|

|

|

|

TABLE OF CONTENTS

|

|

Introduction

|

4

|

| |

|

|

Shareholder Letter

|

5

|

| |

|

|

Financial Insights

|

10

|

| |

|

|

u Book Value

|

10

|

| |

|

|

u Balance Sheet

|

11

|

| |

|

|

u GAAP Income

|

16

|

| |

|

|

u Taxable Income and Dividends

|

20

|

| |

|

|

u Cash Flow

|

22

|

| |

|

|

Market Update on Private Residential Mortgage Securitization

|

23 |

| |

|

|

Housing Outlook

|

27 |

| |

|

|

Residential Mortgage Loan Business

|

30

|

| |

|

|

Investments in New Sequoia

|

31

|

| |

|

|

Residential Real Estate Securities

|

32

|

| |

|

|

Commercial Real Estate

|

40

|

| |

|

|

Legacy Investments in Other Consolidated Entities

|

42

|

| |

|

| |

|

|

Appendix

|

|

| |

|

|

Accounting Discussion

|

44

|

| |

|

|

Glossary

|

45

|

| |

|

|

Financial Tables

|

51

|

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

1

|

|

|

|

CAUTIONARY STATEMENT

|

Cautionary Statement

This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as “anticipate,” “estimate,” “will,” “should,” “expect,” “believe,” “intend,” “seek,” “plan,” and similar

expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our most recent Annual Report on Form 10-K under the caption “Risk Factors.” Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: (i) our competitive position and our ability to compete in the future, including our ability to effectively compete to acquire residential mortgage loans and our ability to compete to invest in commercial real estate loans; (ii) our future investment strategy and our ability to find attractive investments and future trends relating to our pace of acquiring or selling assets, including, without limitation, statements relating to our efforts to acquire residential mortgage loans and make commercial real estate investments; (iii) the $119 million of loans that we have identified for purchase from originators through our conduit

program and that we plan to subsequently acquire, references to future securitizations of loans we have acquired, which future securitizations may not be completed, and, more generally, statements regarding the likelihood and timing of, and our participation in, future securitization transactions and our ability to finance loan acquisitions through the execution of securitization transactions; (iv) that we plan to securitize residential mortgage loans we own and plan to acquire, our expectation that new Sequoia securitization entities will represent a larger portion of our balance sheet in the future, and our expectations that there will be an increase in types of commercial lending transaction on which we want to lend and that a significant portion of the capital we have to invest in 2011 will go into commercial assets, so that commercial assets could rise to account for 20% of, or a

meaningful amount of, our invested capital in the next year or two; (v) that we do not anticipate a need to issue equity in the near term, our estimates of our short-term borrowing capacity and our short-term investment capacity, our statements regarding our ability to access additional short-term borrowings and capital, and our expectations regarding an increase in the balance of our outstanding short-term debt; (vi) the future returns we may earn on our investment portfolio, including future trends in interest income and interest expense, and our statements that in the near-term we expect interest income will be primarily derived from our residential securities and that in future periods we expect our residential and commercial loan businesses to contribute more significantly to interest income; (vii) future market and economic conditions, including, without limitation, future

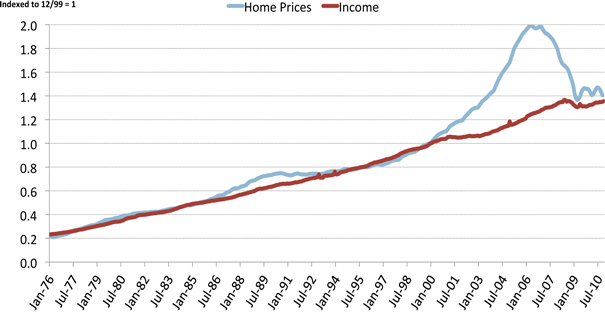

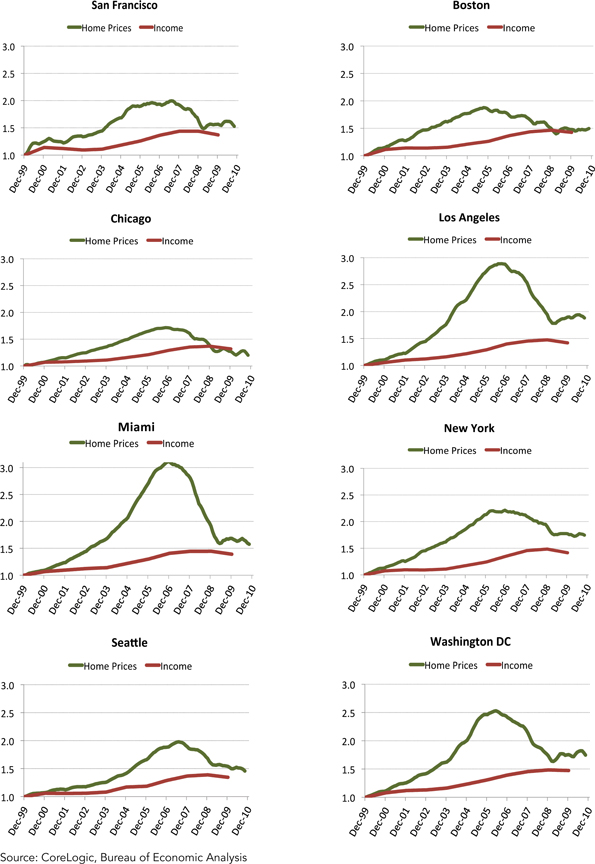

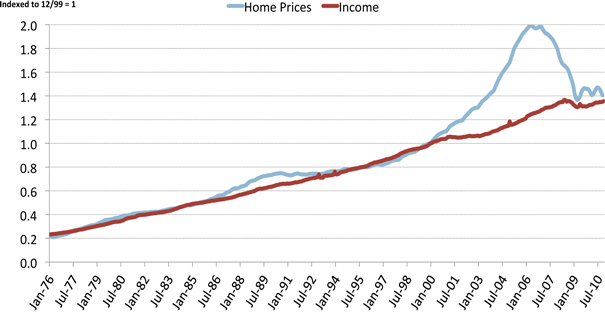

conditions in the residential and commercial real estate markets and related financing markets (including our statement that we believe there is an abundance of private sector money seeking investment in appropriately structured and originated mortgage-backed securities at attractive, risk-adjusted yields), and the related potential opportunities for our residential and commercial businesses; (viii) our beliefs about the future direction of housing market fundamentals, including, without limitation, home prices, demand for housing, delinquency rates, foreclosure rates, prepayment rates, inventory of homes for sale, and mortgage interest rates and their potential impact on our business and results of operations and our statements regarding how the historical relationship between income and home prices may imply that a significant “double dip” in housing prices is unlikely;

