|

|

|

|

TABLE OF CONTENTS

|

|

Introduction

|

4

|

| |

|

|

Shareholder Letter

|

5

|

| |

|

|

Quarterly Overview

|

7

|

| |

|

|

Financial Insights

|

11

|

| |

|

|

u Book Value

|

11

|

| |

|

|

u Balance Sheet

|

12

|

| |

|

|

u GAAP Income

|

17

|

| |

|

|

u Taxable Income and Dividends

|

21

|

| |

|

|

u Cash Flow

|

22

|

| |

|

|

Residential Mortgage Loan Business

|

24

|

| |

|

|

Investments in New Sequoia

|

25

|

| |

|

|

Residential Real Estate Securities

|

26

|

| |

|

|

Commercial Real Estate

|

30

|

| |

|

|

Legacy Investments in Other Consolidated Entities

|

31

|

| |

|

| |

|

|

Appendix

|

|

| |

|

|

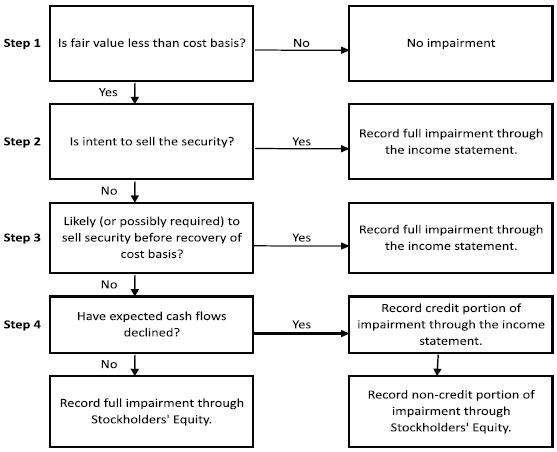

Accounting Discussion

|

34

|

| |

|

|

Glossary

|

35

|

| |

|

|

Financial Tables

|

41

|

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

1

|

|

|

|

CAUTIONARY STATEMENT

|

Cautionary Statement

This Redwood Review contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve numerous risks and uncertainties. Our actual results may differ from our expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements are not historical in nature and can be identified by words such as "anticipate," "estimate," "will," "should," "expect," "believe," "intend," "seek," "plan," and similar expressions or their negative forms, or by references to strategy, plans, or intentions. These forward-looking statements are subject to risks and uncertainties, including, among other things, those described in our most recent Annual Report on Form 10-K under the caption "Risk Factors." Other risks, uncertainties, and factors that could cause actual results to differ materially from those projected are described below and may be described from time to time in reports we file with the Securities and Exchange Commission, including reports on Forms 10-K, 10-Q, and 8-K. We undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Statements regarding the following subjects, among others, are forward-looking by their nature: (i) our belief that rebuilding our core residential and commercial businesses of managing, facilitating, and investing in mortgage credit offers the best long-term opportunity to increase earnings and dividends and to build franchise value for our shareholders; (ii) our competitive position and our ability to compete in the future, including our ability to effectively compete to acquire residential mortgage loans and our statement that we are making steady progress in building relationships with loans sellers and our ability to compete to originate and acquire commercial real estate loans; (iii) our future investment strategy and our ability to find attractive investments and future trends relating to our pace of acquiring or selling assets, including, without limitation, statements relating to our efforts to acquire residential mortgage loans, make commercial real estate investments, and potentially leverage the capital we have invested in commercial real estate investments without taking funding risk; (iv) our plan to acquire the $201 million of loans comprising the pipeline of residential mortgage loans that, as of the end of the second quarter of 2011, we planned to purchase through our conduit program and our plan to acquire additional loans that we have already added, or plan in the future to add, to our pipeline after the end of the second quarter of 2011, including the $198 million of loans comprising the pipeline of residential mortgage loans as of July 29, 2011; (v) our belief that our hedging strategy relating to loans acquired through our conduit has worked well in the face of significant interest rate volatility and that, if we use effective hedging strategies, a loss on hedges that relate to mortgage loans we are holding for future securitization will be roughly matched by an increase in the value of those loans; (vi) our belief that our loan conduit business and the systems and operational infrastructure we have in place for our loan conduit business can handle a substantially higher volume of business without a significant increase in our cost base and our statement that we believe the scale of the operational infrastructure we have in place will ultimately pay off; (vii) future securitization transactions, the timing of the completion of those future securitization transactions, and the number and size of such transactions we expect to complete in 2011 and future periods, which future securitizations may not be completed when planned or at all, and, more generally, statements regarding the likelihood and timing of, and our participation in, future securitization transactions and our ability to finance loan acquisitions through the execution of securitization transactions; (viii) our expectation that new Sequoia securitization entities will represent a larger portion of our balance sheet in the future; (ix) our statement that we expect to recover an aggregate of $6 million of loan loss reserves that relate to eleven Sequoia securitization entities in future periods upon the payoff or deconsolidation of those entities; (x) our expectations of future levels of our securities purchase and sale activity and our plans to invest our excess capital and our statements relating to the cash flows we expect to receive from our investments in securities; (xi) that we do not anticipate considering raising equity capital financing before 2012, that we do not plan to raise equity capital unless we believe we have attractive investment opportunities that exceed our investment capacity, our estimates of our short-term borrowing capacity, our investment capacity, and our excess capital, our statements regarding our ability to access additional short-term borrowings and to access capital through re-securitization transactions or other forms of debt financing, and our expectation that we will have established a warehouse borrowing facility to finance the acquisition of residential mortgage loans in the next several months; (xii) future market and economic conditions, including, without limitation, future conditions in the residential and commercial real estate markets and related financing markets, and the related potential opportunities for our residential and commercial businesses; (xiii) that the size of the jumbo residential mortgage market is potentially vast and could represent an opportunity that exceeds the current capital we have to invest and the potential that regulatory reforms could increase the size of the jumbo mortgage market, our statement that these trends could present a growth opportunity for us and our statements regarding our beliefs about our competitive advantages; (xiv) our beliefs about, and our outlook for, the future direction of housing market fundamentals, including, without limitation, home prices, demand for housing, delinquency rates, foreclosure rates, prepayment rates, inventory of homes for sale, and mortgage interest rates and their potential impact on our business and results of operations and our belief that the housing market is in the process of forming a bottom and our expectation that housing, in general, will not be a significantly appreciating asset class for several years; (xv) our beliefs about the future direction of commercial real estate fundamentals and statements regarding the competitive landscape for and availability of financing for commercial real estate; (xvi) our estimate that our commercial real estate loan originations are likely to be in the range of $25 million to $50 million per quarter over the next several quarters, and statements regarding the future of the CMBS market; (xvii) statements relating to the impact of recent and future legislative and regulatory changes that affect our business, the regulation of securitization transactions, and the mortgage finance markets, the manner in which the reform of the GSEs, including Fannie Mae and Freddie Mac, may take place and the timeline for that reform, and our statements that GSE reform and bank regulatory capital reforms could result in a larger portion of the mortgage market being available to us; (xviii) our expectations regarding credit reserves, credit losses, the adequacy of credit support, and impairments and their impact on our investments (including as compared to our original expectations and credit reserve levels) and the timing of losses and impairments, and statements that the amount of credit reserves we designate may require changes in the future; (ixx) that we continue to expect interest income to be derived primarily from our senior residential securities and that in future periods we expect our residential and commercial loan businesses to expand and contribute more significantly to interest income; (xx) expectations regarding future interest income, future earnings, future earnings volatility, and future trends in operating expenses and the factors that may affect those trends; (xxi) our board of directors' intention to pay a regular dividend of $0.25 per share per quarter in 2011; and (xxii) our expectations relating to tax accounting, including our expectation that we will realize a taxable loss for the full year 2011, and our anticipation of additional credit losses for tax purposes in 2011 and future periods and the level of those losses.

