result of increases in the fair values of our assets. In addition, our

GAAP income exceeded our dividend distributions.

|

|

u

|

Our excess

capital position was $198 million at September 30, 2009, compared to $325

million at June 30, 2009. During the third quarter, our sources of capital

were: $68 million from portfolio cash flows and management fees in excess

of operating and interest expenses and $74 million from asset sales. Uses

of capital included $246 million for asset acquisitions, $19 million for

dividends, $3 million for the repurchase of long term debt, and $1 million

in net changes in the balance of unsettled trades and working

capital.

|

|

22

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

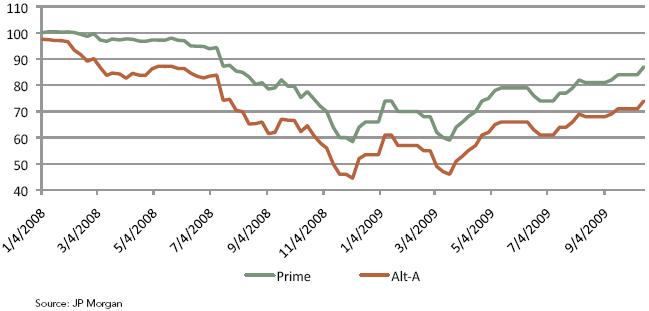

u

|

Market prices

for senior RMBS continued to rise during the third quarter driven by

broad-based demand, technical factors, and by a substantial amount of

excess liquidity that moved virtually all credit and equity markets

higher. In addition to government programs that injected substantial

liquidity into the market, money market funds had outflows of $395 billion

while bond funds had inflows of over $290 billion during the first nine

months of 2009.

|

|

u

|

The following

chart illustrates generically the prices that investors were willing to

pay for senior RMBS since the beginning of

2008.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

23

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

We remain

pessimistic about housing prices and expect further declines in the near

term.

|

|

u

|

We are

primarily focused on supply overhang, as we believe it is the most

important driver of home prices at this time. The official

inventory statistics do not reflect the extent of the

problem. According to recent research from Amherst Securities

Group LP, a record number of delinquent loans could transition into as

many as seven million additional units that are likely to hit the market

within the next approximately 18 months, which is nearly two times the

most recent inventory level of 3.6 million units and larger than the

September annualized existing housing sales rate of 5.6 million units.

These numbers do not suggest to us that stabilization or recovery in

housing prices is likely in the near

term.

|

|

u

|

Additionally,

we believe that the improvements in recent housing data are not

representative of jumbo RMBS collateral. Home sales (and thus

all home statistics) remain heavily skewed to the lower end, mostly as a

result of government policy. According to September data from

the National Association of Realtors, 70% of home sales were on houses

priced less than $250,000, and less than 10% of sales were on houses

priced over $500,000. Reflecting the lack of government support

for higher priced houses that require jumbo mortgages, less than 3% of

sales were on houses priced over $750,000. Over 49% of sales this year

have been to first-time home buyers, while the move-up buyers that

traditionally support jumbo housing markets have played a significantly

reduced role in the overall transaction

volume.

|

|

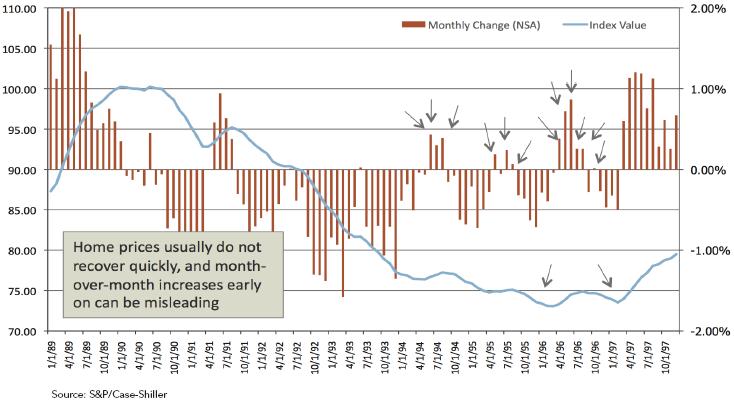

u

|

Some market

observers are beginning to call a bottom in home prices, pointing to

increases in the indexes over the last four months. We are not in that

camp. As shown in the chart below, which reflects the Los Angeles housing

downturn of the early to mid 90’s, it is not uncommon for housing prices

to give a few upward “head fakes” over consecutive months while the market

continues to move lower (see the arrows we’ve added to the

chart).