(ix) our beliefs about the future direction of commercial real estate fundamentals, including, without limitation, vacancy rates, rental rates, default rates, and availability of financing; (x) the impact of recent and future legislative and regulatory changes that affect our business and the mortgage finance markets, the manner in which the reform of the GSEs, including Fannie Mae and Freddie Mac, may take place and the timeline for that reform, and our statements that if reform of the GSEs is implemented as set forth in the Treasury Department’s recent released plan it will be a positive long-term development and favorable for Redwood’s business model and that we believe we are well positioned to take advantage of opportunities we expect will result from a meaningful reduction in the federal government’s role in supporting mortgage finance and that any such advantage

is more likely to begin to affect our results in 2012; (xi) our expectations regarding credit reserves, credit losses and impairments on our investments (including as compared to our original expectations and credit reserve levels) and the timing of those losses and impairments, and our statement that the amount of credit reserves we designate may require changes in the future; (xii) future earnings, future earnings volatility, and future trends in operating expenses and the factors that may affect those trends; (xiii) our board of directors’ intention to pay a regular dividend of $0.25 per share per quarter in 2011; and (xiv) our expectations relating to tax accounting, including our anticipation of additional losses for tax accounting purposes, that we currently anticipate reporting a taxable loss for the full year 2011, and our expectations regarding taxable income for 2010 and

the tax characterization of the 2010 dividends we paid.

|

2

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

Cautionary Statement (continued)

Important factors, among others, that may affect our actual results include: general economic trends, the performance of the housing, commercial real estate, mortgage, credit, and broader financial markets, and their effects on the prices of earning assets and the credit status of borrowers; federal and state legislative and regulatory developments, and the actions of governmental authorities, including those affecting the mortgage industry or our business; our exposure to credit risk and the timing of credit losses within our portfolio; the concentration of the credit risks we are exposed to, including due to the structure of assets we hold and the geographical concentration of real estate underlying assets we own; our

exposure to adjustable-rate and negative amortization mortgage loans; the efficacy and expense of our efforts to manage or hedge credit risk, interest rate risk, and other financial and operational risks; changes in credit ratings on assets we own and changes in the rating agencies’ credit rating methodologies; changes in interest rates; changes in mortgage prepayment rates; the availability of assets for purchase at attractive prices and our ability to reinvest cash we hold; changes in the values of assets we own; changes in liquidity in the market for real estate securities and loans; our ability to finance the acquisition of real estate-related assets with short-term debt; the ability of counterparties to satisfy their obligations to us; our involvement in securitization transactions and the risks we are exposed to in engaging in securitization transactions; exposure to

litigation arising from our involvement in securitization transactions; whether we have sufficient liquid assets to meet short-term needs; our ability to successfully compete and retain or attract key personnel; our ability to adapt our business model and strategies to changing circumstances; changes in our investment, financing, and hedging strategies and new risks we may be exposed to if we expand our business activities; exposure to environmental liabilities and the effects of global climate change; failure to comply with applicable laws and regulations; our failure to maintain appropriate internal controls over financial reporting and disclosure controls and procedures; the impact on our reputation that could result from our actions or omissions or from those of others; changes in accounting principles and tax rules; our ability to maintain our status as a real estate investment

trust (REIT) for tax purposes; limitations imposed on our business due to our REIT status and our status as exempt from registration under the Investment Company Act of 1940; decisions about raising, managing, and distributing capital; and other factors not presently identified.

This Redwood Review may contain statistics and other data that in some cases have been obtained from or compiled from information made available by servicers and other third-party service providers.

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

3

|

|

|

|

INTRODUCTION

|

Note to Readers:

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about Redwood and our financial results in accordance with generally accepted accounting principles (GAAP). We urge you to review these documents, which are available through our web site, www.redwoodtrust.com.

This document, called The Redwood Review, is an additional format for providing information about Redwood through a discussion of many GAAP as well as non-GAAP metrics, such as taxable income and economic book value. Supplemental information is also provided in the Financial Tables in this Review to facilitate more detailed understanding and analysis of Redwood. When we use non-GAAP metrics it is because we believe that these figures provide additional insight into Redwood’s business. In each case in which we discuss a non-GAAP metric you will find an explanation of how it has been calculated, why we think the figure is important, and reconciliations between the GAAP and non-GAAP figures.

References herein to “Redwood,” the “company,” “we,” “us,” and “our” include Redwood Trust, Inc. and its consolidated subsidiaries. References to “at Redwood” exclude all consolidated securitization entities in order to present our operations in the way management analyzes them.

We hope you find this Review helpful to your understanding of our business. We thank you for your input and suggestions, which have resulted in our changing the form and content of The Redwood Review over time.

We welcome your continued interest and comments.

| |

|

|

|

|

|

|

|

Selected Financial Highlights

|

| |

|

|

|

|

|

|

| |

|

|

|

|

Non-GAAP

|

|

| |

GAAP Income

|

|

|

|

Economic

|

|

| |

(Loss) per

|

Taxable Income

|

Annualized

|

GAAP Book

|

Value per

|

Dividends per

|

|

Quarter:Year

|

Share

|

(Loss) per Share (1)

|

Return on Equity

|

Value per Share

|

Share (2)

|

Share

|

|

Q408

|

($3.46)

|

($0.39)

|

(124%)

|

$9.02

|

$11.10

|

$0.75

|

|

Q109

|

($0.65)

|

($0.22)

|

(25%)

|

$8.40

|

$10.01

|

$0.25

|

|

Q209

|

$0.10

|

($0.16)

|

5%

|

$10.35

|

$11.30

|

$0.25

|

|

Q309

|

$0.34

|

($0.30)

|

13%

|

$11.68

|

$12.28

|

$0.25

|

|

Q409

|

$0.51

|

($0.44)

|

17%

|

$12.50

|

$13.03

|

$0.25

|

|

Q110

|

$0.58

|

$0.01

|

19%

|

$12.84

|

$13.32

|

$0.25

|

|

Q210

|

$0.35

|

($0.03)

|

11%

|

$12.71

|

$13.37

|

$0.25

|

|

Q310

|

$0.25

|

($0.11)

|

8%

|

$13.02

|

$13.73

|

$0.25

|

|

Q410

|

$0.18

|

($0.07)

|

6%

|

$13.63

|

$14.31

|

$0.25

|

(1) Taxable income (loss) per share for 2010 are estimates until we file tax returns for that year.