|

2

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

Cautionary Statement (continued)

Important factors, among others, that may affect our actual results include: general economic trends, the performance of the housing, commercial real estate, mortgage, credit, and broader financial markets, and their effects on the prices of earning assets and the credit status of borrowers; federal and state legislative and regulatory developments, and the actions of governmental authorities, including those affecting the mortgage industry or our business; our exposure to credit risk and the timing of credit losses within our portfolio; the concentration of the credit risks we are exposed to, including due to the structure of assets we hold and the geographical concentration of real estate underlying assets we own; our exposure to adjustable-rate and negative amortization mortgage loans; the efficacy and expense of our efforts to manage or hedge credit risk, interest rate risk, and other financial and operational risks; changes in credit ratings on assets we own and changes in the rating agencies' credit rating methodologies; changes in interest rates; changes in mortgage prepayment rates; the availability of assets for purchase at attractive prices and our ability to reinvest cash we hold; changes in the values of assets we own; changes in liquidity in the market for real estate securities and loans; our ability to finance the acquisition of real estate-related assets with short-term debt; the ability of counterparties to satisfy their obligations to us; our involvement in securitization transactions and the risks we are exposed to in engaging in securitization transactions; exposure to litigation arising from our involvement in securitization transactions; whether we have sufficient liquid assets to meet short-term needs; our ability to successfully compete and retain or attract key personnel; our ability to adapt our business model and strategies to changing circumstances; changes in our investment, financing, and hedging strategies and new risks we may be exposed to if we expand our business activities; exposure to environmental liabilities and the effects of global climate change; failure to comply with applicable laws and regulations; our failure to maintain appropriate internal controls over financial reporting and disclosure controls and procedures; the impact on our reputation that could result from our actions or omissions or from those of others; changes in accounting principles and tax rules; our ability to maintain our status as a real estate investment trust (REIT) for tax purposes; limitations imposed on our business due to our REIT status and our status as exempt from registration under the Investment Company Act of 1940; decisions about raising, managing, and distributing capital; and other factors not presently identified.

This Redwood Review may contain statistics and other data that in some cases have been obtained from or compiled from information made available by servicers and other third-party service providers.

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

3

|

|

|

|

INTRODUCTION

|

Note to Readers:

We file annual reports (on Form 10-K) and quarterly reports (on Form 10-Q) with the Securities and Exchange Commission. These filings and our earnings press releases provide information about Redwood and our financial results in accordance with generally accepted accounting principles (GAAP). We urge you to review these documents, which are available through our website, www.redwoodtrust.com.

This document, called The Redwood Review, is an additional format for providing information about Redwood through a discussion of many GAAP as well as non-GAAP metrics, such as taxable income and economic book value. Supplemental information is also provided in the Financial Tables in this Review to facilitate more detailed understanding and analysis of Redwood. When we use non-GAAP metrics it is because we believe that these figures provide additional insight into Redwood’s business. In each case in which we discuss a non-GAAP metric you will find an explanation of how it has been calculated, why we think the figure is important, and a reconciliation between the GAAP and non-GAAP figures.

References herein to “Redwood,” the “company,” “we,” “us,” and “our” include Redwood Trust, Inc. and its consolidated subsidiaries. References to “at Redwood” and “Redwood Parent” exclude all consolidated securitization entities in order to present our operations in the way management analyzes them.

Note that because we round numbers in the tables to millions, except per share amounts, some numbers may not foot due to rounding.

We hope you find this Review helpful to your understanding of our business. We thank you for your input and suggestions, which have resulted in our changing the form and content of The Redwood Review over time.

We welcome your continued interest and comments.

| |

|

|

|

|

|

|

|

Selected Financial Highlights

|

| |

|

|

|

|

|

|

|

Quarter:Year

|

GAAP Income (Loss)

per Share

|

Taxable

Income (Loss)

per Share(1)

|

Annualized

GAAP Return

on Equity

|

GAAP Book

Value per

Share

|

Non-GAAP

Economic

Value per

Share (2)

|

Dividends

per Share

|

|

Q209

|

$0.10

|

($0.16)

|

5%

|

$10.35

|

$11.30

|

$0.25

|

|

Q309

|

$0.34

|

($0.30)

|

13%

|

$11.68

|

$12.28

|

$0.25

|

|

Q409

|

$0.51

|

($0.44)

|

17%

|

$12.50

|

$13.03

|

$0.25

|

|

Q110

|

$0.58

|

$0.01

|

19%

|

$12.84

|

$13.32

|

$0.25

|

|

Q210

|

$0.35

|

($0.03)

|

11%

|

$12.71

|

$13.37

|

$0.25

|

|

Q310

|

$0.25

|

($0.11)

|

8%

|

$13.02

|

$13.73

|

$0.25

|

|

Q410

|

$0.18

|

($0.07)

|

6%

|

$13.63

|

$14.31

|

$0.25

|

|

Q111

|

$0.22

|

$0.06

|

8%

|

$13.76

|

$14.45

|

$0.25

|

|

Q211

|

$0.11

|

($0.00)

|

4%

|

$13.04

|

$13.82

|

$0.25

|

|

(1) Taxable income (loss) per share for 2010 and 2011 are estimates until we file tax returns for that year.

|

| |

|

(2) Non-GAAP economic value per share is calculated using estimated bid-side values (which take into account available bid-side marks) for our financial assets and estimated offer-side values (which take into account available offer-side marks) for our financial liabilities and we believe it more accurately reflects liquidation value than does GAAP book value per share. Non-GAAP economic value per share is reconciled to GAAP book value per share in Table 3 in the Financial Tables in this Review.

|

|

4

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

|

|

|

|

SHAREHOLDER LETTER

|

Dear Fellow Shareholders:

We often tinker with the format of and discussion topics in the Redwood Review in an attempt to provide relevant and fresh insights into management’s thinking. Most times the tinkering helps, but every so often, we realize we should have left well enough alone.

