|

|

|

TABLE

OF CONTENTS

|

|

Introduction

|

4

|

|

Shareholder

Letter

|

5

|

|

Financial

Insights

|

12

|

|

u

Book Value

|

12

|

|

u

Balance Sheet

|

14

|

|

u

GAAP Income

|

18

|

|

u

Taxable Income and Dividends

|

21

|

|

u

Cash Flow

|

22

|

|

Residential

Mortgage Loan Business

|

25

|

|

Investments

in New Sequoia

|

26

|

|

Residential

Real Estate Securities

|

27

|

|

Commercial

Real Estate

|

35

|

|

Investments

in Other Consolidated Entities

|

36

|

|

Appendix

|

|

|

Redwood’s GSE

Reform Proposal

|

38

|

|

Accounting

Discussion

|

44

|

|

Glossary

|

45

|

|

Financial

Tables

|

51

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

1

|

|

|

|

CAUTIONARY

STATEMENT

|

|

2

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

CAUTIONARY

STATEMENT

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

3

|

|

|

|

INTRODUCTION

|

|

Selected

Financial Highlights

|

||||||

|

Quarter:Year

|

GAAP

Income

(Loss)

per

Share

|

Taxable

Income

(Loss) per Share(1)

|

Annualized

Return on

Equity

|

GAAP

Book

Value per

Share

|

Non-GAAP

Economic

Value

per

Share (2)

|

Total

Dividends per

Share

|

|

Q208

|

($1.40)

|

$0.11

|

(30%)

|

$17.00

|

$16.72

|

$0.75

|

|

Q308

|

($3.34)

|

$0.07

|

(83%)

|

$12.40

|

$13.18

|

$0.75

|

|

Q408

|

($3.46)

|

($0.39)

|

(124%)

|

$9.02

|

$11.10

|

$0.75

|

|

Q109

|

($0.65)

|

($0.22)

|

(25%)

|

$8.40

|

$10.01

|

$0.25

|

|

Q209

|

$0.10

|

($0.16)

|

(05%)

|

$10.35

|

$11.30

|

$0.25

|

|

Q309

|

$0.34

|

($0.30)

|

13%

|

$11.68

|

$12.28

|

$0.25

|

|

Q409

|

$0.51

|

($0.44)

|

17%

|

$12.50

|

$13.03

|

$0.25

|

|

Q110

|

$0.58

|

$0.01

|

19%

|

$12.84

|

$13.32

|

$0.25

|

|

Q210

|

$0.35

|

($0.03)

|

11%

|

$12.71

|

$13.37

|

$0.25

|

|

4

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

SHAREHOLDER

LETTER

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

5

|

|

|

|

SHAREHOLDER

LETTER

|

|

6

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

SHAREHOLDER

LETTER

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

7

|

|

|

|

SHAREHOLDER

LETTER

|

|

8

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

SHAREHOLDER

LETTER

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

9

|

|

|

|

SHAREHOLDER

LETTER

|

|

10

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

SHAREHOLDER

LETTER

|

|

|

|

Martin S.

Hughes

|

Brett D.

Nicholas

|

|

President

and

|

Executive

Vice President,

|

|

Chief

Executive Officer

|

Chief

Investment Officer, and

Chief

Operating Officer

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

11

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

table shows the components of our GAAP Book Value and Management’s

Estimate of Non-GAAP Economic Value at June 30,

2010.

|

|

Components

of Book Value*

|

|||||||

|

June

30, 2010

|

|||||||

|

($

in millions, except per share data)

|

|||||||

|

Management's

|

|||||||

|

Estimate

of

|

|||||||

|

GAAP

|

Non-GAAP

|

||||||

|

Book

Value

|

Adj.

|

Economic

Value

|

|||||

|

Cash and cash

equivalents

|

$

|

288

|

|

$

|

288

|

||

|

Real estate securities at

Redwood

|

|||||||

|

Residential

|

725

|

725

|

|||||

|

Commercial

|

8

|

8

|

|||||

|

CDO

|

1

|

1

|

|||||

|

Total real estate securities at

Redwood

|

$

|

734

|

$

|

734

|

|||

|

Investments in the

Fund

|

15

|

15

|

|||||

|

Investments in

Sequoia

|

101

|

(25

|

) |

76

|

|||

|

Investments in

Acacia

|

3

|

(2

|

) |

1

|

|||

|

Total cash, securities, and

investments

|

$

|

1,141

|

$

|

1,114

|

|||

|

|

|||||||

|

Long-term

debt

|

(140)

|

78

|

(62)

|

||||

|

|

|||||||

|

Other assets/liabilities,

net

|

(10)

|

(10)

|

|||||

|

Stockholders'

equity

|

$

|

991

|

$

|

1,042

|

|||

|

Book value per

share

|

$

|

12.71

|

$

|

13.37

|

|||

|

u

|

During the

second quarter of 2010 our GAAP book value decreased by $0.13 per share to

$12.71 per share. The net decrease resulted from $0.41 per share from

earnings before market valuation adjustments plus $0.02 per share from our

equity issuance related to dividend reinvestment, less $0.26 per share of

unrealized loss on cash flow hedges, $0.05 per share of negative market

valuation adjustments, and $0.25 per share of dividends paid to

shareholders.

|

|

u

|

During the

second quarter our estimate of non-GAAP economic value increased by $0.05

per share to $13.37 per share. The net increase resulted from $0.23 per

share net cash flows and net positive market valuation adjustments on our

securities and investments plus $0.14 per share from valuation changes

related to our long-term debt and $0.02 per share from equity issuance

related to dividend reinvestment, less $0.09 per share of cash operating

and interest expense and $0.25 per share of dividends paid to

shareholders.

|

|

*

|

The components of book value

table presents our assets and liabilities as calculated and reported under

GAAP and as adjusted to reflect our estimate of economic value, a non-GAAP

metric. We show our investments in the Redwood Opportunity Fund, L.P. (the

Fund) and in Sequoia and Acacia securitization entities in separate line

items, similar to the equity method of accounting, reflecting the reality

that the underlying assets and liabilities owned by these entities are

legally not ours. We own only the securities and interests that we have

acquired from these entities. See pages 16 and 17 for an explanation of

the adjustments set forth in this

table.

|

|

12

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

FINANCIAL

INSIGHTS

|

|

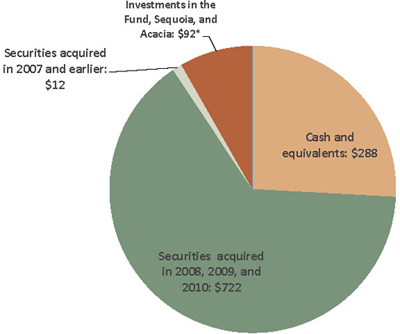

u

|

In the chart

below we present our securities portfolio by acquisition period, which

highlights that 91% of the economic value of our investments were held in

cash or in securities acquired since the beginning of 2008. Our future

earnings will be driven primarily by the performance of these investments

along with how we deploy our existing cash and future cash

flow.

|

|

*

|

Estimate

of non-GAAP economic value; see pages 12

and

16-17 for explanation and reconcilation to

GAAP.