(2) Non-GAAP economic value per share is calculated using estimated bid-side values (which take into account available bid-side marks) for our financial assets and estimated offer-side values (which take into account available offer-side marks) for our financial liabilities and we believe it more accurately reflects liquidation value than does GAAP book value per share. Non-GAAP economic value per share is reconciled to GAAP book value per share in Table 3 in the Financial Tables in this Review.

|

4

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

|

|

|

|

SHAREHOLDER LETTER

|

Dear Fellow Shareholders:

Overview

As we reflect on 2010 and look forward to 2011, an old refrain comes to mind: “sometimes you have to look back…to see how far you have come…” With this refrain as a backdrop, we will share our perspective on our recent progress and on what is yet to come.

A year ago, we observed in our letter that new private securitization was within sight, hurdles remained, commercial investment opportunities were near, and we liked our competitive position. At the time we made these comments, we had not completed a residential mortgage-backed securitization since August 2007 because the market was frozen in the wake of the financial crisis. Our commercial team was in its early formative stage and we had just recently hired our department head.

We were right about new private securitization being within sight. In April 2010, we completed the first non-agency residential mortgage-backed securitization backed by newly originated loans since mid-2008. Going into 2010, we had plans to help restart private mortgage securitization, but we had no assurances that we could do so. In fact, residential mortgage-backed securities (RMBS) investors were still aggressively buying seasoned senior RMBS at yields well above jumbo mortgage rates, making the securitization math unworkable at that time.

We accomplished most of our residential plans in 2010. After completing the securitization in April, we launched our residential mortgage conduit program and began signing up originators. By year-end 2010, we had acquired $253 million of loans and had a pipeline of $119 million of additional loans from conduit program originators identified for subsequent acquisition. We submitted our Government Sponsored Enterprises (GSE) reform plan to regulators in July and published the Redwood Guide to Restoring Private-Sector Residential Mortgage Securitization in November. We had several opportunities to discuss both our write-ups with regulators and policy makers.

We believed then and we believe now that the best time to build a business is when operating conditions are challenging to the point of obscuring long-term opportunities. At that point, competitors are few and naysayers are plentiful. It was against such a challenging backdrop that, in the fall of 2009, we started rebuilding our Sequoia securitization platform. We did so based on our beliefs that the government’s role in backing roughly 90% of annual mortgage originations was unsustainable; private securitization would return; we had several competitive advantages in private securitization; building a better jumbo mortgage conduit would likely and ultimately benefit our shareholders; and Redwood should take a leading

role in restarting private securitization.

Taking a longer view, we believe we are well positioned to take advantage of the opportunities we expect will result from a meaningful reduction in the federal government’s role in supporting mortgage finance, which will take time and more likely begin to affect our results in 2012. We would, of course, like more volume now for our residential mortgage conduit to make the activity efficient, profitable, and beneficial for shareholders. With respect to new securitization activity conducted through our Sequoia platform, we refer you to our recent press release, which is attached to the Form 8-K we filed with the Securities and Exchange Commission on February 18, 2011.

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

5

|

|

|

|

SHAREHOLDER LETTER

|

Overview (continued)

On the commercial side, our business is now fully up and running. We invested $30 million in the fourth quarter of 2010 as we funded our first three mezzanine loans. Early in February 2011, we originated another $6 million loan. Our team is in place, we have built processes and strengthened relationships, and our lending opportunities are expanding. We currently expect a significant portion of the capital we invest in 2011 to go into commercial assets, so that commercial could rise to 20% of our invested capital in the next year or two.

As we look back, we realize we have come a long way over the past year. There is a real sense of momentum in our residential and commercial businesses, even though progress in 2010 was slower than we would have liked. We are patient as we invest and build our businesses, mindful of the mistakes made when companies push too hard for rapid growth and confident that we are laying a proper foundation. We expect continued opportunities and challenges in 2011 and beyond.

In the interest of providing topical and timely insights, we have included two special sections later in this Review, specifically addressing our outlook for housing and private residential mortgage securitization and the Treasury’s report on GSE reform.

Fourth Quarter 2010

GAAP earnings for the fourth quarter of 2010 were $15 million or $0.18 per share, down somewhat from the $20 million or $0.25 per share we earned in the prior quarter. The most notable difference in the recent quarter was that our loan loss provision came in higher — at $8 million in the fourth quarter 2010, up from $2 million in the third quarter 2010. The fourth quarter included no market valuation adjustments and $2 million in realized gains — equal to the level posted in the prior quarter.

Book value increased by $0.61 per share to $13.63 per share. The increase resulted from $0.18 per share in reported earnings, $0.39 per share in net valuation increases on securities not reflected in earnings, $0.27 per share in increases in value of hedges related to long-term debt, and $0.02 per share in other items, less $0.25 per share from dividends paid to shareholders. Our estimate of non-GAAP economic value is $14.31 per share at year-end 2010, which is $0.68 per share or $55 million higher than year-end 2010 GAAP book value per share.

Looking Ahead

As we look ahead to 2011, we believe that:

| |

u

|

Well managed, efficient funding will be increasingly important

|

| |

u

|

High quality commercial real estate is recovering, attracting more capital

|

| |

u

|

Housing prices are approaching a bottom, but pressures persist on a local basis

|

| |

u

|

Uncertainty will likely create risks and opportunities

|

| |

u

|

GSE reform is increasingly likely

|

We expand on each of these topics on the following pages.

|

6

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

|

|

|

|

SHAREHOLDER LETTER

|

Well Managed, Efficient Funding Will Be Increasingly Important

In recent years, our quarter-end cash balance was a relatively good proxy for the amount of excess capital we had available to invest since we were only using cash to fund long-term investments. More recently, we are using cash, along with short-term borrowings, to fund the accumulation of residential loans, on a temporary basis, prior to securitization. As a consequence, our cash balance now and going forward will reveal little about the capital we have available for long-term investments. Hence, the drop in our cash balance from $189 million at September 30, 2010 to $47 million at year-end 2010 is not meaningful as an indicator of investment capacity.

To gauge the amount of capital readily available for long-term investment, we look at the amount of the cash we estimate we could raise by financing all our residential loans with short-term borrowings less the amount of cash we estimate we would need over the short term for operations, working capital, and a liquidity cushion. On this basis, our investment capacity was $224 million at year-end 2010 and has not changed much thus far in 2011. In addition, with a little lead time, we could raise additional investment capacity by permanently financing a portion of our securities portfolio either through a resecuritization or by other means.