In one such example, about a year ago we combined the shareholder letter in the Redwood Review, which traditionally focused on the big picture, with the quarterly overview, which focused on current operating and financial results. Upon re-reading many past Redwood Reviews, we believe that move was a mistake. In combining the two discussions, we lost the clarity of measuring our short-term progress and the bumps in the road against a clear long-term strategic backdrop — i.e., where we are heading and why. So starting with this issue of the Review, it’s back to the future and you’ll find a quarterly overview after this letter. We hope you like the change.

We continue to believe that rebuilding our core residential and commercial businesses of managing, facilitating, and investing in mortgage credit offers the best long-term opportunity to increase earnings and dividends and to build franchise value for our shareholders. Why? It plays to our competitive strengths and the potential market opportunity is huge. The big question is how long it will take to realize that “potential,” especially on the residential mortgage front.

The government now subsidizes over 90% of all new residential mortgage originations and large banks can easily portfolio the remainder. As long as these conditions persist, big opportunities for traditional triple-A institutional investors and credit investors like Redwood to provide mortgage financing through private securitization are blocked.

Many real estate agents, home builders, and banks are screaming and lobbying to keep the status quo. In the short-term, they may get their way. Our strategic bet is that, over time, the current outsized role of government supporting a $9.6 trillion residential mortgage market is simply not sustainable, especially in light of the painfully heated debates over raising the $14.3 trillion federal debt ceiling. As the government eventually and gradually withdraws support for mortgage financing, we believe private capital (outside of banks) will be called on to step in and fill the void.

Although the pace of reform is glacial, there are encouraging steps by policymakers and regulators to pave the way for the return of private mortgage financing. The Obama Administration Mortgage Reform Plan calls for the “wind down” of Fannie Mae and Freddie Mac on a responsible timeline. The first step toward this goal could happen on October 1, when the high-cost government conforming loan limit is scheduled by law to drop from $729,750 to $625,500. If we were to hazard a guess, the odds of the loan limit reduction going through seem pretty good. However, you can count on an all-out, two-month assault by pro-status quo forces. So who knows?

Attracting triple-A investors back to buying senior mortgage-backed securities is essential to bringing private mortgage financing back. There are several regulatory and industry reform efforts underway to meet the demands of triple-A investors. These include initiatives around establishing new servicing standards and practices, strengthening structural investor protection mechanisms (in particular, around representations and warranties), improving alignment of interests, and increasing transparency. As part of this process, Redwood has been actively engaged with policymakers, regulators, and industry representatives.

THE REDWOOD REVIEW 2ND QUARTER 2011

|

5

|

|

|

|

SHAREHOLDER LETTER

|

If banks decide to be more active sellers of non-conforming residential mortgage loans, that would also add to the size of Redwood’s opportunity. The good news is that with major banks facing a stricter regulatory environment and higher capital requirements (as proposed under Basel III), they are likely to rethink how they participate in the mortgage market. There are already anecdotes of major banks expressing a willingness to shrink mortgage assets.

Our residential loan conduit and credit investment businesses work together “hand in glove.” The goal is to source high-quality loans on an ongoing basis that we can securitize, thereby creating a flow of attractive credit investments for Redwood and senior investments for triple-A investors. To achieve this goal, we took the approach: “if you build it, they will come.” We believed Redwood needed to demonstrate our ability to bring the highest value to borrowers, lenders, and triple-A investors. In addition, we needed to be recognized as a real and reliable counterparty by loan sellers.

As a result, we invested upfront in sales and back-office personnel, operational infrastructure, and technology. The good news is that, even in this market dominated by government financing, we are making steady progress in building sticky relationships with loan sellers and investors. Furthermore, we believe our loan conduit business can handle substantially higher volume without a significant increase in our cost base. The bad news is that until we put more capital to work in residential credit investments, our conduit cost basis will be a drag on earnings.

Switching gears to the Commercial Group, our opportunity in commercial is very different than that in residential. We are not waiting for a highly government-dominated market to allow the private sector back in. In fact, the commercial market is largely unregulated, with private capital driving the trends in all sectors, with the exception of multi-family finance (dominated by Fannie Mae and Freddie Mac). Our opportunities will not be driven by expected seismic shifts in the market.

Rather, our effort to expand our commercial business is centered on building a team and a franchise, by focusing on getting the underwriting right, starting slow, and learning to walk before we run. We are originating mezzanine loans alongside senior loans extended by banks and insurance companies. We can create opportunities to invest permanent capital and earn good returns, potentially leveraging capital without taking funding risk. We have good relationships with borrowers, senior lenders, and brokers who appreciate our flexibility, responsiveness, and reliability.

In closing, we continue to work hard at building our franchises and growing the businesses where we can create value. We are doing what we have said, recognizing that the pace of progress is, at times, frustratingly slow, but we are confident we are moving in the right direction.

We appreciate your continued interest and support.

|

|

|

Martin S. Hughes

|

Brett D. Nicholas

|

|

President and

|

Executive Vice President,

|

|

Chief Executive Officer

|

Chief Investment Officer, and

|

| |

Chief Operating Officer

|

|

6

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

|

|

|

|

QUARTERLY OVERVIEW

|

QUARTERLY OVERVIEW

In this summary, we will begin with a review of market activity and the overall environment, followed by a brief discussion of our hedging and changes in derivatives values. Next, we will review financial results for the quarter, followed by the fundamentals in and key developments that pertain to our businesses. Finally, we will share our thoughts on our capital position. More details follow this overview in the rest of this Redwood Review.