|

|

24

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

We believe

the recent increases in the S&P/Case-Shiller Home Price index have

more to do with the decreasing prevalence of distressed sales. The number

of these sales, as a percentage of total sales, has dropped significantly

since the spring — according to the National Association of Realtors, the

share of existing home sales that were distressed decreased to 29% in

September, down from 50% in March. This introduces an upwards bias into

the month-over-month home price statistics; since the data points do not

reflect a consistent sample of homes, it is not clear that any homes have

actually increased in value, or if the stronger ones are just being

weighted more heavily in the index. We believe that the

decreased percentage of distressed sales is largely due to temporary

forces like seasonality and the home-buyer tax credit. Therefore, as the

summer moving season draws to a close, we expect involuntary transactions

to again increase as a percentage of existing sales and cause the index to

decline.

|

|

u

|

Nationally,

mortgage fundamentals continue to deteriorate. According to data from

LoanPerformance, serious delinquencies continue to climb rapidly and

losses were up in the third quarter. Prepayment rates slowed in the third

quarter. Voluntary prepayments on prime loans decreased to 15%

CPR by the end of

the third quarter — down from 22% CPR at the end of the second quarter.

Higher quality Alt-A loans also saw a downtick in prepayment rates

throughout the quarter, while lower quality

Alt-A loans continued to prepay at even slower

levels.

|

|

u

|

Interest

income generated by our residential securities was $28 million in the

third quarter, an annualized yield of 16.6% on our amortized cost of these

securities.

|

|

u

|

At September

30, 2009, the market value of our residential securities totaled $732

million, consisting of $337 million in prime senior securities, $279

million in non-prime senior securities, $93 million in re-REMIC

securities, and $23 million in subordinate securities. Each of these is

further discussed in a separate module

below.

|

|

u

|

During the

third quarter, we invested $246 million in securities. The table below

shows selected information on these

acquisitions.

|

|

Acquisitions

|

||||||||||||||||

|

Three Months Ended September 30,

2009

|

||||||||||||||||

|

($ in

millions)

|

||||||||||||||||

|

Weighted

|

At

Acquisiton

|

|||||||||||||||

|

Average

|

Credit

|

Seriously

|

||||||||||||||

|

Purchases

|

Price

%

|

Support

%

|

Delinquent

%

|

|||||||||||||

|

Prime

|

||||||||||||||||

|

Senior

|

$ | 137 | 75 | 8 | 7 | |||||||||||

|

Re-REMIC

|

25 | 31 | 9 | 5 | ||||||||||||

|

Subordinate

|

1 | 37 | 8 | 9 | ||||||||||||

|

Total Prime

|

163 | |||||||||||||||

|

Alt-A

|

||||||||||||||||

|

Senior

|

83 | 64 | 14 | 11 | ||||||||||||

|

Total

Acquisitions

|

$ | 246 | ||||||||||||||

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

25

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

Since the

beginning of 2008, our investment strategy has shifted toward acquiring

residential senior securities with what we believe is a comfortable margin

of safety to protect against a larger range of expected credit losses. Due

to the dislocations in the credit markets, we have acquired senior

securities at significant discounts to principal value. Our returns on

these investments will be based on how much principal and interest we

ultimately receive and how quickly we receive it.

|

|

u

|

We continue

to pursue opportunities with regulated entities to provide customized

credit-risk transfers and capital relief transactions that utilize our

core competencies in credit and structuring, although the accounting and

regulatory treatment for these transactions are in transition. As a

result, counterparties may not enter into these types of transactions

unless and until there is clarity that they will receive favorable capital

treatment.

|

|

u

|

At September

30, 2009, the net unamortized purchase discount on our residential

securities was $423 million, comprised of $126 million on prime senior

securities, $132 million on non-prime senior securities, $144 million on

re-REMIC securities, and $21 million on subordinate securities. The rate

at which we recognize this discount as income is dependent on how fast the

underlying loans prepay — the faster the prepayments, the higher the

yield.

|

|

u

|

The following

table breaks out the underlying loans of our prime residential securities

by size, loan type, and vintage.