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

13

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

table shows the components of our balance sheet at June 30,

2010.

|

|

Consolidating Balance

Sheet

|

||||||||||||||||||||

|

June 30,

2010

|

||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||

|

Redwood

Parent

|

2010

Sequoia

|

Other Consolidated

Entities

|

Intercompany

|

Redwood

Consolidated

|

||||||||||||||||

|

Real estate

loans

|

$ | 3 | $ | 226 | $ | 3,581 | $ | - | $ | 3,810 | ||||||||||

|

Real estate

securities

|

734 | - | 310 | (27 | ) | 1,017 | ||||||||||||||

|

Investments

in 2010 Sequoia

|

28 | - | - | (28 | ) | - | ||||||||||||||

|

Investment in

Other Consolidated Entities

|

91 | - | - | (91 | ) | - | ||||||||||||||

|

Other

investments

|

- | - | 4 | - | 4 | |||||||||||||||

|

Cash and cash

equivalents

|

288 | - | - | - | 288 | |||||||||||||||

|

Total earning

assets

|

1,144 | 226 | 3,895 | (146 | ) | 5,119 | ||||||||||||||

|

Other

assets

|

41 | 3 | 56 | - | 100 | |||||||||||||||

|

Total

assets

|

$ | 1,185 | $ | 229 | $ | 3,951 | $ | (146 | ) | $ | 5,219 | |||||||||

|

Short-term

debt

|

$ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

|

Other

liabilities

|

54 | 1 | 87 | - | 142 | |||||||||||||||

|

Asset-backed

securities issued

|

- | 200 | 3,761 | (27 | ) | 3,934 | ||||||||||||||

|

Long-term

debt

|

140 | - | - | - | 140 | |||||||||||||||

|

Total

liabilities

|

194 | 201 | 3,848 | (27 | ) | 4,216 | ||||||||||||||

|

Stockholders’

equity

|

991 | 28 | 91 | (119 | ) | 991 | ||||||||||||||

|

Noncontrolling

interest

|

- | - | 12 | - | 12 | |||||||||||||||

|

Total equity

|

991 | 28 | 103 | (119 | ) | 1,003 | ||||||||||||||

|

Total

liabilities and stockholders’ equity

|

$ | 1,185 | $ | 229 | $ | 3,951 | $ | (146 | ) | $ | 5,219 | |||||||||

|

u

|

We present

our consolidating balance to highlight the impact that consolidation has

on our GAAP consolidated balance sheet. As shown above, Redwood’s $119

million GAAP investment in the consolidated entities (including 2010

Sequoia) increased our consolidated assets and liabilities by over $4

billion.

|

|

u

|

We are

required under GAAP to consolidate all of the assets, liabilities, and

noncontrolling interests of the Fund (due to our significant general and

limited partnership interests in the Fund and ongoing asset management

responsibilities), and certain Sequoia and Acacia securitization entities

that are treated as secured borrowing transactions. However, the

securitized assets of these entities are not available to Redwood.

Similarly, the liabilities of these entities are obligations payable only

from the cash flow generated by their securitized assets and are not

obligations of Redwood.

|

|

u

|

The

consolidating balance sheet presents the 2010 Sequoia securitization

entity separate from all prior Sequoia securitizations to highlight our

renewed focus on growing our core business of creating credit investments.

As we complete additional securitizations, we expect new Sequoia

securitization entities to represent a larger portion of our consolidated

balance sheet as prior Sequoia securitization entities continue to pay

down.

|

|

14

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

table presents the fair value (which equals GAAP carrying value) of real

estate securities at Redwood at June 30, 2010. We segment our securities

portfolio by vintage (the year(s) the securities were issued), priority of

cash flow (senior, re-REMIC, and subordinate), and for residential

securities by quality of underlying loans (prime and

non-prime).

|

|

Real Estate Securities at

Redwood

|

||||||||||||||||||||

|

June 30,

2010

|

||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||

|

%

of Total

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006-2008

|

Total

|

Securities

|

||||||||||||||||

|

Residential

|

||||||||||||||||||||

|

Seniors

|

||||||||||||||||||||

|

Prime

|

$ | 14 | $ | 227 | $ | 69 | $ | 310 | 42 | % | ||||||||||

|

Non-prime

|

114 | 197 | 9 | 320 | 44 | % | ||||||||||||||

|

Total

Seniors

|

$ | 128 | $ | 424 | $ | 78 | $ | 630 | 86 | % | ||||||||||

|

Re-REMIC

|

||||||||||||||||||||

|

Prime

|

$ | 5 | $ | 9 | $ | 55 | $ | 69 | 9 | % | ||||||||||

|

Total

Re-REMIC

|

$ | 5 | $ | 9 | $ | 55 | $ | 69 | 9 | % | ||||||||||

|

Subordinates

|

||||||||||||||||||||

|

Prime

|

$ | 12 | $ | 3 | $ | 1 | $ | 16 | 2 | % | ||||||||||

|

Non-prime

|

9 | 1 | - | 10 | 2 | % | ||||||||||||||

|

Total

Subordinates

|

$ | 21 | $ | 4 | $ | 1 | $ | 26 | 4 | % | ||||||||||

|

Total

Residential

|

$ | 154 | $ | 437 | $ | 134 | $ | 725 | 99 | % | ||||||||||

|

Commercial

Subordinates

|

$ | 7 | $ | 1 | $ | - | $ | 8 | 1 | % | ||||||||||

|

CDO

Subordinates

|

$ | - | $ | 1 | $ | - | $ | 1 | - | |||||||||||

|

Total

|

$ | 161 | $ | 439 | $ | 134 | $ | 734 | 100 | % | ||||||||||

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

15

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The table

below details the change in fair value of securities at Redwood during the

second and first quarters of 2010.

|

|

Real Estate Securities at

Redwood

|

||||||||

|

($ in

millions)

|

||||||||

|

Three

Months Ended

|

||||||||

|

6/30/10

|

3/31/10

|

|||||||

|

Beginning fair

value

|

$ | 840 | $ | 781 | ||||

|

Acquisitions

|

23 | 180 | ||||||

|

Sales

proceeds

|

(116 | ) | (124 | ) | ||||

|

Gain on

sale

|

16 | 38 | ||||||

|

Effect of principal

payments

|

(27 | ) | (22 | ) | ||||

|

Change in fair value,

net

|

(2 | ) | (13 | ) | ||||

|

Ending fair

value

|

$ | 734 | $ | 840 | ||||

|

u

|

During the

second quarter there was limited price volatility and relatively small

supply in the secondary RMBS markets. As a result, loss adjusted yields on

secondary RMBS assets remained relatively unattractive to us as compared

to recent historical levels and our rate of new acquisitions declined

accordingly.

|

|

u

|

During July,

we acquired $24 million of securities and we sold no

securities.

|

|

u

|

Our

investments in the Fund, Sequoia, and Acacia securitization entities, as

reported for GAAP, totaled $119 million, or 12% of our equity at June 30,

2010.

|

|

u

|

The GAAP

carrying value and the fair value of our investment in the Fund was $15

million. The Fund is primarily invested in non-prime residential

securities and is managed by a subsidiary of Redwood. Our investment

represents a 52% interest in the

Fund.

|

|

u

|

The GAAP

carrying value of our investments in Sequoia was $101 million and

management’s estimate of the non-GAAP economic value of those investments

was $76 million. We estimated the non-GAAP economic value for our

investments, consisting of $43 million of IOs and $33 million of senior

and subordinate securities, using the same valuation process that we

follow to fair value our other real estate securities. For GAAP, we

account for the assets and liabilities at historical cost and the net $101

million carrying value represents the difference between the carrying

costs of the assets ($3.9 billion at June 30, 2010) and liabilities ($3.8

billion at June 30, 2010) owned by the Sequoia

entities.