Second Quarter 2011 Market Environment

What a difference a quarter makes. We began the second quarter with a continuation of the trend that had essentially been in place since early 2009: rising prices, improving liquidity, and tightening bid-ask spreads. In fact, the Federal Reserve’s Maiden Lane portfolio sales were heralded by most market participants (including us) as a welcome source of supply which would help tighten bid-ask spreads. Our prognostication turned out to be wrong.

As the quarter unfolded, a steady stream of bad news — domestic economic trends, the end of the Fed’s QE 2 program, the looming debt ceiling problem in the U.S., and the debt crisis in Europe — contributed to an abrupt turn in market dynamics. Investors pulled back from higher risk securities and bid-ask spreads widened. The trend of consistently higher prices was interrupted in the second quarter of 2011, with residential mortgage-backed securities (RMBS) prices falling across the board — with the sharpest declines for the riskiest securities.

Late in the second quarter and into July, increasingly risk-averse investors in commercial mortgage-backed securities (CMBS) transactions have demanded higher yields and better terms. In a recently marketed new issue CMBS transaction, in fact, investors insisted on increased subordination levels, ignoring what had been set by the rating agencies involved. These developments could help reinforce discipline in the marketplace, which would be constructive for commercial property financings over time.

Accounting for Pipeline Hedging

Interest rate volatility affects the financial results of our conduit business. We hedge our pipeline of loans awaiting securitization, since the value of our loans changes with the level of interest rates. When we incur a loss on our hedges due to an interest rate move, the loss on our hedges is roughly matched by an increase in the value of the loans, assuming we have hedged well. Similarly, a gain on our hedges due to an interest rate move is roughly matched by a decrease in the value of the loans. From a GAAP perspective, the gain or loss on hedging is taken into earnings right away while the loss or gain on the value of the loans is taken through lower or higher interest income over time. Thus, while hedging protects economic values, the accounting treatment results in unavoidable lumpiness in reported results.

THE REDWOOD REVIEW 2ND QUARTER 2011

|

7

|

|

|

|

QUARTERLY REPORT

|

Second Quarter 2011 Results

We are not satisfied with our second quarter results. Fully investing our excess capital alone is not the answer. We have built our origination businesses for more volume than is currently available on the right terms. We believe our scale will ultimately pay off. For now, however, our operating costs are high relative to the net revenues we can earn off our invested capital without taking undue risk. Over time, we plan to invest more capital, leverage our cost structure, and continue to manage risk.

GAAP earnings for the second quarter of 2011 were $9 million or $0.11 per share, down from $18 million or $0.22 per share reported for the first quarter of 2011. The second quarter was affected by lower interest rates, which resulted in a $5 million negative mark-to-market adjustment realized on derivatives used to hedge our residential pipeline, which was an $8 million negative swing from the prior quarter. Said another way, this cost us $0.10 per share relative to first quarter EPS. These derivatives marks are included in market valuation adjustments.

In addition, net interest income declined to $29 million in the second quarter of 2011 from $32 million in the first quarter of 2011. This decline reflects lower average balances of securities (partly reflecting greater sales and paydowns than acquisitions in the first quarter) as well as modestly lower yields (slower prepayments reduced the pace at which we accreted discount into income). Loan loss provisions declined to $2 million in the second quarter, from $3 million in the first quarter of 2011, reflecting better than expected performance trends in previously modified Sequoia loans. Operating expenses remained relatively flat with the first quarter, at $12 million for the quarter.

Book value declined by $0.72 per share in the second quarter of 2011, to $13.04 compared with $13.76. The $50 million decline in book value during the quarter reflected a $37 million decline in the value of securities (which reduced unrealized gains), a $4 million unrealized loss on derivatives, $20 million in dividends, only partially offset by $9 million in net income and $2 million in net other items. We estimate that non-GAAP economic value is $13.81 per share at June 30, 2011. This compares with $14.45 per share estimated as of March 31, 2011.

Residential Loan Business

We continued to sign up more sellers and locked loans throughout the quarter. We deployed $152 million in capital to purchase residential loans in the second quarter. By June 30, 2011, we had a total pipeline of $404 million of residential mortgage loans, comprised of $203 million on our balance sheet (for future securitization) and $201 million of locked loans we planned to purchase. As of July 29, our total pipeline had grown to $500 million. We continue to target two additional securitizations in 2011, even as this goal seems a bit more challenging than it did a few months ago.

We see signs that things are slowly moving in the right direction for private market financing of residential mortgages. Still, we are not idly waiting for external factors to change. We are focused on buying loans from jumbo mortgage originators, realizing that it will likely take until 2012 to start to gain real traction.

|

8

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

|

|

|

|

QUARTERLY OVERVIEW

|

Residential Portfolio

We welcomed the change that took place in the market — in which higher quality securities outperformed riskier securities in the second quarter. We were fortunate to have made some select credit risk sales prior to the market turn and to have found selected opportunities to reinvest at more attractive levels as the second quarter unfolded. Specifically, we put $33 million in capital to work adding new securities to our portfolio, while we sold $9 million in securities at Redwood. We continue to feel good about the expected cash flow from the securities we own.

Early in the second quarter, we completed our sales of the remaining Opportunity Fund positions. We expect to finish our accounting for the Fund and distribute final cash sometime in the third quarter. The Fund did not deliver returns in the range we initially expected, as it was difficult to overcome the decision to launch the Opportunity Fund in late 2007, which clearly turned out to be poor timing. We feel good that our patience and price discipline in liquidating positions helped us to get nearly 100 cents on the dollar back for the investors in the Fund.

Commercial Real Estate

Transaction volumes have increased in 2011 for CMBS lenders, portfolio lenders, and agencies. Most prognosticators continue to expect volumes to expand and CMBS aggregators in particular are staffing up, even as there are some signs of stress in the market. Meanwhile, portfolio lenders — including life insurance companies and banks — are posting strong new origination results for targeted assets. The Government-Sponsored Entities (GSEs) continue to dominate multi-family lending, though life insurance companies, banks, and now CMBS lenders are making inroads.

During the second quarter, we put $29 million of capital to work in three separate loans. Our portfolio consists of $71 million in loans on stabilized multi-family properties, central business district office buildings in major markets, necessity/grocery-anchored retail centers, and hotels with strong brands and operators. We continue to expect to originate in the range of $25 million to $50 million per quarter. Our portfolio has a weighted average maturity of over five years and an average unlevered yield of approximately 10.5%. We plan to provide information on new loans on our website as they are funded.