|

|

Prime

Securities at Redwood

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Composition

by Product Type, Vintage, and Balance

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

September

30, 2009

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

<=

2004

|

2005

|

2006

|

2007

|

2008

|

Total

|

|||||||||||||||||||||||||||||||||||||||||||

|

Product

|

% of

Balance

|

Wtd Avg Loan Rate (1)

|

% of

Balance

|

Wtd Avg Loan Rate (1)

|

% of

Balance

|

Wtd Avg Loan Rate (1)

|

% of

Balance

|

Wtd Avg Loan Rate (1)

|

% of

Balance

|

Wtd Avg Loan Rate (1)

|

% of

Balance

|

Wtd Avg Loan Rate (1)

|

||||||||||||||||||||||||||||||||||||

|

Hybrid/ARM

(2)

|

25 | % | 4.26 | % | 41 | % | 5.39 | % | 30 | % | 5.94 | % | 14 | % | 6.47 | % | 9 | % | 6.13 | % | 28 | % | 4.92 | % | ||||||||||||||||||||||||

|

Fixed

|

12 | % | 5.68 | % | 5 | % | 6.08 | % | 14 | % | 6.30 | % | 46 | % | 6.38 | % | 73 | % | 6.58 | % | 14 | % | 6.01 | % | ||||||||||||||||||||||||

|

Jumbo

|

37 | % | 46 | % | 44 | % | 60 | % | 82 | % | 42 | % | ||||||||||||||||||||||||||||||||||||

|

Hybrid/ARM

(2)

|

35 | % | 4.37 | % | 48 | % | 5.45 | % | 40 | % | 5.99 | % | 6 | % | 6.45 | % | 3 | % | 6.38 | % | 36 | % | 4.92 | % | ||||||||||||||||||||||||

|

Fixed

|

28 | % | 5.64 | % | 6 | % | 6.05 | % | 16 | % | 6.27 | % | 34 | % | 6.38 | % | 15 | % | 6.46 | % | 22 | % | 5.82 | % | ||||||||||||||||||||||||

|

Conforming

|

63 | % | 54 | % | 56 | % | 40 | % | 18 | % | 58 | % | ||||||||||||||||||||||||||||||||||||

|

Totals

|

100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||||||||||||||||||||||

|

(1) Average rate is based on

underlying loan balances.

|

|

(2) ARMs represent approximately

2% of our

portfolio.

|

|

u

|

The majority

— or 58% — of the loans underlying our securities are within the

Agency conforming loan limits. These limits vary by county and are as high

as $729,750 in high cost areas.

|

|

u

|

The table

above also provides the weighted average coupon rates for the respective

year of issuance. As of the end of October 2009, the current fixed

mortgage rate for a conforming Agency loan was approximately 5.2%. Should

mortgage rates decline, the ability of borrowers to refinance and the

attractiveness of financing will increase, although mortgage rates are

only one of the factors affecting refinancing.

|

|

26

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

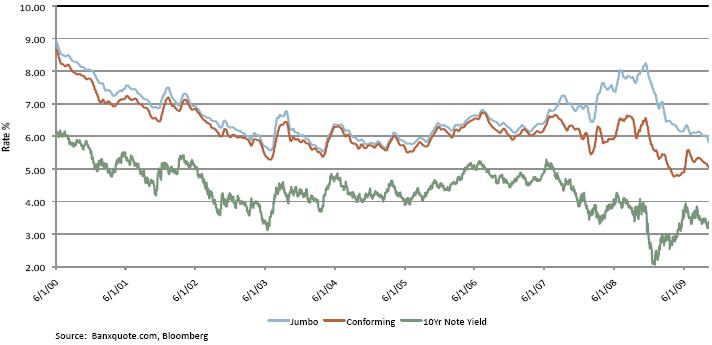

Historically,

conforming loan rates have generally been about 200 basis points over

10-year Treasury rates and jumbo mortgage rates have been roughly 25 basis

points over conforming loan rates. As illustrated in the chart below,

spreads have widened over the last two years during the credit crisis.

More recently, spreads between conforming loans and the 10-year have

normalized due to Treasury Department and Federal Reserve policy programs.