|

|

u

|

The GAAP

carrying value of our investments in Acacia entities was $3 million and

management’s estimate of the non-GAAP economic value of those investments

was $1 million, which primarily reflects the present value of the

management fees we expect to earn from these entities. The equity

interests and securities we own in the Acacia entities have minimal

value.

|

|

16

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

We had no

short-term recourse debt at June 30, 2010. We continue to fund our

investments with permanent capital (equity and long-term debt) that is not

subject to margin calls or financial

covenants.

|

|

u

|

We expect to

utilize short-term debt to finance the acquisition of prime mortgage loans

prior to securitizing those loans through our Sequoia program. We remain

in discussion with counterparties to re-establish warehouse credit

facilities for this purpose. For now, we plan to use our excess cash to

purchase mortgage loans and are considering using repurchase facilities

collateralized by certain of our existing senior residential

mortgage-backed securities (RMBS) to temporarily finance our mortgage loan

acquisitions. During the second quarter, we utilized our repurchase

facilities for a short period of time to ensure that the operational

processes for using these facilities would function as

expected.

|

|

u

|

At June 30,

2010, we had $140 million of long-term debt outstanding with a stated

interest rate of LIBOR plus 225 basis points due in 2037. During the first

six months of 2010, through interest rate hedging arrangements, we

effectively fixed the interest rate on this long-term debt at 6.75%. We

calculated the $62 million estimate of non-GAAP economic value of this

long-term debt based on its stated interest rate using the same valuation

process used to fair value our other financial assets and liabilities. The

reduction in the estimated economic value of the debt in the second

quarter reflects wider credit spreads and lower future interest rates as

implied by the yield curve. As a result of declining interest rates during

the second quarter of 2010, the fair value of the interest rate hedges

related to this long-term debt declined by $20 million, as reflected in

shareholders’ equity on our balance sheet.

|

|

u

|

At June 30,

2010, our total capital equaled $1.1 billion, including $991 million in

shareholders’ equity and $140 million of long-term

debt.

|

|

u

|

At June 30,

2010, our cash totaled $288 million and our excess capital was $240

million. At July 31, 2010, our cash totaled $258 million and our excess

capital was $178 million.

|

|

u

|

We use our

capital to invest in earning assets, meet lender capital requirements, and

to fund our operations and working capital needs. The difference between

our cash balance and excess capital is primarily unsettled trades and

margin requirements for hedging agreements. We allocate capital to our

investments under our risk-adjusted capital guidelines based on numerous

factors including the liquidity of the assets and the availability of

financing.

|

|

u

|

We have

generally allocated capital equal to 100% of the fair value of all our

investments, a policy that has served us well over the past few years of

market turmoil. We have successfully managed through two tumultuous

periods (1998 and 2008) and we will remain thoughtful about managing

funding risk when we re-enter the short-term debt

market.

|

|

u

|

In July, as

discussed further below, we started to acquire residential mortgage loans

for future securitization. Since we have the ability to access financing

during the accumulation period, we have allocated less than 100% capital

on these residential loans under our risk-adjusted capital

policy.

|

|

u

|

In addition,

we may change the amount of capital we allocate to the more liquid

securities we own. Consistent with our past practices, we will make these

changes only when we believe it is in the best long-term interest of our

shareholders. We believe we have significantly greater capital capacity

than reflected in our stated excess capital amounts, given our

conservative choice to allocate 100% capital to most of our assets. Given

our capacity, we would likely look to our own balance sheet for sources of

liquidity before looking externally and are unlikely to seek additional

capital in the near term.

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

17

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

table provides a summary of our consolidated GAAP income for the second

and first quarters of 2010.

|

|

GAAP

Income

|

||||||||

|

($

in millions, except per share data)

|

||||||||

|

Three

Months Ended

|

||||||||

|

6/30/10

|

3/31/10

|

|||||||

|

Interest

income

|

$ | 56 | $ | 58 | ||||

|

Interest

expense

|

(21 | ) | (18 | ) | ||||

|

Net interest

income

|

35 | 40 | ||||||

|

Provision for loan

losses

|

(4 | ) | (9 | ) | ||||

|

Market valuation adjustments,

net

|

(7 | ) | (11 | ) | ||||

|

Net interest income (loss) after

provision and market valuation adjustments

|

24 | 20 | ||||||

|

Operating

expenses

|

(11 | ) | (17 | ) | ||||

|

Realized gains,

net

|

16 | 44 | ||||||

|

Noncontrolling

interest

|

- | - | ||||||

|

Benefit from (provision for)

income taxes

|

- | - | ||||||

|

|

||||||||

|

GAAP income

|

$ | 29 | $ | 47 | ||||

|

GAAP income per

share

|

$ | 0.35 | $ | 0.58 | ||||

|

u

|

Our

consolidated GAAP income for the second quarter of 2010 was $29 million,

or $0.35 per share, as compared to $47 million, or $0.58 per share, for

the first quarter of 2010. The decrease in earnings is a result of a

decline in realized gains from fewer sales of securities and a decline in

net interest income from holding fewer securities during the quarter,

partially offset by reductions in our loan loss provision and operating

expenses.

|

|

18

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The following

tables show the estimated effect that Redwood, our recent Sequoia

securitization, and our other consolidated entities (all consolidated

entities established in 2007 or prior) had on GAAP income for the second

quarter of 2010 and the first quarter of 2010. These components of our

income statement are not separate business

segments.

|

|

Consolidating

Income Statement

|

|||||||||||||||

|

Three

Months Ended June 30, 2010

|

|||||||||||||||

|

($

in millions)

|

|||||||||||||||

| Redwood Parent |

2010

Sequoia

|

Other Consolidated Entities | Intercompany Adjustments |

Redwood

Consolidated

|

|||||||||||

|

Interest

income

|

$ | 16 | $ | 1 | $ | 30 | $ | - | $ | 47 | |||||

|

Net discount (premium)

amortization

|

10 | - | (1 | ) | - | 9 | |||||||||

|

Total interest

income

|

26 | 1 | 29 | - | 56 | ||||||||||

|

|

|||||||||||||||

|

Management

fees

|

- | - | - | - | - | ||||||||||

|

Interest

expense

|

(2 | ) | (1 | ) | (18 | ) | - | (21 | ) | ||||||

|

Net interest

income

|

24 | - | 11 | - | 35 | ||||||||||

|

Provision for loan

losses

|

- | - | (4 | ) | - | (4 | ) | ||||||||

|

Market valuation adjustments,

net

|

(4 | ) | - | (3 | ) | - | (7 | ) | |||||||

|

Net interest income after

provision and market valuation adjustments

|

20 | - | 4 | - | 24 | ||||||||||

|

Operating

expenses

|

(11 | ) | - | - | - | (11 | ) | ||||||||

|

Realized gains,

net

|

16 | - | - | - | 16 | ||||||||||

|

Income from 2010

Sequoia

|

- | - | - | - | - | ||||||||||

|

Income from Other Consolidated

Entities

|

4 | - | - | (4 | ) | - | |||||||||

|

Noncontrolling

interest

|

- | - | - | - | - | ||||||||||

|

Provision for income

taxes

|

- | - | - | - | - | ||||||||||

|

Net income

|

$ | 29 | $ | - | $ | 4 | $ | (4 | ) | $ | 29 | ||||

|

Consolidating Income

Statement

|

|||||||||||||||

|

Three Months Ended March 31,

2010

|

|||||||||||||||

|

($ in

millions)