When Will We Need More Capital?

This is a question on many investors’ minds. With mortgage REITs of all types raising equity, we are often asked if we plan to raise equity as well. Our message is unchanged. We would consider raising equity or another form of long-term capital when investment opportunities make raising capital attractive, providing we have exhausted our ability to raise financing internally. For example, we can (and recently did) look to our residential mortgage-backed securities (RMBS) or commercial loans to raise financing. We always look for ways to leverage our capital without taking undue funding risk.

We estimate that our investment capacity — or the amount of capital we have readily available to support long-term investments — was $210 million as of June 30. We estimate our investment capacity as (1) cash on hand, plus (2) cash we could raise by increasing short-term borrowings to finance all our residential mortgage loans held for securitization, less (3) cash needed to cover short-term operations, working capital, and a liquidity cushion.

THE REDWOOD REVIEW 2ND QUARTER 2011

|

9

|

|

|

|

QUARTERLY REPORT

|

When Will We Need More Capital? (continued)

In July, we resecuritized $365 million (market value) of senior RMBS, freeing up $243 million in capital for us to invest in long-term assets. This capital will increase our investment capacity to over $400 million, once we have established warehouse funding for our pipeline (which we expect to do in the next several months). We expect this amount of capital to allow us to make all the investments we have planned through 2011. Thus, we would not anticipate considering raising equity before 2012.

|

10

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

|

|

|

|

FINANCIAL INSIGHTS

|

|

„

|

The following table shows the components of our GAAP book value at June 30 and March 31, 2011.

|

| |

|

|

|

|

|

|

|

Components of GAAP Book Value(1)

|

|

|

($ in millions, except per share data)

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

As of

|

|

| |

|

6/30/2011

|

|

|

3/31/2011

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

80 |

|

|

$ |

220 |

|

| |

|

|

|

|

|

|

|

|

|

Real estate loans at Redwood

|

|

|

|

|

|

|

|

|

|

Residential

|

|

|

205 |

|

|

|

55 |

|

|

Commercial

|

|

|

71 |

|

|

|

42 |

|

|

Total real estate loans at Redwood

|

|

$ |

276 |

|

|

$ |

97 |

|

| |

|

|

|

|

|

|

|

|

|

Real estate securities at Redwood

|

|

|

|

|

|

|

|

|

|

Residential

|

|

|

754 |

|

|

|

780 |

|

|

Commercial

|

|

|

6 |

|

|

|

7 |

|

|

CDO

|

|

|

1 |

|

|

|

1 |

|

|

Total real estate securities at Redwood

|

|

$ |

761 |

|

|

$ |

788 |

|

| |

|

|

|

|

|

|

|

|

|

Investments in Sequoia

|

|

|

90 |

|

|

|

97 |

|

|

Investments in Acacia

|

|

|

1 |

|

|

|

2 |

|

|

Investments in the Fund

|

|

|

3 |

|

|

|

11 |

|

|

Other assets

|

|

|

39 |

|

|

|

34 |

|

|

Total assets

|

|

$ |

1,250 |

|

|

$ |

1,249 |

|

| |

|

|

|

|

|

|

|

|

|

Short-term debt

|

|

|

(41 |

) |

|

|

- |

|

|

Long-term debt

|

|

|

(140 |

) |

|

|

(140 |

) |

| |

|

|

|

|

|

|

|

|

|

Other liabilities

|

|

|

(44 |

) |

|

|

(34 |

) |

| |

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

$ |

1,025 |

|

|

$ |

1,075 |

|

| |

|

|

|

|

|

|

|

|

|

Book value per share

|

|

$ |

13.04 |

|

|

$ |

13.76 |

|

|

„

|

During the second quarter of 2011, our GAAP book value decreased by $0.72 per share to $13.04 per share. The decrease resulted from $0.11 per share in reported earnings, which was offset by $0.47 per share in net valuation decreases on securities not reflected in earnings, $0.06 per share in decreases in value of hedges related to long-term debt not reflected in earnings, $0.05 per share in other net negative items, and $0.25 per share in dividends paid to shareholders.

|

|

„

|

At June 30, 2011, our estimate of non-GAAP economic value was $13.81 per share, or $0.77 per share higher than our reported GAAP book value. Approximately $0.78 of this difference relates to an economic valuation of our long-term debt of $78 million, which is $62 million below the unamortized cost basis used to determine GAAP book value. The difference of negative $0.01 relates to an economic valuation of our net investment in Sequoia of $89 million, which is $1 million below the estimated cost basis used to determine GAAP book value. For all other components of book value, the GAAP values equal our estimated economic values. A further reconciliation of our estimate of non-GAAP economic value to GAAP book value is set forth in Table 3 of the Appendix.

|

1 This table presents our assets and liabilities as calculated and reported under GAAP and as adjusted to reflect our investments in the Redwood Opportunity Fund, L.P. (the Fund) and in Sequoia and Acacia securitization entities in separate line items, similar to the equity method of accounting, reflecting the reality that the underlying assets and liabilities of these entities are legally not ours. We own only the securities and interests that we have acquired from these entities.

THE REDWOOD REVIEW 2ND QUARTER 2011

|

11

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet

|

„

|

The following table shows the components of our balance sheet at June 30, 2011.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidating Balance Sheet