The spread between jumbo and conforming mortgages remains wide but has

improved from an average of 147 basis points in the first quarter of 2009

to 81 basis points in the third quarter, and more recently to 72 basis

points in mid-October.

|

|

u

|

For the past

18 months, there has been a high correlation between prepayments on loans

underlying Fannie Mae 5.5% coupon securities and prepayments on jumbo

fixed-rate loans. For most of that time period, prepayments on loans

underlying the Fannie Mae 5.5% coupon securities have been faster than

jumbo fixed-rate loan prepayments, primarily reflecting the wide spread

between the Agency and jumbo loan rates. As mentioned above, this spread

has been tightening, causing the difference between prepayment speeds to

narrow to its lowest level this year, as seen in the graph

below.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

27

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

The following

table presents information on our residential prime senior securities at

Redwood at September 30, 2009. Most of our senior securities are from the

2005 vintage.

|

|

Credit

Support Analysis - Prime Senior Securities at

Redwood

|

||||||||||||||||||||

|

By

Vintage

|

||||||||||||||||||||

|

September 30,

2009

|

||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006

|

2007

|

Total

|

||||||||||||||||

|

Current

face

|

$ | 19 | $ | 337 | $ | 18 | $ | 59 | $ | 433 | ||||||||||

|

Net unamortized

discount

|

(5 | ) | (103 | ) | (4 | ) | (14 | ) | (126 | ) | ||||||||||

|

Credit

reserve

|

- | (6 | ) | - | (5 | ) | (11 | ) | ||||||||||||

|

Unrealized gains

(losses)

|

1 | 36 | (1 | ) | 5 | 41 | ||||||||||||||

|

Fair value of AFS Prime Senior

Securities

|

$ | 15 | $ | 264 | $ | 13 | $ | 45 | $ | 337 | ||||||||||

|

Overall credit

support to Prime Senior Securities (1)

|

10.61 | % | 7.40 | % | 6.27 | % | 7.40 | % | 7.48 | % | ||||||||||

|

Serious

delinquencies as a % of collateral balance (1)

|

5.78 | % | 6.32 | % | 6.70 | % | 5.51 | % | 6.05 | % | ||||||||||

|

(1) Overall credit support and

serious delinquency rates are weighted by securitization

balances. Credit support and delinquencies may vary

significantly by

securitization.

|

|

u

|

The overall

credit support data presented in the table above represents the level of

support for the position owned by Redwood. The credit reserve represents

the losses we expect these securities to absorb. Over time, the

performance of these securities may require us to reassess the amount of

credit reserves we designate. We acquire securities assuming a range of

outcomes and believe our returns can still be attractive even if losses

increase above our current

estimates.

|

|

u

|

Comparing the

level of credit support available to seriously delinquent loans provides a

measure of the low level of credit sensitivity that exists within our

senior securities portfolio. For example, a senior security may have 7% of

credit support with serious delinquencies currently at 4%. Assuming a

historically high 50% loss severity on these delinquencies would produce

losses of 2%, leaving enough credit support for an additional 5% of losses

before the senior security would start to absorb credit

losses.

|

|

28

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

The following

table presents information on our residential non-prime senior securities

at Redwood at September 30, 2009. Most of our non-prime senior securities

are from 2005 and prior vintages.

|

|

Credit

Support Analysis - Non-Prime Senior Securities at

Redwood

|

||||||||||||||||||||

|

By

Vintage

|

||||||||||||||||||||

|

September 30,

2009

|

||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006

|

2007

|

Total

|

||||||||||||||||

|

Current

face

|

$ | 138 | $ | 231 | $ | 24 | $ | 2 | $ | 395 | ||||||||||

|

Net unamortized

discount

|

(41 | ) | (80 | ) | (10 | ) | (1 | ) | (132 | ) | ||||||||||

|

Credit

reserve

|

- | (10 | ) | - | - | (10 | ) | |||||||||||||

|

Unrealized gains

(losses)

|

13 | 12 | (2 | ) | - | 23 | ||||||||||||||

|

Fair value of Non-Prime Senior

Securities (AFS)

|

$ | 110 | $ | 153 | $ | 12 | $ | 1 | $ | 276 | ||||||||||

|

Overall credit

support to Non-Prime Senior Securities (1)

|

15.37 | % | 21.60 | % | 35.46 | % | 4.50 | % | 20.21 | % | ||||||||||

|

Serious

delinquencies as a % of collateral balance (1)