|

|||||||||||||||

|

Redwood

Parent

|

2010

Sequoia*

|

Other

Consolidated Entities

|

Intercompany

Adjustments

|

Redwood

Consolidated

|

|||||||||||

|

Interest

income

|

$ | 18 | $ | - | $ | 32 | $ | - | $ | 50 | |||||

|

Net discount (premium)

amortization

|

9 | - | (1 | ) | - | 8 | |||||||||

|

Total interest

income

|

27 | - | 31 | - | 58 | ||||||||||

|

Management

fees

|

1 | - | - | (1 | ) | - | |||||||||

|

Interest

expense

|

(1 | ) | - | (17 | ) | - | (18 | ) | |||||||

|

Net interest

income

|

27 | - | 14 | (1 | ) | 40 | |||||||||

|

Provision for loan

losses

|

- | - | (9 | ) | - | (9 | ) | ||||||||

|

Market valuation adjustments,

net

|

(3 | ) | - | (8 | ) | - | (11 | ) | |||||||

|

Net interest income after

provision and market valuation adjustments

|

24 | - | (3 | ) | (1 | ) | 20 | ||||||||

|

Operating

expenses

|

(17 | ) | - | (1 | ) | 1 | (17 | ) | |||||||

|

Realized gains,

net

|

38 | - | 6 | - | 44 | ||||||||||

|

Income from Other Consolidated

Entities

|

2 | - | - | (2 | ) | - | |||||||||

|

Noncontrolling

interest

|

- | - | - | - | - | ||||||||||

|

Provision for income

taxes

|

- | - | - | - | - | ||||||||||

|

Net income

|

$ | 47 | $ | - | $ | 2 | $ | (2 | ) | $ | 47 | ||||

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

19

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

At Redwood,

net interest income was $24 million for the second quarter of 2010, as

compared to $27 million for the first quarter of 2010. The decrease in net

interest income was primarily due to lower average holdings of earning

assets due to sales of securities, as well as higher effective interest

costs on our long-term debt due to

hedging.

|

|

u

|

In the near

term, we continue to expect net interest income to be driven primarily by

our residential senior securities, which comprised 86% of the securities

we held at June 30, 2010. During the second quarter, these securities

generated $17 million of interest income, or a 13% effective annual yield

comprised of 6% coupon interest and 7% discount amortization

income.

|

|

u

|

Gains on

sales of securities were $16 million (and generated total proceeds of $116

million) for the second quarter of 2010, as compared to $38 million for

the first quarter of 2010. Of the $16 million of gains, $8 million were

already reflected in our balance sheet at the beginning of the quarter and

$8 million resulted from increases in value during the

quarter.

|

|

u

|

Negative

market valuation adjustments (MVA) were $4 million in the second quarter,

a $1 million increase from the prior quarter due to impairments on

securities. To the extent our loss expectations do not significantly

change, we expect the pace of future impairments on securities to remain

near levels observed in recent

quarters.

|

|

u

|

Operating

expenses at Redwood were $11 million in the second quarter of 2010, a

decrease of $6 million from the first quarter. The decline in operating

expenses was primarily due to $4 million of compensation expense in first

quarter that was non-recurring. Lower variable compensation expenses and

reduced legal accrual expenses associated with our recent Sequoia

securitization also contributed to the decrease in operating

expenses.

|

|

u

|

We recognized

net income of $4 million in the second quarter from our investments in the

Fund, Sequoia, and Acacia securitization entities established in 2008 or

prior.

|

|

u

|

Net interest

income was $11 million in the second quarter, a decrease of $3 million

from the first quarter of 2010. This decrease was primarily due to the

poor credit performance on securities held at Acacia, resulting in lower

interest income.

|

|

u

|

The provision

for loan losses for Sequoia entities totaled $4 million in the second

quarter, a decrease of $5 million from the first quarter of 2010. Serious

delinquencies (90+ days past due) declined to 4.04% (excluding the Sequoia

2010 securitization) in the second quarter from 4.32% at the end of the

first quarter as more loans were liquidated than transitioned to serious

delinquency status. There are currently four Sequoia entities for which we

have expensed aggregate loan loss provisions of $2 million in excess of

our reported investment for GAAP purposes. At this time we do not expect

to deconsolidate any Sequoia entities in

2010.

|

|

u

|

Market

valuation adjustments were negative $3 million in the second quarter, a

decrease of $5 million from the first quarter. Net market valuation

adjustments at Acacia entities represent most of this

difference.

|

|

20

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

Redwood’s

estimated taxable loss for the second quarter of 2010 was $3 million, or

$0.03 per share, as compared to estimated taxable income of $1 million, or

$0.01 per share, for the first quarter of 2010. (Reconciliations of GAAP

and tax income are shown in Table 2 in the Financial Tables in this

Review.)

|

|

u

|

Credit losses

continue to be the significant driver of our taxable results and accounts

for the majority of the difference between GAAP and taxable income. In

both the second and first quarters credit losses as calculated for tax

purposes totaled $24 million and were expensed through our tax-based

earnings. (For earnings calculated under GAAP, credit losses were charged

to our credit reserves. Credit reserves are not allowed for tax

purposes.)

|

|

u

|

Another

difference between GAAP and taxable income is sales. Our tax-based gains

in the second quarter were offset by prior period capital losses, which

stood at $81 million as of June 30, 2010. For earnings calculated under

GAAP, we recognized gains of $16

million.

|

|

u

|

We continue

to expect to realize a taxable loss for the full year in 2010. However,

the timing of credit losses on securities we own has a large impact on our

quarterly taxable income. We anticipate an additional $197 million of

losses on securities in future periods for tax purposes; for GAAP

purposes, as noted above, we have already established credit reserves for

these anticipated losses.

|

|

u

|

Since we

currently expect a REIT taxable loss in 2010, we anticipate that this

year’s dividend distributions will be characterized as return of capital.

However, if credit losses remain at lower levels than we experienced in

2009 and we do generate positive taxable income, a portion of this year’s

dividend distributions would be characterized as ordinary income (to the

extent of the 2010 REIT taxable

income).

|

|

u

|

On May 18,

2010, our board of directors declared a regular dividend of $0.25 per

share for the second quarter, which was paid on July 21, 2010 to

shareholders of record on June 30, 2010. This is consistent with the board

of directors’ announcement in November 2009 that it intended to declare

and pay quarterly regular dividends at this rate throughout

2010.

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

21

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

In the second

quarter, our business cash flow remained in line with our expectations.