|

|

|

June 30, 2011

|

|

|

($ in millions)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At Redwood

|

|

|

New Sequoia

|

|

|

Other Consolidated Entities

|

|

|

Intercompany

|

|

|

Redwood Consolidated

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential real estate loans

|

|

$ |

205 |

|

|

$ |

392 |

|

|

$ |

3,263 |

|

|

$ |

- |

|

|

$ |

3,860 |

|

|

Commercial real estate loans

|

|

|

71 |

|

|

|

- |

|

|

|

13 |

|

|

|

- |

|

|

|

84 |

|

|

Real estate securities

|

|

|

761 |

|

|

|

- |

|

|

|

277 |

|

|

|

- |

|

|

|

1,038 |

|

|

Investments in New Sequoia

|

|

|

37 |

|

|

|

- |

|

|

|

- |

|

|

|

(37 |

) |

|

|

- |

|

|

Investment in Other Consolidated Entities

|

|

|

57 |

|

|

|

- |

|

|

|

- |

|

|

|

(57 |

) |

|

|

- |

|

|

Cash and cash equivalents

|

|

|

80 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

80 |

|

|

Total earning assets

|

|

|

1,211 |

|

|

|

392 |

|

|

|

3,552 |

|

|

|

(93 |

) |

|

|

5,062 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets

|

|

|

39 |

|

|

|

4 |

|

|

|

60 |

|

|

|

- |

|

|

|

103 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

1,250 |

|

|

$ |

396 |

|

|

$ |

3,613 |

|

|

$ |

(93 |

) |

|

$ |

5,165 |

|

|

Short-term debt

|

|

$ |

41 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

41 |

|

|

Other liabilities

|

|

|

44 |

|

|

|

1 |

|

|

|

72 |

|

|

|

- |

|

|

|

119 |

|

|

Asset-backed securities issued

|

|

|

- |

|

|

|

358 |

|

|

|

3,481 |

|

|

|

- |

|

|

|

3,839 |

|

|

Long-term debt

|

|

|

140 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

140 |

|

|

Total liabilities

|

|

|

225 |

|

|

|

359 |

|

|

|

3,554 |

|

|

|

- |

|

|

|

4,138 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

1,025 |

|

|

|

37 |

|

|

|

57 |

|

|

|

(93 |

) |

|

|

1,025 |

|

|

Noncontrolling interest

|

|

|

- |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

|

2 |

|

|

Total equity

|

|

|

1,025 |

|

|

|

37 |

|

|

|

59 |

|

|

|

(93 |

) |

|

|

1,027 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity

|

|

$ |

1,250 |

|

|

$ |

396 |

|

|

$ |

3,613 |

|

|

$ |

(93 |

) |

|

$ |

5,165 |

|

|

„

|

We present this table to highlight the impact that consolidation has on our GAAP balance sheet. As shown, Redwood’s $94 million GAAP investment in the consolidated entities (including the consolidated entities we refer to as New Sequoia) increased our consolidated assets by $4.0 billion and liabilities by $3.9 billion.

|

|

„

|

We are required under GAAP to consolidate all of the assets and liabilities of the Fund (due to our significant general and limited partnership interests in the Fund and asset management responsibilities) and certain Sequoia and Acacia securitization entities that are treated as secured borrowing transactions. However, the securitized assets of these entities are not available to Redwood. Similarly, the liabilities of these entities are obligations payable only from the cash flow generated by their securitized assets and are not obligations of Redwood.

|

|

„

|

The consolidating balance sheet presents the New Sequoia securitization entities separately from Other Consolidated Entities to highlight our renewed focus on growing our core business of creating residential credit investments. As we complete additional securitizations, we expect New Sequoia securitization entities to represent a larger portion of our consolidated balance sheet as prior Sequoia securitization entities continue to pay down.

|

|

12

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

|

„

|

At June 30, 2011, we had $205 million of residential real estate loans, compared to $55 million at March 31, 2011. The increase reflects the $152 million of residential loan acquisitions (net of $2 million in paydowns) in the second quarter. We intend to securitize most of these residential loans (and others we have identified for future acquisition), at which point they will be reflected in the “New Sequoia” column on the consolidating balance sheet shown on page 12.

|

|

„

|

At June 30, 2011, we had $71 million of commercial real estate loans held for investment, compared to $42 million at March 31, 2011. The increase reflects the origination of three loans totaling $29 million in the second quarter. We started originating commercial loans in the fourth quarter of 2010 and we intend to hold these loans for investment. See the Commercial Real Estate module on page 30 for more information.

|

|

„

|

The following table presents the fair value (which equals GAAP carrying value) of real estate securities at Redwood at June 30, 2011. We segment our securities portfolio by vintage (the year(s) the securities were issued), priority of cash flow (senior, re-REMIC, and subordinate), and by quality of underlying residential loans (prime and non-prime).

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Securities at Redwood

|

|

|

June 30, 2011

|

|

|

($ in millions)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

% of Total

|

|

| |

|

<=2004

|

|

|

2005

|

|

|

|

2006-2008 |

|

|

Total

|

|

|

Securities

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seniors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prime

|

|

$ |

12 |

|

|

$ |

208 |

|

|

$ |

66 |

|

|

$ |

286 |

|

|

|

38 |

% |

|

Non-prime(1)

|

|

|

108 |

|

|

|

193 |

|

|

|

6 |

|

|

|

307 |

|

|

|

40 |

% |

|

Total Seniors

|

|

$ |

120 |

|

|

$ |

401 |

|

|

$ |

72 |

|

|

$ |

593 |

|

|

|

78 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Re-REMIC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prime

|

|

$ |

2 |

|

|

$ |

11 |

|

|

$ |

65 |

|

|

$ |

78 |

|

|

|

10 |

% |

|

Total Re-REMIC

|

|

$ |

2 |

|

|

$ |

11 |

|

|

$ |

65 |

|

|

$ |

78 |

|

|

|

10 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subordinates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prime

|

|

$ |

62 |

|

|

$ |

6 |

|

|

$ |

4 |

|

|

$ |

72 |

|

|

|

9 |

% |

|

Non-prime(1)

|

|

|

11 |

|

|

|

- |

|

|

|

- |

|

|

|

11 |

|

|

|

2 |

% |

|

Total Subordinates

|

|

$ |

73 |

|

|

$ |

6 |

|

|

$ |

4 |

|

|

$ |

83 |

|

|

|

11 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Residential

|

|

$ |

195 |

|

|

$ |

418 |

|

|

$ |

141 |

|

|

$ |

754 |

|

|

|

99 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial subordinates

|

|

$ |

5 |

|

|

$ |

1 |

|

|

$ |

- |

|

|

$ |

6 |

|

|

|

1 |

% |

|

CDO subordinates

|

|

$ |

- |

|

|

$ |

1 |

|

|

$ |

- |

|

|

$ |

1 |

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total real estate securities

|

|

$ |

200 |

|

|

$ |

420 |

|

|

$ |

141 |

|

|

$ |

761 |

|

|

|

100 |

% |

|

(1) Non-prime residential securities consist of $316 million of Alt-A senior and subordinate and $2 million of subprime subordinate securities.