We intend to more fully employ our capital in 2011, which will involve increased borrowing activity. Our estimates of investment capacity presume that we are able to borrow on a secured basis. We continue to have a healthy respect for the dangers of liquidity risk and recognize that funding illiquid assets with recourse debt can end quite badly.

High Quality Commercial Real Estate is Recovering, Attracting More Capital

The commercial real estate market is experiencing a significant increase in the volume of financing transactions. As we have noted in recent quarters, liquidity has increasingly returned in earnest for stabilized commercial assets. Fundamentals appear to have at least stabilized in select metropolitan markets, especially for multifamily properties, strong anchored retail space, and class-A office space in central business districts.

The increased capital flows to commercial real estate can be seen in the recent resurgence in the commercial mortgage-backed securities (CMBS) market. For high quality commercial loans, the stars are lining up for CMBS issuance velocity. Investor demand is strong, triple-A spreads continue to tighten, and borrowers are able to refinance at attractive rates and on easing credit terms. Furthermore, many banks and Wall Street firms are building CMBS platforms that will “feed the beast.” There are no meaningful regulatory challenges to commercial real estate finance, which distinguishes commercial from residential real estate.

Last year, CMBS issuance totaled roughly $10 billion excluding agency originations. Market observers expect CMBS issuance of approximately $40 to $50 billion for 2011. The environment for building our commercial business and making investments is favorable, particularly since we expect an increase in the flow of the types of quality transactions on which we want to lend.

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

7

|

|

|

|

SHAREHOLDER LETTER

|

High Quality Commercial Real Estate is Recovering, Attracting More Capital (continued)

Redwood Trust is actively engaged as an originator and underwriter of commercial mezzanine loans on high quality, stabilized assets. Our progress and results have been promising. We recently originated and closed four mezzanine loans and we have many possible new opportunities. As is the case with all of our investment activities, we are focused on getting credit right. We have built the in-house expertise, platform, market recognition, and relationships to allow us to prosper over time. It is our objective to be well positioned to originate attractive, risk-adjusted commercial investments on a sustainable basis, as market conditions ebb and flow.

Our balance sheet is well suited for retaining long-term credit risk. Our capital and origination process provide reliability, flexibility, and advantages to borrowers, including the advantage of permanent funding of longer-term assets. Currently, we are focused on providing long-term solutions to the challenge of financing the gap between the amount of equity a borrower will put into a property and the amount of financing available from the senior lender. We like what we see in the commercial real estate markets. Currently, we expect a meaningful portion of our capital invested in 2011 to go into commercial assets.

Housing Prices Are Approaching a Bottom, but Pressures Persist on a Local Basis

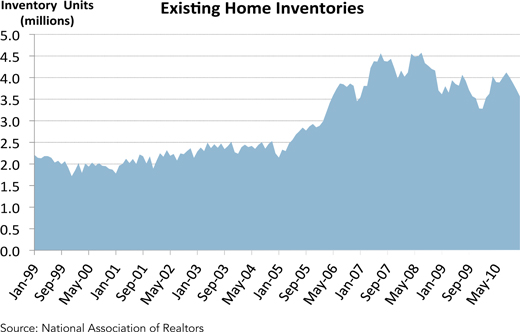

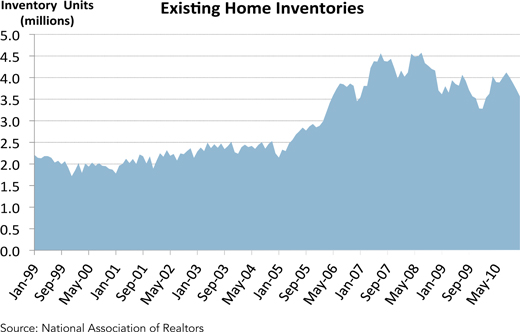

Affordability looks better than it has in years, considering income and house prices. Improved affordability will eventually form a bottom for housing prices. On a nationwide basis, we think an additional 5 to 10% decline will be necessary to get to that point. However there remains, as always, significant regional variation. While some markets appear to have bottomed, other markets could see drops beyond this range. We acknowledge that there are risks to the outlook for housing prices and once housing has bottomed, we do not expect appreciable gains in prices for years, for two reasons. First, we believe the “shadow inventory” waiting to come on the market will provide an ongoing headwind to price appreciation.

Second, we believe tighter residential mortgage loan underwriting standards are here to stay for many years. Ultimately, we believe that a house is going back to being a home first and an investment only secondarily. Importantly, our investment decisions are made with our views on local housing prices in mind. Please see the separate module on housing on page 27 in this Review for further commentary.

Uncertainty Will Likely Create Risks and Opportunities

There are many sources of uncertainty that could potentially impact our residential businesses, including our residential portfolio business. For example, uncertainty exists around residential mortgage foreclosures, regulatory details to be determined that will affect private residential mortgage securitization, and the pace at which the government scales back its support of housing finance. In our residential portfolio business, we will continue to manage our approximately $800 million in mortgage securities with an eye to protecting credit and enhancing returns, as possible. In fact, while we do not anticipate significant further across-the-board price appreciation, we will stay vigilant for opportunities that result from

uncertainty and changes in perceptions in the market. For example, negative headlines on housing could help create investment opportunities in select non-agency RMBS. We view the volatility that often comes with uncertainty as potentially a good source of opportunities. On the margin, we expect to continue to manage the risk/reward of our portfolio.

|

8

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

|

|

|

|

SHAREHOLDER LETTER

|

GSE Reform is Increasingly Likely

The good news is that we are now discussing and debating GSE reform rather than just kicking the can down the road. Treasury has delivered its proposal on housing finance reform, including three specific options. We expect that a version of one of these options will ultimately be enacted. Meanwhile, we believe temporary loan limits for high cost areas will likely be allowed to expire on September 30, 2011. Lowering loan limits – which help determine how big a role Fannie and Freddie play in financing housing – is an easy way to effectively take a “first step” in GSE reform. Lowering limits makes sense in the context of price declines, it limits the additional burden to the taxpayer, and it opens a

door for the private sector to return to financing mortgages in a more significant way.

Please see the more detailed discussion of the Treasury Proposal beginning on page 23 in this Review. For background, please see our website for Redwood’s proposal on reforming the GSEs, entitled “Fixing the U.S. Mortgage Market,” posted July 30, 2010. We believe that supporting the return of the private sector to residential mortgage securitization is critical to moving forward on GSE reform.