Our business cash flow exceeded our cash operating expenses, acquisitions,

and dividend distributions. We ended the second quarter with $288 million

of cash, up from $242 million at the end of prior

quarter.

|

|

u

|

We believe

our current GAAP income statements are reflective of our current

underlying business trends, especially given the nature of the assets we

currently hold. We also consider cash flow one of a number of important

operating metrics; however, we realize that quarterly cash flow measures

have limitations. In particular, we

note:

|

|

•

|

When

securities are purchased at large discounts from face value it is

difficult to determine what portion of the cash received is a return “of”

principal and what portion is a return “on” principal. It is only at the

end of an asset’s life that we can accurately determine what portion of

the cumulative cash received (whether principal or interest) was income

and what was a return of capital.

|

|

•

|

Certain

investments may generate cash flow in a quarter that is not necessarily

reflective of the long-term economic yield we will earn on the

investments. For example, we acquired certain re-REMIC support securities

at what we believe will produce attractive yields. Due to their terms,

however, these securities are locked out of receiving any principal

payments for years. Because of the deferred receipt of principal payments,

formulating any conclusions on the value or performance of these

securities by looking solely at the early quarterly cash flow may not be

indicative of economic returns.

|

|

•

|

Cash flow

from securities and investments can be volatile from quarter to quarter

depending on the level of invested capital, the timing of credit losses,

acquisitions, sales, and changes in prepayments and interest

rates.

|

|

22

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

The sources

and uses of cash in the table below are derived from our GAAP Consolidated

Statement of Cash Flow for the second and first quarters of 2010 by

aggregating and netting all items in a manner consistent with the way

management analyzes them. This table excludes the gross cash flow

generated by our Sequoia and Acacia securitization entities and the Fund

(cash flow that is not available to Redwood), but does include the cash

flow distributed to Redwood as a result of our investments in these

entities. The beginning and ending cash balances presented in the table

below are GAAP amounts.

|

|

u

|

As detailed

in the table below, we include proceeds from sales as a component of

business cash flow. While it is generally our intention when we acquire

assets to hold them to maturity and receive principal and interest

payments over their lives, we sell assets from time to time as part of our

continuing management of risk and return expectations. A sale effectively

accelerates the receipt of these cash

flows.

|

|

Redwood

|

||||||||

|

Sources

and Uses of Cash

|

||||||||

|

($

in millions)

|

||||||||

|

Three

Months Ended

|

||||||||

|

6/30/10

|

3/31/10

|

|||||||

|

Beginning cash

balance

|

$ | 242 | $ | 243 | ||||

|

Business cash

flow:

|

||||||||

|

Cash flow from securities and

investments

|

$ | 177 | $ | 193 | ||||

|

Cash operating

expenses

|

(10 | ) | (15 | ) | ||||

|

Interest expense on long-term

debt

|

(1 | ) | (1 | ) | ||||

|

Total business cash

flow

|

166 | 177 | ||||||

|

Other sources and

uses:

|

||||||||

|

Investment in 2010

Sequoia

|

(28 | ) | - | |||||

|

Changes in working

capital

|

3 | (2 | ) | |||||

|

Acquistions (1)

|

(55 | ) | (156 | ) | ||||

|

Derivative margins posted,

net

|

(20 | ) | - | |||||

|

Dividends

|

(20 | ) | (20 | ) | ||||

|

Net other

uses

|

(120 | ) | (178 | ) | ||||

|

|

||||||||

|

Net sources (uses) of

cash

|

$ | 46 | $ | (1 | ) | |||

|

Ending cash

balance

|

$ | 288 | $ | 242 | ||||

|

(1)

Total acquisitions in the second quarter of 2010 were $23 million, $1

million which are not reflected in this table because they did not settle

until early July. Also, $33 million of acquisitions made in the first

quarter that did not settle until early April are reflected in this

table.

|

||||||||

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

23

|

|

|

|

FINANCIAL

INSIGHTS

|

|

u

|

Total cash

flow from securities and investments was $177 million for the second

quarter, a decrease of $16 million from first quarter, primarily due to a

decreased level of security sales at Redwood and the

Fund.

|

|

u

|

Total

proceeds from the sale of senior and re-REMIC securities at Redwood were

$116 million in the second quarter, compared to $124 million in first

quarter, primarily due to a decreased level of sales of re-REMIC

securities.

|

|

Redwood

|

||||||||

|

Cash Flow from Securities and

Investments

|

||||||||

|

($ in

millions)

|

||||||||

|

Three Months

Ended

|

||||||||

|

6/30/10

|

3/31/10

|

|||||||

|

Securities at

Redwood

|

||||||||

|

Residential

Seniors

|

||||||||

|

Principal and

Interest

|

$ | 42 | $ | 40 | ||||

|

Proceeds from

Sales

|

111 | 73 | ||||||

|

Total

|

153 | 113 | ||||||

|

Residential

Re-REMICs

|

||||||||

|

Principal and

Interest

|

2 | 3 | ||||||

|

Proceeds from

Sales

|

5 | 51 | ||||||

|

Total

|

7 | 54 | ||||||

|

Residential Subordinates principal

and interest

|

8 | 8 | ||||||

|

Commercial and CDO

Subordinates

|

||||||||

|

Principal and

Interest

|

1 | 1 | ||||||

|

Proceeds from

Sales

|

- | - | ||||||

|

Total

|

1 | 1 | ||||||

|

Total cash flow from securities

at Redwood

|

169 | 176 | ||||||

|

Investments in the

Fund

|

1 | 9 | ||||||

|

Investments in Sequoia

entities

|

7 | 8 | ||||||

|

Investments in Acacia

entities

|

- | - | ||||||

|

Total cash flow from securities

and investments

|

$ | 177 | $ | 193 | ||||

|

u

|

Redwood’s

investment in the Fund generated $1 million of cash flow in the second

quarter, compared to $9 million in the prior quarter, due to a decreased

level of sales in the second quarter. In the first quarter, our share of

the proceeds from asset sales by the Fund represented $7 million of the

cash received.

|

|

u

|

Cash flow

excluding proceeds from sales totaled $61 million in the second quarter,

compared to $69 million in the prior quarter, and continued to exceed cash

operating expenses ($10 million), interest expense ($1 million), and

dividends ($20 million).

|

|

24

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

RESIDENTAL

MORTGAGE LOAN BUSINESS

|

|

u

|

At June 30,

2010, our committed pipeline of residential mortgage loans totaled $80

million, consisting of 10/1 hybrids and 30-year fixed rate loans. At July

31, 2010, the pipeline totaled $154 million. During the period beginning

on April 1, 2010 and continuing through July 31, 2010, we completed the

purchase of $5 million in loans.

|

|

u

|

We are

encouraged by our progress and contemplate executing a new Sequoia

securitization once we acquire approximately $300 million of loans,

perhaps in the fourth quarter, depending on market conditions and other

factors.

|

|

u

|

Over time,

our goal is to establish our conduit as the leading source of liquidity

for the prime jumbo mortgage market, where originators are able to obtain

timely purchase commitment decisions and price

protection.

|

|

u

|

The size of

the jumbo market is potentially vast — suggesting an opportunity that well

exceeds our current capital available to invest. For example, if annual

residential originations return to $1.3 trillion (one-third of the peak

level in 2003) and jumbo loans account for 20%, jumbo loan originations

would amount to $260 billion. If half of these loans were securitized and

Redwood were to credit enhance 10%, or $13 billion, our annual investment

would be approximately $400 million, assuming we retained the subordinate

securities (at market prices) equal to 5% of the

securitizations.

|

|

u

|

We anticipate

that the current maximum GSE conforming loan limit of $729,750 will be

reduced from its current elevated level through either GSE reform or from

an improvement in the mortgage market that will eliminate the need for the

higher limits that were established during the financial crisis. Reduced

limits should increase the universe of loans available to the private

market, including Redwood.