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

13

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

|

Real Estate Securities (continued)

|

|

„

|

The table below details the change in fair value of securities at Redwood during the second and first quarters of 2011.

|

| |

|

|

|

|

|

|

|

Real Estate Securities at Redwood

|

|

|

($ in millions)

|

|

| |

|

|

|

|

|

|

| |

|

Three Months Ended

|

|

| |

|

6/30/2011

|

|

|

3/31/2011

|

|

|

Beginning fair value

|

|

$ |

788 |

|

|

$ |

823 |

|

| |

|

|

|

|

|

|

|

|

|

Acquisitions

|

|

|

33 |

|

|

|

13 |

|

|

Sales

|

|

|

(9 |

) |

|

|

(35 |

) |

|

Effect of principal payments

|

|

|

(21 |

) |

|

|

(23 |

) |

|

Change in fair value, net

|

|

|

(30 |

) |

|

|

10 |

|

| |

|

|

|

|

|

|

|

|

|

Ending fair value

|

|

$ |

761 |

|

|

$ |

788 |

|

|

„

|

Our acquisitions in the second quarter included $9 million of prime senior securities, $21 million of prime subordinate securities, and $3 million of non-prime senior securities, all from 2005 and earlier vintages. We sold $9 million of prime senior securities in the second quarter.

|

|

„

|

From the end of the second quarter of 2011 through July 29, 2011, we acquired $14 million of securities at Redwood, and there were no sales.

|

|

Investments in the Fund and the Securitization Entities

|

|

„

|

Our investments in the Fund, Sequoia, and Acacia securitization entities, as reported for GAAP, totaled $94 million at June 30, 2011.

|

|

„

|

At June 30, 2011, the GAAP carrying value and the fair value of our investment in the Fund was $3 million, consisting of cash that we expect will be distributed in the third quarter.

|

|

„

|

At June 30, 2011, the GAAP carrying value of our investments in Sequoia (new and legacy) was $90 million and management’s estimate of the non-GAAP economic value of those investments was $89 million. We estimate the non-GAAP economic value for these investments, consisting of $53 million of IOs and $36 million of senior and subordinate securities, using the same valuation process that we follow to fair value our other real estate securities. For GAAP, we account for these assets and liabilities at historical cost, and the net $90 million carrying value represents the difference between the carrying costs of the assets ($3.7 billion) and liabilities ($3.6 billion) of the Sequoia entities.

|

|

„

|

At June 30, 2011, the GAAP carrying value of our investments in Acacia entities was $1 million.

|

|

14

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

|

„

|

At June 30, 2011, we had $41 million of short-term debt outstanding, compared to no short-term debt outstanding at March 31, 2011. We use short-term debt, in addition to our excess cash, to finance the acquisition of residential mortgage loans prior to securitizing them through our Sequoia securitization platform. In mid-July, our short-term debt was repaid from the proceeds of a resecuritization of a portion of our senior securities. As of July 29, 2011, we had no short-term debt outstanding.

|

|

„

|

At June 30, 2011, we had $140 million of long-term debt outstanding with a stated interest rate of three-month LIBOR plus 225 basis points due in 2037. In 2010, we effectively fixed the interest rate on this long-term debt through interest rate swaps at a rate of approximately 6.75%.

|

|

„

|

Although we report our long-term debt based on its $140 million historical cost, we estimate the non-GAAP economic value of this debt at $78 million based on its stated interest rate using the same valuation process used to fair value our other financial assets and liabilities.

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

15

|

|

|

|

FINANCIAL INSIGHTS

|

Balance Sheet (continued)

|

„

|

At June 30, 2011, our total capital was $1.2 billion, including $1.0 billion of shareholders’ equity and $140 million of long-term debt. We use our capital to invest in earning assets, meet lender capital requirements, and to fund our operations and working capital needs.

|

|

„

|

We manage our capital through our risk-adjusted capital policy, which has served us well since the company was founded. We have successfully managed through two tumultuous periods (1998 and 2008) and we remain thoughtful about managing funding risk when we use short-term debt.

|

|

„

|

Our cash balance was $80 million at June 30, 2011. We hold cash for two main reasons. First, we hold sufficient cash to comply with covenants, to meet potential margin calls, and to cover near-term cash operating expenses. Second, we hold cash in anticipation of having opportunities to invest in long-term assets at attractive yields.

|

|

„

|

Cash was a good barometer of our ability to invest when we used only cash to fund long-term investments. We are now using cash and short-term borrowings to fund the accumulation of loans on a temporary basis. Thus, the amount of reported cash alone tells us little about the capital we have available for long-term investments.

|

|

„

|

We estimate that our immediately available investment capacity was $210 million at June 30, 2011, down from $249 million at March 31, 2011. This capacity to make long-term investments equals the amount of cash we have, plus the cash we estimate could be readily available to us by financing our residential loans held for securitization with short-term borrowings, less the amount of cash we set aside for operating expenses, pending trades, and potential margin requirements. The decrease in our investment capacity reflects our investments in commercial loans and residential securities during the second quarter.

|

|

„

|

In mid-July 2011, we completed a resecuritization of $365 million (market value) of senior securities and generated net cash proceeds of $243 million. Although the resecuritization will be accounted for as a financing for GAAP and for tax purposes, the resecuritized assets were transfered to a bankruptcy-remote securitization trust and we retained only the subordinate tranche of securities issued by that trust. This transaction provided permanent financing for those senior securities included in the resecuritization and generated additional investment capital.

|

|

„

|

In the near term, we do not anticipate a need to raise equity. Although we plan to invest much of our excess capital in 2011, we are more likely to look to our investments, including our commercial real estate loans, as a source of liquidity by applying permanent financing to them at the appropriate time. We always retain the flexibility to raise equity or other forms of capital in the future, but our practice is to ask shareholders for new equity only when we believe we have attractive investment opportunities that exceed our longer-term investment capacity.

|

|

16

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

|

|

|

|

FINANCIAL INSIGHTS

|

|

„

|

The following table provides a summary of our consolidated GAAP income for the second and first quarters of 2011.