Concluding Thoughts

We are building for the future, which requires patience by management and especially by shareholders. We have laid a strong foundation for our commercial business and our residential conduit business. In commercial, there are encouraging signs that we are well positioned and that the market freeze (in our target market) is coming to an end. In our residential business, we feel highly confident that the government’s market share will be coming down for some time to come — though the timing of when it will begin is impossible to predict. Working through the stops and starts associated with the major shifts in housing finance will continue to be challenging. Whether that takes 6 or 12 months longer than we plan

will not ultimately be what matters most. In the end, we expect to have a well positioned, first-rate franchise in private residential securitization that focuses on providing originators and investors with what they want. We appreciate your support and confidence and we will continue to work hard to keep your trust.

|

|

|

Martin S. Hughes

|

Brett D. Nicholas

|

|

President and

|

Executive Vice President,

|

|

Chief Executive Officer

|

Chief Investment Officer, and

|

| |

Chief Operating Officer

|

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

9

|

|

|

|

FINANCIAL INSIGHTS

|

Book Value

Summary

|

|

The following table shows the components of our GAAP book value and management’s estimate of non-GAAP economic value at December 31, 2010.

|

|

Components of Book Value*

December 31, 2010

($ in millions, except per share data)

|

|

| |

|

GAAP

Book Value

|

|

|

Adj.

|

|

|

Management's

Estimate of

Non-GAAP

Economic Value

|

|

| |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

47 |

|

|

|

|

|

$ |

47 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Real estate loans at Redwood

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential

|

|

|

255 |

|

|

|

|

|

|

255 |

|

|

Commercial

|

|

|

30 |

|

|

|

|

|

|

30 |

|

|

Total real estate loans at Redwood

|

|

$ |

285 |

|

|

|

|

|

$ |

285 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Real estate securities at Redwood

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential

|

|

|

814 |

|

|

|

|

|

|

814 |

|

|

Commercial

|

|

|

8 |

|

|

|

|

|

|

8 |

|

|

CDO

|

|

|

1 |

|

|

|

|

|

|

1 |

|

|

Total real estate securities at Redwood

|

|

$ |

823 |

|

|

|

|

|

$ |

823 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Investments in the Fund

|

|

|

14 |

|

|

|

|

|

|

14 |

|

|

Investments in Sequoia

|

|

|

87 |

|

|

|

(9 |

) |

|

|

78 |

|

|

Investments in Acacia

|

|

|

4 |

|

|

|

(3 |

) |

|

|

1 |

|

|

Other assets

|

|

|

35 |

|

|

|

|

|

|

|

35 |

|

|

Total assets

|

|

$ |

1,295 |

|

|

|

|

|

|

$ |

1,283 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term debt

|

|

|

(44 |

) |

|

|

|

|

|

|

(44 |

) |

|

Long-term debt

|

|

|

(140 |

) |

|

|

65 |

|

|

|

(75 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

(46 |

) |

|

|

|

|

|

|

(46 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

$ |

1,065 |

|

|

|

|

|

|

$ |

1,118 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value per share

|

|

$ |

13.63 |

|

|

|

|

|

|

$ |

14.31 |

|

|

|

During the fourth quarter of 2010, our GAAP book value increased by $0.61 per share to $13.63 per share. The increase resulted from $0.18 per share in reported earnings, $0.39 per share in net valuation increases on securities not reflected in earnings, $0.27 per share in increases in value of hedges related to long-term debt, and $0.02 per share in other items, less $0.25 per share from dividends paid to shareholders.

|

|

|

During the fourth quarter of 2010, our estimate of non-GAAP economic value increased by $0.58 per share to $14.31 per share. The increase resulted from $0.80 per share in cash flows and net positive market valuation adjustments on our securities and investments, $0.12 per share from the hedged valuation increase related to our long-term debt, plus $0.05 per share from changes in working capital and other items, less $0.14 per share of cash operating and interest expense and $0.25 per share of dividends paid to shareholders.

|

|

*

|

The components of book value table presents our assets and liabilities as calculated and reported under GAAP and as adjusted to reflect our estimate of economic value, a non-GAAP metric. We show our investments in the Redwood Opportunity Fund, L.P. (the Fund) and in Sequoia and Acacia securitization entities in separate line items, similar to the equity method of accounting, reflecting the reality that the underlying assets and liabilities owned by these entities are legally not ours. We own only the securities and interests that we have acquired from these entities. See pages 13 and 14 for an explanation of the adjustments set forth in this table.

|

|

10

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet

|

|

The following table shows the components of our balance sheet at December 31, 2010.

|

Consolidating Balance Sheet

December 31, 2010

($ in millions)

|

|

| |

|

| |

|

At

Redwood

|

|

|

New

Sequoia

|

|

|

Other

Consolidated

Entities

|

|

|

Intercompany

|

|

|

Redwood

Consolidated

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate loans

|

|

$ |

285 |

|

|

$ |

145 |

|

|

$ |

3,417 |

|

|

$ |

- |

|

|

$ |

3,847 |

|

|

Real estate securities

|

|

|

823 |

|

|

|

- |

|

|

|

332 |

|

|

|

- |

|

|

|

1,155 |

|

|

Investments in New Sequoia

|

|

|

24 |

|

|

|

- |

|

|

|

- |

|

|

|

(24 |

) |

|

|

- |

|

|

Investment in Other Consolidated Entities

|

|

|

81 |

|

|

|

- |

|

|

|

- |

|

|

|

(81 |

) |

|

|

- |

|

|

Cash and cash equivalents

|

|

|

47 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

47 |

|

|

Total earning assets

|

|

|

1,260 |

|

|

|

145 |

|

|

|

3,749 |

|

|

|

(105 |

) |

|

|

5,049 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets

|

|

|

35 |

|

|

|

2 |

|

|

|

58 |

|

|

|

- |

|

|

|

95 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

1,295 |

|

|

$ |

147 |

|

|

$ |

3,807 |

|

|

$ |

(105 |

) |

|

$ |

5,144 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term debt

|

|

$ |

44 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

44 |

|

|

Other liabilities

|

|

|

46 |

|

|

|

- |

|

|

|

77 |

|

|

|

- |

|

|

|

123 |

|

|

Asset-backed securities issued

|

|

|

- |

|

|

|

123 |

|

|

|

3,638 |

|

|

|

- |

|

|

|

3,761 |

|

|

Long-term debt

|

|

|

140 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

140 |

|

|

Total liabilities

|

|

|

230 |

|

|

|

123 |

|

|

|

3,715 |

|

|

|

- |

|

|

|

4,068 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

1,065 |

|

|

|

24 |

|

|

|

81 |

|

|

|

(105 |

) |

|

|

1,065 |

|

|

Noncontrolling interest

|

|

|

- |

|

|

|

- |

|

|

|

11 |

|

|

|

- |

|

|

|

11 |

|

|

Total equity

|

|

|

1,065 |

|

|

|

24 |

|

|

|

92 |

|

|

|

(105 |

) |

|

|

1,076 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$ |

1,295 |

|

|

$ |

147 |

|

|

$ |

3,807 |

|

|

$ |

(105 |

) |

|

$ |

5,144 |

|

|

|

We present this table to highlight the impact that consolidation has on our GAAP balance sheet. As shown, Redwood’s $105 million GAAP investment in the consolidated entities (including New Sequoia) increased our consolidated assets by $3.9 billion and liabilities by $3.8 billion.