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

25

|

|

|

| INVESTMENTS IN NEW SEQUOIA |

|

u

|

In April

2010, Redwood (through Sequoia) sponsored a $238 million residential prime

jumbo mortgage securitization, referred to as SEMT 2010-H1. This was the

first prime jumbo securitization in the mortgage market to be backed by

newly originated loans in nearly two years and was well received by

triple-A investors. As with all our Sequoia securitizations, this issuance

did not require credit support from the

government.

|

|

u

|

Second

quarter GAAP income of $0.2 million from this new securitization reflects

two months of income, net of one-time

expenses.

|

|

u

|

For GAAP

purposes, we account for our Sequoia securitizations as financings and the

assets and liabilities are carried on our balance sheet at their amortized

cost. As a result, our $28 million investment in new Sequoia does not

appear on our GAAP consolidated balance sheet as an investment; rather, it

is reflected as the difference between the $229 million of consolidated

assets of new Sequoia and the $201 million of consolidated ABS issued to

third parties, at June 30, 2010. (The difference between the $238 million

amount at issuance and the balance at June 30, 2010, represents principal

payments.)

|

|

26

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

While the

market for Treasuries and equities experienced significant volatility

during the second quarter of 2010, the non-agency RMBS market had limited

price volatility over the period. While we did experience some dips in

pricing during the quarter, these were predominantly characterized by a

widening in the bid-ask spread, making it difficult to add assets at

prices we would have found attractive. The majority of supply, which

declined in the second quarter, came from the liquidation of

collateralized debt obligations and structured investment vehicles during

the second quarter. The liquidation sales have been well

bid.

|

|

|

Source: JP

Morgan

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

27

|

|

|

| RESIDENTIAL REAL ESTATE SECURITIES |

|

u

|

Oversupply

remains a primary obstacle to a housing market recovery and the situation

appears to be getting worse. The National Association of Realtors reported

a 10% increase in inventories in the second quarter, which increases the

supply to an 11-month high of 8.9 months of supply as of June

2010.

|

|

u

|

The relative

stability of home prices in 2009 was due in large part to falling

inventories. That trend appears to have reversed, as housing inventory is

up 22% year-to-date, which suggests another downward move in

prices.

|

|

u

|

Some of the

new supply represents listings of delinquent, distressed, or repossessed

homes. This “shadow inventory” is difficult to measure, but likely

represents a larger inventory of homes than the entire stock of currently

listed properties. Additional sources of supply could come from more

voluntary listings by previously reluctant home owners testing the

market.

|

|

u

|

It does not

appear that the increase in inventory over the last six months is due to

accelerated servicing of distressed collateral. Foreclosed homes are still

being repossessed into REO at a very slow pace at about 5% per month

compared to an average of 10% per month in pre-crisis 2007. This suggests

that there is still potential for a spike in distressed supply if

servicers accelerate foreclosures.

|

|

u

|

Housing

market activity remains skewed towards the low end of the price range,

with first-time home buyers responsible for 43% of June 2010 sales,

according to the NAR. Unburdened by existing mortgages, these buyers have

been taking advantage of historically low rates and prices, but their

demand is concentrated in less expensive markets, which are not Redwood’s

traditional focus.

|

|

u

|

On average,

we expect an additional 5-8% decline in the value of currently securitized

non-agency collateral over the next 12-18 months, with significant

geographic variation.

|

|

u

|

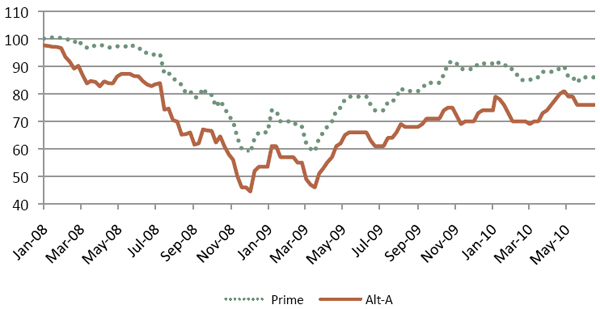

Serious (60+

days) delinquencies for prime and Alt-A loans continued to show

improvement in recent months. According to LoanPerformance, the rate of

increase in serious delinquencies has slowed for non-conforming prime

loans and has been declining in recent months for Alt-A loans. From March

2010 to June 2010, serious delinquencies increased for fixed-rate prime

loans from 8.1% to 8.3% and for hybrid loans from 11.8% to 12.2%, and for

Alt-A loans declined from 31.5% to 30.7%. At Redwood, 60+ days

delinquencies on loans underlying the prime and non-prime residential

securities we own are modestly lower than the

industry.

|

|

u

|

We have

noticed a significant improvement in roll rates (from performing to

delinquent) over the last few months for both prime and Alt-A collateral.

In the fourth quarter of 2009, about 1% of previously “always current”

prime borrowers went delinquent each month (2.1% per month for Alt-A).

Since then, that roll rate has fallen to 0.74% per month for prime (1.48%

per month for Alt-A) — a 26%

decrease.

|

|

u

|

This

transition — from “always current” to the first missed payment — is one of

the metrics we follow. It has been well correlated with labor market

conditions and mortgage liquidity. Thus these declining roll rates could

suggest that mortgage market conditions have improved noticeably over the

last three to six months, but it is too early to determine if this

improvement represents a sustainable

trend.

|

|

28

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

According to

data from LoanPerformance, industry-wide prepayment rates on non-agency

prime loans were nearly unchanged from the first quarter at 14% CPR.

Prepayment rates on loans underlying prime RMBS held by Redwood continue

to be modestly faster than the industry average, reflecting the

concentration of securities we own in older

vintages.

|

|

u

|

Industry-wide,

prepayment rates for non-agency Alt-A loans were 5% in the second quarter

according to data from LoanPerformance. The prepayment rates on non-prime

securities we own (which are predominately backed by Alt-A loans) were

also modestly faster than the industry average, also reflecting the

concentration of our securities in older vintages. Given the more

stringent underwriting guidelines in the current environment, we expect

prepayment rates on Alt-A loans to remain at low levels as many borrowers

may not qualify to refinance.

|

|

u

|

Industry-wide,

prime prepayment speeds have been strongly correlated with loan age as

more seasoned loans (which generally have more equity) are prepaying in

the mid-to-high teens compared to the low-teens for more recent

vintages.

|

|

u

|

Prepayment

speeds on many of the securities we own have generally been ahead of our

expectations from the time of acquisition. To the extent that prepayment

rates remain above our expectations, all else being equal, the yields on

our securities will increase as we will realize our unamortized discount

sooner.

|

|

u

|

Loan

modifications continue to move forward but at a slow pace. The goal of the

Administration’s Home Affordable Modification Program (HAMP) is to help

three to four million homeowners avoid foreclosure through 2012. The

program has been in existence since early 2009, and according to the

latest data for June 2010, of the 1.5 million borrowers who have been

offered trial modifications, only 398,000 borrowers have received

permanent modifications and 521,000 trial modifications have been

cancelled. In June, there were 51,000 new permanent modifications and

91,000 trial modifications were cancelled. However, new data from HAMP

shows that of the cancellations, approximately 45% have entered

alternative modification programs and fewer than 2% of borrowers went into

foreclosure. At Redwood, loan modifications have had little impact on the

securities we own, as part of our acquisition strategy has been to invest

in securities less likely to be impacted by modification, such as older

vintage prime and Alt-A securities.

|

|

u

|

Interest

income generated by residential securities we own was $25 million in the

second quarter of 2010, an annualized yield of 15% on the amortized cost

of these securities.

|

|

u

|

At June 30,

2010, the fair value of residential securities we own totaled $725

million, consisting of $310 million in prime senior securities, $320

million in non-prime senior securities, $69 million in re-REMIC

securities, and $26 million in subordinate securities. Each of these

categories is further discussed

below.

|

|

u

|

The

securities we held at June 30, 2010, consisted of fixed-rate assets (38%),

adjustable-rate assets that reset within the next year (42%), hybrid

assets that reset between 12 and 36 months from now (5%), and hybrid

assets that reset more than 36 months from now

(15%).