|

| |

|

|

|

|

|

|

|

GAAP Income

|

|

|

($ in millions, except per share data)

|

|

| |

|

Three Months Ended

|

|

| |

|

6/30/2011

|

|

|

3/31/2011

|

|

|

Interest income

|

|

$ |

53 |

|

|

$ |

54 |

|

|

Interest expense

|

|

|

(24 |

) |

|

|

(22 |

) |

|

Net interest income

|

|

|

29 |

|

|

|

32 |

|

| |

|

|

|

|

|

|

|

|

|

Provision for loan losses

|

|

|

(2 |

) |

|

|

(3 |

) |

|

Market valuation adjustments, net

|

|

|

(11 |

) |

|

|

(6 |

) |

|

Net interest income after provision and market valuation adjustments

|

|

|

17 |

|

|

|

24 |

|

| |

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

(12 |

) |

|

|

(12 |

) |

|

Realized gains on sales and calls, net

|

|

|

6 |

|

|

|

4 |

|

|

Noncontrolling interest

|

|

|

(1 |

) |

|

|

2 |

|

|

Provision for income taxes

|

|

|

(0 |

) |

|

|

(0 |

) |

| |

|

|

|

|

|

|

|

|

|

GAAP income

|

|

$ |

9 |

|

|

$ |

18 |

|

| |

|

|

|

|

|

|

|

|

|

GAAP income per share

|

|

$ |

0.11 |

|

|

$ |

0.22 |

|

|

„

|

Our consolidated GAAP income for the second quarter was $9 million, or $0.11 per share, as compared to $18 million, or $0.22 per share, for the previous quarter. The decrease was primarily a result of lower net interest income from securities as sales and principal paydowns outpaced acquisitions and originations, as they affected second quarter average balances. In addition, due to declining interest rates during the quarter, we recorded higher negative market valuation adjustments on derivatives used to hedge our residential loans pipeline.

|

|

„

|

Additional information related to GAAP income at Redwood, New Sequoia, and Other Consolidated Entities is discussed in the following pages.

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

17

|

|

|

|

FINANCIAL INSIGHTS

|

GAAP Income (continued)

Summary (continued)

|

„

|

The following tables show the estimated effect that Redwood, New Sequoia, and our Other Consolidated Entities had on GAAP income for the second and first quarters of 2011.

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidating Income Statement

|

|

|

Three Months Ended June 30, 2011

|

|

|

($ in millions)

|

|

| |

|

|

|

|

|

|

|

|

|

| |

At Redwood

|

|

|

New Sequoia

|

|

|

Other Consolidated Entities

|

|

|

Intercompany Adjustments

|

|

|

Redwood Consolidated

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

$ |

16 |

|

|

$ |

5 |

|

|

$ |

25 |

|

|

$ |

- |

|

|

$ |

45 |

|

|

Net discount (premium) amortization

|

|

|

10 |

|

|

|

- |

|

|

|

(2 |

) |

|

|

- |

|

|

|

8 |

|

|

Total interest income

|

|

|

26 |

|

|

|

5 |

|

|

|

23 |

|

|

|

- |

|

|

|

53 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(2 |

) |

|

|

(4 |

) |

|

|

(17 |

) |

|

|

- |

|

|

|

(24 |

) |

|

Net interest income

|

|

|

23 |

|

|

|

1 |

|

|

|

5 |

|

|

|

- |

|

|

|

29 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for loan losses

|

|

|

- |

|

|

|

(0 |

) |

|

|

(2 |

) |

|

|

- |

|

|

|

(2 |

) |

|

Market valuation adjustments, net

|

|

|

(7 |

) |

|

|

- |

|

|

|

(4 |

) |

|

|

- |

|

|

|

(11 |

) |

|

Net interest income (loss) after provision and market valuation adjustments

|

|

|

16 |

|

|

|

1 |

|

|

|

(0 |

) |

|

|

- |

|

|

|

17 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

(12 |

) |

|

|

(0 |

) |

|

|

(0 |

) |

|

|

- |

|

|

|

(12 |

) |

|

Realized gains on sales and calls, net

|

|

|

4 |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

|

6 |

|

|

Income from New Sequoia

|

|

|

1 |

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

Income from Other Consolidated Entities

|

|

|

0 |

|

|

|

- |

|

|

|

- |

|

|

|

(0 |

) |

|

|

- |

|

|

Noncontrolling interest

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

|

(1 |

) |

|

Provision for income taxes

|

|

|

(0 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(0 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

9 |

|

|

$ |

1 |

|

|

$ |

0 |

|

|

$ |

(1 |

) |

|

$ |

9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidating Income Statement

|

|

|

Three Months Ended March 31, 2011

|

|

|

($ in millions)

|

|

| |

|

|

|

|

|

|

|

|

|

| |

At Redwood

|

|

|

New Sequoia

|

|

|

Other Consolidated Entities

|

|

|

Intercompany Adjustments

|

|

|

Redwood Consolidated

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

$ |

16 |

|

|

$ |

3 |

|

|

$ |

25 |

|

|

$ |

- |

|

|

$ |

43 |

|

|

Net discount (premium) amortization

|

|

|

12 |

|

|

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

|

11 |

|

|

Total interest income

|

|

|

28 |

|

|

|

3 |

|

|

|

24 |

|

|

|

- |

|

|

|

54 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(3 |

) |

|

|

(2 |

) |

|

|

(17 |

) |

|

|

- |

|

|

|

(22 |

) |

|

Net interest income

|

|

|

26 |

|

|

|

0 |

|

|

|

6 |

|

|

|

- |

|

|

|

32 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for loan losses

|

|

|

- |

|

|

|

(0 |

) |

|

|

(3 |

) |

|

|

- |

|

|

|

(3 |

) |

|

Market valuation adjustments, net

|

|

|

1 |

|

|

|

- |

|

|

|

(7 |

) |

|

|

- |

|

|

|

(6 |

) |

|

Net interest income (loss) after provision and market valuation adjustments

|

|

|

26 |

|

|

|

0 |

|

|

|

(3 |

) |

|

|

- |

|

|

|

24 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

(11 |

) |

|

|

- |

|

|

|

(0 |

) |

|

|

- |

|

|

|

(12 |

) |

|

Realized gains (losse) on sales and calls, net

|

|

|

7 |

|

|

|

- |

|

|

|

(3 |

) |

|

|

- |

|

|

|

4 |

|

|

Income from New Sequoia

|

|

|

0 |

|

|

|

- |

|

|

|

- |

|

|

|

(0 |

) |

|

|

- |

|

|

Loss from Other Consolidated Entities

|

|

|

(4 |

) |

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

Noncontrolling interest

|

|

|

- |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

|

|

2 |

|

|

Provision for income taxes

|

|

|

(0 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(0 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

18 |

|

|

$ |

0 |

|

|

$ |

(4 |

) |

|

$ |

4 |

|

|

$ |

18 |

|

|

18

|

THE REDWOOD REVIEW 2ND QUARTER 2011

|

GAAP Income (continued)

|

„

|