|

|

|

We are required under GAAP to consolidate all of the assets and liabilities of the Fund (due to our significant general and limited partnership interests in the Fund and ongoing asset management responsibilities) and certain Sequoia and Acacia securitization entities that are treated as secured borrowing transactions. However, the securitized assets of these entities are not available to Redwood. Similarly, the liabilities of these entities are obligations payable only from the cash flow generated by their securitized assets and are not obligations of Redwood.

|

|

|

The consolidating balance sheet presents the New Sequoia securitization entity separately from all Other Consolidated Entities to highlight our renewed focus on growing our core business of creating residential credit investments. As we complete additional securitizations, we expect New Sequoia securitization entities to represent a larger portion of our consolidated balance sheet as prior Sequoia securitization entities continue to pay down.

|

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

11

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

Real Estate Loans

|

|

At December 31, 2010, we had $285 million of real estate loans held for investment, comprised of $255 million of residential loans and $30 million of commercial loans. We intend to securitize most of the residential loans (and others we have identified for future acquisition), at which point they will be reflected in the “New Sequoia” column on the consolidating balance sheet shown on page 11.

|

|

|

The commercial loans were originated in the fourth quarter and we intend to hold these loans for investment.

|

Real Estate Securities

|

|

The following table presents the fair value (which equals GAAP carrying value) of real estate securities at Redwood at December 31, 2010. We segment our securities portfolio by vintage (the year(s) the securities were issued), priority of cash flow (senior, re-REMIC, and subordinate), and by quality of underlying loans (prime and non-prime securities) for residential.

|

Real Estate Securities at Redwood

December 31, 2010

($ in millions)

|

|

| |

|

<=2004

|

|

|

2005

|

|

|

2006-2008 |

|

|

Total

|

|

|

% of Total

Securities

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seniors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prime

|

|

$ |

13 |

|

|

$ |

228 |

|

|

$ |

75 |

|

|

$ |

316 |

|

|

|

38 |

% |

|

Non-prime*

|

|

|

117 |

|

|

|

220 |

|

|

|

9 |

|

|

|

346 |

|

|

|

42 |

% |

|

Total Seniors

|

|

$ |

130 |

|

|

$ |

448 |

|

|

$ |

84 |

|

|

$ |

662 |

|

|

|

80 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Re-REMIC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prime

|

|

$ |

6 |

|

|

$ |

12 |

|

|

$ |

67 |

|

|

$ |

85 |

|

|

|

10 |

% |

|

Total Re-REMIC

|

|

$ |

6 |

|

|

$ |

12 |

|

|

$ |

67 |

|

|

$ |

85 |

|

|

|

10 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subordinates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prime

|

|

$ |

42 |

|

|

$ |

7 |

|

|

$ |

5 |

|

|

$ |

54 |

|

|

|

7 |

% |

|

Non-prime*

|

|

|

13 |

|

|

|

- |

|

|

|

- |

|

|

|

13 |

|

|

|

2 |

% |

|

Total Subordinates

|

|

$ |

55 |

|

|

$ |

7 |

|

|

$ |

5 |

|

|

$ |

67 |

|

|

|

9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Residential

|

|

$ |

191 |

|

|

$ |

467 |

|

|

$ |

156 |

|

|

$ |

814 |

|

|

|

99 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial subordinates

|

|

$ |

7 |

|

|

$ |

1 |

|

|

$ |

- |

|

|

$ |

8 |

|

|

|

1 |

% |

|

CDO subordinates

|

|

$ |

- |

|

|

$ |

1 |

|

|

$ |

- |

|

|

$ |

1 |

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total real estate securities

|

|

$ |

198 |

|

|

$ |

469 |

|

|

$ |

156 |

|

|

$ |

823 |

|

|

|

100 |

% |

| |

*

|

Non-prime residential securities consist of $356 million of Alt-A senior and subordinate and $3 million of subprime subordinate securities.

|

|

12

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

Real Estate Securities (continued)

|

|

The table below details the change in fair value of securities at Redwood during the fourth and third quarters of 2010.

|

|

Real Estate Securities at Redwood

($ in millions)

|

|

| |

|

Three Months Ended

|

|

| |

|

12/31/10

|

|

|

9/30/10

|

|

|

Beginning fair value

|

|

$ |

797 |

|

|

$ |

734 |

|

| |

|

|

|

|

|

|

|

|

|

Acquisitions

|

|

|

26 |

|

|

|

50 |

|

|

Sales

|

|

|

- |

|

|

|

- |

|

|

Effect of principal payments

|

|

|

(29 |

) |

|

|

(21 |

) |

|

Change in fair value, net

|

|

|

29 |

|

|

|

34 |

|

| |

|

|

|

|

|

|

|

|

|

Ending fair value

|

|

$ |

823 |

|

|

$ |

797 |

|

|

|

Our acquisitions in the fourth quarter included $6 million of prime senior securities, $1 million of non-prime senior securities, $15 million of prime subordinate securities, and $4 million of non-prime subordinate securities. Of the $26 million of securities acquired, $24 million were from 2005 and earlier vintages.

|

|

|

During January 2011, we did not acquire or sell any securities at Redwood.

|

Investments in the Fund and the Securitization Entities

|

|

Our investments in the Fund, Sequoia, and Acacia securitization entities, as reported for GAAP, totaled $105 million, or 10% of our equity at December 31, 2010.

|

|

|

The GAAP carrying value and the fair value of our investment in the Fund was $14 million. The Fund is primarily invested in non-prime residential securities and is managed by a subsidiary of Redwood. Our investment represents a 52% interest in the Fund.

|

|

|

The GAAP carrying value of our investments in Sequoia was $87 million and management’s estimate of the non-GAAP economic value of those investments was $78 million. We estimate the non-GAAP economic value for our investments, consisting of $48 million of IOs and $30 million of senior and subordinate securities, using the same valuation process that we follow to fair value our other real estate securities. For GAAP, we account for the assets and liabilities at historical cost and the net $87 million carrying value represents the difference between the carrying costs of the assets ($3.6 billion) and liabilities ($3.5 billion) owned by the Sequoia entities.