|

9.45 | % | 15.30 | % | 21.58 | % | 13.52 | % | 14.36 | % | ||||||||||

|

Fair value of Non-Prime Senior

Securities (trading)

|

$ | - | $ | 2 | $ | - | $ | 1 | $ | 3 | ||||||||||

|

Total fair value of Non-Prime

Senior Securities

|

$ | 110 | $ | 155 | $ | 12 | $ | 2 | $ | 279 | ||||||||||

|

(1) Overall credit support and

serious delinquency rates are weighted by securitization

balances. Credit support and delinquencies may vary

significantly by

securitization.

|

|

u

|

Serious

delinquencies in our non-prime senior portfolio are significantly higher

than in our prime senior portfolio. However, the levels of credit and

structural support are also significantly higher and, as a result, our

non-prime senior portfolio is better able to withstand the

higher levels of credit losses we expect to incur on these pools.

Please see the discussion on the previous page on comparing the level of

credit support to serious

delinquencies.

|

|

u

|

We sold our

remaining subprime senior security in the third quarter and recognized a

small gain.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

29

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

The following

table presents information on our residential re-REMIC support securities

at Redwood at September 30, 2009.

|

|

Credit

Support Analysis - Re-REMIC Support Securities at

Redwood

|

||||||||||||||||||||

|

By

Vintage

|

||||||||||||||||||||

|

September 30,

2009

|

||||||||||||||||||||

|

($

in millions)

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006

|

2007

|

Total

|

||||||||||||||||

|

Current

face

|

$ | 6 | $ | 35 | $ | 243 | $ | 35 | $ | 319 | ||||||||||

|

Net unamortized

discount

|

(4 | ) | (20 | ) | (104 | ) | (16 | ) | (144 | ) | ||||||||||

|

Credit

reserve

|

(1 | ) | (5 | ) | (80 | ) | (9 | ) | (95 | ) | ||||||||||

|

Unrealized

gains

|

- | - | 13 | - | 13 | |||||||||||||||

|

Fair value of AFS re-REMIC Support

Securities

|

$ | 1 | $ | 10 | $ | 72 | $ | 10 | $ | 93 | ||||||||||

|

Overall credit

support to re-REMIC support securities

(1)

|

8.13 | % | 7.80 | % | 3.41 | % | 6.83 | % | 6.70 | % | ||||||||||

|

Serious

delinquencies as a % of collateral balance (1)

|

4.39 | % | 5.49 | % | 3.11 | % | 4.86 | % | 4.68 | % | ||||||||||

|

(1) Overall credit support and

serious delinquency rates are weighted by securitization

balances. Credit support and delinquencies may vary

significantly by

securitization.

|

|

30

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

The table

below presents the components of fair value (which equals GAAP carrying

value) of residential subordinate securities at Redwood at September 30,

2009.

|

|

Residential

Subordinate Securities at Redwood

|

||||||||||||

|

September

30, 2009

|

||||||||||||

|

($

in millions)

|

||||||||||||

|

Vintage

|

||||||||||||

|

<=2004

|

>=2005

|

Total

|

||||||||||

|

Available for sale

(AFS)

|

||||||||||||

|

Current

face

|

$ | 214 | $ | 307 | $ | 521 | ||||||

|

Credit

reserve

|

(166 | ) | (283 | ) | (449 | ) | ||||||

|

Net unamortized

discount

|

(16 | ) | (5 | ) | (21 | ) | ||||||

|

Amortized

cost

|

32 | 19 | 51 | |||||||||

|

Unrealized

gains

|

1 | 1 | 2 | |||||||||

|

Unrealized

losses

|

(18 | ) | (13 | ) | (31 | ) | ||||||

|

Fair value of AFS Subordinate

Securities

|

$ | 15 | $ | 7 | $ | 22 | ||||||

|

Fair value of trading subordinate

securities

|

1 | - | 1 | |||||||||

|

Total fair value of Subordinate

Securities

|

$ | 16 | $ | 7 | $ | 23 | ||||||

|

u

|

Credit losses

totaled $97 million in our residential subordinate portfolio in the third

quarter, down from $127 million in the second quarter. We expect future

losses will extinguish the large majority of our securities in the 2005

and later category as reflected by our $283 million of credit reserves

compared to the $307 million face value of those securities. We expect

losses on the securities in the 2004 and earlier category will also be

high based on our level of reserves to face value, but we expect to

recover some principal over time. Until then, we will continue to earn

interest on the face value of those securities.