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

29

|

|

|

| RESIDENTIAL REAL ESTATE SECURITIES |

|

u

|

The following

table presents information on residential prime senior securities at

Redwood at June 30, 2010. We account for all of these securities as

available-for-sale.

|

|

Credit Support Analysis - Prime

Senior Securities at Redwood

|

||||||||||||||||||||

|

By

Vintage

|

||||||||||||||||||||

|

June 30,

2010

|

||||||||||||||||||||

|

($ in

millions)

|

||||||||||||||||||||

|

<=2004

|

2005

|

2006

|

2007

|

Total

|

||||||||||||||||

|

Current

face

|

$ | 16 | $ | 270 | $ | 15 | $ | 70 | $ | 371 | ||||||||||

|

Net unamortized

discount

|

(3 | ) | (70 | ) | (4 | ) | (16 | ) | (93 | ) | ||||||||||

|

Credit

reserve

|

- | (7 | ) | - | (3 | ) | (10 | ) | ||||||||||||

|

Unrealized gains

(losses)

|

1 | 34 | (1 | ) | 8 | 42 | ||||||||||||||

|

Fair value of Prime Senior

Securities

|

$ | 14 | $ | 227 | $ | 10 | $ | 59 | $ | 310 | ||||||||||

|

Overall credit

support to Prime Senior Securities (1)

|

11.24 | % | 7.31 | % | 6.04 | % | 8.50 | % | 7.77 | % | ||||||||||

|

Serious

delinquencies as a % of collateral balance (1)

|

9.09 | % | 8.05 | % | 8.83 | % | 8.07 | % | 8.13 | % | ||||||||||

|

u

|

The overall

credit support data presented in the table above represents the level of

support for prime securities owned by Redwood weighted by the

securitization, or underlying collateral, balance rather than the book

value or market value of the securities, and we present similar tables for

our non-prime securities on page 32 and non-senior securities on page

33.

|

|

u

|

At June 30,

2010, the average overall level of credit support was 7.77%. For an

individual security with this level of credit support, this would mean

that losses experienced on the collateral would have to exceed 7.77%

before the security would suffer losses. Comparing the level of credit

support available to seriously delinquent loans provides one measure of

the level of credit sensitivity that exists within our senior securities

portfolio. For example, assuming an individual bond has the average

characteristics of the portfolio, 7.77% of credit support and serious

delinquencies of 8.13%, all of the seriously delinquent loans could be

liquidated with a 50% severity, generating losses of 4.07%. The security

would then have 3.7% credit support remaining to absorb future losses,

before the senior securities would start to absorb

losses.

|

|

30

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

We would

emphasize that no individual security has the average characteristics of

the portfolio. Individual securities may have more or less credit support

than the average, or more or less seriously delinquent loans than the

average. As such, certain securities have a more positive credit

enhancement to serious delinquency ratio while others have a less positive

or negative ratio. As a result, it is possible for some securities to

incur losses without aggregate losses exceeding the overall credit

support. For example, in the first quarter of 2010, we incurred credit

losses of $2 million for GAAP purposes on senior securities, even though

aggregate losses did not exceed our overall credit

support.

|

|

u

|

Securities

are acquired assuming a range of outcomes based on modeling of expected

performance at the individual loan level for both delinquent and current

loans. Over time, the performance of these securities may require a change

in the amount of credit reserves we designate. There were no credit losses

on our prime senior securities in the second

quarter.

|

|

u

|

The fair

market value of our prime senior securities was equal to 83% of the face

value of the portfolio, while our amortized cost was equal to 72% of the

face value at June 30, 2010. These securities generated $21 million of

cash from principal and interest in the second quarter compared to $19

million in the first quarter, excluding proceeds from sales. The

annualized yield in the second quarter for our prime senior securities was

11.3%.

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

31

|

|

|

| RESIDENTIAL REAL ESTATE SECURITIES |

|

u

|

The following

table presents information on residential non-prime senior securities at

Redwood at June 30, 2010. We account for all of these securities as

available-for-sale.

|

|

Credit Support Analysis -

Non-Prime Senior Securities at Redwood

|

||||||||||||||||

|

By

Vintage

|

||||||||||||||||

|

June 30,

2010

|

||||||||||||||||

|

($ in

millions)

|

||||||||||||||||

|

<=2004

|

2005

|

2006

|

Total

|

|||||||||||||

|

Current

face

|

$ | 138 | $ | 251 | $ | 11 | $ | 400 | ||||||||

|

Net unamortized

discount

|

(38 | ) | (70 | ) | (2 | ) | (110 | ) | ||||||||

|

Credit

reserve

|

(1 | ) | (10 | ) | (1 | ) | (12 | ) | ||||||||

|

Unrealized

gains

|

14 | 10 | 1 | 25 | ||||||||||||

|

Fair value of Non-Prime Senior

Securities - AFS

|

$ | 113 | $ | 181 | $ | 9 | $ | 303 | ||||||||

|

Overall credit

support to Non-Prime Senior Securities (1)

|

16.25 | % | 13.97 | % | 20.42 | % | 14.74 | % | ||||||||

|

Serious

delinquencies as a % of collateral balance (1)

|

11.42 | % | 13.01 | % | 18.29 | % | 12.87 | % | ||||||||

|

Fair value of Non-Prime Senior

Securities - Trading

|

$ | 1 | $ | 16 | $ | - | $ | 17 | ||||||||

|

Total fair value of Non-Prime

Senior Securities

|

$ | 114 | $ | 197 | $ | 9 | $ | 320 | ||||||||

|

u

|

Serious

delinquencies in our non-prime senior portfolio are significantly higher

than in our prime senior portfolio. However, the levels of credit and

structural support are also significantly higher and, as a result, our

non-prime senior portfolio is better able to withstand the higher levels

of credit losses we expect to incur on these pools. In the second quarter,

our senior non-prime securities incurred credit losses of $3 million,

which was in line with our expectations. Please refer to the first two

bullets under the table on page 30 and the first bullet on the top of page

31 for further discussion on the characteristics and limitations of the

table on page 31, which discussion is also applicable to the table

above.

|

|

u

|

The fair

market value of our non-prime senior securities AFS was equal to 76% of

the face value of the portfolio while our amortized cost was equal to 70%

of the face value at June 30, 2010. (We also own non-prime senior

securities that are accounted for as trading securities, which are carried

at their fair market value of $17 million and which do not have GAAP

credit reserves or purchase discounts.) The combined non-prime senior

securities portfolio generated $21 million of cash from principal and

interest in the second and first quarters, excluding proceeds from sales.