|

|

|

The GAAP carrying value of our investments in Acacia entities was $4 million and management’s estimate of the non-GAAP economic value of those investments was $1 million, which primarily reflects the present value of the management fees we expect to earn from these entities. The equity interests and securities we own in the Acacia entities have minimal value.

|

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

13

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

Debt

|

u

|

We noted in prior Redwood Reviews that we expected to utilize short-term debt to finance the acquisition of prime mortgage loans prior to securitizing them through our Sequoia securitization platform. At December 31, 2010, we had $44 million of short-term recourse debt (collateralized by mortgage-backed securities) that was used to fund the acquisition of mortgage loans that we intend to securitize. Our outstanding balance of short-term debt will increase until the securitization has been completed.

|

|

u

|

At December 31, 2010, we had $140 million of long-term debt outstanding with a stated interest rate of three-month LIBOR plus 225 basis points due in 2037. Earlier in 2010, we effectively fixed the interest rate on this long-term debt through interest rate swaps at a rate of approximately 6.75%.

|

|

u

|

We calculated the $75 million estimate of non-GAAP economic value of this long-term debt based on its stated interest rate using the same valuation process used to fair value our other financial assets and liabilities. During the fourth quarter, we repurchased $500,000 of our long-term debt at a price of 54% of face value, which is consistent with our estimate of its fair value at the end of the fourth quarter.

|

|

14

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

Capital and Cash

|

u

|

At December 31, 2010, our total capital was $1.2 billion, including $1.1 billion in shareholders’ equity and $140 million of long-term debt. We use our capital to invest in earning assets, meet lender capital requirements, and to fund our operations and working capital needs.

|

|

u

|

We manage our capital through our risk-adjusted capital policy, which has served us well since the company was founded. We have successfully managed through two tumultuous periods (1998 and 2008) and we remain thoughtful about managing funding risk as we use short-term debt.

|

|

u

|

Our cash balance was $47 million at year-end 2010. We currently hold cash for two main reasons. First, we hold sufficient cash to comply with covenants, to meet potential margin calls, and to cover near term cash operating expenses. Second, we hold cash in anticipation of having opportunities to invest at attractive yields.

|

|

u

|

Cash was a good barometer of our ability to invest when we used only cash to fund long-term investments. We are now using cash and short-term borrowings to fund the accumulation of loans on a temporary basis. Thus, cash tells us little about the capital we have available for long-term investments.

|

|

u

|

We estimate that our short-term investment capacity was $224 million at December 31, 2010, up slightly from $222 million at September 30, 2010. This (immediately available) capacity to make long-term investments equals the amount of cash we could raise by financing our loans with short-term borrowings, less the amount of cash we set aside for operating expenses, pending trades, and potential margin requirements.

|

|

u

|

Beyond the short term, we could raise additional capacity for long-term investment by re-securitizing a portion of our securities portfolio or by other means.

|

|

u

|

In the near term, we do not anticipate a need to issue equity. Although we plan to invest much of our excess capital in 2011, we are more likely to look to our residential securities portfolio as a source of liquidity for additional investment capacity. We always retain the flexibility to raise equity capital in the future, but we seek to ask shareholders for new capital only when we believe we have accretive investment opportunities that exceed our investment capacity.

|

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

15

|

|

|

|

FINANCIAL INSIGHTS

|

Summary

|

|

The following table provides a summary of our consolidated GAAP income for the fourth and third quarters of 2010.

|

GAAP Income

($ in millions, except per share data)

|

|

| |

|

Three Months Ended

|

|

| |

|

12/31/10

|

|

|

9/30/10

|

|

|

Interest income

|

|

$ |

56 |

|

|

$ |

59 |

|

|

Interest expense

|

|

|

(22 |

) |

|

|

(24 |

) |

|

Net interest income

|

|

|

34 |

|

|

|

35 |

|

| |

|

|

|

|

|

|

|

|

|

Provision for loan losses

|

|

|

(8 |

) |

|

|

(2 |

) |

|

Market valuation adjustments, net

|

|

|

- |

|

|

|

(2 |

) |

|

Net interest income after provision and market valuation adjustments

|

|

|

26 |

|

|

|

31 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

(13 |

) |

|

|

(12 |

) |

|

Realized gains on sales and calls, net

|

|

|

2 |

|

|

|

2 |

|

|

Noncontrolling interest

|

|

|

- |

|

|

|

(1 |

) |

|

Provision for income taxes

|

|

|

- |

|

|

|

- |

|

|

GAAP income

|

|

$ |

15 |

|

|

$ |

20 |

|

| |

|

|

|

|

|

|

|

|

|

GAAP income per share

|

|

$ |

0.18 |

|

|

$ |

0.25 |

|

|

|

Our consolidated GAAP income for the fourth quarter of 2010 was $15 million, or $0.18 per share, as compared to $20 million or $0.25 per share, for the third quarter of 2010. The decrease in income is the result of a higher provision for loan losses, partially offset by lower negative market valuation adjustments.

|

|

|

Additional information related to GAAP income at Redwood, New Sequoia, and Other Consolidated Entities is discussed in the following pages.

|

|

16

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

|

|

|

|

FINANCIAL INSIGHTS

|

GAAP Income (continued)

Summary (continued)

|

u

|

The following tables show the estimated effect that Redwood, New Sequoia, and our OtherConsolidated Entities had on GAAP income for the fourth quarter of 2010 and the third quarter of 2010. These components of our income statement are not separate business segments.

|

|

Consolidating Income Statement

Three Months Ended December 31, 2010

($ in millions)