|

|

u

|

Due to the

structure of RMBS, once losses in a pool of mortgages exceed our

investment in that pool, we cannot suffer additional losses as the most we

have to lose is capped at our investment in the securities in that

pool.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

31

|

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

The following

table presents information on our residential available for sale (AFS)

subordinate securities at Redwood at September 30, 2009, by their priority

to absorb losses within their respective

securitization.

|

|

Residential

AFS Subordinate Securities at Redwood

|

||||||||||||||||||||||||||||||||||||

|

By

Loss Ranking and Vintage

|

||||||||||||||||||||||||||||||||||||

|

September 30,

2009

|

||||||||||||||||||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||||||||||||||||||

|

<2004

|

2005-2008

|

Total

|

||||||||||||||||||||||||||||||||||

|

Face

|

Credit

Reserve

|

Market

Value

|

Face

|

Credit

Reserve

|

Market

Value

|

Face

|

Credit

Reserve

|

Market

Value

|

||||||||||||||||||||||||||||

|

Loss

rank

|

||||||||||||||||||||||||||||||||||||

|

6th

|

$21 | $4 | $4 | $73 | $52 | $3 | $94 | $56 | $7 | |||||||||||||||||||||||||||

|

5th

|

22 | 16 | 1 | 38 | 38 | - | 60 | 54 | 1 | |||||||||||||||||||||||||||

|

4th

|

14 | 11 | 1 | 32 | 32 | 1 | 46 | 43 | 2 | |||||||||||||||||||||||||||

|

3rd

|

41 | 36 | 2 | 86 | 85 | 1 | 127 | 121 | 3 | |||||||||||||||||||||||||||

|

2nd

|

35 | 30 | 3 | 52 | 51 | 1 | 87 | 81 | 4 | |||||||||||||||||||||||||||

|

1st

|

81 | 69 | 4 | 26 | 25 | 1 | 107 | 94 | 5 | |||||||||||||||||||||||||||

|

Total

|

$214 | $166 | $15 | $307 | $283 | $7 | $521 | $449 | $22 | |||||||||||||||||||||||||||

|

32

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

COMMERCIAL REAL ESTATE

SECURITIES

|

|

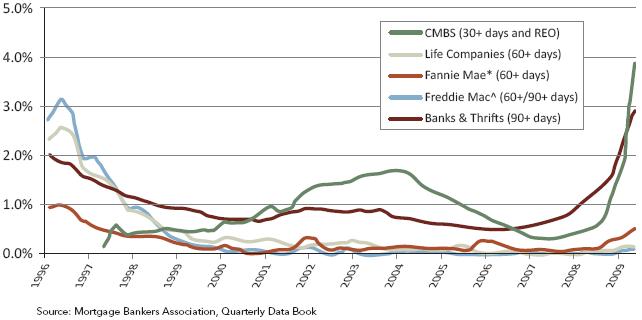

u

|

Commercial

real estate values are in the process of establishing a new equilibrium.

According to the Moody’s/REAL Commercial Property Price Index (CPPI),

commercial property prices have fallen over 40% from their October 2007

peak. The consensus among many market participants is that prices will

continue to decline.

|

|

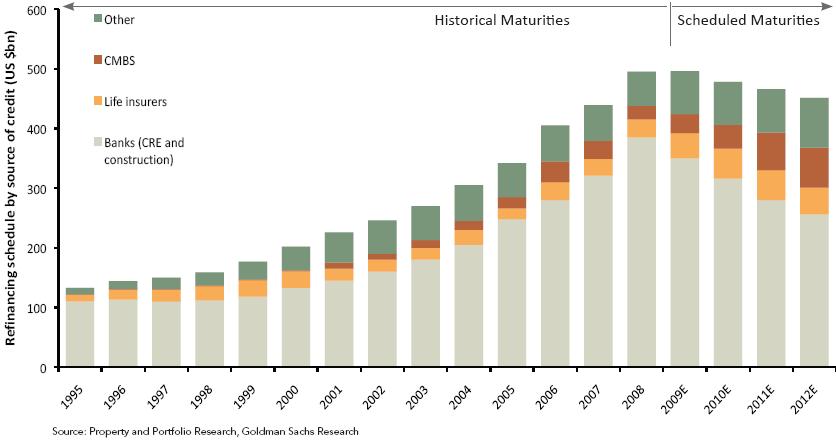

u

|

Approximately

half of the $3.4 trillion outstanding commercial mortgage loans are

scheduled to mature sometime before the end of 2012, as illustrated in the

chart below.