The annualized yield in the second quarter for our non-prime senior

securities was 15.1%.

|

|

32

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

RESIDENTIAL REAL ESTATE

SECURITIES

|

|

u

|

The following

table presents information on residential non-senior securities at Redwood

at June 30, 2010. We account for all of these securities as

available-for-sale.

|

|

Residential

Non-Senior Securities at Redwood

|

||||||||||||

|

June 30,

2010

|

||||||||||||

|

($ in

millions)

|

||||||||||||

|

Subordinate

|

Re-REMIC

|

Total

|

||||||||||

|

Current

face

|

$ | 343 | $ | 139 | 482 | |||||||

|

Credit

reserve

|

(256 | ) | (38 | ) | (294 | ) | ||||||

|

Net unamortized

discount

|

(43 | ) | (68 | ) | (111 | ) | ||||||

|

Amortized

cost

|

44 | 33 | 77 | |||||||||

|

Unrealized

gains

|

2 | 36 | 38 | |||||||||

|

Unrealized

losses

|

(20 | ) | - | (20 | ) | |||||||

|

Fair value of Non-senior

Securities

|

$ | 26 | $ | 69 | $ | 95 | ||||||

|

u

|

Credit losses

totaled $57 million in our residential subordinate portfolio in the second

quarter, compared to $45 million of losses in the first quarter of 2010.

We expect future losses will extinguish the majority of these securities

as reflected by the $256 million of credit reserves we have provided for

the $343 million face value of those securities. Until the losses occur,

we will continue to earn interest on the face value of those

securities.

|

|

u

|

The fair

market value of our subordinate securities was equal to 8% of the face

value while our amortized cost was equal to 13% of the face value of the

portfolio at June 30, 2010. These securities generated $8 million of cash

in both the second and first quarters of 2010. The annualized yield in the

second quarter for our non-senior securities portfolio was

34.2%.

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

33

|

|

|

| RESIDENTIAL REAL ESTATE SECURITIES |

|

u

|

Our existing

portfolio of re-REMIC securities consists of prime residential senior

securities that were pooled and re-securitized in 2009 to create

two-tranche structures and we own support (or junior) securities within

those structures.

|

|

u

|

The fair

market value of our re-REMIC securities was equal to 50% of the face value

of the portfolio, while our amortized cost was equal to 24% of the face

value at June 30, 2010. These securities generated $2 million of cash

exclusively from interest in the second quarter, compared to $3 million in

the first quarter of 2010, excluding proceeds from sales. The annualized

yield in the second quarter for our re-REMIC securities portfolio was

16.1%.

|

|

u

|

There were no

credit losses in our re-REMIC portfolio in the second quarter. We

anticipate losses, which were included in our acquisition assumptions, and

have allocated $38 million of the purchase discount to credit reserves for

the $139 million face value.

|

|

34

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|

|

|

COMMERCIAL

REAL ESTATE SECURITIES

|

|

u

|

There

continues to be an elevated level of distress in the commercial mortgage

market. As lenders continue to employ an “extend and pretend” strategy,

resolution of troubled assets is really just beginning. Real Capital

Analytics characterizes $187 billion of mortgages (approximately 6% of

total commercial mortgages outstanding) as distressed, and estimates that

just 15% of troubled assets have been resolved, 15% have been modified /

extended, and 70% still await

resolution.

|

|

u

|

Generally,

property level fundamentals continue to deteriorate, albeit at a

significantly slower pace compared to the rapid declines in occupancy

rates and rental rates witnessed in 2008 and 2009. In the second quarter

of 2010, the national vacancy rate on office properties increased by 10

basis points to 17.4% and the national vacancy rate on retail properties

increased by 10 basis points to 10.9%. The national vacancy rate on

multifamily properties declined for the first time in two years, dropping

20 basis points to 7.8% in the second quarter. The market seems to expect

growth in rents to remain relatively flat in the near

term.

|

|

u

|

The financing

market is increasingly split between high-quality, stabilized assets and

all other assets. Significant competition among lenders for the best

properties in strong markets has led to compressed lending spreads. In

fact, lending spreads have declined up to 200 basis points from the start

of the year, as life insurance companies, Fannie Mae, Freddie Mac, and,

more recently, CMBS conduit lenders are competing for the limited number

of loans on the best quality

assets.

|

|

u

|

Similar to

the single-family residential market, Fannie Mae and Freddie Mac are

increasingly dominating the multifamily market. In 2009, their combined

market share of originations increased to 85% from 79% in 2008, 41% in

2007, and in 33% in 2006.We expect the agency share of the market to

decline due to GSE reform, which should increase the share available for

the private market.

|

|

u

|

Our near-term

commercial mortgage investment strategy remains to target high-quality

subordinate and mezzanine investments. We now have the team, experience,

relationships, resources, discipline, patience, policies, and procedures

to capitalize on opportunities that should result from the trillion dollar

funding gap facing the commercial real estate industry in the coming

years.

|

|

u

|

Our portfolio

of commercial securities generated $1 million of cash flow in both the

second and first quarters of 2010.

|

|

u

|

Realized

credit losses in the second quarter of 2010 on our commercial subordinate

securities were $12 million, compared to $7 million in the prior quarter,

and were charged against our designated credit

reserve.

|

|

u

|

At June 30,

2010, our investments in commercial securities consisted of predominantly

2004 and 2005 vintage subordinate securities with a fair market value of

$8 million. These securities have a face value of $141 million and credit

reserves of $128 million.

|

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

35

|

|

|

|

INVESTMENTS

IN OTHER CONSOLIDATED ENTITIES

|

|

u

|

In the second

quarter, we reported GAAP income of $4 million from the legacy Sequoia and

Acacia entities. This was an increase from the $2 million reported in the

first quarter due to lower negative mark-to-market adjustments of $5

million, lower loss provision expense of $5 million, offset by a decrease

in realized gains of $6 million (as we did not repurchase any asset-backed

securities in the second quarter), and lower net interest income of $2

million.

|

|

u

|

Cash

generated by our investments in Sequoia and Acacia entities totaled $7

million in the second quarter of 2010 compared to $8 million in the first

quarter. All of this second quarter cash flow was generated from Sequoia

IOs we own which were primarily issued in 2005 and earlier. The decrease

in cash received is a result of the decline in the interest payments on

six month LIBOR loans as coupon rates on the underlying mortgages reset

down during the quarter.

|

|

u

|

For the 48

prime jumbo residential mortgage securitizations totaling $35 billion

issued by our legacy Sequoia securitization entities (including five

securitizations for which a subsidiary of Redwood was the depositor but

which were not issued under the Sequoia program shelf registration

statement and which we do not consolidate), cumulative losses total 0.32%

of the original face amount of the securities through June 30, 2010, up

from 0.28% through March 31, 2010.

|

|

u

|

To date,

credit losses have not yet been incurred on any of the senior securities

issued by Sequoia securitization entities, although some of these senior

securities may incur losses in the future, depending on the magnitude and

timing of additional credit losses incurred on the underlying

loans.

|

|

u

|

The

consolidation of the assets and liabilities of securitization entities may

lead to potentially volatile quarterly reported earnings for a variety of

reasons, including the amortization of premium on the loans and

liabilities of Sequoia entities, changes in credit loss provisions for

loans held by Sequoia entities, fair value adjustments for the assets and

liabilities of the Acacia entities, and deconsolidation

events.

|

|

36

|

THE REDWOOD

REVIEW 2ND QUARTER 2010

|

|