|

|

| |

|

At

Redwood

|

|

|

New

Sequoia

|

|

|

Other

Consolidated

Entities

|

|

|

Intercompany

Adjustments

|

|

|

Redwood

Consolidated

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

$ |

16 |

|

|

$ |

2 |

|

|

$ |

27 |

|

|

$ |

- |

|

|

$ |

45 |

|

|

Net discount (premium) amortization

|

|

|

12 |

|

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

|

11 |

|

|

Total interest income

|

|

|

28 |

|

|

|

2 |

|

|

|

26 |

|

|

|

- |

|

|

|

56 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(3 |

) |

|

|

(1 |

) |

|

|

(18 |

) |

|

|

- |

|

|

|

(22 |

) |

|

Net interest income

|

|

|

25 |

|

|

|

1 |

|

|

|

8 |

|

|

|

- |

|

|

|

34 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for loan losses

|

|

|

- |

|

|

|

- |

|

|

|

(8 |

) |

|

|

- |

|

|

|

(8 |

) |

|

Market valuation adjustments, net

|

|

|

2 |

|

|

|

- |

|

|

|

(2 |

) |

|

|

- |

|

|

|

- |

|

|

Net interest income (loss) after provision and market valuation adjustments

|

|

|

27 |

|

|

|

1 |

|

|

|

(2 |

) |

|

|

- |

|

|

|

26 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

(13 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(13 |

) |

|

Realized gains on sales and calls, net

|

|

|

1 |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

|

|

2 |

|

|

Income from New Sequoia

|

|

|

1 |

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

Loss from Other Consolidated Entities

|

|

|

(1 |

) |

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

|

Noncontrolling interest

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Provision for income taxes

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

15 |

|

|

$ |

1 |

|

|

$ |

(1 |

) |

|

$ |

- |

|

|

$ |

15 |

|

|

Consolidating Income Statement

Three Months Ended September 30, 2010

($ in millions)

|

|

| |

|

At

Redwood

|

|

|

New

Sequoia

|

|

|

Other

Consolidated

Entities

|

|

|

Intercompany

Adjustments

|

|

|

Redwood

Consolidated

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

$ |

17 |

|

|

$ |

2 |

|

|

$ |

30 |

|

|

$ |

- |

|

|

$ |

49 |

|

|

Net discount (premium) amortization

|

|

|

10 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10 |

|

|

Total interest income

|

|

|

27 |

|

|

|

2 |

|

|

|

30 |

|

|

|

- |

|

|

|

59 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(3 |

) |

|

|

(1 |

) |

|

|

(20 |

) |

|

|

- |

|

|

|

(24 |

) |

|

Net interest income

|

|

|

24 |

|

|

|

1 |

|

|

|

10 |

|

|

|

- |

|

|

|

35 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for loan losses

|

|

|

- |

|

|

|

- |

|

|

|

(2 |

) |

|

|

- |

|

|

|

(2 |

) |

|

Market valuation adjustments, net

|

|

|

- |

|

|

|

- |

|

|

|

(2 |

) |

|

|

- |

|

|

|

(2 |

) |

|

Net interest income after provision and market valuation adjustments

|

|

|

24 |

|

|

|

1 |

|

|

|

6 |

|

|

|

- |

|

|

|

31 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

(12 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(12 |

) |

|

Realized gains on sales and calls, net

|

|

|

2 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2 |

|

|

Income from New Sequoia

|

|

|

1 |

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

Income from Other Consolidated Entities

|

|

|

5 |

|

|

|

- |

|

|

|

- |

|

|

|

(5 |

) |

|

|

- |

|

|

Noncontrolling interest

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

|

(1 |

) |

|

Provision for income taxes

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

20 |

|

|

$ |

1 |

|

|

$ |

5 |

|

|

$ |

(6 |

) |

|

$ |

20 |

|

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

17

|

|

|

|

FINANCIAL INSIGHTS

|

GAAP Income (continued)

Redwood Parent

|

|

Net interest income at Redwood increased to $26 million in the fourth quarter from $24 million inthe third quarter, primarily as a result of higher interest earned on residential senior securities and unsecuritized residential loans.

|

|

|

Interest income from senior residential securities increased $1 million to $25 million during the fourthquarter as a result of slightly faster prepayment speeds on certain securities. The amount of income we recognize on senior securities is most affected by changes in prepayment rates, and to a lesser extent, changes in interest rates and credit performance.

|

|

|

In the near term, we expect interest income will be primarily derived from our residential securities.However, our rate of investment activity for this portfolio has declined in recent quarters. In future periods, we expect our expanding residential and commercial loan businesses to contribute more significantly to interest income.

|

|

|

During the fourth quarter, loans accumulated for securitization generated $2 million of interest income.The amount of interest income we will earn in future periods from loans accumulated for securitization will vary with the amount of loans acquired, the timing of the loan acquisitions, and the timing of securitizations.

|

|

|

Interest expense totaled $2 million in the fourth quarter, of which the large majority was related toour long-term debt and the related hedges. To hedge the variability in our long-term debt interest expense, we entered into interest rate swaps with aggregate notional values totaling $140 million during the first quarter of 2010, fixing our gross interest expense yield at 6.75%. These swaps are accounted for as cash flow hedges with all interest income recorded as a component of net interest income and other valuation changes recorded as a component of equity through the life of the hedge.

|

|

|

Net positive market valuation adjustments were $2 million in the fourth quarter. These were the resultof a $4 million change in the value of derivatives used to manage certain risks associated with our accumulation of residential loans. Partially offsetting this positive change were impairments of $1 million and a $1 million decline in the value of certain residential securities we mark-to-market through the income statement.

|

|

|

During the fourth quarter of 2010, we recognized $1 million of gains on called securities. When asecurity we own is called we receive a cash payment equal to the outstanding principal and, to the extent this is above our carrying value, a gain is realized. There were no sales of securities during the fourth quarter.

|

|

18

|

THE REDWOOD REVIEW 4TH QUARTER 2010

|

GAAP Income (continued)

Redwood Parent (continued)

|

u

|

The following table presents the components of Redwood’s operating expenses for the fourth and third quarters of 2010.

|

| |

|

|

Operating Expenses at Redwood

|

|

|

($ in millions)

|

|

| |

|

Three Months Ended

|

|

| |

|

12/31/10

|

|

|

9/30/10

|

|

|

Fixed compensation expense

|

|

$ |

3 |

|

|

$ |

3 |

|

|

Variable compensation expense

|

|

|

2 |

|

|

|

2 |

|

|

Equity compensation expense

|

|

|

2 |

|

|

|

2 |

|

|

Total compensation expense

|

|

$ |

7 |

|

|

$ |

7 |

|

| |

|

|

|

|

|

|

|

|

|

Systems

|

|

|

2 |

|

|

|

2 |

|

|

Office costs

|

|

|

2 |

|

|

|

2 |

|

|

Accounting and legal

|

|

|

2 |

|

|

|

1 |

|

|

Total non-compensation expense

|

|

$ |

6 |

|

|

$ |

5 |

|

| |

|

|

|

|

|

|

|

|

|

Total operating expense

|

|

$ |

13 |

|

|

$ |

12 |

|

|

u

|

In the fourth quarter, operating expenses at Redwood were $13 million and remained in line with our expectations.

|

New Sequoia

|

u

|

Information about New Sequoia’s contribution to Redwood’s earnings and other related comments are in the Investments in New Sequoia module on page 31.

|

Other Consolidated Entities

|

|