|

|

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

33

|

|

|

|

|

COMMERCIAL REAL ESTATE

SECURITIES

|

|

u

|

Traditional

mortgage market participants (including CMBS lenders, banks, and insurance

companies) have diminished capacity for new lending. Many of these lenders

are primarily focused on their own capital and risk management issues and

have significantly tightened their underwriting standards in response to

deteriorating fundamentals in the commercial sector (see chart

below).

|

|

u

|

Falling

commercial property values, more conservative lending standards, and debt

shortfalls should result in opportunities to carefully invest in

commercial assets with attractive long term cash flows. We are prepared to

take advantage of these opportunities and to provide solutions for

targeted borrowers and assets that require new capital.

|

|

u

|

Despite

deteriorating fundamentals, prices on most CMBS improved materially during

the third quarter. In part, the rally was fueled by the Federal

Reserve’s TALF program and the Treasury Department’s PPIP program, each of

which provide non-recourse leverage for the acquisition of certain types

of these securities.

|

|

u

|

Our legacy

portfolio of commercial securities (acquired prior to 2008) generated $3

million of cash flow during the third quarter, down from $4 million in the

second quarter as delinquencies increased and reduced our cash receipts.

|

|

u

|

In early

October, we sold the majority of our 2006 and 2007 vintage CMBS and

generated proceeds of $8 million. We continually manage our portfolio and

determined that it was prudent to sell these assets in

October.

|

|

u

|

Our remaining

investments in commercial securities consist of predominantly 2004 and

2005 subordinate bonds with a market value of $9 million. These securities

have a face value of $176 million and credit reserves of $162

million.

|

|

u

|

Realized

credit losses on our commercial subordinate securities of $21 million were

charged against our designated credit reserve in the third quarter of

2009, up from $5 million in the second quarter. The large majority of

these losses were incurred on the securities we sold in October.

|

|

34

|

THE REDWOOD

REVIEW 3RD QUARTER 2009

|

|

|

|

|

|

|

INVESTMENTS IN SECURITIZATION

ENTITIES

|

|

u

|

At September

30, 2009, our aggregate investments in Sequoia and Acacia represented 9%

of our GAAP book value.

|

|

u

|

Cash

generated by our investments in Sequoia and Acacia totaled $12 million in

the third quarter of 2009 compared to $15 million in the second quarter of

2009. The majority — $10 million— of this cash flow was generated from the

Sequoia IOs we own, which were primarily issued prior to

2006.

|

|

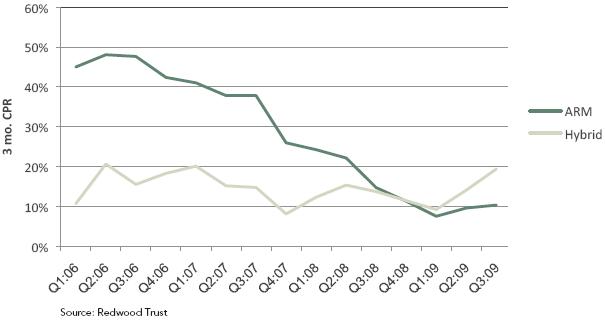

u

|

Our Sequoia

IOs have significant prepayment risk. These IOs earn the “spread” between

the coupon rate on the $2.5 billion notional amount of underlying

adjustable rate mortgage (ARM) loans and the cost of funds (indexed to

one-month LIBOR) on the ABS issued within each respective securitization

entity. Returns on these investments increase when prepayments slow and

decrease when prepayments speed up.

|

|

u

|

Prepayment

speeds remain low as the ARM loans at Sequoia are largely indexed to one

and six-month LIBOR. For September 2009, these loans had a weighted

average coupon of 2.69%. Given the current very low coupon rate, we expect